Deck : 1 Upstream Oil and Gas Operations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck : 1 Upstream Oil and Gas Operations

1

Mr. Zeman owns the mineral rights in a property in Grant County, Oklahoma. He

leases the property to Force Petroleum, reserving a 1/5 royalty. Force drills a successful

well and begins producing oil. Revenue from the first year of operations totaled $20,000

and costs of development and operation totaled $150,000. How much revenue will each

party receive? How much of the costs will each party pay?

leases the property to Force Petroleum, reserving a 1/5 royalty. Force drills a successful

well and begins producing oil. Revenue from the first year of operations totaled $20,000

and costs of development and operation totaled $150,000. How much revenue will each

party receive? How much of the costs will each party pay?

Working interest and royalty interest

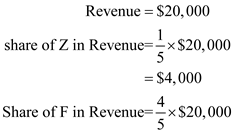

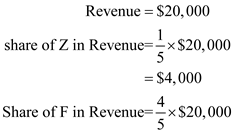

Consider this case, Z own mineral rights in G County. However he decided to lease the same to F petroleum ascertaining a royalty of 1/5. Since F started drilling and development of the well for producing the oil and incurred a cost of $150,000. Therefore the revenue being received by Z and F is shown below:

Thus it is ascertained that the cost incurred by F petroleum is $150,000 on the other hand incurred by Z is nil since he possess non working interest. Hence the share of Z in revenue amounts to

Thus it is ascertained that the cost incurred by F petroleum is $150,000 on the other hand incurred by Z is nil since he possess non working interest. Hence the share of Z in revenue amounts to  and the share of F petroleum in the revenue amounts to

and the share of F petroleum in the revenue amounts to

Consider this case, Z own mineral rights in G County. However he decided to lease the same to F petroleum ascertaining a royalty of 1/5. Since F started drilling and development of the well for producing the oil and incurred a cost of $150,000. Therefore the revenue being received by Z and F is shown below:

Thus it is ascertained that the cost incurred by F petroleum is $150,000 on the other hand incurred by Z is nil since he possess non working interest. Hence the share of Z in revenue amounts to

Thus it is ascertained that the cost incurred by F petroleum is $150,000 on the other hand incurred by Z is nil since he possess non working interest. Hence the share of Z in revenue amounts to  and the share of F petroleum in the revenue amounts to

and the share of F petroleum in the revenue amounts to

2

Pressure Oil Corporation owns a working interest in an oil and gas lease. Lacking

the funds to develop the lease, Pressure assigns the working interest to Tritium Oil

Company, reserving 1/32 of 6/7 of production. What kind of interest has Tritium

acquired? What kind of interest has Pressure retained?

the funds to develop the lease, Pressure assigns the working interest to Tritium Oil

Company, reserving 1/32 of 6/7 of production. What kind of interest has Tritium

acquired? What kind of interest has Pressure retained?

Overriding royalty interest

Unlike royalty interest it does not entitle the owner to enjoy the ownership of minerals underlying in the ground. Thus under such type of interest without paying for cost of production and exploration the lessor ascertains a portion of the profit being generated from the sale of oil and gas production. Therefore ordinary royalty interest arises when the working interest is transferred, sold or being carved out due to some reason.

Thus in this case, P Corporation owns interest in gas and oil lease. However due to lack of funds to proceed with development of well P assign his interest to T Company reserving his share of revenue in the lease. Since in this situation P has transferred his working interest to T a carved out overriding royalty interest is being initiated. Hence the interest retained by P Corporation is overriding royalty interest.

Unlike royalty interest it does not entitle the owner to enjoy the ownership of minerals underlying in the ground. Thus under such type of interest without paying for cost of production and exploration the lessor ascertains a portion of the profit being generated from the sale of oil and gas production. Therefore ordinary royalty interest arises when the working interest is transferred, sold or being carved out due to some reason.

Thus in this case, P Corporation owns interest in gas and oil lease. However due to lack of funds to proceed with development of well P assign his interest to T Company reserving his share of revenue in the lease. Since in this situation P has transferred his working interest to T a carved out overriding royalty interest is being initiated. Hence the interest retained by P Corporation is overriding royalty interest.

3

Dwight Energy owns the working interest in a tract of land in Texas. Lacking the funds

to develop the property, Dwight assigns Bartz Oil 30,000 barrels of oil to be paid out

of 1/7 of the working interest's share of production in exchange for $600,000 in cash.

What type of interest has Bartz acquired?

to develop the property, Dwight assigns Bartz Oil 30,000 barrels of oil to be paid out

of 1/7 of the working interest's share of production in exchange for $600,000 in cash.

What type of interest has Bartz acquired?

Working interest:

It is an interest refers to a type of investment in operation of oil and gas drilling. In which the owner is liable to pay a portion of the ongoing cost those are related with drilling, exploration and production. In similar way owner also fully participate in the profits.

Operating interest:

Those owner has working interest, are liable to pay the equivalent amount of the cost of drilling, leasing, producing and operating well unit is called operating interest.

This interest is created via leasing and is responsible for the exploration, operation and development of a property. The owners who have working interest are responsible for paying all (100%) of the cost of exploring, drilling, developing, and producing the property.

The share of revenue which is working interest, is the total amount after the deduction of royalty interest which is non-working.

Hence, Company B acquired working interest.

It is an interest refers to a type of investment in operation of oil and gas drilling. In which the owner is liable to pay a portion of the ongoing cost those are related with drilling, exploration and production. In similar way owner also fully participate in the profits.

Operating interest:

Those owner has working interest, are liable to pay the equivalent amount of the cost of drilling, leasing, producing and operating well unit is called operating interest.

This interest is created via leasing and is responsible for the exploration, operation and development of a property. The owners who have working interest are responsible for paying all (100%) of the cost of exploring, drilling, developing, and producing the property.

The share of revenue which is working interest, is the total amount after the deduction of royalty interest which is non-working.

Hence, Company B acquired working interest.

4

Aggie Company obtained a lease with a three-year primary term on August 1, 2016.

a. Drilling operations were commenced on June 1, 2017, and continued until October 15, 2017, when the well was determined to be dry.

1) Would the first delay rental payment be required?

2) How many more delay rentals would be necessary to hold the lease without further drilling?

b. Drilling operations were started on May 1, 2019, and the well was completed on October 12, 2019, as a producer."

1) Did the lease terminate on August 1, 2019? Explain.

2) How many years will the lease continue, assuming production in commercial quantities?"

a. Drilling operations were commenced on June 1, 2017, and continued until October 15, 2017, when the well was determined to be dry.

1) Would the first delay rental payment be required?

2) How many more delay rentals would be necessary to hold the lease without further drilling?

b. Drilling operations were started on May 1, 2019, and the well was completed on October 12, 2019, as a producer."

1) Did the lease terminate on August 1, 2019? Explain.

2) How many years will the lease continue, assuming production in commercial quantities?"

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

Cowboy Oil Corporation incurred $275,000 in drilling costs prior to deciding whether

to complete the well. Estimated completion costs are $175,000. The expected net cash

flows from the sale of the oil and gas from this well are $300,000. Should the well be

completed?

to complete the well. Estimated completion costs are $175,000. The expected net cash

flows from the sale of the oil and gas from this well are $300,000. Should the well be

completed?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Answer the following questions related to horizontal drilling:

a. Under what conditions would horizontal drilling operations be considered?

b. Would horizontal drilling operations be more difficult and expensive than the

regular vertical drilling process? Explain.

c. Would horizontal drilling operations be appropriate for most producing

formations? Explain.

a. Under what conditions would horizontal drilling operations be considered?

b. Would horizontal drilling operations be more difficult and expensive than the

regular vertical drilling process? Explain.

c. Would horizontal drilling operations be appropriate for most producing

formations? Explain.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

Discuss the following:

well spacing

proration

field and well allowable

drilling permit

well spacing

proration

field and well allowable

drilling permit

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Describe the organic theory of the origin of oil and gas.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Discuss the requirements generally necessary to exist for a petroleum reservoir to be

commercially productive.

commercially productive.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

Terms

a. Define the following:

fault trap

anticline

salt dome

porosity

permeability

b. Define the following:

day-rate contract

footage-rate contract

turnkey contract

horizontal drilling

c. Explain the following:

petroleum reservoir

primary recovery

secondary recovery

tertiary recovery

a. Define the following:

fault trap

anticline

salt dome

porosity

permeability

b. Define the following:

day-rate contract

footage-rate contract

turnkey contract

horizontal drilling

c. Explain the following:

petroleum reservoir

primary recovery

secondary recovery

tertiary recovery

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

Explain the following terms:

fracturing

acidizing

tripping in/out

well casing

fracturing

acidizing

tripping in/out

well casing

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

List the steps in finding oil and gas.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Describe the primary types of geological and geophysical studies.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

What is the difference between an operating (working) interest and a nonoperating

(nonworking) interest?

(nonworking) interest?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

Explain the role of a landman in oil and gas operations.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Define the following:

economic interest in oil and gas

mineral rights

mineral interest

royalty interest

working interest

overriding royalty interest

production payment interest

economic interest in oil and gas

mineral rights

mineral interest

royalty interest

working interest

overriding royalty interest

production payment interest

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

Define and discuss the important provisions of the typical oil and gas lease.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

What are the drilling operations that give rise to accounting implications?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following would not be a mineral interest?

a. production payment interest

b. working interest

c. overriding royalty interest

d. surface rights interest

e. net profits interest

f. royalty interest

g. joint working interest

a. production payment interest

b. working interest

c. overriding royalty interest

d. surface rights interest

e. net profits interest

f. royalty interest

g. joint working interest

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

Celsius Oil Company signed a lease contract on January 1, 2016. The primary term

specified in the contract was a four-year term.

a. On what date is the first delay rental payment due?

b. What is the maximum number of delay rental payments that may be made?

c. By what date must drilling be commenced in order to keep the lease from

terminating?

d. Assume Celsius Oil begins drilling a well on January 2, 2017.

1) Would the first delay rental be necessary to keep the lease from terminating?

2) If the well is still in process 14 months later, would the second delay rental be necessary?

3) If instead, the well was completed and production begun by October 3, 2017,would the second delay rental be necessary?

4) If production ceased by December 25, 2018, would the third delay rental payment be necessary?"

specified in the contract was a four-year term.

a. On what date is the first delay rental payment due?

b. What is the maximum number of delay rental payments that may be made?

c. By what date must drilling be commenced in order to keep the lease from

terminating?

d. Assume Celsius Oil begins drilling a well on January 2, 2017.

1) Would the first delay rental be necessary to keep the lease from terminating?

2) If the well is still in process 14 months later, would the second delay rental be necessary?

3) If instead, the well was completed and production begun by October 3, 2017,would the second delay rental be necessary?

4) If production ceased by December 25, 2018, would the third delay rental payment be necessary?"

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck