Deck 2: Money and Its Role in the Economy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/116

Play

Full screen (f)

Deck 2: Money and Its Role in the Economy

1

The unique and most primary function of money is that it serves as a

A)unit of account.

B)generally acceptable means of payment.

C)store of value.

D)means for barter.

A)unit of account.

B)generally acceptable means of payment.

C)store of value.

D)means for barter.

B

2

Which of the following is not an important characteristic of something that functions as money?

A)It is generally accepted to make payments.

B)It is durable and scarce.

C)It is only issued by the government.

D)It is a unit of account and a store of value.

A)It is generally accepted to make payments.

B)It is durable and scarce.

C)It is only issued by the government.

D)It is a unit of account and a store of value.

C

3

Which of the following is an important characteristic of something that functions as money?

A)It is generally accepted to make payments.

B)It is durable and scarce.

C)It is only issued by the government.

D)Both a and b are important characteristics of money.

A)It is generally accepted to make payments.

B)It is durable and scarce.

C)It is only issued by the government.

D)Both a and b are important characteristics of money.

D

4

A store of value has

A)a plethora of discounted goods.

B)purchasing power that is retained over time.

C)to be issued by government.

D)only designer name products.

A)a plethora of discounted goods.

B)purchasing power that is retained over time.

C)to be issued by government.

D)only designer name products.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

5

When using the barter system, it is necessary

A)to find something to serve as money.

B)to engage in either direct or indirect finance.

C)that financial markets be unregulated.

D)to find a double coincidence of wants.

A)to find something to serve as money.

B)to engage in either direct or indirect finance.

C)that financial markets be unregulated.

D)to find a double coincidence of wants.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

6

When using the barter system, it is not necessary

A)to find something to serve as money.

B)to engage in either direct or indirect finance.

C)that financial markets be unregulated.

D)All of the above are not necessary.

A)to find something to serve as money.

B)to engage in either direct or indirect finance.

C)that financial markets be unregulated.

D)All of the above are not necessary.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

7

The dollar is considered to be which of these?

A)the profit standard for economic evaluation

B)an excellent store of value even in highly inflationary times

C)the monetary unit of account

D)an efficient means of payment since the federal government is the only issuer of the dollar

A)the profit standard for economic evaluation

B)an excellent store of value even in highly inflationary times

C)the monetary unit of account

D)an efficient means of payment since the federal government is the only issuer of the dollar

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

8

Which of these is considered money in the U.S. today?

A)credit cards

B)currency

C)gold coins issued by the Treasury

D)U.S. Government Securities

E)All of the above are considered money in the U.S. today.

A)credit cards

B)currency

C)gold coins issued by the Treasury

D)U.S. Government Securities

E)All of the above are considered money in the U.S. today.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

9

Which of these is not considered money in the U.S. today?

A)Credit cards

B)U.S. Government Securities

C)gold coins issued by the Treasury

D)None of the above are considered money in the U.S. today.

A)Credit cards

B)U.S. Government Securities

C)gold coins issued by the Treasury

D)None of the above are considered money in the U.S. today.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

10

Compared to a regular checking account, money market deposit accounts generally

A)provide limited check writing.

B)pay higher interest.

C)require a higher minimum balance.

D)All of the above are characteristics of money market deposit accounts.

A)provide limited check writing.

B)pay higher interest.

C)require a higher minimum balance.

D)All of the above are characteristics of money market deposit accounts.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

11

M1 contains which of the following?

A)Travelers' checks

B)checkable deposits

C)domestic non-financial debt

D)Both a and b are in M1.

A)Travelers' checks

B)checkable deposits

C)domestic non-financial debt

D)Both a and b are in M1.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

12

M1 does not contain which of the following?

A)travelers' checks

B)Checkable deposits

C)Domestic Nonfinancial debt

D)Currency in the hands of the public

A)travelers' checks

B)Checkable deposits

C)Domestic Nonfinancial debt

D)Currency in the hands of the public

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

13

Money market deposit accounts are now included in

A)M1

B)M2

C)currency

D)nonfinancial assets

A)M1

B)M2

C)currency

D)nonfinancial assets

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

14

If either the cost is high or a substantial amount of time is needed to convert an asset to money, it is usually referred to as which of these?

A)illiquid

B)highly liquid

C)perfectly liquid

D)near monies

A)illiquid

B)highly liquid

C)perfectly liquid

D)near monies

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

15

"Means of payment" best describes which monetary aggregate?

A)M1

B)M2

C)only currency is a means of payment.

D)domestic Nonfinancial Deposits

A)M1

B)M2

C)only currency is a means of payment.

D)domestic Nonfinancial Deposits

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

16

Domestic Nonfinancial Deposits does not include the debt of financial institutions. This is done to avoid

A)double counting.

B)inefficiencies.

C)high debt-GDP ratios for the economy as a whole.

D)public outcries about the high level of debt.

A)double counting.

B)inefficiencies.

C)high debt-GDP ratios for the economy as a whole.

D)public outcries about the high level of debt.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

17

When credit flows increase, domestic nonfinancial debt

A)increases.

B)decreases.

C)is not affected.

D)is irrelevant.

A)increases.

B)decreases.

C)is not affected.

D)is irrelevant.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

18

When credit flows decrease, domestic nonfinancial debt

A)increases.

B)decreases.

C)is not affected.

D)is irrelevant.

A)increases.

B)decreases.

C)is not affected.

D)is irrelevant.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

19

A measure of the unpaid claims lenders have against borrowers excluding the debt of financial institutions is called

A)M1.

B)M2.

C)money.

D)domestic nonfinancial debt.

A)M1.

B)M2.

C)money.

D)domestic nonfinancial debt.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

20

Checkable deposits are included in which monetary aggregate?

A)M1

B)M2

C)DNFD

D)Both a and b contain checkable deposits.

A)M1

B)M2

C)DNFD

D)Both a and b contain checkable deposits.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

21

During the late 1980s, which measure gained importance to the Fed?

A)M1

B)small time deposits

C)money market deposit accounts

D)M2

A)M1

B)small time deposits

C)money market deposit accounts

D)M2

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

22

The means by which transactions are completed is called

A)an automated teller Machine (ATM).

B)the payments mechanism.

C)Pay Pal.

D)verification.

A)an automated teller Machine (ATM).

B)the payments mechanism.

C)Pay Pal.

D)verification.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

23

Plastic cards that have a certain amount of funds embedded on a magnetic strip are called

A)carbon-copy written checks.

B)debit cards.

C)stored-value cards.

D)credit cards.

A)carbon-copy written checks.

B)debit cards.

C)stored-value cards.

D)credit cards.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

24

Computer terminals used in conjunction with a debit card to electronically transfer funds from checking accounts to third parties are called

A)payments mechanism.

B)ATMs.

C)point-of-sale terminals.

D)NOW accounts.

A)payments mechanism.

B)ATMs.

C)point-of-sale terminals.

D)NOW accounts.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

25

The intent of an electronic funds transfer system is to

A)eliminate overdrafts that check writing allows.

B)expand written check use.

C)strengthen the dollar as a means of payment.

D)increase convenience and service to the public and reduce the costs of making payments.

A)eliminate overdrafts that check writing allows.

B)expand written check use.

C)strengthen the dollar as a means of payment.

D)increase convenience and service to the public and reduce the costs of making payments.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

26

A card with a microprocessor chip embedded in it that usually includes a digital signature is called a

A)smart card.

B)debit card.

C)card shark.

D)stored-value card.

A)smart card.

B)debit card.

C)card shark.

D)stored-value card.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

27

The best known and most popular form of electronic transfer of funds is

A)an automated teller machine (ATM).

B)clearinghouse interbank payment system.

C)stored-value card.

D)checkout lines.

A)an automated teller machine (ATM).

B)clearinghouse interbank payment system.

C)stored-value card.

D)checkout lines.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

28

If significant costs are required to convert a particular type of asset to money, it is usually referred to as

A)a checkable deposit.

B)a savings account.

C)liquid.

D)illiquid.

A)a checkable deposit.

B)a savings account.

C)liquid.

D)illiquid.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

29

Something that serves as a generally acceptable means of payment will, of necessity, function as a

A)means for barter.

B)near-money.

C)store of value.

D)unit of DNFD.

A)means for barter.

B)near-money.

C)store of value.

D)unit of DNFD.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

30

Which is not a function of money?

A)to serve as a store of value

B)to serve as a unit of account

C)to serve as a means for barter

D)to serve as a means of payment

A)to serve as a store of value

B)to serve as a unit of account

C)to serve as a means for barter

D)to serve as a means of payment

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

31

The distinguishing factor of money in the financial system is which of the following?

A)It is issued only by the Fed.

B)It is a generally acceptable medium of exchange.

C)It is illiquid.

D)It has little or no transaction costs.

A)It is issued only by the Fed.

B)It is a generally acceptable medium of exchange.

C)It is illiquid.

D)It has little or no transaction costs.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

32

The best definition of a medium of exchange is which of the following?

A)something that encourages the specialization and division of labor

B)something that retains it value if held

C)the accounting unit or standardized measure of value in which prices are quoted

D)a means of payment; something used in transactions to make payments.

A)something that encourages the specialization and division of labor

B)something that retains it value if held

C)the accounting unit or standardized measure of value in which prices are quoted

D)a means of payment; something used in transactions to make payments.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

33

The barter system is considered to be which of the following?

A)highly effective for making transactions

B)highly efficient

C)costly, cumbersome, and inefficient

D)a necessary part of the financial system

A)highly effective for making transactions

B)highly efficient

C)costly, cumbersome, and inefficient

D)a necessary part of the financial system

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

34

Compared to a monetary system of exchange, the barter system does which of the following?

A)increases transaction costs

B)lowers the volume of exchange in the economy

C)promotes inefficient use of time and energy

D)The barter system does all of the above.

A)increases transaction costs

B)lowers the volume of exchange in the economy

C)promotes inefficient use of time and energy

D)The barter system does all of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

35

Barter systems tend to be found most often in which of the following economies?

A)agricultural economies

B)service-oriented economies

C)shipping economies

D)industrial economies

A)agricultural economies

B)service-oriented economies

C)shipping economies

D)industrial economies

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

36

In an economy, money promotes

A)limited exchanges of goods and services.

B)ineffective time management.

C)individual consumption.

D)efficient production.

A)limited exchanges of goods and services.

B)ineffective time management.

C)individual consumption.

D)efficient production.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

37

A unit of account refers to which of the following?

A)an standardized accounting unit that provides a measure of value

B)monetary aggregates

C)large time deposits

D)money market deposit accounts

A)an standardized accounting unit that provides a measure of value

B)monetary aggregates

C)large time deposits

D)money market deposit accounts

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

38

It is possible with a unit of account to do which of the following?

A)compare relative values of various goods and services

B)keep records about prices and debts

C)simplify actual transactions throughout the economy

D)It is possible to do all of the above.

A)compare relative values of various goods and services

B)keep records about prices and debts

C)simplify actual transactions throughout the economy

D)It is possible to do all of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

39

The development of money facilitates all of the following except

A)exchange.

B)specialization and division of labor.

C)economic development.

D)the double coincidence of wants

A)exchange.

B)specialization and division of labor.

C)economic development.

D)the double coincidence of wants

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

40

M2 contains which of the following?

A)travelers' checks

B)government debt

C)Domestic nonfinancial debt (DNFD)

D)savings bonds

A)travelers' checks

B)government debt

C)Domestic nonfinancial debt (DNFD)

D)savings bonds

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

41

Domestic nonfinancial debt is a measure of which of the following?

A)bankers' acceptances

B)outstanding foreign loans

C)outstanding loans and debts, accumulated in the present and past excluding the debt of financial institutions

D)debt of financial institutions used for relending purposes

A)bankers' acceptances

B)outstanding foreign loans

C)outstanding loans and debts, accumulated in the present and past excluding the debt of financial institutions

D)debt of financial institutions used for relending purposes

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

42

M1 includes all of the following except

A)currency.

B)checkable deposits.

C)money market deposit accounts.

D)travelers' checks.

A)currency.

B)checkable deposits.

C)money market deposit accounts.

D)travelers' checks.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

43

Which aggregate is the largest?

A)M1

B)M2

C)checkable deposits

D)DNFD

A)M1

B)M2

C)checkable deposits

D)DNFD

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

44

Which is used as a measure of transactions money?

A)DNFD

B)M2

C)M1

D)None of the above is a measure of money used in transactions.

A)DNFD

B)M2

C)M1

D)None of the above is a measure of money used in transactions.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

45

In the early 1990s, the Fed was most interested in which aggregate for an indicator of the level of economic activity?

A)U.S. Savings Bonds

B)domestic nonfinancial debt (DNFD)

C)money market mutual funds

D)money market deposit accounts

A)U.S. Savings Bonds

B)domestic nonfinancial debt (DNFD)

C)money market mutual funds

D)money market deposit accounts

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

46

The payment mechanism is how money is

A)divided among investors.

B)used for a measure of wealth.

C)used to make payments.

D)considered a store of value.

A)divided among investors.

B)used for a measure of wealth.

C)used to make payments.

D)considered a store of value.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

47

The balance in a personal checking account is considered which of these?

A)capital

B)currency

C)a nonmonetary financial asset

D)money

A)capital

B)currency

C)a nonmonetary financial asset

D)money

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

48

A store of value is which of the following?

A)a standardized measure of value

B)a means of payment

C)something which retains its value if held

D)something used to make exchanges in a nonmonetary economy

A)a standardized measure of value

B)a means of payment

C)something which retains its value if held

D)something used to make exchanges in a nonmonetary economy

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is not included in M1?

A)small savings

B)currency in the hands of the public

C)other checkable deposits

D)demand deposits at commercial banks

A)small savings

B)currency in the hands of the public

C)other checkable deposits

D)demand deposits at commercial banks

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

50

Interest earning checking accounts are part of?

A)small savings accounts

B)currency in the hands of the public

C)demand deposits at commercial banks

D)other checkable deposits at depository institutions

A)small savings accounts

B)currency in the hands of the public

C)demand deposits at commercial banks

D)other checkable deposits at depository institutions

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

51

When credit flows decline, DNFD

A)increases.

B)declines.

C)remains the same.

D)declines then increases.

A)increases.

B)declines.

C)remains the same.

D)declines then increases.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

52

Domestic nonfinancial debt (DNFD)

A)is a measure of current debts accumulated this fiscal year.

B)includes total credit market debt owned by domestic spending units.

C)is a measure of total credit market debt owned by the domestic nonfinancial sector, excluding government debt.

D)includes total outstanding credit market debt owed by the domestic public and private nonfinancial sectors, including government and private debt.

A)is a measure of current debts accumulated this fiscal year.

B)includes total credit market debt owned by domestic spending units.

C)is a measure of total credit market debt owned by the domestic nonfinancial sector, excluding government debt.

D)includes total outstanding credit market debt owed by the domestic public and private nonfinancial sectors, including government and private debt.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

53

How do demand deposits differ from other checkable deposits?

A)Demand deposits are not as liquid as other checkable deposits.

B)Demand deposits earn a higher interest rate than other checkable deposits.

C)Demand deposits are non-interest-earning checking deposits while other checkable deposits earn interest..

D)There is no difference between demand deposits and other checkable deposits.

A)Demand deposits are not as liquid as other checkable deposits.

B)Demand deposits earn a higher interest rate than other checkable deposits.

C)Demand deposits are non-interest-earning checking deposits while other checkable deposits earn interest..

D)There is no difference between demand deposits and other checkable deposits.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

54

The difference between other checkable deposits and demand deposits can best be described as follows:

A)Checkable deposits are a subset of demand deposits.

B)Demand deposits are checkable deposits that are non-interest-earning.

C)Demand deposits earn interest; checkable deposits do not.

D)Demand deposits are part of M1; checkable deposits are not.

A)Checkable deposits are a subset of demand deposits.

B)Demand deposits are checkable deposits that are non-interest-earning.

C)Demand deposits earn interest; checkable deposits do not.

D)Demand deposits are part of M1; checkable deposits are not.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

55

In recent years, a new currency was introduced. The primary reason was

A)to make the currency more difficult to counterfeit (technological advances had made counterfeiting easier).

B)to increase the supply of currency in a growing economy.

C)to improve the appearance of the U.S. currency which was much less attractive than some foreign currencies.

D)to recall old dollars that were held in large amounts outside the United States.

A)to make the currency more difficult to counterfeit (technological advances had made counterfeiting easier).

B)to increase the supply of currency in a growing economy.

C)to improve the appearance of the U.S. currency which was much less attractive than some foreign currencies.

D)to recall old dollars that were held in large amounts outside the United States.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is true?

A)The U.S. money supply as defined by M1 consists of currency in the hands of the public.

B)Checks have become more important as a result of technological innovation.

C)Checks themselves are not money; the balances in checkable deposits are money.

D)The evolution of money and the payments system is often unrelated to the development of the economy.

A)The U.S. money supply as defined by M1 consists of currency in the hands of the public.

B)Checks have become more important as a result of technological innovation.

C)Checks themselves are not money; the balances in checkable deposits are money.

D)The evolution of money and the payments system is often unrelated to the development of the economy.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

57

Smart cards differ from stored-value cards in that stored-value cards

A)have multiple uses and smart cards have a single use.

B)Are less sophisticated than smart cards.

C)have an embedded computer chip that stores information and may include a digital signature.

D)can be used in vending machines.

A)have multiple uses and smart cards have a single use.

B)Are less sophisticated than smart cards.

C)have an embedded computer chip that stores information and may include a digital signature.

D)can be used in vending machines.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is false?

A)Domestic nonfinancial debt (DNFD) is a measure of outstanding loans and debts accumulated in the present and past years.

B)DNFD refers to total credit market debt owed by the domestic nonfinancial sector including the U.S. government, state and local governments, private nonfinancial firms, and households.

C)Domestic nonfinancial debt excludes the debt of financial institutions-those institutions that borrow solely to re-lend.

D)DNFD is the broadest monetary aggregate.

A)Domestic nonfinancial debt (DNFD) is a measure of outstanding loans and debts accumulated in the present and past years.

B)DNFD refers to total credit market debt owed by the domestic nonfinancial sector including the U.S. government, state and local governments, private nonfinancial firms, and households.

C)Domestic nonfinancial debt excludes the debt of financial institutions-those institutions that borrow solely to re-lend.

D)DNFD is the broadest monetary aggregate.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is false?

A)The payments mechanism is the means by which transactions are completed; how money is transferred among transactors.

B)When you write a check at the grocers, dollars are then credited (added) to the deposit account of the grocer, and debited (removed) from your account.

C)The balances in checkable deposits are money.

D)Technological advances are making checks much more important as a means of payment than in the past.

A)The payments mechanism is the means by which transactions are completed; how money is transferred among transactors.

B)When you write a check at the grocers, dollars are then credited (added) to the deposit account of the grocer, and debited (removed) from your account.

C)The balances in checkable deposits are money.

D)Technological advances are making checks much more important as a means of payment than in the past.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

60

An electronic funds transfer system

A)makes payments to third parties in response to electronic instructions rather than instructions written on a paper check.

B)eliminates the need for deposit accounts.

C)is an inefficient way of transferring funds.

D)increases the costs of making payments at point of sales terminals.

A)makes payments to third parties in response to electronic instructions rather than instructions written on a paper check.

B)eliminates the need for deposit accounts.

C)is an inefficient way of transferring funds.

D)increases the costs of making payments at point of sales terminals.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is most liquid?

A)a rare oil painting

B)my house that has increased in value tremendously in recent years

C)my checkable deposit

D)my pension fund

A)a rare oil painting

B)my house that has increased in value tremendously in recent years

C)my checkable deposit

D)my pension fund

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

62

The rental rate that is associated with borrowing or lending money is called

A)the exchange rate.

B)the rate of depreciation.

C)the rate of inflation.

D)the interest rate.

A)the exchange rate.

B)the rate of depreciation.

C)the rate of inflation.

D)the interest rate.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

63

The specific amount of money that net spenders wish to hold at a specific interest rate is the

A)quantity supplied of money.

B)quantity demanded of money.

C)demand for money.

D)supply of money.

A)quantity supplied of money.

B)quantity demanded of money.

C)demand for money.

D)supply of money.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

64

Ceteris paribus, the relationship between the quantity of money demanded and the interest rate is

A)direct.

B)positive

C)inverse.

D)constant over time

A)direct.

B)positive

C)inverse.

D)constant over time

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

65

The ceteris paribus assumption refers to which of these?

A)holding all other factors constant

B)assuming economic variables are always fluctuating

C)assuming economic theory never changes

D)holding one variable constant and allowing all others to vary

A)holding all other factors constant

B)assuming economic variables are always fluctuating

C)assuming economic theory never changes

D)holding one variable constant and allowing all others to vary

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

66

The demand for money is primarily determined by

A)government.

B)spending plans and the need to pay for purchases.

C)the residual claim on assets.

D)taxation.

A)government.

B)spending plans and the need to pay for purchases.

C)the residual claim on assets.

D)taxation.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

67

An increase in income will generally raise

A)the purchases of households.

B)the purchases of firms.

C)the demand for money at a given interest rate.

D)all of the above.

A)the purchases of households.

B)the purchases of firms.

C)the demand for money at a given interest rate.

D)all of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

68

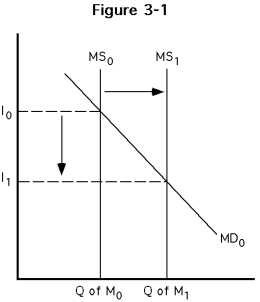

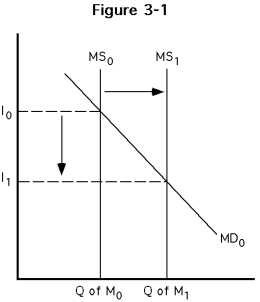

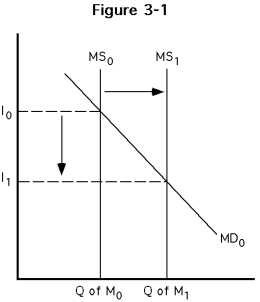

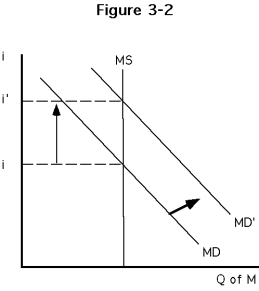

-Which of the following statements best describes Figure?

A)As the Fed increases reserves and with them the money supply, the interest rate falls.

B)As the Fed decreases available reserves and decreases money supply, the interest rate falls.

C)As consumer incomes rise, consumers are more willing to spend money. As a result, they increase their demand for money and the interest rate falls.

D)As the Fed increases the required reserve ratio, the money supply increases and the interest rate falls.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

69

-In Figure, which of the following is true?

A)Money demand is vertical.

B)Money supply is vertical.

C)As the interest rate increases, the quantity demanded of money also increases.

D)As the interest rate decreases, the quantity demanded of money also decreases.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

70

-The decrease in the interest rate shown in Figure could have been caused by

A)an increase in consumer income.

B)the Fed increasing the money supply.

C)the Congress decreasing taxes.

D)an increase in the required reserve ratio.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

71

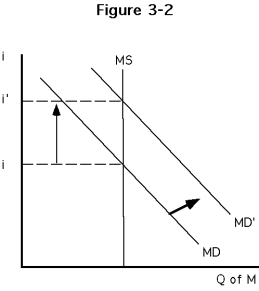

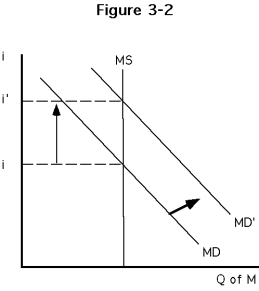

-Which of the following statements best describes Figure ?

A)As the Fed increases reserves and with them the money supply, the interest rate tends to increase.

B)As the Fed decreases available reserves and decreases the money supply, the interest rate tends to increase.

C)As consumer incomes fall, consumers become more frugal. As a result they increase their demand for money and the interest rate increases.

D)An increase in household incomes is likely to increase the demand for money. As money demand increases, the interest rate rises.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

72

-What may have caused the changes illustrated in Figure ?

A)A decrease in the required reserve ratio

B)A decrease in interest

C)An increase in consumer incomes

D)An increase in interest rates

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

73

-In Figure 3-2,

A)an increase in interest rates causes money demand to increase.

B)an increase in money demand causes interest rates to increase.

C)a decrease in the money supply causes the interest rate to increase.

D)an increase in the interest rate causes money supply to increase.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

74

Graphically, an increase in income would tend to

A)shift the demand curve for money to the left.

B)shift the demand curve for money to the right.

C)have no effect on the demand curve for money.

D)cause a movement along the demand curve for money.

A)shift the demand curve for money to the left.

B)shift the demand curve for money to the right.

C)have no effect on the demand curve for money.

D)cause a movement along the demand curve for money.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

75

If a commercial bank has checkable deposit liabilities of $50,000 and the required reserve ratio is set at 12%, the commercial bank must hold how much in reserves assets?

A)None. It is not mandatory to hold reserves.

B)$3,000

C)$6,000

D)$44,000

A)None. It is not mandatory to hold reserves.

B)$3,000

C)$6,000

D)$44,000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

76

If the interest rate is above the equilibrium rate, there is an

A)excess demand for money and downward pressure on the interest rate.

B)excess quantity supplied of money and upward pressure on the interest rate.

C)excess supply of money and upward pressure on the interest rate.

D)excess quantity supplied of money and downward pressure on the interest rate.

A)excess demand for money and downward pressure on the interest rate.

B)excess quantity supplied of money and upward pressure on the interest rate.

C)excess supply of money and upward pressure on the interest rate.

D)excess quantity supplied of money and downward pressure on the interest rate.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

77

If the interest rate is below the equilibrium point, there is an

A)excess supply of money and rising interest rates.

B)excess quantity demanded of money and rising interest rates.

C)excess demand of money and falling interest rates.

D)excess quantity demanded and falling interest rates.

A)excess supply of money and rising interest rates.

B)excess quantity demanded of money and rising interest rates.

C)excess demand of money and falling interest rates.

D)excess quantity demanded and falling interest rates.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is false?

A)The quantity supplied of money is the amount that will be supplied at a specific interest rate.

B)The supply curve of money is vertical.

C)The supply of money is directly related to the interest rate; that is, when the interest rate increases, the supply of money increases.

D)When the Fed raises the required reserve ratio, the supply of money decreases.

A)The quantity supplied of money is the amount that will be supplied at a specific interest rate.

B)The supply curve of money is vertical.

C)The supply of money is directly related to the interest rate; that is, when the interest rate increases, the supply of money increases.

D)When the Fed raises the required reserve ratio, the supply of money decreases.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

79

As the interest rate falls, the demand for money

A)remains the same.

B)Increases.

C)Decreases.

D)increases causing the quantity supplied of money to increase.

A)remains the same.

B)Increases.

C)Decreases.

D)increases causing the quantity supplied of money to increase.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is false?

A)Depository institutions must hold reserve assets equal to a certain fraction of deposit liabilities-called the required reserve ratio-which is set by the Fed.

B)The Fed influences the amount of cash assets outstanding and thus the amount available for reserves.

C)The Fed has significant influence over the money supply.

D)The required reserve ratio is set by the president of the United States.

A)Depository institutions must hold reserve assets equal to a certain fraction of deposit liabilities-called the required reserve ratio-which is set by the Fed.

B)The Fed influences the amount of cash assets outstanding and thus the amount available for reserves.

C)The Fed has significant influence over the money supply.

D)The required reserve ratio is set by the president of the United States.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck