Deck 17: Oligopoly.

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/410

Play

Full screen (f)

Deck 17: Oligopoly.

1

The simplest type of oligopoly is

A) monopoly.

B) duopoly.

C) monopolistic competition.

D) oligopolistic competition.

A) monopoly.

B) duopoly.

C) monopolistic competition.

D) oligopolistic competition.

B

2

Which of the following statements is correct?

A) If duopolists successfully collude, then their combined output will be equal to the output that would be observed if the market were a monopoly.

B) Although the logic of self-interest decreases a duopoly's price below the monopoly price, it does not push the duopolists to reach the competitive price.

C) Although the logic of self-interest increases a duopoly's level of output above the monopoly level, it does not push the duopolists to reach the competitive level.

D) All of the above are correct.

A) If duopolists successfully collude, then their combined output will be equal to the output that would be observed if the market were a monopoly.

B) Although the logic of self-interest decreases a duopoly's price below the monopoly price, it does not push the duopolists to reach the competitive price.

C) Although the logic of self-interest increases a duopoly's level of output above the monopoly level, it does not push the duopolists to reach the competitive level.

D) All of the above are correct.

D

3

In choosing among alternative courses of action,Raj must consider how others might respond to the action he takes.In the language of game theory,we say that Raj must think

A) openly.

B) strategically.

C) dominantly.

D) cooperatively.

A) openly.

B) strategically.

C) dominantly.

D) cooperatively.

B

4

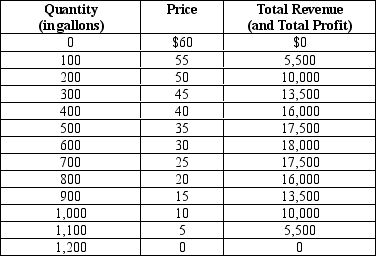

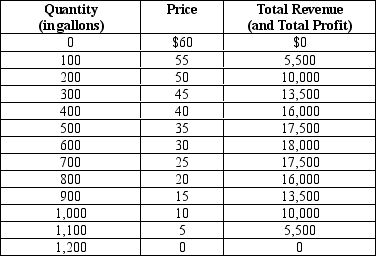

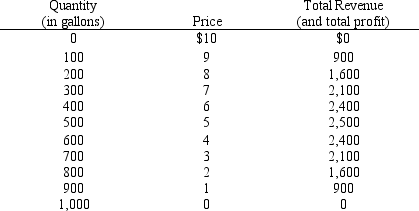

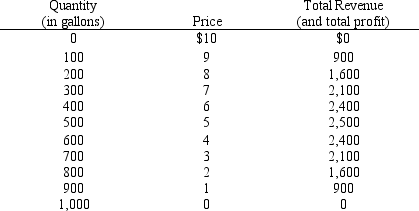

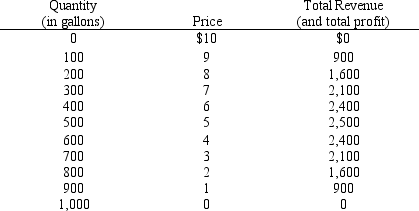

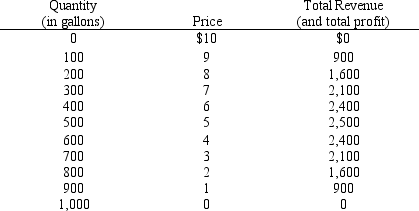

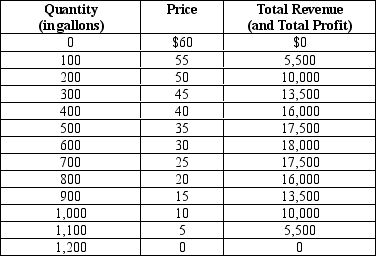

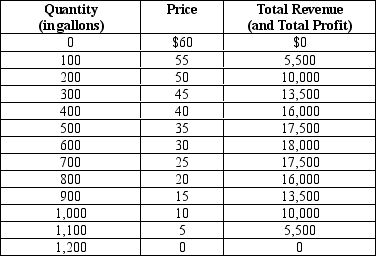

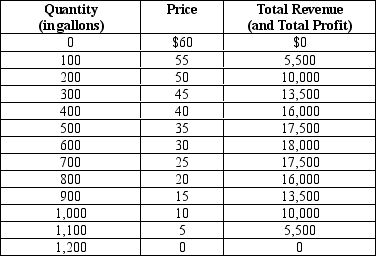

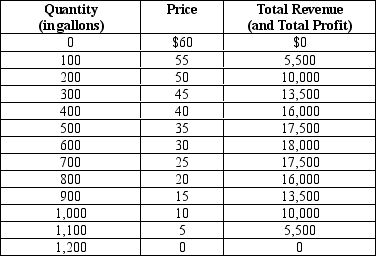

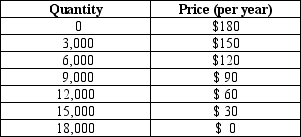

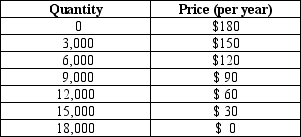

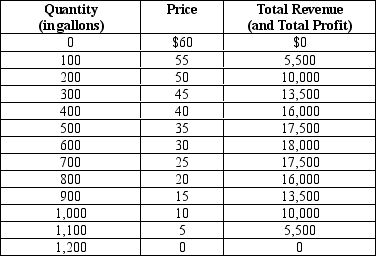

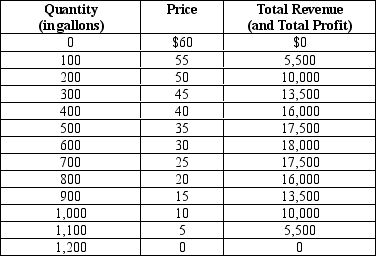

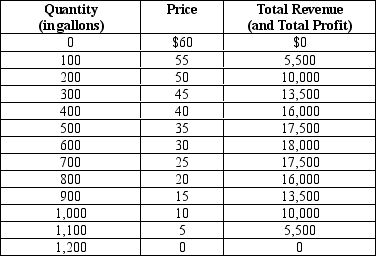

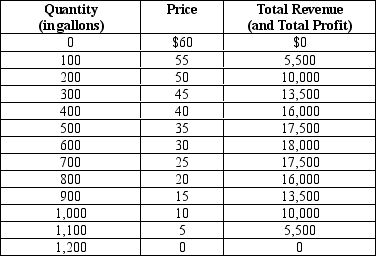

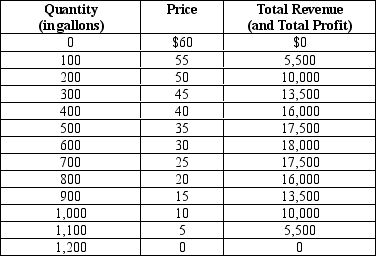

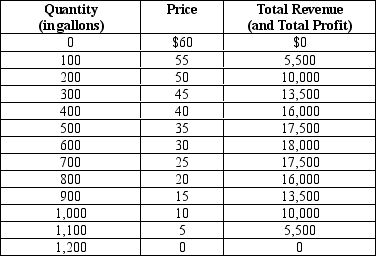

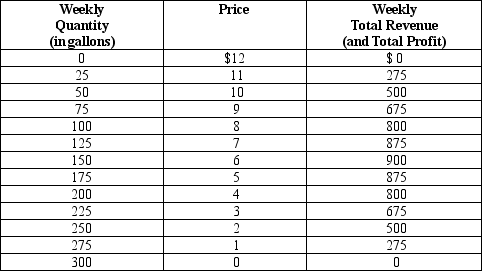

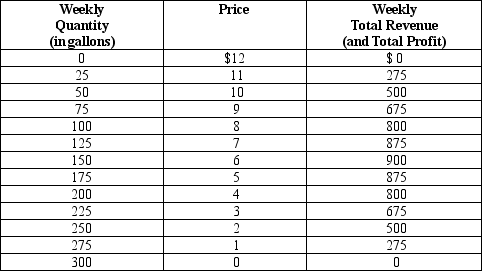

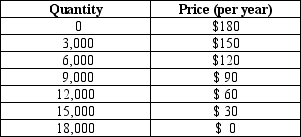

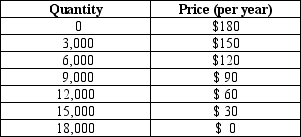

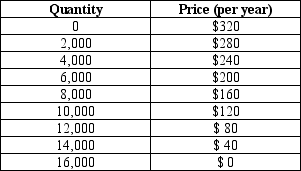

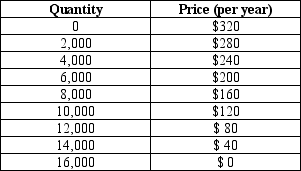

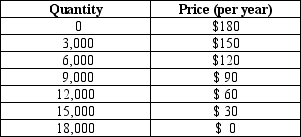

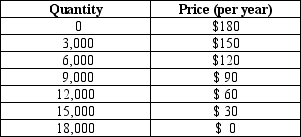

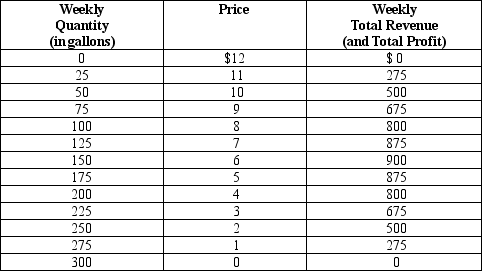

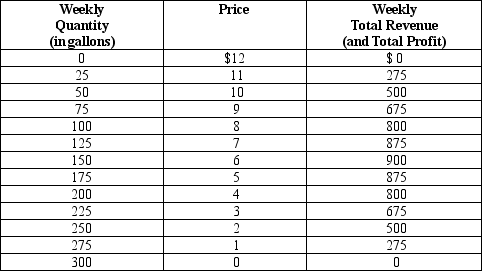

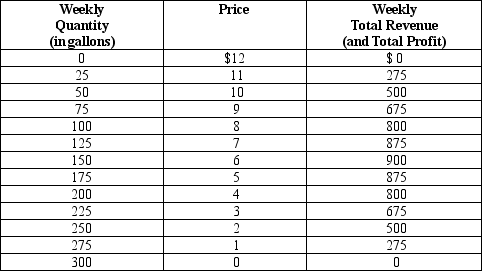

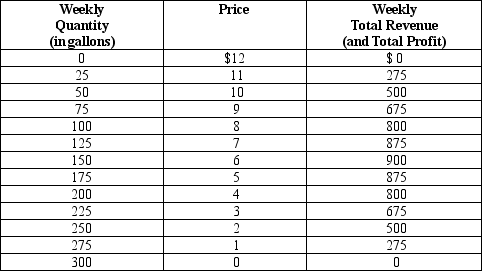

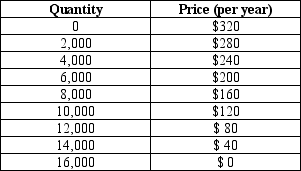

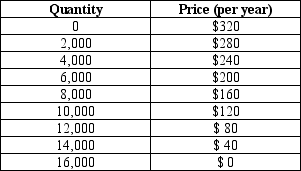

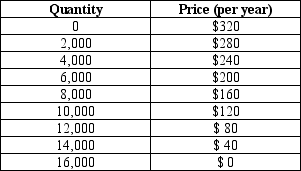

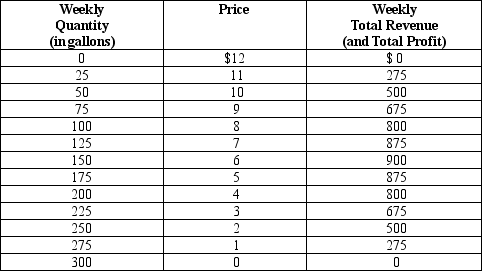

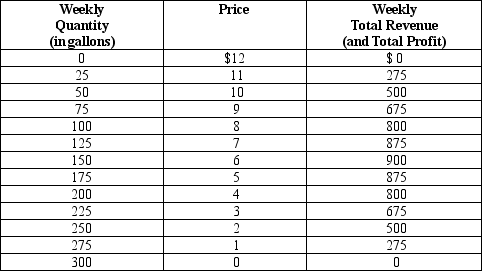

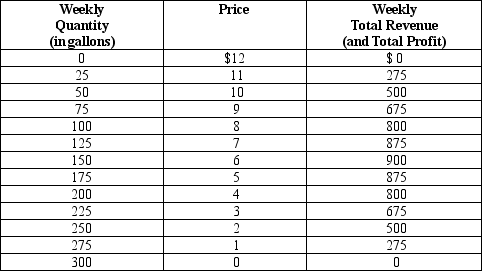

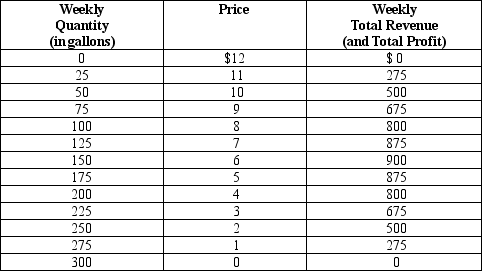

Table 17-1

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.If Rochelle and Alec operate as a profit-maximizing monopoly in the market for water,what price will they charge?

A) $25

B) $30

C) $35

D) $40

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.If Rochelle and Alec operate as a profit-maximizing monopoly in the market for water,what price will they charge?

A) $25

B) $30

C) $35

D) $40

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

5

In the language of game theory,a situation in which each person must consider how others might respond to his or her own actions is called a

A) quantifiable situation.

B) cooperative situation.

C) strategic situation.

D) tactical situation.

A) quantifiable situation.

B) cooperative situation.

C) strategic situation.

D) tactical situation.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

6

An agreement between two duopolists to function as a monopolist usually breaks down because

A) they cannot agree on the price that a monopolist would charge.

B) they cannot agree on the output that a monopolist would produce.

C) each duopolist wants a larger share of the market in order to capture more profit.

D) each duopolist wants to charge a higher price than the monopoly price.

A) they cannot agree on the price that a monopolist would charge.

B) they cannot agree on the output that a monopolist would produce.

C) each duopolist wants a larger share of the market in order to capture more profit.

D) each duopolist wants to charge a higher price than the monopoly price.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is correct?

A) Strategic situations are more likely to arise when the number of decision-makers is very large rather than very small.

B) Strategic situations are more likely to arise in monopolistically competitive markets than in oligopolistic markets.

C) Game theory is useful in understanding certain business decisions, but it is not really applicable to ordinary games such as chess or tic-tac-toe.

D) Game theory is not necessary for understanding competitive or monopoly markets.

A) Strategic situations are more likely to arise when the number of decision-makers is very large rather than very small.

B) Strategic situations are more likely to arise in monopolistically competitive markets than in oligopolistic markets.

C) Game theory is useful in understanding certain business decisions, but it is not really applicable to ordinary games such as chess or tic-tac-toe.

D) Game theory is not necessary for understanding competitive or monopoly markets.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

8

As the number of firms in an oligopoly increases,the

A) price approaches marginal cost, and the quantity approaches the socially efficient level.

B) price and quantity approach the monopoly levels.

C) price effect exceeds the output effect.

D) individual firms' profits increase.

A) price approaches marginal cost, and the quantity approaches the socially efficient level.

B) price and quantity approach the monopoly levels.

C) price effect exceeds the output effect.

D) individual firms' profits increase.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose that Jay-Z and Beyonce are duopolists in the music industry.In January,they agree to work together as a monopolist,charging the monopoly price for their music and producing the monopoly quantity of songs.By February,each singer is considering breaking the agreement.What would you expect to happen next?

A) Jay-Z and Beyonce will determine that it is in each singer's best self interest to maintain the agreement.

B) Jay-Z and Beyonce will each break the agreement. The new equilibrium quantity of songs will increase, and the new equilibrium price will decrease.

C) Jay-Z and Beyonce will each break the agreement. The new equilibrium quantity of songs will decrease, and the new equilibrium price will increase.

D) Jay-Z and Beyonce will each break the agreement. The new equilibrium quantity of songs will increase, and the new equilibrium price also will increase.

A) Jay-Z and Beyonce will determine that it is in each singer's best self interest to maintain the agreement.

B) Jay-Z and Beyonce will each break the agreement. The new equilibrium quantity of songs will increase, and the new equilibrium price will decrease.

C) Jay-Z and Beyonce will each break the agreement. The new equilibrium quantity of songs will decrease, and the new equilibrium price will increase.

D) Jay-Z and Beyonce will each break the agreement. The new equilibrium quantity of songs will increase, and the new equilibrium price also will increase.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

10

A distinguishing feature of an oligopolistic industry is the tension between

A) profit maximization and cost minimization.

B) cooperation and self interest.

C) producing a small amount of output and charging a price above marginal cost.

D) short-run decisions and long-run decisions.

A) profit maximization and cost minimization.

B) cooperation and self interest.

C) producing a small amount of output and charging a price above marginal cost.

D) short-run decisions and long-run decisions.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

11

A special kind of imperfectly competitive market that has only two firms is called

A) a two-tier competitive structure.

B) an incidental monopoly.

C) a doublet.

D) a duopoly.

A) a two-tier competitive structure.

B) an incidental monopoly.

C) a doublet.

D) a duopoly.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

12

In general,game theory is the study of

A) how people behave in strategic situations.

B) how people behave when the possible actions of other people are irrelevant.

C) oligopolistic markets.

D) all types of markets, including competitive markets, monopolistic markets, and oligopolistic markets.

A) how people behave in strategic situations.

B) how people behave when the possible actions of other people are irrelevant.

C) oligopolistic markets.

D) all types of markets, including competitive markets, monopolistic markets, and oligopolistic markets.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

13

In which of the following markets are strategic interactions among firms most likely to occur?

A) markets to which patent and copyright laws apply

B) the market for piano lessons

C) the market for tennis balls

D) the market for corn

A) markets to which patent and copyright laws apply

B) the market for piano lessons

C) the market for tennis balls

D) the market for corn

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

14

We must be knowledgeable of how people behave in strategic situations if we are to understand

A) perfectly competitive markets.

B) monopolistically competitive markets.

C) oligopolistic markets.

D) All of the above are correct.

A) perfectly competitive markets.

B) monopolistically competitive markets.

C) oligopolistic markets.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements about oligopolies is not correct?

A) An oligopolistic market has only a few sellers.

B) The actions of any one seller can have a large impact on the profits of all other sellers.

C) Oligopolistic firms are interdependent in a way that competitive firms are not.

D) Unlike monopolies and monopolistically competitive markets, oligopolies prices do not exceed their marginal revenues.

A) An oligopolistic market has only a few sellers.

B) The actions of any one seller can have a large impact on the profits of all other sellers.

C) Oligopolistic firms are interdependent in a way that competitive firms are not.

D) Unlike monopolies and monopolistically competitive markets, oligopolies prices do not exceed their marginal revenues.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

16

In studying oligopolistic markets,economists assume that

A) there is no conflict or tension between cooperation and self-interest.

B) it is easy for a group of firms to cooperate and thereby establish and maintain a monopoly outcome.

C) each oligopolist cares only about its own profit.

D) strategic decisions do not play a role in such markets.

A) there is no conflict or tension between cooperation and self-interest.

B) it is easy for a group of firms to cooperate and thereby establish and maintain a monopoly outcome.

C) each oligopolist cares only about its own profit.

D) strategic decisions do not play a role in such markets.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

17

If a certain market were a monopoly,then the monopolist would maximize its profit by producing 1,000 units of output.If,instead,that market were a duopoly,then which of the following outcomes would be most likely if the duopolists successfully collude?

A) Each duopolist produces 1,000 units of output.

B) Each duopolist produces 600 units of output.

C) One duopolist produces 400 units of output and the other produces 600 units of output.

D) One duopolist produces 800 units of output and the other produces 400 units of output.

A) Each duopolist produces 1,000 units of output.

B) Each duopolist produces 600 units of output.

C) One duopolist produces 400 units of output and the other produces 600 units of output.

D) One duopolist produces 800 units of output and the other produces 400 units of output.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

18

In an oligopoly,each firm knows that its profits

A) depend only on how much output it produces.

B) depend only on how much output its rival firms produce.

C) depend on both how much output it produces and how much output its rival firms produce.

D) will be zero in the long run because of free entry.

A) depend only on how much output it produces.

B) depend only on how much output its rival firms produce.

C) depend on both how much output it produces and how much output its rival firms produce.

D) will be zero in the long run because of free entry.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

19

Game theory is important for understanding which of the following market types?

A) perfectly competitive and oligopolistic markets

B) perfectly competitive markets but not oligopolistic markets

C) oligoplistic but not perfectly competitive markets

D) neither oligopolistic nor perfectly competitive markets.

A) perfectly competitive and oligopolistic markets

B) perfectly competitive markets but not oligopolistic markets

C) oligoplistic but not perfectly competitive markets

D) neither oligopolistic nor perfectly competitive markets.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

20

An agreement among firms in a market about quantities to produce or prices to charge is called

A) collusion.

B) a strategic situation.

C) excess capacity.

D) tying.

A) collusion.

B) a strategic situation.

C) excess capacity.

D) tying.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

21

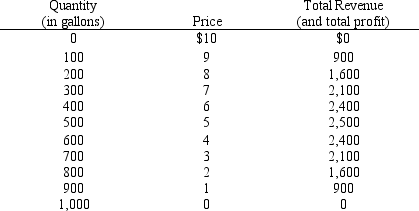

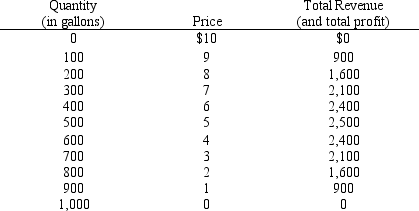

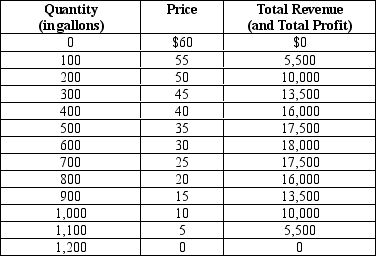

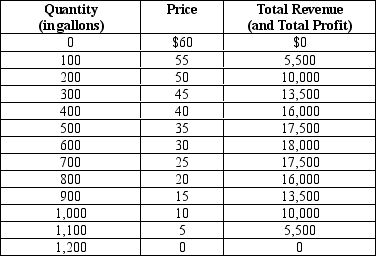

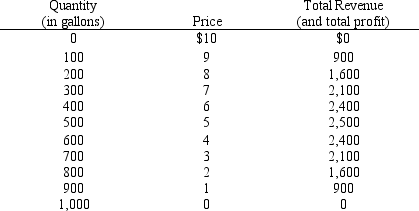

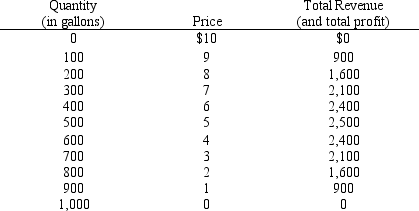

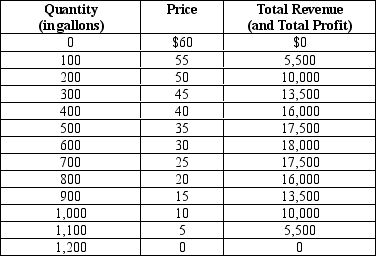

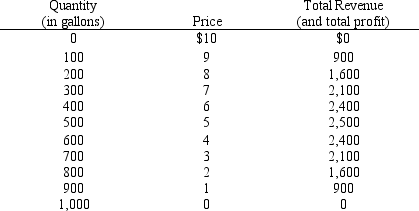

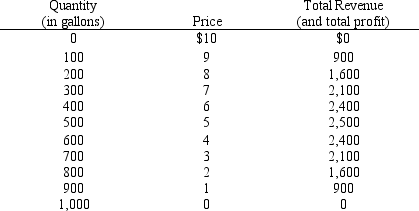

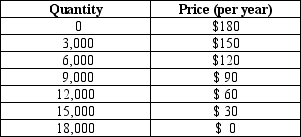

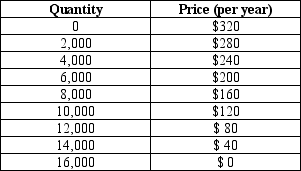

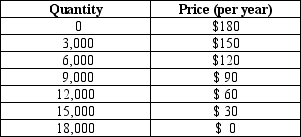

Table 17-2. The table shows the town of Pittsville's demand schedule for gasoline. For simplicity, assume the town's gasoline seller(s) incur no costs in selling gasoline.

Refer to Table 17-2.If the market for gasoline in Pittsville is a monopoly,then the profit-maximizing monopolist will charge a price of

A) $8 and sell 200 gallons.

B) $5 and sell 500 gallons.

C) $2 and sell 800 gallons.

D) $0 and sell 1,000 gallons.

Refer to Table 17-2.If the market for gasoline in Pittsville is a monopoly,then the profit-maximizing monopolist will charge a price of

A) $8 and sell 200 gallons.

B) $5 and sell 500 gallons.

C) $2 and sell 800 gallons.

D) $0 and sell 1,000 gallons.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

22

Table 17-2. The table shows the town of Pittsville's demand schedule for gasoline. For simplicity, assume the town's gasoline seller(s) incur no costs in selling gasoline.

Refer to Table 17-2.If there are exactly three sellers of gasoline in Pittsville and if they collude,then which of the following outcomes is most likely?

A) Each seller will sell 166.67 gallons and charge a price of $1.33.

B) Each seller will sell 166.67 gallons and charge a price of $5.

C) Each seller will sell 200 gallons and charge a price of $4.

D) Each seller will sell 233.33 gallons and charge a price of $5.

Refer to Table 17-2.If there are exactly three sellers of gasoline in Pittsville and if they collude,then which of the following outcomes is most likely?

A) Each seller will sell 166.67 gallons and charge a price of $1.33.

B) Each seller will sell 166.67 gallons and charge a price of $5.

C) Each seller will sell 200 gallons and charge a price of $4.

D) Each seller will sell 233.33 gallons and charge a price of $5.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

23

As the number of sellers in an oligopoly becomes very large,

A) the quantity of output approaches the socially efficient quantity.

B) the price approaches marginal cost.

C) the price effect is diminished.

D) All of the above are correct.

A) the quantity of output approaches the socially efficient quantity.

B) the price approaches marginal cost.

C) the price effect is diminished.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

24

Table 17-1

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.Suppose the town enacts new antitrust laws that prohibit Rochelle and Alec from operating as a monopoly.How many gallons of water will be produced and sold once Rochelle and Alec reach a Nash equilibrium?

A) 600

B) 700

C) 800

D) 900

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.Suppose the town enacts new antitrust laws that prohibit Rochelle and Alec from operating as a monopoly.How many gallons of water will be produced and sold once Rochelle and Alec reach a Nash equilibrium?

A) 600

B) 700

C) 800

D) 900

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

25

In markets characterized by oligopoly,

A) the oligopolists earn the highest profit when they cooperate and behave like a monopolist.

B) collusive agreements will always prevail.

C) collective profits are always lower with cartel arrangements than they are without cartel arrangements.

D) pursuit of self-interest by profit-maximizing firms always maximizes collective profits in the market.

A) the oligopolists earn the highest profit when they cooperate and behave like a monopolist.

B) collusive agreements will always prevail.

C) collective profits are always lower with cartel arrangements than they are without cartel arrangements.

D) pursuit of self-interest by profit-maximizing firms always maximizes collective profits in the market.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

26

Table 17-2. The table shows the town of Pittsville's demand schedule for gasoline. For simplicity, assume the town's gasoline seller(s) incur no costs in selling gasoline.

Refer to Table 17-2.Suppose there are exactly two sellers of gasoline in Pittsville: Exxoff and BQ.If Exxoff sells 300 gallons and BQ sells 400 gallons,then

A) Exxoff's profit is $900 and BQ's profit is $1,200.

B) Exxoff's profit is $2,100 and BQ's profit is $2,400.

C) there is an excess demand for gasoline in Pittsville.

D) there is an excess supply of gasoline in Pittsville.

Refer to Table 17-2.Suppose there are exactly two sellers of gasoline in Pittsville: Exxoff and BQ.If Exxoff sells 300 gallons and BQ sells 400 gallons,then

A) Exxoff's profit is $900 and BQ's profit is $1,200.

B) Exxoff's profit is $2,100 and BQ's profit is $2,400.

C) there is an excess demand for gasoline in Pittsville.

D) there is an excess supply of gasoline in Pittsville.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

27

Because each oligopolist cares about its own profit rather than the collective profit of all the oligopolists together,

A) they are unable to maintain the same degree of monopoly power enjoyed by a monopolist.

B) each firm's profit always ends up being zero.

C) society is worse off as a result.

D) Both a and c are correct.

A) they are unable to maintain the same degree of monopoly power enjoyed by a monopolist.

B) each firm's profit always ends up being zero.

C) society is worse off as a result.

D) Both a and c are correct.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements is correct?

A) When duopoly firms reach a Nash equilibrium, their combined level of output is the monopoly level of output.

B) When oligopoly firms collude, they are behaving as a cartel.

C) In an oligopoly, self-interest drives the market to the competitive outcome.

D) An oligopoly is an example of monopolistic competition.

A) When duopoly firms reach a Nash equilibrium, their combined level of output is the monopoly level of output.

B) When oligopoly firms collude, they are behaving as a cartel.

C) In an oligopoly, self-interest drives the market to the competitive outcome.

D) An oligopoly is an example of monopolistic competition.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

29

As a group,oligopolists would always earn the highest profit if they would

A) produce the perfectly competitive quantity of output.

B) produce more than the perfectly competitive quantity of output.

C) charge the same price that a monopolist would charge if the market were a monopoly.

D) operate according to their own individual self-interests.

A) produce the perfectly competitive quantity of output.

B) produce more than the perfectly competitive quantity of output.

C) charge the same price that a monopolist would charge if the market were a monopoly.

D) operate according to their own individual self-interests.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

30

Table 17-2. The table shows the town of Pittsville's demand schedule for gasoline. For simplicity, assume the town's gasoline seller(s) incur no costs in selling gasoline.

Refer to Table 17-2.If the market for gasoline in Pittsville is perfectly competitive,then the equilibrium price of gasoline is

A) $8 and the equilibrium quantity is 200 gallons.

B) $5 and the equilibrium quantity is 500 gallons.

C) $2 and the equilibrium quantity is 800 gallons.

D) $0 and the equilibrium quantity is 1,000 gallons.

Refer to Table 17-2.If the market for gasoline in Pittsville is perfectly competitive,then the equilibrium price of gasoline is

A) $8 and the equilibrium quantity is 200 gallons.

B) $5 and the equilibrium quantity is 500 gallons.

C) $2 and the equilibrium quantity is 800 gallons.

D) $0 and the equilibrium quantity is 1,000 gallons.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

31

As a group,oligopolists would always be better off if they would act collectively

A) as if they were each seeking to maximize their own individual profits.

B) in a manner that would prohibit collusive agreements.

C) as a single monopolist.

D) as a single perfectly competitive firm.

A) as if they were each seeking to maximize their own individual profits.

B) in a manner that would prohibit collusive agreements.

C) as a single monopolist.

D) as a single perfectly competitive firm.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

32

Table 17-1

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.If Rochelle and Alec operate as a profit-maximizing monopoly in the market for water,how many gallons of water will be produced and sold?

A) 0

B) 500

C) 600

D) 1,200

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.If Rochelle and Alec operate as a profit-maximizing monopoly in the market for water,how many gallons of water will be produced and sold?

A) 0

B) 500

C) 600

D) 1,200

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

33

Table 17-1

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.What is the socially efficient quantity of water?

A) 0 gallons

B) 600 gallons

C) 900 gallons

D) 1,200 gallons

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.What is the socially efficient quantity of water?

A) 0 gallons

B) 600 gallons

C) 900 gallons

D) 1,200 gallons

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

34

As the number of firms in an oligopoly increases,the magnitude of the

A) output effect increases.

B) output effect decreases.

C) price effect increases.

D) price effect decreases.

A) output effect increases.

B) output effect decreases.

C) price effect increases.

D) price effect decreases.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

35

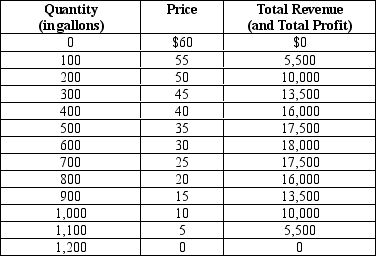

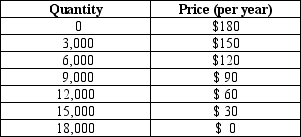

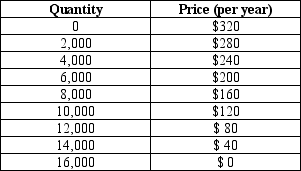

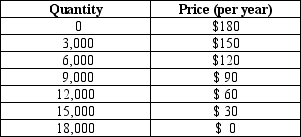

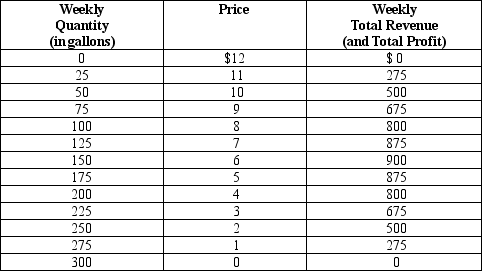

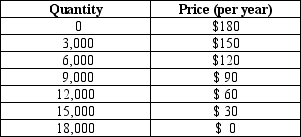

Table 17-3. The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

Refer to Table 17-3.If there is only one digital cable TV company in this market,what price would it charge for a premium digital channel subscription to maximize its profit?

A) $30

B) $60

C) $90

D) $150

Refer to Table 17-3.If there is only one digital cable TV company in this market,what price would it charge for a premium digital channel subscription to maximize its profit?

A) $30

B) $60

C) $90

D) $150

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

36

Table 17-1

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.If Rochelle and Alec operate as a profit-maximizing monopoly in the market for water,how much profit will each of them earn?

A) $8,750

B) $9,000

C) $12,000

D) $18,000

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.If Rochelle and Alec operate as a profit-maximizing monopoly in the market for water,how much profit will each of them earn?

A) $8,750

B) $9,000

C) $12,000

D) $18,000

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

37

Table 17-1

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.Suppose the town enacts new antitrust laws that prohibit Rochelle and Alec from operating as a monopoly.What will be the price of water once Rochelle and Alec reach a Nash equilibrium?

A) $15

B) $20

C) $25

D) $30

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.Suppose the town enacts new antitrust laws that prohibit Rochelle and Alec from operating as a monopoly.What will be the price of water once Rochelle and Alec reach a Nash equilibrium?

A) $15

B) $20

C) $25

D) $30

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

38

Table 17-2. The table shows the town of Pittsville's demand schedule for gasoline. For simplicity, assume the town's gasoline seller(s) incur no costs in selling gasoline.

Refer to Table 17-2.If there are exactly two sellers of gasoline in Pittsville and if they collude,then which of the following outcomes is most likely?

A) Each seller will sell 500 gallons and charge a price of $5.

B) Each seller will sell 250 gallons and charge a price of $2.50.

C) Each seller will sell 350 gallons and charge a price of $3.

D) Each seller will sell 250 gallons and charge a price of $5.

Refer to Table 17-2.If there are exactly two sellers of gasoline in Pittsville and if they collude,then which of the following outcomes is most likely?

A) Each seller will sell 500 gallons and charge a price of $5.

B) Each seller will sell 250 gallons and charge a price of $2.50.

C) Each seller will sell 350 gallons and charge a price of $3.

D) Each seller will sell 250 gallons and charge a price of $5.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

39

Table 17-1

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.If the market for water were perfectly competitive instead of monopolistic,how many gallons of water would be produced and sold?

A) 0

B) 600

C) 900

D) 1,200

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.If the market for water were perfectly competitive instead of monopolistic,how many gallons of water would be produced and sold?

A) 0

B) 600

C) 900

D) 1,200

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

40

Table 17-1

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.If this market for water were perfectly competitive instead of monopolistic,what price would be charged?

A) $0

B) $30

C) $40

D) $60

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The weekly town demand schedule and total revenue schedule for water is shown in the table below:

Refer to Table 17-1.If this market for water were perfectly competitive instead of monopolistic,what price would be charged?

A) $0

B) $30

C) $40

D) $60

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

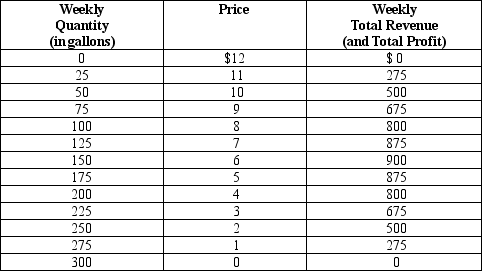

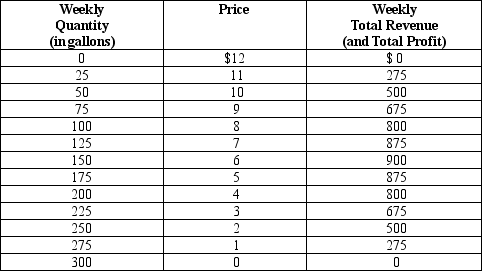

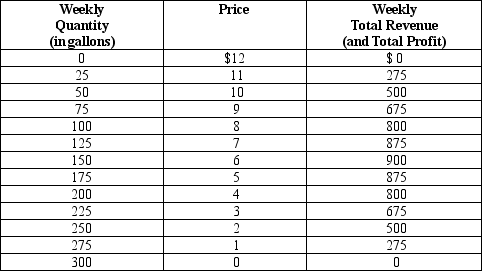

41

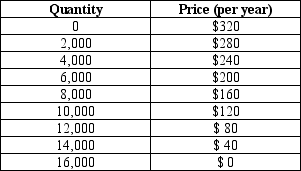

Table 17-5. Imagine a small town in which only two residents, Kunal and Naj, own wells that produce safe drinking water. Each week Kunal and Naj work together to decide how many gallons of water to pump, to bring the water to town, and to sell it at whatever price the market will bear. Assume Kunal and Naj can pump as much water as they want without cost so that the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.If the market for water were perfectly competitive instead of monopolistic,how many gallons of water would be produced and sold?

A) 25

B) 100

C) 200

D) 300

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.If the market for water were perfectly competitive instead of monopolistic,how many gallons of water would be produced and sold?

A) 25

B) 100

C) 200

D) 300

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

42

Table 17-5. Imagine a small town in which only two residents, Kunal and Naj, own wells that produce safe drinking water. Each week Kunal and Naj work together to decide how many gallons of water to pump, to bring the water to town, and to sell it at whatever price the market will bear. Assume Kunal and Naj can pump as much water as they want without cost so that the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.Suppose the town enacts new antitrust laws that prohibit Kunal and Naj from operating as a monopolist.What will the new price of water be once the Nash equilibrium is reached?

A) $3

B) $4

C) $5

D) $6

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.Suppose the town enacts new antitrust laws that prohibit Kunal and Naj from operating as a monopolist.What will the new price of water be once the Nash equilibrium is reached?

A) $3

B) $4

C) $5

D) $6

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

43

Table 17-3. The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

Refer to Table 17-3.Assume there are two profit-maximizing digital cable TV companies operating in this market.Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell.How many premium digital channel cable TV subscriptions will be sold altogether when this market reaches a Nash equilibrium?

A) 6,000

B) 9,000

C) 12,000

D) 15,000

Refer to Table 17-3.Assume there are two profit-maximizing digital cable TV companies operating in this market.Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell.How many premium digital channel cable TV subscriptions will be sold altogether when this market reaches a Nash equilibrium?

A) 6,000

B) 9,000

C) 12,000

D) 15,000

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

44

Table 17-3. The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

Refer to Table 17-3.Assume there are two profit-maximizing digital cable TV companies operating in this market.Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell.What price will premium digital channel cable TV subscriptions be sold at when this market reaches a Nash equilibrium?

A) $30

B) $60

C) $90

D) $120

Refer to Table 17-3.Assume there are two profit-maximizing digital cable TV companies operating in this market.Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell.What price will premium digital channel cable TV subscriptions be sold at when this market reaches a Nash equilibrium?

A) $30

B) $60

C) $90

D) $120

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

45

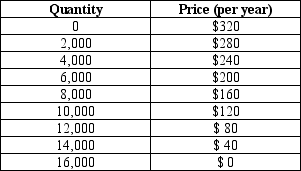

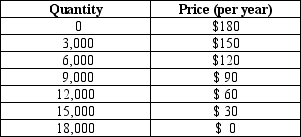

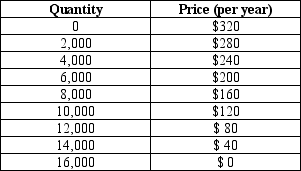

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $80.

Refer to Table 17-4.Assume that there are two profit-maximizing high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.How much profit will each firm earn when this market reaches a Nash equilibrium?

A) $120,000

B) $150,000

C) $200,000

D) $225,000

Refer to Table 17-4.Assume that there are two profit-maximizing high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.How much profit will each firm earn when this market reaches a Nash equilibrium?

A) $120,000

B) $150,000

C) $200,000

D) $225,000

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

46

Scenario 17-1. Assume that the countries of Irun and Urun are the only two producers of crude oil. Further assume that both countries have entered into an agreement to maintain certain production levels in order to maximize profits. In the world market for oil, the demand curve is downward sloping.

Refer to Scenario 17-1.The fact that both countries have colluded to earn higher profit shows their desire to keep their combined level of output

A) above the monopoly level.

B) below the Nash equilibrium level.

C) equal to the Nash equilibrium level.

D) above the Nash equilibrium level.

Refer to Scenario 17-1.The fact that both countries have colluded to earn higher profit shows their desire to keep their combined level of output

A) above the monopoly level.

B) below the Nash equilibrium level.

C) equal to the Nash equilibrium level.

D) above the Nash equilibrium level.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

47

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $80.

Refer to Table 17-4.Assume there are two profit-maximizing high-speed Internet service providers operating in this market.Further assume that they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for subscriptions.How much profit will each company earn?

A) $80,000

B) $120,000

C) $160,000

D) $210,000

Refer to Table 17-4.Assume there are two profit-maximizing high-speed Internet service providers operating in this market.Further assume that they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for subscriptions.How much profit will each company earn?

A) $80,000

B) $120,000

C) $160,000

D) $210,000

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

48

Table 17-3. The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

Refer to Table 17-3.Assume that there are two profit-maximizing digital cable TV companies operating in this market.Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell.How much profit will each firm earn when this market reaches a Nash equilibrium?

A) $25,000

B) $90,000

C) $160,000

D) $215,000

Refer to Table 17-3.Assume that there are two profit-maximizing digital cable TV companies operating in this market.Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell.How much profit will each firm earn when this market reaches a Nash equilibrium?

A) $25,000

B) $90,000

C) $160,000

D) $215,000

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

49

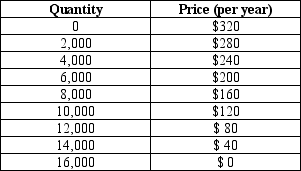

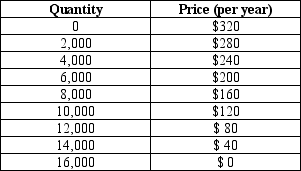

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $80.

Refer to Table 17-4.Suppose there is only one high-speed Internet service provider in this market and it seeks to maximize its profit.The company will

A) sell 6,000 subscriptions and charge a price of $200 for each subscription.

B) sell 8,000 subscriptions and charge a price of $160 for each subscription.

C) sell 10,000 subscriptions and charge a price of $120 for each subscription.

D) sell 12,000 subscriptions and charge a price of $80 for each subscription.

Refer to Table 17-4.Suppose there is only one high-speed Internet service provider in this market and it seeks to maximize its profit.The company will

A) sell 6,000 subscriptions and charge a price of $200 for each subscription.

B) sell 8,000 subscriptions and charge a price of $160 for each subscription.

C) sell 10,000 subscriptions and charge a price of $120 for each subscription.

D) sell 12,000 subscriptions and charge a price of $80 for each subscription.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

50

Table 17-5. Imagine a small town in which only two residents, Kunal and Naj, own wells that produce safe drinking water. Each week Kunal and Naj work together to decide how many gallons of water to pump, to bring the water to town, and to sell it at whatever price the market will bear. Assume Kunal and Naj can pump as much water as they want without cost so that the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.Suppose the town enacts new antitrust laws that prohibit Kunal and Naj from operating as a monopolist.What will quantity of water will each of them produce once the Nash equilibrium is reached?

A) Each will produce 50 gallons, for a total of 100 gallons.

B) Eacb will produce 75 gallons, for a total of 150 gallons.

C) Each will produce 100 gallons, for a total of 200 gallons.

D) Each will produce 125 gallons, for a total of 250 gallons.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.Suppose the town enacts new antitrust laws that prohibit Kunal and Naj from operating as a monopolist.What will quantity of water will each of them produce once the Nash equilibrium is reached?

A) Each will produce 50 gallons, for a total of 100 gallons.

B) Eacb will produce 75 gallons, for a total of 150 gallons.

C) Each will produce 100 gallons, for a total of 200 gallons.

D) Each will produce 125 gallons, for a total of 250 gallons.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

51

Table 17-5. Imagine a small town in which only two residents, Kunal and Naj, own wells that produce safe drinking water. Each week Kunal and Naj work together to decide how many gallons of water to pump, to bring the water to town, and to sell it at whatever price the market will bear. Assume Kunal and Naj can pump as much water as they want without cost so that the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.As long as Kunal and Naj operate as a profit-maximizing monopoly,what will their combined weekly revenue amount to?

A) $450

B) $675

C) $875

D) $900

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.As long as Kunal and Naj operate as a profit-maximizing monopoly,what will their combined weekly revenue amount to?

A) $450

B) $675

C) $875

D) $900

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

52

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $80.

Refer to Table 17-4.Assume there are two profit-maximizing high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.How many subscriptions will be sold altogether when this market reaches a Nash equilibrium?

A) 6,000

B) 8,000

C) 10,000

D) 12,000

Refer to Table 17-4.Assume there are two profit-maximizing high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.How many subscriptions will be sold altogether when this market reaches a Nash equilibrium?

A) 6,000

B) 8,000

C) 10,000

D) 12,000

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

53

Table 17-3. The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

Refer to Table 17-3.Assume there are two digital cable TV companies operating in this market.If they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for subscriptions,then their agreement will stipulate that

A) each firm will charge a price of $90 and each firm will sell 4,500 subscriptions.

B) each firm will charge a price of $90 and each firm will sell 9,000 subscriptions.

C) each firm will charge a price of $120 and each firm will sell 3,000 subscriptions.

D) each firm will charge a price of $150 and each firm will sell 1,500 subscriptions.

Refer to Table 17-3.Assume there are two digital cable TV companies operating in this market.If they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for subscriptions,then their agreement will stipulate that

A) each firm will charge a price of $90 and each firm will sell 4,500 subscriptions.

B) each firm will charge a price of $90 and each firm will sell 9,000 subscriptions.

C) each firm will charge a price of $120 and each firm will sell 3,000 subscriptions.

D) each firm will charge a price of $150 and each firm will sell 1,500 subscriptions.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

54

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $80.

Refer to Table 17-4.Assume there are two high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.What price will they charge for a subscription when this market reaches a Nash equilibrium?

A) $120

B) $160

C) $200

D) $240

Refer to Table 17-4.Assume there are two high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.What price will they charge for a subscription when this market reaches a Nash equilibrium?

A) $120

B) $160

C) $200

D) $240

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

55

Scenario 17-1. Assume that the countries of Irun and Urun are the only two producers of crude oil. Further assume that both countries have entered into an agreement to maintain certain production levels in order to maximize profits. In the world market for oil, the demand curve is downward sloping.

Refer to Scenario 17-1.As long as the combined level of output is less than the Nash equilibrium level,both Irun and Urun have the individual incentive to

A) hold production constant.

B) decrease production.

C) increase production.

D) increase price.

Refer to Scenario 17-1.As long as the combined level of output is less than the Nash equilibrium level,both Irun and Urun have the individual incentive to

A) hold production constant.

B) decrease production.

C) increase production.

D) increase price.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

56

Table 17-5. Imagine a small town in which only two residents, Kunal and Naj, own wells that produce safe drinking water. Each week Kunal and Naj work together to decide how many gallons of water to pump, to bring the water to town, and to sell it at whatever price the market will bear. Assume Kunal and Naj can pump as much water as they want without cost so that the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.Since Kunal and Naj operate as a profit-maximizing monopoly in the market for water,what price will they charge for water?

A) $2

B) $4

C) $6

D) $7

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.Since Kunal and Naj operate as a profit-maximizing monopoly in the market for water,what price will they charge for water?

A) $2

B) $4

C) $6

D) $7

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

57

Table 17-5. Imagine a small town in which only two residents, Kunal and Naj, own wells that produce safe drinking water. Each week Kunal and Naj work together to decide how many gallons of water to pump, to bring the water to town, and to sell it at whatever price the market will bear. Assume Kunal and Naj can pump as much water as they want without cost so that the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.The socially efficient level of water supplied to the market would be

A) 50 gallons.

B) 150 gallons.

C) 225 gallons.

D) 300 gallons.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.The socially efficient level of water supplied to the market would be

A) 50 gallons.

B) 150 gallons.

C) 225 gallons.

D) 300 gallons.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

58

Table 17-3. The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

Refer to Table 17-3.Assume there are two profit-maximizing digital cable TV companies operating in this market.Further assume that they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for subscriptions.How much profit will each company earn?

A) $610,000

B) $550,000

C) $405,000

D) $205,000

Refer to Table 17-3.Assume there are two profit-maximizing digital cable TV companies operating in this market.Further assume that they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for subscriptions.How much profit will each company earn?

A) $610,000

B) $550,000

C) $405,000

D) $205,000

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

59

Table 17-5. Imagine a small town in which only two residents, Kunal and Naj, own wells that produce safe drinking water. Each week Kunal and Naj work together to decide how many gallons of water to pump, to bring the water to town, and to sell it at whatever price the market will bear. Assume Kunal and Naj can pump as much water as they want without cost so that the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.Suppose the town enacts new antitrust laws that prohibit Kunal and Naj from operating as a monopolist.Once the Nash equilibrium is reached,how much profit will each producer earn?

A) $400.00

B) $437.50

C) $450.00

D) $800.00

The weekly town demand schedule and total revenue schedule for water are shown in the table below.

Refer to Table 17-5.Suppose the town enacts new antitrust laws that prohibit Kunal and Naj from operating as a monopolist.Once the Nash equilibrium is reached,how much profit will each producer earn?

A) $400.00

B) $437.50

C) $450.00

D) $800.00

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

60

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $80.

Refer to Table 17-4.Assume there are two high-speed Internet service providers that operate in this market.If they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for subscriptions,then their agreement will stipulate that

A) each firm will charge a price of $120 and each firm will sell 5,000 subscriptions.

B) each firm will charge a price of $160 and each firm will sell 4,000 subscriptions.

C) each firm will charge a price of $100 and each firm will sell 3,000 subscriptions.

D) each firm will charge a price of $200 and each firm will sell 3,000 subscriptions.

Refer to Table 17-4.Assume there are two high-speed Internet service providers that operate in this market.If they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged for subscriptions,then their agreement will stipulate that

A) each firm will charge a price of $120 and each firm will sell 5,000 subscriptions.

B) each firm will charge a price of $160 and each firm will sell 4,000 subscriptions.

C) each firm will charge a price of $100 and each firm will sell 3,000 subscriptions.

D) each firm will charge a price of $200 and each firm will sell 3,000 subscriptions.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

61

The equilibrium quantity in markets characterized by oligopoly is

A) higher than in monopoly markets and higher than in perfectly competitive markets.

B) higher than in monopoly markets and lower than in perfectly competitive markets.

C) lower than in monopoly markets and higher than in perfectly competitive markets.

D) lower than in monopoly markets and lower than in perfectly competitive markets.

A) higher than in monopoly markets and higher than in perfectly competitive markets.

B) higher than in monopoly markets and lower than in perfectly competitive markets.

C) lower than in monopoly markets and higher than in perfectly competitive markets.

D) lower than in monopoly markets and lower than in perfectly competitive markets.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

62

A group of firms that act in unison to maximize collective profits is called a

A) monopolistically competitive industry.

B) monopoly.

C) cartel.

D) Nash equilibrium market.

A) monopolistically competitive industry.

B) monopoly.

C) cartel.

D) Nash equilibrium market.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

63

Cartels are difficult to maintain because

A) antitrust laws are difficult to enforce.

B) cartel agreements are conducive to monopoly outcomes.

C) there is always tension between cooperation and self-interest in a cartel.

D) firms pay little attention to the decisions made by other firms.

A) antitrust laws are difficult to enforce.

B) cartel agreements are conducive to monopoly outcomes.

C) there is always tension between cooperation and self-interest in a cartel.

D) firms pay little attention to the decisions made by other firms.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

64

A situation in which firms choose their best strategy given the strategies chosen by the other firms in the market is called

A) a competitive equilibrium.

B) an open-market solution.

C) a socially-optimal solution.

D) a Nash equilibrium.

A) a competitive equilibrium.

B) an open-market solution.

C) a socially-optimal solution.

D) a Nash equilibrium.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

65

As a group,oligopolists earn the highest profit when they

A) achieve a Nash equilibrium.

B) produce a total quantity of output that falls short of the Nash-equilibrium total quantity.

C) produce a total quantity of output that exceeds the Nash-equilibrium total quantity.

D) charge a price that falls short of the Nash-equilibrium price.

A) achieve a Nash equilibrium.

B) produce a total quantity of output that falls short of the Nash-equilibrium total quantity.

C) produce a total quantity of output that exceeds the Nash-equilibrium total quantity.

D) charge a price that falls short of the Nash-equilibrium price.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

66

Scenario 17-1. Assume that the countries of Irun and Urun are the only two producers of crude oil. Further assume that both countries have entered into an agreement to maintain certain production levels in order to maximize profits. In the world market for oil, the demand curve is downward sloping.

Refer to Scenario 17-1.If Irun fails to live up to the production agreement and overproduces,which of the following statements will be true of Urun's condition?

A) Urun will invariably be worse off than before the agreement was broken.

B) Urun will counter by decreasing its production in order to maintain price stability.

C) Urun's profit will be maximized by holding its production constant.

D) Urun's profit will be unaffected by Irun's actions.

Refer to Scenario 17-1.If Irun fails to live up to the production agreement and overproduces,which of the following statements will be true of Urun's condition?

A) Urun will invariably be worse off than before the agreement was broken.

B) Urun will counter by decreasing its production in order to maintain price stability.

C) Urun's profit will be maximized by holding its production constant.

D) Urun's profit will be unaffected by Irun's actions.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

67

When oligopolistic firms interacting with one another each choose their best strategy given the strategies chosen by other firms in the market,we have

A) a cartel.

B) a group of oligopolists behaving as a monopoly.

C) a Nash equilibrium.

D) the perfectly competitive outcome.

A) a cartel.

B) a group of oligopolists behaving as a monopoly.

C) a Nash equilibrium.

D) the perfectly competitive outcome.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

68

As the number of firms in an oligopoly market

A) decreases, the price charged by firms likely decreases.

B) decreases, the market approaches the competitive market outcome.

C) increases, the market approaches the competitive market outcome.

D) increases, the market approaches the monopoly outcome.

A) decreases, the price charged by firms likely decreases.

B) decreases, the market approaches the competitive market outcome.

C) increases, the market approaches the competitive market outcome.

D) increases, the market approaches the monopoly outcome.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

69

Assume oligopoly firms are profit maximizers,they do not form a cartel,and they take other firms' production levels as given.Then in equilibrium the output effect

A) must dominate the price effect.

B) must be smaller than the price effect.

C) must balance with the price effect.

D) can be larger or smaller than the price effect.

A) must dominate the price effect.

B) must be smaller than the price effect.

C) must balance with the price effect.

D) can be larger or smaller than the price effect.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

70

Suppose a market is initially perfectly competitive with many firms selling an identical product.Over time,however,suppose the merging of firms results in the market being served by only three or four firms selling this same product.As a result,we would expect

A) an increase in market output and an increase in the price of the product.

B) an increase in market output and an decrease in the price of the product.

C) a decrease in market output and an increase in the price of the product.

D) a decrease in market output and a decrease in the price of the product.

A) an increase in market output and an increase in the price of the product.

B) an increase in market output and an decrease in the price of the product.

C) a decrease in market output and an increase in the price of the product.

D) a decrease in market output and a decrease in the price of the product.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

71

Assuming that oligopolists do not have the opportunity to collude,once they have reached the Nash equilibrium,it

A) is always in their best interest to supply more to the market.

B) is always in their best interest to supply less to the market.

C) is always in their best interest to leave their quantities supplied unchanged.

D) may be in their best interest to do any of the above, depending on market conditions.

A) is always in their best interest to supply more to the market.

B) is always in their best interest to supply less to the market.

C) is always in their best interest to leave their quantities supplied unchanged.

D) may be in their best interest to do any of the above, depending on market conditions.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

72

Which of these situations produces the largest profits for oligopolists?

A) The firms reach a Nash equilibrium.

B) The firms reach the monopoly outcome.

C) The firms reach the competitive outcome.

D) The firms produce a quantity of output that lies between the competitive outcome and the monopoly outcome.

A) The firms reach a Nash equilibrium.

B) The firms reach the monopoly outcome.

C) The firms reach the competitive outcome.

D) The firms produce a quantity of output that lies between the competitive outcome and the monopoly outcome.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

73

In a duopoly situation,the logic of self-interest results in a total output level that

A) equals the output level that would prevail in a competitive market.

B) equals the output level that would prevail in a monopoly.

C) exceeds the monopoly level of output, but falls short of the competitive level of output.

D) falls short of the monopoly level of output.

A) equals the output level that would prevail in a competitive market.

B) equals the output level that would prevail in a monopoly.

C) exceeds the monopoly level of output, but falls short of the competitive level of output.

D) falls short of the monopoly level of output.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

74

In a particular town,Comvision and Veriview are the only two providers of cable TV service.Comvision and Veriview constitute a

A) duopoly, whether they collude or not.

B) cartel, whether they collude or not.

C) Nash industry, whether they collude or not.

D) monopolistically competitive market if they charge the same price.

A) duopoly, whether they collude or not.

B) cartel, whether they collude or not.

C) Nash industry, whether they collude or not.

D) monopolistically competitive market if they charge the same price.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

75

There are two types of markets in which firms face some competition yet are still able to have some control over the prices of their products.Those two types of market are

A) monopolistic competition and oligopoly.

B) duopoly and triopoly.

C) perfect competition and monopolistic competition.

D) duopoly and imperfect competition.

A) monopolistic competition and oligopoly.

B) duopoly and triopoly.

C) perfect competition and monopolistic competition.

D) duopoly and imperfect competition.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

76

The equilibrium price in a market characterized by oligopoly is

A) higher than in monopoly markets and higher than in perfectly competitive markets.

B) higher than in monopoly markets and lower than in perfectly competitive markets.

C) lower than in monopoly markets and higher than in perfectly competitive markets.

D) lower than in monopoly markets and lower than in perfectly competitive markets.

A) higher than in monopoly markets and higher than in perfectly competitive markets.

B) higher than in monopoly markets and lower than in perfectly competitive markets.

C) lower than in monopoly markets and higher than in perfectly competitive markets.

D) lower than in monopoly markets and lower than in perfectly competitive markets.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

77

When an oligopoly market reaches a Nash equilibrium,

A) the market price will be different for each firm.

B) the firms will not have behaved as profit maximizers.

C) a firm will have chosen its best strategy, given the strategies chosen by other firms in the market.

D) a firm will not take into account the strategies of competing firms.

A) the market price will be different for each firm.

B) the firms will not have behaved as profit maximizers.

C) a firm will have chosen its best strategy, given the strategies chosen by other firms in the market.

D) a firm will not take into account the strategies of competing firms.

Unlock Deck

Unlock for access to all 410 flashcards in this deck.

Unlock Deck

k this deck

78

For cartels,as the number of firms (members of the cartel)increases,

A) the monopoly outcome becomes more likely.

B) the magnitude of the price effect decreases.

C) the more concerned each seller is about its own impact on the market price.

D) the easier it becomes to observe members violating their agreements.

A) the monopoly outcome becomes more likely.

B) the magnitude of the price effect decreases.