Deck 13: Inequality, Social Insurance, and Redistribution

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/190

Play

Full screen (f)

Deck 13: Inequality, Social Insurance, and Redistribution

1

In the text, the population is divided into _____ groups based on income, and each group is called _____ when data on the distribution of income in a country are presented.

A)four; a quarter

B)five; a quintile

C)six; a section

D)three; an income bracket

A)four; a quarter

B)five; a quintile

C)six; a section

D)three; an income bracket

B

2

Assume that a country with total income of $160,000 has a population of 10 households whose incomes are listed in Table: Income of Households.

What percentage of income is earned by the top quintile of the population?

A)110%

B)94%

C)69%

D)6%

What percentage of income is earned by the top quintile of the population?

A)110%

B)94%

C)69%

D)6%

69%

3

Assume that a country with total income of $160,000 has a population of 10 households whose incomes are listed in Table: Income of Households.

What percentage of income is earned by the bottom quintile of the population?

A)8%

B)4%

C)3%

D)2%

What percentage of income is earned by the bottom quintile of the population?

A)8%

B)4%

C)3%

D)2%

2%

4

Table: Income Distribution in Four Countries provides recent data from the World Bank on the distribution of income in four countries.

Based on the data, the country with the most unequal distribution of income is:

A)Bangladesh.

B)El Salvador.

C)Mexico.

D)Costa Rica.

Based on the data, the country with the most unequal distribution of income is:

A)Bangladesh.

B)El Salvador.

C)Mexico.

D)Costa Rica.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

5

Table: Income Distribution in Four Countries provides recent data from the World Bank on the distribution of income in four countries.

Based on the data, the country with the distribution of income that is closest to equal is:

A)Bangladesh.

B)El Salvador.

C)Mexico.

D)Costa Rica.

Based on the data, the country with the distribution of income that is closest to equal is:

A)Bangladesh.

B)El Salvador.

C)Mexico.

D)Costa Rica.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

6

Data on the distribution of income for the United States show that from 1970 through 2014, the share of income earned by the top quintile _____, and the share earned by the bottom quintile _____.

A)rose; rose

B)rose; fell

C)fell; rose

D)fell; fell

A)rose; rose

B)rose; fell

C)fell; rose

D)fell; fell

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

7

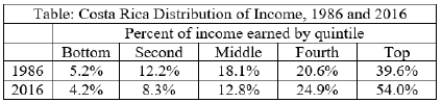

Data from the World Bank for the top and bottom quintiles of the distribution of income in Costa Rica for two years are presented in Table: Costa Rica Income Distribution, Top and Bottom Quintiles.

Which of the following statements is correct for the time period based on the data in the table?

A)The incomes of those in the top quintile decreased.

B)The incomes of those in the bottom quintile increased.

C)The distribution of income has become more equal in the country.

D)The distribution of income has become more unequal in the country.

Which of the following statements is correct for the time period based on the data in the table?

A)The incomes of those in the top quintile decreased.

B)The incomes of those in the bottom quintile increased.

C)The distribution of income has become more equal in the country.

D)The distribution of income has become more unequal in the country.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

8

Data from the World Bank for the top and bottom quintiles of the distribution of income in Costa Rica for two years are presented in Table: Costa Rica Income Distribution, Top and Bottom Quintiles.

Which of the following claims CANNOT be made conclusively for the time period based on the data in the table?

A)Costa Rica's distribution of income became more unequal.

B)The top quintile percentage of total income became a larger multiple of the bottom quintile percentage of total income between 1986 and 2016.

C)Average income in the bottom quintile was lower in 2016 than it was in 1986.

D)The top quintile earned a higher share of total income in 2016 than in 1986.

Which of the following claims CANNOT be made conclusively for the time period based on the data in the table?

A)Costa Rica's distribution of income became more unequal.

B)The top quintile percentage of total income became a larger multiple of the bottom quintile percentage of total income between 1986 and 2016.

C)Average income in the bottom quintile was lower in 2016 than it was in 1986.

D)The top quintile earned a higher share of total income in 2016 than in 1986.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

9

Recent data from the World Bank for the distribution of income and average income in Sri Lanka and Mongolia are presented in Table: Distribution of Income and Average Income for Sri Lanka and Mongolia.

Based on the data in the table, which of the following statements is correct?

A)Average household income varies more in Mongolia than in Sri Lanka.

B)The rich tend to be richer in Mongolia than in Sri Lanka.

C)Average income in the top quintile is lower in Sri Lanka than in Mongolia.

D)Average income in the bottom quintile is lower in Sri Lanka than in Mongolia.

Based on the data in the table, which of the following statements is correct?

A)Average household income varies more in Mongolia than in Sri Lanka.

B)The rich tend to be richer in Mongolia than in Sri Lanka.

C)Average income in the top quintile is lower in Sri Lanka than in Mongolia.

D)Average income in the bottom quintile is lower in Sri Lanka than in Mongolia.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

10

Table: Average Income and Distribution of Income Data provides recent data from the World Bank on average income and the distribution of income in four countries.

Based on the data in the table, those in the bottom quintile have the lowest average income in which country?

A)Bangladesh

B)Uganda

C)Sri Lanka

D)Mongolia

Based on the data in the table, those in the bottom quintile have the lowest average income in which country?

A)Bangladesh

B)Uganda

C)Sri Lanka

D)Mongolia

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

11

Table: Average Income and Distribution of Income Data provides recent data from the World Bank on average income and the distribution of income in four countries.

Based on the data in the table, those in the top quintile have the highest average income in which country?

A)Bangladesh

B)Uganda

C)Sri Lanka

D)Mongolia

Based on the data in the table, those in the top quintile have the highest average income in which country?

A)Bangladesh

B)Uganda

C)Sri Lanka

D)Mongolia

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

12

Table: Average Income and Distribution of Income Data provides data on average income and the distribution of income in four countries.

According to the data in the table, which country has the largest dollar gap between the average income of those in the top and bottom quintiles?

A)country A

B)country B

C)country C

D)country D

According to the data in the table, which country has the largest dollar gap between the average income of those in the top and bottom quintiles?

A)country A

B)country B

C)country C

D)country D

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

13

Table: Average Income and Distribution of Income Data provides recent data from the World Bank on average income and the distribution of income in four countries.

According to the data in the table, which statement is correct regarding the situations of Sri Lanka and Mongolia?

A)The average household is more prosperous in Mongolia than in Sri Lanka.

B)Average income in the top quintile is higher in Mongolia than in Sri Lanka.

C)Average income in the bottom quintile is higher in Mongolia than in Sri Lanka.

D)There is a bigger gap in average income between the top and bottom quintiles in Mongolia than in Sri Lanka.

According to the data in the table, which statement is correct regarding the situations of Sri Lanka and Mongolia?

A)The average household is more prosperous in Mongolia than in Sri Lanka.

B)Average income in the top quintile is higher in Mongolia than in Sri Lanka.

C)Average income in the bottom quintile is higher in Mongolia than in Sri Lanka.

D)There is a bigger gap in average income between the top and bottom quintiles in Mongolia than in Sri Lanka.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

14

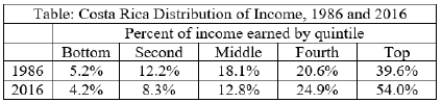

Use the World Bank data in Table: Costa Rica Distribution of Income, 1986 and 2016 to determine what happened to the distribution of income in Costa Rica over the time period 1986 to 2016.

A)It remained the same.

B)It became more unequal.

C)It moved closer to equality.

D)It became more equal at the top and bottom and less equal in the middle.

A)It remained the same.

B)It became more unequal.

C)It moved closer to equality.

D)It became more equal at the top and bottom and less equal in the middle.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

15

Hedra is a legislator who is concerned about income inequality in her country. She has data on the distribution of income over time that show that the distribution is becoming more unequal. Which important step should she take next in order to make credible arguments in the legislature that income inequality is an issue that needs attention?

A)Examine current data on the issue.

B)Check to see if data related to the issue have changed over time.

C)Determine if the outcome is fair.

D)Determine if her conclusions are consistent across alternative ways of conceptualizing and measuring the issue.

A)Examine current data on the issue.

B)Check to see if data related to the issue have changed over time.

C)Determine if the outcome is fair.

D)Determine if her conclusions are consistent across alternative ways of conceptualizing and measuring the issue.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

16

Jose has spent most of his life in the top two quintiles of income distribution, although he did spend a year without earned income when he lost his job during a recession. Which of the following ways of thinking about inequality explains why someone might make the observation that Jose's living standard did not vary as much as his income varied?

A)permanent income

B)consumption and inequality of living standards

C)wealth and inequality of purchasing power

D)intergenerational mobility

A)permanent income

B)consumption and inequality of living standards

C)wealth and inequality of purchasing power

D)intergenerational mobility

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

17

In the field of economics, the observation that the living standard of a household is more stable than its income, because people think in terms of their long-term earnings as they spend, is known as:

A)permanent income versus current income.

B)consumption and inequality of living standards.

C)wealth and inequality of purchasing power.

D)intergenerational mobility and inequality of opportunity.

A)permanent income versus current income.

B)consumption and inequality of living standards.

C)wealth and inequality of purchasing power.

D)intergenerational mobility and inequality of opportunity.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

18

Focusing on differences in the amount people actually spend on goods and services as a measure of their material well-being rather than comparing their current incomes leads to a focus on _____ in discussions of the level of economic inequality across households.

A)permanent income

B)consumption

C)wealth

D)intergenerational mobility

A)permanent income

B)consumption

C)wealth

D)intergenerational mobility

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

19

_____ is a stock that is more unequal across households than income, which is a flow.

A)Wealth

B)Age

C)Permanent income

D)Consumption

A)Wealth

B)Age

C)Permanent income

D)Consumption

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

20

Economists believe that average lifetime income is a better predictor of a person's current living standard than current income because:

A)wealth from assets allows increasing consumption as a person gets older.

B)people can save and borrow to average out consumption over their lifetimes.

C)income levels in a person's childhood home are a strong predictor of adult income.

D)the distribution of income is fixed over a person's lifetime.

A)wealth from assets allows increasing consumption as a person gets older.

B)people can save and borrow to average out consumption over their lifetimes.

C)income levels in a person's childhood home are a strong predictor of adult income.

D)the distribution of income is fixed over a person's lifetime.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

21

_____ is often used as a measure of the equality or inequality of opportunity rather than using equality or inequality of outcomes.

A)Childhood household income

B)Permanent income

C)Intergenerational mobility

D)Wealth

A)Childhood household income

B)Permanent income

C)Intergenerational mobility

D)Wealth

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

22

Intergenerational mobility is the extent to which:

A)children own more personal transportation vehicles (such as cars and motorcycles) than their parents did.

B)the geographic dispersion of families occurs as children pursue economic opportunities.

C)the income of children in a given family varies across the children.

D)the economic status of children is independent of the economic status of their parents.

A)children own more personal transportation vehicles (such as cars and motorcycles) than their parents did.

B)the geographic dispersion of families occurs as children pursue economic opportunities.

C)the income of children in a given family varies across the children.

D)the economic status of children is independent of the economic status of their parents.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

23

How do people's beliefs about the distribution of wealth in the United States compare to the actual distribution of wealth in the country?

A)People have an accurate view of the distribution of wealth.

B)People believe the distribution of wealth is more equal than it actually is.

C)People believe the distribution of wealth is more unequal than it actually is.

D)People believe the distribution of wealth is changing rapidly and becoming more equal.

A)People have an accurate view of the distribution of wealth.

B)People believe the distribution of wealth is more equal than it actually is.

C)People believe the distribution of wealth is more unequal than it actually is.

D)People believe the distribution of wealth is changing rapidly and becoming more equal.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

24

How do American's beliefs about the ideal distribution of wealth compare to their perception of the distribution of wealth in the United States?

A)The ideal distribution of wealth is more equal than the perceived distribution of wealth.

B)The ideal distribution of wealth is less equal than the perceived distribution of wealth.

C)The ideal distribution of wealth is the same as the perceived distribution of wealth.

D)Views of the ideal distribution are becoming more unequal, and the perception of the distribution of wealth is becoming more equal.

A)The ideal distribution of wealth is more equal than the perceived distribution of wealth.

B)The ideal distribution of wealth is less equal than the perceived distribution of wealth.

C)The ideal distribution of wealth is the same as the perceived distribution of wealth.

D)Views of the ideal distribution are becoming more unequal, and the perception of the distribution of wealth is becoming more equal.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

25

Permanent income is a person's:

A)average income over the past 10 years.

B)fixed income in retirement.

C)average income over their lifetime.

D)estimate of future income based on education and skills.

A)average income over the past 10 years.

B)fixed income in retirement.

C)average income over their lifetime.

D)estimate of future income based on education and skills.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

26

Differences in consumer spending tend to vary _____ differences in income.

A)in proportion to

B)more than

C)less than

D)not at all compared to

A)in proportion to

B)more than

C)less than

D)not at all compared to

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

27

The distribution of wealth is _____ the distribution of income.

A)the same as

B)more unequal than

C)less unequal than

D)unrelated to

A)the same as

B)more unequal than

C)less unequal than

D)unrelated to

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

28

Juan is 80 years old. Over Juan's adult lifetime, he accumulated savings for several decades and is using that savings to cover his expenses in retirement. Early in life when his income was low, he borrowed funds several times to cover his expenses, paying back the loans over the next few years. Juan's consumption pattern over his lifetime was influenced heavily by his:

A)permanent income.

B)annual income.

C)wealth.

D)intergenerational mobility.

A)permanent income.

B)annual income.

C)wealth.

D)intergenerational mobility.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

29

How has the U.S. poverty rate varied over the past 40 years?

A)The rate has had an upward trend.

B)The rate has had a downward trend.

C)The rate has been relatively stable.

D)The rate rose for 20 years and then fell for 20 years.

A)The rate has had an upward trend.

B)The rate has had a downward trend.

C)The rate has been relatively stable.

D)The rate rose for 20 years and then fell for 20 years.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

30

The poverty line is:

A)a measure that is used to define relative poverty and is based on housing and food costs.

B)an estimate of the minimum income needed to provide a comfortable standard of living.

C)an income level determined by the government, below which a family is defined to be in poverty.

D)an income level set by the poor to identify the income needed to cover their basic needs.

A)a measure that is used to define relative poverty and is based on housing and food costs.

B)an estimate of the minimum income needed to provide a comfortable standard of living.

C)an income level determined by the government, below which a family is defined to be in poverty.

D)an income level set by the poor to identify the income needed to cover their basic needs.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

31

The poverty rate is the:

A)portion of the population who cannot afford to pay rent.

B)percent of people whose family income is below the poverty line.

C)income level below which a household cannot provide itself with necessities.

D)income level based on three times the cost of basic food.

A)portion of the population who cannot afford to pay rent.

B)percent of people whose family income is below the poverty line.

C)income level below which a household cannot provide itself with necessities.

D)income level based on three times the cost of basic food.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

32

The percent of the population whose household income falls below the poverty line is known as the:

A)poverty line proportion.

B)needs rate.

C)poverty prevalence.

D)poverty rate.

A)poverty line proportion.

B)needs rate.

C)poverty prevalence.

D)poverty rate.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

33

The poverty line in the United States is based on an estimate of:

A)the cost of basic food, housing, medical care, and transportation.

B)minimum wage income.

C)three times the value of low-cost food for the household.

D)the income level that separates the bottom and second quintiles of the population.

A)the cost of basic food, housing, medical care, and transportation.

B)minimum wage income.

C)three times the value of low-cost food for the household.

D)the income level that separates the bottom and second quintiles of the population.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

34

In the United States, the poverty line income:

A)is based on estimated medical care costs.

B)excludes medical care costs.

C)is the same for all households.

D)is adjusted based on family size.

A)is based on estimated medical care costs.

B)excludes medical care costs.

C)is the same for all households.

D)is adjusted based on family size.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

35

What is the basis for the income level that the U.S. government uses as the poverty line?

A)the value of low-cost rent, food, transportation, and medical care annually for the family size

B)the income line that separates the bottom quintile from the second quintile of earners

C)the average household income of the lowest-paid 15% of households

D)the value of a low-cost food plan multiplied by three, updated annually for inflation

A)the value of low-cost rent, food, transportation, and medical care annually for the family size

B)the income line that separates the bottom quintile from the second quintile of earners

C)the average household income of the lowest-paid 15% of households

D)the value of a low-cost food plan multiplied by three, updated annually for inflation

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

36

When a poverty line is based on relative poverty, a household is poor if its income is less than:

A)one-half the median household income in the country.

B)three times the cost of a low-cost food plan for the household.

C)twice the rent on a low-cost two-bedroom apartment.

D)$3 per day per person in the household.

A)one-half the median household income in the country.

B)three times the cost of a low-cost food plan for the household.

C)twice the rent on a low-cost two-bedroom apartment.

D)$3 per day per person in the household.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements describes a poverty line based on absolute poverty?

A)It is the income level that separates the bottom and second quintiles in the distribution of income.

B)Household assets are worth less than a third of the average household assets in the nation.

C)Income is below $5 per day per person in the household.

D)It is an income that provides less than the average household is able to buy.

A)It is the income level that separates the bottom and second quintiles in the distribution of income.

B)Household assets are worth less than a third of the average household assets in the nation.

C)Income is below $5 per day per person in the household.

D)It is an income that provides less than the average household is able to buy.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

38

The United Nations and the World Bank use poverty lines that are based on:

A)an absolute poverty measure.

B)a relative poverty measure.

C)a higher standard of living than what is represented by the U.S. poverty line.

D)the same standard of living as the U.S. poverty line.

A)an absolute poverty measure.

B)a relative poverty measure.

C)a higher standard of living than what is represented by the U.S. poverty line.

D)the same standard of living as the U.S. poverty line.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

39

When the definition of poverty focuses on relative poverty, a person is in poverty if the household income is:

A)in the bottom 10% of household incomes in the nation.

B)insufficient to provide basic food, shelter, medical care, and transportation.

C)is less than three times the cost of a basic food plan.

D)below $3.10 per day.

A)in the bottom 10% of household incomes in the nation.

B)insufficient to provide basic food, shelter, medical care, and transportation.

C)is less than three times the cost of a basic food plan.

D)below $3.10 per day.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

40

Yifen lives in a very prosperous nation. Her household income is high enough to allow her family to take a vacation to the mountains each year and pay for piano lessons for her daughter after covering food, shelter, medical care, transportation, and clothing. It exceeds the official poverty line. However, because her household income is in the bottom 10% of households in her nation, Yifen often claims that she is poor. Yifen is claiming:

A)absolute poverty because her income is below an officially set minimum standard of living.

B)absolute poverty because she has less income than most others in her society.

C)relative poverty because her income is below an officially set minimum standard of living.

D)relative poverty because she has less income than most others in her society.

A)absolute poverty because her income is below an officially set minimum standard of living.

B)absolute poverty because she has less income than most others in her society.

C)relative poverty because her income is below an officially set minimum standard of living.

D)relative poverty because she has less income than most others in her society.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

41

Malia and Asi have a household income that is insufficient to pay for both food and shelter, with no funds available for other types of expenses. However, their household income is higher than 75% of the households in their developing nation. Malia feels that they are poor, and Asi feels that they are prosperous. Their feelings are consistent with which views of poverty?

A)Malia focuses on relative poverty, and Asi focuses on extreme poverty.

B)Malia focuses on extreme poverty, and Asi focuses on absolute poverty.

C)Malia focuses on absolute poverty, and Asi focuses on relative poverty.

D)Malia focuses on relative poverty, and Asi focuses on absolute poverty.

A)Malia focuses on relative poverty, and Asi focuses on extreme poverty.

B)Malia focuses on extreme poverty, and Asi focuses on absolute poverty.

C)Malia focuses on absolute poverty, and Asi focuses on relative poverty.

D)Malia focuses on relative poverty, and Asi focuses on absolute poverty.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

42

Otto and Marta live in a nation with a 15% poverty rate. Their household income is sufficient to pay for food, shelter, and basic needs with some funds available for other things their family wants. However, their household income is lower than 75% of the households in their nation. Otto believes that they are prosperous and not poor, but Marta believes that they are poor. Otto is defining poverty in _____ terms, and Marta is defining poverty in _____ terms.

A)absolute; relative

B)relative; absolute

C)relative, relative

D)relative; extreme

A)absolute; relative

B)relative; absolute

C)relative, relative

D)relative; extreme

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

43

Olya and her husband share an apartment. He feels prosperous because they have enough income to cover food, shelter, and other basic needs without going into debt. She feels poor because she has less than her sister's family and the families of some of her friends. Olya is defining poverty in _____ terms, while her husband is defining poverty in _____ terms.

A)absolute; extreme

B)relative; absolute

C)extreme, relative

D)relative; extreme

A)absolute; extreme

B)relative; absolute

C)extreme, relative

D)relative; extreme

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following poverty standards uses a measure of relative poverty?

A)annual income below $8,000 per person in the household

B)the minimum income level that covers basic food, shelter, transportation, and medical care

C)the bottom 10% of household incomes

D)income of $3.10 or less per day

A)annual income below $8,000 per person in the household

B)the minimum income level that covers basic food, shelter, transportation, and medical care

C)the bottom 10% of household incomes

D)income of $3.10 or less per day

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

45

If a poverty line is set at a third of the median household income in a country, the poverty line is based on a _____ poverty standard.

A)fixed

B)absolute

C)relative

D)extreme

A)fixed

B)absolute

C)relative

D)extreme

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

46

Rachelle is considered poor because her income is in the bottom quintile of the population. Marcella is considered poor because her income is below a long-standing poverty line of $10,000. Rachelle is considered to be in poverty under _____ poverty standard, and Marcella is considered to be in poverty under _____ poverty standard.

A)an absolute; an absolute

B)an absolute; a relative

C)a relative; an absolute

D)a relative; a relative

A)an absolute; an absolute

B)an absolute; a relative

C)a relative; an absolute

D)a relative; a relative

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

47

The global extreme poverty line of $1.90 per day is:

A)the same as the U.S. poverty line.

B)lower than the U.S. poverty line.

C)higher than the U.S. poverty line.

D)the same as the U.S. poverty line but adjusted for local price levels.

A)the same as the U.S. poverty line.

B)lower than the U.S. poverty line.

C)higher than the U.S. poverty line.

D)the same as the U.S. poverty line but adjusted for local price levels.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is NOT true of the incidence of poverty in the United States?

A)People of color are more likely than others to experience poverty.

B)Elderly people are more likely than other age groups to be in poverty.

C)Children and single moms are most likely to be in poverty.

D)Most people in poverty will spend much of their lives in poverty, but most people will spend some time in poverty during their lifetime.

A)People of color are more likely than others to experience poverty.

B)Elderly people are more likely than other age groups to be in poverty.

C)Children and single moms are most likely to be in poverty.

D)Most people in poverty will spend much of their lives in poverty, but most people will spend some time in poverty during their lifetime.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements is NOT correct for the United States?

A)Most people who are in poverty will spend much of their lives in poverty.

B)Most people will spend some time in poverty in their lifetime.

C)Children and single moms are the most likely to be in poverty.

D)People of color are less likely than others to experience poverty.

A)Most people who are in poverty will spend much of their lives in poverty.

B)Most people will spend some time in poverty in their lifetime.

C)Children and single moms are the most likely to be in poverty.

D)People of color are less likely than others to experience poverty.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

50

When there is a high level of intergenerational mobility among the poor in a nation:

A)most of the individuals who are poor remain poor.

B)most of the poor have incomes that are barely below the poverty line.

C)the age distribution among the poor is the same as the age distribution in the total population.

D)children of poor parents do not remain in poverty when they are adults.

A)most of the individuals who are poor remain poor.

B)most of the poor have incomes that are barely below the poverty line.

C)the age distribution among the poor is the same as the age distribution in the total population.

D)children of poor parents do not remain in poverty when they are adults.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

51

In which of the following situations would 100 people in poverty in a country be LEAST worrisome to policy makers?

A)There is a low level of intergenerational mobility among the poor.

B)Most of the poor have incomes just barely below the poverty line.

C)The poor remain poor for long periods of time.

D)There is little turnover among the poor. The same people stay in poverty.

A)There is a low level of intergenerational mobility among the poor.

B)Most of the poor have incomes just barely below the poverty line.

C)The poor remain poor for long periods of time.

D)There is little turnover among the poor. The same people stay in poverty.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

52

Data for the United States show that poverty is not evenly distributed across groups in the population. Which of the following groups has the LOWEST poverty rate?

A)single fathers

B)married couples

C)children

D)single mothers

A)single fathers

B)married couples

C)children

D)single mothers

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

53

Certain events can trigger a spell of poverty. Which of the following is NOT among the events that normally can trigger a spell of poverty?

A)retirement

B)divorce or separation in a marriage

C)the birth of a child

D)the loss of a job

A)retirement

B)divorce or separation in a marriage

C)the birth of a child

D)the loss of a job

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is NOT correct regarding the incidence of poverty in the United States?

A)People in long-term poverty are both a small proportion of those who enter poverty and a large share of the poor at a point in time.

B)Poverty is often recurrent, with over half of all people who escape poverty returning within five years.

C)Over half of all spells of poverty last no more than three months.

D)Long-term poverty is an important problem.

A)People in long-term poverty are both a small proportion of those who enter poverty and a large share of the poor at a point in time.

B)Poverty is often recurrent, with over half of all people who escape poverty returning within five years.

C)Over half of all spells of poverty last no more than three months.

D)Long-term poverty is an important problem.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

55

Across demographic groups in the U.S. population, the poverty rate:

A)tends to be equal.

B)varies by race/ethnicity and employment but not by family structure.

C)varies by employment and family structure but not by race/ethnicity.

D)varies by race/ethnicity, family structure, and employment.

A)tends to be equal.

B)varies by race/ethnicity and employment but not by family structure.

C)varies by employment and family structure but not by race/ethnicity.

D)varies by race/ethnicity, family structure, and employment.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

56

How common is it for Americans to have a spell of poverty during their lifetime?

A)Less than 10% will experience poverty.

B)Approximately 25% will have a spell of poverty.

C)No more than 35% will have a spell of poverty.

D)Over 50% will have a spell of poverty.

A)Less than 10% will experience poverty.

B)Approximately 25% will have a spell of poverty.

C)No more than 35% will have a spell of poverty.

D)Over 50% will have a spell of poverty.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

57

The cash-assistance, goods, and services provided by the government to better the lives of those at the bottom of the income distribution are known as the:

A)progressive tax system.

B)offset tax system.

C)social insurance.

D)social safety net.

A)progressive tax system.

B)offset tax system.

C)social insurance.

D)social safety net.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

58

What is social insurance?

A)It is the cash-assistance, goods, and services provided by the government to better the lives of those at the bottom of the income distribution.

B)It is government-provided financial funding to households to compensate for bad outcomes such as unemployment, illness, disability, or outliving their savings.

C)It is the government assignment of jobs to individuals based on household need and employee education and skills.

D)It is a system where those with more income tend to pay a higher share of their income in taxes than those with lower incomes.

A)It is the cash-assistance, goods, and services provided by the government to better the lives of those at the bottom of the income distribution.

B)It is government-provided financial funding to households to compensate for bad outcomes such as unemployment, illness, disability, or outliving their savings.

C)It is the government assignment of jobs to individuals based on household need and employee education and skills.

D)It is a system where those with more income tend to pay a higher share of their income in taxes than those with lower incomes.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

59

What is a social safety net?

A)It is the cash-assistance, goods, and services provided by the government to better the lives of those at the bottom of the income distribution.

B)It is government-provided financial funding to people to compensate for bad outcomes such as unemployment, illness, disability, or outliving their savings.

C)It is the government assignment of jobs to individuals based on household need and employee education and skills.

D)It is a system where those with more income tend to pay a higher share of their income in taxes than those with lower incomes.

A)It is the cash-assistance, goods, and services provided by the government to better the lives of those at the bottom of the income distribution.

B)It is government-provided financial funding to people to compensate for bad outcomes such as unemployment, illness, disability, or outliving their savings.

C)It is the government assignment of jobs to individuals based on household need and employee education and skills.

D)It is a system where those with more income tend to pay a higher share of their income in taxes than those with lower incomes.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

60

What is a progressive tax system?

A)It is the cash assistance, goods, and services provided by the government to better the lives of those at the bottom of the income distribution.

B)It is government-provided financial funding to people to compensate for bad outcomes such as unemployment, illness, disability, or outliving their savings.

C)It is the government assignment of jobs to individuals based on household need and employee education and skills.

D)It is a system where those with more income pay a higher share of their income in taxes than those with lower incomes.

A)It is the cash assistance, goods, and services provided by the government to better the lives of those at the bottom of the income distribution.

B)It is government-provided financial funding to people to compensate for bad outcomes such as unemployment, illness, disability, or outliving their savings.

C)It is the government assignment of jobs to individuals based on household need and employee education and skills.

D)It is a system where those with more income pay a higher share of their income in taxes than those with lower incomes.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

61

Government-provided financial funding to households to compensate for bad outcomes such as unemployment, illness, disability, or outliving your savings is known as a:

A)progressive tax system.

B)social safety net.

C)social insurance system.

D)disaster relief program.

A)progressive tax system.

B)social safety net.

C)social insurance system.

D)disaster relief program.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

62

A system where high-income households pay a higher share of their income in taxes than those with lower incomes is known as a:

A)social safety net.

B)regressive tax system.

C)social insurance program.

D)progressive tax system.

A)social safety net.

B)regressive tax system.

C)social insurance program.

D)progressive tax system.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

63

Social safety nets, social insurance programs, and progressive tax systems are all types of income _____ programs that have the impact of moving income distribution _____ equality.

A)redistribution; closer to

B)replacement; further from

C)redistribution; further from

D)replacement; closer to

A)redistribution; closer to

B)replacement; further from

C)redistribution; further from

D)replacement; closer to

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is NOT a means-tested social safety net program in the United States?

A)Medicaid

B)Social Security

C)housing assistance

D)earned income tax credit

A)Medicaid

B)Social Security

C)housing assistance

D)earned income tax credit

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

65

A government program provides needed medical care to households whose income falls below the poverty line. The program is funded through the general tax revenues in the country. This program would be classified as:

A)an income redistribution program in the social safety net.

B)an income maintenance program as a type of social insurance.

C)a progressive tax inversion in the social safety net.

D)a social insurance program to enhance poverty levels.

A)an income redistribution program in the social safety net.

B)an income maintenance program as a type of social insurance.

C)a progressive tax inversion in the social safety net.

D)a social insurance program to enhance poverty levels.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is a mean-tested social safety net program in the United States?

A)Social Security

B)worker's compensation

C)Medicare

D)earned income tax credit

A)Social Security

B)worker's compensation

C)Medicare

D)earned income tax credit

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

67

In the United States, the social insurance programs do NOT meet which of the following criteria?

A)They provide benefits to everyone, both rich and poor.

B)The benefits are based on certain bad outcomes.

C)People pay into social insurance programs.

D)They are means-tested.

A)They provide benefits to everyone, both rich and poor.

B)The benefits are based on certain bad outcomes.

C)People pay into social insurance programs.

D)They are means-tested.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

68

Government programs that are "means-tested" require:

A)all citizens to be eligible for benefits regardless of income.

B)the program to verify that it accomplishes its purposes through its activities.

C)recipients to be examined to verify health status.

D)eligibility to be based on income and sometimes on wealth.

A)all citizens to be eligible for benefits regardless of income.

B)the program to verify that it accomplishes its purposes through its activities.

C)recipients to be examined to verify health status.

D)eligibility to be based on income and sometimes on wealth.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

69

When eligibility for a government program is based on income and sometimes on wealth, the program is classified as _____ program.

A)an income-limited

B)a means-tested

C)a poverty-tested

D)a social insurance

A)an income-limited

B)a means-tested

C)a poverty-tested

D)a social insurance

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following statements describes a means-tested government program?

A)All persons are able to receive benefits after they reach 66 years of age.

B)Zain is eligible to receive benefits because he is disabled.

C)Hua Xing can receive benefits if she is too young to be head of a household.

D)Holly is eligible for benefits only if her household income is below $10,000 per year.

A)All persons are able to receive benefits after they reach 66 years of age.

B)Zain is eligible to receive benefits because he is disabled.

C)Hua Xing can receive benefits if she is too young to be head of a household.

D)Holly is eligible for benefits only if her household income is below $10,000 per year.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is an example of an in-kind transfer?

A)Junko receives an old-age pension from her former employer.

B)Tomasi is eligible for an income supplement because he lost his job.

C)Ellen is eligible for income because she had a type of accident that qualifies.

D)Martin receives housing from the government due to his low income.

A)Junko receives an old-age pension from her former employer.

B)Tomasi is eligible for an income supplement because he lost his job.

C)Ellen is eligible for income because she had a type of accident that qualifies.

D)Martin receives housing from the government due to his low income.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

72

Some safety net programs provide specific goods rather than income or tax breaks. This type of program benefit is known as:

A)an in-kind transfer.

B)an income-substitute transfer.

C)a product-specific transfer.

D)an alternative need transfer.

A)an in-kind transfer.

B)an income-substitute transfer.

C)a product-specific transfer.

D)an alternative need transfer.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is NOT one of the four key reasons that the government provides in-kind benefits rather than cash benefits?

A)Giving goods rather than cash prevents recipients from making bad choices.

B)An in-kind benefit like child care is a complement to work, which provides some incentive for recipients to provide for themselves rather than rely on the safety net.

C)In-kind benefits give the recipient the greatest flexibility to choose what matters most.

D)Taxpayers may care more about reducing homelessness or hunger than what will make the recipient happiest.

A)Giving goods rather than cash prevents recipients from making bad choices.

B)An in-kind benefit like child care is a complement to work, which provides some incentive for recipients to provide for themselves rather than rely on the safety net.

C)In-kind benefits give the recipient the greatest flexibility to choose what matters most.

D)Taxpayers may care more about reducing homelessness or hunger than what will make the recipient happiest.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following gifts is most like an income transfer rather than an in-kind transfer?

A)membership in a gym for a year

B)an antique book

C)a custom-tailored suit with the recipient choosing fabric and style

D)a gift card branded through one of the main credit card companies

A)membership in a gym for a year

B)an antique book

C)a custom-tailored suit with the recipient choosing fabric and style

D)a gift card branded through one of the main credit card companies

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

75

Benefits from social safety net programs may come in the forms of:

A)cash assistance, expense reimbursements, or in-kind transfers.

B)expense reimbursements, tax breaks, or cash assistance.

C)cash assistance, tax breaks, or in-kind transfers.

D)tax breaks, in-kind transfers, or expense reimbursements.

A)cash assistance, expense reimbursements, or in-kind transfers.

B)expense reimbursements, tax breaks, or cash assistance.

C)cash assistance, tax breaks, or in-kind transfers.

D)tax breaks, in-kind transfers, or expense reimbursements.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is a social insurance program in the United States?

A)Medicaid

B)Social Security

C)housing assistance

D)earned income tax credit

A)Medicaid

B)Social Security

C)housing assistance

D)earned income tax credit

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is NOT a social insurance program in the United States?

A)housing assistance

B)Social Security

C)worker's compensation

D)Medicare

A)housing assistance

B)Social Security

C)worker's compensation

D)Medicare

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is NOT a characteristic of social insurance programs?

A)Benefits are based on past earnings.

B)Employers and workers pay for social insurance programs.

C)Benefit eligibility is based on experiencing specified bad outcomes.

D)Benefits are available only to the poor.

A)Benefits are based on past earnings.

B)Employers and workers pay for social insurance programs.

C)Benefit eligibility is based on experiencing specified bad outcomes.

D)Benefits are available only to the poor.

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

79

A difference between a means-tested government social safety net program and a government social insurance program is that means-tested social safety net benefits are available based on _____ while social insurance benefits are available to those who _____.

A)low income; experience specified negative outcomes

B)experiencing specified negative outcomes; have low incomes

C)regressive taxes; pay progressive taxes

D)progressive taxes; pay regressive taxes

A)low income; experience specified negative outcomes

B)experiencing specified negative outcomes; have low incomes

C)regressive taxes; pay progressive taxes

D)progressive taxes; pay regressive taxes

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck

80

_____ program benefits are available only to those whose incomes meet a poverty standard, and _____ program benefits are available to anyone who experiences specified negative outcomes.

A)Absolute poverty; relative poverty

B)Relative poverty; absolute poverty

C)Social insurance; means-tested social safety net

D)Means-tested social safety net; social insurance

A)Absolute poverty; relative poverty

B)Relative poverty; absolute poverty

C)Social insurance; means-tested social safety net

D)Means-tested social safety net; social insurance

Unlock Deck

Unlock for access to all 190 flashcards in this deck.

Unlock Deck

k this deck