Deck 5: Present Worth Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/16

Play

Full screen (f)

Deck 5: Present Worth Analysis

1

The annual maintenance cost of a monument in the state capital is estimated to be $4850. A perpetual i fund of $100,000 is set up to pay for this maintenance expenditure. Determine the interest rate this fund earns if the interest is compounded quarterly.

A) 4.58%

B) 4.76%

C) 4.39%

D) None of these

A) 4.58%

B) 4.76%

C) 4.39%

D) None of these

4.76%

2

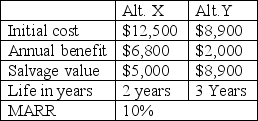

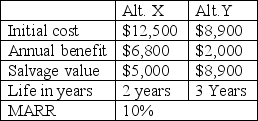

Case Study 5

Dunn Manufacturing is considering the following two alternatives. The cost information for the two proposals for replacing an equipment are provided are in table below.

-The NPW of machine X is ________________.

A) $35,158

B) $48,192

C) $50,752

D) $61,239

Dunn Manufacturing is considering the following two alternatives. The cost information for the two proposals for replacing an equipment are provided are in table below.

-The NPW of machine X is ________________.

A) $35,158

B) $48,192

C) $50,752

D) $61,239

$50,752

3

Case Study 5

Dunn Manufacturing is considering the following two alternatives. The cost information for the two proposals for replacing an equipment are provided are in table below.

-The NPW of machine Y is ________________.

A) $42,196

B) $29,508

C) $26,106

D) $32,103

Dunn Manufacturing is considering the following two alternatives. The cost information for the two proposals for replacing an equipment are provided are in table below.

-The NPW of machine Y is ________________.

A) $42,196

B) $29,508

C) $26,106

D) $32,103

$26,106

4

Case Study 5

Dunn Manufacturing is considering the following two alternatives. The cost information for the two proposals for replacing an equipment are provided are in table below.

-If machine "Y" has no salvage value, what would be the NPW of machine "Y"?

A) $19,891

B) $20,626

C) $23,478

D) $21,816

Dunn Manufacturing is considering the following two alternatives. The cost information for the two proposals for replacing an equipment are provided are in table below.

-If machine "Y" has no salvage value, what would be the NPW of machine "Y"?

A) $19,891

B) $20,626

C) $23,478

D) $21,816

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

5

How much money would have to be placed in a sinking fund each year to replace a machine costing $20,000 today at the end of 10 years if the fund yields 9% annual interest rate compounded yearly and if the cost of the machine is assumed to increase at 5% annually for the next 10 years? Assume the salvage value is zero.

A) $2,143.63

B) $2150

C) $2,340

D) $1923

A) $2,143.63

B) $2150

C) $2,340

D) $1923

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

6

Given the cash flows in table below. Determine the value of P. i= 6% per year

A) $4709.14

B) $6125.15

C) $5125.63

D) $4978.23

A) $4709.14

B) $6125.15

C) $5125.63

D) $4978.23

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

7

Determine the net present worth (NPW) of the cash flows given in table below for an investment opportunity being presented to a company. MARR =12%

A) $90,030

B) $80,914

C) $72,916

D) $112,200

A) $90,030

B) $80,914

C) $72,916

D) $112,200

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

8

Kal Tech Engineering Systems is considering buying a CNC machining center for its operation in Tennessee. The net benefits in the first year is estimated to be $40,000 and increasing at the rate $5,000 for the next four years and stays at the same level as that of year 5 for the next 5 years. If MARR is 8%, determine the amount of money that the company can invest justifying on this machining center. A salvage value of 20% of the initial cost is reasonable to assume at the end of year 10.

A) $396,357

B) $416,182

C) $411,202

D) $399,500

A) $396,357

B) $416,182

C) $411,202

D) $399,500

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

9

Sam is considering investing in a bond with a face value of $20,000. The bond pays an interest of 4% payable quarterly. If he expects to make a 1 ½ % return per quarter on this investment with a maturity of 20 years, determine the most he can pay for the bond ________.

A) $18,102.65

B) $14,923.86

C) $15,355.40

D) $16,000

A) $18,102.65

B) $14,923.86

C) $15,355.40

D) $16,000

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

10

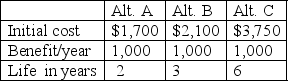

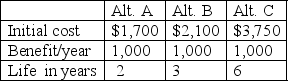

Table 5

-The NPW of alt. A is __________________.

A) $13,420

B) $17,380

C) $11,000

D) $6,000

-The NPW of alt. A is __________________.

A) $13,420

B) $17,380

C) $11,000

D) $6,000

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

11

Table 5

-The NPW of alt. B is __________________.

A) $13,420

B) $17,380

C) $11,000

D) $6,000

-The NPW of alt. B is __________________.

A) $13,420

B) $17,380

C) $11,000

D) $6,000

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

12

Table 5

-The NPW of alt. C is __________________.

A) $13,420

B) $17,380

C) $11,000

D) $6,000

-The NPW of alt. C is __________________.

A) $13,420

B) $17,380

C) $11,000

D) $6,000

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

13

Determine the better of the two alternatives using the present worth analysis. Use an interest rate of 10%.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

14

Solve the following problem using the present worth analysis for an interest rate of 8%.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

15

The capitalized cost of any investment may be determined using the equation P = A/i where P is the capitalized cost, A is the annual amount and i is the interest rate.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

16

The NPW of a set of cash flows will decrease as the interest rate is increased.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck