Deck 15: The Federal Reserve and Monetary Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/84

Play

Full screen (f)

Deck 15: The Federal Reserve and Monetary Policy

1

As the U.S. central bank, the Federal Reserve is owned and operated by the federal government.

False

2

The Federal Open Market Committee is the Fed's most important policy-making body for controlling the growth of the money supply.

True

3

Although the Federal Reserve Banks are not motivated by profit, they do earn substantial revenues on the Fed's holdings of securities, and these revenues are largely turned over to the U.S. Treasury.

True

4

Most studies of central bank independence rank the Federal Reserve among the least independent in the world.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

5

The major functions of the Federal Reserve include controlling the money supply, serving as a lender of last resort, and regulating and supervising banks.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

6

The required reserve ratio is the most important and widely used monetary tool of the Federal Reserve.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

7

Compared to the discount rate and required reserve ratio, open market operations are the most flexible tool of monetary policy.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

8

By lending funds to banks through its discount window during a crisis, the Federal Reserve attempts to protect the safety and soundness of the nation's financial system.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

9

Increasing the discount rate increases the money supply and decreasing the discount rate decreases the money supply.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

10

A lower required reserve ratio results in an increase in the money supply; a higher required reserve ratio results in a decrease in the money supply.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

11

To combat a recession, the Federal Reserve would decrease the money supply and decrease the level of aggregate demand.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

12

To combat inflation, the Federal Reserve would decrease the discount rate, decrease the required reserve ratio, or buy securities on the open market.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

13

During the stock market crash of 1987, the Fed reversed the crisis psychology by selling securities to banks and corporations.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

14

The discount rate is another name for the federal funds rate.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

15

If the Federal Reserve adopts a contractionary monetary policy, it increases domestic interest rates, which results in an increase in the exchange value of the dollar.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

16

Proponents of the Federal Reserve maintain that the short-run compatibility between full employment and price stability enhances the Fed's ability to fine tune the economy.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

17

The Federal Reserve is required by law to focus mainly on controlling unemployment.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

18

To combat the recession of 2001, the Federal Reserve rapidly increased the money supply and lowered interest rates.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

19

Critics argue that because of timing lags and a lack of knowledge about the economy, the Federal Reserve should terminate its activist monetary policies and increase the supply of money each year at a constant rate.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

20

The main argument for Federal Reserve independence is that monetary policy-which affects inflation, employment, growth, and exchange rates-is too important to be determined by politicians.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

21

The discount rate is the interest rate that banks pay when they borrow reserves from one another.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

22

An expansionary monetary policy is more effective in combating recession when the public's demand for money does not decrease.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

23

When the Federal Reserve increases the required reserve ratio, the excess reserves of banks decline.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

24

Open market operations is the monetary policy tool that directly affects the money multiplier of the commercial banking system.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

25

The Federal System regulates the supply of money primarily by altering the required reserve ratio, thus affecting the ability of banks to make loans.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

26

The Chairman of the Board of Governors appears before Congress to report on Federal Reserve policies.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

27

The Federal Open Market Committee always includes the president of the Federal Reserve Bank of New York as one of its members, while the other Federal Reserve Bank presidents serve on a rotating basis.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

28

The Federal Reserve Banks offer checking account privileges to banks, businesses, government, and private investors.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

29

A typical federal funds transaction takes place over an extended period of time.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

30

Immediately after the September 11, 2001 terrorist attack on the World Trade Center and the Pentagon, the Federal Reserve announced it would keep its discount window open to any bank that needed cash.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

31

One of the functions of the Federal Reserve System is to regulate and supervise banks.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

32

Concerning the Federal Reserve System, which of the following statements is false?

A) It is the central bank of the U.S.

B) It is owned and operated by the federal government.

C) It attempts to provide a safer and more stable financial system.

D) It is financed from internally generated funds rather than taxpayer dollars.

A) It is the central bank of the U.S.

B) It is owned and operated by the federal government.

C) It attempts to provide a safer and more stable financial system.

D) It is financed from internally generated funds rather than taxpayer dollars.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

33

At the head of the Fed is the ______, whose members are appointed by the President and confirmed by the Senate to serve 14-year terms of office.

A) Board of Governors

B) Federal Open Market Committee

C) Council of Economic Advisors

D) Federal Advisory Council

A) Board of Governors

B) Federal Open Market Committee

C) Council of Economic Advisors

D) Federal Advisory Council

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

34

The ______ is the Fed's most important policy-making body for controlling the growth of the money supply.

A) Board of Governors

B) Federal Open Market Committee

C) Office of Monetary Responsibility

D) Federal Monetary Council

A) Board of Governors

B) Federal Open Market Committee

C) Office of Monetary Responsibility

D) Federal Monetary Council

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

35

To control the growth of the money supply, the ______ oversees the purchases and sales of U.S. government securities.

A) Board of Governors

B) Federal Open Market Committee

C) U.S. Mint

D) Federal Monetary Council

A) Board of Governors

B) Federal Open Market Committee

C) U.S. Mint

D) Federal Monetary Council

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

36

Although the Federal Reserve Banks are not motivated by profit, they do earn substantial revenues that are largely

A) turned over to the U.S. Treasury

B) turned over to state and local governments

C) used to finance the construction of roads, dams, and bridges

D) used to finance public education

A) turned over to the U.S. Treasury

B) turned over to state and local governments

C) used to finance the construction of roads, dams, and bridges

D) used to finance public education

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

37

The most important function of the Federal Reserve System is to

A) insure the deposits of commercial banks

B) control the nation's money supply

C) supply check-clearing services to the banking system

D) stabilize the exchange value of the dollar

A) insure the deposits of commercial banks

B) control the nation's money supply

C) supply check-clearing services to the banking system

D) stabilize the exchange value of the dollar

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

38

All of the following are functions of the Federal Reserve System except

A) serving as a lender of last resort for forestalling financial panics

B) regulating and supervise commercial banks

C) carrying out foreign exchange operations to stabilize the dollar's value

D) insuring the deposits of commercial banks throughout the U.S.

A) serving as a lender of last resort for forestalling financial panics

B) regulating and supervise commercial banks

C) carrying out foreign exchange operations to stabilize the dollar's value

D) insuring the deposits of commercial banks throughout the U.S.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

39

The Federal Reserve System is the source of the nation's

A) demand deposits

B) savings deposits

C) paper currency

D) coins

A) demand deposits

B) savings deposits

C) paper currency

D) coins

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

40

______ consists of alterations in the economy's money supply to assist the economy in achieving maximum output and employment, and also stable prices.

A) Fiscal policy

B) Incomes policy

C) Financial policy

D) Monetary policy

A) Fiscal policy

B) Incomes policy

C) Financial policy

D) Monetary policy

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

41

The major tools of monetary policy include all of the following except

A) the required reserve ratio

B) personal income tax

C) the discount rate

D) open market operations

A) the required reserve ratio

B) personal income tax

C) the discount rate

D) open market operations

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

42

To combat a recession, the Federal Reserve would

A) increase the money supply and shift the aggregate demand curve rightward

B) increase the money supply and shift the aggregate demand curve leftward

C) decrease the money supply and shift the aggregate demand curve rightward

D) decrease the money supply and shift the aggregate demand curve leftward

A) increase the money supply and shift the aggregate demand curve rightward

B) increase the money supply and shift the aggregate demand curve leftward

C) decrease the money supply and shift the aggregate demand curve rightward

D) decrease the money supply and shift the aggregate demand curve leftward

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

43

To combat demand-pull inflation, the Federal Reserve would

A) increase the money supply and shift the aggregate demand curve leftward

B) increase the money supply and shift the aggregate demand curve rightward

C) decrease the money supply and shift the aggregate demand curve leftward

D) decrease the money supply and shift the aggregate demand curve rightward

A) increase the money supply and shift the aggregate demand curve leftward

B) increase the money supply and shift the aggregate demand curve rightward

C) decrease the money supply and shift the aggregate demand curve leftward

D) decrease the money supply and shift the aggregate demand curve rightward

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

44

To combat a recession, the Federal Reserve could

A) increase the required reserve ratio, increase the discount rate, and/or sell securities on the open market

B) increase the required reserve ratio, decrease the discount rate, and/or buy securities on the open market

C) decrease the required reserve ratio, decrease the discount rate, and/or sell securities on the open market

D) decrease the required reserve ratio, decrease the discount rate, and/or buy securities on the open market

A) increase the required reserve ratio, increase the discount rate, and/or sell securities on the open market

B) increase the required reserve ratio, decrease the discount rate, and/or buy securities on the open market

C) decrease the required reserve ratio, decrease the discount rate, and/or sell securities on the open market

D) decrease the required reserve ratio, decrease the discount rate, and/or buy securities on the open market

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

45

To combat demand-pull inflation, the Federal Reserve could

A) increase the required reserve ratio, increase the discount rate, and/or sell securities on the open market

B) increase the required reserve ratio, decrease the discount rate, and/or buy securities on the open market

C) decrease the required reserve ratio, decrease the discount rate, and/or sell securities on the open market

D) decrease the required reserve ratio, decrease the discount rate, and/or buy securities on the open market

A) increase the required reserve ratio, increase the discount rate, and/or sell securities on the open market

B) increase the required reserve ratio, decrease the discount rate, and/or buy securities on the open market

C) decrease the required reserve ratio, decrease the discount rate, and/or sell securities on the open market

D) decrease the required reserve ratio, decrease the discount rate, and/or buy securities on the open market

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

46

The Federal Reserve would be adopting an expansionary monetary policy if it

A) increased the required reserve ratio

B) bought securities on the open market

C) increased the discount rate

D) decreased personal income taxes

A) increased the required reserve ratio

B) bought securities on the open market

C) increased the discount rate

D) decreased personal income taxes

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

47

The Federal Reserve would be adopting a restrictive monetary policy if it

A) bought securities on the open market

B) increased personal income taxes

C) increased the required reserve ratio

D) decreased the discount rate

A) bought securities on the open market

B) increased personal income taxes

C) increased the required reserve ratio

D) decreased the discount rate

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

48

Which policy of the Federal Reserve would directly reduce the money multiplier of the commercial banking system?

A) increase in the required reserve ratio

B) decrease in the required reserve ratio

C) increase in the discount rate

D) decrease in the discount rate

A) increase in the required reserve ratio

B) decrease in the required reserve ratio

C) increase in the discount rate

D) decrease in the discount rate

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

49

To provide more liquidity and guarantee the safety and soundness of the banking system during a stock market crash, the Federal Reserve should

A) increase the required reserve ratio

B) buy securities on the open market

C) increase the federal funds rate

D) increase the discount rate

A) increase the required reserve ratio

B) buy securities on the open market

C) increase the federal funds rate

D) increase the discount rate

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

50

A contractionary monetary policy of the Federal Reserve tends to

A) increase consumption spending

B) decrease the exchange value of the dollar

C) increase investment spending

D) decrease net exports of goods and services

A) increase consumption spending

B) decrease the exchange value of the dollar

C) increase investment spending

D) decrease net exports of goods and services

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

51

To help the economy recover after the terrorist attacks on the World Trade Center on September 11, 2001, the Federal Reserve

A) opened a new Federal Reserve Bank in upstate New York

B) took direct steps to boost stock prices

C) lowered interest rates and supplied new reserves to banks

D) raised required reserve ratios to ensure the safety of banks

A) opened a new Federal Reserve Bank in upstate New York

B) took direct steps to boost stock prices

C) lowered interest rates and supplied new reserves to banks

D) raised required reserve ratios to ensure the safety of banks

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

52

The Federal Reserve controls the money supply primarily by affecting the quantity of ____ that banks use to make loans.

A) paperwork

B) stocks and bonds

C) demand deposits

D) reserves

A) paperwork

B) stocks and bonds

C) demand deposits

D) reserves

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

53

To decrease the money supply, the Federal Reserve could

A) decrease the required reserve ratio

B) lower the federal funds rate

C) lower the discount rate

D) sell securities on the open market

A) decrease the required reserve ratio

B) lower the federal funds rate

C) lower the discount rate

D) sell securities on the open market

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

54

If the Bank of Florida obtains a loan from the Fed's discount window, then the

A) supply of money automatically rises

B) supply of money automatically falls

C) Bank of Florida's reserves increase

D) Bank of Florida's reserves decrease

A) supply of money automatically rises

B) supply of money automatically falls

C) Bank of Florida's reserves increase

D) Bank of Florida's reserves decrease

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

55

Suppose that the required reserve ratio is 25 percent. If the Federal Reserve purchases $20 million of government securities from Bank of America, the maximum amount that the bank can safely lend is

A) $5 million

B) $15 million

C) $20 million

D) $25 million

A) $5 million

B) $15 million

C) $20 million

D) $25 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

56

The Federal Reserve can alter or influence all of the following except the

A) discount rate

B) federal funds rate

C) required reserve ratio

D) investment tax credit

A) discount rate

B) federal funds rate

C) required reserve ratio

D) investment tax credit

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

57

A difference between a commercial bank and the Federal Reserve is that a commercial bank

A) maximizes profits and the Fed does not

B) buys securities and the Fed does not

C) makes loans and the Fed does not

D) issues paper currency and the Fed does not

A) maximizes profits and the Fed does not

B) buys securities and the Fed does not

C) makes loans and the Fed does not

D) issues paper currency and the Fed does not

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following sequences of events represents an expansionary monetary policy?

A) The Fed lowers the required reserve ratio, market interest rates increase, and aggregate demand increases.

B) The Fed buys securities on the open market, market interest rates decrease, and aggregate demand increases.

C) The Fed raises the discount rate, the stock market increases in value, and aggregate demand increases.

D) The federal government lowers income taxes and aggregate demand increases.

A) The Fed lowers the required reserve ratio, market interest rates increase, and aggregate demand increases.

B) The Fed buys securities on the open market, market interest rates decrease, and aggregate demand increases.

C) The Fed raises the discount rate, the stock market increases in value, and aggregate demand increases.

D) The federal government lowers income taxes and aggregate demand increases.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

59

Critics maintain that the short-run tradeoffs between ______ make it difficult for the Fed to formulate monetary policy.

A) nominal gross domestic product and real gross domestic product

B) price stability and full employment

C) economic growth and high interest rates

D) wage stability and interest rate stability

A) nominal gross domestic product and real gross domestic product

B) price stability and full employment

C) economic growth and high interest rates

D) wage stability and interest rate stability

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

60

Suppose that the evening economic report on television describes how the Federal Reserve increased the discount rate twice in the last three months. The report suggests that the Fed was most likely attempting to

A) reduce the exchange value of the dollar

B) decrease the rate of inflation in the economy

C) decrease the purchasing power of the dollar

D) increase the economy's net exports of goods and services

A) reduce the exchange value of the dollar

B) decrease the rate of inflation in the economy

C) decrease the purchasing power of the dollar

D) increase the economy's net exports of goods and services

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

61

Which component of aggregate demand tends to be most sensitive to changes in interest rates by the Federal Reserve?

A) government expenditures on goods and services

B) net exports of goods and services

C) personal consumption expenditures on food and clothing

D) investment spending on machinery, factories, and new homes

A) government expenditures on goods and services

B) net exports of goods and services

C) personal consumption expenditures on food and clothing

D) investment spending on machinery, factories, and new homes

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

62

The monetary policy of the United States is conducted by the

A) Comptroller of the Currency

B) Office of the Management and Budget

C) Federal Reserve

D) President and Congress

A) Comptroller of the Currency

B) Office of the Management and Budget

C) Federal Reserve

D) President and Congress

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

63

The strengths of monetary policy include all of the following except

A) relatively small interference with the freedom of the market

B) relative insulation from day-to-day political pressures

C) ability to enact policies quickly in response to changing economic conditions

D) instantaneous effect on real output, employment, and the price level

A) relatively small interference with the freedom of the market

B) relative insulation from day-to-day political pressures

C) ability to enact policies quickly in response to changing economic conditions

D) instantaneous effect on real output, employment, and the price level

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

64

Supporters of the Fed's independence maintain that monetary policy tends to become too ______ if left to policy makers with short-run horizons, thus intensifying ______.

A) contractionary, inflation

B) contractionary, recession

C) expansionary, inflation

D) expansionary, recession

A) contractionary, inflation

B) contractionary, recession

C) expansionary, inflation

D) expansionary, recession

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

65

All of the following contribute to the political independence of the Federal Reserve except

A) the Fed is responsible to the President and Congress rather than itself

B) members of the Fed's Board of Governors have 14-year terms

C) the Fed finances its operations from internally-generated income

D) the Fed is owned by member banks rather than the federal government

A) the Fed is responsible to the President and Congress rather than itself

B) members of the Fed's Board of Governors have 14-year terms

C) the Fed finances its operations from internally-generated income

D) the Fed is owned by member banks rather than the federal government

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

66

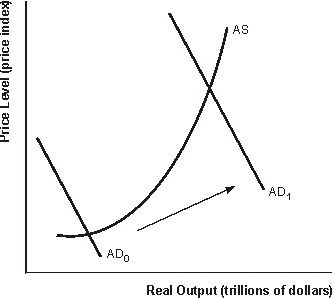

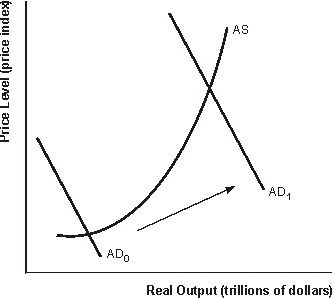

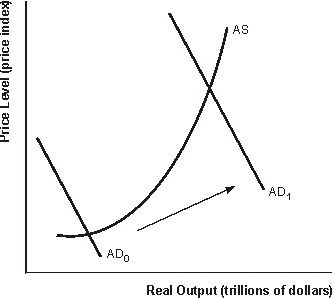

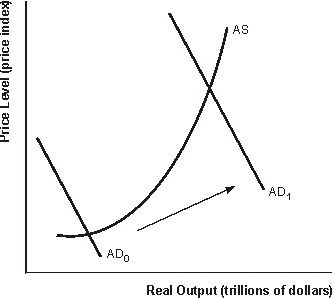

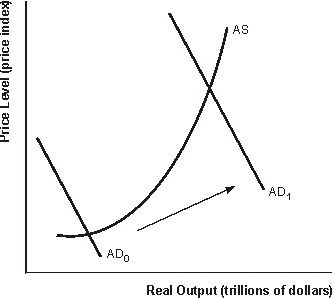

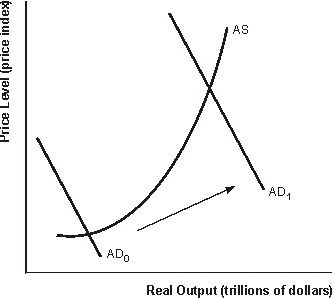

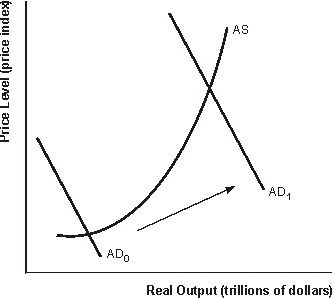

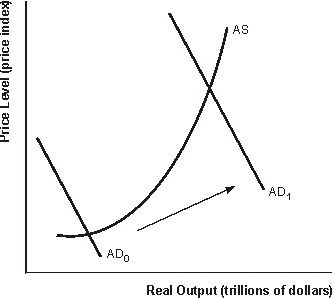

Figure 15.1 Aggregate Supply and Aggregate Demand

-Refer to Figure 15.1. A shift in aggregate demand from AD0 to AD1 is consistent with a(n)

A) decrease in the required reserve ratio

B) increase in the discount rate

C) selling of securities by the Fed

D) tight monetary policy

-Refer to Figure 15.1. A shift in aggregate demand from AD0 to AD1 is consistent with a(n)

A) decrease in the required reserve ratio

B) increase in the discount rate

C) selling of securities by the Fed

D) tight monetary policy

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

67

Figure 15.1 Aggregate Supply and Aggregate Demand

-Refer to Figure 15.1. The Fed will enact a monetary policy to shift AD0 to AD1 when

A) its members want to be re-elected by the voting public

B) the economy had been experiencing demand-pull inflation

C) the economy had been experiencing a recession

D) interest rates are too low

-Refer to Figure 15.1. The Fed will enact a monetary policy to shift AD0 to AD1 when

A) its members want to be re-elected by the voting public

B) the economy had been experiencing demand-pull inflation

C) the economy had been experiencing a recession

D) interest rates are too low

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

68

Figure 15.1 Aggregate Supply and Aggregate Demand

-Refer to Figure 15.1. If the Fed enacts a monetary policy that shifts AD0 to AD1, it is successful in increasing ______, but the tradeoff is that the economy also experiences some ______.

A) unemployment, deflation

B) real output, deflation

C) unemployment, inflation

D) real output, inflation

-Refer to Figure 15.1. If the Fed enacts a monetary policy that shifts AD0 to AD1, it is successful in increasing ______, but the tradeoff is that the economy also experiences some ______.

A) unemployment, deflation

B) real output, deflation

C) unemployment, inflation

D) real output, inflation

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

69

Figure 15.1 Aggregate Supply and Aggregate Demand

-Refer to Figure 15.1. If the Fed's goal is to increase AD0 to AD1 through monetary policy, it may have trouble doing so because

A) monetary policy is inflexible by nature

B) banks may not make enough new loans

C) the public's demand for money might increase at the same time

D) the president may not allow the Fed to change interest rates

-Refer to Figure 15.1. If the Fed's goal is to increase AD0 to AD1 through monetary policy, it may have trouble doing so because

A) monetary policy is inflexible by nature

B) banks may not make enough new loans

C) the public's demand for money might increase at the same time

D) the president may not allow the Fed to change interest rates

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

70

The passage of the Federal Reserve Act was prompted by

A) the beginning of World War I

B) the 1929 stock market crash

C) the Great Depression of the 1930s

D) a banking panic in 1907

A) the beginning of World War I

B) the 1929 stock market crash

C) the Great Depression of the 1930s

D) a banking panic in 1907

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

71

Who is not a member of the Federal Open Market Committee (FOMC)?

A) the 7-member Board of Governors

B) the chair of the FDIC

C) the president of the Federal Reserve Bank of New York

D) 4 presidents of Federal Reserve Banks

A) the 7-member Board of Governors

B) the chair of the FDIC

C) the president of the Federal Reserve Bank of New York

D) 4 presidents of Federal Reserve Banks

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

72

The Fed is responsible for all of the following functions except

A) setting required reserve ratios

B) being the lender of last resort

C) conducting fiscal policy

D) supplying services to banks

A) setting required reserve ratios

B) being the lender of last resort

C) conducting fiscal policy

D) supplying services to banks

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

73

If the Fed wanted to increase the money supply, the general approach to doing this would be to

A) print more currency

B) increase the volume of bank reserves

C) lower taxes

D) sell U.S. government securities

A) print more currency

B) increase the volume of bank reserves

C) lower taxes

D) sell U.S. government securities

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

74

The "lender of last resort" role of the Fed is demonstrated by which of the following?

A) federal funds market transactions

B) required reserve ratio changes

C) open market operations

D) discount window activities

A) federal funds market transactions

B) required reserve ratio changes

C) open market operations

D) discount window activities

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

75

A decrease in the required reserve ratio would

A) decrease the money supply

B) significantly affect savings and time deposits

C) be a frequent tool used by the Fed

D) have a large effect on banks' reserves

A) decrease the money supply

B) significantly affect savings and time deposits

C) be a frequent tool used by the Fed

D) have a large effect on banks' reserves

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

76

What did the Fed do during the Great Recession

A) It lowered short-term interest rates to stimulate the economy.

B) It froze all bank reserves.

C) It merged with the U.S. Treasury Department.

D) It closed the stock exchanges to stabilize the dollar.

A) It lowered short-term interest rates to stimulate the economy.

B) It froze all bank reserves.

C) It merged with the U.S. Treasury Department.

D) It closed the stock exchanges to stabilize the dollar.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

77

The actual required reserve ratio set by the Fed in 2003 for bank deposits in excess of $42.1 million is

A) 0%

B) 3%

C) 10%

D) 20%

A) 0%

B) 3%

C) 10%

D) 20%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

78

The actual required reserve ratio set by the Fed in 2003 for savings deposits is

A) 0%

B) 3%

C) 10%

D) 20%

A) 0%

B) 3%

C) 10%

D) 20%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

79

If the Fed adopts a contractionary monetary policy, what sequence of events will happen?

A) U.S. interest rates will fall, the value of the dollar will fall, and U.S. net exports will fall

B) U.S. interest rates will rise, the value of the dollar will rise, and U.S. net exports will fall

C) U.S. interest rates will rise, the value of the dollar will rise, and U.S. net exports will rise

D) U.S. interest rates will fall, the value of the dollar will fall, and U.S. net exports will rise

A) U.S. interest rates will fall, the value of the dollar will fall, and U.S. net exports will fall

B) U.S. interest rates will rise, the value of the dollar will rise, and U.S. net exports will fall

C) U.S. interest rates will rise, the value of the dollar will rise, and U.S. net exports will rise

D) U.S. interest rates will fall, the value of the dollar will fall, and U.S. net exports will rise

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

80

The advantages of monetary policy include all of the following except

A) it lets the market dictate the form of spending changes

B) it is flexible

C) it is based on economic, rather than political, considerations

D) it can result in policy lags

A) it lets the market dictate the form of spending changes

B) it is flexible

C) it is based on economic, rather than political, considerations

D) it can result in policy lags

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck