Deck 3: The Structure of Interest Rates

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/7

Play

Full screen (f)

Deck 3: The Structure of Interest Rates

1

According to the expectations theory, if next year's expected short-term rate is below the current short-term rate,

A) the current long-term rate will be below the current short-term rate.

B) the current long-term rate will be above the current long-term rate.

C) the current long-term rate will be horizontal.

D) the current long-term rate will be vertical.

A) the current long-term rate will be below the current short-term rate.

B) the current long-term rate will be above the current long-term rate.

C) the current long-term rate will be horizontal.

D) the current long-term rate will be vertical.

the current long-term rate will be below the current short-term rate.

2

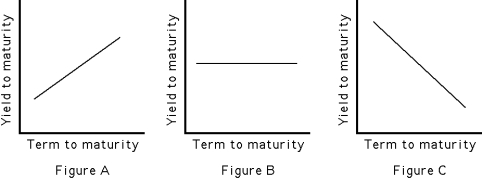

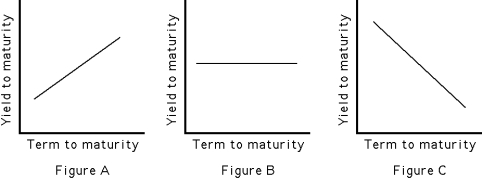

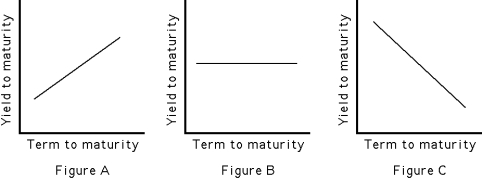

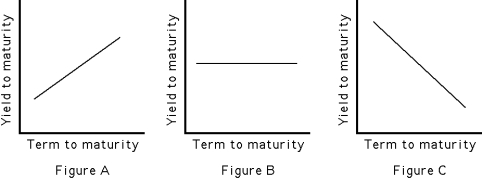

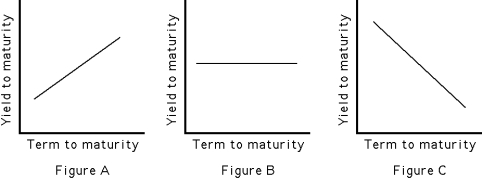

-According to expectations theory, which of the figures above reflects expectations of a rise in the interest rate on short-term securities?

A) Figure A

B) Figure B

C) Figure C

D) Both a and b

Figure A

3

-Refer to Figures A, B, and C. According to expectations theory, which of the figures above reflects expectations of a fall in the interest rate on short-term securities?

A) Figure A

B) Figure B

C) Figure C

D) Both a and b

Figure C

4

-Refer to Figures A, B, and C. According to expectations theory, which of the figures is most likely to be associated with expected growth in income, expected increases in prices, and slower growth of money supply?

A) Figure A

B) Figure B

C) Figure C

D) Both a and b

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

5

-Refer to Figures A, B, and C. According to expectations theory, which of the figures reflects expectations that the short-term interest rate is expected to remain constant in the future but that borrowers and lenders also must be compensated with a liquidity premium for lending long?

A) Figure A

B) Figure B

C) Figure C

D) Both a and b

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

6

-Refer to Figures A, B, and C. According to expectations theory, which of the figures best reflects a situation where i?>i???

A) Figure A

B) Figure B

C) Figure C

D) None of the above

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

7

According to the expectations theory, if the 1-year rate is 2.5% and the 2-year rate is 3.64%, the expected 1-year rate would be

A) 3.80%.

B) 4.80%.

C) 5.80%.

D) 6.80%.

A) 3.80%.

B) 4.80%.

C) 5.80%.

D) 6.80%.

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck