Deck 10: Government Expenditures and Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/47

Play

Full screen (f)

Deck 10: Government Expenditures and Taxation

1

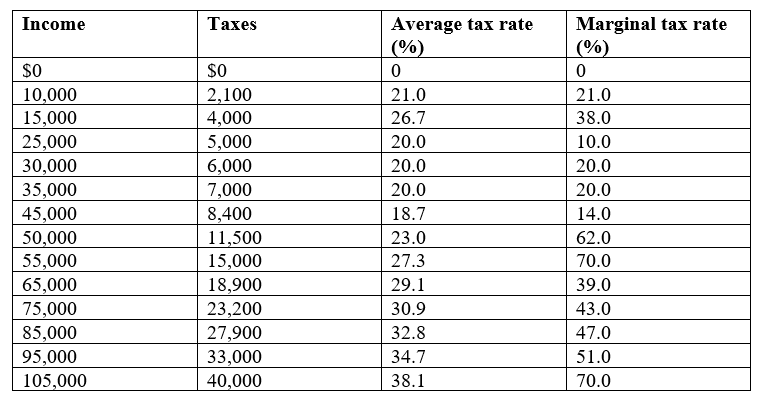

Using the data in the table below, respond to the following questions.

a. Complete the table by calculating the average and marginal tax rates.

b. Taxes are regressive over what range of income?

c. What range of income exhibits proportional tax rates?

d. To what range of income are progressive tax rates applied?

a. Complete the table by calculating the average and marginal tax rates.

b. Taxes are regressive over what range of income?

c. What range of income exhibits proportional tax rates?

d. To what range of income are progressive tax rates applied?

b. $35,000-$45,000

b. $35,000-$45,000c. $25,000-35,000

d. $10,000-$15,000 and $50,000-$105,000

2

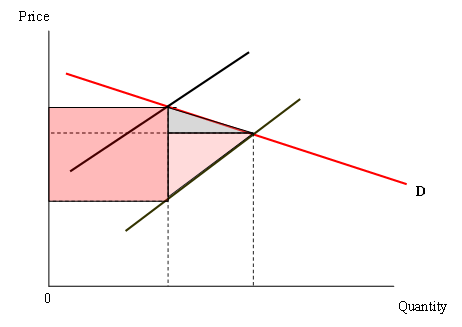

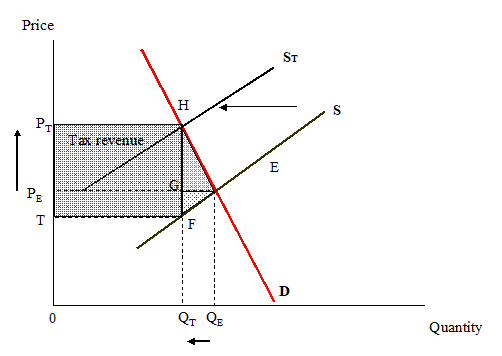

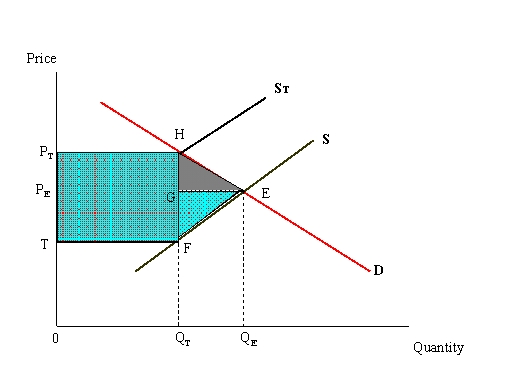

a. Use the following diagram to demonstrate the imposition of a unit excise tax, and identify and explain the tax burden falling upon producer versus consumer. Indicate the revenue and excess burden. Clearly label the diagram in support of your explanation.

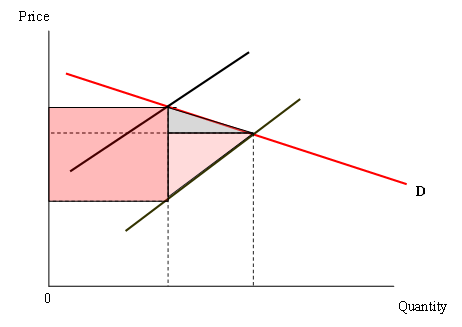

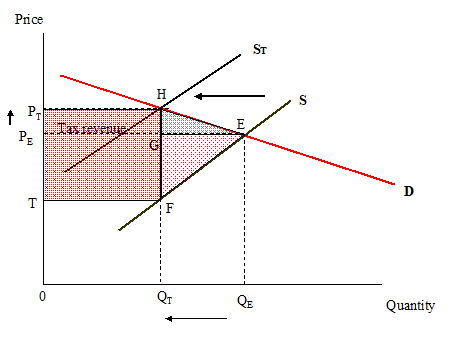

b. Now make appropriate ajustments to illustrate a sitiuation where demand is relatively inelastic compared to supply. Demonstrate the imposition of a unit excise tax, identify and explain the tax burden falling upon producer versus consumer. Indicate the revenue and excess burden. Clearly label the diagram in support of your explanation.

b. Now make appropriate ajustments to illustrate a sitiuation where demand is relatively inelastic compared to supply. Demonstrate the imposition of a unit excise tax, identify and explain the tax burden falling upon producer versus consumer. Indicate the revenue and excess burden. Clearly label the diagram in support of your explanation.

a. A relatively large cost in terms of deadweight loss (FHE) is conferred upon society to raise tax revenue TPTHF. The producers' burden is TPE and the consumers' burden is PEPT.

b. The bulk of the impact is to raise price. Consumers bear a larger share of tax burden compared to sellers. In this case, the excess burden (deadweight loss) of the tax is relatively small in relation to the revenue raised by the tax.

b. The bulk of the impact is to raise price. Consumers bear a larger share of tax burden compared to sellers. In this case, the excess burden (deadweight loss) of the tax is relatively small in relation to the revenue raised by the tax.

3

Why should the government intervene in the economy? Provide a justification.

The government should intervene in the economy for several reasons. Firstly, to ensure fair competition and prevent monopolies from forming, which can lead to higher prices and reduced choice for consumers. Secondly, to provide public goods and services that the private sector may not adequately provide, such as infrastructure, national defense, and education. Thirdly, to address market failures, such as externalities (e.g. pollution) and information asymmetry, where one party has more information than the other in a transaction. Additionally, government intervention can help to stabilize the economy during times of recession or inflation through fiscal and monetary policies. Finally, the government can also intervene to promote social welfare and reduce income inequality through policies such as progressive taxation and social welfare programs. Overall, government intervention in the economy is necessary to ensure a well-functioning and equitable market system.

4

Which of the following formulas is used to calculate the marginal tax rate?

A) change in tax liabilty/change in taxable income

B) percent change in tax liability/percent change in taxable income

C) tax liabilty/taxable income

D) natural log of tax liability/taxable income squared

A) change in tax liabilty/change in taxable income

B) percent change in tax liability/percent change in taxable income

C) tax liabilty/taxable income

D) natural log of tax liability/taxable income squared

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

5

What are some of the consumption-based tax alternatives that have been proposed? Discuss their respective merits and problems.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

6

What is meant by the entitlement crisis?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

7

Explain why some observers believe the official poverty rate could be overstated.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

8

What is the difference between a government purchase and a government transfer payment? Why does it matter?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

9

What are the key features of the following taxes?

a. a progressive income tax

b. a value-added tax

c. a progressive consumption tax

a. a progressive income tax

b. a value-added tax

c. a progressive consumption tax

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

10

The highest rate bracket in the current federal personal income tax is 90 percent.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

11

The increased role of the central government was enabled by the 16th Amendment to the U.S. Constitution.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

12

Government purchases contribute to national product.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

13

A government transfer payment directly contributes to national output.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

14

The concept of "diminishing marginal utility for money income" is an argument that could be used to justify lower tax rate taxes on higher income individuals.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

15

Most state and local governments are required by law to balance their budget annually while the federal government is not required to attain a balanced budget each year.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

16

The primary tax source for the federal government is the corporation income tax.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

17

A progressive tax is one in which average effective tax rates rise as income rises.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

18

A regressive tax will fall most heavily upon those least able to pay the tax.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

19

The property tax is the most proportional of all taxes.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

20

The economic concept of tax incidence is concerned with who actually pays a tax.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

21

Poverty rates in the United States were markedly higher prior to 1960.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

22

The social security payroll tax is proportional because all Americans pay fixed percent of earned income up to a specified level of earnings.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

23

The burden of the federal corporate income tax is borne by the corporation being taxed.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

24

One proposal to raise more revenue for the federal government is to impose a national consumption tax.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

25

Capital income in the United States is taxed at one of the lowest levels of all advanced countries.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

26

The most expedient way to deal with the looming fiscal crisis of the Social Security System is to hold the payroll tax at the same rate.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

27

Poverty rates for people over age 65 are much higher than those of children under age 18.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

28

Female-headed households tend to have lower poverty rates than the general population.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

29

Spending on education tends to be the dominant expenditure category for local

governments.

governments.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

30

The filings of corporate tax returns reveal that most corporations:

A) are in the 34, 35, or 38 percent marginal tax bracket

B) paid no corporation income taxes

C) paid a 65 percent corporate tax

D) are seeking bankruptcy protection to avoid paying taxes

E) don't know how to file their federal income taxes

A) are in the 34, 35, or 38 percent marginal tax bracket

B) paid no corporation income taxes

C) paid a 65 percent corporate tax

D) are seeking bankruptcy protection to avoid paying taxes

E) don't know how to file their federal income taxes

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

31

Examining government budget trends since the 1960s, it is apparent that:

A) government outlays as a share of GDP have steadily risen

B) dollar outlays by all governments have risen but expenditures as a share of GDP have fallen

C) the increase in total tax burden is mostly the result of state and local tax changes

D) no governmental unit makes serious efforts to balance its budget

A) government outlays as a share of GDP have steadily risen

B) dollar outlays by all governments have risen but expenditures as a share of GDP have fallen

C) the increase in total tax burden is mostly the result of state and local tax changes

D) no governmental unit makes serious efforts to balance its budget

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is the largest outlay in the federal budget?

A) interest on the debt

B) national defense

C) education

D) income security

E) licensing fees

A) interest on the debt

B) national defense

C) education

D) income security

E) licensing fees

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

33

The largest single category of outlays made by state and local governments is:

A) police protection and corrections

B) education

C) highways

D) public welfare

A) police protection and corrections

B) education

C) highways

D) public welfare

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

34

The benefits-received tax principle is best illustrated in the United States by:

A) personal income taxes

B) estate taxes

C) payroll taxes

D) fishing-license fees

A) personal income taxes

B) estate taxes

C) payroll taxes

D) fishing-license fees

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following techniques would make good economic sense in determining how governmental expenditures could be rated according to their useful contribution to an economy?

A) the number of people actually benefiting from the outlay

B) marginal social cost-marginal social benefit analysis

C) the age of the recipients of the benefits

D) the ability-to-pay principle

A) the number of people actually benefiting from the outlay

B) marginal social cost-marginal social benefit analysis

C) the age of the recipients of the benefits

D) the ability-to-pay principle

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

36

A value-added tax:

A) evinces a semi-utilitarian attitude from its payers

B) is imposed upon all stages of production

C) is imposed on the value added at each stage of production excluding the stage of final sale

D) is identical to a retail sales tax

E) is revenue neutral

A) evinces a semi-utilitarian attitude from its payers

B) is imposed upon all stages of production

C) is imposed on the value added at each stage of production excluding the stage of final sale

D) is identical to a retail sales tax

E) is revenue neutral

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

37

An argument in favor of a progressive consumption tax is that:

A) unlike personal income taxes, it doesn't tax savings

B) people are unaware of it because it is hidden in the product price

C) it is more difficult for the government to spend the revenue from the tax

D) all of the above

E) none of the above

A) unlike personal income taxes, it doesn't tax savings

B) people are unaware of it because it is hidden in the product price

C) it is more difficult for the government to spend the revenue from the tax

D) all of the above

E) none of the above

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

38

The corporate income tax:

A) is the largest revenue source for the federal government

B) expired during the Obama administration

C) is one where the statutory and economic incidences of the tax completely coincide

D) all of the above

E) none of the above

A) is the largest revenue source for the federal government

B) expired during the Obama administration

C) is one where the statutory and economic incidences of the tax completely coincide

D) all of the above

E) none of the above

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

39

Which is not an argument posed by opponents of higher personal income tax rates?

A) taxes discourage savings

B) taxes that hit the well-to-do disproportionately hard are unfair

C) a heavy tax rate on the rich sacrifices efficiency in favor of equity

D) heavy taxation destroys work incentives

E) all of the above

A) taxes discourage savings

B) taxes that hit the well-to-do disproportionately hard are unfair

C) a heavy tax rate on the rich sacrifices efficiency in favor of equity

D) heavy taxation destroys work incentives

E) all of the above

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

40

When taxpayers tax rates fall as their incomes rise, the tax is:

A) a proportional tax

B) a regressive tax

C) a progressive tax

D) all of the above

E) none of the above

A) a proportional tax

B) a regressive tax

C) a progressive tax

D) all of the above

E) none of the above

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is the best example of a proportional tax?

A) a city's 1-percent gross income tax

B) a property tax

C) a 7 percent sales tax

D) the federal personal income tax

A) a city's 1-percent gross income tax

B) a property tax

C) a 7 percent sales tax

D) the federal personal income tax

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

42

Poverty rates in the U.S. reveal:

A) that poverty rates tend to be lower for Asians versus other ethnic or racial groups

B) equally distributed poverty rates across different demographic groups

C) systematically lower rates for households headed by women

D) that educational attainment has little impact upon the incidence of poverty

A) that poverty rates tend to be lower for Asians versus other ethnic or racial groups

B) equally distributed poverty rates across different demographic groups

C) systematically lower rates for households headed by women

D) that educational attainment has little impact upon the incidence of poverty

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

43

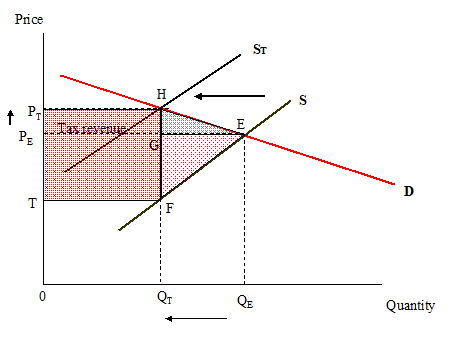

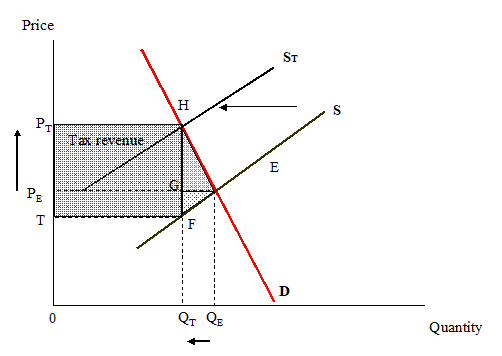

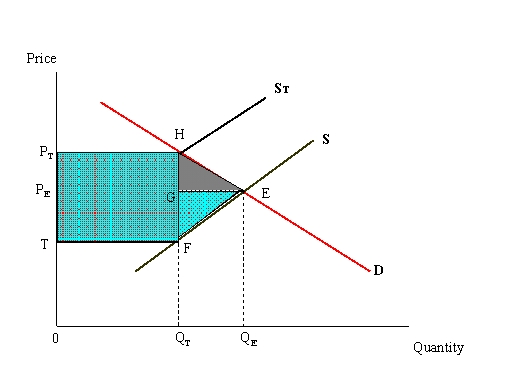

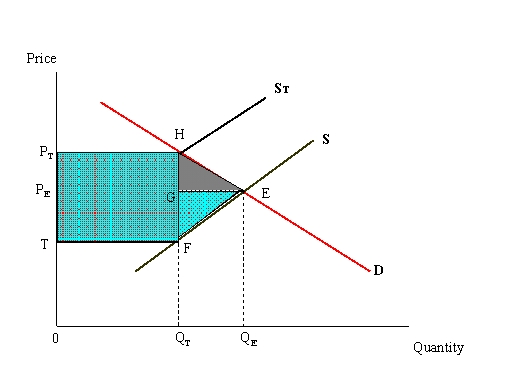

Use the diagram below to answer the next two questions

-The imposition of a tax will:

A) move the supply curve from S to ST

B) move the supply curve from ST to S

C) increase output from QT to QE

D) generate tax revenue of FGE

-The imposition of a tax will:

A) move the supply curve from S to ST

B) move the supply curve from ST to S

C) increase output from QT to QE

D) generate tax revenue of FGE

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

44

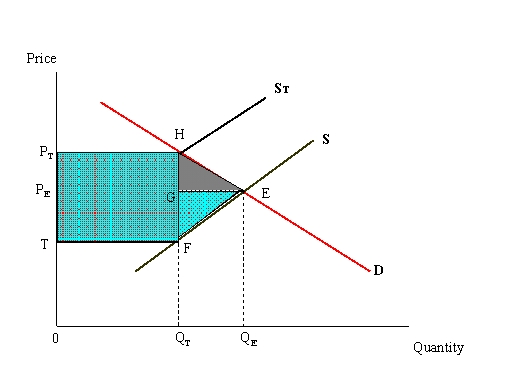

Use the diagram below to answer the next two questions

-The deadweight loss from a tax can be represented by:

A) the distance PTH

B) the rectangle TPTHF

C) the triangle FGE

D) the trapezoid FEQEQT

E) none of the above

-The deadweight loss from a tax can be represented by:

A) the distance PTH

B) the rectangle TPTHF

C) the triangle FGE

D) the trapezoid FEQEQT

E) none of the above

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following formulas is used to calculate the average tax rate?

A) change in tax liabilty/change in taxable income

B) percent change in tax liability/percent change in taxable income

C) tax liabilty/taxable income

D) natural log of tax liability/taxable income squared

A) change in tax liabilty/change in taxable income

B) percent change in tax liability/percent change in taxable income

C) tax liabilty/taxable income

D) natural log of tax liability/taxable income squared

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

46

Among state and local governments, the primary source of revenues is:

A) sales taxes

B) personal taxes

C) property taxes

D) revenues from the federal government

E) tariffs on imported goods

A) sales taxes

B) personal taxes

C) property taxes

D) revenues from the federal government

E) tariffs on imported goods

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

47

The "entitlement crisis" as it applies to the Social Security and Medicare programs:

A) is merely a function of a stingy government

B) should resolve itself within the next 30 years or so

C) occurred because veteran's benefits were consuming too much of the federal budget

D) refers to the long-run financing problems that raise the questions of society's willingness and ability to pay for these programs

A) is merely a function of a stingy government

B) should resolve itself within the next 30 years or so

C) occurred because veteran's benefits were consuming too much of the federal budget

D) refers to the long-run financing problems that raise the questions of society's willingness and ability to pay for these programs

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck