Deck 9: Taxation of Corporations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/44

Play

Full screen (f)

Deck 9: Taxation of Corporations

1

Determine the corporate income tax for the following taxable incomes?

a. $72,000

b. $173,000

c. $699,000

d. $11,000,000

e. $17,000,000

f. $19,000,000

a. $72,000

b. $173,000

c. $699,000

d. $11,000,000

e. $17,000,000

f. $19,000,000

a. $72,000: ($50,000 x .15) + ($22,000 x .25) = $13,000

b. $173,000: ($50,000 x .15) + ($25,000 x .25) + ($25,000 x .34) + ($73,000 x .39) = $50,720

c. $699,000: $699,000 x .34 = $237,660

d. $11,000,000: ($10,000,000 x .34) + ($1,000,000 x .35) = $3,750,000

e. $17,000,000: ($10,000,000 x .34) + ($5,000,000 x .35) + ($2,000,000 x .38)= $5,910,000

f. $19,000,000: $19,000,000 x .35 = $6,650,000

b. $173,000: ($50,000 x .15) + ($25,000 x .25) + ($25,000 x .34) + ($73,000 x .39) = $50,720

c. $699,000: $699,000 x .34 = $237,660

d. $11,000,000: ($10,000,000 x .34) + ($1,000,000 x .35) = $3,750,000

e. $17,000,000: ($10,000,000 x .34) + ($5,000,000 x .35) + ($2,000,000 x .38)= $5,910,000

f. $19,000,000: $19,000,000 x .35 = $6,650,000

2

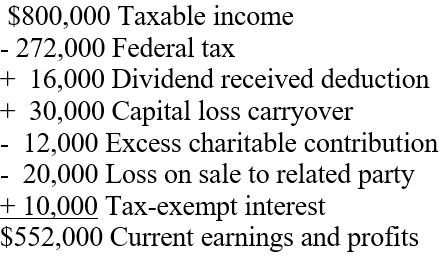

Ardbeg Corporation has $800,000 of taxable income on which it pays a tax of $272,000. In determining its earnings and profits for the year, the accountant used the following information:

a. Ardbeg received a dividend of $20,000 from a company in which it has a 60 percent interest.

b. It used a $30,000 capital loss carryover to offset its entire capital gain.

c. It was unable to deduct $12,000 of its charitable contribution due to the limitation.

d. It had a loss of $20,000 on the sale of some investments to its sole shareholder.

e. It received $10,000 in interest on City of Cleveland bonds

What is the corporations current earnings and profits?

a. Ardbeg received a dividend of $20,000 from a company in which it has a 60 percent interest.

b. It used a $30,000 capital loss carryover to offset its entire capital gain.

c. It was unable to deduct $12,000 of its charitable contribution due to the limitation.

d. It had a loss of $20,000 on the sale of some investments to its sole shareholder.

e. It received $10,000 in interest on City of Cleveland bonds

What is the corporations current earnings and profits?

3

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Insurance premium on key-person life insurance.

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Insurance premium on key-person life insurance.

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

addition to book income in determining taxable income(A)

4

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Tax-exempt bond interest income

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Tax-exempt bond interest income

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

5

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Tax depreciation in excess of book depreciation

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Tax depreciation in excess of book depreciation

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

6

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Fines and bribes

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Fines and bribes

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

7

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Nondeductible portion of meals and entertainment

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Nondeductible portion of meals and entertainment

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

8

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Federal income tax

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Federal income tax

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

9

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Carryover of a charitable contribution from a prior year

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Carryover of a charitable contribution from a prior year

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

10

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Increase in cash value of key-person life insurance

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Increase in cash value of key-person life insurance

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

11

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Bad debt expense in excess of the addition to bad debt reserves

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Bad debt expense in excess of the addition to bad debt reserves

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

12

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Excess of book depreciation over tax depreciation

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Excess of book depreciation over tax depreciation

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

13

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Expenses related to tax-exempt income

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Expenses related to tax-exempt income

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

14

Designate by an A if the item would be an addition to book income in determining taxable income; designate by an S if the item would be a subtraction from book income in determining taxable income.

-Excess capital losses over capital gains

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

-Excess capital losses over capital gains

A)addition to book income in determining taxable income(A)

B)subtraction from book income in determining taxable income(S)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

15

Indicate by I if the following is an increase in taxable income to determine current earnings and profits or D if it is a decrease in taxable income in determining current earnings and profits.

-Corporate charitable contributions in excess of 10 percent limit.

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

-Corporate charitable contributions in excess of 10 percent limit.

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

16

Indicate by I if the following is an increase in taxable income to determine current earnings and profits or D if it is a decrease in taxable income in determining current earnings and profits.

-A fine for monopolistic practices

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

-A fine for monopolistic practices

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

17

Indicate by I if the following is an increase in taxable income to determine current earnings and profits or D if it is a decrease in taxable income in determining current earnings and profits.

-Net operating loss carryovers

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

-Net operating loss carryovers

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

18

Indicate by I if the following is an increase in taxable income to determine current earnings and profits or D if it is a decrease in taxable income in determining current earnings and profits.

-Life insurance proceeds

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

-Life insurance proceeds

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

19

Indicate by I if the following is an increase in taxable income to determine current earnings and profits or D if it is a decrease in taxable income in determining current earnings and profits.

-Expenses related to tax-exempt income

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

-Expenses related to tax-exempt income

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

20

Indicate by I if the following is an increase in taxable income to determine current earnings and profits or D if it is a decrease in taxable income in determining current earnings and profits.

-Capital loss carryovers

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

-Capital loss carryovers

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

21

Indicate by I if the following is an increase in taxable income to determine current earnings and profits or D if it is a decrease in taxable income in determining current earnings and profits.

-Dividends received deduction

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

-Dividends received deduction

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

22

Indicate by I if the following is an increase in taxable income to determine current earnings and profits or D if it is a decrease in taxable income in determining current earnings and profits.

-Federal income tax refunds

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

-Federal income tax refunds

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

23

Indicate by I if the following is an increase in taxable income to determine current earnings and profits or D if it is a decrease in taxable income in determining current earnings and profits.

-Disallowed losses on sales to related parties

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

-Disallowed losses on sales to related parties

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

24

Indicate by I if the following is an increase in taxable income to determine current earnings and profits or D if it is a decrease in taxable income in determining current earnings and profits.

-Section 179 expense in excess of allowable depreciation

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

-Section 179 expense in excess of allowable depreciation

A)increase in taxable income to determine current earnings and profits(I)

B)decrease in taxable income in determining current earnings and profits(D)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

25

Coho is a corporation that has $1,100,000 of gross revenue and $1,021,000 of deductible expenses? What is its income tax liability?

A) $79,000

B) $30,494

C) $26,860

D) $15,110

E) None of the above

A) $79,000

B) $30,494

C) $26,860

D) $15,110

E) None of the above

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

26

Soho is a personal service corporation that has $1,100,000 of gross revenue and $1,021,000 of deductible expenses? What is its income tax liability?

A) $79,000

B) $30,494

C) $27,650

D) $26,860

E) $15,110

A) $79,000

B) $30,494

C) $27,650

D) $26,860

E) $15,110

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

27

Cloud Corporation has a taxable income of $100,000 in 2011 along with a $30,000 general business credit. What is the amount of its credit carryover and the last year to which the carryover could be used?

A) $70,000, 2031

B) $7,750, 2031

C) $7,750, 2016

D) $13,125, 2031

A) $70,000, 2031

B) $7,750, 2031

C) $7,750, 2016

D) $13,125, 2031

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

28

The Shepherd Corporation has $40,000 of taxable income, $200,000 of positive adjustments, and a $10,000 preference item. What is its alternative minimum taxable income?

A) $250,000

B) $235,000

C) $230,00

D) $225,000

E) None of the above

A) $250,000

B) $235,000

C) $230,00

D) $225,000

E) None of the above

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

29

Corporation P files a consolidated return with Corporation S. In preparing a consolidated return, their accountant finds the following:

What is the consolidated return taxable income?

A) $365,000

B) $295,000

C) $280,000

D) $315,000

What is the consolidated return taxable income?

A) $365,000

B) $295,000

C) $280,000

D) $315,000

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

30

Casey Corporation has three assets when it decides to liquidate:

Book income

- 50,000 Insurance payment

+ 4,000 Insurance premium

- 10,000 Tax-exempt income

- 5,000 Excess bad-debt deduction

Excess book depreciation

Taxable income

The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder. What is its tax liability on its final tax return if it had $45,000 of income from operations prior to liquidating?

A) $6,750

B) $5,000

C) $3,750

D) $750

E) 0

Book income

- 50,000 Insurance payment

+ 4,000 Insurance premium

- 10,000 Tax-exempt income

- 5,000 Excess bad-debt deduction

Excess book depreciation

Taxable income

The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder. What is its tax liability on its final tax return if it had $45,000 of income from operations prior to liquidating?

A) $6,750

B) $5,000

C) $3,750

D) $750

E) 0

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

31

Whyley Corporation, a C corporation, has gross profits on sales of $50,000 and deductible expenses of $60,000. In addition, Whyley has a net capital gain of $30,000. Whyley's taxable income is:

A) 0

B) $10,000

C) $20,000

D) $30,000

E) $80,000

A) 0

B) $10,000

C) $20,000

D) $30,000

E) $80,000

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

32

BarBRanch has had taxable income of $450,000, $570,000, $760,000 and $680,000 in years 2008 through 2011, respectively. What were the equal minimum quarterly estimated tax payments for 2011 that BarBRanch should have made in 2011 to avoid any penalty?

A) $57,676

B) $57,800

C) $64,600

D) $170,000

A) $57,676

B) $57,800

C) $64,600

D) $170,000

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

33

Who is a disqualified person?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

34

An exempt organization has dividend income of $200,000. It receives contributions of $350,000 and grants totaling $175,000. Is this a private foundation?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

35

What is the difference between a corporate franchise tax and a corporate income tax for state tax purposes?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

36

What are the three factors normally used to determine a state's share of a corporation's taxable income?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

37

What is meant by the term nexus?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is normally not an adjustment to federal taxable income to determine state taxable income?

A) Interest on federal bonds or notes

B) Interest on state bonds

C) Corporate dividends

D) State income taxes

A) Interest on federal bonds or notes

B) Interest on state bonds

C) Corporate dividends

D) State income taxes

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following will not establish nexus in a state for a corporation?

A) Catalogs are delivered by mail to potential customers.

B) Phone orders are taken from all over the country in a facility owned by the corporation

C) The company has a small factory in the state

D) The company has a small sales office for 5 of its 50 sales persons.

A) Catalogs are delivered by mail to potential customers.

B) Phone orders are taken from all over the country in a facility owned by the corporation

C) The company has a small factory in the state

D) The company has a small sales office for 5 of its 50 sales persons.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

40

The purpose of the use tax is to:

A) Tax tangible property used in a state

B) Have out-of-state companies collect taxes on in-state purchases

C) Equalize the tax on out-of-state purchases with that on in-state purchases when no sales taxes were paid

D) Increase income tax revenues

A) Tax tangible property used in a state

B) Have out-of-state companies collect taxes on in-state purchases

C) Equalize the tax on out-of-state purchases with that on in-state purchases when no sales taxes were paid

D) Increase income tax revenues

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is normally not used as part of the apportionment factor for determining state income tax?

A) Payroll

B) Sales

C) Property

D) Expenses

A) Payroll

B) Sales

C) Property

D) Expenses

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

42

The sales and use taxes would be classified as

A) Income taxes

B) Property taxes

C) Wealth taxes

D) Consumption taxes

E) Transfer taxes

A) Income taxes

B) Property taxes

C) Wealth taxes

D) Consumption taxes

E) Transfer taxes

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

43

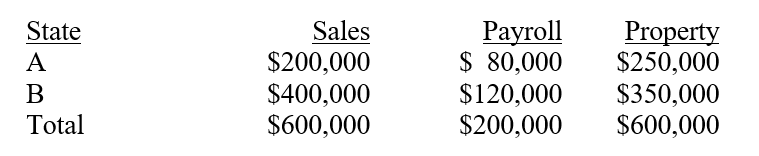

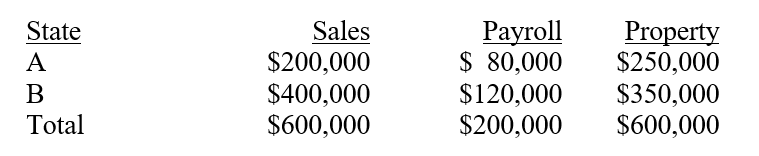

A corporation supplies the following information to you to determine its taxable income for states A and B:

If State A uses an equally-weighted formula but State B weights payroll twice as much as sales and property, what are the apportionment factors for States A and B?

If State A uses an equally-weighted formula but State B weights payroll twice as much as sales and property, what are the apportionment factors for States A and B?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

44

How much tax does Tom legally avoid if he buys a camera for $1,000 in Delaware but uses it in Maryland where he lives and the sales tax there is 7 percent?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck