Deck 2: The Tax Practice Environment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/15

Play

Full screen (f)

Deck 2: The Tax Practice Environment

1

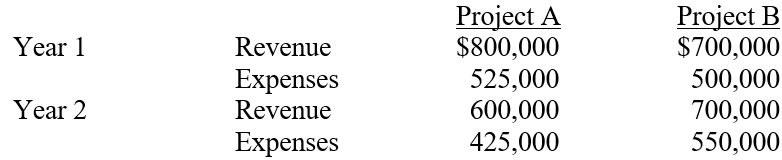

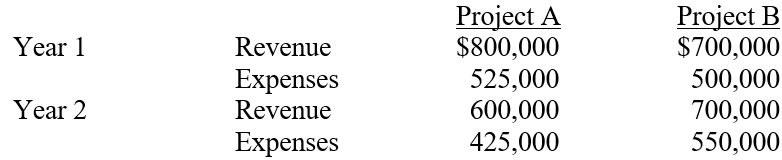

Berman Corporation can accept only one of two projects. The revenue and expenses for each of the projects is shown below. Which project should Berman accept if the corporation has a 10 percent cost of capital and a 34 percent marginal tax rate?

PV of Project A: [$275,000 x (1 - .34) x .909] + [$175,000 x (1 - .34) x .826] = $260,386.50

PV of Project B: [$200,000 x (1 - .34) x .909] + [$150,000 x (1 - .34) x .826] = $201,762

Project A should be undertaken.

PV of Project B: [$200,000 x (1 - .34) x .909] + [$150,000 x (1 - .34) x .826] = $201,762

Project A should be undertaken.

2

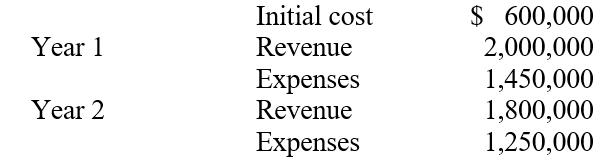

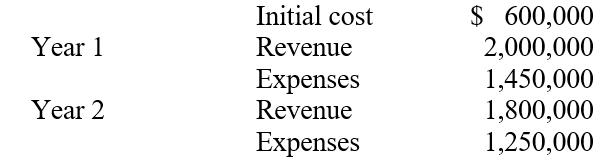

What is the after-tax net present value of a project costing $600,000 that Plud Corporation can invest in, if the project has the following estimated revenues and expenses?

Plud uses an 8 percent discount rate for evaluation and expects a 34 percent marginal tax rate in the relevant years.

Plud uses an 8 percent discount rate for evaluation and expects a 34 percent marginal tax rate in the relevant years.

Year 1: $550,000 x (1 - .34) x .926 = $336,138; Year 2: $550,000 x (1 - .34) x .857 = $311,091; NPV = $336,138 + $311,091 - $600,000 = $47,229

3

Cynthia and John have dependent twins ages 24. Their joint income places them in the 35 percent marginal tax bracket. What are their total tax savings if they can transfer $7,500 of taxable income to each of the children? The children have no other taxable income.

Children's tax: ($7,500 - $950 standard deduction) x .10 x 2 = $1,310; Parents' tax savings: $15,000 x .35 = $5,250. Net tax savings = $5,250 - $1,310 = $3,940

4

Claudia owns business property that has increased in value by $20,000. If she sells now, three weeks before the end of the tax year, it will be subject to her current 35 percent marginal tax rate. If she waits until the beginning of the next year, she expects her marginal tax rate to decrease to 25 percent. How much more tax will she pay if she sells now rather than waiting the three weeks until next year?

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

5

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

-A tax textbook

A) primary source(P)

B) secondary source(S)

-A tax textbook

A) primary source(P)

B) secondary source(S)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

6

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

-Tax Court Decision

A) primary source(P)

B) secondary source(S)

-Tax Court Decision

A) primary source(P)

B) secondary source(S)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

7

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

-Kiplinger Tax Letter

A) primary source(P)

B) secondary source(S)

-Kiplinger Tax Letter

A) primary source(P)

B) secondary source(S)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

8

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

-Journal of Accountancy

A) primary source(P)

B) secondary source(S)

-Journal of Accountancy

A) primary source(P)

B) secondary source(S)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

9

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

-Legislative regulations

A) primary source(P)

B) secondary source(S)

-Legislative regulations

A) primary source(P)

B) secondary source(S)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

10

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

-Internal Revenue Code

A) primary source(P)

B) secondary source(S)

-Internal Revenue Code

A) primary source(P)

B) secondary source(S)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

11

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

-A Court of Federal Claims decision

A) primary source(P)

B) secondary source(S)

-A Court of Federal Claims decision

A) primary source(P)

B) secondary source(S)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

12

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

-Committee reports

A) primary source(P)

B) secondary source(S)

-Committee reports

A) primary source(P)

B) secondary source(S)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

13

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

-The Tax Adviser

A) primary source(P)

B) secondary source(S)

-The Tax Adviser

A) primary source(P)

B) secondary source(S)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

14

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

-Revenue ruling

A) primary source(P)

B) secondary source(S)

-Revenue ruling

A) primary source(P)

B) secondary source(S)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

15

How much tax can be saved if John shifts $6,000 of income to his 24 year old dependent son? John is in the 25 percent tax bracket and his son has no other taxable income in 2011.

A) $1,500

B) $990

C) $900

D) $600

A) $1,500

B) $990

C) $900

D) $600

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck