Deck 12: Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/166

Play

Full screen (f)

Deck 12: Capital Budgeting

1

All capital budgeting proposals require the authorization of upper management.

False

2

A higher rate of return usually makes a proposal more attractive to a company.

True

3

Capital Budgeting has to do with the acquisition of long-term assets.

True

4

Rate of Return = Investment / Returns on the Investment

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

5

The "hurdle rate"

is the minimum rate of return that a company expects to receive from any investment that they undertake.

is the minimum rate of return that a company expects to receive from any investment that they undertake.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

6

A "buffer margin"

is the number of percentage points by which the cost of capital may exceed the expected rate of return for a project, where the company will still accept the project

is the number of percentage points by which the cost of capital may exceed the expected rate of return for a project, where the company will still accept the project

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

7

Comparing current returns with future returns, without accounting for the time value of money, will overstate the relative value of the future returns.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

8

The present value of an annuity is equal to the amount that, if invested today at the specified discount rate, would return the value of the annuity in a specific number of years.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

9

The present value of an annuity is equal to the amount that, if invested today at the specified discount rate, would return the value of the annuity every year for a specified number of years.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

10

The present value of a single sum is equal to the amount that, if invested today at the specified discount rate, would return the value of the single sum in a specific number of years.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

11

The present value of a single sum is equal to the amount that, if invested today at the specified discount rate, would return the value of the single sum every year for a specified number of years.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

12

A tax shield is equal to the related non-cash expense multiplied by (1 - tax rate).

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

13

After-tax cash flows for a cash outflow is equal to the related pre-tax outflow multiplied by the tax rate.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

14

After-tax cash flows for a cash inflow is equal to the related pre-tax inflow multiplied by (1 - tax rate).

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

15

The after-tax cash flows for Depreciation expense is the same amount as the Depreciation tax shield.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

16

A loss recognized on the disposal of an asset at the end of the project creates a tax shield.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

17

When disposing of a fully depreciated asset, the net after-tax value is equal to the Proceeds × (1 - tax rate).

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

18

Excess Present Value Index is a measure to determine whether a project meets the required rate of return, and is equal to the NPV of the project divided by the Initial Investment.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

19

The disposal value of an asset is always subject to taxes.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

20

One disadvantage of the internal rate of return is that it does not consider the time value of money.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

21

The Cash Payback Period is the number of years it takes for non-discounted cash flows to equal the amount of the original investment.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

22

The Average Rate of Return focuses on accrual Net Income figures rather than Cash Flows.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

23

The Cash Payback method analyzes the relative profitability of various investments.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

24

If two investments have the same average rate of return, they will be considered to be equally attractive to management.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

25

It is possible to calculate the internal rate of return on a project with a financial calculator.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

26

It is not possible to calculate the internal rate of return on a project using a financial spreadsheet.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

27

Cash outflows should be represented as negative amounts when being entered into a financial calculator.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

28

On a financial calculator, the PMT value must always be entered.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not one of the 3 steps in the capital budgeting process?

A) Identify potential investments

B) Hedge selected investments

C) Select investments to be undertaken

D) Monitor selected Investments

E) All of the above are steps in the capital budgeting process

A) Identify potential investments

B) Hedge selected investments

C) Select investments to be undertaken

D) Monitor selected Investments

E) All of the above are steps in the capital budgeting process

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not one of the considerations given to capital budgeting proposals?

A) Whether the proposal is in compliance with capital budgeting policies

B) Whether the proposal would meet the established minimum return on capital

C) Whether there is an immediate need to replace or repair critical assets.

D) Whether the proposal is congruent with the firm's long-term goals

E) All of the above are considerations given to capital budgeting proposals

A) Whether the proposal is in compliance with capital budgeting policies

B) Whether the proposal would meet the established minimum return on capital

C) Whether there is an immediate need to replace or repair critical assets.

D) Whether the proposal is congruent with the firm's long-term goals

E) All of the above are considerations given to capital budgeting proposals

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is not one of the three steps for a typical approved capital expenditure project?

A) Initial investment

B) Operating cash flows

C) Investment selection

D) Project termination

E) None of the above are steps in a capital expenditure project

A) Initial investment

B) Operating cash flows

C) Investment selection

D) Project termination

E) None of the above are steps in a capital expenditure project

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following would be considered a capital expenditure?

A) Purchasing inventory for resale

B) Depreciation Expense

C) Repurchasing company shares as Treasury Stock

D) Replacing a defective piece of equipment

E) None of the above

A) Purchasing inventory for resale

B) Depreciation Expense

C) Repurchasing company shares as Treasury Stock

D) Replacing a defective piece of equipment

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is a potential source of capital for a company to invest in long-term assets?

A) Issuing additional common stock

B) Bank loans

C) Net Income from past years

D) Issuing bonds

E) All of the above

A) Issuing additional common stock

B) Bank loans

C) Net Income from past years

D) Issuing bonds

E) All of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is not a potential source of capital for a company to invest in long-term assets?

A) Credit terms from inventory suppliers

B) Bank loans

C) Net Income from past years

D) Issuing additional common stock

E) All of the above are potential sources of capital

A) Credit terms from inventory suppliers

B) Bank loans

C) Net Income from past years

D) Issuing additional common stock

E) All of the above are potential sources of capital

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following affect the weighted average cost of capital?

A) Bond interest payments

B) Expected increases in the value of stock in the company

C) Interest on bank loans

D) Dividends expected by investors

E) All of the above

A) Bond interest payments

B) Expected increases in the value of stock in the company

C) Interest on bank loans

D) Dividends expected by investors

E) All of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

36

The time value of money dictates that money received today will be worth ______ in the future than it is worth today?

A) more

B) less

C) the same

D) It depends on the discount

A) more

B) less

C) the same

D) It depends on the discount

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

37

Because of the time value of money, a company would prefer to receive a payment due to them:

A) As late as possible

B) As early as possible

C) It does not make a difference when the payment is received

D) It depends on the discount rate

E) None of the above

A) As late as possible

B) As early as possible

C) It does not make a difference when the payment is received

D) It depends on the discount rate

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

38

Because of the time value of money, a company would prefer to make a payment that they owe:

A) As late as possible

B) As early as possible

C) It does not make a difference when the payment is made

D) It depends on the discount rate

E) None of the above

A) As late as possible

B) As early as possible

C) It does not make a difference when the payment is made

D) It depends on the discount rate

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

39

The present value of an ordinary annuity is:

A) The amount that would be paid today in order to receive a series of unequal payments in the future

B) The amount that would be paid in the future in order to receive a series of unequal payments leading up to that point

C) The amount that would be paid in the future in order to receive a series of equal payments leading up to that point

D) The amount that would be paid today in order to receive a series of equal payments in the future

E) None of the above

A) The amount that would be paid today in order to receive a series of unequal payments in the future

B) The amount that would be paid in the future in order to receive a series of unequal payments leading up to that point

C) The amount that would be paid in the future in order to receive a series of equal payments leading up to that point

D) The amount that would be paid today in order to receive a series of equal payments in the future

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

40

The present value of a single sum is:

A) The amount that would be paid today to receive a single amount at an unspecified date in the future

B) The amount that would be paid at a specified date in the future to receive a single amount today

C) The amount that would be paid today to receive a single amount at a specified date in the future

D) The amount that would be paid at an unspecified date in the future to receive a single amount today

E) None of the above

A) The amount that would be paid today to receive a single amount at an unspecified date in the future

B) The amount that would be paid at a specified date in the future to receive a single amount today

C) The amount that would be paid today to receive a single amount at a specified date in the future

D) The amount that would be paid at an unspecified date in the future to receive a single amount today

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

41

The formula for calculating an after-tax cash inflow is:

A) Pre-tax cash inflow / (1 - tax rate)

B) Pre-tax cash inflow x (1-tax rate)

C) Pre-tax cash inflow / (tax rate - 1)

D) Pre-tax cash inflow × (tax rate - 1)

E) None of the above

A) Pre-tax cash inflow / (1 - tax rate)

B) Pre-tax cash inflow x (1-tax rate)

C) Pre-tax cash inflow / (tax rate - 1)

D) Pre-tax cash inflow × (tax rate - 1)

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

42

The formula for calculating an after-tax cash outflow is:

A) Pre-tax cash outflow / (1 - tax rate)

B) Pre-tax cash outflow x (1-tax rate)

C) Pre-tax cash outflow / (tax rate - 1)

D) Pre-tax cash outflow × (tax rate - 1)

E) None of the above

A) Pre-tax cash outflow / (1 - tax rate)

B) Pre-tax cash outflow x (1-tax rate)

C) Pre-tax cash outflow / (tax rate - 1)

D) Pre-tax cash outflow × (tax rate - 1)

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

43

If the cash method of accounting is used rather than the accrual method, which of the following adjustments must be made to Net Income to arrive at after-tax cash flows?

A) Change in Accounts Payable

B) Depreciation expense

C) Change in Accounts Receivable

D) Change in Expense Liability accounts

E) None of the above

A) Change in Accounts Payable

B) Depreciation expense

C) Change in Accounts Receivable

D) Change in Expense Liability accounts

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is a step required in the determination of the net-present value of a capital investment project?

A) Net the present value of future cash flows with current cash flows

B) Determine the net after-tax cash flows in future periods

C) Determine the net after-tax cash flows of initial outlay

D) Discount future cash flows to present values

E) All of the above

A) Net the present value of future cash flows with current cash flows

B) Determine the net after-tax cash flows in future periods

C) Determine the net after-tax cash flows of initial outlay

D) Discount future cash flows to present values

E) All of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is not a step required in the determination of the net-present value of a capital investment project?

A) Determine the net after-tax cash flow of initial outlay

B) Subtract future cash flows from current cash flows

C) Determine the net after-tax cash flows in future periods

D) Discount future cash flows to present values

E) None of the above, all are steps in the determination of net present value.

A) Determine the net after-tax cash flow of initial outlay

B) Subtract future cash flows from current cash flows

C) Determine the net after-tax cash flows in future periods

D) Discount future cash flows to present values

E) None of the above, all are steps in the determination of net present value.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following items is typically not impacted by taxes when considering Net Present Value?

A) Cash receipts from future sales

B) Cash outlays for future expenses

C) Cash receipts for disposal of fully-depreciated assets

D) Cash outlays for initial investment

E) None of the above, all are impacted by taxes.

A) Cash receipts from future sales

B) Cash outlays for future expenses

C) Cash receipts for disposal of fully-depreciated assets

D) Cash outlays for initial investment

E) None of the above, all are impacted by taxes.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following items are impacted by taxes when considering Net Present Value?

A) Cash outlays for future expenses

B) Cash receipts for disposal of fully-depreciated assets

C) Cash receipts from future sales

D) Depreciation expense

E) All of the above

A) Cash outlays for future expenses

B) Cash receipts for disposal of fully-depreciated assets

C) Cash receipts from future sales

D) Depreciation expense

E) All of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

48

What would a project's excess present value index be if the project has an internal rate of return which is equal to the company's discount rate?

A) It would be 0.5.

B) It would be 1.0.

C) It would be 0.0.

D) It cannot be determined from information provided

A) It would be 0.5.

B) It would be 1.0.

C) It would be 0.0.

D) It cannot be determined from information provided

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

49

What will happen to the internal rate of return (IRR) of a project if the discount rate is decreased from 8% to 6%?

A) IRR will always increase.

B) IRR will always decrease

C) The discount rate change will not affect IRR.

D) We cannot determine the direction of the effect on IRR from the information provided.

A) IRR will always increase.

B) IRR will always decrease

C) The discount rate change will not affect IRR.

D) We cannot determine the direction of the effect on IRR from the information provided.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

50

The cash payback period is:

A) The number of years needed on an investment for the after-tax cash flows to equal the original investment

B) The number of years of positive after-tax cash flows needed to make the net present value of an investment equal 0.

C) The number of years of positive after-tax cash flows, discounted to the present period, needed to equal the original investment

D) The total time that an investment will return positive after-tax cash flows

E) None of the above

A) The number of years needed on an investment for the after-tax cash flows to equal the original investment

B) The number of years of positive after-tax cash flows needed to make the net present value of an investment equal 0.

C) The number of years of positive after-tax cash flows, discounted to the present period, needed to equal the original investment

D) The total time that an investment will return positive after-tax cash flows

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

51

The Cash Payback Method:

A) Is preferable to the Net Present Value method for evaluating relative profitability

B) Reflects the total life of the investment project

C) Considers discounted cash flows

D) Includes calculations of depreciation tax shields

E) None of the above

A) Is preferable to the Net Present Value method for evaluating relative profitability

B) Reflects the total life of the investment project

C) Considers discounted cash flows

D) Includes calculations of depreciation tax shields

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

52

The Average Rate of Return:

A) Is not as understandable for management as NPV

B) Is based strictly on the value of the Initial Investment

C) Takes into account the time value of money

D) Considers the financial statement impact of an investment rather than cash flows consequences

E) None of the above

A) Is not as understandable for management as NPV

B) Is based strictly on the value of the Initial Investment

C) Takes into account the time value of money

D) Considers the financial statement impact of an investment rather than cash flows consequences

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

53

The Average Rate of Return is equal to:

A) Net Present Value / Initial Investment

B) Average Annual Net Income from Investment / Average Investment

C) Average Present Value of future cash flows / Initial Investment

D) Average Annual Net Income from Investment / Initial Investment

E) None of the above

A) Net Present Value / Initial Investment

B) Average Annual Net Income from Investment / Average Investment

C) Average Present Value of future cash flows / Initial Investment

D) Average Annual Net Income from Investment / Initial Investment

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

54

In a financial spreadsheet calculation, "Nper" stands for:

A) The number of accounting periods that the investment will cover

B) The expected return on the investment

C) The amount of the initial investment

D) The interest rate that is required by the company

E) None of the above

A) The number of accounting periods that the investment will cover

B) The expected return on the investment

C) The amount of the initial investment

D) The interest rate that is required by the company

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

55

In a financial calculator, "PMT" stands for:

A) The amount of the initial investment

B) The number of accounting periods that the investment will cover

C) The interest rate that is required by the company

D) A period cash inflow or outflow of equal amounts

E) None of the above

A) The amount of the initial investment

B) The number of accounting periods that the investment will cover

C) The interest rate that is required by the company

D) A period cash inflow or outflow of equal amounts

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

56

In a financial spreadsheet calculation, the interest rate must be entered as:

A) A whole number

B) A percentage (with the percent sign "%" )

C) A decimal (with the decimal point ".")

D) A fraction (with the division sign "/" )

E) None of the above

A) A whole number

B) A percentage (with the percent sign "%" )

C) A decimal (with the decimal point ".")

D) A fraction (with the division sign "/" )

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following cannot be calculated on a financial spreadsheet?

A) Future value of a series of payments made

B) Present Value of a stream of future payments

C) Present Value of a single lump sum to be received in the future

D) Future value of a single lump sum deposited today

E) All of these can be calculated on a financial spreadsheet

A) Future value of a series of payments made

B) Present Value of a stream of future payments

C) Present Value of a single lump sum to be received in the future

D) Future value of a single lump sum deposited today

E) All of these can be calculated on a financial spreadsheet

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

58

Acme Co. has excess cash that it wants to invest. Acme is considering purchasing an asset that is expected to return $25,000 per year after tax for the next 5 years, with an after-tax disposal value of $10,000. Acme's required rate of return on this investment is 8%.

What is the maximum amount that Ames would be willing to pay to purchase this asset? (Use the appropriate discount factor from Appendix A and round your final answer to the nearest dollar.)

A) $99,818

B) $168,349

C) $115,000

D) None of the above

What is the maximum amount that Ames would be willing to pay to purchase this asset? (Use the appropriate discount factor from Appendix A and round your final answer to the nearest dollar.)

A) $99,818

B) $168,349

C) $115,000

D) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

59

Shelton Tax Services is considering investing in new software for their corporate tax business. The investment will require an outlay of $350,000 initially, and is expected to generate the following after-tax cash flows: Year 1, $60,000; Year 2, $80,000; Year 3, $105,000; Year 4, $120,000; Year 5, $145,000. Shelton uses a discount rate of 10%.

What is the Net Present Value of the proposed investment? (Use the tables in Appendix A to determine the appropriate discount factor and round your final answer to the nearest dollar.)

A) $160,000

B) $371,544

C) $21,544

D) None of the above

What is the Net Present Value of the proposed investment? (Use the tables in Appendix A to determine the appropriate discount factor and round your final answer to the nearest dollar.)

A) $160,000

B) $371,544

C) $21,544

D) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

60

Bagley Inc. is considering purchasing a piece of farm equipment worth $280,000. The equipment would be depreciated on a straight-line basis assuming no residual value over the course of 7 years, after which time it would be scrapped.

Assuming that the tax rate is 25%, and the discount rate is 6%, what would be the amount of the annual depreciation tax shield of the proposed equipment?

A) $40,000

B) $12,000

C) $10,000

D) None of the above

Assuming that the tax rate is 25%, and the discount rate is 6%, what would be the amount of the annual depreciation tax shield of the proposed equipment?

A) $40,000

B) $12,000

C) $10,000

D) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

61

Bagley Inc. reported Sales of $250,000, Cost of Goods Sold of $200,000 (including depreciation expense of $50,000), and Office Expenses of $40,000. The tax rate is 25%. The company had no significant changes in Accounts Receivable, Inventory, Accounts Payable, Prepaid Expenses, or Unearned Revenue.

What is the value of after-tax cash flows?

A) $ 7,000

B) $22,000

C) $57,500

D) None of the above

What is the value of after-tax cash flows?

A) $ 7,000

B) $22,000

C) $57,500

D) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

62

Bagley Inc. had after-tax cash flows related to the purchase of inventory of $7,000 for September.

What is the pre-tax cash flow relating to inventory purchases for the month, assuming a tax rate of 20%?

A) $10,000

B) $ 4,900

C) $ 8,750

D) None of the above

What is the pre-tax cash flow relating to inventory purchases for the month, assuming a tax rate of 20%?

A) $10,000

B) $ 4,900

C) $ 8,750

D) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

63

Fantastic Flooring (FF) is a carpet wholesale company. FF is considering building a new inventory warehouse for $500,000. The warehouse would allow FF to increase their pre-tax cash flows by $100,000 each year. The company would plan to use the warehouse for 10 years before selling it for $200,000. The company uses straight-line depreciation. FF's tax rate is 20%, and the required rate of return is 10%.

What is the Net Present Value of the proposed investment?

A) $105,541.02

B) ($ 57,590.96)

C) $ 19,517.04

D) None of the above

What is the Net Present Value of the proposed investment?

A) $105,541.02

B) ($ 57,590.96)

C) $ 19,517.04

D) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

64

Woodpecker Pipeline (WPP) is a contracting company that lays oil pipeline infrastructure. WPP is considering purchasing a piece of excavating equipment worth $5,000,000. The machine would generate a net $300,000 yearly pre-tax cash flows. The machine would be depreciated over the course of 20 years, at which time it is predicted to have a disposal value of $500,000. Management plans to depreciate full value of the asset (not deducting the anticipated disposal value in the calculation), and will take a full year of depreciation the first year. WPP's tax rate is 20%, and the discount rate is 11%.

What is the Excess Present Value Index of the proposed machinery (rounded to 4 decimal places)?

A) 0.4718

B) 0.4539

C) 2.1617

D) None of the above

What is the Excess Present Value Index of the proposed machinery (rounded to 4 decimal places)?

A) 0.4718

B) 0.4539

C) 2.1617

D) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

65

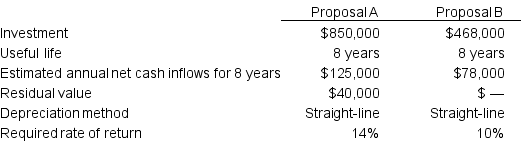

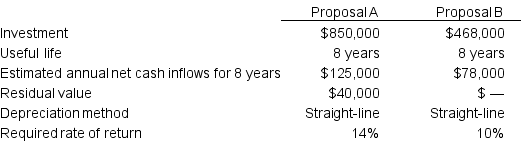

Sammy Corporation is considering two alternative investment proposals with the following data:

Using a financial calculator, determine the internal rate of return for Proposal A? (Ignore taxes)

Using a financial calculator, determine the internal rate of return for Proposal A? (Ignore taxes)

A) 2.88 %

B) 14.71 %

C) 4.57 %

D) 2.79%

Using a financial calculator, determine the internal rate of return for Proposal A? (Ignore taxes)

Using a financial calculator, determine the internal rate of return for Proposal A? (Ignore taxes)A) 2.88 %

B) 14.71 %

C) 4.57 %

D) 2.79%

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

66

Sammy Corporation is considering two alternative investment proposals with the following data:

Using a financial calculator, determine the internal rate of return for Proposal B? (Ignore taxes)

Using a financial calculator, determine the internal rate of return for Proposal B? (Ignore taxes)

A) 2.88 %

B) 6.88 %

C) 4.57 %

D) 2.79%

Using a financial calculator, determine the internal rate of return for Proposal B? (Ignore taxes)

Using a financial calculator, determine the internal rate of return for Proposal B? (Ignore taxes)A) 2.88 %

B) 6.88 %

C) 4.57 %

D) 2.79%

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

67

Pink Petunias, a wholesale nursery, is considering purchasing a new plot of land for their business for $300,000. The land would allow Pink Petunias to increase their pre-tax cash flows by $90,000 each year. The company would plan to keep the land for 20 years before selling it for $300,000. Because the land is real property, the company would not take any related depreciation. Pink Petunias' tax rate is 25%, and the required rate of return is 9%.

What is the Cash Payback Period of the proposed investment?

A) 20 years

B) 3.33 years

C) 4.44 years

D) None of the above

What is the Cash Payback Period of the proposed investment?

A) 20 years

B) 3.33 years

C) 4.44 years

D) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

68

Pink Petunias, a wholesale nursery, is considering purchasing a new plot of land for their business for $300,000. The land would allow Pink Petunias to increase their pre-tax cash flows by $90,000 each year. The company would plan to keep the land for 20 years before selling it for $300,000. Because the land is real property, the company would not take any related depreciation. Pink Petunias' tax rate is 25%, and the required rate of return is 9%.

What is the Average Rate of Return of the proposed investment?

A) 22.5%

B) 30.0%

C) 21.6%

D) None of the above

What is the Average Rate of Return of the proposed investment?

A) 22.5%

B) 30.0%

C) 21.6%

D) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

69

In a financial spreadsheet calculation, "Nper" stands for:

A) The expected return on the investment

B) The amount of the initial investment

C) The number of accounting periods that the investment will cover

D) The interest rate that is required by the company

E) None of the above

A) The expected return on the investment

B) The amount of the initial investment

C) The number of accounting periods that the investment will cover

D) The interest rate that is required by the company

E) None of the above

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

70

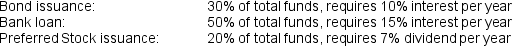

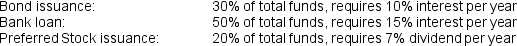

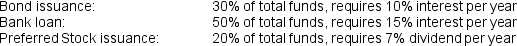

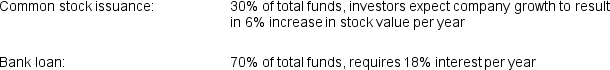

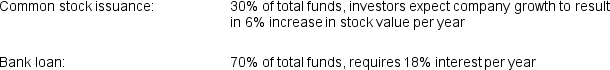

Shumer Inc. is a construction company that plans on purchasing new equipment this year for a new project. The project is expected to return $350,000 per year for the next 5 years. The equipment needed will cost $2,500,000. In order to purchase this equipment, Shumer must acquire the necessary funds from several sources.

The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

71

Shumer Inc. is a construction company that plans on purchasing new equipment this year for a new project. The project is expected to return $3500,000 per year for the next 5 years. The equipment needed will cost $2,500,000. In order to purchase this equipment, Shumer must acquire the necessary funds from several sources.

The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Shumer is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

Shumer is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

Does the proposed project meet the company's required rate of return?

The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Shumer is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

Shumer is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.Does the proposed project meet the company's required rate of return?

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

72

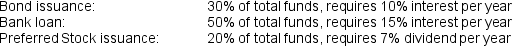

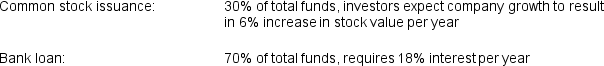

TG Enterprises owns a small start-up company, and wants to expand his business. In order to do so, he is soliciting capital investments and loans. He has incorporated his company, and plans to issue stock and take out a bank loan in order to finance the expansion. He projects that the funds invested now will produce returns of 10% per year.

Following is information related to the capital sources TG Enterprises plans to use.

Does the proposed project clear TG Enterprises' hurdle rate, or the weighted cost of capital?

Does the proposed project clear TG Enterprises' hurdle rate, or the weighted cost of capital?

Following is information related to the capital sources TG Enterprises plans to use.

Does the proposed project clear TG Enterprises' hurdle rate, or the weighted cost of capital?

Does the proposed project clear TG Enterprises' hurdle rate, or the weighted cost of capital?

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

73

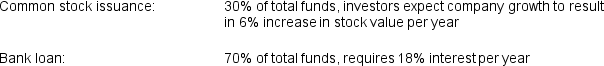

TG Enterprises owns a small start-up company, and wants to expand his business. In order to do so, he is soliciting capital investments and loans. He has incorporated his company, and plans to issue stock and take out a bank loan in order to finance the expansion. He projects that the funds invested now will produce returns of 10% per year.

Following is information related to the capital sources TG Enterprises plans to use.

TG Enterprises is also interested in making sure that he also profits from the project, and he will only accept the project if the rate of return exceed the cost of capital by at least 2 percentage points.

TG Enterprises is also interested in making sure that he also profits from the project, and he will only accept the project if the rate of return exceed the cost of capital by at least 2 percentage points.

Does the proposed project clear TG Enterprises' hurdle rate?

Following is information related to the capital sources TG Enterprises plans to use.

TG Enterprises is also interested in making sure that he also profits from the project, and he will only accept the project if the rate of return exceed the cost of capital by at least 2 percentage points.

TG Enterprises is also interested in making sure that he also profits from the project, and he will only accept the project if the rate of return exceed the cost of capital by at least 2 percentage points.Does the proposed project clear TG Enterprises' hurdle rate?

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

74

IBBC Co. has additional funds that need to be invested, and is considering purchasing an asset that is expected to return $100,000 per year after tax for the next 20 years, with no disposal value. IBBC Co.'s required rate of return is 12%.

What is the maximum amount that IBBC Co. would be willing to pay to purchase this asset? (Use the appropriate discount factor from Appendix A.)

What is the maximum amount that IBBC Co. would be willing to pay to purchase this asset? (Use the appropriate discount factor from Appendix A.)

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

75

Harrison Co. has additional funds that need to be invested, and is considering purchasing an asset that is expected to return $30,000 per year after tax for the next 5 years, with an after-tax disposal value of $30,000. Merrill Co.'s required rate of return is 10%.

What is the maximum amount that Harrison Co. would be willing to pay to purchase this asset? (Use the appropriate discount factor from Appendix A.)

What is the maximum amount that Harrison Co. would be willing to pay to purchase this asset? (Use the appropriate discount factor from Appendix A.)

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

76

Scription Inc. has additional cash available for investment. One of the production machines needs to be replaced, and management is considering two options. Both options require a similar initial outlay and have a useful life of 10 years. However, one of the machines will generate $60,000 annually in positive after-tax cash flows and would have an after-tax residual value of $50,000. The other option will generate $50,000 annually in positive after-tax cash flows and would have an after-tax residual value of $100,000.

Using a discount rate of 8%, which option is the most attractive? (Use the appropriate discount factor from Appendix A.)

Using a discount rate of 8%, which option is the most attractive? (Use the appropriate discount factor from Appendix A.)

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

77

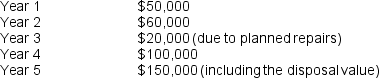

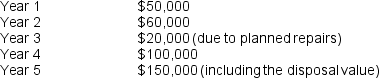

Madison Movers is considering investing in new trucks for their residential moving business. The investment will require an outlay of $180,000 initially, and is expected to generate the following after-tax cash flows:

The company uses a discount rate of 9%.

The company uses a discount rate of 9%.

What is the Net Present Value of the proposed investment? (Use the tables in Appendix A to determine the appropriate discount factor.)

The company uses a discount rate of 9%.

The company uses a discount rate of 9%.What is the Net Present Value of the proposed investment? (Use the tables in Appendix A to determine the appropriate discount factor.)

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

78

Lofty Expectations is considering purchasing a piece of equipment worth $1,000,000. The machine would have a net $0 of pre-tax cash flows: the expense required to maintain the machine would offset any revenues generated. The machine would be depreciated over the course of 40 years, after which time the machine would be scrapped.

Assuming that the company takes a full year of depreciation the first year, the tax rate is 25%, and the discount rate is 5%, what is the Net Present Value of the proposed machine?

Assuming that the company takes a full year of depreciation the first year, the tax rate is 25%, and the discount rate is 5%, what is the Net Present Value of the proposed machine?

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

79

SGM Corporation reported Sales of $100,000, Cost of Goods Sold of $60,000 (including depreciation expense of $5,000), and Office Expenses of $15,000. The tax rate is 25%. The company has no significant changes in Accounts Receivable, Inventory, Accounts Payable, Prepaid Expenses, or Unearned Revenue.

What is the value of after-tax cash flows?

What is the value of after-tax cash flows?

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

80

SGM Corporation had after-tax cash flows related to the purchase of inventory of $203,000 for June. What is the pre-tax cash flow relating to inventory purchases for the month, assuming a tax rate of 25%?

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck