Deck 9: Planning and Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

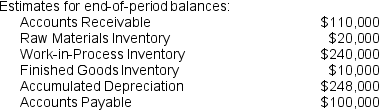

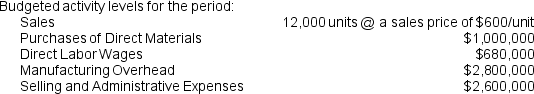

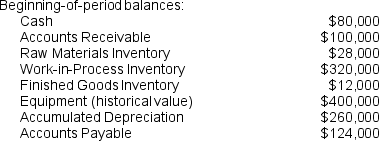

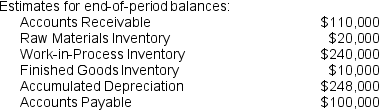

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/111

Play

Full screen (f)

Deck 9: Planning and Budgeting

1

Longer planning horizons are usually used in high-level strategic business planning.

True

2

Strategic planning is essentially a form of short-range decision making regarding day-to-day operations.

False

3

A long-term operating plan usually covers a period of 1 year.

False

4

Formal planning processes usually include both strategic planning and operational planning.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

5

The budget committee usually consists of the CEO, CFO, and Board of Directors.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

6

The budget period is the span of days or weeks that are set aside for preparing the budget.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

7

The capital expenditures budget generally covers multiple years because it involves acquiring long-term assets.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

8

Most companies that employ zero-based budgeting do NOT do so in all departments every year.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

9

The Production Budget is determined by the Direct Materials, Direct Labor, and Manufacturing Overhead Budgets.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

10

The Selling and Administrative Budget is prepared by determining the level of support needed to meet the Sales Budget.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

11

The amount of materials to be purchased is not necessarily equal to the amount to be paid for materials on the Direct Materials Budget.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

12

The Selling and Administrative Budget typically includes only fixed corporate expenses.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

13

The Capital Expenditures Budget only impacts the Cash Budget.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

14

If materials are purchased on account, then changes in Accounts Payable must be considered when preparing the Direct Materials Budget.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

15

To prepare the Budgeted Income Statement, several additional schedules and worksheets are often necessary.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

16

The Budgeted Balance Sheet is simply the balance sheet from the prior year, adjusted for budgeted changes.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

17

The Budgeted Statement of Cash Flows generally requires a different set of information than the Cash Flow Budget.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

18

On the Budgeted Statement of Cash Flows, cash receipts from customers are generally equal to the budgeted level of Sales.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

19

In SWOT analysis, Strengths are factors that are:

A) Internal and Harmful

B) Internal and Helpful

C) External and Harmful

D) External and Helpful

A) Internal and Harmful

B) Internal and Helpful

C) External and Harmful

D) External and Helpful

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

20

In SWOT analysis, Threats are factors that are:

A) Internal and Harmful

B) Internal and Helpful

C) External and Harmful

D) External and Helpful

A) Internal and Harmful

B) Internal and Helpful

C) External and Harmful

D) External and Helpful

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

21

In SWOT analysis, external factors that are helpful to a company are called:

A) Strengths

B) Opportunities

C) Weaknesses

D) Threats

A) Strengths

B) Opportunities

C) Weaknesses

D) Threats

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

22

In SWOT analysis, internal factors that are harmful to a company are called:

A) Strengths

B) Opportunities

C) Weaknesses

D) Threats

A) Strengths

B) Opportunities

C) Weaknesses

D) Threats

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following are advantages of budgeting?

A) It helps management to get out of just doing things the same way and notice what can be improved.

B) It helps a company achieve their long-range goals.

C) It can be used for performance evaluation.

D) It unifies the efforts of various departments in pursuit of company objectives.

E) All of the above

A) It helps management to get out of just doing things the same way and notice what can be improved.

B) It helps a company achieve their long-range goals.

C) It can be used for performance evaluation.

D) It unifies the efforts of various departments in pursuit of company objectives.

E) All of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following are not advantages of budgeting?

A) It helps a company achieve their long-range goals.

B) It can be used for performance evaluation.

C) It gives greater control to lower management and lets each department define their own objectives.

D) It helps management to get out of just doing things the same way and notice what can be improved.

E) None of the above are advantages of budgeting.

A) It helps a company achieve their long-range goals.

B) It can be used for performance evaluation.

C) It gives greater control to lower management and lets each department define their own objectives.

D) It helps management to get out of just doing things the same way and notice what can be improved.

E) None of the above are advantages of budgeting.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

25

When a budget is updated at every incremental budget period, the process is called:

A) Continuous budgeting

B) Participative budgeting

C) Capital budgeting

D) Zero-based budgeting

E) None of the above

A) Continuous budgeting

B) Participative budgeting

C) Capital budgeting

D) Zero-based budgeting

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

26

A budget used to plan for the acquisition of long-term assets is called a:

A) Participative budget

B) Capital Expenditures budget

C) Continuous budget

D) Zero-based budget

E) None of the above

A) Participative budget

B) Capital Expenditures budget

C) Continuous budget

D) Zero-based budget

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

27

What is the original metric that determines the levels of all budgets?

A) Planned production levels

B) Approved capital expenditures

C) Yearly cash flows

D) Forecasted sales levels

E) None of these

A) Planned production levels

B) Approved capital expenditures

C) Yearly cash flows

D) Forecasted sales levels

E) None of these

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

28

What is the source of input for the Production Budget?

A) Cash budget

B) Direct materials budget

C) Direct labor budget

D) Manufacturing overhead budget

E) None of the above

A) Cash budget

B) Direct materials budget

C) Direct labor budget

D) Manufacturing overhead budget

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following budgets flows directly into the Budgeted Income Statement?

A) Capital expenditures budget

B) Selling and administrative budget

C) Budgeted balance sheet

D) Production budget

E) All of the above flow directly into the Budgeted Income Statement

A) Capital expenditures budget

B) Selling and administrative budget

C) Budgeted balance sheet

D) Production budget

E) All of the above flow directly into the Budgeted Income Statement

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following are not inputs to the Cash Budget?

A) Materials purchased and paid-for from the Direct Materials Budget

B) Purchases of long-term assets from the Capital Expenditures Budget

C) Cost of goods sold from the Budgeted Income Statement

D) Rental payments from the Manufacturing Overhead Budget

E) None of the above are inputs to the Cash Budget

A) Materials purchased and paid-for from the Direct Materials Budget

B) Purchases of long-term assets from the Capital Expenditures Budget

C) Cost of goods sold from the Budgeted Income Statement

D) Rental payments from the Manufacturing Overhead Budget

E) None of the above are inputs to the Cash Budget

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following are factors that may be evaluated when preparing the sales forecast?

A) Number of full-time employees available to work

B) Expected business activities of competitors

C) Market research studies

D) Upcoming advertising campaigns

E) Three of the above

A) Number of full-time employees available to work

B) Expected business activities of competitors

C) Market research studies

D) Upcoming advertising campaigns

E) Three of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following are considered cash disbursements?

A) Accrued interest

B) Direct materials purchased on account

C) Proceeds from stock sales

D) Tax payments

E) Sale of investments

A) Accrued interest

B) Direct materials purchased on account

C) Proceeds from stock sales

D) Tax payments

E) Sale of investments

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

33

What can cause a difference between the Cash budget and another budget?

A) Sales made to customers on account

B) Direct materials purchased on account

C) Depreciation expense

D) Prepayments for expenses such as Rent

E) All of the above

A) Sales made to customers on account

B) Direct materials purchased on account

C) Depreciation expense

D) Prepayments for expenses such as Rent

E) All of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following would not be included on the Selling and Administrative Expense Budget?

A) Factory Rent

B) Sales Commission

C) Accounting Department salaries

D) Legal Fees

E) Depreciation on office equipment

A) Factory Rent

B) Sales Commission

C) Accounting Department salaries

D) Legal Fees

E) Depreciation on office equipment

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

35

Which budgeted financial statement is generally prepared first?

A) Balance Sheet

B) Statement of Cash Flows

C) Income Statement

D) Statement of Retained Earnings

E) None of the above

A) Balance Sheet

B) Statement of Cash Flows

C) Income Statement

D) Statement of Retained Earnings

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

36

The balance in Materials Inventory on the Budgeted Balance Sheet is equal to:

A) Materials Purchased during the period

B) Materials Used during the period

C) Budgeted Beginning Materials Inventory

D) A minus B

E) None of the above

A) Materials Purchased during the period

B) Materials Used during the period

C) Budgeted Beginning Materials Inventory

D) A minus B

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

37

The difference between the budgeted amounts of Sales and Cash Received for sales is equal to the budgeted change in:

A) Accounts Receivable

B) Accounts Payable

C) Cash

D) Retained Earnings

E) None of the Above

A) Accounts Receivable

B) Accounts Payable

C) Cash

D) Retained Earnings

E) None of the Above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

38

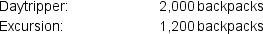

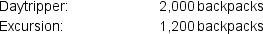

Glacier Trails manufactures backpacks for adventurers. The backpacks come in two types: Daytripper, and Excursion. Glacier anticipates the following sales volumes for the coming period:

If total budgeted revenue for the period is $250,000 and the sales price for Daytripper backpacks is $50, what is the budgeted sales price for Excursion backpacks?

If total budgeted revenue for the period is $250,000 and the sales price for Daytripper backpacks is $50, what is the budgeted sales price for Excursion backpacks?

A) $ 78

B) $125

C) $130

D) $158

E) None of the above

If total budgeted revenue for the period is $250,000 and the sales price for Daytripper backpacks is $50, what is the budgeted sales price for Excursion backpacks?

If total budgeted revenue for the period is $250,000 and the sales price for Daytripper backpacks is $50, what is the budgeted sales price for Excursion backpacks?A) $ 78

B) $125

C) $130

D) $158

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

39

Teton Trails manufactures backpacks for adventurers. The backpacks come in two types: Daytripper, and Excursion. Teton anticipates the following sales volumes:

Daytripper: 2,000 backpacks in July, 2,200 backpacks in August

Excursion: 1,200 backpacks in July, 900 backpacks in August

Teton's policy is to maintain ending inventories at 5% of what is expected for the next month.

What is the budgeted level of production in July for both styles?

A) 2,210 Daytripper backpacks and 885 Excursion backpacks

B) 1,990 Daytripper backpacks and 1,215 Excursion backpacks

C) 2,000 Daytripper backpacks and 1,200 Excursion backpacks

D) 2,010 Daytripper backpacks and 1,185 Excursion backpacks

E) None of the above

Daytripper: 2,000 backpacks in July, 2,200 backpacks in August

Excursion: 1,200 backpacks in July, 900 backpacks in August

Teton's policy is to maintain ending inventories at 5% of what is expected for the next month.

What is the budgeted level of production in July for both styles?

A) 2,210 Daytripper backpacks and 885 Excursion backpacks

B) 1,990 Daytripper backpacks and 1,215 Excursion backpacks

C) 2,000 Daytripper backpacks and 1,200 Excursion backpacks

D) 2,010 Daytripper backpacks and 1,185 Excursion backpacks

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

40

Teton Trails manufactures backpacks for adventurers. The backpacks come in two types: Daytripper, and Excursion. Teton anticipates the following production volumes:

Daytripper: 2,000 backpacks in July, 2,200 backpacks in August

Excursion: 1,200 backpacks in July, 900 backpacks in August

Each Daytripper backpack requires 1 yard of 800 denier polyester fabric and each Excursion backpack requires 2 yards of 1200 denier polyester fabric. Teton's policy is to maintain ending inventories of each type of fabric at 10% of expected production needs for the next month.

What is the budgeted level of material purchases in July for both types?

A) 2,020 yards of 800 denier polyester and 2,340 yards of 1200 denier polyester

B) 1,980 yards of 800 denier polyester and 2,460 yards of 1200 denier polyester

C) 2,020 yards of 800 denier polyester and 1,140 yards of 1200 denier polyester

D) 2,000 yards of 800 denier polyester and 2,400 yards of 1200 denier polyester

E) None of the above

Daytripper: 2,000 backpacks in July, 2,200 backpacks in August

Excursion: 1,200 backpacks in July, 900 backpacks in August

Each Daytripper backpack requires 1 yard of 800 denier polyester fabric and each Excursion backpack requires 2 yards of 1200 denier polyester fabric. Teton's policy is to maintain ending inventories of each type of fabric at 10% of expected production needs for the next month.

What is the budgeted level of material purchases in July for both types?

A) 2,020 yards of 800 denier polyester and 2,340 yards of 1200 denier polyester

B) 1,980 yards of 800 denier polyester and 2,460 yards of 1200 denier polyester

C) 2,020 yards of 800 denier polyester and 1,140 yards of 1200 denier polyester

D) 2,000 yards of 800 denier polyester and 2,400 yards of 1200 denier polyester

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

41

Teton Trails manufactures backpacks for adventurers. The backpacks come in two types: Daytripper, and Excursion. Teton anticipates the following production volumes:

Daytripper: 2,000 backpacks in July, 2,200 backpacks in August

Excursion: 1,200 backpacks in July, 900 backpacks in August

Each Daytripper backpack requires 1 hour of direct labor and each Excursion backpack requires 2.5 hours of direct labor.

If the total budgeted labor for August is 5,000 hours, how much indirect labor did Teton budget?

A) None

B) 1,550 hours

C) 550 hours

D) 1,900 hours

E) None of the above

Daytripper: 2,000 backpacks in July, 2,200 backpacks in August

Excursion: 1,200 backpacks in July, 900 backpacks in August

Each Daytripper backpack requires 1 hour of direct labor and each Excursion backpack requires 2.5 hours of direct labor.

If the total budgeted labor for August is 5,000 hours, how much indirect labor did Teton budget?

A) None

B) 1,550 hours

C) 550 hours

D) 1,900 hours

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

42

Mountain Trails manufactures backpacks for adventurers. Management is preparing budgets for the month, and is trying to determine the Overhead Budget amounts. Variable overhead is budgeted to be incurred at a rate of $5/direct labor hour (including utilities, indirect materials, and indirect labor). Budgeted direct labor hours are 4,500 hours for the period. Fixed overhead amounts include the following: Factory rent $5,000; Factory supervisor salary $6,000; Depreciation $8,000; Insurance $1,500; and Factory security $2,500.

What is the predetermined overhead rate (applied on the basis of direct labor hours? (Round to 3 decimal places)

A) $5.000

B) $5.111

C) $8.333

D) $13.333

E) None of the above

What is the predetermined overhead rate (applied on the basis of direct labor hours? (Round to 3 decimal places)

A) $5.000

B) $5.111

C) $8.333

D) $13.333

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

43

High Trails manufactures backpacks for adventurers. Totals sales for the year are budgeted at 3,200 backpacks, at a price of $90 each. Variable selling expenses include commissions (3% of sales price) and delivery costs ($12/backpack). Annual fixed selling and administrative expenses include general liability insurance ($12,000), sales fleet depreciation ($180,000), administrative salaries ($360,000), and rent on the office building ($84,000). High Trails pays all costs as they are incurred.

What is the amount of cash budgeted for Selling and Administrative expenses for the year?

A) $503,040

B) $683,040

C) $419,040

D) $636,000

E) None of the above

What is the amount of cash budgeted for Selling and Administrative expenses for the year?

A) $503,040

B) $683,040

C) $419,040

D) $636,000

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

44

Valley Trails is preparing the Cash Budget for the upcoming period, and is concerned about their ability to meet their financial obligations in the short term. Following is information relating to Valley's financial performance:

Beginning-of-period balances:

Accounts Receivable: $54,000

Accounts Payable: $27,000

Accumulated Factory Depreciation: $288,000

Cash: $13,500

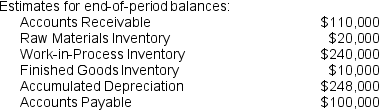

Estimates for end-of-period balances:

Accounts Receivable: $67,500

Accounts Payable: $18,000

Accumulated Factory Depreciation: $296,000

Budgeted activity levels for the period:

Sales: $250,000

Purchases of Direct Materials: $44,800

Direct Labor Wages: $75,000

Manufacturing Overhead: $25,000

Selling and Administrative Expenses: $42,000

Except for purchases of direct materials, all expenses are paid as incurred.

What is the budgeted ending cash balance for the period?

A) $76,700

B) $62,200

C) $70,200

D) $89,200

E) None of the above

Beginning-of-period balances:

Accounts Receivable: $54,000

Accounts Payable: $27,000

Accumulated Factory Depreciation: $288,000

Cash: $13,500

Estimates for end-of-period balances:

Accounts Receivable: $67,500

Accounts Payable: $18,000

Accumulated Factory Depreciation: $296,000

Budgeted activity levels for the period:

Sales: $250,000

Purchases of Direct Materials: $44,800

Direct Labor Wages: $75,000

Manufacturing Overhead: $25,000

Selling and Administrative Expenses: $42,000

Except for purchases of direct materials, all expenses are paid as incurred.

What is the budgeted ending cash balance for the period?

A) $76,700

B) $62,200

C) $70,200

D) $89,200

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

45

Forest Trails is preparing their budgeted financial statements for the coming period, and has accumulated the following data:

Beginning-of-period balances:

Cash: $13,500

Accounts Receivable: $54,000

Raw Materials Inventory: $16,000

Work in Process Inventory: $60,000

Finished Goods Inventory: $24,000

Equipment (historical value): $480,000

Accumulated Depreciation: $288,000

Accounts Payable: $27,000

Estimates for end-of-period balances:

Accounts Receivable: $67,500

Raw Materials Inventory: $10,000

Work in Process Inventory: $50,000

Finished Goods Inventory: $29,000

Accumulated Depreciation: $296,000

Accounts Payable: $18,000

Budgeted activity levels for the period:

Sales: 3,125 units, at an average sales price of $80/unit

Purchases of Direct Materials: $44,800

Direct Labor Wages: $75,000

Manufacturing Overhead: $25,000

Selling and Administrative Expenses: $42,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. Forest Trails has planned to purchase new equipment worth $25,000, and to sell equipment for $8,000 (Original purchase price $15,000, accumulated depreciation $10,000) to help finance the purchase.

What is budgeted amount of Cost of Goods Sold for the period?

A) $144,800

B) $153,800

C) $143,800

D) $155,800

E) None of the above

Beginning-of-period balances:

Cash: $13,500

Accounts Receivable: $54,000

Raw Materials Inventory: $16,000

Work in Process Inventory: $60,000

Finished Goods Inventory: $24,000

Equipment (historical value): $480,000

Accumulated Depreciation: $288,000

Accounts Payable: $27,000

Estimates for end-of-period balances:

Accounts Receivable: $67,500

Raw Materials Inventory: $10,000

Work in Process Inventory: $50,000

Finished Goods Inventory: $29,000

Accumulated Depreciation: $296,000

Accounts Payable: $18,000

Budgeted activity levels for the period:

Sales: 3,125 units, at an average sales price of $80/unit

Purchases of Direct Materials: $44,800

Direct Labor Wages: $75,000

Manufacturing Overhead: $25,000

Selling and Administrative Expenses: $42,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. Forest Trails has planned to purchase new equipment worth $25,000, and to sell equipment for $8,000 (Original purchase price $15,000, accumulated depreciation $10,000) to help finance the purchase.

What is budgeted amount of Cost of Goods Sold for the period?

A) $144,800

B) $153,800

C) $143,800

D) $155,800

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

46

Forest Trails is preparing their budgeted financial statements for the coming period, and has accumulated the following data:

Beginning-of-period balances:

Cash: $13,500

Accounts Receivable: $54,000

Raw Materials Inventory: $16,000

Work in Process Inventory: $60,000

Finished Goods Inventory: $24,000

Equipment (historical value): $480,000

Accumulated Depreciation: $288,000

Accounts Payable: $27,000

Estimates for end-of-period balances:

Accounts Receivable: $67,500

Raw Materials Inventory: $10,000

Work in Process Inventory: $50,000

Finished Goods Inventory: $29,000

Accumulated Depreciation: $296,000

Accounts Payable: $18,000

Budgeted activity levels for the period:

Sales: 3,125 units, at an average sales price of $80/unit

Purchases of Direct Materials: $44,800

Direct Labor Wages: $75,000

Manufacturing Overhead: $25,000

Selling and Administrative Expenses: $42,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. Forest Trails has planned to purchase new equipment worth $25,000, and to sell equipment for $8,000 (Original purchase price $15,000, accumulated depreciation $10,000) to help finance the purchase.

What is budgeted amount of cash received from customers for the period?

A) $259,000

B) $236,500

C) $250,000

D) $263,500

E) None of the above

Beginning-of-period balances:

Cash: $13,500

Accounts Receivable: $54,000

Raw Materials Inventory: $16,000

Work in Process Inventory: $60,000

Finished Goods Inventory: $24,000

Equipment (historical value): $480,000

Accumulated Depreciation: $288,000

Accounts Payable: $27,000

Estimates for end-of-period balances:

Accounts Receivable: $67,500

Raw Materials Inventory: $10,000

Work in Process Inventory: $50,000

Finished Goods Inventory: $29,000

Accumulated Depreciation: $296,000

Accounts Payable: $18,000

Budgeted activity levels for the period:

Sales: 3,125 units, at an average sales price of $80/unit

Purchases of Direct Materials: $44,800

Direct Labor Wages: $75,000

Manufacturing Overhead: $25,000

Selling and Administrative Expenses: $42,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. Forest Trails has planned to purchase new equipment worth $25,000, and to sell equipment for $8,000 (Original purchase price $15,000, accumulated depreciation $10,000) to help finance the purchase.

What is budgeted amount of cash received from customers for the period?

A) $259,000

B) $236,500

C) $250,000

D) $263,500

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

47

Forest Trails is preparing their budgeted financial statements for the coming period, and has accumulated the following data:

Beginning-of-period balances:

Cash: $13,500

Accounts Receivable: $54,000

Raw Materials Inventory: $16,000

Work in Process Inventory: $60,000

Finished Goods Inventory: $24,000

Equipment (historical value): $480,000

Accumulated Depreciation: $288,000

Accounts Payable: $27,000

Estimates for end-of-period balances:

Accounts Receivable: $67,500

Raw Materials Inventory: $10,000

Work in Process Inventory: $50,000

Finished Goods Inventory: $29,000

Accumulated Depreciation: $296,000

Accounts Payable: $18,000

Budgeted activity levels for the period:

Sales: 3,125 units, at an average sales price of $80/unit

Purchases of Direct Materials: $44,800

Direct Labor Wages: $75,000

Manufacturing Overhead: $25,000

Selling and Administrative Expenses: $42,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. Forest Trails has planned to purchase new equipment worth $25,000, and to sell equipment for $8,000 (Original purchase price $15,000, accumulated depreciation $10,000) to help finance the purchase.

What is the budgeted level of Cash Flow from Operating Activities?

A) $58,700 positive cash flow

B) $72,000 positive cash flow

C) $63,200 positive cash flow

D) $73,200 positive cash flow

E) None of the above

Beginning-of-period balances:

Cash: $13,500

Accounts Receivable: $54,000

Raw Materials Inventory: $16,000

Work in Process Inventory: $60,000

Finished Goods Inventory: $24,000

Equipment (historical value): $480,000

Accumulated Depreciation: $288,000

Accounts Payable: $27,000

Estimates for end-of-period balances:

Accounts Receivable: $67,500

Raw Materials Inventory: $10,000

Work in Process Inventory: $50,000

Finished Goods Inventory: $29,000

Accumulated Depreciation: $296,000

Accounts Payable: $18,000

Budgeted activity levels for the period:

Sales: 3,125 units, at an average sales price of $80/unit

Purchases of Direct Materials: $44,800

Direct Labor Wages: $75,000

Manufacturing Overhead: $25,000

Selling and Administrative Expenses: $42,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. Forest Trails has planned to purchase new equipment worth $25,000, and to sell equipment for $8,000 (Original purchase price $15,000, accumulated depreciation $10,000) to help finance the purchase.

What is the budgeted level of Cash Flow from Operating Activities?

A) $58,700 positive cash flow

B) $72,000 positive cash flow

C) $63,200 positive cash flow

D) $73,200 positive cash flow

E) None of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

48

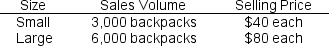

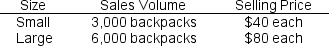

Young Scholar, Inc. manufactures backpacks for students. The backpacks come in two sizes: Small, and Large. Young Scholar anticipates the following sales volumes and prices for the coming period:

What is the budgeted level of revenue for the coming period?

What is the budgeted level of revenue for the coming period?

What is the budgeted level of revenue for the coming period?

What is the budgeted level of revenue for the coming period?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

49

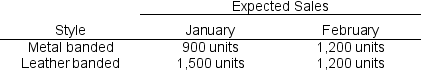

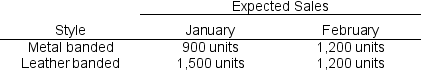

Wrist Works Inc. manufactures two styles of watches. Following is information relating to these two styles:

Wrist Works' policy is to maintain ending inventories at 5% of what is expected for the next month. What is the budgeted level of production for both styles for January?

Wrist Works' policy is to maintain ending inventories at 5% of what is expected for the next month. What is the budgeted level of production for both styles for January?

Wrist Works' policy is to maintain ending inventories at 5% of what is expected for the next month. What is the budgeted level of production for both styles for January?

Wrist Works' policy is to maintain ending inventories at 5% of what is expected for the next month. What is the budgeted level of production for both styles for January?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

50

Mighty Tow manufactures trailer hitches for personal vehicles. The company has production levels budgeted for this period of 2,000 hitches. Each hitch requires 7.5 feet of steel to manufacture.

The company has a policy of always having 250 feet of steel on hand at the end of the period, in case of excess demand. Last period orders were higher than expected, so the company ended the period with only 200 feet of steel on hand. Steel costs $10/foot, and Mighty Tow has an agreement to pay their supplier 75% of the cost of purchases in the month bought, and the remainder in the month following.

The Accounts Payable balance at the beginning of the period is $15,000.

What is the budgeted amount of cash to be paid for raw materials this month?

The company has a policy of always having 250 feet of steel on hand at the end of the period, in case of excess demand. Last period orders were higher than expected, so the company ended the period with only 200 feet of steel on hand. Steel costs $10/foot, and Mighty Tow has an agreement to pay their supplier 75% of the cost of purchases in the month bought, and the remainder in the month following.

The Accounts Payable balance at the beginning of the period is $15,000.

What is the budgeted amount of cash to be paid for raw materials this month?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

51

Olde Clothiers manufactures vintage clothing through a labor-intensive manual process. Workers are paid $30/hour. Each sweater takes 2.5 hours to knit, and each shirt requires 1 hour of total labor to complete. Management has budgeted for 1,500 items to be produced this period, with a ratio of 3:2 of shirts to sweaters. Olde Clothiers pays wages as incurred.

What is the total amount budgeted to be paid in Direct Labor wages for the period?

What is the total amount budgeted to be paid in Direct Labor wages for the period?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

52

Quality Floors is small local manufacturing firm that makes carpet and vinyl floors at low cost. Management is preparing budgets for the month, and is trying to determine the Overhead Budget amounts.

Variable overhead is budgeted to be incurred at a rate of $8/direct labor hour (including utility usage, indirect materials, and indirect labor). Budgeted direct labor hours are 4,000 hours for the period. Fixed overhead amounts include the following: Rent $6,000; Factory supervisor salary $10,000; Depreciation $4,000; Insurance $2,000; and Property taxes $1,500.

What is the predetermined overhead rate (applied on the basis of direct labor hours-round to 3 decimal places)?

Variable overhead is budgeted to be incurred at a rate of $8/direct labor hour (including utility usage, indirect materials, and indirect labor). Budgeted direct labor hours are 4,000 hours for the period. Fixed overhead amounts include the following: Rent $6,000; Factory supervisor salary $10,000; Depreciation $4,000; Insurance $2,000; and Property taxes $1,500.

What is the predetermined overhead rate (applied on the basis of direct labor hours-round to 3 decimal places)?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

53

Petit Patisserie is a commercial bakery that caters for commercial clients. The company's specialty is a small breakfast basket that can feed up to 3 people.

Totals sales for the month are budgeted at 3,000 baskets, at a price of $45/basket. Variable selling expenses include commissions (2% of sales price) and delivery costs ($10/basket). Fixed selling expenses included insurance ($5,000), office equipment depreciation ($3,000), administrative salaries ($20,000), and rent on the office building ($4,000).

Petit Patisserie pays all costs as they are incurred.

What is the amount of cash budgeted for Selling and Administrative expenses for the month?

Totals sales for the month are budgeted at 3,000 baskets, at a price of $45/basket. Variable selling expenses include commissions (2% of sales price) and delivery costs ($10/basket). Fixed selling expenses included insurance ($5,000), office equipment depreciation ($3,000), administrative salaries ($20,000), and rent on the office building ($4,000).

Petit Patisserie pays all costs as they are incurred.

What is the amount of cash budgeted for Selling and Administrative expenses for the month?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

54

Quality Printing Inc. has a machine that is wearing out and needs to be replaced. It has a book value of $9,000, with accumulated depreciation of $71,000. The machine can be sold for 10% of the original purchase value.

In order to meet production needs, the machine needs to be replaced with a newer model that costs $100,000 and will be depreciated by $20,000 in the first year.

What is the net amount that will be spent on Equipment in the coming period?

In order to meet production needs, the machine needs to be replaced with a newer model that costs $100,000 and will be depreciated by $20,000 in the first year.

What is the net amount that will be spent on Equipment in the coming period?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

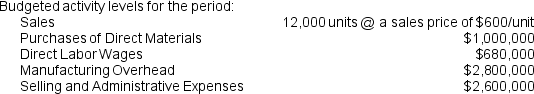

55

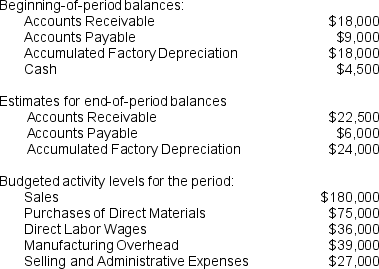

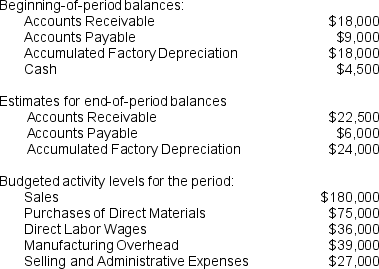

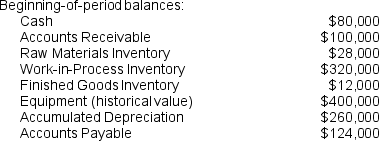

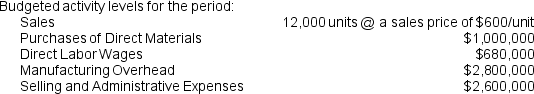

Red Suspenders Co. is preparing the Cash Budget for the upcoming period, and is concerned about their ability to meet their financial obligations in the short term. Following is information relating to Red Suspenders' financial performance:

Except for purchases of direct materials, all expenses are paid as incurred. What is the budgeted ending cash balance for the period?

Except for purchases of direct materials, all expenses are paid as incurred. What is the budgeted ending cash balance for the period?

Except for purchases of direct materials, all expenses are paid as incurred. What is the budgeted ending cash balance for the period?

Except for purchases of direct materials, all expenses are paid as incurred. What is the budgeted ending cash balance for the period?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

56

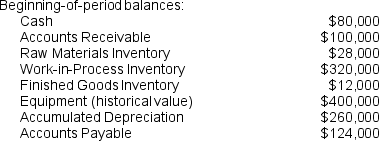

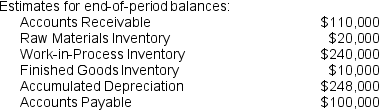

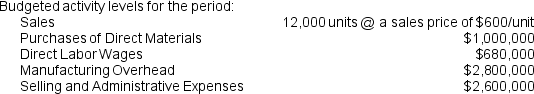

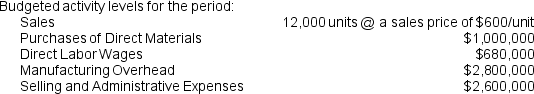

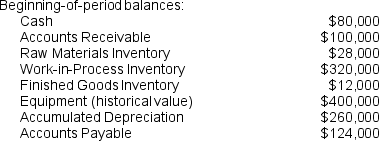

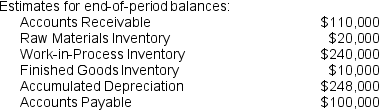

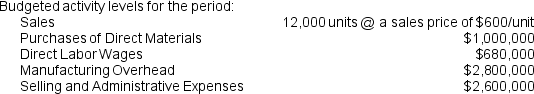

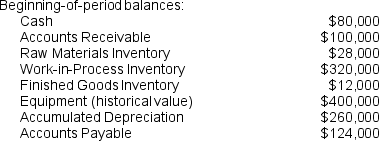

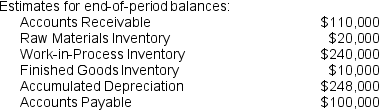

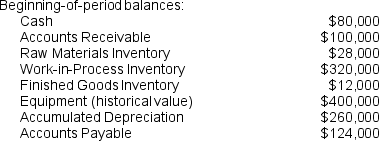

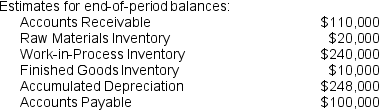

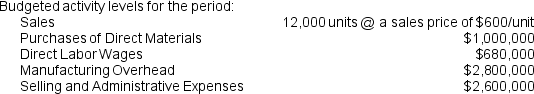

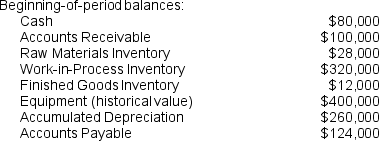

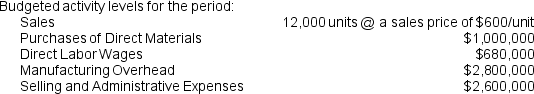

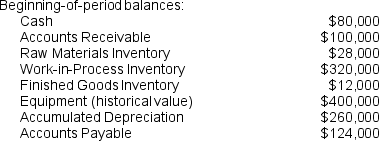

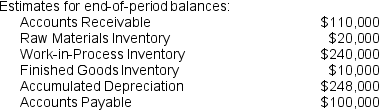

Use the following information to complete Exercises below:

Public Manufacturing Company (PMC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

-What is the budgeted Cost of Goods Sold for the period?

Public Manufacturing Company (PMC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.-What is the budgeted Cost of Goods Sold for the period?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

57

Use the following information to complete Exercises below:

Public Manufacturing Company (PMC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

-What is the budgeted cash received from customers?

Public Manufacturing Company (PMC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.-What is the budgeted cash received from customers?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

58

Use the following information to complete Exercises below:

Public Manufacturing Company (PMC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

-What is the amount of the budgeted change to Owners Equity (assuming no dividends are planned and ignoring taxes)?

Public Manufacturing Company (PMC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.-What is the amount of the budgeted change to Owners Equity (assuming no dividends are planned and ignoring taxes)?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

59

Use the following information to complete Exercises below:

Public Manufacturing Company (PMC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

-What is budgeted level of Cash Flow from Operating Activities?

Public Manufacturing Company (PMC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.

During the period, PMC plans to sell an asset with an historical cost of $30,000 and a current book value of $10,000 for an estimated $8,000 cash.-What is budgeted level of Cash Flow from Operating Activities?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

60

Happy Eating manufactures lunchboxes for students. The lunchboxes come in two sizes: Small, and Medium. Happy Eating anticipates the following sales volumes and prices for the coming period:

Small: 5,000 lunchboxes, selling price $10 each

Medium: 3,000 lunchboxes, selling price $25 each

What is the budgeted level of revenue for the coming period?

Small: 5,000 lunchboxes, selling price $10 each

Medium: 3,000 lunchboxes, selling price $25 each

What is the budgeted level of revenue for the coming period?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

61

Case-up Inc. manufactures 2 styles of cell phone cases. Following is information relating to these two styles:

Plastic case: Expected Sales this month 450 units, Expected Sales next month 380 units

Leather case: Expected Sales this month 300 units, Expected Sales next month 350 units

Case-up's policy is to maintain ending inventories at 10% of what is expected for the next month. What is the budgeted level of production for both styles?

Plastic case: Expected Sales this month 450 units, Expected Sales next month 380 units

Leather case: Expected Sales this month 300 units, Expected Sales next month 350 units

Case-up's policy is to maintain ending inventories at 10% of what is expected for the next month. What is the budgeted level of production for both styles?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

62

Cappin' manufactures personalized baseball caps for companies. The company has production levels budgeted for this period of 5,000 caps. Each cap requires 1 yard of fabric to manufacture. The company has a policy of always having 300 yards of fabric on hand at the end of the period, in case of excess demand. Last period orders were higher than expected, so the company ended the period with only 175 yards of fabric on hand. Fabric costs $8/yard, and Cappin' has an agreement to pay their supplier 75% of the cost of purchases in the month bought, and the remainder in the month following. The Accounts Payable balance at the beginning of the period is $15,000.

What is the budgeted amount of cash to be paid for raw materials this month?

What is the budgeted amount of cash to be paid for raw materials this month?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

63

Spinning Wheel manufactures leather accessories through a labor-intensive manual process. Workers are paid $10/hour. Each handbag takes 2 hours to sew, and each wallet requires 0.5 hours of total labor to complete. Management has budgeted for 1,000 items to be produced this period, with a ratio of 1:3 of handbags to wallets.

What is the total amount budgeted to be paid in Direct Labor wages for the period?

What is the total amount budgeted to be paid in Direct Labor wages for the period?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

64

Fancy Drapes is a small local manufacturing firm that makes curtains and blinds at low cost. Management is preparing budgets for the month, and is trying to determine the Overhead Budget amounts. Variable overhead is budgeted to be incurred at a rate of $7/direct labor hour (including utility usage, indirect materials, and indirect labor). Budgeted direct labor hours are 2,500 hours for the period. Fixed overhead amounts include the following: Rent $4,000; Factory supervisor salary $4,000; Depreciation $1,500; Insurance $2,500; and Property taxes $2,000.

What is the predetermined overhead rate (applied on the basis of direct labor hours)?

What is the predetermined overhead rate (applied on the basis of direct labor hours)?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

65

Cherry Florals is a florist that caters for weddings. The company's specialty is bouquets for brides and bridesmaids. Total sales for the month are budgeted at 2,000 bouquets, at a price of $45/bouquet. Variable selling expenses include commissions (1% of sales price) and delivery costs ($10/bouquet). Fixed selling expenses included insurance ($1,000), office equipment depreciation ($2,500), shop assistants' salaries ($20,000), and rent on the shop space ($5,000). Cherry Florals pays all costs as they are incurred.

What is the amount of cash budgeted for Selling and Administrative expenses for the month?

What is the amount of cash budgeted for Selling and Administrative expenses for the month?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

66

Hare Construction Inc. has a machine that is wearing out and needs to be replaced. It has a book value of $8,000, with accumulated depreciation of $48,000. The machine can be sold for 10% of the original purchase value.

In order to meet production needs, the machine needs to be replaced with a newer model that costs $60,000, and will be depreciated by $5,000 in the first year.

What is the net amount that will be spent on Equipment in the coming period?

In order to meet production needs, the machine needs to be replaced with a newer model that costs $60,000, and will be depreciated by $5,000 in the first year.

What is the net amount that will be spent on Equipment in the coming period?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

67

Rising Sparks Co. is preparing the Cash Budget for the upcoming period, and is concerned about their ability to meet their financial obligations in the short term. Following is information relating to Rising Spark's financial performance:

Beginning-of-period balances:

Accounts Receivable: $4,000

Accounts Payable: $2,500

Accumulated Factory Depreciation: $4,000

Cash: $3,500

Estimates for end-of-period balances:

Accounts Receivable: $3,000

Accounts Payable: $2,000

Accumulated Factory Depreciation: $5,000

Budgeted activity levels for the period:

Sales: $15,000

Purchases of Direct Materials: $8,000

Direct Labor Wages: $4,000

Manufacturing Overhead: $4,500

Selling and Administrative Expenses: $3,000

Except for purchases of direct materials, all expenses are paid as incurred.

What is the budgeted ending cash balance for the period?

Beginning-of-period balances:

Accounts Receivable: $4,000

Accounts Payable: $2,500

Accumulated Factory Depreciation: $4,000

Cash: $3,500

Estimates for end-of-period balances:

Accounts Receivable: $3,000

Accounts Payable: $2,000

Accumulated Factory Depreciation: $5,000

Budgeted activity levels for the period:

Sales: $15,000

Purchases of Direct Materials: $8,000

Direct Labor Wages: $4,000

Manufacturing Overhead: $4,500

Selling and Administrative Expenses: $3,000

Except for purchases of direct materials, all expenses are paid as incurred.

What is the budgeted ending cash balance for the period?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

68

Use the following information to answer Exercises below

Inventive Creations Co. (ICC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

Beginning-of-period balances:

Cash: $55,000

Accounts Receivable: $30,000

Raw Materials Inventory: $20,000

Work in Process Inventory: $100,000

Finished Goods Inventory: $10,000

Equipment (historical value): $250,000

Accumulated Depreciation: $125,000

Accounts Payable: $25,000

Estimates for end-of-period balances:

Accounts Receivable: $40,000

Raw Materials Inventory: $15,000

Work in Process Inventory: $80,000

Finished Goods Inventory: $7,000

Accumulated Depreciation: $120,000

Accounts Payable: $20,000

Budgeted activity levels for the period:

Sales: 15,000 units, at a sales price of $175/unit

Purchases of Direct Materials: $300,000

Direct Labor Wages: $150,000

Manufacturing Overhead: $1,000,000

Selling and Administrative Expenses: $900,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. ICC has planned to purchase new equipment worth $30,000, and to sell equipment for $8,000 (Original purchase price $25,000, accumulated depreciation $15,000) to help finance the purchase.

-What is the budgeted Cost of Goods Sold for the period?

Inventive Creations Co. (ICC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

Beginning-of-period balances:

Cash: $55,000

Accounts Receivable: $30,000

Raw Materials Inventory: $20,000

Work in Process Inventory: $100,000

Finished Goods Inventory: $10,000

Equipment (historical value): $250,000

Accumulated Depreciation: $125,000

Accounts Payable: $25,000

Estimates for end-of-period balances:

Accounts Receivable: $40,000

Raw Materials Inventory: $15,000

Work in Process Inventory: $80,000

Finished Goods Inventory: $7,000

Accumulated Depreciation: $120,000

Accounts Payable: $20,000

Budgeted activity levels for the period:

Sales: 15,000 units, at a sales price of $175/unit

Purchases of Direct Materials: $300,000

Direct Labor Wages: $150,000

Manufacturing Overhead: $1,000,000

Selling and Administrative Expenses: $900,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. ICC has planned to purchase new equipment worth $30,000, and to sell equipment for $8,000 (Original purchase price $25,000, accumulated depreciation $15,000) to help finance the purchase.

-What is the budgeted Cost of Goods Sold for the period?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following information to answer Exercises below

Inventive Creations Co. (ICC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

Beginning-of-period balances:

Cash: $55,000

Accounts Receivable: $30,000

Raw Materials Inventory: $20,000

Work in Process Inventory: $100,000

Finished Goods Inventory: $10,000

Equipment (historical value): $250,000

Accumulated Depreciation: $125,000

Accounts Payable: $25,000

Estimates for end-of-period balances:

Accounts Receivable: $40,000

Raw Materials Inventory: $15,000

Work in Process Inventory: $80,000

Finished Goods Inventory: $7,000

Accumulated Depreciation: $120,000

Accounts Payable: $20,000

Budgeted activity levels for the period:

Sales: 15,000 units, at a sales price of $175/unit

Purchases of Direct Materials: $300,000

Direct Labor Wages: $150,000

Manufacturing Overhead: $1,000,000

Selling and Administrative Expenses: $900,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. ICC has planned to purchase new equipment worth $30,000, and to sell equipment for $8,000 (Original purchase price $25,000, accumulated depreciation $15,000) to help finance the purchase.

-What is the budgeted cash received from customers?

Inventive Creations Co. (ICC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

Beginning-of-period balances:

Cash: $55,000

Accounts Receivable: $30,000

Raw Materials Inventory: $20,000

Work in Process Inventory: $100,000

Finished Goods Inventory: $10,000

Equipment (historical value): $250,000

Accumulated Depreciation: $125,000

Accounts Payable: $25,000

Estimates for end-of-period balances:

Accounts Receivable: $40,000

Raw Materials Inventory: $15,000

Work in Process Inventory: $80,000

Finished Goods Inventory: $7,000

Accumulated Depreciation: $120,000

Accounts Payable: $20,000

Budgeted activity levels for the period:

Sales: 15,000 units, at a sales price of $175/unit

Purchases of Direct Materials: $300,000

Direct Labor Wages: $150,000

Manufacturing Overhead: $1,000,000

Selling and Administrative Expenses: $900,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. ICC has planned to purchase new equipment worth $30,000, and to sell equipment for $8,000 (Original purchase price $25,000, accumulated depreciation $15,000) to help finance the purchase.

-What is the budgeted cash received from customers?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

70

Use the following information to answer Exercises below

Inventive Creations Co. (ICC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

Beginning-of-period balances:

Cash: $55,000

Accounts Receivable: $30,000

Raw Materials Inventory: $20,000

Work in Process Inventory: $100,000

Finished Goods Inventory: $10,000

Equipment (historical value): $250,000

Accumulated Depreciation: $125,000

Accounts Payable: $25,000

Estimates for end-of-period balances:

Accounts Receivable: $40,000

Raw Materials Inventory: $15,000

Work in Process Inventory: $80,000

Finished Goods Inventory: $7,000

Accumulated Depreciation: $120,000

Accounts Payable: $20,000

Budgeted activity levels for the period:

Sales: 15,000 units, at a sales price of $175/unit

Purchases of Direct Materials: $300,000

Direct Labor Wages: $150,000

Manufacturing Overhead: $1,000,000

Selling and Administrative Expenses: $900,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. ICC has planned to purchase new equipment worth $30,000, and to sell equipment for $8,000 (Original purchase price $25,000, accumulated depreciation $15,000) to help finance the purchase.

-What is the amount of the budgeted change to Owners Equity (assuming no dividends are planned and ignoring taxes)?

Inventive Creations Co. (ICC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

Beginning-of-period balances:

Cash: $55,000

Accounts Receivable: $30,000

Raw Materials Inventory: $20,000

Work in Process Inventory: $100,000

Finished Goods Inventory: $10,000

Equipment (historical value): $250,000

Accumulated Depreciation: $125,000

Accounts Payable: $25,000

Estimates for end-of-period balances:

Accounts Receivable: $40,000

Raw Materials Inventory: $15,000

Work in Process Inventory: $80,000

Finished Goods Inventory: $7,000

Accumulated Depreciation: $120,000

Accounts Payable: $20,000

Budgeted activity levels for the period:

Sales: 15,000 units, at a sales price of $175/unit

Purchases of Direct Materials: $300,000

Direct Labor Wages: $150,000

Manufacturing Overhead: $1,000,000

Selling and Administrative Expenses: $900,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. ICC has planned to purchase new equipment worth $30,000, and to sell equipment for $8,000 (Original purchase price $25,000, accumulated depreciation $15,000) to help finance the purchase.

-What is the amount of the budgeted change to Owners Equity (assuming no dividends are planned and ignoring taxes)?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

71

Use the following information to answer Exercises below

Inventive Creations Co. (ICC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

Beginning-of-period balances:

Cash: $55,000

Accounts Receivable: $30,000

Raw Materials Inventory: $20,000

Work in Process Inventory: $100,000

Finished Goods Inventory: $10,000

Equipment (historical value): $250,000

Accumulated Depreciation: $125,000

Accounts Payable: $25,000

Estimates for end-of-period balances:

Accounts Receivable: $40,000

Raw Materials Inventory: $15,000

Work in Process Inventory: $80,000

Finished Goods Inventory: $7,000

Accumulated Depreciation: $120,000

Accounts Payable: $20,000

Budgeted activity levels for the period:

Sales: 15,000 units, at a sales price of $175/unit

Purchases of Direct Materials: $300,000

Direct Labor Wages: $150,000

Manufacturing Overhead: $1,000,000

Selling and Administrative Expenses: $900,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. ICC has planned to purchase new equipment worth $30,000, and to sell equipment for $8,000 (Original purchase price $25,000, accumulated depreciation $15,000) to help finance the purchase.

-What is budgeted level of Cash Flow from Operating Activities?

Inventive Creations Co. (ICC) is preparing their budgeted financial statements for the coming year, and has accumulated the following data:

Beginning-of-period balances:

Cash: $55,000

Accounts Receivable: $30,000

Raw Materials Inventory: $20,000

Work in Process Inventory: $100,000

Finished Goods Inventory: $10,000

Equipment (historical value): $250,000

Accumulated Depreciation: $125,000

Accounts Payable: $25,000

Estimates for end-of-period balances:

Accounts Receivable: $40,000

Raw Materials Inventory: $15,000

Work in Process Inventory: $80,000

Finished Goods Inventory: $7,000

Accumulated Depreciation: $120,000

Accounts Payable: $20,000

Budgeted activity levels for the period:

Sales: 15,000 units, at a sales price of $175/unit

Purchases of Direct Materials: $300,000

Direct Labor Wages: $150,000

Manufacturing Overhead: $1,000,000

Selling and Administrative Expenses: $900,000

All sales are on account. Only raw materials are purchased on account. The company has no debt aside from current liabilities. ICC has planned to purchase new equipment worth $30,000, and to sell equipment for $8,000 (Original purchase price $25,000, accumulated depreciation $15,000) to help finance the purchase.

-What is budgeted level of Cash Flow from Operating Activities?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

72

What are some threats that a company might face in the commercial farming industry?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

73

What is operational planning? What length of planning horizon does it generally cover?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

74

What are some examples of reports that can be used to measure a company's progress against their goals and plans?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

75

How is SWOT analysis used in the planning process?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

76

In evaluating company performance, what may be wrong with simply comparing current period performance against previous-period results?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

77

How can participative budgeting lead to greater acceptance of performance standards?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

78

What budgets are affected by the Production Budget?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

79

Which budget should be prepared first and why?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

80

What is the source of input for the Budgeted Statement of Cash Flows?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck