Deck 12: Capital Budgeting Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/108

Play

Full screen (f)

Deck 12: Capital Budgeting Decisions

1

The cost of capital is the average cost an organization pays to obtain the resources (i.e., borrowed funds, as well as on funds provided by investors in the company's stock) necessary to make investments.

True

2

The payback period method is frequently used as a screening tool, but it does not take into consideration the profitability of a project.

True

3

The payback period and the accounting rate of return methods are inferior to the net present value method because neither considers cash flows.

False

4

The net present value method and internal rate of return method are both deficient to the extent that neither method considers investment size.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

5

To avoid accepting projects that actually should be rejected, a company should ignore all nonquantitative benefits in evaluating net present value.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

6

The objective of capital budgeting models is to eliminate risk.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

7

The depreciation tax shield is calculated as depreciation divided by tax rate.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

8

Taxes have the effect of reducing both cash inflows from taxable revenues and cash outflows for tax deductible expenses.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

9

When given a choice between $500 today or $500 tomorrow, a rationale decision maker will choose $500 today only because of risk.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

10

An annuity is a series of payments of any size received over equal intervals of time.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

11

_______________ involve(s) investment of significant financial resources in projects to develop or introduce new products or services, to expand current production or service capacity, or to change current production or service facilities.

A) Capital budgeting

B) Capital expenditures

C) Long range planning

D) Profitability analysis

A) Capital budgeting

B) Capital expenditures

C) Long range planning

D) Profitability analysis

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following activities falls under the range of responsibility assumed by the capital budgeting committee?

A) Analysis of major capital expenditure proposals

B) Approval of major capital expenditure proposals

C) Review of major capital expenditure proposals

D) All of the above

A) Analysis of major capital expenditure proposals

B) Approval of major capital expenditure proposals

C) Review of major capital expenditure proposals

D) All of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following processes involve the development of capital budgeting project performance reports that compare planned to actual results?

A) Annual reviews

B) Compliance audits

C) Financials statement audits

D) Post-audit reviews

A) Annual reviews

B) Compliance audits

C) Financials statement audits

D) Post-audit reviews

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

14

A precondition for effective capital budgeting requires having:

A) A clearly defined mission

B) A well-defined business strategy

C) Long-range goals

D) All of the above

A) A clearly defined mission

B) A well-defined business strategy

C) Long-range goals

D) All of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following expenditures would be classified as part of the initial investment phase for equipment?

A) Expenditures to increase working capital

B) Expenditures to maintain equipment

C) Expenditures for production operations

D) All of the above

A) Expenditures to increase working capital

B) Expenditures to maintain equipment

C) Expenditures for production operations

D) All of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

16

The third phase of a project's cash flows is:

A) Initial project investment

B) Disinvestment

C) Operations

D) Remodeling

A) Initial project investment

B) Disinvestment

C) Operations

D) Remodeling

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

17

Firefox Company is considering the following investment proposal:

Additional information for interest rate of 10 percent and four time periods:

What is the net present value for the investment?

A) $ 4,781

B) $18,322

C) $ 9,159

D) $44,378

Additional information for interest rate of 10 percent and four time periods:

What is the net present value for the investment?

A) $ 4,781

B) $18,322

C) $ 9,159

D) $44,378

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

18

Firefox Company is considering the following investment proposal:

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The investment's net present value is:

A) $ 8,756

B) $ 9,154

C) $44,378

D) $ 9,159

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The investment's net present value is:

A) $ 8,756

B) $ 9,154

C) $44,378

D) $ 9,159

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is part of a project's operations phase?

A) Collections of accounts receivable from sales

B) Depreciation on working capital

C) Payments of principal and interest on bonds used to finance the project

D) All of the above

A) Collections of accounts receivable from sales

B) Depreciation on working capital

C) Payments of principal and interest on bonds used to finance the project

D) All of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following amounts would be classified as part of the disinvestment phase for a project?

A) Depreciation

B) Collections of accounts receivable from sales

C) Expenditure to return plant site to its pre-project condition

D) Retiring bonds issues to finance the project

A) Depreciation

B) Collections of accounts receivable from sales

C) Expenditure to return plant site to its pre-project condition

D) Retiring bonds issues to finance the project

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following capital budgeting techniques provides the decision maker with answers expressed in dollars?

A) Accounting rate of return

B) Internal rate of return

C) Net present value

D) Payback method

A) Accounting rate of return

B) Internal rate of return

C) Net present value

D) Payback method

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

22

The internal rate of return:

A) Does not require a predetermined discount rate

B) Is often used to rank investment proposals

C) May be compared to the cost of capital in project evaluation

D) All of the above

A) Does not require a predetermined discount rate

B) Is often used to rank investment proposals

C) May be compared to the cost of capital in project evaluation

D) All of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

23

A project's __________________is computed as the present value of project related cash inflows and outflows.

A) Accounting rate of return

B) Internal rate of return

C) Net present value

D) Present value index

A) Accounting rate of return

B) Internal rate of return

C) Net present value

D) Present value index

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is needed to compute a project's net present value?

A) A computer

B) Accounting rate of return

C) Discount rate

D) Internal rate of return

A) A computer

B) Accounting rate of return

C) Discount rate

D) Internal rate of return

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

25

Pipette Medical Services is considering an investment of $200,000. Data related to the investment and present value factors are as follows:

The investment's net present value is:

A) $150,092

B) $114,237

C) $175,820

D) $ 75,830

The investment's net present value is:

A) $150,092

B) $114,237

C) $175,820

D) $ 75,830

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

26

Pipette Medical Services is considering an investment of $200,000. Assume the discount rate is 18%. Data related to the cash inflows are as follows:

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The investment's net present value is:

A) $ 62,920

B) $150,092

C) $114,237

D) $ 75,046

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The investment's net present value is:

A) $ 62,920

B) $150,092

C) $114,237

D) $ 75,046

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

27

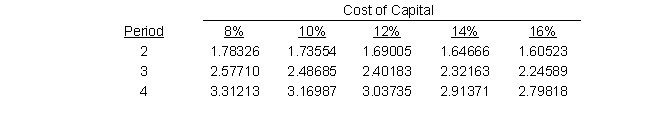

Westmont Publishing is considering the purchase of a used printing press costing $75,200. The printing press would generate a net cash inflow of $31,310 a year for 3 years. At the end of 3 years, the press would have no salvage value. The company's cost of capital is 10 percent. The company uses straight-line depreciation. The present value factors of an annuity of $1.00 for different rates of return are as follows:

The investments internal rate of return (rounded to the nearest percent) is:

The investments internal rate of return (rounded to the nearest percent) is:

A) 10 percent

B) 16 percent

C) 14 percent

D) 12 percent

The investments internal rate of return (rounded to the nearest percent) is:

The investments internal rate of return (rounded to the nearest percent) is:A) 10 percent

B) 16 percent

C) 14 percent

D) 12 percent

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

28

Westmont Publishing is considering the purchase of a used printing press costing $75,200. The printing press would generate a net cash inflow of $31,310 a year for 3 years. At the end of 3 years, the press would have no salvage value. The company's cost of capital is 10 percent.

Using a spreadsheet or financial calculator, determine the internal rate of return for the investment.

The investment's internal rate of return (rounded to the nearest percent) is:

A) 10 percent

B) 16 percent

C) 14 percent

D) 12 percent

Using a spreadsheet or financial calculator, determine the internal rate of return for the investment.

The investment's internal rate of return (rounded to the nearest percent) is:

A) 10 percent

B) 16 percent

C) 14 percent

D) 12 percent

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

29

Westmont Publishing is considering the purchase of a used printing press costing $69,700. The printing press would generate a net cash inflow of $31,000 a year for 3 years. At the end of 3 years, the press would have no salvage value. The company's cost of capital is 10 percent. The company uses straight-line depreciation. The present value factors of an annuity of $1.00 for different rates of return are as follows:

The investment's net present value is:

The investment's net present value is:

A) $ 5,480

B) $23,300

C) $ 7,392

D) $ 8,981

The investment's net present value is:

The investment's net present value is:A) $ 5,480

B) $23,300

C) $ 7,392

D) $ 8,981

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

30

Westmont Publishing is considering the purchase of a used printing press costing $69,700. The printing press would generate a net cash inflow of $31,000 a year for 3 years. At the end of 3 years, the press would have no salvage value. The company's cost of capital is 10 percent. The company uses straight-line depreciation.

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The investment's net present value is:

A) $ 5,480

B) $ 7,392

C) $23,300

D) $ 8,863

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The investment's net present value is:

A) $ 5,480

B) $ 7,392

C) $23,300

D) $ 8,863

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

31

The internal rate of return is sometimes called the:

A) Adjusted accounting rate or return

B) Cost of capital

C) Discount rate

D) Time-adjusted rate of return

A) Adjusted accounting rate or return

B) Cost of capital

C) Discount rate

D) Time-adjusted rate of return

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

32

The___________________is the discount rate that equates the present value of a project's cash inflows with the present value of the project's outflows.

A) Cost of capital

B) Internal rate of return

C) Present value index

D) Time adjusted accounting rate of return

A) Cost of capital

B) Internal rate of return

C) Present value index

D) Time adjusted accounting rate of return

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

33

Dutch Donut Shop is considering an investment of $50,000. Data related to the investment and present value factors are as follows:

The net present value of the investment is:

A) $214,352

B) $223,122

C) $111,616

D) $314,352

The net present value of the investment is:

A) $214,352

B) $223,122

C) $111,616

D) $314,352

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

34

Dutch Donut Shop is considering an investment of $50,000. The cost of capital is 14%. Data related to the investment are as follows:

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The net present value of the investment is:

A) $214,352

B) $223,233

C) $382,000

D) $111,616

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The net present value of the investment is:

A) $214,352

B) $223,233

C) $382,000

D) $111,616

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

35

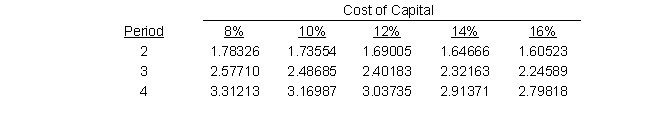

Copa Corporation is considering the purchase of a new machine costing $150,000. The machine would generate net cash inflows of $43,690 per year for 5 years. At the end of 5 years, the machine would have no salvage value. Copa's cost of capital is 12 percent. Copa uses straight-line depreciation. The present value factors of annuity of $1.00 for different rates of return are as follows:

The proposal's internal rate of return (rounded to the nearest percent) is:

A) 12 percent

B) 14 percent

C) 16 percent

D) 18 percent

The proposal's internal rate of return (rounded to the nearest percent) is:

A) 12 percent

B) 14 percent

C) 16 percent

D) 18 percent

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

36

Copa Corporation is considering the purchase of a new machine costing $150,000. The machine would generate net cash inflows of $43,690 per year for 5 years. At the end of 5 years, the machine would have no salvage value. Copa's cost of capital is 12 percent. Copa uses straight-line depreciation.

Using a spreadsheet or financial calculator, determine the proposal's internal rate of return for the investment.

The proposal's internal rate of return is:

A) 12.993 percent

B) 14.251 percent

C) 16.012 percent

D) 13.998 percent

Using a spreadsheet or financial calculator, determine the proposal's internal rate of return for the investment.

The proposal's internal rate of return is:

A) 12.993 percent

B) 14.251 percent

C) 16.012 percent

D) 13.998 percent

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

37

Copa Corporation is considering the purchase of a new machine costing $169,000. The machine would generate net cash inflows of $43,690 per year for 5 years. At the end of 5 years, the machine would have no salvage value. Copa's cost of capital is 14 percent. Copa uses straight-line depreciation. The present value factors of annuity of $1.00 for different rates of return are as follows:

The proposal's net present value is:

A) $ (19,009)

B) $ (49,450)

C) $ 1,070

D) $ 18,921

The proposal's net present value is:

A) $ (19,009)

B) $ (49,450)

C) $ 1,070

D) $ 18,921

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

38

Copa Corporation is considering the purchase of a new machine costing $169,000. The machine would generate net cash inflows of $43,690 per year for 5 years. At the end of 5 years, the machine would have no salvage value. Copa's cost of capital is 14 percent. Copa uses straight-line depreciation.

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The proposal's net present value is (rounded to the nearest dollar):

A) $ (19,009)

B) $ (49,450)

C) $ 1,070

D) $ 18,921

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The proposal's net present value is (rounded to the nearest dollar):

A) $ (19,009)

B) $ (49,450)

C) $ 1,070

D) $ 18,921

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

39

Kansas Mining is evaluating a proposal to invest in a new piece of equipment costing $50,000 with the following annual cash flows over the equipment's 4-year useful life:

The investment's net present value is:

A) $28,971

B) $63,184

C) $70,072

D) $81,592

The investment's net present value is:

A) $28,971

B) $63,184

C) $70,072

D) $81,592

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

40

Kansas Mining is evaluating a proposal to invest in a new piece of equipment costing $50,000 with the following annual cash flows over the equipment's 4-year useful life:

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The investment's net present value is:

A) $ 9,346

B) $170,093

C) $ 70,092

D) $ 28,971

Using a spreadsheet or financial calculator, determine the net present value for the investment.

The investment's net present value is:

A) $ 9,346

B) $170,093

C) $ 70,092

D) $ 28,971

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

41

If a company invests in a project with an internal rate of return higher than the company's cost of capital, the project should:

A) Decrease the market value of the company's stock

B) Have little or no effect on the market value of the company's stock

C) Increase the market value of the company's stock

D) Reduce the weighted average cost of capital

A) Decrease the market value of the company's stock

B) Have little or no effect on the market value of the company's stock

C) Increase the market value of the company's stock

D) Reduce the weighted average cost of capital

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

42

A project under consideration has a net present value of $5,000 for a required investment of $30,000. There are no other investment options at this time. However, the assumed discount rate used to calculate the net present value is 10%.

On the basis of this information alone, this project should:

A) Definitely be rejected because $10,000 is only 17% of $60,000

B) Be rejected on the basis that the project loses $50,000

C) Probably be approved since the net present value is greater than zero

D) Be accepted if the cost of capital is greater than or equal to 20 percent

On the basis of this information alone, this project should:

A) Definitely be rejected because $10,000 is only 17% of $60,000

B) Be rejected on the basis that the project loses $50,000

C) Probably be approved since the net present value is greater than zero

D) Be accepted if the cost of capital is greater than or equal to 20 percent

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following considerations is most likely to influence the determination of a company's cost of capital?

A) The discount rate used in last year's project approvals

B) The expected return of Standard and Poor's 500 stock index

C) The interest rate on bonds issued

D) The return on the company's stock over the past twelve months

A) The discount rate used in last year's project approvals

B) The expected return of Standard and Poor's 500 stock index

C) The interest rate on bonds issued

D) The return on the company's stock over the past twelve months

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

44

Cornell Manufacturing Company is considering the following investment proposal:

The investment's payback period in years (rounded to two decimal points) is:

A) 1.50

B) 4.00

C) 3.56

D) 4.67

The investment's payback period in years (rounded to two decimal points) is:

A) 1.50

B) 4.00

C) 3.56

D) 4.67

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

45

Cornell Manufacturing Company is considering the following investment proposal:

The investment's accounting rate of return (rounded to two decimal points) on the original investment is:

A) 5.88 percent

B) 8.33 percent

C) 3.85 percent

D) 10.71 percent

The investment's accounting rate of return (rounded to two decimal points) on the original investment is:

A) 5.88 percent

B) 8.33 percent

C) 3.85 percent

D) 10.71 percent

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

46

Tiger Management Services is considering an investment of $75,000. Data related to the investment are as follows:

The investment's payback period in years (rounded to two decimal points) is:

A) 3.30

B) 2.23

C) 3.38

D) 3.00

The investment's payback period in years (rounded to two decimal points) is:

A) 3.30

B) 2.23

C) 3.38

D) 3.00

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

47

Clarinet Publishing is considering the purchase of a used printing press costing $40,000. The printing press would generate a net cash inflow of $10,000 a year for 10 years. At the end of 10 years, the press would have no salvage value. The company's cost of capital is 10 percent. The company uses straight-line depreciation.

The project's accounting rate of return on the initial investment is:

A) 32 percent

B) 19 percent

C) 15 percent

D) 75 percent

The project's accounting rate of return on the initial investment is:

A) 32 percent

B) 19 percent

C) 15 percent

D) 75 percent

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

48

Clarinet Publishing is considering the purchase of a used printing press costing $25,600. The printing press would generate a net cash inflow of $10,000 a year for 10 years. At the end of 10 years, the press would have no salvage value. The company's cost of capital is 10 percent. The company uses straight-line depreciation.

The investment's payback period in years (rounded to two decimal points) is:

A) 2.56

B) 2.13

C) 1.92

D) 3.00

The investment's payback period in years (rounded to two decimal points) is:

A) 2.56

B) 2.13

C) 1.92

D) 3.00

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

49

Dutch Donut Shop is considering an investment of $72,000. Data related to the investment are as follows:

The investments payback period (rounded to two decimal points) is:

A) 3.20

B) 2.33

C) 3.13

D) 3.25

The investments payback period (rounded to two decimal points) is:

A) 3.20

B) 2.33

C) 3.13

D) 3.25

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

50

Copa Cabana Corporation is considering the purchase of a new machine costing $30,000. The machine would generate net cash inflows of $12,000 per year for 5 years. At the end of 5 years, the machine would have no salvage value. Copa Cabana's cost of capital is 12 percent. Copa Cabana uses straight-line depreciation.

The investment's accounting rate of return on initial investment is:

A) 12.28 percent

B) 10.27 percent

C) 20.00 percent

D) 30.55 percent

The investment's accounting rate of return on initial investment is:

A) 12.28 percent

B) 10.27 percent

C) 20.00 percent

D) 30.55 percent

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

51

Copa Cabana Corporation is considering the purchase of a new machine costing $30,000. The machine would generate net cash inflows of $12,000 per year for 5 years. At the end of 5 years, the machine would have no salvage value. Copa Cabana's cost of capital is 12 percent. Copa Cabana uses straight-line depreciation.

The investment's payback period in years is:

A) 3.3

B) 3.1

C) 4.0

D) 2.5

The investment's payback period in years is:

A) 3.3

B) 3.1

C) 4.0

D) 2.5

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

52

Tempe Milling is evaluating a proposal to invest in a new piece of equipment costing $50,000 with the following annual cash flows over the equipment's 5-year useful life:

The accounting rate of return on initial investment is:

A) 20.00 percent

B) 16.30 percent

C) 25.56 percent

D) 30.00 percent

The accounting rate of return on initial investment is:

A) 20.00 percent

B) 16.30 percent

C) 25.56 percent

D) 30.00 percent

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

53

Kansas Mining is evaluating a proposal to invest in a new piece of equipment costing $55,000 with the following annual cash flows over the equipment's 4-year useful life:

The investment's payback period is (rounded to two decimal places):

A) 3.91

B) 1.88

C) 2.37

D) 2.56

The investment's payback period is (rounded to two decimal places):

A) 3.91

B) 1.88

C) 2.37

D) 2.56

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

54

The primary focus of the payback period method is:

A) Increasing shareholder wealth

B) Liquidity

C) Maintaining market value of stock

D) Profitability

A) Increasing shareholder wealth

B) Liquidity

C) Maintaining market value of stock

D) Profitability

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

55

The following is a disadvantage of the payback period method:

A) It is more complicated to calculate with unequal annual cash flows

B) There is no consideration of cash flows after the payback period

C) There is no consideration of the timing of cash flows

D) Both A and B are disadvantages of this method

A) It is more complicated to calculate with unequal annual cash flows

B) There is no consideration of cash flows after the payback period

C) There is no consideration of the timing of cash flows

D) Both A and B are disadvantages of this method

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

56

The payback period method of evaluating investment projects is most appropriate:

A) When a project is expected to lose money

B) When it is used as the sole investment criterion

C) When no information is available concerning the timing of cash inflows

D) When rapid recovery of initial investment is a primary concern

A) When a project is expected to lose money

B) When it is used as the sole investment criterion

C) When no information is available concerning the timing of cash inflows

D) When rapid recovery of initial investment is a primary concern

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

57

Project A has a predicted payback period of 2.5 and Project B has a predicted payback period of 5. Based on this information we can conclude:

A) Project A is preferred to Project B

B) Project B provides twice the return of Project A

C) Project B is preferred to Project A, but it is not necessarily twice as profitable

D) More information should be gathered before deciding on which project, if either, is desirable

A) Project A is preferred to Project B

B) Project B provides twice the return of Project A

C) Project B is preferred to Project A, but it is not necessarily twice as profitable

D) More information should be gathered before deciding on which project, if either, is desirable

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

58

This capital budgeting model considers the time value of money.

A) Accounting rate of return

B) Payback period

C) Both A and B

D) Neither A nor B

A) Accounting rate of return

B) Payback period

C) Both A and B

D) Neither A nor B

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

59

This capital budgeting model considers the time value of money.

A) Accounting rate of return

B) Internal rate of return

C) Both A and B

D) Neither A nor B

A) Accounting rate of return

B) Internal rate of return

C) Both A and B

D) Neither A nor B

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

60

This capital budgeting model does not consider profitability.

A) Accounting rate of return

B) Internal rate of return

C) Payback period

D) All of the above

A) Accounting rate of return

B) Internal rate of return

C) Payback period

D) All of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

61

This capital budgeting model gives explicit consideration to investment size.

A) Accounting rate of return

B) Internal rate of return

C) Net present value

D) Payback period

A) Accounting rate of return

B) Internal rate of return

C) Net present value

D) Payback period

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

62

This capital budgeting models assumes all net cash inflows are reinvested at the discount rate.

A) Accounting rate of return

B) Internal rate of return

C) Net present value

D) Payback period

A) Accounting rate of return

B) Internal rate of return

C) Net present value

D) Payback period

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

63

This is a reason to employ the net present value method in making capital expenditure decisions.

A) The NPV method determines the length of time necessary to recover the entire cost of an investment from the resulting annual net cash flow.

B) The NPV method determines the rate of return on average investment.

C) The NPV method considers the timing of future cash flows.

D) All of the above

A) The NPV method determines the length of time necessary to recover the entire cost of an investment from the resulting annual net cash flow.

B) The NPV method determines the rate of return on average investment.

C) The NPV method considers the timing of future cash flows.

D) All of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

64

This capital budgeting model concerns how long it takes to recover the initial investment from a project.

A) Accounting rate of return

B) Internal rate of return

C) Net present value

D) Payback period

A) Accounting rate of return

B) Internal rate of return

C) Net present value

D) Payback period

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

65

How is depreciation included in determining a project's NPV?

A) Depreciation is a deduction in determining net operating cash inflows before computing NPV

B) Depreciation is added to net operating cash inflows before computing NPV

C) Depreciation is not a factor in determining a project's NPV

D) Depreciation indirectly influences cash flows through effects on taxes

A) Depreciation is a deduction in determining net operating cash inflows before computing NPV

B) Depreciation is added to net operating cash inflows before computing NPV

C) Depreciation is not a factor in determining a project's NPV

D) Depreciation indirectly influences cash flows through effects on taxes

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

66

When determining net present value, this is commonly done to consider the risks associated with a proposed investment:

A) Decrease the discount rate used in the analysis

B) Decrease the expected cash flows

C) Increase the discount rate used in the analysis

D) Increase the required payback period

A) Decrease the discount rate used in the analysis

B) Decrease the expected cash flows

C) Increase the discount rate used in the analysis

D) Increase the required payback period

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

67

The depreciation tax shield is computed as:

A) Depreciation times (one minus the tax rate)

B) Depreciation times the tax rate

C) (Net income minus depreciation) times (one minus the tax rate)

D) The book value of equipment times (one minus the tax rate)

A) Depreciation times (one minus the tax rate)

B) Depreciation times the tax rate

C) (Net income minus depreciation) times (one minus the tax rate)

D) The book value of equipment times (one minus the tax rate)

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

68

Arsenal Company is considering an investment in equipment costing $30,000 with a six-year life and no salvage value. Arsenal uses straight-line depreciation and is subject to a 35 percent tax rate. The expected net cash inflow before depreciation and taxes is projected to be $20,000 per year.

The Year 1 annual after-tax net cash inflow is:

A) $11,880

B) $ 9,000

C) $14,750

D) $29,800

The Year 1 annual after-tax net cash inflow is:

A) $11,880

B) $ 9,000

C) $14,750

D) $29,800

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

69

Arsenal Company is considering an investment in equipment costing $30,000 with a five-year life and no salvage value. Arsenal uses straight-line depreciation and is subject to a 35 percent tax rate. The expected net cash inflow before depreciation and taxes is projected to be $20,000 per year.

Over the life of the project, the total tax shield created by depreciation is:

A) $10,500

B) $39,600

C) $20,400

D) $10,750

Over the life of the project, the total tax shield created by depreciation is:

A) $10,500

B) $39,600

C) $20,400

D) $10,750

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

70

Souza Corporation is considering an investment in equipment for $75,000 with a four-year life and no salvage value. Souza uses the straight-line method of depreciation and is subject to a 35 percent tax rate.

Over the life of the project, the total tax shield created by depreciation is:

A) $12,500

B) $26,250

C) $25,000

D) $75,000

Over the life of the project, the total tax shield created by depreciation is:

A) $12,500

B) $26,250

C) $25,000

D) $75,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

71

The management of Leahy Enterprises is currently evaluating the following investment proposal:

The proposal's payback period and proposal's internal rate of return (IRR) approximate:

A) Payback period 3 years, IRR 12 percent

B) Payback period 3 years, IRR 8 percent

C) Payback period 4 years, IRR 12 percent

D) Payback period 3.5 years, IRR 16 percent

The proposal's payback period and proposal's internal rate of return (IRR) approximate:

A) Payback period 3 years, IRR 12 percent

B) Payback period 3 years, IRR 8 percent

C) Payback period 4 years, IRR 12 percent

D) Payback period 3.5 years, IRR 16 percent

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

72

The management of Leahy Enterprises is currently evaluating the following investment proposal:

Given the amount of the initial investment, the minimum annual net cash inflows required to obtain an internal rate of return of 16 percent. (Round the answer to the nearest dollar.)

A) $100,000

B) $107,213

C) $300,000

D) $142,950

Given the amount of the initial investment, the minimum annual net cash inflows required to obtain an internal rate of return of 16 percent. (Round the answer to the nearest dollar.)

A) $100,000

B) $107,213

C) $300,000

D) $142,950

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

73

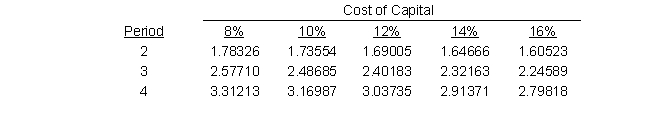

Randel Company is evaluating a capital expenditure proposal that has the following predicted cash flows:

The present value factors of $1 for different rates of return are as follows:

Given a discount rate of 14 percent, determine the net present value of the investment proposal.

A) $ 5,618

B) $40,000

C) $45,110

D) $ 2,829

The present value factors of $1 for different rates of return are as follows:

Given a discount rate of 14 percent, determine the net present value of the investment proposal.

A) $ 5,618

B) $40,000

C) $45,110

D) $ 2,829

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

74

Mark decided to purchase a new automobile. Being concerned about environmental issues, he is leaning toward the hybrid rather than the gasoline only model. Nevertheless, as a new business school graduate, he wants to determine if there is an economic justification for purchasing the hybrid, which costs $1,000 more than the regular model. He has determined that city/highway combined gas mileage of the hybrid and regular models are 30 and 24 miles per gallon respectively. Mark anticipates he will travel an average of 10,000 miles per year for the next several years.

The payback period of the incremental investment if gasoline costs $3 per gallon is:

A) 4.80 years

B) 6.00 years

C) 5.80 years

D) 4.00 years

The payback period of the incremental investment if gasoline costs $3 per gallon is:

A) 4.80 years

B) 6.00 years

C) 5.80 years

D) 4.00 years

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

75

Janice decided to purchase a new automobile. Being concerned about environmental issues, she is leaning toward the hybrid rather than the gasoline only model. Nevertheless, as a new business school graduate, she wants to determine if there is an economic justification for purchasing the hybrid, which costs $1,200 more than the regular model. She has determined that city/highway combined gas mileage of the hybrid and regular models are 30 and 24 miles per gallon respectively. Janice anticipates she will travel an average of 10,000 miles per year for the next several years.

Assuming that Janice plans to keep the car about 5 years and does not believe there will be a trade-in premium associated with the hybrid model, determine the net present value of the incremental investment at 4 percent time value of money.

A) $1,200.00

B) $1,000.00

C) $ 87.04

D) $ (87.04)

Assuming that Janice plans to keep the car about 5 years and does not believe there will be a trade-in premium associated with the hybrid model, determine the net present value of the incremental investment at 4 percent time value of money.

A) $1,200.00

B) $1,000.00

C) $ 87.04

D) $ (87.04)

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

76

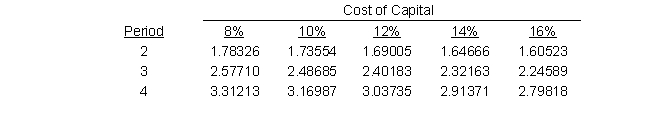

Rick's Repairs, Inc. is considering renting a new shop. The landlord has offered a number of alternatives for paying the rent. The present value factors at the company's rate of return are as follows:

The landlord offered a 2-year lease with $20,000 to be paid for rent at the end of each year. The present value of rent payments over the life of the lease is:

A) $20,000

B) $33,208

C) $34,711

D) $40,000

The landlord offered a 2-year lease with $20,000 to be paid for rent at the end of each year. The present value of rent payments over the life of the lease is:

A) $20,000

B) $33,208

C) $34,711

D) $40,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

77

Rick's Repairs, Inc. is considering renting a new shop. The landlord has offered a number of alternatives for paying the rent. The company's desired rate of return is 10%. The landlord offered a 2-year lease with $20,000 to be paid for rent at the end of each year.

Using a spreadsheet or a financial calculator, calculate the present value of the rent payments over the life of the lease.

The present value of rent payments over the life of the lease is:

A) $20,000

B) $33,208

C) $34,711

D) $40,000

Using a spreadsheet or a financial calculator, calculate the present value of the rent payments over the life of the lease.

The present value of rent payments over the life of the lease is:

A) $20,000

B) $33,208

C) $34,711

D) $40,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

78

Rick's Repairs, Inc. is considering renting a new shop. The landlord has offered a number of alternatives for paying the rent. The present value factors at the company's rate of return are as follows:

The landlord offered a 3-year lease with the rent payments as follows: $16,000 at the end of the first year, $24,000 at the end of the second year, and $20,000 at the end of the third year.

The present value of the rent payments over the life of the lease is:

A) $45,079

B) $49,200

C) $49,406

D) $60,000

The landlord offered a 3-year lease with the rent payments as follows: $16,000 at the end of the first year, $24,000 at the end of the second year, and $20,000 at the end of the third year.

The present value of the rent payments over the life of the lease is:

A) $45,079

B) $49,200

C) $49,406

D) $60,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

79

Rick's Repairs, Inc. is considering renting a new shop. The landlord has offered a number of alternatives for paying the rent. The company's desired rate of return is 10%. The landlord offered a 3-year lease with the rent payments as follows: $16,000 at the end of the first year, $24,000 at the end of the second year, and $20,000 at the end of the third year.

Using a spreadsheet or a financial calculator, calculate the present value of the rent payments over the life of the lease.

The present value of the rent payments over the life of the lease is:

A) $45,079

B) $49,200

C) $49,406

D) $60,000

Using a spreadsheet or a financial calculator, calculate the present value of the rent payments over the life of the lease.

The present value of the rent payments over the life of the lease is:

A) $45,079

B) $49,200

C) $49,406

D) $60,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

80

Black Company will receive $30,000 at the end of each year for the next 8 years. Black has an annual cost of capital equal to 10 percent per year. The present value of $1 and the present value of an annuity of $1 for eight periods at ten percent are 0.46651 and 5.33493, respectively.

What is the present value of these cash receipts?

A) $160,048

B) $240,000

C) $ 13,995

D) $ 30,000

What is the present value of these cash receipts?

A) $160,048

B) $240,000

C) $ 13,995

D) $ 30,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck