Deck 1: Financial Accounting and Business Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/129

Play

Full screen (f)

Deck 1: Financial Accounting and Business Decisions

1

A major function of managerial accounting is to provide general purpose financial statements for parties outside the organization.

False

2

It is unusual for U.S. businesses to develop written codes of ethics to guide their employees.

False

3

An emphasis on short-term profits may contribute to ethical breakdowns within a business.

True

4

Financial accounting is designed primarily for decision makers within a company.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

5

The goal of the Sarbanes-Oxley Act of 2002 was to increase the level of confidence that external users have in a company's financial statements.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

6

Investing activities involve the acquiring and disposing of liabilities that a company needs in order to finance its operating activities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

7

Other than operating profit, there are three main sources of external financing.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

8

Financing activities are defined as the acquiring and disposing of resources for the purpose of selling products and services.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

9

The basic purpose of accounting is to provide useful financial information.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

10

Generally accepted accounting principles apply to the general-purpose financial statements prepared primarily for parties outside of an organization.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

11

Federal income tax regulations constitute a primary source of generally accepted accounting principles.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

12

Currently, the organization in the private sector with the primary responsibility for formulating accounting principles is the Financial Accounting Standards Board.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

13

Assets must always equal the sum of liabilities plus stockholders' equity.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

14

If a company reports retained earnings of $22.4 million on its balance sheet, it will also report $22.4 million in cash.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

15

The accounting equation states that the economic resources of an entity are equal to the claims on those resources.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

16

The key characteristic of an asset is that it represents a probable future economic benefit owned or controlled by an entity.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

17

The net assets of an entity are equal to the assets minus the stockholders' equity.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

18

A statement of cash flows reports on the cash flows for operating, investing and financing activities at a point in time.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

19

Retained earnings are reported on both the income statement and the statement of stockholders' equity.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

20

The income statement is also called the earnings statement.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

21

The income statement, statement of stockholders' equity, and statement of cash flows are referred to as period-in-time statements.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

22

The statement of cash flows reports information about cash flows in two categories: cash received and cash disbursed.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

23

When financial statements are prepared, the balance sheet is usually prepared first.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

24

Computational techniques that companies use to reveal patterns, trends and associations in human behavior are known as data analytics.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

25

Blockchain is a distributed ledger accounting system which requires centralized record keeping.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following forms of business organizations exists as a legal entity?

A) A sole proprietorship

B) A partnership

C) A corporation

D) A labor union

A) A sole proprietorship

B) A partnership

C) A corporation

D) A labor union

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

27

Which one of the following is not an external user of financial information?

A) Stockholders

B) Creditors

C) Internal Revenue Service

D) Senior company management

A) Stockholders

B) Creditors

C) Internal Revenue Service

D) Senior company management

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

28

The accounting activities carried out by a firm's accounting staff primarily to provide management with accounting data for decisions related to a firm's operations is referred to as:

A) Financial accounting

B) Managerial accounting

C) Tax accounting

D) Regulatory accounting

E) None of the above

A) Financial accounting

B) Managerial accounting

C) Tax accounting

D) Regulatory accounting

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

29

The area of accounting dealing with the preparation of financial statements showing a business's results of operations, financial position, and cash flow is referred to as:

A) Financial accounting

B) Managerial accounting

C) Tax accounting

D) Regulatory accounting

E) None of the above

A) Financial accounting

B) Managerial accounting

C) Tax accounting

D) Regulatory accounting

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following represents an aspect of the accounting environment that may create ethical pressures on an accountant?

A) Accountants have access to confidential and sensitive information.

B) The output produced by accountants may have significant financial implications for one or more persons.

C) Management may emphasize short-run profits.

D) All of the above

E) None of the above

A) Accountants have access to confidential and sensitive information.

B) The output produced by accountants may have significant financial implications for one or more persons.

C) Management may emphasize short-run profits.

D) All of the above

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following situations has the potential to create ethical pressure on an accountant?

A) Preparing an individual's income tax return when much of the supporting documentation is missing

B) Informing a sales manager that the travel and entertainment expenses turned in by the top performing sales representative exceed company allowances

C) Discovering that the company has made a mistake in computing refunds granted customers, causing the refunds to be too small

D) All of the above

E) None of the above

A) Preparing an individual's income tax return when much of the supporting documentation is missing

B) Informing a sales manager that the travel and entertainment expenses turned in by the top performing sales representative exceed company allowances

C) Discovering that the company has made a mistake in computing refunds granted customers, causing the refunds to be too small

D) All of the above

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is true regarding generally accepted accounting principles (GAAP)?

A) GAAP is a set of laws

B) GAAP is subject to change as conditions warrant

C) Under GAAP, if two companies engage in the same transactions, they must choose the same accounting methods

D) U.S. GAAP is the same as GAAP in other countries

A) GAAP is a set of laws

B) GAAP is subject to change as conditions warrant

C) Under GAAP, if two companies engage in the same transactions, they must choose the same accounting methods

D) U.S. GAAP is the same as GAAP in other countries

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

33

Currently, the organization with the primary responsibility for formulating U.S. generally accepted accounting principles is the:

A) American Institute of Certified Public Accountants

B) Securities and Exchange Commission

C) Financial Accounting Standards Board

D) Internal Revenue Service

E) None of the above

A) American Institute of Certified Public Accountants

B) Securities and Exchange Commission

C) Financial Accounting Standards Board

D) Internal Revenue Service

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

34

Generally accepted accounting principles are:

A) Guides to action that apply primarily to the process of managerial accounting

B) Accounting standards enforced by the Internal Revenue Service

C) Accounting standards that never change

D) Guides to action that apply primarily to the process of financial accounting

E) None of the above

A) Guides to action that apply primarily to the process of managerial accounting

B) Accounting standards enforced by the Internal Revenue Service

C) Accounting standards that never change

D) Guides to action that apply primarily to the process of financial accounting

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is a correct statement of the accounting equation in economic terms?

A) Economic resources = Operating assets + Financial assets

B) Economic resources = Creditor financing + Owner financing

C) Economic resources = Creditor financing - Owner financing

D) Creditor financing = Investing + Operating

A) Economic resources = Operating assets + Financial assets

B) Economic resources = Creditor financing + Owner financing

C) Economic resources = Creditor financing - Owner financing

D) Creditor financing = Investing + Operating

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

36

What are the obligations or debts that a business must pay in cash or in goods and services at some future time because of past transactions or events called and how are they reported?

A) Assets on the balance sheet

B) Stockholders' equity on the balance sheet

C) Dividends on the statement of stockholders' equity

D) Liabilities on the balance sheet

A) Assets on the balance sheet

B) Stockholders' equity on the balance sheet

C) Dividends on the statement of stockholders' equity

D) Liabilities on the balance sheet

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

37

The accounting equation states:

A) Assets + Liabilities = Stockholders' Equity

B) Assets = Liabilities - Stockholders' Equity

C) Assets = Liabilities + Stockholders' Equity

D) Assets + Stockholders' Equity = Liabilities

E) None of the above

A) Assets + Liabilities = Stockholders' Equity

B) Assets = Liabilities - Stockholders' Equity

C) Assets = Liabilities + Stockholders' Equity

D) Assets + Stockholders' Equity = Liabilities

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

38

The economic resources of an entity that can be usefully expressed in monetary terms are called?

A) Stockholders' equity

B) Revenues

C) Liabilities

D) Assets

E) None of the above

A) Stockholders' equity

B) Revenues

C) Liabilities

D) Assets

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is correct?

A) Ownership is an essential test for an asset.

B) An example of an asset is notes payable.

C) The key characteristic of an asset is that it represents a probable future economic benefit owned or controlled by the entity.

D) Liabilities represent the interest of the owners in the assets of an entity.

E) None of the above

A) Ownership is an essential test for an asset.

B) An example of an asset is notes payable.

C) The key characteristic of an asset is that it represents a probable future economic benefit owned or controlled by the entity.

D) Liabilities represent the interest of the owners in the assets of an entity.

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

40

The obligations that an entity must pay in money or services at some time in the future because of past transactions or events are called?

A) Liabilities

B) Expenses

C) Stockholders' equity

D) Cost principle

E) None of the above

A) Liabilities

B) Expenses

C) Stockholders' equity

D) Cost principle

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is an example of a liability?

A) Supplies

B) Accounts receivable

C) Subscriptions received in advance

D) Prepaid advertising

E) None of the above

A) Supplies

B) Accounts receivable

C) Subscriptions received in advance

D) Prepaid advertising

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is not a component of the accounting equation?

A) Stockholders' equity

B) Income statement

C) Liabilities

D) Assets

E) None of the above

A) Stockholders' equity

B) Income statement

C) Liabilities

D) Assets

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is incorrect?

A) To qualify as a liability, an obligation must be payable in cash or in goods and services.

B) A copyright is an example of a liability.

C) To qualify as a liability, an obligation must be scheduled for settlement at some future time.

D) All of the above

E) None of the above

A) To qualify as a liability, an obligation must be payable in cash or in goods and services.

B) A copyright is an example of a liability.

C) To qualify as a liability, an obligation must be scheduled for settlement at some future time.

D) All of the above

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

44

Stockholders' equity:

A) Is equal to assets minus liabilities

B) Represents the interest of the owners in the assets of an entity

C) Is equal to the net assets of an entity

D) All of the above

E) None of the above

A) Is equal to assets minus liabilities

B) Represents the interest of the owners in the assets of an entity

C) Is equal to the net assets of an entity

D) All of the above

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is correct?

A) Some liabilities may involve the performance of services.

B) Liabilities are claims on an entity's assets that remain after the claims of owners have been settled.

C) To qualify as an asset, a resource must have a physical existence.

D) Accounts receivable and Wages payable are examples of liabilities.

E) None of the above

A) Some liabilities may involve the performance of services.

B) Liabilities are claims on an entity's assets that remain after the claims of owners have been settled.

C) To qualify as an asset, a resource must have a physical existence.

D) Accounts receivable and Wages payable are examples of liabilities.

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

46

On which statement are assets, liabilities and stockholders' equity reported?

A) Balance sheet

B) Income statement

C) Statement of retained earnings

D) Statement of cash flows

A) Balance sheet

B) Income statement

C) Statement of retained earnings

D) Statement of cash flows

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following items are disclosed on the balance sheet? (Select all that apply.)

A) Inventory

B) Operating expenses

C) Account receivable

D) Equipment

E) Cash payments

A) Inventory

B) Operating expenses

C) Account receivable

D) Equipment

E) Cash payments

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is not part of the standard heading of a financial statement?

A) The company name

B) The statement title

C) The date or time period of the statement

D) The company's industry

A) The company name

B) The statement title

C) The date or time period of the statement

D) The company's industry

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the four basic financial statements would contain a line item for expenses?

A) Balance sheet

B) Income statement

C) Statement of retained earnings

D) Statement of cash flows

A) Balance sheet

B) Income statement

C) Statement of retained earnings

D) Statement of cash flows

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following would be reported on a statement of stockholders' equity?

A) Cash

B) Total expenses

C) Dividends

D) Financing cash flow

A) Cash

B) Total expenses

C) Dividends

D) Financing cash flow

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

51

How are the balance sheet and the statement of cash flows linked?

A) By the cash balance

B) By the amount of total retained earnings

C) By the total shareholder equity

D) By the amount of net income

A) By the cash balance

B) By the amount of total retained earnings

C) By the total shareholder equity

D) By the amount of net income

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

52

Which one of the following is not a key linkage among the four primary financial statements?

A) The expenses in the income statement link to the total liability balance.

B) The statement of cash flows links to ending cash balance reported on the balance sheet.

C) The income statement links to the ending retained earnings in the statement of stockholders' equity.

D) The statement of retained earnings links to ending retained earnings on the balance sheet.

A) The expenses in the income statement link to the total liability balance.

B) The statement of cash flows links to ending cash balance reported on the balance sheet.

C) The income statement links to the ending retained earnings in the statement of stockholders' equity.

D) The statement of retained earnings links to ending retained earnings on the balance sheet.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

53

The increases to a company's resources that result when goods or services are provided to customers are called?

A) Assets

B) Liabilities

C) Expenses

D) Revenues

E) None of the above

A) Assets

B) Liabilities

C) Expenses

D) Revenues

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

54

What is the definition of sales revenue?

A) Increases to a company's resources or decreases to its obligations that result when goods or services are provided to customers

B) The obligations that an entity must pay at some time in the future because of past transactions or events

C) Decreases in stockholders' equity that a firm incurs in the process of earning revenues

D) The economic resources of an entity that can be usefully expressed in monetary terms

E) None of the above

A) Increases to a company's resources or decreases to its obligations that result when goods or services are provided to customers

B) The obligations that an entity must pay at some time in the future because of past transactions or events

C) Decreases in stockholders' equity that a firm incurs in the process of earning revenues

D) The economic resources of an entity that can be usefully expressed in monetary terms

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

55

What is the definition of expenses?

A) Increases in stockholders' equity that a firm earns by providing goods or services for its customers

B) The obligations that an entity must pay at some time in the future because of past transactions or events

C) Decreases in a company's resources that a firm incurs in the process of earning revenues

D) The economic resources of an entity that can be usefully expressed in money terms

E) None of the above

A) Increases in stockholders' equity that a firm earns by providing goods or services for its customers

B) The obligations that an entity must pay at some time in the future because of past transactions or events

C) Decreases in a company's resources that a firm incurs in the process of earning revenues

D) The economic resources of an entity that can be usefully expressed in money terms

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not a basic financial statement?

A) Income statement

B) Statement of cash flows

C) Statement of common stock

D) Balance sheet

E) None of the above

A) Income statement

B) Statement of cash flows

C) Statement of common stock

D) Balance sheet

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

57

An income statement:

A) Reports the results of operations for a period

B) Reports on the events causing a change in stockholders' equity during a period

C) Presents a firm's assets, liabilities, and stockholders' equity on a given date

D) Reports cash inflows and outflows during a period

E) None of the above

A) Reports the results of operations for a period

B) Reports on the events causing a change in stockholders' equity during a period

C) Presents a firm's assets, liabilities, and stockholders' equity on a given date

D) Reports cash inflows and outflows during a period

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

58

A balance sheet:

A) Reports the results of operations for a period

B) Reports on the events causing a change in stockholders' equity during a period

C) Presents a firm's assets, liabilities, and stockholders' equity as of a given date

D) Reports cash inflows and outflows during a period

E) None of the above

A) Reports the results of operations for a period

B) Reports on the events causing a change in stockholders' equity during a period

C) Presents a firm's assets, liabilities, and stockholders' equity as of a given date

D) Reports cash inflows and outflows during a period

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

59

What categories of cash flows are presented in a statement of cash flows?

A) Operating and non-operating

B) Receipts and disbursements

C) Financial and non-financial

D) Operating, investing, and financing

E) None of the above

A) Operating and non-operating

B) Receipts and disbursements

C) Financial and non-financial

D) Operating, investing, and financing

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following financial statements is a point in time statement?

A) Income statement

B) Statement of stockholders' equity

C) Balance sheet

D) Statement of cash flows

E) None of the above

A) Income statement

B) Statement of stockholders' equity

C) Balance sheet

D) Statement of cash flows

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following financial statements is a period of time statement?

A) Income statement

B) Statement of stockholders' equity

C) Statement of cash flows

D) All of the above

E) None of the above

A) Income statement

B) Statement of stockholders' equity

C) Statement of cash flows

D) All of the above

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

62

A financial statement either presents information covering a period of time (for example, a month, a quarter, or a year) or it presents information as of a particular date (for example, December 31, 2019).

Which of the following financial statements presents information as of a particular date?

A) Balance sheet

B) Income statement

C) Statement of retained earnings

D) Both the balance sheet and the income statement

E) None of the above

Which of the following financial statements presents information as of a particular date?

A) Balance sheet

B) Income statement

C) Statement of retained earnings

D) Both the balance sheet and the income statement

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is not contained in the heading for a balance sheet?

A) The name of the company

B) The time period (for example, a month, quarter, or year) covered by the balance sheet

C) The title of the financial statement (that is, balance sheet)

D) The date (a single day) of the balance sheet

E) None of the above

A) The name of the company

B) The time period (for example, a month, quarter, or year) covered by the balance sheet

C) The title of the financial statement (that is, balance sheet)

D) The date (a single day) of the balance sheet

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is not contained in the heading for an income statement?

A) The name of the company

B) The time period (for example, a month, quarter, or year) covered by the income statement

C) The title of the financial statement (that is, income statement)

D) The date (a single day) of the income statement

E) None of the above

A) The name of the company

B) The time period (for example, a month, quarter, or year) covered by the income statement

C) The title of the financial statement (that is, income statement)

D) The date (a single day) of the income statement

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is not contained in the heading for a statement of stockholders' equity?

A) The name of the company

B) The time period (for example, a month, quarter, or year) covered by the statement of stockholders' equity

C) The title of the financial statement (that is, statement of stockholders' equity)

D) The date (a single day) of the statement of stockholders' equity

E) None of the above

A) The name of the company

B) The time period (for example, a month, quarter, or year) covered by the statement of stockholders' equity

C) The title of the financial statement (that is, statement of stockholders' equity)

D) The date (a single day) of the statement of stockholders' equity

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is presented in a statement of stockholders' equity?

A) Revenues

B) Expenses

C) Net income

D) Assets

E) None of the above

A) Revenues

B) Expenses

C) Net income

D) Assets

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is not presented in a statement of stockholders' equity?

A) Retained earnings at the beginning of the year

B) Revenues

C) Net income

D) Dividends

E) None of the above

A) Retained earnings at the beginning of the year

B) Revenues

C) Net income

D) Dividends

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

68

An income statement does not include which of the following?

A) Operating expenses

B) Cost of goods sold

C) Retained earnings

D) Sales

A) Operating expenses

B) Cost of goods sold

C) Retained earnings

D) Sales

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

69

USE THE FOLLOWING INFORMATION FOR QUESTIONS BELOW:

Loweman's Car Repair Shop started the year with total assets of $30,000, total liabilities of $21,000, and retained earnings of $9,000. During the year, the business recorded $50,000 in car repair revenues, $35,000 in expenses, and the company paid dividends of $5,000. The investors did not make any additional investments during the year.

-The net income reported by Loweman's Car Repair Shop for the year was:

A) $15,000

B) $20,000

C) $25,000

D) $90,000

E) None of the above

Loweman's Car Repair Shop started the year with total assets of $30,000, total liabilities of $21,000, and retained earnings of $9,000. During the year, the business recorded $50,000 in car repair revenues, $35,000 in expenses, and the company paid dividends of $5,000. The investors did not make any additional investments during the year.

-The net income reported by Loweman's Car Repair Shop for the year was:

A) $15,000

B) $20,000

C) $25,000

D) $90,000

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

70

USE THE FOLLOWING INFORMATION FOR QUESTIONS BELOW:

Loweman's Car Repair Shop started the year with total assets of $30,000, total liabilities of $21,000, and retained earnings of $9,000. During the year, the business recorded $50,000 in car repair revenues, $35,000 in expenses, and the company paid dividends of $5,000. The investors did not make any additional investments during the year.

-Loweman's balance of retained earnings at the end of the year was:

A) $19,000

B) $20,000

C) $25,000

D) $35,000

E) None of the above

Loweman's Car Repair Shop started the year with total assets of $30,000, total liabilities of $21,000, and retained earnings of $9,000. During the year, the business recorded $50,000 in car repair revenues, $35,000 in expenses, and the company paid dividends of $5,000. The investors did not make any additional investments during the year.

-Loweman's balance of retained earnings at the end of the year was:

A) $19,000

B) $20,000

C) $25,000

D) $35,000

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

71

The transactions carried out by Palmer Corporation during the year caused an increase in total assets of $25,000 and a decrease in total liabilities of $10,000.

If no additional investment was made by the investors during the year and dividends of $7,000 were paid, what was the net income for the year?

A) $53,000

B) $42,000

C) $21,000

D) $30,000

E) None of the above

If no additional investment was made by the investors during the year and dividends of $7,000 were paid, what was the net income for the year?

A) $53,000

B) $42,000

C) $21,000

D) $30,000

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

72

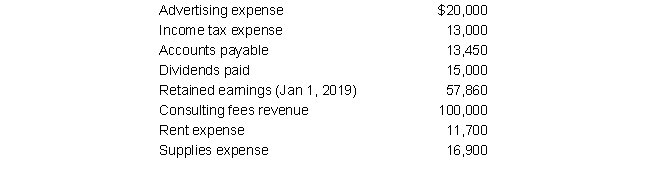

The following information was taken from the records of Hart Corporation for the year ended December 31, 2019.

Given the above information, retained earnings as of December 31, 2019 is:

Given the above information, retained earnings as of December 31, 2019 is:

A) $79,245

B) $79,045

C) $55,795

D) $81,260

Given the above information, retained earnings as of December 31, 2019 is:

Given the above information, retained earnings as of December 31, 2019 is:A) $79,245

B) $79,045

C) $55,795

D) $81,260

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

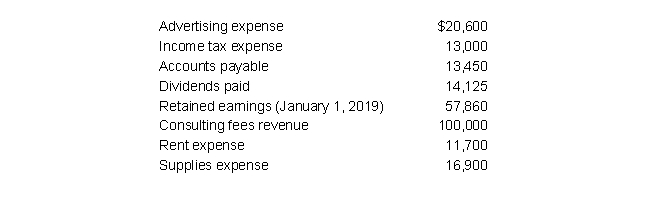

73

The following information was taken from the records of Tellers Corporation for the month ended December 31, 2019.

Given the above information, net income for the year is:

Given the above information, net income for the year is:

A) $44,280

B) $35,310

C) $37,800

D) $17,060

Given the above information, net income for the year is:

Given the above information, net income for the year is:A) $44,280

B) $35,310

C) $37,800

D) $17,060

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

74

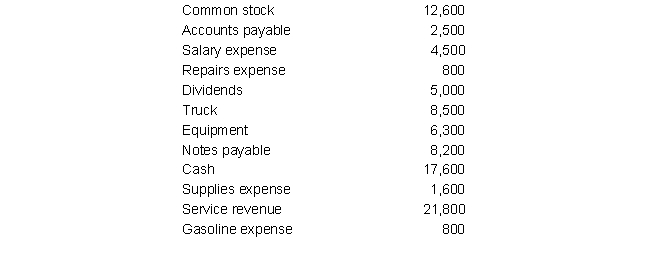

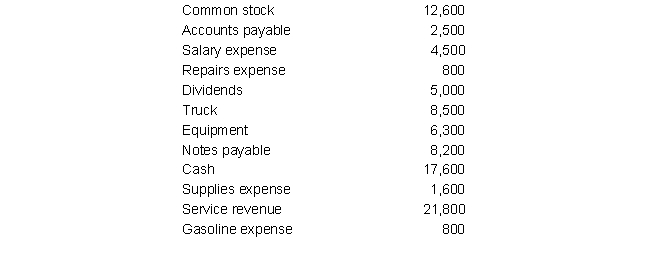

Use the following information for questions below:

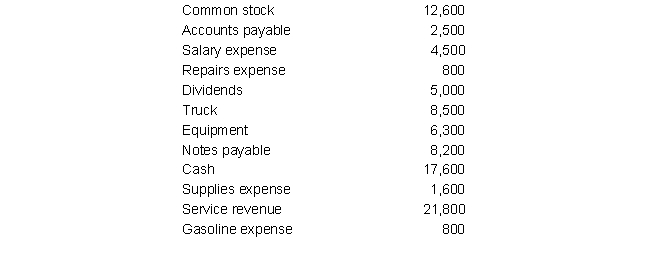

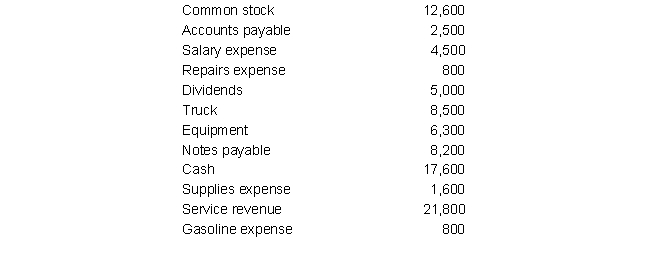

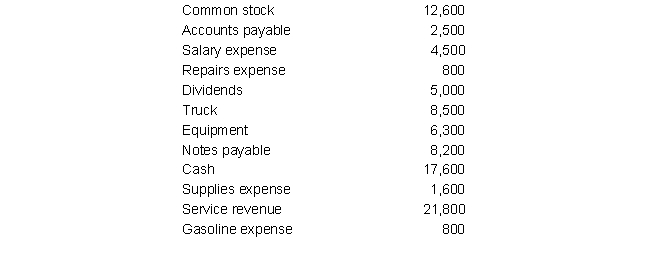

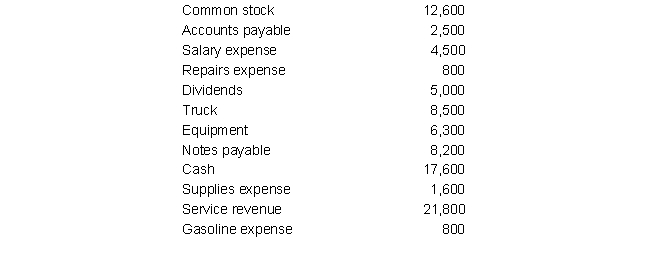

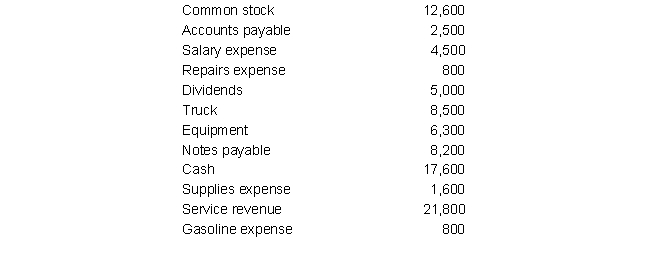

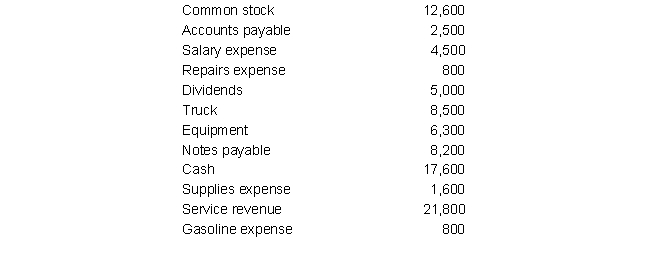

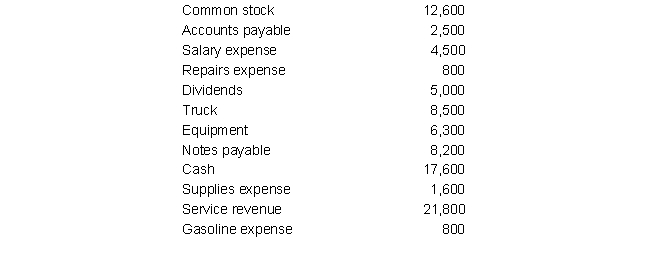

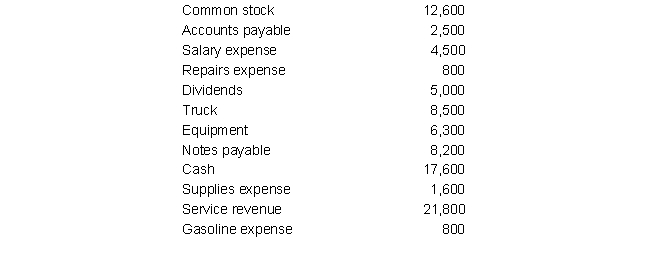

Randy's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The net income for Randy's Landscaping for the year was:

A) $12,800

B) $ 5,700

C) $ 5,900

D) $14,100

Randy's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The net income for Randy's Landscaping for the year was:

A) $12,800

B) $ 5,700

C) $ 5,900

D) $14,100

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

75

Use the following information for questions below:

Randy's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total liabilities for Randy's Landscaping on December 31, 2019 are:

A) $10,700

B) $36,500

C) $18,900

D) $11,700

Randy's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total liabilities for Randy's Landscaping on December 31, 2019 are:

A) $10,700

B) $36,500

C) $18,900

D) $11,700

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

76

Use the following information for questions below:

Randy's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total assets for Randy's Landscaping on December 31, 2019 are:

A) $21,600

B) $32,400

C) $28,100

D) $31,600

Randy's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total assets for Randy's Landscaping on December 31, 2019 are:

A) $21,600

B) $32,400

C) $28,100

D) $31,600

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

77

Use the following information for questions below:

Randy's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The retained earnings for Randy's Landscaping on December 31, 2019 are:

A) $14,100

B) $3,100

C) $700

D) $9,100

Randy's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The retained earnings for Randy's Landscaping on December 31, 2019 are:

A) $14,100

B) $3,100

C) $700

D) $9,100

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

78

Use the following information for questions below:

Randy's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The stockholders' equity for Randy's Landscaping on December 31, 2019 is:

A) $22,500

B) $27,700

C) $21,700

D) $22,600

Randy's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The stockholders' equity for Randy's Landscaping on December 31, 2019 is:

A) $22,500

B) $27,700

C) $21,700

D) $22,600

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

79

Stockholders' equity and total assets were $32,000 and $79,000 respectively at the beginning of the period. Assets increased 50% and liabilities decreased 60% during the period.

What is stockholders' equity at the end of the period?

A) $ 99,700

B) $111,700

C) $ 45,000

D) $ 47,000

What is stockholders' equity at the end of the period?

A) $ 99,700

B) $111,700

C) $ 45,000

D) $ 47,000

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

80

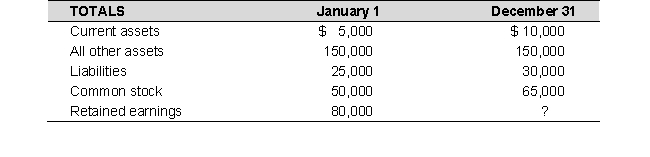

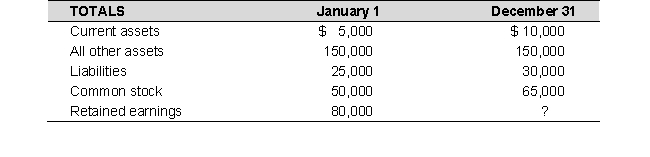

Use the following information for questions below

Additional data: Total expenses for the year were $35,000; Dividends paid during the year were $8,000

Additional data: Total expenses for the year were $35,000; Dividends paid during the year were $8,000

-Using the above table, determine the retained earnings as of December 31?

A) $55,000

B) $65,000

C) $75,000

D) $85,000

Additional data: Total expenses for the year were $35,000; Dividends paid during the year were $8,000

Additional data: Total expenses for the year were $35,000; Dividends paid during the year were $8,000-Using the above table, determine the retained earnings as of December 31?

A) $55,000

B) $65,000

C) $75,000

D) $85,000

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck