Deck 11: Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 11: Cash Flows

1

The statement of cash flows encompasses only a firm's cash because cash equivalents are really marketable securities, which are short-term investments.

False

2

The statement of cash flows separates cash flows into operating, nonoperating, and financing categories.

False

3

Two different methods of determining and presenting the net cash flow from operating activities are the direct method and the reconciliation method.

False

4

The net change in cash during a period must equal the net change in all other balance sheet accounts.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

The direct method of presenting the net cash flow from operating activities reconciles net income to the net cash flow from operating activities.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

If accounts payable decreases during an accounting period, then the cash paid for merchandise purchased is less than the merchandise purchases for the period.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

If prepaid insurance increases during an accounting period, then the cash paid for insurance is less than the period's insurance expense.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

If accounts receivable decrease during an accounting period, then the cash received from customers is more than the sales revenue for the period.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

Caterpillar Inc. sells heavy equipment and also finances the sales for its customer. The interest earned from customers on the financing piece of the sale is classified as cash from financing activities on the statement of cash flows.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

Cash received from the sale of one of a firm's warehouses is classified as a cash flow from operating activities in a statement of cash flows but only if the warehouse was used for ordinary operations.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

A gain from the sale of a company's property, plant, and equipment does not appear in the statement of cash flows prepared on the indirect method.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

Sales proceeds from disposal of marketable securities that are debt instruments such as long-term bonds represent cash from investing activities.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

Cash paid as interest is classified as a cash flow from financing activities in a statement of cash flows because it arises from short-term and long-term debt, which are both financing activities.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

Bonds issued during the year generate cash that is reported in the financing section of the statement of cash flows.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

The ratio of operating cash flow to annual capital expenditures is a liquidity ratio.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

The ratio of operating cash flow to current liabilities is a liquidity ratio.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

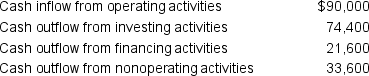

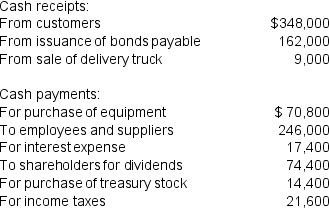

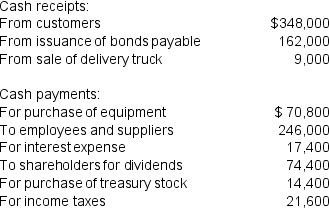

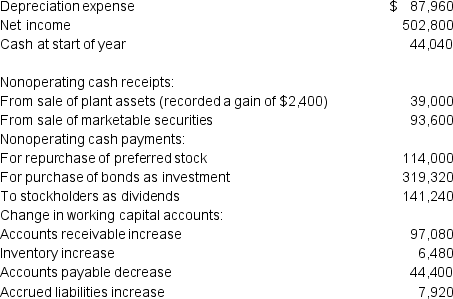

During the year, a company had the cash flows listed below. What was the total net cash flow for the year?

A) Cash outflow of $68,400

B) Cash inflow of $216,800

C) Cash inflow of $136,800

D) Cash outflow of $9,600

E) None of the above

A) Cash outflow of $68,400

B) Cash inflow of $216,800

C) Cash inflow of $136,800

D) Cash outflow of $9,600

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is classified as a cash flow from operating activities in a statement of cash flows?

A) Payment of dividends

B) Receipt of dividends

C) Receipt of cash for loan collection

D) Payment of cash for loan repayment

E) None of the above

A) Payment of dividends

B) Receipt of dividends

C) Receipt of cash for loan collection

D) Payment of cash for loan repayment

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

In a statement of cash flows, interest received from loans made as investments is classified as a cash flow from:

A) Operating activities

B) Trading activities

C) Financing activities

D) Investing activities

E) None of the above

A) Operating activities

B) Trading activities

C) Financing activities

D) Investing activities

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

A firm's net cash flow from operating activities is not affected by:

A) Cash paid for interest

B) Cash paid to suppliers

C) Cash received for income tax refunds

D) Cash received from customers

E) None of the above

A) Cash paid for interest

B) Cash paid to suppliers

C) Cash received for income tax refunds

D) Cash received from customers

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is added to net income to reconcile to cash from operations?

A) Increases in accounts receivable

B) Increases in inventory

C) Increase in taxes payable

D) Decrease in accounts payable

E) None of the above

A) Increases in accounts receivable

B) Increases in inventory

C) Increase in taxes payable

D) Decrease in accounts payable

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is added to net income to reconcile to cash from operations?

A) Loss from sale of property, plant and equipment

B) Decrease in accounts receivable

C) Depreciation expense

D) All of the above

E) None of the above

A) Loss from sale of property, plant and equipment

B) Decrease in accounts receivable

C) Depreciation expense

D) All of the above

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is correct?

A) An increase in accounts receivable is added to sales to convert sales to cash received from customers.

B) A decrease in prepaid insurance is added to insurance expense to convert insurance expense to cash paid for insurance.

C) An increase in wages payable is deducted from wages expense to convert wages expense to cash paid to employees.

D) A decrease in accumulated depreciation is added to depreciation expense to convert depreciation expense to cash paid for depreciation.

E) None of the above

A) An increase in accounts receivable is added to sales to convert sales to cash received from customers.

B) A decrease in prepaid insurance is added to insurance expense to convert insurance expense to cash paid for insurance.

C) An increase in wages payable is deducted from wages expense to convert wages expense to cash paid to employees.

D) A decrease in accumulated depreciation is added to depreciation expense to convert depreciation expense to cash paid for depreciation.

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

A company reported annual sales revenue of $2,772,000. During the year, accounts receivable decreased from a $102,000 beginning balance to a $69,600 ending balance.

How much cash was received from customers for the year?

A) $2,804,400

B) $3,036,600

C) $3,003,000

D) $ 33,600

E) None of the above

How much cash was received from customers for the year?

A) $2,804,400

B) $3,036,600

C) $3,003,000

D) $ 33,600

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

A company reported cost of goods sold of $826,800 for the year. During the year, inventory increased from a $180,000 beginning balance to a $216,000 ending balance, and accounts payable increased from a $56,400 beginning balance to a $66,000 ending balance.

How much cash was paid for merchandise purchased during the year?

A) $826,800

B) $800,400

C) $945,100

D) $853,200

E) None of the above

How much cash was paid for merchandise purchased during the year?

A) $826,800

B) $800,400

C) $945,100

D) $853,200

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

A company reported annual wages expense of $348,000 and insurance expense of $42,000. During the year, wages payable decreased from an $18,000 beginning balance to a $13,200 ending balance, and prepaid insurance decreased from a $90,000 beginning balance to a $54,000 ending balance.

How much cash was paid to employees as wages and paid for insurance during the year?

A) $348,000 for wages and $42,000 for insurance

B) $343,200 for wages and $6,000 for insurance

C) $352,800 for wages and $6,000 for insurance

D) $352,800 for wages and $78,000 for insurance

E) None of the above

How much cash was paid to employees as wages and paid for insurance during the year?

A) $348,000 for wages and $42,000 for insurance

B) $343,200 for wages and $6,000 for insurance

C) $352,800 for wages and $6,000 for insurance

D) $352,800 for wages and $78,000 for insurance

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

A company reported annual interest expense of $46,800. During the year, interest payable decreased from a $10,200 beginning balance to a $5,640 ending balance.

How much cash was paid for interest during the year?

A) $52,440

B) $51,360

C) $42,240

D) $57,000

E) None of the above

How much cash was paid for interest during the year?

A) $52,440

B) $51,360

C) $42,240

D) $57,000

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

A firm's cash flow from investing activities is not affected by:

A) Cash received from sale of a piece of land

B) Cash received from issuance of bonds payable

C) Cash paid to purchase a plant asset

D) Cash paid to purchase common stock of another company

E) None of the above

A) Cash received from sale of a piece of land

B) Cash received from issuance of bonds payable

C) Cash paid to purchase a plant asset

D) Cash paid to purchase common stock of another company

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

A firm sold property, plant, and equipment for cash proceeds of $4,200. The equipment originally cost $8,160. The company recorded a loss on sale of $2,520. The company uses the indirect method to prepare its statement of cash flows.

Which of the following amounts would be included in cash from operations and cash from investing, respectively?

A) $2,520 and $3,300

B) $4,200 and $2,520

C) $2,520 and $4,200

D) $2,520 and $0

E) None of the above

Which of the following amounts would be included in cash from operations and cash from investing, respectively?

A) $2,520 and $3,300

B) $4,200 and $2,520

C) $2,520 and $4,200

D) $2,520 and $0

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not a cash flow from financing activities?

A) Cash received from issuance of preferred stock

B) Cash paid to settle accounts payable

C) Cash paid as dividends on common stock

D) Cash received from issuance of bonds payable

E) None of the above

A) Cash received from issuance of preferred stock

B) Cash paid to settle accounts payable

C) Cash paid as dividends on common stock

D) Cash received from issuance of bonds payable

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

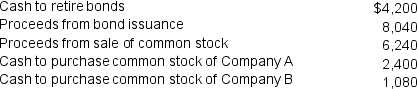

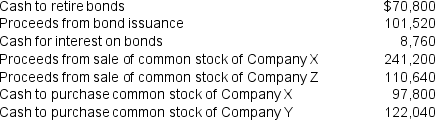

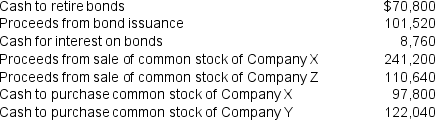

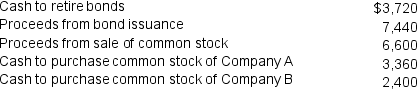

During the year Company A had the transactions listed below.

What amount would the company include in the financing section of the statement of cash flow?

What amount would the company include in the financing section of the statement of cash flow?

A) $ 6,600

B) $20,880

C) $ 7,680

D) $ (7,680)

E) None of the above

What amount would the company include in the financing section of the statement of cash flow?

What amount would the company include in the financing section of the statement of cash flow?A) $ 6,600

B) $20,880

C) $ 7,680

D) $ (7,680)

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

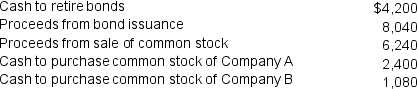

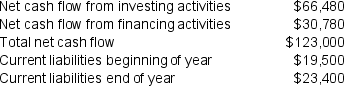

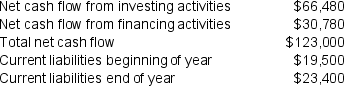

32

A company reports the amounts below in its financial statements.

What is the company's operating cash flows to current liabilities ratio at the end of the year?

What is the company's operating cash flows to current liabilities ratio at the end of the year?

A) 0.92

B) 0.85

C) 1.80

D) 1.70

E) None of the above

What is the company's operating cash flows to current liabilities ratio at the end of the year?

What is the company's operating cash flows to current liabilities ratio at the end of the year?A) 0.92

B) 0.85

C) 1.80

D) 1.70

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

33

A company reports the amounts below in its statement of cash flows.

What is the company's operating cash flows to current liabilities ratio?

What is the company's operating cash flows to current liabilities ratio?

A) 1.19

B) 1.30

C) 1.20

D) 6.21

E) None of the above

What is the company's operating cash flows to current liabilities ratio?

What is the company's operating cash flows to current liabilities ratio?A) 1.19

B) 1.30

C) 1.20

D) 6.21

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

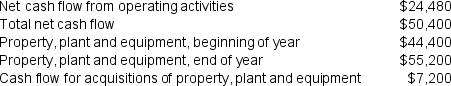

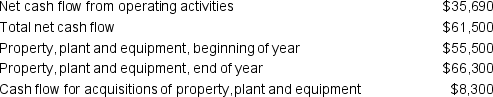

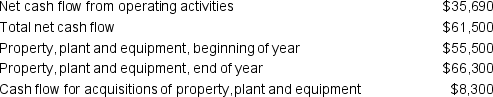

A company reports the amounts below in its financial statements.

What is the company's operating cash flows to capital expenditures ratio at the end of the year?

What is the company's operating cash flows to capital expenditures ratio at the end of the year?

A) 2.3

B) 3.4

C) 3.1

D) 7.0

E) None of the above

What is the company's operating cash flows to capital expenditures ratio at the end of the year?

What is the company's operating cash flows to capital expenditures ratio at the end of the year?A) 2.3

B) 3.4

C) 3.1

D) 7.0

E) None of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

A statement of cash flows usually does not include which of the following?

A) Net income

B) Increase in accounts receivable

C) Contributed Capital

D) Depreciation expense

E) All of the above

A) Net income

B) Increase in accounts receivable

C) Contributed Capital

D) Depreciation expense

E) All of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

36

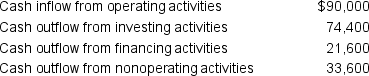

During the year, a company had the cash flows listed below. What was the total net cash flow for the year?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

37

A company reported annual sales revenue of $5,544,000. During the year, accounts receivable decreased from an $204,000 beginning balance to a $139,200 ending balance.

How much cash was received from customers during the year?

How much cash was received from customers during the year?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

38

A company reported cost of goods sold of $826,800 for the year. During the year, inventory increased from a $180,000 beginning balance to a $216,000 ending balance, and accounts payable decreased from a $66,000 beginning balance to a $56,400 ending balance.

How much cash was paid for merchandise purchased during the year?

How much cash was paid for merchandise purchased during the year?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

39

A company reported annual wages expense of $696,000 and insurance expense of $84,000. During the year, wages payable decreased from a $36,000 beginning balance to an $26,400 ending balance, and prepaid insurance decreased from a $180,000 beginning balance to a $108,000 ending balance.

How much cash was paid to employees as wages and paid for insurance during the year?

How much cash was paid to employees as wages and paid for insurance during the year?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

40

A company reported annual interest expense of $78,000. During the year, interest payable decreased from a $10,200 beginning balance to a $9,120 ending balance.

How much cash was paid for interest during the year?

How much cash was paid for interest during the year?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

41

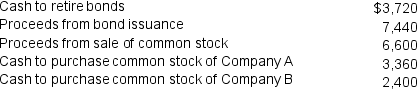

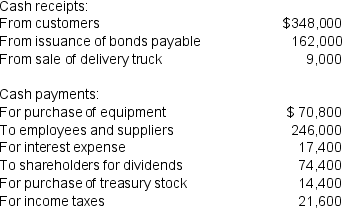

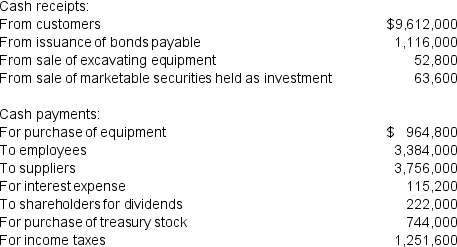

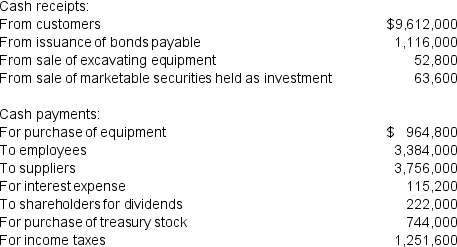

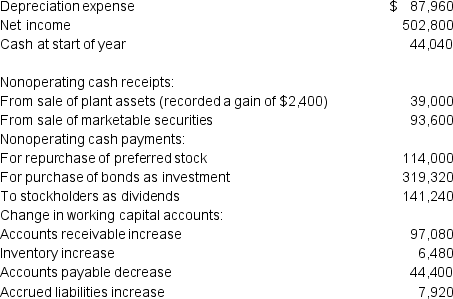

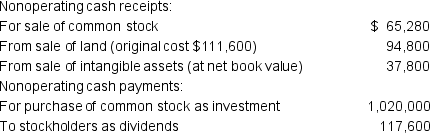

The following schedule of cash receipts and payments relates to Yosemo, Inc. for the year 2017:

What is the cash flow from operations for Yosemo, Inc. for 2017?

What is the cash flow from operations for Yosemo, Inc. for 2017?

What is the cash flow from operations for Yosemo, Inc. for 2017?

What is the cash flow from operations for Yosemo, Inc. for 2017?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

42

The following schedule of cash receipts and payments relates to Yosemo, Inc. for the year 2017:

What is the cash flow from investing for Yosemo, Inc. for 2017?

What is the cash flow from investing for Yosemo, Inc. for 2017?

What is the cash flow from investing for Yosemo, Inc. for 2017?

What is the cash flow from investing for Yosemo, Inc. for 2017?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

43

A firm sold property, plant, and equipment for cash proceeds of $8,400. The equipment originally cost $16,320. The company recorded a loss on sale of $5,040. The company uses the indirect method to prepare its statement of cash flows.

What amounts would be included in cash from operations and cash from investing, respectively?

What amounts would be included in cash from operations and cash from investing, respectively?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

44

A firm sold property, plant, and equipment that had a net book value of $1,050,000 for a loss of $110,400. The equipment originally cost $1,265,600. The company uses the indirect method to prepare its statement of cash flows.

What amounts would the company include in cash from operations and cash from investing respectively?

What amounts would the company include in cash from operations and cash from investing respectively?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

45

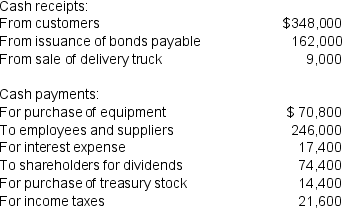

During the year Company X recorded the transactions listed below. What amount would the company include in the financing section of the statement of cash flow?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

46

During the year Company A had the transactions listed below. What amount would the company include in the financing section of the statement of cash flow?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

47

The following schedule of cash receipts and payments relates to Yosemo, Inc. for the year 2017:

What is the cash flow from financing for Yosemo, Inc. for 2017?

What is the cash flow from financing for Yosemo, Inc. for 2017?

What is the cash flow from financing for Yosemo, Inc. for 2017?

What is the cash flow from financing for Yosemo, Inc. for 2017?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

48

A company reports the amounts below in its financial statements. What is the company's operating cash flows to current liabilities ratio at the end of the year?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

49

A company reports the amounts below in its statement of cash flows. What is the company's operating cash flows to current liabilities ratio?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

50

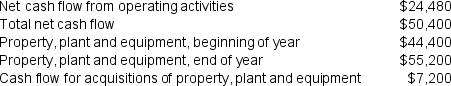

A company reports the amounts below in its financial statements. What is the company's operating cash flows to capital expenditures ratio at the end of the year?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

51

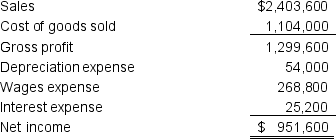

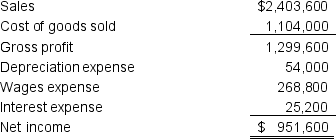

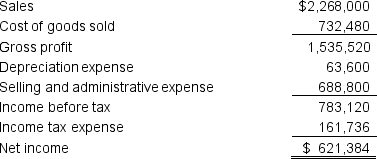

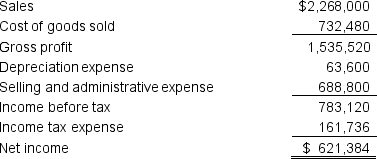

Moffett Company reports the following income statement for the year ended October 31, 2017:

The company also reports the following information from the balance sheet:

The company also reports the following information from the balance sheet:

Required:

Required:

a. Prepare, in good form, the operating section of the statement of cash flow, using the direct method for Moffett Company for October 31, 2017.

b. Prepare, in good form, the operating section of the statement of cash flow, using the indirect method for Moffett Company for October 31, 2017.

The company also reports the following information from the balance sheet:

The company also reports the following information from the balance sheet: Required:

Required: a. Prepare, in good form, the operating section of the statement of cash flow, using the direct method for Moffett Company for October 31, 2017.

b. Prepare, in good form, the operating section of the statement of cash flow, using the indirect method for Moffett Company for October 31, 2017.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

52

Lake Isabella, Inc. reports the following income statement for the year ended December 31, 2017:

The company also reports the following information from the balance sheet:

The company also reports the following information from the balance sheet:

Required:

Required:

a. Prepare, in good form, the operating section of the statement of cash flow, using the direct method for Lake Isabella, Inc. for December 31, 2017.

b. Prepare, in good form, the operating section of the statement of cash flow, using the indirect method for Lake Isabella, Inc. for December 31, 2017.

The company also reports the following information from the balance sheet:

The company also reports the following information from the balance sheet: Required:

Required: a. Prepare, in good form, the operating section of the statement of cash flow, using the direct method for Lake Isabella, Inc. for December 31, 2017.

b. Prepare, in good form, the operating section of the statement of cash flow, using the indirect method for Lake Isabella, Inc. for December 31, 2017.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

53

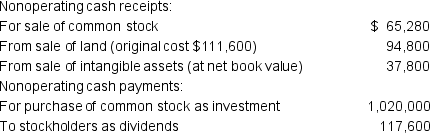

Lupin, Inc. began fiscal 2017 with cash and cash equivalents of $1,018,800. The following schedule of cash receipts and payments relates to the company for the year 2017:

Required:

Required:

Prepare, in good form, a statement of cash flow using the direct method for fiscal 2017.

Required:

Required:Prepare, in good form, a statement of cash flow using the direct method for fiscal 2017.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

54

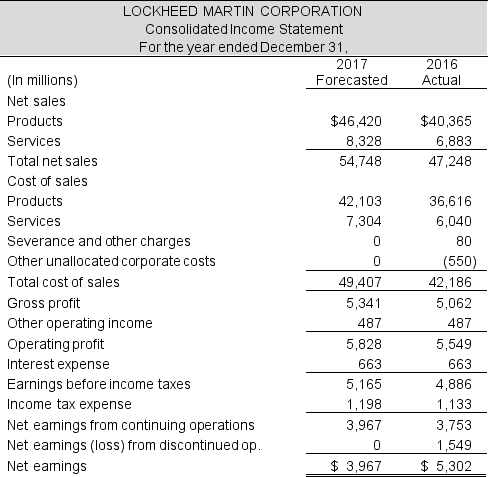

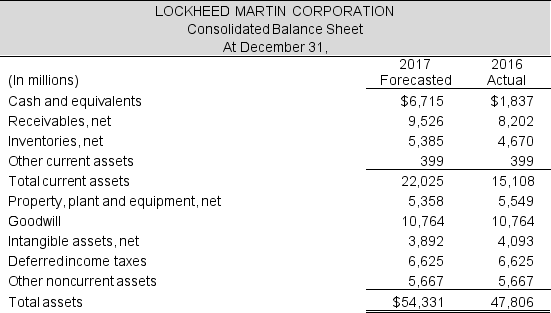

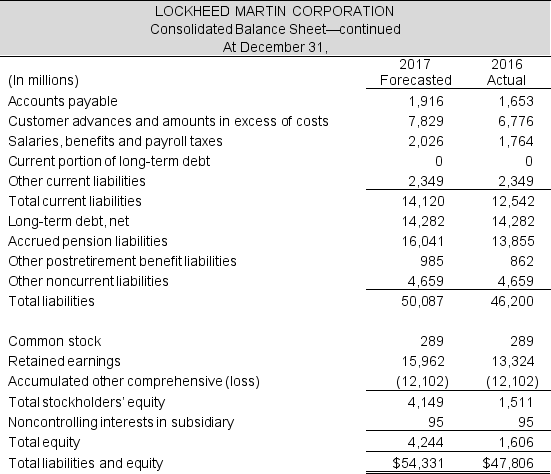

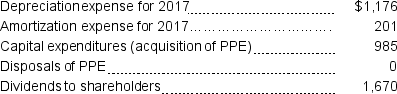

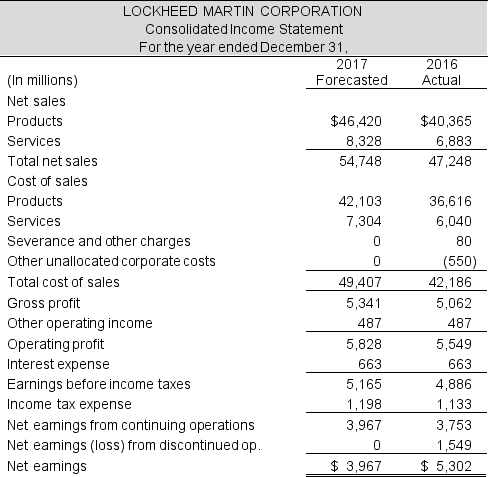

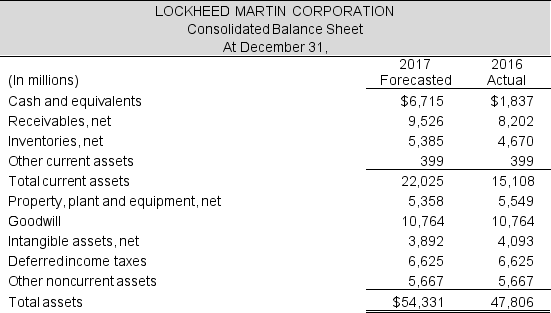

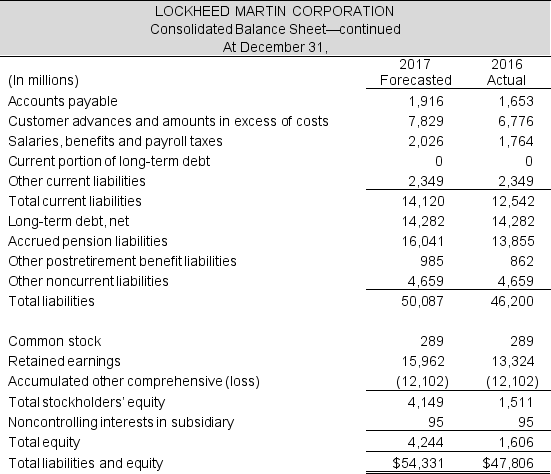

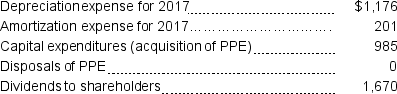

Assume following are the forecasted income statement and balance sheet for Lockheed Martin Corporation for the year ended December 31, 2017.

Table continued next page

Table continued next page

Table continued

The following additional information is relevant to the 2017 forecasted financial statements:

The following additional information is relevant to the 2017 forecasted financial statements:

Required:

Required:

Prepare a forecasted statement of cash flows for the company for 2017 using the indirect method.

Table continued next page

Table continued next pageTable continued

The following additional information is relevant to the 2017 forecasted financial statements:

The following additional information is relevant to the 2017 forecasted financial statements: Required:

Required:Prepare a forecasted statement of cash flows for the company for 2017 using the indirect method.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

55

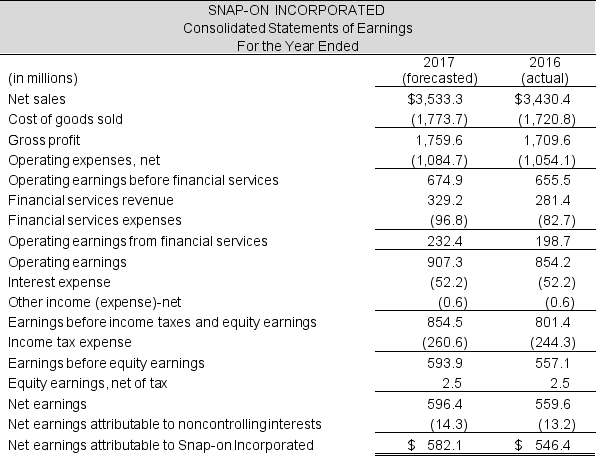

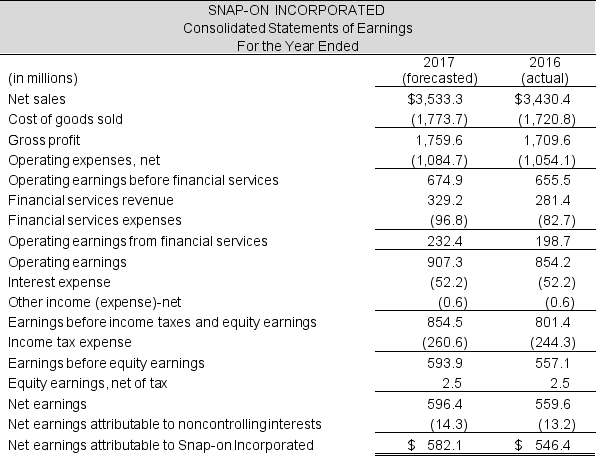

Assume following are the forecasted income statement and balance sheet for Snap-On Corporation for the year ended December 31, 2017.

Continued next page

Continued next page

Continued next page

Continued next page

The following additional information is relevant to the 2017 forecasted financial statements:

Required:

Required:

Prepare, in good form, a forecasted statement of cash flows for the company for 2017 using the indirect method.

Continued next page

Continued next page Continued next page

Continued next pageThe following additional information is relevant to the 2017 forecasted financial statements:

Required:

Required:Prepare, in good form, a forecasted statement of cash flows for the company for 2017 using the indirect method.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

56

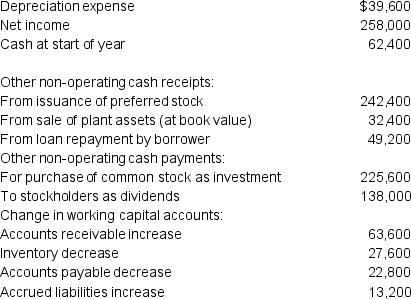

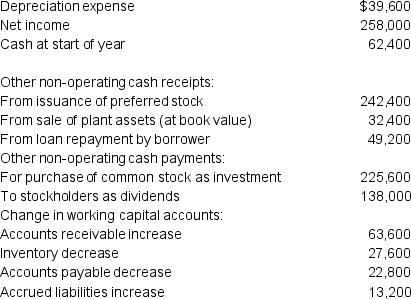

The following schedule of information relates to Sirius Company for the year ended December 31, 2017:

Required:

Required:

Prepare, in good form, a 2017 statement of cash flows for Sirius Company using the indirect method.

Required:

Required:Prepare, in good form, a 2017 statement of cash flows for Sirius Company using the indirect method.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

57

The following schedule of information relates to Minerva Systems, Inc. for the year ended November 30, 2017:

Required:

Required:

Prepare, in good form, a 2017 statement of cash flows for Minerva Systems, Inc. using the indirect method.

Required:

Required:Prepare, in good form, a 2017 statement of cash flows for Minerva Systems, Inc. using the indirect method.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

58

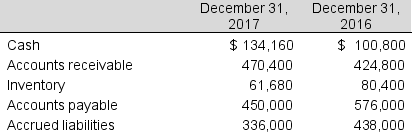

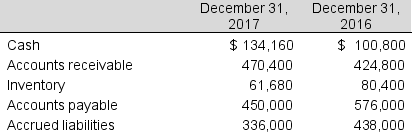

The following schedule of information relates to Lumos, Inc. for the year ended December 31, 2017:

The company's balance sheet reports the following:

The company's balance sheet reports the following:

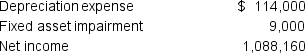

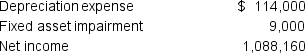

The company's 2017 income statement reports the following:

The company's 2017 income statement reports the following:

Required:

Required:

Prepare a statement of cash flow, in good form, for December 31, 2017 for Lumos, Inc. using the indirect method.

The company's balance sheet reports the following:

The company's balance sheet reports the following: The company's 2017 income statement reports the following:

The company's 2017 income statement reports the following: Required:

Required:Prepare a statement of cash flow, in good form, for December 31, 2017 for Lumos, Inc. using the indirect method.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

59

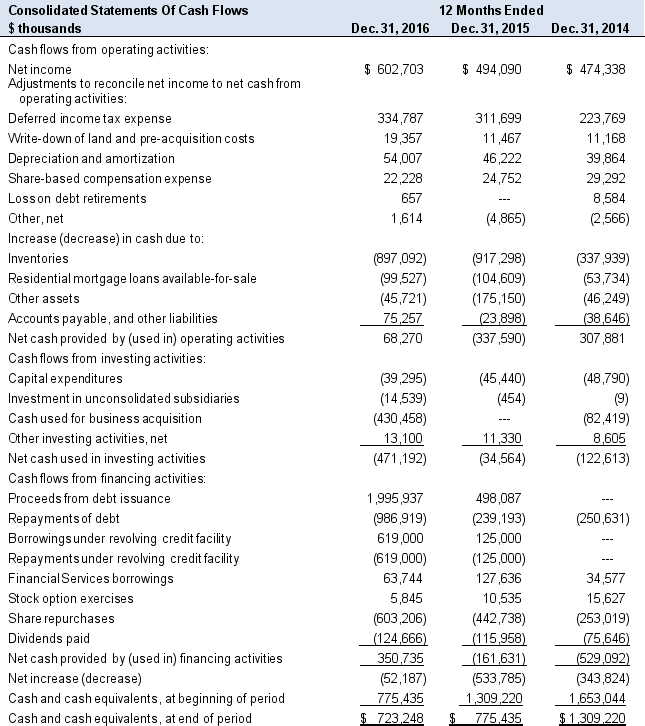

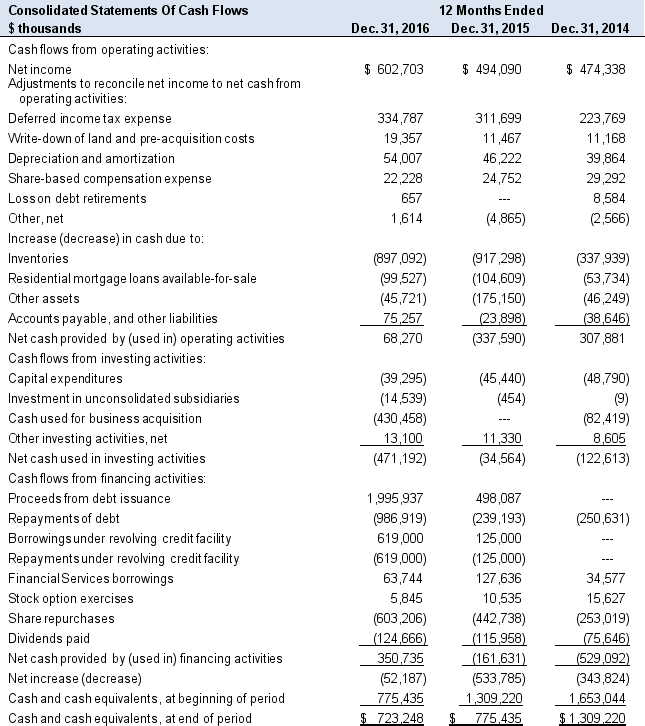

The following is the 2016 statement of cash flows for PulteGroup, Inc.

Required:

Required:

a. In determining operating cash flow in 2016, the company includes share-based compensation expense of $22,228 thousand. Why does the company add this amount?

b. The operating section in 2016 includes an increase in cash of $75,257 for "Accounts payable, accrued and other liabilities." Explain this reconciling item.

c. Does the composition of PulteGroup's cash flow statement present a "healthy" picture? Explain.

Required:

Required: a. In determining operating cash flow in 2016, the company includes share-based compensation expense of $22,228 thousand. Why does the company add this amount?

b. The operating section in 2016 includes an increase in cash of $75,257 for "Accounts payable, accrued and other liabilities." Explain this reconciling item.

c. Does the composition of PulteGroup's cash flow statement present a "healthy" picture? Explain.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

60

What information is conveyed by the statement of cash flows? How does the statement convey that information?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

61

What is the chief difference between the direct-method and the indirect-method statement of cash flows?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

62

What types of cash flows are included in the investing section of statement of cash flows? Provide four examples of investing cash flows.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

63

What types of cash flows are included in the financing section of statement of cash flows? Provide four examples of financing cash flows.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

64

Investors, creditors, and analysts often have as a goal to assess a company's cash flow strength. Suggest two ratios that might be calculated to accomplish this goal and explain what each ratio measures.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck