Deck 9: Intercorporate Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/75

Play

Full screen (f)

Deck 9: Intercorporate Investments

1

When debt securities are classified as held-to-maturity, fair-value changes are recognized in the balance sheet as unrealized gains or losses that affect owners' equity.

False

2

Realized gains and losses on passive investments classified as marketable equity securities are reported in a company's net income in the period that they are realized.

True

3

Fair-value changes in available-for-sale debt securities are recognized in the income statement as unrealized gains or losses.

False

4

Under the equity method, fair-value changes in the investee company's stock are not reflected in the investor's accounting records.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

5

Regardless of the legal agreements, technology licensing, and the like between two companies, significant influence is determined by ownership of a sufficient percentage of outstanding common stock. This is called the significance influence test.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

6

Under the equity method, the investment account is recorded at fair value but only if fair value exceeds original cost.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

7

Dividends received from an investee company are reported as investment income by the investor company when the investor does not control the investee.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

8

Goodwill is recorded when the fair value of the assets acquired in a business acquisition exceeds the net book value of those same assets.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

9

Equity carve-outs make it easier to evaluate the individual business units of a conglomerate.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

10

Pro rata distributions associated with split-offs, can result in the company reporting gains or losses on the carve out.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements does not accurately describe the fair-value method of accounting?

A) Investments for which current, reliable fair values exist are accounted for using this method.

B) Held-to-maturity investments are not accounted for using this method.

C) Dividends and interest received are recognized in current income.

D) The investment is recorded on the balance sheet at its fair value.

E) None of the above

A) Investments for which current, reliable fair values exist are accounted for using this method.

B) Held-to-maturity investments are not accounted for using this method.

C) Dividends and interest received are recognized in current income.

D) The investment is recorded on the balance sheet at its fair value.

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

12

When the fair value of a company's portfolio of passive investments in marketable equity securities exceeds its book value, the difference should be:

A) Added to the investment account

B) Added to stockholders' equity of the investee

C) Written off as an impairment

D) Added to goodwill

E) None of the above

A) Added to the investment account

B) Added to stockholders' equity of the investee

C) Written off as an impairment

D) Added to goodwill

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

13

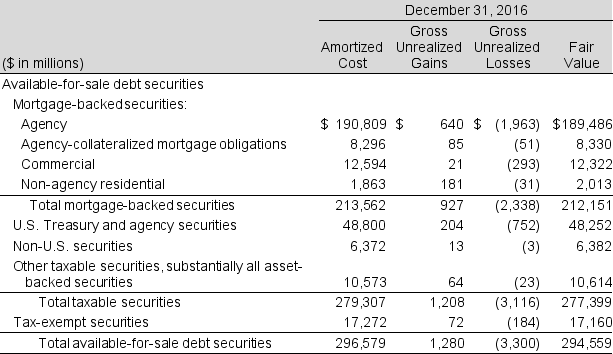

On its 2016 form 10-K, Bank of America Corporation reports marketable debt securities of $277,399 million. The footnotes disclose that these securities have an amortized cost of $279,307 million.

Which of the following is true?

A) These are available-for-sale securities.

B) These are trading securities.

C) There are net unrealized losses of $1,908 million on these securities.

D) Both A and C

E) Both B and C

Which of the following is true?

A) These are available-for-sale securities.

B) These are trading securities.

C) There are net unrealized losses of $1,908 million on these securities.

D) Both A and C

E) Both B and C

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

14

Following is a portion of the investments footnote from Redfield Inc.'s 2017 annual report.

What amount does Redfield report for its passive investments in marketable equity securities on it 2017 balance sheet?

What amount does Redfield report for its passive investments in marketable equity securities on it 2017 balance sheet?

A) $19,899 million

B) $400,619 million

C) $380,443 million

D) $520,804 million

E) None of the above

What amount does Redfield report for its passive investments in marketable equity securities on it 2017 balance sheet?

What amount does Redfield report for its passive investments in marketable equity securities on it 2017 balance sheet?A) $19,899 million

B) $400,619 million

C) $380,443 million

D) $520,804 million

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements is not true of the fair-value method of accounting for marketable securities?

A) The investment account is recorded at current fair value on the balance sheet.

B) Interim changes in the investments' fair value may or may not affect income depending on the securities' classification.

C) This method is used when the reporting company generally owns less than 20% of the investee company.

D) Dividends are treated as a return of the capital invested.

E) None of the above.

A) The investment account is recorded at current fair value on the balance sheet.

B) Interim changes in the investments' fair value may or may not affect income depending on the securities' classification.

C) This method is used when the reporting company generally owns less than 20% of the investee company.

D) Dividends are treated as a return of the capital invested.

E) None of the above.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

16

Following is a portion of the investments footnote from Allstate's 2016 10-K.

What amount does Allstate report for available-for-sale securities on its 2016 balance sheet?

What amount does Allstate report for available-for-sale securities on its 2016 balance sheet?

A) $59,008 million

B) $57,839 million

C) $60,910 million

D) $61,483 million

E) None of the above

What amount does Allstate report for available-for-sale securities on its 2016 balance sheet?

What amount does Allstate report for available-for-sale securities on its 2016 balance sheet?A) $59,008 million

B) $57,839 million

C) $60,910 million

D) $61,483 million

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

17

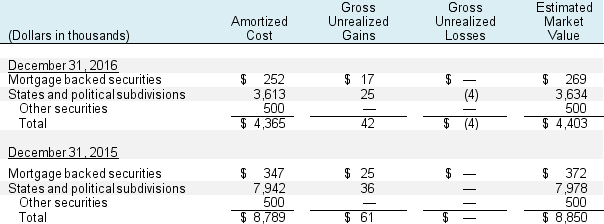

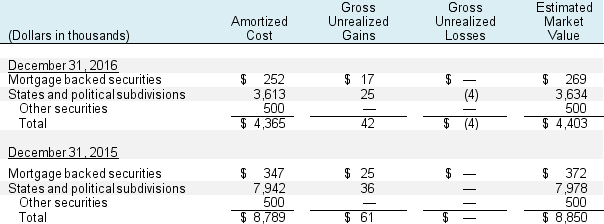

In footnotes to its 2016 annual report, Bancfirst Corp. reported that held-to-maturity debt securities with an amortized cost of $4,365 thousand had an estimated fair value of $4,403 thousand.

The balance sheet reported:

A) Held-to-maturity assets of $4,365 thousand

B) Held-to-maturity assets of $4,403 thousand

C) Accumulated other comprehensive income of $38 thousand related to held-to-maturity assets

D) Both A and C

E) Both B and C

The balance sheet reported:

A) Held-to-maturity assets of $4,365 thousand

B) Held-to-maturity assets of $4,403 thousand

C) Accumulated other comprehensive income of $38 thousand related to held-to-maturity assets

D) Both A and C

E) Both B and C

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

18

Waterton Corporation reported that short-term investments in debt securities consisted of the following (in millions):

Which of the following is true?

Which of the following is true?

A) Waterton's 2016 balance sheet includes short-term investments of $767.7 million.

B) Unrealized losses of $14.9 million on trading securities are included in 2016 income.

C) There are no net unrealized gains on available-for-sale securities.

D) Accumulated other comprehensive income included no unrealized gains or losses.

E) None of the above

Which of the following is true?

Which of the following is true?A) Waterton's 2016 balance sheet includes short-term investments of $767.7 million.

B) Unrealized losses of $14.9 million on trading securities are included in 2016 income.

C) There are no net unrealized gains on available-for-sale securities.

D) Accumulated other comprehensive income included no unrealized gains or losses.

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

19

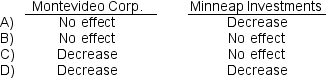

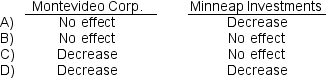

Montevideo Corp. holds a 15% equity investment in Hutchinson Inc. Minneap Investments holds 35% of Hutchinson Inc. stock. On May 1, 2017, Hutchinson Inc. declares and pays dividends to its stockholders. How will the dividend affect each company's balance sheet account: Hutchinson Inc. investment?

E) None of the above

E) None of the above

E) None of the above

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

20

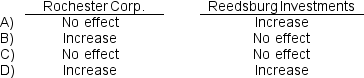

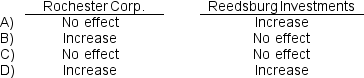

Rochester Corp. holds a 15% equity investment in LaCrosse Inc. Reedsburg Investments holds 45% of LaCrosse's stock. On October 1, 2017, LaCrosse declares and pays dividends to its stockholders. How will the dividend affect each company's net income for the year?

E) There is not enough information to determine the effect.

E) There is not enough information to determine the effect.

E) There is not enough information to determine the effect.

E) There is not enough information to determine the effect.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

21

GAAP identifies several levels of influence / control. If Company One owns 10% of the outstanding voting stock of Company Two, which level of influence / control is in evidence?

A) Fair-value method

B) Significant Influence

C) Control

D) Passive

E) None of the above

A) Fair-value method

B) Significant Influence

C) Control

D) Passive

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

22

Madison Corporation purchases an investment in Lake Geneva, Inc. at a purchase price of $10 million cash, representing 40% of the book value of Lake Geneva, Inc. During the year, Lake Geneva reports net income of $1,700,000 and pays $419,000 of cash dividends. At the end of the year, the market value of Madison's investment is $12.0 million.

What is the year-end balance of the equity investment in Lake Geneva?

A) $10,000,000

B) $10,480,000

C) $18,910,000

D) $10,512,400

E) $12,000,000

What is the year-end balance of the equity investment in Lake Geneva?

A) $10,000,000

B) $10,480,000

C) $18,910,000

D) $10,512,400

E) $12,000,000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

23

Frankfort Corporation purchases an investment in Bradley, Inc. at a purchase price of $9.8 million cash, representing 40% (at book value) of Bradley. During the year, Bradley reports net income of $1,680,000 and pays $413,000 of cash dividends. At the end of the year, the market value of Frankfort's investment is $11.9 million.

What amount of equity earnings would be reported by Frankfort Corporation?

A) $ 165,000

B) $ 672,000

C) $ 507,000

D) $1,267,000

E) None of the above

What amount of equity earnings would be reported by Frankfort Corporation?

A) $ 165,000

B) $ 672,000

C) $ 507,000

D) $1,267,000

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

24

Champaign Corporation purchases 45% of the common stock of Rockville, Inc. at a purchase price of $21.6 million cash. During the year, Rockville reports net income of $2,960,000 and pays $544,000 of cash dividends. At the end of the year, the market value of Champaign's investment is $23.7 million.

What is the year-end balance of the equity investment in Rockville?

A) $22,687,200

B) $25,010,000

C) $24,332,500

D) $21,600,000

E) None of the above

What is the year-end balance of the equity investment in Rockville?

A) $22,687,200

B) $25,010,000

C) $24,332,500

D) $21,600,000

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

25

Indianapolis Corporation makes an equity-method investment in Richmond Inc. at a purchase price of $4.42 million cash, representing 30% (at book value) of Richmond Inc. During the year, Richmond reports net income of $5,280,500 and Indianapolis receives $877,500 of cash dividends from Richmond. At the end of the year, the market value of Indianapolis's investment is $4.03 million.

At year end, what does Indianapolis Corporation report on its balance sheet for its investment in Richmond Inc.?

A) $5,126,650

B) $4,420,000

C) $5,740,900

D) $5,280,500

E) None of the above

At year end, what does Indianapolis Corporation report on its balance sheet for its investment in Richmond Inc.?

A) $5,126,650

B) $4,420,000

C) $5,740,900

D) $5,280,500

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

26

Significant influence is often presumed when the investor owns:

A) Greater than 20% of the voting stock of the investee

B) Greater than 50% of the voting stock of the investee

C) Between 20% and 50% of the voting stock of the investee

D) Greater than 20% of the voting stock or of the fair value of the investee

E) None of the above

A) Greater than 20% of the voting stock of the investee

B) Greater than 50% of the voting stock of the investee

C) Between 20% and 50% of the voting stock of the investee

D) Greater than 20% of the voting stock or of the fair value of the investee

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

27

Columbus Company owns 25% of Zanesville Inc. and accounts for the investment using the equity method. During the year, Zanesville Inc. reports a net loss of $1,602,000 and pays total dividends of $73,800.

Which of the following describes the change in Columbus's investment in Zanesville during the year?

A) The investment increases by $326,700.

B) The investment decreases by $232,750.

C) The investment decreases by $418,950.

D) The investment decreases by $400,500.

E) None of the above

Which of the following describes the change in Columbus's investment in Zanesville during the year?

A) The investment increases by $326,700.

B) The investment decreases by $232,750.

C) The investment decreases by $418,950.

D) The investment decreases by $400,500.

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following would not be considered an intangible asset?

A) Trademarks and internet domain names

B) Plant, Property, and Equipment

C) Patents, computer software, databases and trade secrets

D) Customer lists, production backlog, and customer contracts

E) None of the above

A) Trademarks and internet domain names

B) Plant, Property, and Equipment

C) Patents, computer software, databases and trade secrets

D) Customer lists, production backlog, and customer contracts

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

29

At the beginning of fiscal 2017, Wooster Company acquired a small savings and loan association for $102 million. The book value of the assets of the acquired company were $261 million, its liabilities $172.5 million. An appraiser determined that the acquiree's land had a fair value of $3 million in excess of its net book value. Wooster also determined that the acquiree had an unrecorded liability of $6.75 million relating to a lawsuit. The book value of all other assets and liabilities approximated fair value.

What did Wooster Company record as goodwill for this acquisition?

A) $11.50 million

B) $ 9.75 million

C) $17.25 million

D) $ -0-

E) None of the above

What did Wooster Company record as goodwill for this acquisition?

A) $11.50 million

B) $ 9.75 million

C) $17.25 million

D) $ -0-

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

30

Westfield Bank and Trust acquired 100% of the outstanding voting shares of Cleveland United Bank on January 1, 2017. Before the acquisition, the balance sheets of the two companies are as follows:

Continued next page

Continued next page

Westfield Bank and Trust issues 75,000 shares of its common stock with a market value of $1,062 million to the owners of Cleveland United Bank in return for all of their shares of Cleveland United common stock. The assets of Cleveland United have a fair value in excess of book value of $34.8 million.

The consolidated balance sheet of Westfield Bank and Trust at January 1, 2017 would report goodwill of:

A) $0 (no goodwill)

B) $277.2 million

C) $231.8 million

D) $400.0 million

E) None of the above

Continued next page

Continued next pageWestfield Bank and Trust issues 75,000 shares of its common stock with a market value of $1,062 million to the owners of Cleveland United Bank in return for all of their shares of Cleveland United common stock. The assets of Cleveland United have a fair value in excess of book value of $34.8 million.

The consolidated balance sheet of Westfield Bank and Trust at January 1, 2017 would report goodwill of:

A) $0 (no goodwill)

B) $277.2 million

C) $231.8 million

D) $400.0 million

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

31

On July 1, 2017, Ashtabula Corp. purchases 100% of Blasdell Company for $3.575 million. At the time of acquisition, the fair market value of Blasdell's tangible net assets (excluding goodwill) is $2.99 million. Ashtabula ascribes the excess of $585,000 to goodwill. During the first half of the year, the fair value of Blasdell declines to $3.185 million and the fair value of Blasdell's tangible net assets is estimated at $2.795 million as of December 31, 2017. This decline is deemed permanent.

What impairment charge, if any, should Ashtabula report at December 31, 2017?

A) $195,000

B) $390,000

C) $585,000

D) $-0-

E) None of the above

What impairment charge, if any, should Ashtabula report at December 31, 2017?

A) $195,000

B) $390,000

C) $585,000

D) $-0-

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

32

In 2017, Palmyra Corp. purchased 100% of the common stock of Rochester Tech for a total purchase price of $8,906.8 million. On Palmyra's unconsolidated accounts, it uses the equity method to account for Rochester Tech. For public disclosure, Palmyra Corp. consolidates the accounts of Rochester Tech.

Which of the following is true?

A) The consolidated shareholders' equity exceeds the unconsolidated shareholders' equity by $8,906.8 million.

B) The consolidated total assets are greater than the unconsolidated total assets by $8,906.8 million.

C) Net income is the same on the consolidated and unconsolidated financial statements.

D) The consolidated net income is greater than the unconsolidated net income.

E) None of the above

Which of the following is true?

A) The consolidated shareholders' equity exceeds the unconsolidated shareholders' equity by $8,906.8 million.

B) The consolidated total assets are greater than the unconsolidated total assets by $8,906.8 million.

C) Net income is the same on the consolidated and unconsolidated financial statements.

D) The consolidated net income is greater than the unconsolidated net income.

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

33

The equity carve-out in which the parent company distributes the subsidiary's shares as a dividend to shareholders is called which of the following?

A) Sell-Off

B) Spin-Off

C) Split-Off

D) Stock Split

E) None of the above

A) Sell-Off

B) Spin-Off

C) Split-Off

D) Stock Split

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following transactions is similar to a repurchase of stock in its accounting treatment?

A) Sell-off

B) Spin-off

C) Split-off

D) Carve-out

E) None of the above

A) Sell-off

B) Spin-off

C) Split-off

D) Carve-out

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

35

In November 2004, Kraft Foods sold its confectionery business to Wrigley for $1.85 billion cash, which consisted primarily of the following key candy brands: Lifesavers, Altoids, and Crème Savers.

This deal is referred to as a:

A) Split-off

B) Sell-off

C) Spin-off

D) Carve-off

E) None of the above

This deal is referred to as a:

A) Split-off

B) Sell-off

C) Spin-off

D) Carve-off

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

36

In this form of equity carve-out, the parent company exchanges stock that it owns in the subsidiary for some of the parent shares owned by its shareholders:

A) Sell-Off

B) Spin-Off

C) Split-Off

D) None of the above

A) Sell-Off

B) Spin-Off

C) Split-Off

D) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

37

Drummond Co. recently underwent a sell-off of its home gardening and repair subsidiary, Missoula Co., to an independent party. If Drummond recorded a gain of $94,130 on the carve out and received $128,310 cash for the sale, what are the net assets of Missoula?

A) $128,310

B) $ 94,130

C) $ 34,180

D) $222,440

E) None of the above

A) $128,310

B) $ 94,130

C) $ 34,180

D) $222,440

E) None of the above

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

38

Clearwater, Inc. decided to split-off its subsidiary Kamiah Co. On January 2017, Clearwater, Inc. tendered 18,000 shares of Kamiah Co.'s $5 par value stock to its current shareholders in a non pro rata distribution. On the day of the offer, Kamiah Co. was trading for $81 a share. Clearwater, Inc. had the investment in Kamiah Co. recorded at $1,875,000 on its balance sheet.

What would Clearwater, Inc. record on its income statement as a result of this transaction?

A) $417,000 gain

B) $417,000 loss

C) $ 90,000 loss

D) $ 90,000 gain

E) No gain or loss is recorded on split-offs.

What would Clearwater, Inc. record on its income statement as a result of this transaction?

A) $417,000 gain

B) $417,000 loss

C) $ 90,000 loss

D) $ 90,000 gain

E) No gain or loss is recorded on split-offs.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

39

Assume a company enters into a forward contract to lock in a price on inventory that it will purchase over the next 12 months.

This is an example of what type of hedge?

A) Fair-value

B) Cash flow

C) Speculative

D) Variable

E) Foreign currency

This is an example of what type of hedge?

A) Fair-value

B) Cash flow

C) Speculative

D) Variable

E) Foreign currency

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

40

Assume a company enters into a futures contract to hedge its risk related to an account payable due in six months denominated in a non-U.S. currency.

This is an example of what type of hedge?

A) Fair-value

B) Cash flow

C) Speculative

D) Variable

E) Foreign currency

This is an example of what type of hedge?

A) Fair-value

B) Cash flow

C) Speculative

D) Variable

E) Foreign currency

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

41

Syracuse, Inc., reports the following details of its passive investments in marketable equity securities in its 2017 annual report:

a. What amount appeared on Syracuse's balance sheet in 2017 for its marketable equity securities?

b. Calculate the net unrealized gains and or losses for the marketable equity securities for both years.

a. What amount appeared on Syracuse's balance sheet in 2017 for its marketable equity securities?

b. Calculate the net unrealized gains and or losses for the marketable equity securities for both years.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

42

Syracuse, Inc. reported net income of $202,052 thousand for fiscal 2017. The annual report included the following details about its available-for-sale debt securities:

a. What amount appeared on Syracuse's balance sheet in 2017 for available-for-sale debt securities?

b. If Syracuse had instead classified these debt securities as trading, what would net income have been? Assume a marginal tax rate of 37% for your calculations.

a. What amount appeared on Syracuse's balance sheet in 2017 for available-for-sale debt securities?

b. If Syracuse had instead classified these debt securities as trading, what would net income have been? Assume a marginal tax rate of 37% for your calculations.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

43

The 2017 annual report of Albany Corporation reports the following (in millions):

a. What amount does Albany report as trading debt securities on its balance sheets for 2017?

b. How do the net unrealized gains (losses) on the company's trading debt securities affect pretax income for 2017?

a. What amount does Albany report as trading debt securities on its balance sheets for 2017?

b. How do the net unrealized gains (losses) on the company's trading debt securities affect pretax income for 2017?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

44

In footnotes to its 2016 annual report, Bancfirst Corp. reported that held-to-maturity debt securities with an amortized cost of $4,365 thousand had an estimated fair value of $4,403 thousand.

a. What amount does Bancfirst report on its 2016 balance sheet for these held-to-maturity securities?

b. If these debt securities had instead been classified as available-for-sale securities, how would Bancfirst's pretax income have been affected?

a. What amount does Bancfirst report on its 2016 balance sheet for these held-to-maturity securities?

b. If these debt securities had instead been classified as available-for-sale securities, how would Bancfirst's pretax income have been affected?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

45

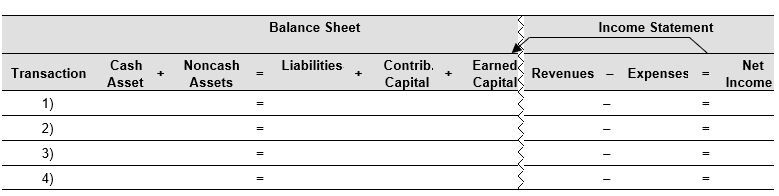

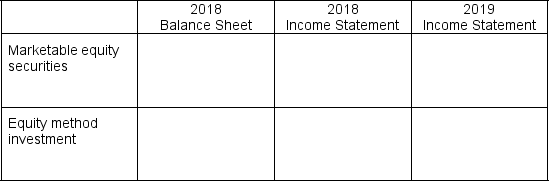

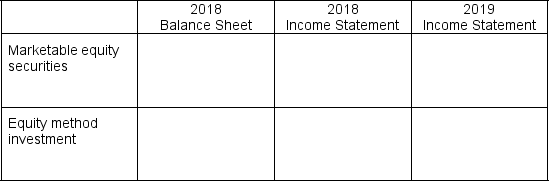

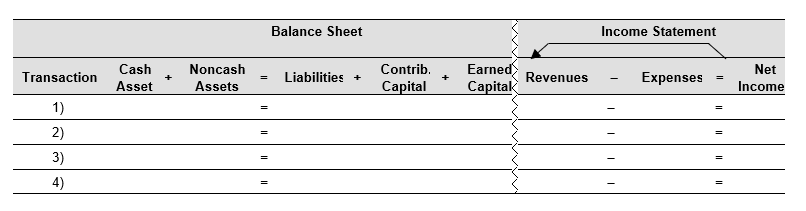

Record the following transactions of Beacon Inc. in the financial statements effects template below. Assume the transactions occur in 2018.

1) Purchased 2,800 shares of New City Corp. common stock for $40 per share. These securities are publicly traded and Beacon has no influence over New City's business decisions.

2) Received a cash dividend of $3.20 per share from New City.

3) Year-end market price of New City common stock is $30.40 per share.

4) Sold 1,200 shares for $25.60 per share, the closing price for the day.

1) Purchased 2,800 shares of New City Corp. common stock for $40 per share. These securities are publicly traded and Beacon has no influence over New City's business decisions.

2) Received a cash dividend of $3.20 per share from New City.

3) Year-end market price of New City common stock is $30.40 per share.

4) Sold 1,200 shares for $25.60 per share, the closing price for the day.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

46

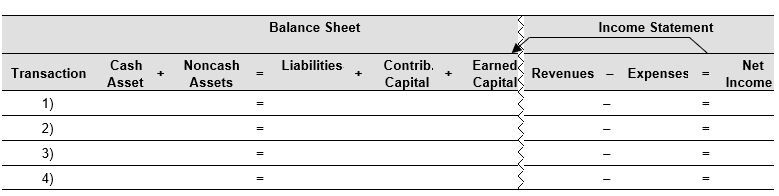

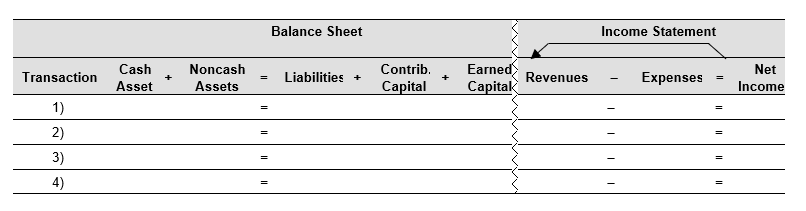

Rapid City Corp. invests in the publicly traded stock of Newcastle, Inc. Record the following transactions in the financial statements effects template below. Assume the transactions occur in 2018.

1) Purchased 2,000 shares of Newcastle, Inc.'s common stock for $57.60 per share. Rapid City has no influence over Newcastle's business decisions.

2) Received a cash dividend of $2.16 per share from Newcastle.

3) Year-end market price of Newcastle's common stock is $68.40 per share.

4) Sold all 2,000 shares for $74.40 per share, the closing price for the day.

1) Purchased 2,000 shares of Newcastle, Inc.'s common stock for $57.60 per share. Rapid City has no influence over Newcastle's business decisions.

2) Received a cash dividend of $2.16 per share from Newcastle.

3) Year-end market price of Newcastle's common stock is $68.40 per share.

4) Sold all 2,000 shares for $74.40 per share, the closing price for the day.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

47

On January 1, 2017, Gillettey Company purchases an investment in Buffalo, Inc., a company whose stock trades over the counter, for $2,700,000, representing 20% of the book value of Buffalo. During the year, Buffalo reports a net income of $942,000 and pays cash dividends of $294,000. The fair value of Buffalo's stock on December 31, 2017, is $15,000,000. Gillettey has a calendar year-end.

a. What amount does Gillettey report on its 2017 balance sheet for its investment in Buffalo, if 20% ownership does not imply any significant influence over Buffalo?

b. What amount does Gillettey report on its 2017 balance sheet for its investment in Buffalo, if 20% ownership implies significant influence over Buffalo?

a. What amount does Gillettey report on its 2017 balance sheet for its investment in Buffalo, if 20% ownership does not imply any significant influence over Buffalo?

b. What amount does Gillettey report on its 2017 balance sheet for its investment in Buffalo, if 20% ownership implies significant influence over Buffalo?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

48

On January 1, 2017, Meadowlark, Inc. acquired common stock of Lake Corp. At the time of acquisition, the book value and the market value of Lake's net assets were $608 million. During the current year, Lake earned $152 million and declared dividends of $25.6 million. The market value of Lake on December 31, 2017 was $659.2 million. For each scenario below, determine the amount that Meadowlark would report on its balance sheet for its investment in Lake at December 31, 2017; and the amount of income Meadowlark would report for 2017 related to its investment.

a. Scenario 1: Meadowlark, Inc. paid $91.2 million for a 15% interest in Lake and classifies the Lake stock as trading securities.

b. Scenario 2: Meadowlark, Inc. paid $212.8 million for a 35% interest in Lake and uses the equity method to account for the investment.

a. Scenario 1: Meadowlark, Inc. paid $91.2 million for a 15% interest in Lake and classifies the Lake stock as trading securities.

b. Scenario 2: Meadowlark, Inc. paid $212.8 million for a 35% interest in Lake and uses the equity method to account for the investment.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

49

Thermopolis Industries acquired common stock of Riverton, Inc. as an investment. Consider the following transactions.

2018:

Purchase 4,000 (15%) of the common shares of Riverton, Inc. for $20.40 cash per share plus a $1,740 brokerage commission

Riverton reports net income of $118,200.

Thermopolis receives a cash dividend of $2.28 per share from Riverton, Inc.

Year-end market price of Riverton is $21.60 per share

2019:

Sell all 4,000 shares for $19.80 per share.

Complete the table below to show what Thermopolis Industries would report on its balance sheet in 2018 and on its income statement in 2018 and 2019 if the investment is classified as a passive investment in marketable equity securities, or as an equity method investment.

2018:

Purchase 4,000 (15%) of the common shares of Riverton, Inc. for $20.40 cash per share plus a $1,740 brokerage commission

Riverton reports net income of $118,200.

Thermopolis receives a cash dividend of $2.28 per share from Riverton, Inc.

Year-end market price of Riverton is $21.60 per share

2019:

Sell all 4,000 shares for $19.80 per share.

Complete the table below to show what Thermopolis Industries would report on its balance sheet in 2018 and on its income statement in 2018 and 2019 if the investment is classified as a passive investment in marketable equity securities, or as an equity method investment.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

50

Dubois Corporation purchases an investment in Teton, Inc. at a purchase price of $9.0 million cash, representing 40% of the book value of Teton. During the year, Teton reports net income of $708,000 and pays $138,000 of cash dividends. At the end of the year, the market value of Dubois' investment is $9.72 million.

a. What is the year-end balance of the equity investment in Teton, Inc.?

b. What amount of equity earnings would be reported by Dubois Corporation?

c. What is the amount of the unrealized gain or loss at the end of the year? How does Dubois Corporation account for this unrealized gain or loss?

a. What is the year-end balance of the equity investment in Teton, Inc.?

b. What amount of equity earnings would be reported by Dubois Corporation?

c. What is the amount of the unrealized gain or loss at the end of the year? How does Dubois Corporation account for this unrealized gain or loss?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

51

In 2013, West Yellow Corporation made a $1.44 million investment in Ennis, Inc. and assumed a 42% ownership of Ennis. The investment in Ennis is accounted for under the equity method. Ennis reported the following financial information for the year ended December 31, 2017 (in thousands):

a. Calculate the equity earnings that West Yellow reported on its 2017 income statement.

b. Determine the investment balance for Ennis on West Yellow's balance sheet at December 31, 2017.

a. Calculate the equity earnings that West Yellow reported on its 2017 income statement.

b. Determine the investment balance for Ennis on West Yellow's balance sheet at December 31, 2017.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

52

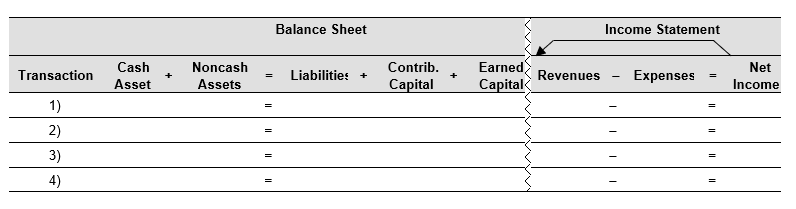

Buttle Co. invests in the stock of Drummond, Inc. Record the following transactions in the financial statements effects template below.

1) Purchased 7,000 shares of Drummond, Inc. common stock for $18 per; these shares represent 30% ownership of Drummond, Inc., which conveys to Buttle Co. significant influence over the operations of Drummond.

2) Received a cash dividend of $4.62 per share from Drummond, Inc.

3) Drummond, Inc. reports net income of $226,800.

4) Sold all 7,000 shares of Drummond, Inc. for $170,400.

1) Purchased 7,000 shares of Drummond, Inc. common stock for $18 per; these shares represent 30% ownership of Drummond, Inc., which conveys to Buttle Co. significant influence over the operations of Drummond.

2) Received a cash dividend of $4.62 per share from Drummond, Inc.

3) Drummond, Inc. reports net income of $226,800.

4) Sold all 7,000 shares of Drummond, Inc. for $170,400.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

53

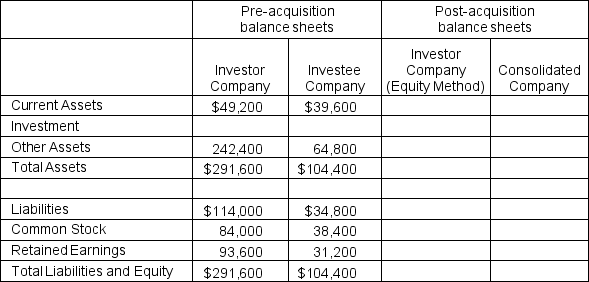

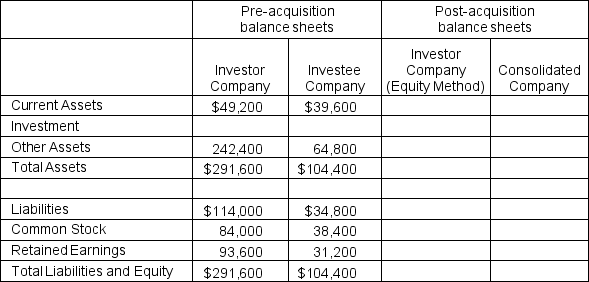

Consider companies with the pre-acquisition balance sheets presented below. Investor Company purchases 100% of Investee Company's stock at book value by issuing new common stock. Complete the columns for Investor's post-acquisition balance sheet and the Consolidated Company post-acquisition balance sheet.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

54

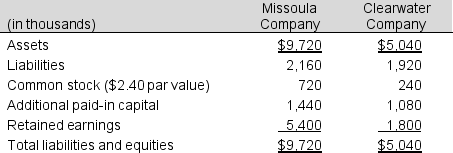

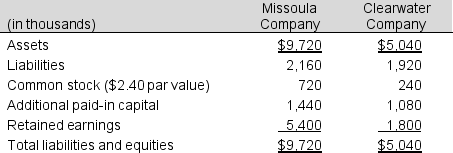

Missoula Company acquires 100% of the outstanding voting shares of Clearwater Company on January 1, 2017. Before the acquisition, the balance sheets of the two companies are as follows:

Missoula issues 50,000 shares of its common stock with a market value of $3,840 thousand to the owners of Clearwater in return for their 100,000 shares of Clearwater Company common stock. The assets of Clearwater Company have a fair value in excess of book value of $480 thousand.

Missoula issues 50,000 shares of its common stock with a market value of $3,840 thousand to the owners of Clearwater in return for their 100,000 shares of Clearwater Company common stock. The assets of Clearwater Company have a fair value in excess of book value of $480 thousand.

Prepare a consolidated balance sheet for the Missoula - Clearwater Company on January 1, 2017.

Missoula issues 50,000 shares of its common stock with a market value of $3,840 thousand to the owners of Clearwater in return for their 100,000 shares of Clearwater Company common stock. The assets of Clearwater Company have a fair value in excess of book value of $480 thousand.

Missoula issues 50,000 shares of its common stock with a market value of $3,840 thousand to the owners of Clearwater in return for their 100,000 shares of Clearwater Company common stock. The assets of Clearwater Company have a fair value in excess of book value of $480 thousand.Prepare a consolidated balance sheet for the Missoula - Clearwater Company on January 1, 2017.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

55

On January 1, 2017, Kamiah Corp. purchases 100% of Lewiston Inc. for $11.52 million. At the time of acquisition, the fair market value of Lewiston's tangible net assets (excluding goodwill) is $9.48 million. Kamiah ascribes the excess of $2.04 million to goodwill. During the year the fair value of Lewiston declines to $9.6 million and the fair value of Lewiston's tangible net assets is estimated at $8.16 million as of December 31, 2017.

a. Determine if the goodwill has become impaired and, if so, the amount of the impairment.

b. What impact does the impairment of goodwill have on Kamiah Corp's financial statements?

a. Determine if the goodwill has become impaired and, if so, the amount of the impairment.

b. What impact does the impairment of goodwill have on Kamiah Corp's financial statements?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

56

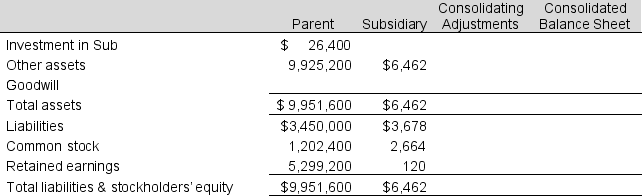

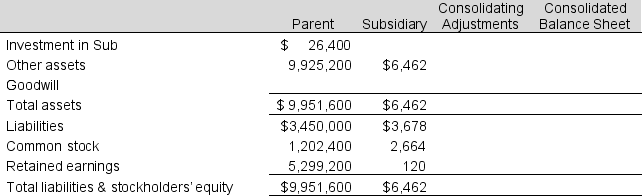

Parent Company purchases 100% of Subsidiary Company for $26,400. Use the following table to consolidate the balance sheets of the two companies as of the acquisition date.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

57

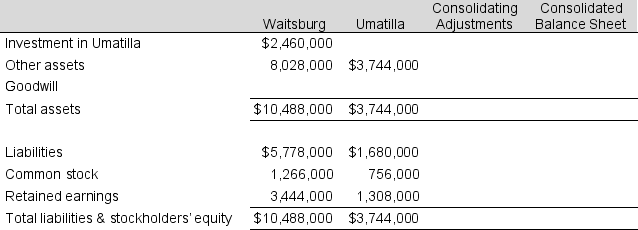

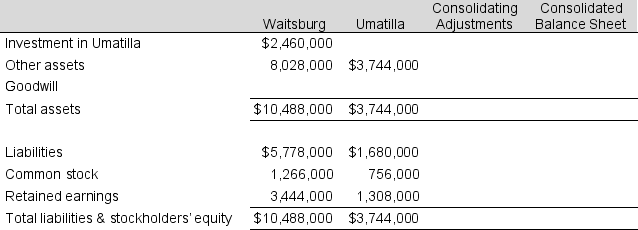

Waitsburg Company purchased all of Umatilla Company's common stock for $2,460,000 cash on January 1. When analyzing the purchase price, Waitsburg determined that the other assets of Umatilla were undervalued by $330,000, with any excess purchase price considered to be goodwill.

Use the following table to consolidate the balance sheets of the two companies as of the acquisition date.

Use the following table to consolidate the balance sheets of the two companies as of the acquisition date.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

58

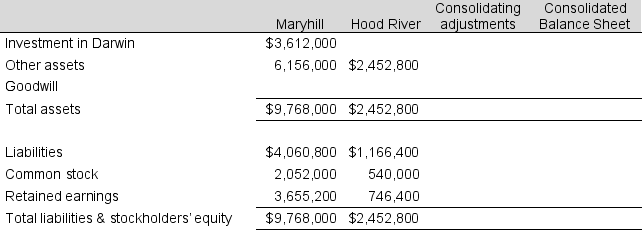

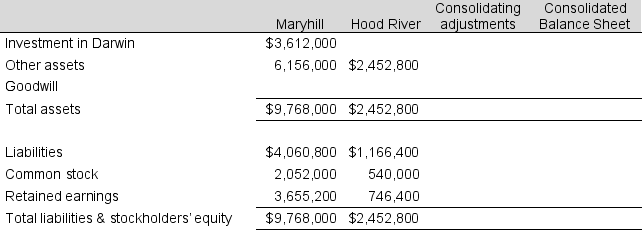

Maryhill Corp. purchased all of Hood River Company's common stock for $3,612,000 cash on January 1. When analyzing the purchase price, Maryhill Corp. determined that the other assets of Hood River were undervalued by $633,600 and that the company had an unrecorded liability of $240,000 related to ongoing litigation. Any excess purchase price was for goodwill.

Use the following table to consolidate the balance sheets of the two companies as of the acquisition date.

Use the following table to consolidate the balance sheets of the two companies as of the acquisition date.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

59

Sanfran, Inc. decided to split off its gift retail subsidiary named J. Wall (JW). Assume Sanfran holds 1.5 million shares of JW at a net book value $72 million and the current market value of JW shares is $57.60 per share. Assume a 1 to 1 share transaction.

a. What would be the effect on the balance sheet if shares are distributed pro rata?

b. What would be the effect on the balance sheet if shares are distributed non pro rata?

a. What would be the effect on the balance sheet if shares are distributed pro rata?

b. What would be the effect on the balance sheet if shares are distributed non pro rata?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

60

Kadoka, Inc. has an investment on its balance sheet for Pierre Corp., with a book value of $54.6 million. Kadoka has decided to divest itself of 60% of its Pierre investment. To accomplish this, Kadoka will distribute 1 share of Pierre stock for every 5 shares of Kadoka stock as a dividend to existing Kadoka shareholders.

a. What kind of equity carve-out is Kadoka, Inc. planning?

b. What is the effect on the Kadoka, Inc. balance sheet of this spin-off?

c. What is the effect on the Kadoka, Inc. income statement of this spin-off in the current period?

a. What kind of equity carve-out is Kadoka, Inc. planning?

b. What is the effect on the Kadoka, Inc. balance sheet of this spin-off?

c. What is the effect on the Kadoka, Inc. income statement of this spin-off in the current period?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

61

The 2016 annual report of Bank of America includes the following footnote related to its available-for-sale debt securities:

a. What amount will Bank of America report for available-for-sale debt securities on the balance sheet? Explain.

b. How do gross unrealized gains and losses arise on these available-for-sale debt securities?

c. Calculate the net unrealized gains or losses for 2016.

d. How do these unrealized gains and losses affect Bank of America's 2016 income statement?

e. How do these unrealized gains and losses affect Bank of America's 2016 balance sheet?

a. What amount will Bank of America report for available-for-sale debt securities on the balance sheet? Explain.

b. How do gross unrealized gains and losses arise on these available-for-sale debt securities?

c. Calculate the net unrealized gains or losses for 2016.

d. How do these unrealized gains and losses affect Bank of America's 2016 income statement?

e. How do these unrealized gains and losses affect Bank of America's 2016 balance sheet?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

62

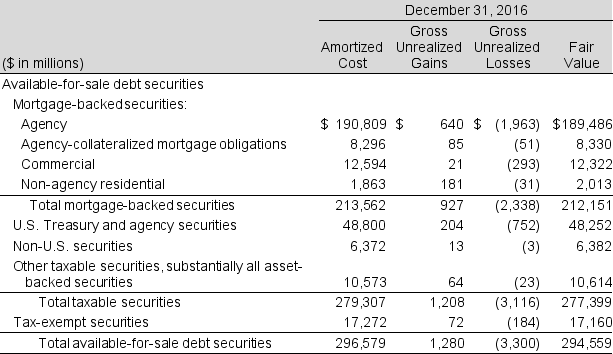

Following is a portion of the investments footnote from Allstate's 2016 10-K. Investment earnings are a crucial component of the financial performance of insurance companies such as Allstate, and investments comprise a large part of Allstate's assets. Allstate accounts for its debt securities as available-for-sale securities.

Required:

Required:

a. What amount does Allstate report for available-for-sale debt securities on its balance sheets for 2016 and 2015?

b. What are the net unrealized gains (losses) at year-end 2016 and 2015? How did these unrealized gains (losses) affect the company's reported income in 2016 and 2015?

c. If the company had accounted for these debt securities as trading securities, how would income before income tax have been affected in 2016? Your response should quantify the effect in dollars.

d. What is the difference between realized and unrealized gains and losses? Relating to debt securities, are realized gains and losses treated differently in the income statement than unrealized gains and losses?

Required:

Required: a. What amount does Allstate report for available-for-sale debt securities on its balance sheets for 2016 and 2015?

b. What are the net unrealized gains (losses) at year-end 2016 and 2015? How did these unrealized gains (losses) affect the company's reported income in 2016 and 2015?

c. If the company had accounted for these debt securities as trading securities, how would income before income tax have been affected in 2016? Your response should quantify the effect in dollars.

d. What is the difference between realized and unrealized gains and losses? Relating to debt securities, are realized gains and losses treated differently in the income statement than unrealized gains and losses?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

63

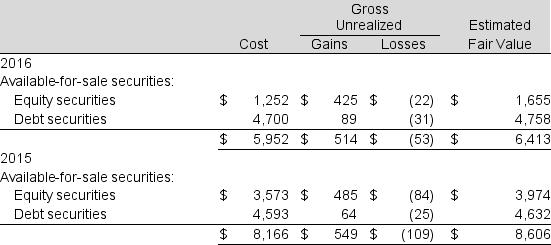

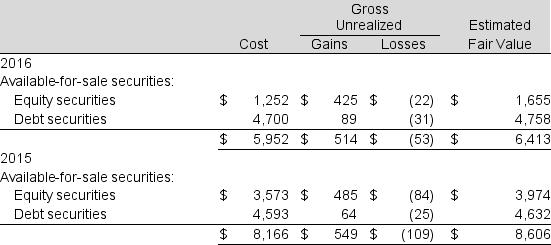

The following is from the footnotes to The Coca-Cola Company's recent financial statements. (Note: Coca-Cola's 2016 disclosures are consistent with the former accounting rules for marketable equity securities.)

Trading Securities

As of December 31, 2016 and 2015, our trading securities had a fair value of $384 million and $322 million, respectively, and consisted primarily of equity securities. The Company had net unrealized gains on trading securities of $39 million, $19 million and $40 million as of December 31, 2016, 2015 and 2014, respectively. The Company's trading securities were included in the following line items in our consolidated balance sheets (in millions):

Available-for-Sale and Held-to-Maturity Securities

Available-for-Sale and Held-to-Maturity Securities

As of December 31, 2016 and 2015, the Company did not have any held-to-maturity securities. Available-for-sale securities consisted of the following (in millions):

In 2016 and 2015, the Company did not have any held-to-maturity securities. The Company's available-for-sale securities were included in the following captions in our consolidated balance sheets (in millions):

In 2016 and 2015, the Company did not have any held-to-maturity securities. The Company's available-for-sale securities were included in the following captions in our consolidated balance sheets (in millions):

Continued next page

Continued next page

Required:

a. Explain the difference between "Held-to-maturity securities," "Available-for-sale securities," and "Trading securities."

b. What amount does The Coca-Cola Company report for available-for-sale securities on its balance sheets at December 31, 2016, and 2015? How are these values measured?

c. What are the net unrealized gains (losses) on available-for-sale securities for 2016 and 2015?

d. How did these unrealized gains (losses) on available-for-sale securities affect the company's reported income in 2016?

e. What is the difference between realized and unrealized gains and losses? Are realized gains and losses treated differently in the income statement than unrealized gains and losses? Under new accounting rules that take effect in 2018, how does the treatment of unrealized gains and losses differ?

Trading Securities

As of December 31, 2016 and 2015, our trading securities had a fair value of $384 million and $322 million, respectively, and consisted primarily of equity securities. The Company had net unrealized gains on trading securities of $39 million, $19 million and $40 million as of December 31, 2016, 2015 and 2014, respectively. The Company's trading securities were included in the following line items in our consolidated balance sheets (in millions):

Available-for-Sale and Held-to-Maturity Securities

Available-for-Sale and Held-to-Maturity SecuritiesAs of December 31, 2016 and 2015, the Company did not have any held-to-maturity securities. Available-for-sale securities consisted of the following (in millions):

In 2016 and 2015, the Company did not have any held-to-maturity securities. The Company's available-for-sale securities were included in the following captions in our consolidated balance sheets (in millions):

In 2016 and 2015, the Company did not have any held-to-maturity securities. The Company's available-for-sale securities were included in the following captions in our consolidated balance sheets (in millions): Continued next page

Continued next pageRequired:

a. Explain the difference between "Held-to-maturity securities," "Available-for-sale securities," and "Trading securities."

b. What amount does The Coca-Cola Company report for available-for-sale securities on its balance sheets at December 31, 2016, and 2015? How are these values measured?

c. What are the net unrealized gains (losses) on available-for-sale securities for 2016 and 2015?

d. How did these unrealized gains (losses) on available-for-sale securities affect the company's reported income in 2016?

e. What is the difference between realized and unrealized gains and losses? Are realized gains and losses treated differently in the income statement than unrealized gains and losses? Under new accounting rules that take effect in 2018, how does the treatment of unrealized gains and losses differ?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

64

Following is a portion of the investments footnote from the 2016 10-K report of Bancfirst Corporation (in thousands), related to held-to-maturity securities.

The following table summarizes the amortized cost and estimated market values of securities held for investment:

Required:

Required:

a. What amount does Bancfirst report on its balance sheet at December 31, 2016, for these held-to-maturity securities?

b. Calculate the unrealized gains or losses on these securities at December 31, 2016. How do these unrealized gains or losses affect the 2016 balance sheet and the 2016 income statement?

c. If these held-to-maturity securities had instead been classified as available-for sale, how would Bancfirst's 2016 balance sheet and income statement been different?

The following table summarizes the amortized cost and estimated market values of securities held for investment:

Required:

Required: a. What amount does Bancfirst report on its balance sheet at December 31, 2016, for these held-to-maturity securities?

b. Calculate the unrealized gains or losses on these securities at December 31, 2016. How do these unrealized gains or losses affect the 2016 balance sheet and the 2016 income statement?

c. If these held-to-maturity securities had instead been classified as available-for sale, how would Bancfirst's 2016 balance sheet and income statement been different?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

65

Waste Management Inc. reports the following in the 2016 Form 10-K (in millions):

a. Why does Waste Management's income statement deduct equity in net losses of the unconsolidated entities?

b. Explain the reconciling item on Waste Management's statement of cash flow that adds back equity in net losses of unconsolidated entities.

c. Explain why the income statement and statement of cash flow line items related to the unconsolidated subsidiaries is the same 2016? Why are the amounts different for 2015?

a. Why does Waste Management's income statement deduct equity in net losses of the unconsolidated entities?

b. Explain the reconciling item on Waste Management's statement of cash flow that adds back equity in net losses of unconsolidated entities.

c. Explain why the income statement and statement of cash flow line items related to the unconsolidated subsidiaries is the same 2016? Why are the amounts different for 2015?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

66

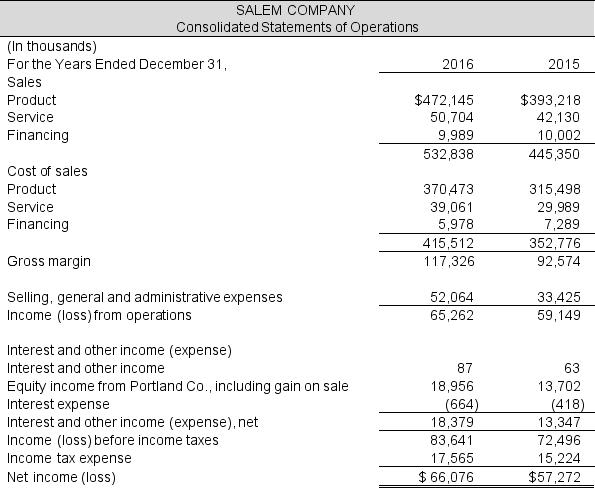

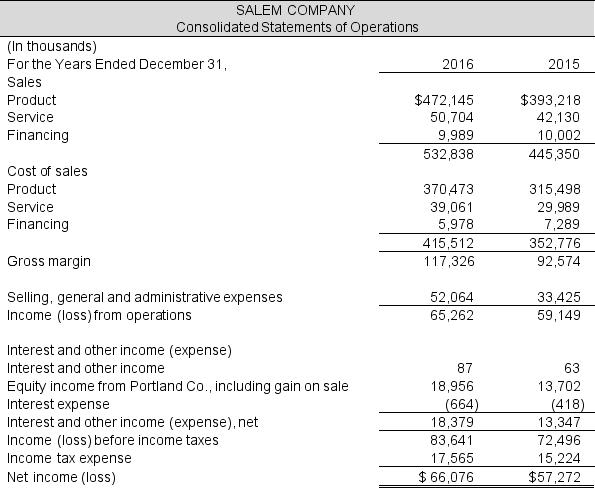

The 2016 income statement of Salem Company follows:

Required:

Required:

a. What accounting method does Salem use to account for its investments in Portland Co.?

b. According to GAAP, when must Salem account for its investments in affiliates by consolidating their financial statements?

c. How does Salem recognize income received from Portland Co.? What amount did Salem report in 2016? What else is included in this number in 2016?

d. What financial reporting benefits arise from Salem keeping its investment in affiliates at less than 50 percent ownership?

e. How do the dividends received from the equity investee affect the equity-method investment on Salem's balance sheet and on Salem's income statement?

f. Describe the effects on Salem's statement of cash flow from the equity method investment. Don't forget about the cash received from the sale of Portland Co.

Required:

Required: a. What accounting method does Salem use to account for its investments in Portland Co.?

b. According to GAAP, when must Salem account for its investments in affiliates by consolidating their financial statements?

c. How does Salem recognize income received from Portland Co.? What amount did Salem report in 2016? What else is included in this number in 2016?

d. What financial reporting benefits arise from Salem keeping its investment in affiliates at less than 50 percent ownership?

e. How do the dividends received from the equity investee affect the equity-method investment on Salem's balance sheet and on Salem's income statement?

f. Describe the effects on Salem's statement of cash flow from the equity method investment. Don't forget about the cash received from the sale of Portland Co.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

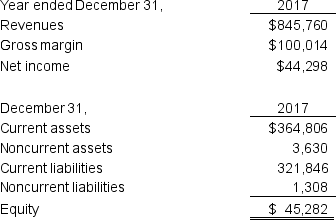

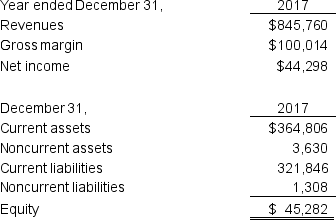

67

The following information comes from the 2016 annual report of Eugene Corp.

On May 2, 2016, Eugene sold its 41% equity interest in Chemult Industries Corporation to Chemult for $25 million and settled all of the pending arbitration proceedings, litigation and related disputes with Chemult and its officers and other owners, pursuant to a settlement and redemption agreement. Eugene had acquired the Chemult equity interest in 2007, when Eugene invested approximately $1.3 million in Chemult. The investment in Chemult was accounted for under the equity method and adjusted for earnings or losses as reported in the financial statements of Chemult and dividends received from Chemult. At December 31, 2015, our investment balance for Chemult was $17.2 million, and for the years ended December 31, 2016, 2015 and 2014, our equity in earnings was $5.2 million, $15.1 million and $11.6 million, respectively.

The following table summarizes Chemult's financial information as of and for the year ended December 31 (in thousands):

Continued next page

Continued next page

Required:

a. Eugene used the equity method to account for its investment in Chemult. Briefly explain how this accounting method affects Eugene's balance sheet and income statement.

b. Use the income statement information for Chemult presented above, to calculate the equity earnings that Eugene reported on its 2015 income statement.

c. Use the balance sheet information for Chemult presented above, to determine the investment balance for Chemult at December 31, 2015.

d. If Chemult did not pay any dividends to Eugene during 2016, based on the above information and your answer to c., what would have been the balance in Eugene's Investment in Chemult account just prior to the sale on May 2, 2016? Calculate the gain or loss on the sale.

On May 2, 2016, Eugene sold its 41% equity interest in Chemult Industries Corporation to Chemult for $25 million and settled all of the pending arbitration proceedings, litigation and related disputes with Chemult and its officers and other owners, pursuant to a settlement and redemption agreement. Eugene had acquired the Chemult equity interest in 2007, when Eugene invested approximately $1.3 million in Chemult. The investment in Chemult was accounted for under the equity method and adjusted for earnings or losses as reported in the financial statements of Chemult and dividends received from Chemult. At December 31, 2015, our investment balance for Chemult was $17.2 million, and for the years ended December 31, 2016, 2015 and 2014, our equity in earnings was $5.2 million, $15.1 million and $11.6 million, respectively.

The following table summarizes Chemult's financial information as of and for the year ended December 31 (in thousands):

Continued next page

Continued next pageRequired:

a. Eugene used the equity method to account for its investment in Chemult. Briefly explain how this accounting method affects Eugene's balance sheet and income statement.

b. Use the income statement information for Chemult presented above, to calculate the equity earnings that Eugene reported on its 2015 income statement.

c. Use the balance sheet information for Chemult presented above, to determine the investment balance for Chemult at December 31, 2015.

d. If Chemult did not pay any dividends to Eugene during 2016, based on the above information and your answer to c., what would have been the balance in Eugene's Investment in Chemult account just prior to the sale on May 2, 2016? Calculate the gain or loss on the sale.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

68

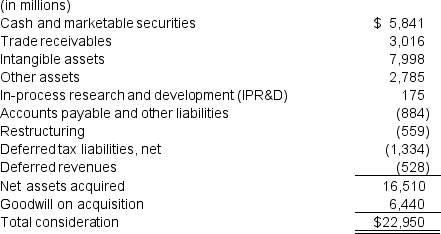

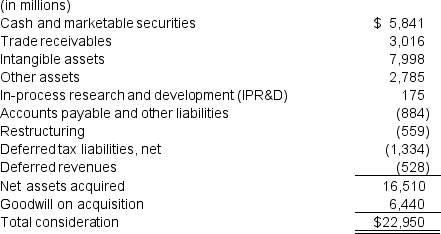

Camire Corp. acquired 100% of the common stock of Koontz Technologies, Inc. The purchase price for Koontz was $22,950 million and was allocated as follows:

a. What method of accounting did Camire use to account for this acquisition?

b. What amount(s) will be recorded in the investment account of Camire's balance sheet for the Koontz Technologies acquisition?

c. Are the intangible assets purchased in the Koontz Technologies acquisition, reported on Camire's consolidated balance sheet at book value or at fair value on the date of the acquisition? Explain.

d. How will the intangible assets account balance change on the consolidated balance sheet in subsequent years?

e. How will the recognition of goodwill affect Camire's consolidated balance sheet? How will this asset change in subsequent years?

a. What method of accounting did Camire use to account for this acquisition?

b. What amount(s) will be recorded in the investment account of Camire's balance sheet for the Koontz Technologies acquisition?

c. Are the intangible assets purchased in the Koontz Technologies acquisition, reported on Camire's consolidated balance sheet at book value or at fair value on the date of the acquisition? Explain.

d. How will the intangible assets account balance change on the consolidated balance sheet in subsequent years?

e. How will the recognition of goodwill affect Camire's consolidated balance sheet? How will this asset change in subsequent years?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

69

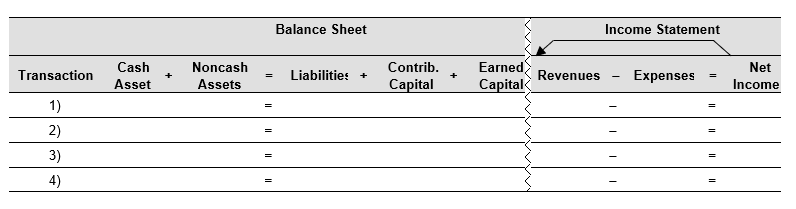

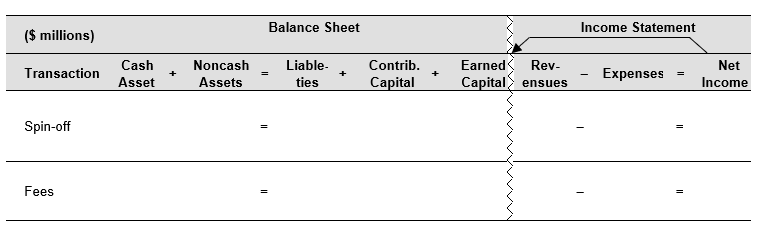

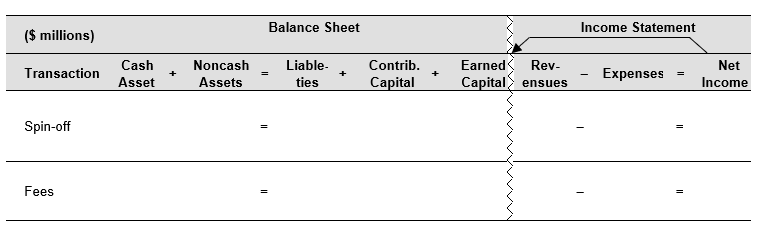

Urbana Coffee Company reported the following in its 2017 annual report.

On September 20, 2017, we completed the spin-off of Champaign Tea, Inc. to shareowners of Urbana Coffee. Urbana Coffee distributed a dividend of two shares of Champaign Tea common stock for every 25 shares of Urbana Coffee common stock. Cash was paid for fractional shares. The distribution of Champaign Tea common stock is considered a tax-free transaction for us and for our shareowners, except for the cash payments for fractional shares, which are generally taxable.

We recorded pretax charges of $150 million ($108 million after-tax, or $0.07 per diluted share) for costs related to the spin-off of Champaign Tea. These costs primarily consisted of banking and legal fees, as well as filing fees, printing and mailing costs.

Required:

a. Explain the accounting for spin-offs.

b. How did the spin-off affect Urbana Coffee's net income in 2017?

c. Use the financial statements effect template, below, to show the spin-off effects on Urbana Coffee's financial statements. Assume the book value of Champaign Tea was $7,200 million.

On September 20, 2017, we completed the spin-off of Champaign Tea, Inc. to shareowners of Urbana Coffee. Urbana Coffee distributed a dividend of two shares of Champaign Tea common stock for every 25 shares of Urbana Coffee common stock. Cash was paid for fractional shares. The distribution of Champaign Tea common stock is considered a tax-free transaction for us and for our shareowners, except for the cash payments for fractional shares, which are generally taxable.

We recorded pretax charges of $150 million ($108 million after-tax, or $0.07 per diluted share) for costs related to the spin-off of Champaign Tea. These costs primarily consisted of banking and legal fees, as well as filing fees, printing and mailing costs.

Required:

a. Explain the accounting for spin-offs.

b. How did the spin-off affect Urbana Coffee's net income in 2017?

c. Use the financial statements effect template, below, to show the spin-off effects on Urbana Coffee's financial statements. Assume the book value of Champaign Tea was $7,200 million.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

70

What are the various methods used to account for investments? When is each appropriate? Explain how each method affects a company's balance sheet and income statement and the appropriate uses for each method.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

71

How does the equity-method of accounting for investments affect financial ratios of the investor company?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

72

What steps are taken to allocate the purchase price when it exceeds the book value of the investee's stockholders' equity? Include an explanation of intangible assets and goodwill.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

73

Why is goodwill not amortized? When is goodwill impaired and how is it treated?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

74

Why would a corporate manager decide to use an equity carve-out to maximize shareholder value?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

75

Early in 2012, Pfizer announced that it intended to move its animal health business into a separate, publicly-traded company. If Pfizer also plans to award some of its key employees with its own stock, what actions can it take to achieve these results? If the market value of the subsidiary is larger than the book value, and if the board members of the company prefer high profitability, what actions should the general manager take?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck