Deck 17: Financial Planning, Forecasting, and Risk Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/51

Play

Full screen (f)

Deck 17: Financial Planning, Forecasting, and Risk Management

1

Which of the following statements is incorrect?

A) Business financial planning is generally done once per year.

B) The most important goal of business financial planning is to predict cash flows.

C) An important step in planning is to compare what actually occurs with what was forecasted.

D) Planning looks at possible outcomes ranging from worst-case scenario to best-cast scenario.

E) Business financial planning includes forecasting revenues, forecasting expenses, planning capital expenditures, managing funding needs, and managing risk.

A) Business financial planning is generally done once per year.

B) The most important goal of business financial planning is to predict cash flows.

C) An important step in planning is to compare what actually occurs with what was forecasted.

D) Planning looks at possible outcomes ranging from worst-case scenario to best-cast scenario.

E) Business financial planning includes forecasting revenues, forecasting expenses, planning capital expenditures, managing funding needs, and managing risk.

Business financial planning is generally done once per year.

2

What is the proper order, from the beginning to the end of the business financial planning process?

A) Create an operating budget, Estimate revenues and expenses, Develop a strategy, Analyze deviations from budget.

B) Develop a strategy, Estimate revenues and expenses, Create an operating budget, Analyze deviations from budget.

C) Develop a strategy, Create an operating budget, Estimate revenues and expenses, Analyze deviations from budget.

D) Estimate revenues and expenses, Create an operating budget, Analyze deviations from budget, Develop a strategy.

A) Create an operating budget, Estimate revenues and expenses, Develop a strategy, Analyze deviations from budget.

B) Develop a strategy, Estimate revenues and expenses, Create an operating budget, Analyze deviations from budget.

C) Develop a strategy, Create an operating budget, Estimate revenues and expenses, Analyze deviations from budget.

D) Estimate revenues and expenses, Create an operating budget, Analyze deviations from budget, Develop a strategy.

Develop a strategy, Estimate revenues and expenses, Create an operating budget, Analyze deviations from budget.

3

Which of the following statements is incorrect?

A) Simple forecasting models cannot be used to predict a financial account.

B) Extrapolating trends from the past into the future must be done with caution.

C) Sustainable growth rate = Return on equity × Proportion of earnings retained

D) Sustainable growth is the expected growth rate of a business entity considering the entity's return on equity and its earnings retention.

E) The natural progression in most industries over time is profitability and growth in the early stages invites competition and imitation, which reduces growth and profitability in the industry.

A) Simple forecasting models cannot be used to predict a financial account.

B) Extrapolating trends from the past into the future must be done with caution.

C) Sustainable growth rate = Return on equity × Proportion of earnings retained

D) Sustainable growth is the expected growth rate of a business entity considering the entity's return on equity and its earnings retention.

E) The natural progression in most industries over time is profitability and growth in the early stages invites competition and imitation, which reduces growth and profitability in the industry.

Simple forecasting models cannot be used to predict a financial account.

4

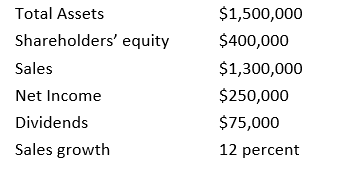

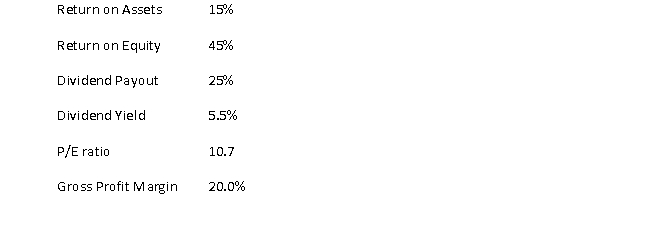

The sustainable growth rate of Sweetie Pies, given the following information from Sweetie Pies' financial results,  is closest to:

is closest to:

A) 12.00 %

B) 43.75%

C) 62.50%

D) 70.00%

is closest to:

is closest to:A) 12.00 %

B) 43.75%

C) 62.50%

D) 70.00%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

5

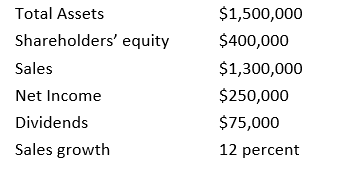

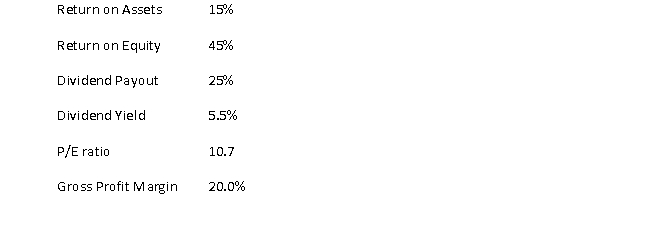

The sustainable growth rate of West Monroe Company given the following information from the firm's financial results?

is closest to:

is closest to:

A) 23.33 %

B) 32.61%

C) 35.00%

D) 50.00%

is closest to:

is closest to:A) 23.33 %

B) 32.61%

C) 35.00%

D) 50.00%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

6

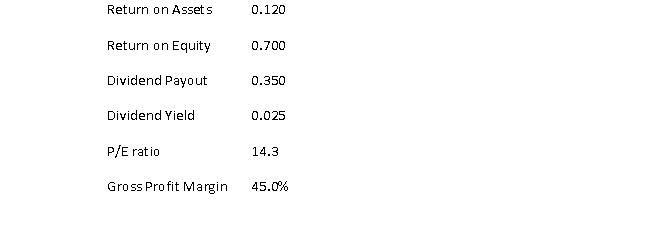

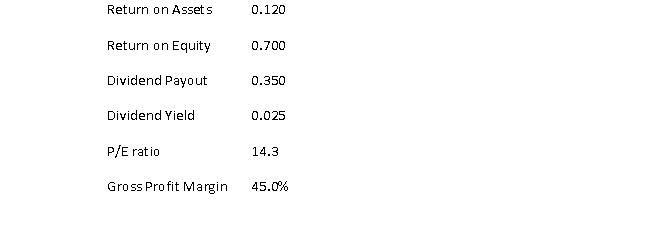

Using the following information from the Daffodil Company's financial results,

the sustainable growth rate of the company is closest to:

the sustainable growth rate of the company is closest to:

A) 24.50%

B) 45.00%

C) 45.50%

D) 68.25%

E) 70.00%

the sustainable growth rate of the company is closest to:

the sustainable growth rate of the company is closest to:A) 24.50%

B) 45.00%

C) 45.50%

D) 68.25%

E) 70.00%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

7

Using the following information from the Farmers Market financial results, calculate the sustainable growth rate of the Farmers Market.

A) 11.25%

B) 20.00%

C) 33.75%

D) 45.00%

E) 75.00%

A) 11.25%

B) 20.00%

C) 33.75%

D) 45.00%

E) 75.00%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is incorrect?

A) In a retail business, one would expect inventory to vary with sales.

B) The percentage of sales method is based on the idea that many types of assets and liabilities move along with sales.

C) The percentage of sales method is the expected growth rate of a business entity considering the entity's return on equity and its earnings retention.

D) When using the percentage of sales method to forecast, one should note that cash balances and other operating accounts tend to vary along with sales.

A) In a retail business, one would expect inventory to vary with sales.

B) The percentage of sales method is based on the idea that many types of assets and liabilities move along with sales.

C) The percentage of sales method is the expected growth rate of a business entity considering the entity's return on equity and its earnings retention.

D) When using the percentage of sales method to forecast, one should note that cash balances and other operating accounts tend to vary along with sales.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

9

A company with a return on equity of 30% and a dividend payout of 40% will have a sustainable growth closest to:

A) 12%.

B) 18%.

C) 30%.

D) 40%.

A) 12%.

B) 18%.

C) 30%.

D) 40%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not a step in financial forecasting using the percentage of sales method?

A) Modify or iterate until the forecast makes sense.

B) Determine the financial policy variables of interest.

C) Set all non-financial policy variables as a percentage of sales.

D) Extrapolate the balance sheet based on the percentage of sales.

E) Estimate sustainable growth rate using return on equity times proportion of earnings retained.

A) Modify or iterate until the forecast makes sense.

B) Determine the financial policy variables of interest.

C) Set all non-financial policy variables as a percentage of sales.

D) Extrapolate the balance sheet based on the percentage of sales.

E) Estimate sustainable growth rate using return on equity times proportion of earnings retained.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

11

The correct order of steps from beginning to end of financial forecasting using the percentage of sales method is:

1) Estimate future retained earnings.

2) Modify or iterate until the forecast makes sense.

3) Determine the financial policy variables of interest.

4) Set all non-financial policy variables as a percentage of sales.

5) Extrapolate the balance sheet based on the percentage of sales.

A) 1, 2, 3, 4, 5

B) 1, 5, 3, 4, 2

C) 3, 4, 5, 1, 2

D) 4, 3, 5, 1, 2

E) 5, 3, 4, 1, 2

1) Estimate future retained earnings.

2) Modify or iterate until the forecast makes sense.

3) Determine the financial policy variables of interest.

4) Set all non-financial policy variables as a percentage of sales.

5) Extrapolate the balance sheet based on the percentage of sales.

A) 1, 2, 3, 4, 5

B) 1, 5, 3, 4, 2

C) 3, 4, 5, 1, 2

D) 4, 3, 5, 1, 2

E) 5, 3, 4, 1, 2

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

12

Accruals and payables that arise during the normal course of business are best described as:

A) long-term debt.

B) common equity.

C) invested capital.

D) short-term debt.

E) spontaneous liabilities.

A) long-term debt.

B) common equity.

C) invested capital.

D) short-term debt.

E) spontaneous liabilities.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

13

Risk management that views the business enterprise as a whole is best described as:

A) entity risk assessment (ERA).

B) corporate risk services (CRS).

C) global risk management (GRM).

D) enterprise risk management (ERM).

A) entity risk assessment (ERA).

B) corporate risk services (CRS).

C) global risk management (GRM).

D) enterprise risk management (ERM).

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

14

The specification of how much risk a company will tolerate is best described as:

A) risk ceiling.

B) risk attitude.

C) risk appetite.

D) risk aversion.

A) risk ceiling.

B) risk attitude.

C) risk appetite.

D) risk aversion.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is incorrect?

A) Financial risk comes from the use of debt to finance operations.

B) All entities face business risk, which is dictated by the line of business the company operates in.

C) Sales risk is the risk that arises when some operating costs are fixed over a wide range of production or unit sales.

D) An enterprise's risk appetite is generally established by the company's board of directors and top management.

A) Financial risk comes from the use of debt to finance operations.

B) All entities face business risk, which is dictated by the line of business the company operates in.

C) Sales risk is the risk that arises when some operating costs are fixed over a wide range of production or unit sales.

D) An enterprise's risk appetite is generally established by the company's board of directors and top management.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not a method of measuring risks to a company?

A) Stress testing

B) Risk transference

C) Value at risk (VaR)

D) Simulation that incorporates uncertain elements, probabilities, and possible outcomes.

A) Stress testing

B) Risk transference

C) Value at risk (VaR)

D) Simulation that incorporates uncertain elements, probabilities, and possible outcomes.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

17

Which method of risk measurement best identifies the most a company can lose?

A) Stress testing

B) Risk transference

C) Value at risk (VaR)

D) Simulation that incorporates uncertain elements, probabilities, and possible outcomes.

A) Stress testing

B) Risk transference

C) Value at risk (VaR)

D) Simulation that incorporates uncertain elements, probabilities, and possible outcomes.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is incorrect?

A) The focus of stress testing is on the negative outcomes and the ability of an entity to survive these outcomes.

B) Volatility, interest rates, equity markets, commodity markets, credit spreads, and swap spreads are all inputs in stress testing.

C) Stress testing is useful to satisfy regulatory requirements, but is not useful in planning and feedback into the company's strategy.

D) Stress testing depends on good inputs and estimates, the ability to develop plausible and useful scenarios, and modeling tools to analyze risk.

A) The focus of stress testing is on the negative outcomes and the ability of an entity to survive these outcomes.

B) Volatility, interest rates, equity markets, commodity markets, credit spreads, and swap spreads are all inputs in stress testing.

C) Stress testing is useful to satisfy regulatory requirements, but is not useful in planning and feedback into the company's strategy.

D) Stress testing depends on good inputs and estimates, the ability to develop plausible and useful scenarios, and modeling tools to analyze risk.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is a form of transferring risk?

A) Avoiding risk

B) Assuming risk

C) Acquiring insurance

D) Mitigate risk

A) Avoiding risk

B) Assuming risk

C) Acquiring insurance

D) Mitigate risk

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

20

A food processor using commodity futures to lock in the sale price of grains is best described as what means of risk mitigation?

A) Insuring

B) Hedging

C) Securitization

D) Credit default swap

A) Insuring

B) Hedging

C) Securitization

D) Credit default swap

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

21

The common form of risk mitigation where a company pays an insurance premium to another party to take on a specific risk is best described as:

A) hedge.

B) insurance.

C) securitization.

D) credit default swap.

A) hedge.

B) insurance.

C) securitization.

D) credit default swap.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

22

From the perspective of a food processor who wants to lock in the future purchase price of a particular commodity, the most useful tool is:

A) selling futures contracts.

B) buying futures contracts.

C) selling a credit default swap.

D) buying a credit default swap.

A) selling futures contracts.

B) buying futures contracts.

C) selling a credit default swap.

D) buying a credit default swap.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

23

Strategy is the direction that the entity intends on moving in the long-term.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

24

Financial decision making is almost always with uncertainty.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

25

Sustainable growth rate = Return on equity × Dividend payout ratio

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

26

Sustainable growth rate = Return on equity × Retention rate

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

27

The most important input in financial forecasting is an accurate sales forecast because sales growth drives a company's financing requirements.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

28

External financing requirements (EFR) are retained earnings that are forecasted to be reinvested to fund the company's operations.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

29

It would be reasonable for company treasurer conducting financial forecasting to assume that spontaneous liabilities would increase at the rate of sales.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

30

A company with a return on equity of 30% and a dividend payout of 25% will have a sustainable growth rate of 7.5%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

31

A company with a return on equity of 45% and a dividend payout of 30% will have a sustainable growth rate of 31.5%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

32

When preparing a financial forecast for a company that does not anticipate changing its payment policy, payables should be projected to increase in line with sales.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

33

It is possible to forecast with certainty.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

34

VaR can be used to evaluate particular investments in isolation.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

35

A long hedge is the commitment to buy a commodity by buying a futures contract.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

36

A credit default swap is a contract in which one party pays another party to assume a specified risk.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

37

Generic Company's treasurer projects the following sales for the company: 2013 $250,000, 2014 $250,000, 2015 $500,000, 2016 $600,000. Inventory for Generic Company was $100,000 at the end of 2013. What should the treasurer forecast inventory to be for 2014, 2015 and 2016 using the percentage of sales method?

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

38

A student decides to finance college by starting a t-shirt company. In 2013, the t-shirt company had $50,000 in sales and ended the year with receivables of $7,000. After conducting some research, the student forecasts a steady sales growth of 15% for the next 5 years, which should take him through graduate school. With this forecasted sales growth, what are expected sales for each of the 5 years following 2013? Also, what is the expected amount of receivables for each of the 5 years following 2013?

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

39

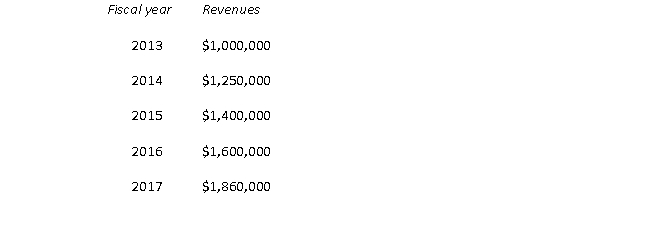

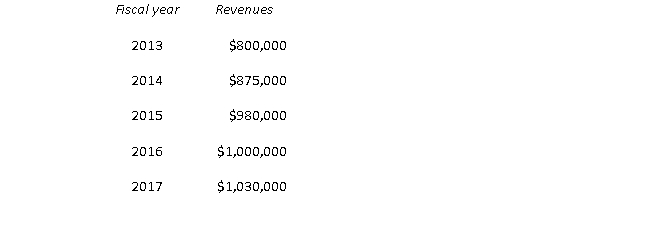

Consider the following historical sales results for Company A:

What is the average annual sales growth for Company A over this 5-year period? What would you predict 2018 sales to be?

What is the average annual sales growth for Company A over this 5-year period? What would you predict 2018 sales to be?

What is the average annual sales growth for Company A over this 5-year period? What would you predict 2018 sales to be?

What is the average annual sales growth for Company A over this 5-year period? What would you predict 2018 sales to be?

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

40

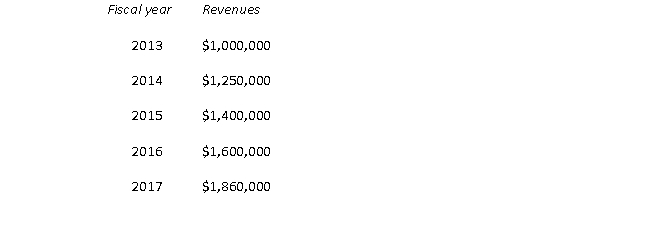

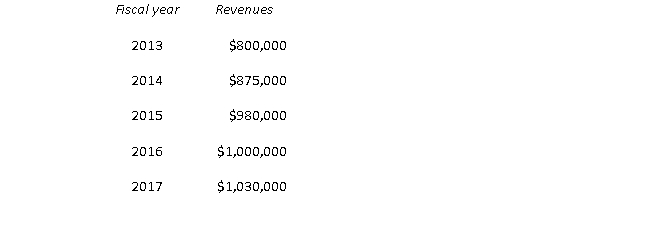

Consider the following historical sales results for Company A:

What is the average annual sales growth for Company A over this 5-year period? What would you predict 2018 sales to be?

What is the average annual sales growth for Company A over this 5-year period? What would you predict 2018 sales to be?

What is the average annual sales growth for Company A over this 5-year period? What would you predict 2018 sales to be?

What is the average annual sales growth for Company A over this 5-year period? What would you predict 2018 sales to be?

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

41

List the three steps in the process of risk management.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

42

Sustainable growth considers the return on equity and the portion of funds reinvested in the business.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

43

The more a company retains in a business, as long as the return on equity is positive, the:

A) lower the sustainable growth.

B) greater the sustainable growth.

A) lower the sustainable growth.

B) greater the sustainable growth.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

44

A company that has a return on assets of 10 percent, an equity multiplier of 2 times, and a dividend payout of 40 percent has a sustainable growth closest to:

A) 8 percent.

B) 12 percent.

C) 20 percent.

A) 8 percent.

B) 12 percent.

C) 20 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

45

Accounts payable are best described as:

A) bank loans.

B) long-term debt.

C) securitized debt.

D) spontaneous liabilities.

A) bank loans.

B) long-term debt.

C) securitized debt.

D) spontaneous liabilities.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

46

The use of the relation between sales and balance sheet and income statement accounts to forecast amounts of future accounts is best described as the:

A) common size method.

B) percentage of sales method.

C) balance sheet equivalent method.

A) common size method.

B) percentage of sales method.

C) balance sheet equivalent method.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

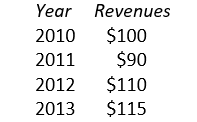

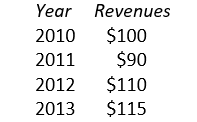

47

Consider a company with the following revenues (in millions):

The average annual rate of growth in revenues is closest to:

The average annual rate of growth in revenues is closest to:

A) 3.56%

B) 3.75%.

C) 4.76%

D) 5.00%.

The average annual rate of growth in revenues is closest to:

The average annual rate of growth in revenues is closest to:A) 3.56%

B) 3.75%.

C) 4.76%

D) 5.00%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

48

The management of the risk of the entity as a whole is best described as:

A) ERP analysis.

B) hedging analysis.

C) enterprise risk management.

A) ERP analysis.

B) hedging analysis.

C) enterprise risk management.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

49

A cereal processor the requires a supply of grains may lock in a future price of grain by:

A) selling futures contracts.

B) buying futures contracts.

A) selling futures contracts.

B) buying futures contracts.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

50

Stress testing is used primarily to forecast outcomes based on typical or usual economic scenarios.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

51

Methods of shifting risk include all but which of the following?

A) Hedging

B) Insurance

C) Speculation

D) Credit default swap

A) Hedging

B) Insurance

C) Speculation

D) Credit default swap

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck