Deck 14: Loan Amortization: Mortgages

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

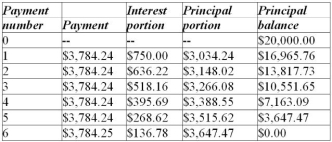

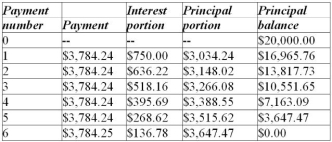

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/88

Play

Full screen (f)

Deck 14: Loan Amortization: Mortgages

1

Golden Dragon Restaurant obtained a $9000 loan at 9% compounded annually to replace some kitchen equipment. Prepare a complete amortization schedule if the loan is to be repaid by semiannual payments over a three-year term. Calculate the total interest charges.

$1436.7

2

Valley Produce received $50,000 in vendor financing at 7.8% compounded semiannually for the purchase of harvesting machinery. The contract requires equal annual payments for seven years to repay the debt. Construct the amortization schedule for the debt. How much interest will be paid over the seven-year term?

$17,115.2

3

Dr. Alvano borrowed $8000 at 8% compounded quarterly to purchase a new X-Ray machine for his clinic. The agreement requires quarterly payments during a two-year amortization period. Suppose that the loan permits an additional prepayment of principal on any scheduled payment date. Prepare an amortization schedule that reflects a prepayment of $1500 with the third scheduled payment.

Not Answered

4

Jean and Walter Pereira financed the addition of a swimming pool using a $24,000 home improvement loan from their bank. Monthly payments were based on an interest rate of 7.2% compounded semiannually and a five-year amortization. Construct a partial amortization schedule showing details of the first two payments, Payments 30 and 31, and the last two payments. What total interest will the Pereiras pay over the life of the loan?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

5

Golden Dragon Restaurant obtained a $9000 loan at 12.75% compounded annually to replace some kitchen equipment. Prepare a complete amortization schedule if payments of $1800 (except for a smaller final payment) are made semiannually.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

6

Valley Produce received $50,000 in vendor financing at 7.8% compounded semiannually for the purchase of harvesting machinery. The contract requires annual payments of $10,000 (except for a smaller final payment). Construct the complete amortization schedule for the debt. How much interest will be paid over the entire life of the loan?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

7

Dr. Alvano borrowed $8000 at 8% compounded quarterly to purchase a new X-Ray machine for his clinic. The agreement requires quarterly payments during a two-year amortization period. Suppose that the loan permits an additional prepayment of principal on any scheduled payment date. Prepare an amortization schedule that reflects a prepayment of $1000 with the third scheduled payment.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

8

Jean and Walter Pereira financed the addition of a swimming pool using a $24,000 home improvement loan from their bank. Monthly payments of $500 (except for a smaller final payment) include interest at 7.2% compounded semiannually. Construct a partial amortization schedule showing details of the first two payments, Payments 28 and 29, and the last two payments. What total interest will the Pereiras pay over the life of the loan?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

9

Using the Loan Amortization Chart Follow the instructions in the NET @ssets box at the beginning of Section 14.1 for accessing and using the Loan Amortization Chart in this student textbook's Online Learning Centre. Enter $10,000 for the "Loan amount"and 7.5% for the monthly compounded "Interest rate."

a) Compare the profiles of the bar charts for loan terms of 30 months and 30 years. Approximately what percentage of the original principal is paid off midway through the term in each case?

b) Prepare a table presenting the total interest paid over the life of the loan for terms of 5, 10, 15, 20, 25, and 30 years.

c) Next, vary the "Term in months"

to find the term for which the total interest paid over the life of the loan equals: (i) the original principal, and (ii) 1.5 times the original principal.

a) Compare the profiles of the bar charts for loan terms of 30 months and 30 years. Approximately what percentage of the original principal is paid off midway through the term in each case?

b) Prepare a table presenting the total interest paid over the life of the loan for terms of 5, 10, 15, 20, 25, and 30 years.

c) Next, vary the "Term in months"

to find the term for which the total interest paid over the life of the loan equals: (i) the original principal, and (ii) 1.5 times the original principal.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

10

Using the Loan Amortization Chart Follow the instructions in the NET @ssets box at the beginning of Section 14.1 for accessing and using the Loan Amortization Chart in this student textbook's Online Learning Centre. Use this chart and its associated report to solve:

a) Monica bought a $1250 stereo system for 20% down, with the balance to be paid with interest at 15%compounded monthly in six equal monthly payments. Construct the full amortization schedule for the debt. Calculate the total interest paid.

a) Monica bought a $1250 stereo system for 20% down, with the balance to be paid with interest at 15%compounded monthly in six equal monthly payments. Construct the full amortization schedule for the debt. Calculate the total interest paid.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

11

Will a loan's balance midway through its amortization period be (pick one): (i) more than (ii) less than or (iii) equal to half of the original principal? Explain.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

12

A loan has a 10-year amortization period. If the interest rate is fixed, will the principal repaid in the third year be (pick one): (i) more than (ii) less than or (iii) equal to the principal repaid in the seventh year? Explain.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

13

A loan has a five-year amortization period. If the interest rate is fixed, will the interest paid in the 4th year be (pick one): (i) more than (ii) less than or (iii) equal to the interest paid in the second year? Explain.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

14

Loan A is for $20,000 while Loan B is for $10,000. Both have the same interest rate and amortization period. Will the total interest paid on Loan A be (pick one): (i) more than (ii) less than or (iii) equal to twice the total interest paid on Loan B? Explain.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

15

The interest rate on a $14,000 loan is 8.4% compounded semiannually. Semiannual payments will pay off the loan in seven years.

a) Calculate the interest component of Payment 10.

b) Calculate the principal component of Payment 3.

c) Calculate the interest paid in Year 6.

d) How much do Payments 3 to 6 inclusive reduce the principal balance?

a) Calculate the interest component of Payment 10.

b) Calculate the principal component of Payment 3.

c) Calculate the interest paid in Year 6.

d) How much do Payments 3 to 6 inclusive reduce the principal balance?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

16

Elkford Logging's bank will fix the interest rate on a $60,000 loan at 8.1% compounded monthly for the first four-year term of an eight-year amortization period. Monthly payments are required on the loan.

a) If the prevailing interest rate on four-year loans at the beginning of the second term is 7.5% compounded monthly, what will be the monthly payments for the last four years?

b) What will be the interest portion of the twenty-third payment?

c) Calculate the principal portion of the fifty-third payment

a) If the prevailing interest rate on four-year loans at the beginning of the second term is 7.5% compounded monthly, what will be the monthly payments for the last four years?

b) What will be the interest portion of the twenty-third payment?

c) Calculate the principal portion of the fifty-third payment

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

17

Christina has just borrowed $12,000 at 9% compounded semiannually. Since she expects to receive a $10,000 inheritance in two years when she turns 25, she has arranged with her credit union to make monthly payments that will reduce the principal balance to exactly $10,000 in two years.

a) What monthly payments will she make?

b) What will be the interest portion of the ninth payment?

c) Determine the principal portion of the sixteenth payment.

a) What monthly payments will she make?

b) What will be the interest portion of the ninth payment?

c) Determine the principal portion of the sixteenth payment.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

18

Using the Loan Amortization Chart Follow the instructions in the NET @ssets box at the beginning of Section 14.1 for accessing and using the Loan Amortization Chart in this textbook's Online Learning Centre (OLC). Use this chart and its associated report to solve:

Ms. Esperanto obtained a $40,000 home equity loan at 7.5% compounded monthly.

a) What will she pay monthly if the amortization period is 15 years?

b) How much of the payment made at the end of the fifth year will go towards principal and how much will go towards interest?

c) What will be the balance on the loan after five years?

d) How much interest did she pay during the fifth year?

Ms. Esperanto obtained a $40,000 home equity loan at 7.5% compounded monthly.

a) What will she pay monthly if the amortization period is 15 years?

b) How much of the payment made at the end of the fifth year will go towards principal and how much will go towards interest?

c) What will be the balance on the loan after five years?

d) How much interest did she pay during the fifth year?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

19

Elkford Logging's bank will fix the interest rate on a $60,000 loan at 8.1% compounded monthly for the first four-year term of an eight-year amortization period. Monthly payments are required on the loan.

a) If the prevailing interest rate on four-year loans at the beginning of the second term is 7.5% compounded monthly, what will be the monthly payments for the last four years?

b) What will be the interest portion of the twenty-third payment?

c) Calculate the principal portion of the fifty-third payment

a) If the prevailing interest rate on four-year loans at the beginning of the second term is 7.5% compounded monthly, what will be the monthly payments for the last four years?

b) What will be the interest portion of the twenty-third payment?

c) Calculate the principal portion of the fifty-third payment

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

20

Using the Composition of Loan Payments Chart An interactive chart for investigating the composition of loan payments is provided in the student textbook's Online Learning Centre (OLC). Go to the Student Edition of the OLC. In the navigation bar, select "Chapter 14" in the drop-down box. In the list of resources for Chapter 14, select "Links in Student textbook" and then click on the link named "Composition of Loan Payments." The chart provides cells for entering the essential information about a loan (PV, j, m, PMT, and payments/year). You can then compare the composition (interest and principal components) of any two payments. Simply enter the serial numbers of the two payments and then click on the "Submit" button. Two bar diagrams provide a visual comparison of the interest and principal components. The actual numerical values are also displayed. Consider a $120,000 mortgage loan at 6.5% compounded semiannually. Monthly payments of $800 will pay off the loan in 25 years and 4 months.

a) How much more interest is paid by the 20th payment than the 220th payment?

b) How long does it take before the interest component of a payment drops below 50%?

c) Which payment number is closest to being comprised of: (i) 75% interest? (ii) 25%interest?

d) Which payment number comes closest to having a mix of principal and interest that is the opposite of the first payment's mix?

e) Which payment number comes closest to having double the principal component of the 5th payment?

f) Which payment number comes closest to having half the interest component of the 10th payment?

a) How much more interest is paid by the 20th payment than the 220th payment?

b) How long does it take before the interest component of a payment drops below 50%?

c) Which payment number is closest to being comprised of: (i) 75% interest? (ii) 25%interest?

d) Which payment number comes closest to having a mix of principal and interest that is the opposite of the first payment's mix?

e) Which payment number comes closest to having double the principal component of the 5th payment?

f) Which payment number comes closest to having half the interest component of the 10th payment?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

21

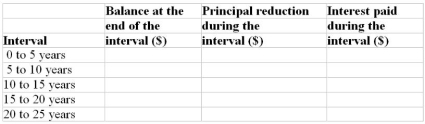

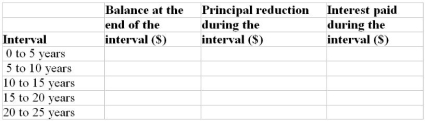

A $100,000 mortgage loan at 7.2% compounded semiannually requires monthly payments based on a 25- year amortization. Assuming that the interest rate does not change for the entire 25 years, complete the following table.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

22

The interest rate on a $100,000 mortgage loan is 7% compounded semiannually.

a) Calculate the monthly payment for each of 20-year, 25-year, and 30-year amortizations.

b) By what percentage must the monthly payment be increased for a 25-year amortization instead of a 30-year amortization?

c) By what percentage must the monthly payment be increased for a 20-year amortization instead of a 30-year amortization?

d) For each of the three amortization periods in part a, calculate the total interest paid over the entire amortization period (assuming that the interest rate and payments do not change).

a) Calculate the monthly payment for each of 20-year, 25-year, and 30-year amortizations.

b) By what percentage must the monthly payment be increased for a 25-year amortization instead of a 30-year amortization?

c) By what percentage must the monthly payment be increased for a 20-year amortization instead of a 30-year amortization?

d) For each of the three amortization periods in part a, calculate the total interest paid over the entire amortization period (assuming that the interest rate and payments do not change).

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

23

The Graftons can afford a maximum mortgage payment of $1000 per month. The current interest rate is

7.2% compounded semiannually. What is the maximum mortgage loan they can afford if the amortization period is:

a) 15 years?

b) 20 years?

c) 25 years?

d) 30 years?

7.2% compounded semiannually. What is the maximum mortgage loan they can afford if the amortization period is:

a) 15 years?

b) 20 years?

c) 25 years?

d) 30 years?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

24

A $100,000 mortgage loan at 7.6% compounded semiannually has a 25-year amortization period.

a) Calculate the monthly payment.

b) If the interest rate were 1% lower (that is, 6.6% compounded semiannually), what loan amount would result in the same monthly payment?

a) Calculate the monthly payment.

b) If the interest rate were 1% lower (that is, 6.6% compounded semiannually), what loan amount would result in the same monthly payment?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

25

The Switzers are nearing the end of the first five-year term of a $100,000 mortgage loan with a 25-year amortization. The interest rate has been 6.5% compounded semiannually for the initial term. How much will their monthly payments increase if the interest rate upon renewal is 7.5% compounded semiannually?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

26

The interest rate for the first three years of an $80,000 mortgage loan is 7.4% compounded semiannually. Monthly payments are calculated using a 25-year amortization.

a) What will be the principal balance at the end of the three-year term?

b) What will the monthly payments be if the loan is renewed at 6.8% compounded semiannually (and the original amortization period is continued)?

a) What will be the principal balance at the end of the three-year term?

b) What will the monthly payments be if the loan is renewed at 6.8% compounded semiannually (and the original amortization period is continued)?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

27

Five years ago, Ms. Halliday received a mortgage loan from the Bank of Nova Scotia for $60,000 at 7.8% compounded semiannually for a five-year term. Monthly payments were based on a 25-year amortization. The bank is agreeable to renewing the loan for another five-year term at 6.8% compounded semiannually. Calculate the principal reduction that will occur in the second five-year term if:

a) The payments are recalculated based on the new interest rate and a continuation of the original 25-year amortization.

b) Ms. Halliday continues to make the same payments as she made for the first five years (resulting in a reduction of the amortization period).

a) The payments are recalculated based on the new interest rate and a continuation of the original 25-year amortization.

b) Ms. Halliday continues to make the same payments as she made for the first five years (resulting in a reduction of the amortization period).

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

28

A $40,000 mortgage loan charges interest at 6.6% compounded monthly for a four-year term. Monthly payments were calculated for a 15-year amortization and then rounded up to the next higher $10.

a) What will be the principal balance at the end of the first term?

b) What will the monthly payments be on renewal for a three-year term if it is calculated for an interest rate of 7.2% compounded monthly and an 11-year amortization period, but again rounded to the next higher $10?

a) What will be the principal balance at the end of the first term?

b) What will the monthly payments be on renewal for a three-year term if it is calculated for an interest rate of 7.2% compounded monthly and an 11-year amortization period, but again rounded to the next higher $10?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

29

The Delgados have a gross monthly income of $6000. Monthly payments on personal loans total $500. Their bank limits the gross debt service ratio at 33% and the total debt service ratio at 42%.

a) Rounded to the nearest $100, what is the maximum 25-year mortgage loan for which they can qualify on the basis of their income? Assume monthly heating costs of $120 and property taxes of $200 per month. Current mortgage rates are 6.8% compounded semiannually.

b) Rounded to the nearest $100, what minimum down payment must they have to qualify for the maximum conventional mortgage (80% loan-to-value ratio) on a new home?

a) Rounded to the nearest $100, what is the maximum 25-year mortgage loan for which they can qualify on the basis of their income? Assume monthly heating costs of $120 and property taxes of $200 per month. Current mortgage rates are 6.8% compounded semiannually.

b) Rounded to the nearest $100, what minimum down payment must they have to qualify for the maximum conventional mortgage (80% loan-to-value ratio) on a new home?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

30

Marge and Homer Sampson have saved $90,000 toward the purchase of their first home. Allowing $7000 for legal costs and moving expenses, they have $83,000 available for a down payment.

a) Based only on a loan-to-value ratio of 80%, what is the maximum purchase price they can consider?

b) After thorough investigation, the Sampsons made a $270,000 offer on a townhouse subject to arranging financing. Next they met with their banker. With an $83,000 down payment, the Sampsons will need a mortgage loan of $187,000. The current interest rate on a five-year term fixed-rate mortgage with a 25-year amortization is 6.9% compounded semiannually. The banker gathered data for calculating the Sampsons' GDS and TDS ratios. Annual property taxes will be $2400. Annual heating costs will be about $1800. The Sampsons make monthly payments of $700 on a car loan ($12,000 balance). Their gross monthly income is $5500. Calculate the GDS and TDS ratios for the Sampsons.

c) Note that the Sampsons meet the GDS criterion (_32%) but exceed the TDS limit (40%). The item causing the problem is the $700 per month car payment. Suppose the Sampsons use $12,000 of their down-payment savings to pay off the car loan. They will still have enough to make the minimum down payment (0.25 _ $270,000 = $67,500) but will have to increase the mortgage loan by $12,000 to $199,000. Recalculate the GDS and TDS ratios. Do the Sampsons satisfy all three ratios by taking this approach?

a) Based only on a loan-to-value ratio of 80%, what is the maximum purchase price they can consider?

b) After thorough investigation, the Sampsons made a $270,000 offer on a townhouse subject to arranging financing. Next they met with their banker. With an $83,000 down payment, the Sampsons will need a mortgage loan of $187,000. The current interest rate on a five-year term fixed-rate mortgage with a 25-year amortization is 6.9% compounded semiannually. The banker gathered data for calculating the Sampsons' GDS and TDS ratios. Annual property taxes will be $2400. Annual heating costs will be about $1800. The Sampsons make monthly payments of $700 on a car loan ($12,000 balance). Their gross monthly income is $5500. Calculate the GDS and TDS ratios for the Sampsons.

c) Note that the Sampsons meet the GDS criterion (_32%) but exceed the TDS limit (40%). The item causing the problem is the $700 per month car payment. Suppose the Sampsons use $12,000 of their down-payment savings to pay off the car loan. They will still have enough to make the minimum down payment (0.25 _ $270,000 = $67,500) but will have to increase the mortgage loan by $12,000 to $199,000. Recalculate the GDS and TDS ratios. Do the Sampsons satisfy all three ratios by taking this approach?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

31

A $200,000 mortgage at 6.6% compounded semiannually with a 25-year amortization requires monthly payments. The mortgage allows the borrower to prepay up to 10% of the original principal once each year. How much will the amortization period be shortened if, on the first anniversary of the mortgage, the borrower makes (in addition to the regular payment) a prepayment of:

a) $10,000?

b) $20,000?

a) $10,000?

b) $20,000?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

32

A $200,000 mortgage at 6.6% compounded semiannually with a 30-year amortization requires monthly payments. The mortgage allows the borrower to prepay up to 10% of the original principal once each year. How much will the amortization period be shortened if, on the first anniversary of the mortgage, the borrower makes (in addition to the regular payment) a prepayment of:

a) $10,000?

b) $20,000?

a) $10,000?

b) $20,000?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

33

A $100,000 mortgage at 6.9% compounded semiannually with a 25-year amortization requires monthly payments. The mortgage entitles the borrower to increase the regular payment by up to 10% once each year. How much will the amortization period be shortened if, after the 12th payment, the payments are increased by:

a) 7.5%?

b) 15%?

a) 7.5%?

b) 15%?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

34

A $100,000 mortgage at 6.9% compounded semiannually with a 30-year amortization requires monthly payments. The mortgage allows the borrower to increase the regular payment by up to 10% once each year. How much will the amortization period be shortened if payments are increased by 10% after the 12th payment, and by another 10% after Payment 24?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

35

A $100,000 mortgage at 6.2% compounded semiannually with a 25-year amortization requires monthly payments. The mortgage allows the borrower to "double up"

on a payment once each year. How much will the amortization period be shortened if the mortgagor doubles the tenth payment?

on a payment once each year. How much will the amortization period be shortened if the mortgagor doubles the tenth payment?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

36

A $100,000 mortgage at 6.8% compounded semiannually with a 30-year amortization requires monthly payments. The mortgage allows the mortgagor to "double up"on a payment once each year. How much will the amortization period be shortened if the borrower doubles the eighth payment?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

37

A $100,000 mortgage at 6.75% compounded semiannually with a 20-year amortization requires monthly payments. The mortgage allows the borrower to miss a payment once each year. How much will the amortization period be lengthened if the borrower misses the ninth payment? (The interest that accrues during the ninth month is converted to principal at the end of the ninth month.)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

38

A $100,000 mortgage at 7.3% compounded semiannually with a 25-year amortization requires monthly payments. The mortgage allows the borrower to miss a payment once each year. How much will the amortization period be lengthened if the borrower misses the 12th payment? (The interest that accrues during the 12th month is converted to principal at the end of the 12th month.)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

39

A $100,000 mortgage at 7.1% compounded semiannually with a 30-year amortization requires monthly payments. How much will the amortization period be shortened if a $10,000 lump payment is made along with the 12th payment and payments are increased by 10% starting in the third year?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

40

Monthly payments on a $150,000 mortgage are based on an interest rate of 6.6% compounded semiannually and a 30-year amortization. If a $5000 prepayment is made along with the 32nd payment.

a) How much will the amortization period be shortened?

b) What will be the principal balance after four years?

a) How much will the amortization period be shortened?

b) What will be the principal balance after four years?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

41

The MacLellans originally chose to make payments of $160 per month on a $138,000 mortgage written at 7.4% compounded semiannually for the first five years. After three years they exercised the right under the mortgage contract to increase the payments by 10%.

a) If the interest rate does not change, when will they extinguish the mortgage debt?

b) What will be the principal balance at the end of the five-year term?

a) If the interest rate does not change, when will they extinguish the mortgage debt?

b) What will be the principal balance at the end of the five-year term?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

42

The monthly payments on the Wolskis' $166,000 mortgage were originally based on a 25-year amortization and an interest rate of 7% compounded semiannually for a five-year term. After two years, they elected to increase their monthly payments by $100, and at the end of the fourth year they made a $10,000 prepayment.

a) How much have they shortened the amortization period?

b) What was the principal balance at the end of the five-year term?

a) How much have they shortened the amortization period?

b) What was the principal balance at the end of the five-year term?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

43

A marketing innovation is the "cash-back mortgage" wherein the lender gives the borrower an up-front bonus cash payment. For example, if you borrow $100,000 on a 3% cash-back mortgage loan, the lender will give you $3000 in addition to the $100,000 loan. You pay back only the $100,000 principal over the amortization period. The $3000 can be immediately applied as a prepayment to reduce the principal balance (to $97,000) or it can be used for any other purpose. You must keep your mortgage with the lender for at least five years.

The cash-back mortgage seems like a good deal but there is more you need to know about advertised mortgage interest rates. The rates you see posted in your local financial institution are just a starting point for negotiations. You can get ¼ % knocked off just by asking for it. With some firm negotiating, you can probably get a ½ % reduction. If the institution really wants your business, you can get a ¾ %, or even a 1% reduction. However, if you take advantage of some other promotion such as a cash-back offer, you will not get any rate discount. So the cash-back offer is not as good as it initially appears.

Which of the following loans should be chosen by the borrower?

--A standard $100,000 mortgage loan at 6.5% compounded semiannually?

--A 3% cash-back mortgage loan for $100,000 at 7.25% compounded semiannually?

In both cases, the interest rate is for a five-year term and the payments are based on a 25-year amortization. For the cash-back mortgage, assume that the $3000 cash bonus is immediately applied to reduce the balance to $97,000. (Since the monthly payments are based on the $100,000 face value, the prepayment will shorten the time required to pay off the loan.) Assume money can earn 4.8% compounded monthly.

The cash-back mortgage seems like a good deal but there is more you need to know about advertised mortgage interest rates. The rates you see posted in your local financial institution are just a starting point for negotiations. You can get ¼ % knocked off just by asking for it. With some firm negotiating, you can probably get a ½ % reduction. If the institution really wants your business, you can get a ¾ %, or even a 1% reduction. However, if you take advantage of some other promotion such as a cash-back offer, you will not get any rate discount. So the cash-back offer is not as good as it initially appears.

Which of the following loans should be chosen by the borrower?

--A standard $100,000 mortgage loan at 6.5% compounded semiannually?

--A 3% cash-back mortgage loan for $100,000 at 7.25% compounded semiannually?

In both cases, the interest rate is for a five-year term and the payments are based on a 25-year amortization. For the cash-back mortgage, assume that the $3000 cash bonus is immediately applied to reduce the balance to $97,000. (Since the monthly payments are based on the $100,000 face value, the prepayment will shorten the time required to pay off the loan.) Assume money can earn 4.8% compounded monthly.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

44

Using the Loan Amortization Chart To access this chart, go to the Student Edition of the textbook's Online Learning Centre. In the navigation bar, select "Chapter 14" in the drop-down box. In the list of resources for Chapter 14, select "Links in Textbook" and then click on the link named "Mortgage Payoff Chart." Over the full amortization period, the chart plots graphs of both the mortgage balance and the cumulative interest paid. Note the "Definitions" section below the chart.

You can select from a variety of accelerated payment and prepayment options. If you enter a nonzero "Prepayment amount", the chart presents additional graphs for the balance and cumulative interest under the prepayment plan. (Round prepayment amounts to the nearest dollar before entry.) These graphs enable you to see how much the prepayments reduce both the cumulative interest cost and the time required to pay off the loan. Use this chart ( and its associated report) to answer the following problems.

In Parts (b) through (f), round the answer to the nearest 0.1 year. Also note that the reduction (referred to as "savings") in the total interest paid is over the life of the loan.

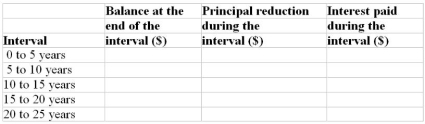

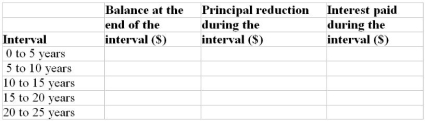

A $100,000 mortgage loan at 7.2% compounded semiannually requires monthly payments based on a 25- year amortization. Assuming that the interest rate does not change for the entire 25 years, complete the following table.

You can select from a variety of accelerated payment and prepayment options. If you enter a nonzero "Prepayment amount", the chart presents additional graphs for the balance and cumulative interest under the prepayment plan. (Round prepayment amounts to the nearest dollar before entry.) These graphs enable you to see how much the prepayments reduce both the cumulative interest cost and the time required to pay off the loan. Use this chart ( and its associated report) to answer the following problems.

In Parts (b) through (f), round the answer to the nearest 0.1 year. Also note that the reduction (referred to as "savings") in the total interest paid is over the life of the loan.

A $100,000 mortgage loan at 7.2% compounded semiannually requires monthly payments based on a 25- year amortization. Assuming that the interest rate does not change for the entire 25 years, complete the following table.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

45

A $200,000 mortgage at 6.6% compounded semiannually with a 30-year amortization requires monthly payments. The mortgage allows the borrower to prepay up to 10% of the original principal once each year. How much will the amortization period be shortened if, on the first anniversary of the mortgage, the borrower makes (in addition to the regular payment) a prepayment of:

a) $10,000? b) $20,000?

a) $10,000? b) $20,000?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

46

A $100,000 mortgage at 6.8% compounded semiannually with a 30-year amortization requires monthly payments. The mortgage allows the mortgagor to "double up" on a payment once each year. How much will the amortization period be shortened if the borrower doubles the eighth payment?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

47

The Gills have arranged a second mortgage loan with a face value of $21,500 at an interest rate of 6.5% compounded monthly. The face value is to be fully amortized by equal monthly payments over a five-year period. The Gills received only $20,000 of the face value, the difference being a bonus retained by the lender. What is the actual cost of borrowing, including the bonus, expressed as an effective interest rate?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

48

A mortgage loan having a face value of $63,000 is arranged by a mortgage broker. From this face value, the broker deducted her fee of $3000. The mortgage is written at a contract rate of 8% compounded semiannually for a five-year term. Monthly payments are calculated on a 25-year amortization. What is the annual cost of borrowing, including the brokerage fee, expressed as an effective interest rate?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

49

A borrower has arranged a $105,000 face value, bonused mortgage loan with a broker at an interest rate of 10.8% compounded semiannually. Monthly payments are based on a 15-year amortization. A $5000 placement fee will be retained by the broker.

What is the effective annual cost of the funds actually advanced to the borrower if the contractual interest rate is for

a. a five-year term?

b. a 10-year term?

c. the entire 15-year amortization period?

What is the effective annual cost of the funds actually advanced to the borrower if the contractual interest rate is for

a. a five-year term?

b. a 10-year term?

c. the entire 15-year amortization period?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

50

A local mortgage broker has arranged a mortgage loan with a face value of $77,500, which included a finder's fee of $2500. The loan is to be amortized by monthly payments over 20 years at 7% compounded semiannually. What is the actual cost of borrowing, expressed as an effective annual rate, if the contractual interest rate is for

a. a three-year term?

b. a seven-year term?

c. the entire 20-year amortization period?

a. a three-year term?

b. a seven-year term?

c. the entire 20-year amortization period?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

51

A borrower has the choice between two mortgage loans. Both are to be amortized by monthly payments over 10 years. A mortgage broker will charge a fee of $2200 for an $82,200 face value loan at 10.25% compounded semiannually. A trust company will grant an $80,000 loan (with no other fees) at 10.75% compounded semiannually.

Determine which loan has the lower effective annual cost of borrowing if the contractual interest rates are for

a. a 5-year term.

b. the entire 10-year amortization period.

Determine which loan has the lower effective annual cost of borrowing if the contractual interest rates are for

a. a 5-year term.

b. the entire 10-year amortization period.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

52

Calculate the effective annual cost of borrowing for each of the following three financing alternatives. All interest rates are for a 7-year term and all mortgages use a 20-year amortization to calculate the monthly payments. Bank B will lend $90,000 at 10.75% compounded semiannually. Credit union C will lend $90,000 at 10.5% compounded monthly. Mortgage broker M will lend $93,000 at 10.25% compounded semiannually but will retain $3000 as a brokerage fee.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

53

The vendor of a residential property accepted a $40,000 take-back mortgage to, facilitate the sale. The agreement calls for quarterly payments to amortize the loan over, 10 years at an interest rate of 7% compounded semiannually. What was the cash value, (or fair market value) of the mortgage at the time of the sale if the market interest rate on 10-year term mortgages was

a. 10.5% compounded semiannually?

b. 9% compounded semiannually?

a. 10.5% compounded semiannually?

b. 9% compounded semiannually?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

54

The vendor of a property agrees to take back a $55,000 mortgage at a rate of 7.5% compounded semiannually with monthly payments of $500 for a two-year term.

Calculate the market value of the mortgage if financial institutions are charging 9.5% compounded semiannually on two-year term mortgages.

Calculate the market value of the mortgage if financial institutions are charging 9.5% compounded semiannually on two-year term mortgages.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

55

A mortgagee wishes to sell his interest in a closed mortgage contract that was written 21 months ago. The original loan was for $60,000 at 6.8% compounded semiannually for a 5-year term. Monthly payments are being made on a 20-year amortization schedule. What price can the mortgagee reasonably expect to receive if the current semiannually compounded interest rate on three-year and four-year term mortgages is

a. 6%?

b. 6.8%?

c. 7.5%?

a. 6%?

b. 6.8%?

c. 7.5%?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

56

An investor is considering the purchase of an existing closed mortgage that was written 20 months ago to secure a $45,000 loan at 10% compounded semiannually paying $500 per month for a 4-year term. What price should the investor pay for the mortgage if she requires a semiannually compounded rate of return on investment of

a. 11%?

b. 10%?

c. 9%?

a. 11%?

b. 10%?

c. 9%?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

57

A property is listed for $175,000. A potential purchaser makes an offer of $170,000, consisting of $75,000 cash and a $95,000 mortgage back to the vendor bearing interest at 8% compounded semiannually with monthly payments for a 10-year term and a 10-year amortization. Calculate the equivalent cash value of the offer if 10-year mortgage rates in the market are at 10.25% compounded semiannually.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

58

What is the equivalent cash value of the offer in Problem 11 if the vendor financing arrangement is for the same 10-year amortization but with

a. a five-year term?

b. a one-year term?

a. a five-year term?

b. a one-year term?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

59

The owner of a property listed at $145,000 is considering two offers. Offer C is for $140,000 cash. Offer M is for $50,000 cash and a mortgage back to the vendor for $100,000 at a rate of 8% compounded semiannually and payments of $750 per month for the five-year term. If current five-year rates are 10.25% compounded semiannually, what is the cash equivalent value of M's offer?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

60

You are interested in purchasing a house listed for $180,000. The owner seems quite determined to stay at the asking price, but you think that the true market value is $165,000. It may be that the owner would accept an offer whose nominal value is the psychologically important $180,000 figure but whose cash value is close to your $165,000 figure. What would be the cash value of the following offer if prevailing long-term mortgage rates are 10.5% compounded semiannually? The offer is for the "full"

price of $180,000, consisting of $60,000 down and the balance by a $120,000 mortgage in favour of the vendor. Base monthly payments on a 20-year term, a 20-year amortization, and an interest rate of 8.5% compounded semiannually.

price of $180,000, consisting of $60,000 down and the balance by a $120,000 mortgage in favour of the vendor. Base monthly payments on a 20-year term, a 20-year amortization, and an interest rate of 8.5% compounded semiannually.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

61

The Phams are almost two years into the first 5-year term of a 25-year $80,000 mortgage loan at 7.5% compounded semiannually. Interest rates on three-year term mortgage loans are now 6% compounded semiannually. A job transfer necessitates the sale of the Phams' home. To prepay the closed mortgage, the mortgage contract requires that the Phams pay a penalty equal to the greater of

a. three months' interest on the balance.

b. the difference between the fair market value of the mortgage and the balance.

What would be the amount of the penalty if they pay out the balance at the time of the twenty fourth payment?

a. three months' interest on the balance.

b. the difference between the fair market value of the mortgage and the balance.

What would be the amount of the penalty if they pay out the balance at the time of the twenty fourth payment?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

62

A $75,000 mortgage loan at 9% compounded semiannually has a 5-year term and a 25-year amortization. Prepayment of the loan at any time within the first five years leads to a penalty equal to the greater of a. three months' interest on the balance.

b. the difference between the fair market value of the mortgage and the balance. What would be the amount of the penalty if the balance was paid out just after the nineteenth monthly payment and the prevailing rate on three-year and four-year-term mortgages was 8% compounded semiannually?

b. the difference between the fair market value of the mortgage and the balance. What would be the amount of the penalty if the balance was paid out just after the nineteenth monthly payment and the prevailing rate on three-year and four-year-term mortgages was 8% compounded semiannually?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

63

Givens, Hong, and Partners obtained a $7000 term loan at 8.75% compounded annually for new boardroom furniture. Prepare a complete amortization schedule in which the loan is repaid by equal semiannual payments over three years. Calculate the total interest paid.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

64

Metro Construction received $60,000 in vendor financing at 10.5% compounded semiannually for the purchase of a loader. The contract requires semiannual payments of $10,000 until the debt is paid off. Construct the complete amortization schedule for the debt. How much total interest will be paid over the life of the loan?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

65

A mortgage contract for $45,000 written 10 years ago is just at the end of its second five-year term. The interest rates were 8% compounded semiannually for the first term and 7% compounded semiannually for the second term. If monthly payments throughout have been based on a 25-year amortization, calculate the principal balance at the end of the second term.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

66

The interest rate for the first three years of an $87,000 mortgage is 7.4% compounded semiannually. Monthly payments are based on a 20-year amortization. If a $4000 prepayment is made at the end of the 16th month:

a) How much will the amortization period be shortened?

b) What will be the principal balance at the end of the three-year term?

a) How much will the amortization period be shortened?

b) What will be the principal balance at the end of the three-year term?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

67

Niagara Haulage obtained an $80,000 loan at 7.2% compounded monthly to build a storage shed. Construct a partial amortization schedule for payments of $1200 per month showing details of the first two payments, Payments 41 and 42, and the last two payments.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

68

The interest rate for the first five years of a $90,000 mortgage loan is 7.25% compounded semiannually.

Monthly payments are calculated using a 20-year amortization.

a) What will be the principal balance at the end of the five-year term?

b) What will be the new payments if the loan is renewed at 6.5% compounded semiannually (and the original amortization period is continued)?

Monthly payments are calculated using a 20-year amortization.

a) What will be the principal balance at the end of the five-year term?

b) What will be the new payments if the loan is renewed at 6.5% compounded semiannually (and the original amortization period is continued)?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

69

The interest rate for the first five years of a $95,000 mortgage is 9.5% compounded semiannually. Monthly payments are based on a 25-year amortization. If a $3000 prepayment is made at the end of the third year:

a) How much will the amortization period be shortened?

b) What will be the principal balance at the end of the five-year term?

a) How much will the amortization period be shortened?

b) What will be the principal balance at the end of the five-year term?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

70

There are two offers on a property listed at $185,000. Mr. Smith is offering $183,000 cash. Ms. Jones's offer consists of $100,000 cash and a mortgage back to the vendor for $90,000 at a rate of 7.5% compounded semiannually and payments of $700 per month for a three-year term. If current three-year rates are 9.5% compounded semiannually, what is the equivalent cash value of Ms. Jones's offer? (change in answer format)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

71

A loan of $20,000 is to be repaid by equal semiannual payments over three years at 7.5% compounded semiannually. Construct an amortization schedule for the loan. How much interest is paid in total?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

72

How much interest will the debtor pay in total over the five-year period?

A) $17,178.60

B) $4116.84

C) $4350.80

D) $17,350.80

E) $4178.60

A) $17,178.60

B) $4116.84

C) $4350.80

D) $17,350.80

E) $4178.60

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

73

A loan of $12,000 with interest at 14% compounded annually is to be amortized by equal payments at the end of each year for six years.

-How much interest is included in the third payment?

A) $1258.80

B) $4421.97

C) $1827.09

D) $7164.30

E) $1680.00

-How much interest is included in the third payment?

A) $1258.80

B) $4421.97

C) $1827.09

D) $7164.30

E) $1680.00

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

74

A loan of $12,000 with interest at 14% compounded annually is to be amortized by equal payments at the end of each year for six years.

-What is the outstanding principal just after the fifth payment?

A) $9293.08

B) $6136.37

C) $2706.92

D) $2374.49

E) $3001.63

-What is the outstanding principal just after the fifth payment?

A) $9293.08

B) $6136.37

C) $2706.92

D) $2374.49

E) $3001.63

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

75

An $80,000 loan is amortized by monthly payments over 25 years. The interest rate charged is 10% compounded semiannually.

-What will the principal balance be after three years?

A) $77,400.72

B) $65,965.72

C) $78,898.93

D) $76,532.48

E) $79,617.86

-What will the principal balance be after three years?

A) $77,400.72

B) $65,965.72

C) $78,898.93

D) $76,532.48

E) $79,617.86

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

76

An $80,000 loan is amortized by monthly payments over 25 years. The interest rate charged is 10% compounded semiannually.

-How much interest will be paid during the first three years?

A) $3911.40

B) $25,282.57

C) $20,817.49

D) $23,161.96

E) $22,293.71

-How much interest will be paid during the first three years?

A) $3911.40

B) $25,282.57

C) $20,817.49

D) $23,161.96

E) $22,293.71

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

77

A $3100 item is paid for by end-of-month payments of $350. The interest rate charged is 15% compounded monthly. What is the size of the final payment?

A) $158.39

B) $236.88

C) $154.52

D) $113.12

E) $193.54

A) $158.39

B) $236.88

C) $154.52

D) $113.12

E) $193.54

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

78

A $60,000 loan at 12% compounded semiannually is to be repaid by monthly payments of $1000.

-What is the size of the final payment?

A) $685.83

B) $692.53

C) $1000.00

D) $307.47

E) $726.98

-What is the size of the final payment?

A) $685.83

B) $692.53

C) $1000.00

D) $307.47

E) $726.98

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

79

A $60,000 loan at 12% compounded semiannually is to be repaid by monthly payments of $1000.

-How much will the principal be reduced by payments 13 to 24 inclusive?

A) $5978.87

B) $6021.13

C) $11,147.84

D) $6101.66

E) $5898.34

-How much will the principal be reduced by payments 13 to 24 inclusive?

A) $5978.87

B) $6021.13

C) $11,147.84

D) $6101.66

E) $5898.34

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

80

A mortgage loan calls for monthly payments of $750 for 25 years. If $80,000 was borrowed, what semiannually compounded nominal rate of interest is being charged?

A) 10.635%

B) 10.755%

C) 10.865%

D) 10.522%

E) 10.401%

A) 10.635%

B) 10.755%

C) 10.865%

D) 10.522%

E) 10.401%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck