Deck 1: Securities Markets, Efficient Diversification, Risk and Return: Past and Prologue

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/11

Play

Full screen (f)

Deck 1: Securities Markets, Efficient Diversification, Risk and Return: Past and Prologue

1

The geometric average of -12%, 20% and 25% is ________.

A) 8.42%

B) 11.00%

C) 9.70%

D) 18.88%

A) 8.42%

B) 11.00%

C) 9.70%

D) 18.88%

9.70%

2

You have an APR of 7.5% with continuous compounding. The EAR is ________.

A) 7.50%

B) 7.65%

C) 7.79%

D) 8.25%

A) 7.50%

B) 7.65%

C) 7.79%

D) 8.25%

7.79%

3

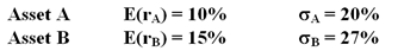

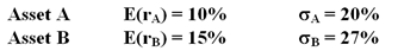

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: An investor with a risk aversion of A = 3 would find that ________ on a risk-return basis.

A) only Asset A is acceptable

B) only Asset B is acceptable

C) neither Asset A nor Asset B is acceptable

D) both Asset A and Asset B are acceptable

A) only Asset A is acceptable

B) only Asset B is acceptable

C) neither Asset A nor Asset B is acceptable

D) both Asset A and Asset B are acceptable

neither Asset A nor Asset B is acceptable

4

The formula is used to calculate the ________.

A) Sharpe measure

B) Treynor measure

C) Coefficient of variation

D) Real rate of return

A) Sharpe measure

B) Treynor measure

C) Coefficient of variation

D) Real rate of return

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

5

Security A has a higher standard deviation of returns than Security B We would expect that ________.

I. Security A would have a higher risk premium than Security B

II. the likely range of returns for Security A in any given year would be higher than the likely range of returns for Security B

III. the Sharpe measure of A will be higher than the Sharpe measure of B.

A) I only

B) I and II only

C) II and III only

D) I, II and III

I. Security A would have a higher risk premium than Security B

II. the likely range of returns for Security A in any given year would be higher than the likely range of returns for Security B

III. the Sharpe measure of A will be higher than the Sharpe measure of B.

A) I only

B) I and II only

C) II and III only

D) I, II and III

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

6

You are considering investing $1000 in a complete portfolio. The complete portfolio is composed of Treasury notes that pay 5% and a risky portfolio, P, constructed with two risky securities X and Y. The optimal weights of X and Y in P are 60% and 40% respectively. X has an expected rate of return of 14% and Y has an expected rate of return of 10%. To form a complete portfolio with an expected rate of return of 8%, you should invest approximately ________ in the risky portfolio. This will mean you will also invest approximately ________ and ________ of your complete portfolio in security X and Y respectively.

A) 0%, 60%, 40%

B) 25%, 45%, 30%

C) 40%, 24%, 16%

D) 50%, 30%, 20%

A) 0%, 60%, 40%

B) 25%, 45%, 30%

C) 40%, 24%, 16%

D) 50%, 30%, 20%

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

7

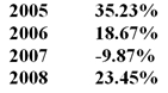

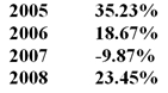

You have the following rates of return for a risky portfolio for several recent years: If you invested $1 000 at the beginning of 2005 your investment at the end of 2008 would be worth ________.

A) $2 176.60

B) $1 785.56

C) $1 645.53

D) $1 247.87

A) $2 176.60

B) $1 785.56

C) $1 645.53

D) $1 247.87

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

8

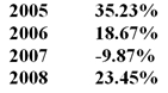

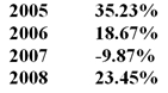

You have the following rates of return for a risky portfolio for several recent years: The annualised average return on this investment is ________.

A) 16.15%

B) 16.87%

C) 21.32%

D) 15.60%

A) 16.15%

B) 16.87%

C) 21.32%

D) 15.60%

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

9

If the bid price is $15.12 and the ask price is $15.14, the bid-ask spread is ________.

A) $0.03

B) $0.01

C) $0.04

D) $0.02

A) $0.03

B) $0.01

C) $0.04

D) $0.02

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

10

Consider the following limit order book of a specialist. The last trade in the share occurred at a price of $40.  If a market buy order for 100 shares comes in, at what price will it be filled?

If a market buy order for 100 shares comes in, at what price will it be filled?

A) $39.75

B) $40.25

C) $40.375

D) $40.25 or less

If a market buy order for 100 shares comes in, at what price will it be filled?

If a market buy order for 100 shares comes in, at what price will it be filled?A) $39.75

B) $40.25

C) $40.375

D) $40.25 or less

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

11

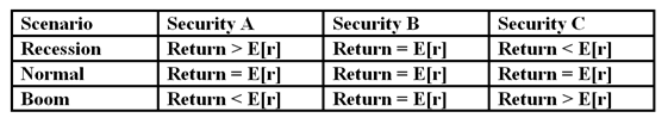

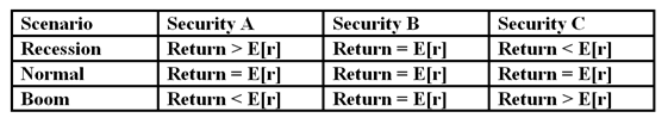

Based on the outcomes in the table below choose which of the statements is/are correct:

I. The covariance of Security A and Security B is zero

II. The correlation coefficient between Security A and C is negative

III. The correlation coefficient between Security B and C is positive

A) I only

B) I and II only

C) II and III only

D) I, II and III

I. The covariance of Security A and Security B is zero

II. The correlation coefficient between Security A and C is negative

III. The correlation coefficient between Security B and C is positive

A) I only

B) I and II only

C) II and III only

D) I, II and III

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck