Deck 24: Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/27

Play

Full screen (f)

Deck 24: Capital Budgeting

1

The "time value" of money implies that money today is worth less than the same amount in the future.

False

2

The formula for calculating the depreciation tax shield is:

A) Depreciation expense / (1 - tax rate)

B) Depreciation expense x tax rate

C) Depreciation expense / tax rate

D) Depreciation expense × (1 - tax rate)

E) None of the above

A) Depreciation expense / (1 - tax rate)

B) Depreciation expense x tax rate

C) Depreciation expense / tax rate

D) Depreciation expense × (1 - tax rate)

E) None of the above

Depreciation expense x tax rate

3

Acme Co. has excess cash that it wants to invest. Acme is considering purchasing an asset that is expected to return $25,000 per year after tax for the next 5 years, with an after-tax disposal value of $10,000. Acme's required rate of return on this investment is 8%.

What is the maximum amount that Ames would be willing to pay to purchase this asset? (Use the appropriate discount factor from Appendix A and round your final answer to the nearest dollar.)

A) $99,818

B) $168,349

C) $115,000

D) None of the above

What is the maximum amount that Ames would be willing to pay to purchase this asset? (Use the appropriate discount factor from Appendix A and round your final answer to the nearest dollar.)

A) $99,818

B) $168,349

C) $115,000

D) None of the above

None of the above

4

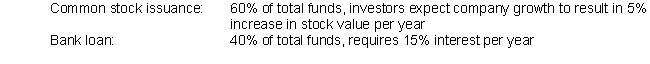

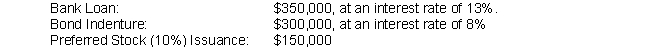

Shumer Inc. is a construction company that plans on purchasing new equipment this year for a new project. The project is expected to return $350,000 per year for the next 5 years. The equipment needed will cost $2,500,000. In order to purchase this equipment, Shumer must acquire the necessary funds from several sources.

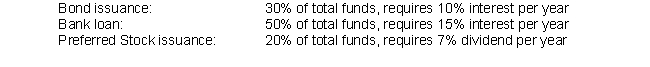

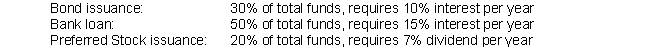

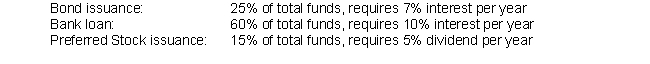

The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

5

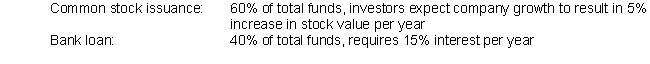

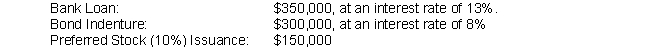

Shumer Inc. is a construction company that plans on purchasing new equipment this year for a new project. The project is expected to return $3500,000 per year for the next 5 years. The equipment needed will cost $2,500,000. In order to purchase this equipment, Shumer must acquire the necessary funds from several sources.

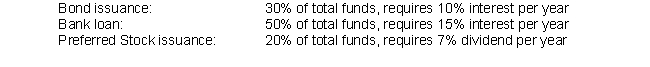

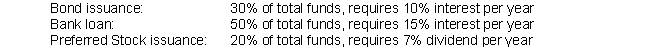

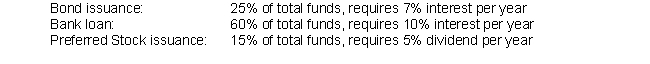

The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Shumer is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

Shumer is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

Does the proposed project meet the company's required rate of return?

The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Shumer is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

Shumer is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.Does the proposed project meet the company's required rate of return?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

6

Scription Inc. has additional cash available for investment. One of the production machines needs to be replaced, and management is considering two options. Both options require a similar initial outlay and have a useful life of 10 years. However, one of the machines will generate $60,000 annually in positive after-tax cash flows and would have an after-tax residual value of $50,000. The other option will generate $50,000 annually in positive after-tax cash flows and would have an after-tax residual value of $100,000.

Using a discount rate of 8%, which option is the most attractive? (Use the appropriate discount factor from Appendix A.)

Using a discount rate of 8%, which option is the most attractive? (Use the appropriate discount factor from Appendix A.)

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

7

Wylie Contracting Inc. (WCI) is a contracting company that lays oil pipeline infrastructure. WCI is considering purchasing a piece of excavating equipment worth $9,000,000. The machine would generate a net $450,000 yearly pre-tax cash flows. The machine would be depreciated over the course of 20 years, at which time it is predicted to have a disposal value of $3,000,000.

Management plans to depreciate full value of the asset (not deducting the anticipated disposal value in the calculation), and will take a full year of depreciation the first year. WCI's tax rate is25%, and the discount rate is 12%.

What is the Excess Present Value Index of the proposed machinery (rounded to 4 decimal places)? What does this indicate about the proposed project?

Management plans to depreciate full value of the asset (not deducting the anticipated disposal value in the calculation), and will take a full year of depreciation the first year. WCI's tax rate is25%, and the discount rate is 12%.

What is the Excess Present Value Index of the proposed machinery (rounded to 4 decimal places)? What does this indicate about the proposed project?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

8

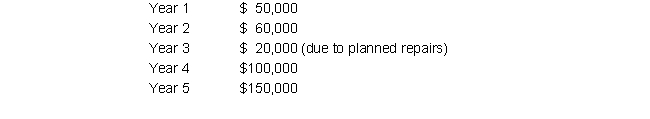

Hilltop Moving Company is considering investing in two new trucks for their residential moving business. The investment will require an outlay of $190,000 initially, and is expected to generate the following pre-tax cash flows:

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company expects the trucks to have a combined salvage value of $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company expects the trucks to have a combined salvage value of $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.

What is the cash payback period of this proposed investment? (Round to 2 decimal places)

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company expects the trucks to have a combined salvage value of $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company expects the trucks to have a combined salvage value of $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.What is the cash payback period of this proposed investment? (Round to 2 decimal places)

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

9

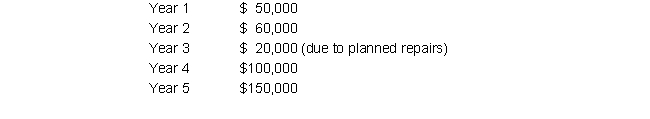

Hilltop Moving Company is considering investing in 2 new trucks for their residential moving business. The investment will require an outlay of $190,000 initially, and is expected to generate the following pre-tax cash flows:

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.

What is the Average Rate of Return of this proposed investment? (Round to 4 decimal places)

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.What is the Average Rate of Return of this proposed investment? (Round to 4 decimal places)

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

10

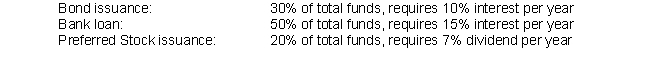

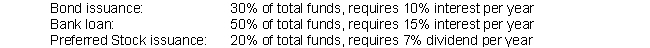

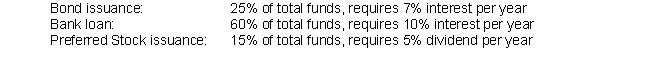

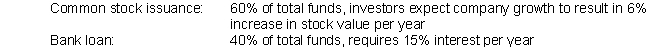

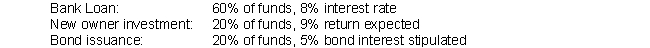

InterCont is a construction company that plans on purchasing new equipment this year for a new project. The project is expected to return $700,000 per year for the next 5 years. The equipment needed will cost $5,000,000. In order to purchase this equipment, InterCont must acquire the necessary funds from several sources. The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

11

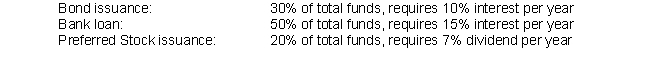

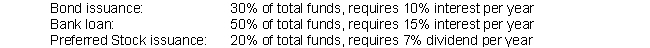

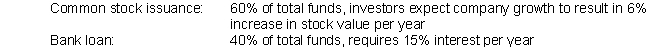

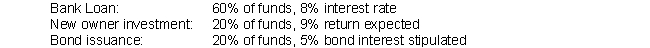

InterCont is a construction company that plans on purchasing new equipment this year for a new project. The project is expected to return $700,000 per year for the next 5 years. The equipment needed will cost $5,000,000. In order to purchase this equipment, InterCont must acquire the necessary funds from several sources. The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

InterCont is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

InterCont is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

Does the proposed project meet the company's required rate of return?

InterCont is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

InterCont is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.Does the proposed project meet the company's required rate of return?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

12

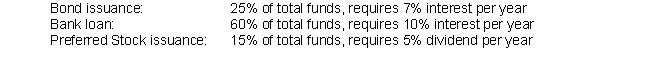

Starsky is a research company that plans on purchasing new equipment this year for an existing project that has shown promising results. The project is expected to return $175,000 per year for the next 10 years. The equipment needed will cost $2,000,000. In order to purchase this equipment, Starsky must acquire the necessary funds from several sources. The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

13

Starsky is a research company that plans on purchasing new equipment this year for an existing project that has shown promising results. The project is expected to return $195,000 per year for the next 10 years. The equipment needed will cost $2,000,000. In order to purchase this equipment, Starsky must acquire the necessary funds from several sources. The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Starsky is a conservative company, and requires a "buffer margin" of 3.5 percentage points for any large investment project. Does the proposed project meet the company's required rate of return?

Starsky is a conservative company, and requires a "buffer margin" of 3.5 percentage points for any large investment project. Does the proposed project meet the company's required rate of return?

Starsky is a conservative company, and requires a "buffer margin" of 3.5 percentage points for any large investment project. Does the proposed project meet the company's required rate of return?

Starsky is a conservative company, and requires a "buffer margin" of 3.5 percentage points for any large investment project. Does the proposed project meet the company's required rate of return?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

14

Jon Blue owns a small start-up company, and wants to expand his business. In order to do so, he is soliciting capital investments and loans. He has incorporated his company, and plans to issue stock and take out a bank loan in order to finance the expansion. He projects that the funds invested now will produce returns of 12% per year. Following is information related to the capital sources Jon plans to use.

Does the proposed project clear Jon's hurdle rate, or the weighted cost of capital?

Does the proposed project clear Jon's hurdle rate, or the weighted cost of capital?

Does the proposed project clear Jon's hurdle rate, or the weighted cost of capital?

Does the proposed project clear Jon's hurdle rate, or the weighted cost of capital?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

15

Jon Blue owns a small start-up company, and wants to expand his business. In order to do so, he is soliciting capital investments and loans. He has incorporated his company, and plans to issue stock and take out a bank loan in order to finance the expansion. He projects that the funds invested now will produce returns of 12% per year. Following is information related to the capital sources Jon plans to use.

Jon is also interested in making sure that he also profits from the project, and he will only accept the project if the rate of return exceeds the cost of capital by at least 2.5 percentage points. Does the proposed project clear Jon's hurdle rate?

Jon is also interested in making sure that he also profits from the project, and he will only accept the project if the rate of return exceeds the cost of capital by at least 2.5 percentage points. Does the proposed project clear Jon's hurdle rate?

Jon is also interested in making sure that he also profits from the project, and he will only accept the project if the rate of return exceeds the cost of capital by at least 2.5 percentage points. Does the proposed project clear Jon's hurdle rate?

Jon is also interested in making sure that he also profits from the project, and he will only accept the project if the rate of return exceeds the cost of capital by at least 2.5 percentage points. Does the proposed project clear Jon's hurdle rate?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

16

LiLi Inc. has additional cash available for investment. One of the production machines needs to be replaced, and management is considering two options. Both options require a similar initial outlay and have a useful life of 15 years. However, one of the machines will generate $15,000 annually in positive after-tax cash flows and would have an after-tax residual value of $80,000. The other option will generate $25,000 annually in positive after-tax cash flows and would have an after-tax residual value of $30,000.

Using a discount rate of 7%, which option is the most attractive? (Use the appropriate discount factor from Appendix A.)

Using a discount rate of 7%, which option is the most attractive? (Use the appropriate discount factor from Appendix A.)

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

17

Atas Threads (AT) is a textile wholesale company. AT is considering building a new inventory warehouse for $900,000. The warehouse would allow AT to increase their pre-tax cash flows by $175,000 each year. The company would plan to use the warehouse for 20 years before selling it for $100,000. The company uses straight-line depreciation. AT's tax rate is 25%, and the required rate of return is 12%.

What is the Excess Present Value Index of the proposed investment (rounded to 4 decimal places)? What does this indicate about the proposed project?

What is the Excess Present Value Index of the proposed investment (rounded to 4 decimal places)? What does this indicate about the proposed project?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

18

Ikan Fishery, a local fish farm, is considering purchasing a new plot of land for their business for $500,000. The land would allow Ikan Fishery to increase their pre-tax cash flows by $150,000 each year. The company would plan to keep the land for 10 years before selling it for $550,000. Because the land is real property, the company would not take any related depreciation. Ikan Fishery's tax rate is 20%, and the required rate of return is 10%.

What is the Average Rate of Return of the proposed investment? (Round to 4 decimal places)

What is the Average Rate of Return of the proposed investment? (Round to 4 decimal places)

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

19

Jensen Co. has additional funds available for investment, and is considering purchasing an asset that is expected to provide an after-tax cash inflow of $45,000 per year for the next 7 years, with an after-tax disposal value of $10,000. Jensen Co.'s required rate of return is 11%.

What is the maximum amount that Jensen Co. would be willing to pay to purchase this asset? (Use a financial spreadsheet or a financial calculator to answer this question.)

What is the maximum amount that Jensen Co. would be willing to pay to purchase this asset? (Use a financial spreadsheet or a financial calculator to answer this question.)

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

20

MRM Inc. has additional cash available for investment. One of the production machines needs to be replaced, and management is considering two options. Both options require a similar initial outlay and have a useful life of 8 years. However, one of the machines will generate $10,000 annually in positive after-tax cash flows and would have an after-tax residual value of $10,000. The other option will generate $11,000 annually in positive after-tax cash flows and would have an after-tax residual value of $1,000.

Using a discount rate of 9%, which option is the most attractive? (Use a financial spreadsheet or a financial calculator to answer this question.)

Using a discount rate of 9%, which option is the most attractive? (Use a financial spreadsheet or a financial calculator to answer this question.)

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

21

What is meant by the term "capital budgeting"?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

22

What is the cost of capital?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

23

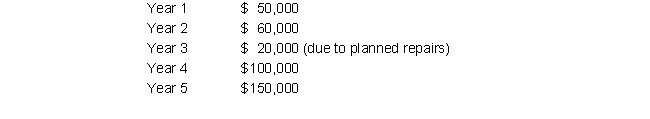

Arbitrary Inc. has is planning to purchase an asset for $1,400,000. The asset is expected to return $180,000 per year for the next 10 years, with a disposal value of $50,000. Arbitrary's required rate of return is 9%, and the applicable tax rate is 20%.

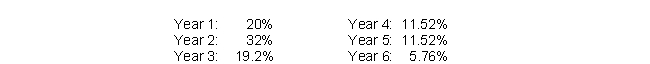

The asset will be depreciated using the 5-Year MACRS rates, with a specific percentage of the original purchase value of the asset recognized as depreciation expense each year, as follows:

What is the NPV of the proposed asset purchase? Use a financial calculator to compute NPV.

What is the NPV of the proposed asset purchase? Use a financial calculator to compute NPV.

The asset will be depreciated using the 5-Year MACRS rates, with a specific percentage of the original purchase value of the asset recognized as depreciation expense each year, as follows:

What is the NPV of the proposed asset purchase? Use a financial calculator to compute NPV.

What is the NPV of the proposed asset purchase? Use a financial calculator to compute NPV.

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

24

Local Grown Inc., a local plant nursery, is considering purchasing a new plot of land for their business for $400,000. The land would allow Local Grown to increase their pre-tax operating income (and cash flow) by $80,000 each year. The company would plan to keep the land for 20 years before selling it for $800,000. Because the land is real property, the company would not take any related depreciation.

Alternatively, Local Grown could purchase a new greenhouse for $600,000. The greenhouse would return $180,000 before depreciation each year for 20 years, and would be fully depreciated over its 20-year useful life, at which point it would be sold for $100,000.

Local Grown's tax rate is 25%, and the required rate of return is 9%.

Based on the Average Rate of Return, which project is more attractive? Based on NPV, which project is more attractive? Use a financial calculator to compute NPV.

Alternatively, Local Grown could purchase a new greenhouse for $600,000. The greenhouse would return $180,000 before depreciation each year for 20 years, and would be fully depreciated over its 20-year useful life, at which point it would be sold for $100,000.

Local Grown's tax rate is 25%, and the required rate of return is 9%.

Based on the Average Rate of Return, which project is more attractive? Based on NPV, which project is more attractive? Use a financial calculator to compute NPV.

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

25

GoodWash Co. is a dishwasher manufacturing company. GoodWash is considering purchasing a new piece of manufacturing equipment for $800,000. The equipment is expected to last for 8 years, and management projects that purchasing the equipment would result in an additional $150,000 in pre-tax cash flow per year. Management does not expect the equipment to have any value at the end of 8 years, and so will fully depreciate the equipment on a straight-line basis.

To obtain the funds to purchase this equipment, GoodWash plans to raise capital from the following sources:

GoodWash's tax rate is 30%.

GoodWash's tax rate is 30%.

What is the Net Present Value of the proposed investment? Use a financial calculator to compute the Present Value of the future cash flows.

To obtain the funds to purchase this equipment, GoodWash plans to raise capital from the following sources:

GoodWash's tax rate is 30%.

GoodWash's tax rate is 30%.What is the Net Present Value of the proposed investment? Use a financial calculator to compute the Present Value of the future cash flows.

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

26

Batter Than Bacon, a local waffle shop, is considering moving from their current rental location by purchasing a new storefront property in the middle of the suburban shopping mall. Management estimates that the move would increase current yearly pre-tax cash inflows by $55,000 per year. Purchasing the new property would cost $350,000. Management expects to remain at the new site for the next 10 years and uses the straight-line depreciation method. At the end of 10 years, they expect the property will only be worth $40,000 because it will be torn down for redevelopment.

Batter Than Bacon can obtain the necessary funds for the project from several sources. The following list details the percentage of the funds provided and the rates of return required by each capital source.

The company pays a marginal tax rate of 25%.

The company pays a marginal tax rate of 25%.

Judging by the Excess Present Value Index, does the proposed relocation at least meet the company's Weighted Average Cost of Capital? Use a financial calculator to compute Present Value of the future cash flows.

Batter Than Bacon can obtain the necessary funds for the project from several sources. The following list details the percentage of the funds provided and the rates of return required by each capital source.

The company pays a marginal tax rate of 25%.

The company pays a marginal tax rate of 25%.Judging by the Excess Present Value Index, does the proposed relocation at least meet the company's Weighted Average Cost of Capital? Use a financial calculator to compute Present Value of the future cash flows.

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

27

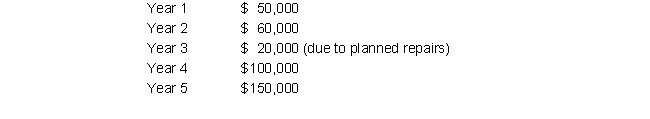

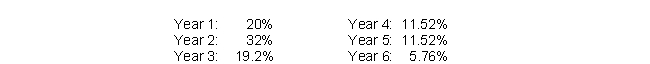

BonClyde Co. is planning to purchase an asset for $400,000. The asset is expected to return $50,000 per year for the next 7 years, with a disposal value of $15,000. BonClyde Co.'s required rate of return is 8%, and the applicable tax rate is 35%. The asset will be depreciated using the 5-Year MACRS rates, with a specific percentage of the original purchase value of the asset recognized as depreciation expense each year, as follows:

What is the NPV of the proposed asset purchase? Use a financial calculator to compute NPV.

What is the NPV of the proposed asset purchase? Use a financial calculator to compute NPV.

What is the NPV of the proposed asset purchase? Use a financial calculator to compute NPV.

What is the NPV of the proposed asset purchase? Use a financial calculator to compute NPV.

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck