Deck 15: Cost Accounting Systemsjob Order Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 15: Cost Accounting Systemsjob Order Costing

1

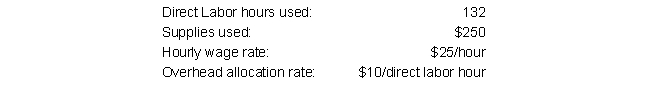

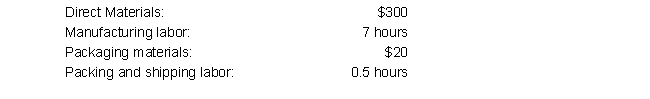

Job number 2288 had the following data:

Assuming this was the only job completed this month, what was the total cost of Job 2288?

Assuming this was the only job completed this month, what was the total cost of Job 2288?

A) $3,300

B) $3,550

C) $4,620

D) $4,870

E) None of the above

Assuming this was the only job completed this month, what was the total cost of Job 2288?

Assuming this was the only job completed this month, what was the total cost of Job 2288?A) $3,300

B) $3,550

C) $4,620

D) $4,870

E) None of the above

$4,870

2

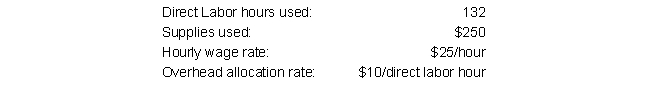

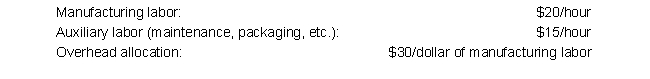

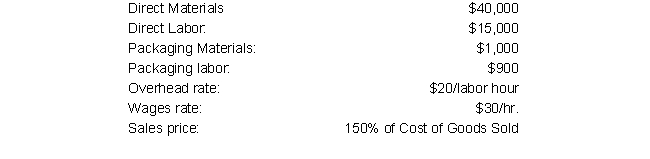

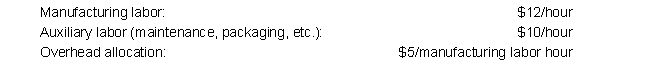

Job #2333 incurred the following during production:

The following data is also available for the company:

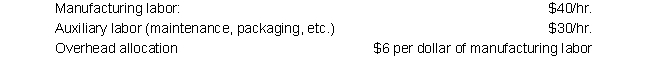

The company incurs costs at the following rates:

The company incurs costs at the following rates:

Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

A) $4,500.00

B) $4,600.00

C) $4,607.50

D) $4,610.00

E) $19,607.50

The following data is also available for the company:

The company incurs costs at the following rates:

The company incurs costs at the following rates: Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?A) $4,500.00

B) $4,600.00

C) $4,607.50

D) $4,610.00

E) $19,607.50

$19,607.50

3

Bricks and Mortar Manufacturing produces building materials for local construction contractors. BMM has 2 production departments (Mixing and Firing) and 2 service departments (Maintenance and Cleaning). Maintenance costs are allocated based on machine hours used. Cleaning costs are allocated based on square feet of floor space. BMM also allocates depreciation on the factory to all departments on the basis of number of employee positions in the department.

The following data is available for BMM:

Mixing: 600 square feet of floor space, 200 machine hours used, 10 employees

Firing: 400 square feet of floor space, 500 machine hours used, 5 employees

Maintenance: $4,900 incurred, 4 employees

Cleaning: $2,300, 6 employees

Depreciation on factory: $4,500

How much in total costs should be allocated to the Mixing department?

A) $1,800.00

B) $2,720.00

C) $3,200.00

D) $5,433.71

E) $4,680.00

The following data is available for BMM:

Mixing: 600 square feet of floor space, 200 machine hours used, 10 employees

Firing: 400 square feet of floor space, 500 machine hours used, 5 employees

Maintenance: $4,900 incurred, 4 employees

Cleaning: $2,300, 6 employees

Depreciation on factory: $4,500

How much in total costs should be allocated to the Mixing department?

A) $1,800.00

B) $2,720.00

C) $3,200.00

D) $5,433.71

E) $4,680.00

$5,433.71

4

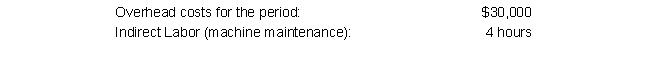

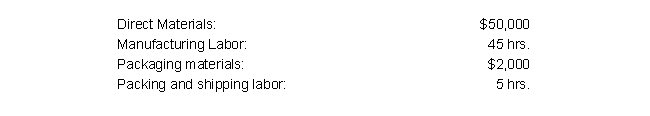

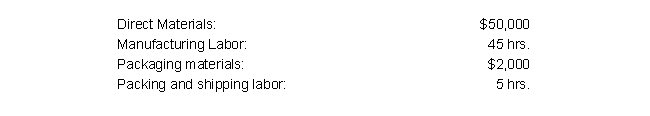

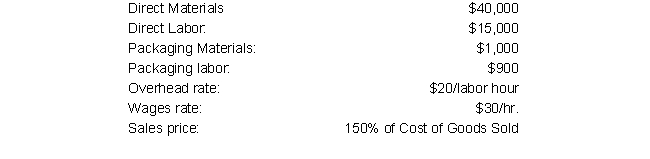

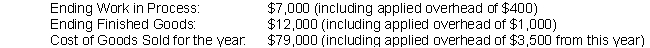

Job #5632 incurred the following during production:

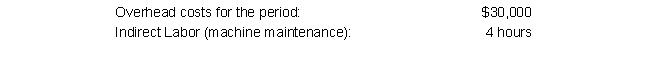

The following data is also available for the company:

The following data is also available for the company:

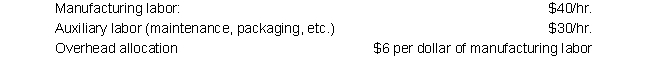

The company incurs costs at the following rates:

The company incurs costs at the following rates:

Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

The following data is also available for the company:

The following data is also available for the company: The company incurs costs at the following rates:

The company incurs costs at the following rates: Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

What is/are the correct journal entry(ies) to record the completion and billing of the following job?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Hardluck Manufacturing produces building materials for local construction contractors. HM has 2 production departments (Mixing and Baking) and 2 service departments (Maintenance and Cleaning). Maintenance costs are allocated based on machine hours used. Cleaning costs are allocated based on square feet of floor space. HM also allocates depreciation on the factory to all departments on the basis of number of employee positions in the department.

The following data is available for HM:

Mixing: 1,100 square feet of floor space, 200 machine hours used, 30 employees

Baking: 900 square feet of floor space, 500 machine hours used, 24 employees

Maintenance: $49,000 incurred, 4 employees

Cleaning: $23,000 incurred, 2 employees

Depreciation on factory: $45,000

What is the total amount that should be allocated to Baking from the Cleaning department?

The following data is available for HM:

Mixing: 1,100 square feet of floor space, 200 machine hours used, 30 employees

Baking: 900 square feet of floor space, 500 machine hours used, 24 employees

Maintenance: $49,000 incurred, 4 employees

Cleaning: $23,000 incurred, 2 employees

Depreciation on factory: $45,000

What is the total amount that should be allocated to Baking from the Cleaning department?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

Hardluck Manufacturing produces building materials for local construction contractors. HM has 2 production departments (Mixing and Baking) and 2 service departments (Maintenance and Cleaning). Maintenance costs are allocated based on machine hours used. Cleaning costs are allocated based on square feet of floor space. HM also allocates depreciation on the factory to all departments on the basis of number of employee positions in the department.

The following data is available for HM:

Mixing: 1,100 square feet of floor space, 200 machine hours used, 30 employees

Baking: 900 square feet of floor space, 500 machine hours used, 24 employees

Maintenance: $49,000 incurred, 4 employees

Cleaning: $23,000, 2 employees

Depreciation on factory: $45,000

How much in total costs should be allocated to the Mixing department?

The following data is available for HM:

Mixing: 1,100 square feet of floor space, 200 machine hours used, 30 employees

Baking: 900 square feet of floor space, 500 machine hours used, 24 employees

Maintenance: $49,000 incurred, 4 employees

Cleaning: $23,000, 2 employees

Depreciation on factory: $45,000

How much in total costs should be allocated to the Mixing department?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

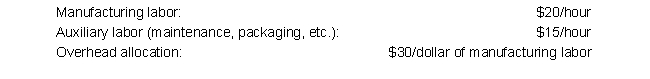

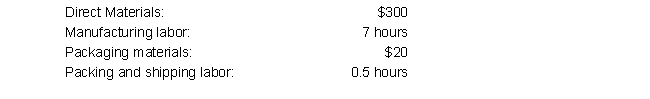

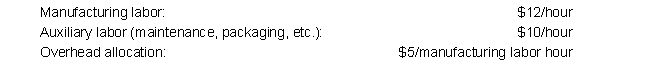

Job #0098 incurred the following during production:

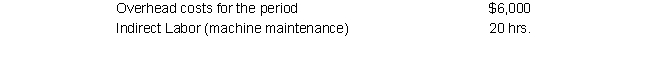

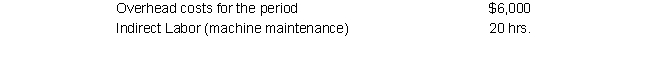

The following data is also available for the company:

The following data is also available for the company:

The company incurs costs at the following rates:

The company incurs costs at the following rates:

Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

The following data is also available for the company:

The following data is also available for the company: The company incurs costs at the following rates:

The company incurs costs at the following rates: Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the Finished Goods Inventory?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

What is/are the correct journal entry(ies) to record the completion and billing of the following job?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

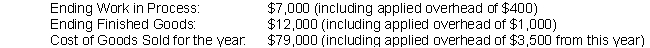

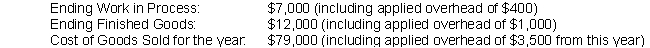

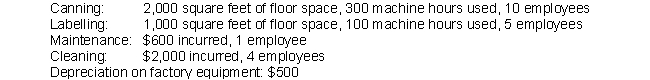

The following information is available for 2019 for Mobile Mfg.:

At year end, the company had an over-applied overhead balance of $200. This amount is NOT considered significant.

At year end, the company had an over-applied overhead balance of $200. This amount is NOT considered significant.

What is the adjusting entry required with respect to overhead at year end?

At year end, the company had an over-applied overhead balance of $200. This amount is NOT considered significant.

At year end, the company had an over-applied overhead balance of $200. This amount is NOT considered significant.What is the adjusting entry required with respect to overhead at year end?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

The following information is available for 2019 for Mobile Mfg.:

At year end, the company had an over-applied overhead balance of $200. This amount IS considered significant.

At year end, the company had an over-applied overhead balance of $200. This amount IS considered significant.

What is the adjusting entry required with respect to overhead at year end? (Round amounts to the nearest dollar.)

At year end, the company had an over-applied overhead balance of $200. This amount IS considered significant.

At year end, the company had an over-applied overhead balance of $200. This amount IS considered significant.What is the adjusting entry required with respect to overhead at year end? (Round amounts to the nearest dollar.)

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

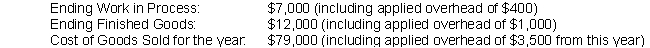

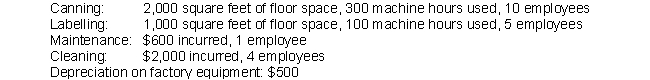

JKL Mfg. cans food products. JKL has 2 production departments (Canning and Labelling) and 2 service departments (Maintenance and Cleaning). Maintenance costs are allocated based on machine hours used. Cleaning costs are allocated based on square feet of floor space. JKL also allocates depreciation on the factory equipment to all departments on the basis of number of employee positions in the department. The following data is available for JKL:

How much in total costs should be allocated to the Labelling department? (Round to the nearest dollar.)

How much in total costs should be allocated to the Labelling department? (Round to the nearest dollar.)

How much in total costs should be allocated to the Labelling department? (Round to the nearest dollar.)

How much in total costs should be allocated to the Labelling department? (Round to the nearest dollar.)

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

What is process costing?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

How is a predetermined overhead rate calculated?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

How does a plant-wide overhead rate differ from a departmental overhead rate?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

BizApp is a software development company that writes specialized programs for businesses. The founder and owner John Sprat runs the business on a "bare bones" philosophy, by reducing or eliminating unneeded activities in the company. As such, BizApp has only two departments (both of them classified as production departments): Design and Production.

Budgeted yearly information for these departments is as follows:

Design: 800 square feet; 6,000 direct labor hours, at $35/hour

Production: 1,600 square feet; 4,000 direct labor hours, at $25/hour

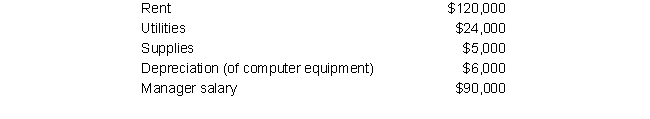

BizApp budgeted for the following overhead costs this year:

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.

Suppose that, due to several significant unexpected contracts, BizApp had much higher levels of demand and production than anticipated. As such, John had to rent a larger office space, buy extra computers, and pay his manager more for working longer hours. At year-end, BizApp reported the following information:

What is the amount of over- or under-applied overhead at the end of the year? (Use the rounded amounts from Problem 1 where applicable)

What is the amount of over- or under-applied overhead at the end of the year? (Use the rounded amounts from Problem 1 where applicable)

Budgeted yearly information for these departments is as follows:

Design: 800 square feet; 6,000 direct labor hours, at $35/hour

Production: 1,600 square feet; 4,000 direct labor hours, at $25/hour

BizApp budgeted for the following overhead costs this year:

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.Suppose that, due to several significant unexpected contracts, BizApp had much higher levels of demand and production than anticipated. As such, John had to rent a larger office space, buy extra computers, and pay his manager more for working longer hours. At year-end, BizApp reported the following information:

What is the amount of over- or under-applied overhead at the end of the year? (Use the rounded amounts from Problem 1 where applicable)

What is the amount of over- or under-applied overhead at the end of the year? (Use the rounded amounts from Problem 1 where applicable)

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

WearsArt, a local clothing design company, has only two departments (both of them classified as production departments): Design and Production. Budgeted yearly information for these departments is as follows:

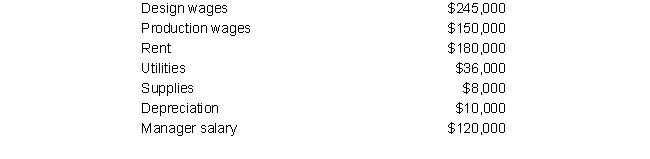

WearsArt budgeted for the following overhead costs this year:

WearsArt budgeted for the following overhead costs this year:

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.

What is the rate used to apply overhead to jobs in the Design department?

In the Production department?

(Do not round intermediate calculations, round final answer to nearest dollar.)

WearsArt budgeted for the following overhead costs this year:

WearsArt budgeted for the following overhead costs this year: Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.What is the rate used to apply overhead to jobs in the Design department?

In the Production department?

(Do not round intermediate calculations, round final answer to nearest dollar.)

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

WearsArt, a local clothing design company, has only two departments (both of them classified as production departments): Design and Production. Budgeted yearly information for these departments is as follows:

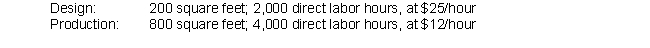

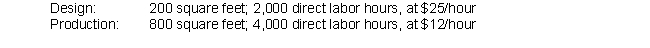

Design: 200 square feet; 2,000 direct labor hours, at $25/hour

Production: 800 square feet; 4,000 direct labor hours, at $12/hour

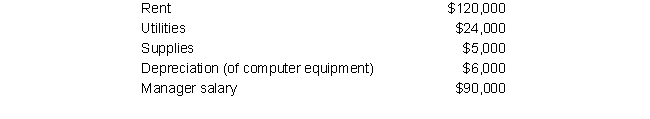

WearsArt budgeted for the following overhead costs this year:

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.

Suppose that, due to a downturn in the economy, WearsArt had much lower levels of demand and production than anticipated. As such, at the end of the year, there were only 1,000 hours worked in design, and 3,500 hours worked in Production. However, the supplies and equipment had been bought at the start of the year, and the amount of overhead was the same as budgeted.

What is the amount of over- or under-applied overhead at the end of the year? (Do not round intermediate calculations, round final answer to nearest dollar.)

Design: 200 square feet; 2,000 direct labor hours, at $25/hour

Production: 800 square feet; 4,000 direct labor hours, at $12/hour

WearsArt budgeted for the following overhead costs this year:

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.

Rent and utilities are allocated to each department based on square footage, and other overhead costs are allocated based on direct labor hours. Design and Production overhead costs are allocated to jobs based on direct labor hours.Suppose that, due to a downturn in the economy, WearsArt had much lower levels of demand and production than anticipated. As such, at the end of the year, there were only 1,000 hours worked in design, and 3,500 hours worked in Production. However, the supplies and equipment had been bought at the start of the year, and the amount of overhead was the same as budgeted.

What is the amount of over- or under-applied overhead at the end of the year? (Do not round intermediate calculations, round final answer to nearest dollar.)

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

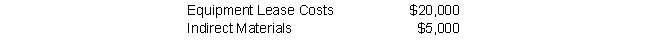

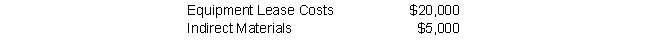

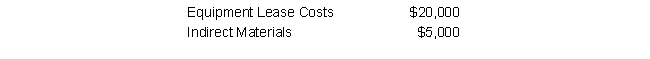

Mortenson & Co. is a construction subcontractor that helps build apartment complexes. The company budgeted the following construction overhead costs for the period:

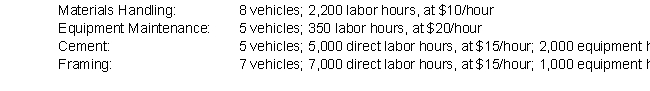

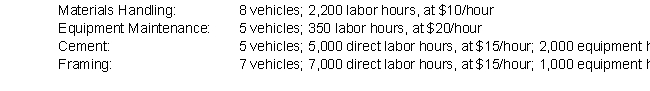

Mortenson has two service departments (Materials Handling and Equipment Maintenance) and two production departments (Cement and Framing). Budgeted yearly information for these departments is as follows:

Mortenson has two service departments (Materials Handling and Equipment Maintenance) and two production departments (Cement and Framing). Budgeted yearly information for these departments is as follows:

Lease and Indirect Materials costs are allocated to each department based on number of vehicles used by the department. Equipment Maintenance costs are allocated based on equipment hours, and Materials Handling costs are allocated based on direct labor hours. Cement costs are allocated to jobs based on direct labor hours, and Framing costs are allocated based on equipment hours.

Lease and Indirect Materials costs are allocated to each department based on number of vehicles used by the department. Equipment Maintenance costs are allocated based on equipment hours, and Materials Handling costs are allocated based on direct labor hours. Cement costs are allocated to jobs based on direct labor hours, and Framing costs are allocated based on equipment hours.

What is the rate used to apply overhead to jobs in the Cement department?

To the Framing department?

(Do not round intermediate calculations, round final answer to 2 decimal places.)

Mortenson has two service departments (Materials Handling and Equipment Maintenance) and two production departments (Cement and Framing). Budgeted yearly information for these departments is as follows:

Mortenson has two service departments (Materials Handling and Equipment Maintenance) and two production departments (Cement and Framing). Budgeted yearly information for these departments is as follows: Lease and Indirect Materials costs are allocated to each department based on number of vehicles used by the department. Equipment Maintenance costs are allocated based on equipment hours, and Materials Handling costs are allocated based on direct labor hours. Cement costs are allocated to jobs based on direct labor hours, and Framing costs are allocated based on equipment hours.

Lease and Indirect Materials costs are allocated to each department based on number of vehicles used by the department. Equipment Maintenance costs are allocated based on equipment hours, and Materials Handling costs are allocated based on direct labor hours. Cement costs are allocated to jobs based on direct labor hours, and Framing costs are allocated based on equipment hours.What is the rate used to apply overhead to jobs in the Cement department?

To the Framing department?

(Do not round intermediate calculations, round final answer to 2 decimal places.)

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

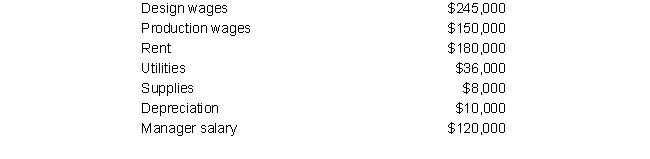

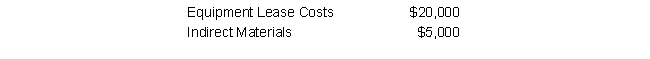

Mortenson & Co. is a construction subcontractor that helps build apartment complexes. The company budgeted the following construction overhead costs for the period:

Mortenson has two service departments (Materials Handling and Equipment Maintenance) and two production departments (Cement and Framing). Budgeted yearly information for these departments is as follows:

Mortenson has two service departments (Materials Handling and Equipment Maintenance) and two production departments (Cement and Framing). Budgeted yearly information for these departments is as follows:

Lease and Indirect Materials costs are allocated to each department based on number of vehicles used by the department. Equipment Maintenance costs are allocated based on equipment hours, and Materials Handling costs are allocated based on direct labor hours. Cement costs are allocated to jobs based on direct labor hours, and Framing costs are allocated based on equipment hours.

Lease and Indirect Materials costs are allocated to each department based on number of vehicles used by the department. Equipment Maintenance costs are allocated based on equipment hours, and Materials Handling costs are allocated based on direct labor hours. Cement costs are allocated to jobs based on direct labor hours, and Framing costs are allocated based on equipment hours.

Mortenson recently won the bid on a contract to help with 3 new apartment buildings. The requirements for this construction job are as follows:

What is the total cost of this job? (Do not round intermediate calculations)

What is the total cost of this job? (Do not round intermediate calculations)

Mortenson has two service departments (Materials Handling and Equipment Maintenance) and two production departments (Cement and Framing). Budgeted yearly information for these departments is as follows:

Mortenson has two service departments (Materials Handling and Equipment Maintenance) and two production departments (Cement and Framing). Budgeted yearly information for these departments is as follows: Lease and Indirect Materials costs are allocated to each department based on number of vehicles used by the department. Equipment Maintenance costs are allocated based on equipment hours, and Materials Handling costs are allocated based on direct labor hours. Cement costs are allocated to jobs based on direct labor hours, and Framing costs are allocated based on equipment hours.

Lease and Indirect Materials costs are allocated to each department based on number of vehicles used by the department. Equipment Maintenance costs are allocated based on equipment hours, and Materials Handling costs are allocated based on direct labor hours. Cement costs are allocated to jobs based on direct labor hours, and Framing costs are allocated based on equipment hours.Mortenson recently won the bid on a contract to help with 3 new apartment buildings. The requirements for this construction job are as follows:

What is the total cost of this job? (Do not round intermediate calculations)

What is the total cost of this job? (Do not round intermediate calculations)

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck