Deck 12: Oligopoly

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/31

Play

Full screen (f)

Deck 12: Oligopoly

1

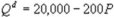

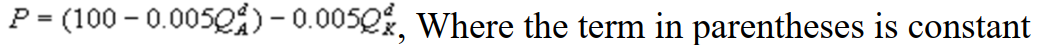

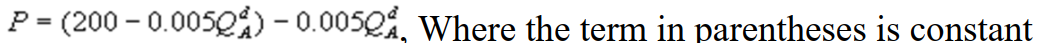

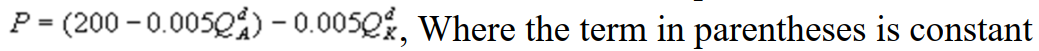

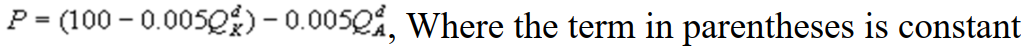

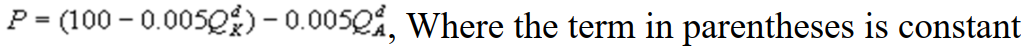

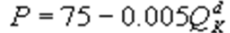

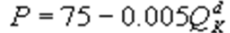

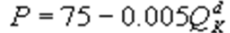

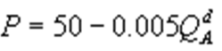

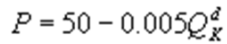

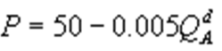

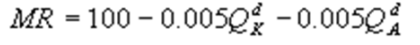

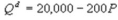

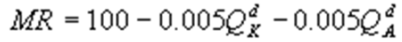

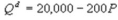

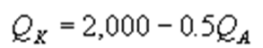

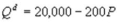

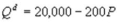

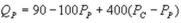

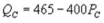

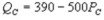

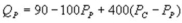

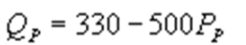

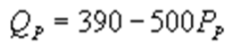

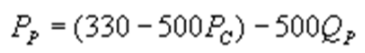

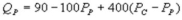

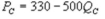

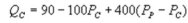

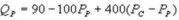

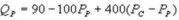

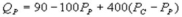

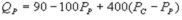

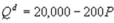

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Kate's inverse residual demand function?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Kate's inverse residual demand function?

A)

B)

C)

D)

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Kate's inverse residual demand function?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Kate's inverse residual demand function?A)

B)

C)

D)

2

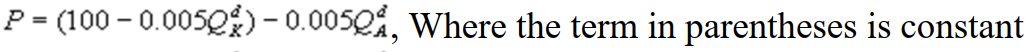

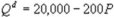

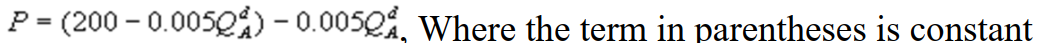

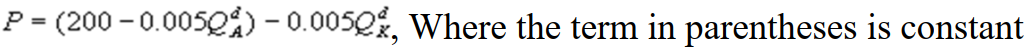

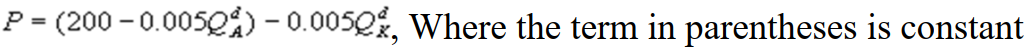

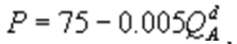

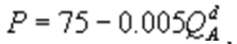

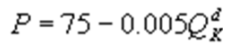

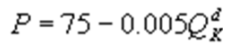

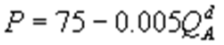

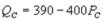

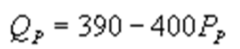

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Alice's inverse residual demand function?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Alice's inverse residual demand function?

A)

B)

C)

D)

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Alice's inverse residual demand function?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Alice's inverse residual demand function?A)

B)

C)

D)

3

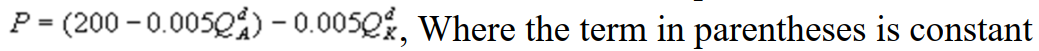

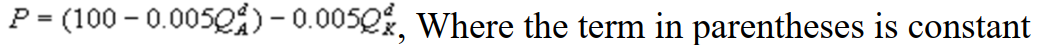

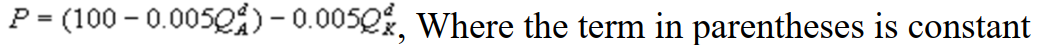

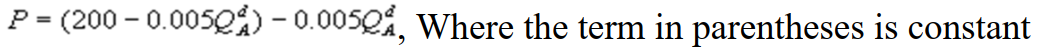

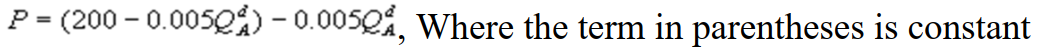

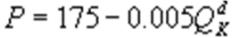

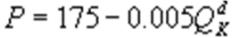

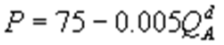

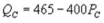

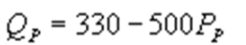

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. If Alice produces 5,000 cubic yards per year, what is Kate's inverse demand function?

where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. If Alice produces 5,000 cubic yards per year, what is Kate's inverse demand function?

A)

B)

C)

D)

where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. If Alice produces 5,000 cubic yards per year, what is Kate's inverse demand function?

where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. If Alice produces 5,000 cubic yards per year, what is Kate's inverse demand function?A)

B)

C)

D)

4

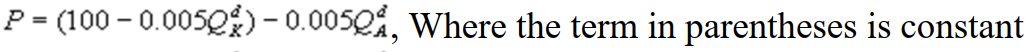

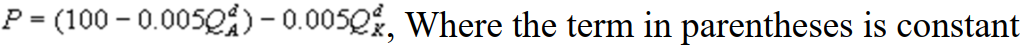

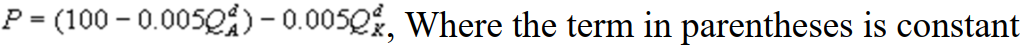

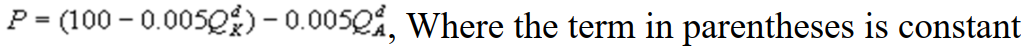

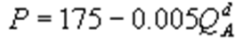

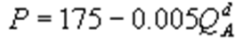

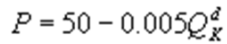

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. If Kate produces 10,000 cubic yards per year, what is Alice's inverse demand function?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. If Kate produces 10,000 cubic yards per year, what is Alice's inverse demand function?

A)

B)

C)

D)

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. If Kate produces 10,000 cubic yards per year, what is Alice's inverse demand function?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. If Kate produces 10,000 cubic yards per year, what is Alice's inverse demand function?A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

5

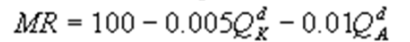

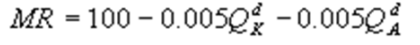

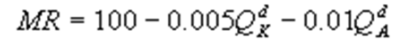

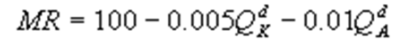

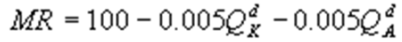

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Alice's marginal revenue function?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Alice's marginal revenue function?

A)

B)

C)

D)

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Alice's marginal revenue function?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Alice's marginal revenue function?A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

6

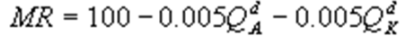

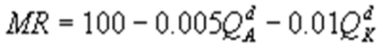

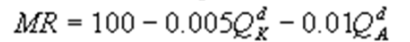

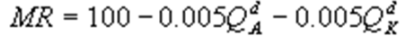

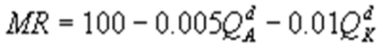

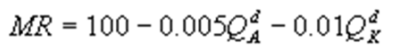

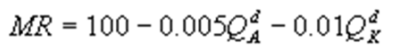

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Kate's marginal revenue function?

where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Kate's marginal revenue function?

A)

B)

C)

D)

where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Kate's marginal revenue function?

where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is Kate's marginal revenue function?A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

7

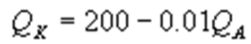

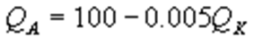

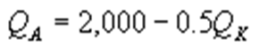

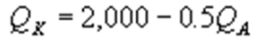

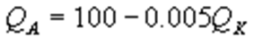

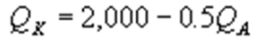

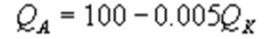

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. Find Alice's best response function.

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. Find Alice's best response function.

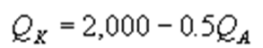

A)

B)

C)

D)

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. Find Alice's best response function.

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. Find Alice's best response function.A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

8

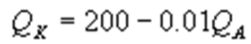

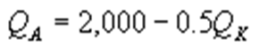

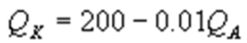

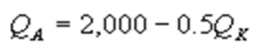

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. Find Kate's best response function.

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. Find Kate's best response function.

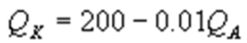

A)

B)

C)

D)

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. Find Kate's best response function.

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. Find Kate's best response function.A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

9

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much does Alice produce in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much does Alice produce in the Nash equilibrium?

A) 2,000

B) 1,333.33

C) 800

D) 4,000

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much does Alice produce in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much does Alice produce in the Nash equilibrium?A) 2,000

B) 1,333.33

C) 800

D) 4,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

10

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much does Kate produce in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much does Kate produce in the Nash equilibrium?

A) 2,000

B) 1,333.33

C) 800

D) 4,000

where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much does Kate produce in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much does Kate produce in the Nash equilibrium?A) 2,000

B) 1,333.33

C) 800

D) 4,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

11

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is total output in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is total output in the Nash equilibrium?

A) 4,000

B) 2,666.66

C) 1,600

D) 8,000

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is total output in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is total output in the Nash equilibrium?A) 4,000

B) 2,666.66

C) 1,600

D) 8,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

12

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the market price in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the market price in the Nash equilibrium?

A) $80

B) $86.67

C) $100

D) $93.34

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the market price in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the market price in the Nash equilibrium?A) $80

B) $86.67

C) $100

D) $93.34

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

13

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much profit does each producer earn in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much profit does each producer earn in the Nash equilibrium?

A) $13,340

B) $0

C) $8893.31

D) $5,336

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much profit does each producer earn in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much profit does each producer earn in the Nash equilibrium?A) $13,340

B) $0

C) $8893.31

D) $5,336

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

14

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much more profit does a monopolist earn compared to the joint profit each producer earns in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much more profit does a monopolist earn compared to the joint profit each producer earns in the Nash equilibrium?

A) $2,213.38

B) $0

C) $11,106.69

D) $2,000

where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much more profit does a monopolist earn compared to the joint profit each producer earns in the Nash equilibrium?

where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. How much more profit does a monopolist earn compared to the joint profit each producer earns in the Nash equilibrium?A) $2,213.38

B) $0

C) $11,106.69

D) $2,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

15

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the amount of the deadweight loss?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the amount of the deadweight loss?

A) $8,893.38

B) $6.67

C) $1,333,33

D) $4,446.69

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the amount of the deadweight loss?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the amount of the deadweight loss?A) $8,893.38

B) $6.67

C) $1,333,33

D) $4,446.69

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

16

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the difference in the deadweight loss compared to a monopoly in this market?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the difference in the deadweight loss compared to a monopoly in this market?

A) $666.66

B) $2,000

C) $5,553.31

D) $10,000

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the difference in the deadweight loss compared to a monopoly in this market?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. What is the difference in the deadweight loss compared to a monopoly in this market?A) $666.66

B) $2,000

C) $5,553.31

D) $10,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

17

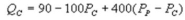

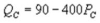

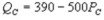

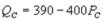

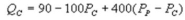

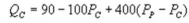

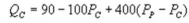

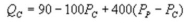

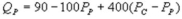

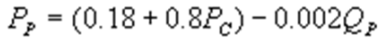

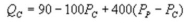

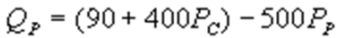

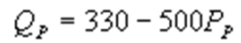

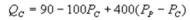

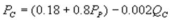

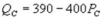

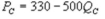

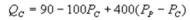

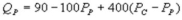

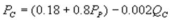

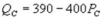

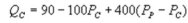

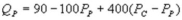

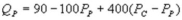

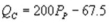

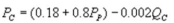

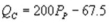

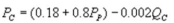

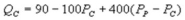

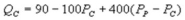

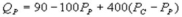

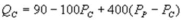

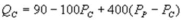

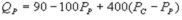

Suppose the daily demand for Coke and Pepsi in a small city are given by  and

and  where QC and QP and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. If PP = $0.75, what is Coke's demand function?

where QC and QP and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. If PP = $0.75, what is Coke's demand function?

A)

B)

C)

D)

and

and  where QC and QP and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. If PP = $0.75, what is Coke's demand function?

where QC and QP and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. If PP = $0.75, what is Coke's demand function?A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

18

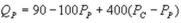

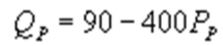

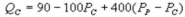

Suppose the daily demand for Coke and Pepsi in a small city are given by  and

and  whereQC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. If PC = $0.6, what is Pepsi's demand function?

whereQC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. If PC = $0.6, what is Pepsi's demand function?

A)

B)

C)

D)

and

and  whereQC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. If PC = $0.6, what is Pepsi's demand function?

whereQC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. If PC = $0.6, what is Pepsi's demand function?A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

19

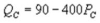

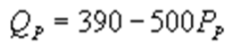

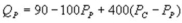

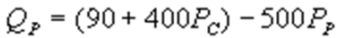

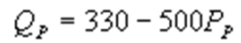

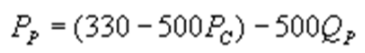

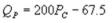

Suppose the daily demand for Coke and Pepsi in a small city are given by  and

and  whereQC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Pepsi's inverse demand function?

whereQC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Pepsi's inverse demand function?

A)

B)

C)

D)

and

and  whereQC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Pepsi's inverse demand function?

whereQC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Pepsi's inverse demand function?A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

20

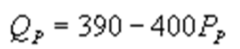

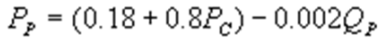

Suppose the daily demand for Coke and Pepsi in a small city are given by  and

and  where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Coke's inverse demand function?

where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Coke's inverse demand function?

A)

B)

C)

D)

and

and  where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Coke's inverse demand function?

where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Coke's inverse demand function?A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

21

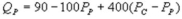

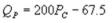

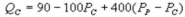

Suppose the daily demand for Coke and Pepsi in a small city are given by  and

and  where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Pepsi's best response function?

where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Pepsi's best response function?

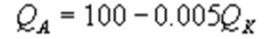

A)

B)

C)

D)

and

and  where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Pepsi's best response function?

where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Pepsi's best response function?A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose the daily demand for Coke and Pepsi in a small city are given by  and

and  where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day.PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Coke's best response function?

where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day.PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Coke's best response function?

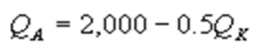

A)

B)

C)

D)

and

and  where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day.PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Coke's best response function?

where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day.PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is Coke's best response function?A)

B)

C)

D)

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose the daily demand for Coke and Pepsi in a small city are given by  and

and  where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is the Nash equilibrium price for Pepsi?

where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is the Nash equilibrium price for Pepsi?

A) $.016

B) $0.45

C) $0.53

D) $0.38

and

and  where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is the Nash equilibrium price for Pepsi?

where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is the Nash equilibrium price for Pepsi?A) $.016

B) $0.45

C) $0.53

D) $0.38

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

24

Suppose the daily demand for Coke and Pepsi in a small city are given by  and

and  where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is the Nash equilibrium price for Coke?

where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is the Nash equilibrium price for Coke?

A) $.016

B) $0.45

C) $0.53

D) $0.38

and

and  where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is the Nash equilibrium price for Coke?

where QC and QP are the number of cans Coke and Pepsi sell, respectively, in thousands per day. PC and PP are the prices of a can of Coke and Pepsi, respectively, measured in dollars. The marginal cost is $0.45 per can. What is the Nash equilibrium price for Coke?A) $.016

B) $0.45

C) $0.53

D) $0.38

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

25

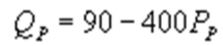

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Kate's profit maximizing output?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Kate's profit maximizing output?

A) 2,000

B) 1,333.34

C) 1,000

D) 4,000

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Kate's profit maximizing output?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Kate's profit maximizing output?A) 2,000

B) 1,333.34

C) 1,000

D) 4,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

26

45 Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Alice's profit maximizing output?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Alice's profit maximizing output?

A) 2,000

B) 1,333.34

C) 1,000

D) 4,000

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Alice's profit maximizing output?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Alice's profit maximizing output?A) 2,000

B) 1,333.34

C) 1,000

D) 4,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

27

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. Given market demand, what is the market price per cubic yard?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. Given market demand, what is the market price per cubic yard?

A) $80

B) $85

C) $90

D) $95

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. Given market demand, what is the market price per cubic yard?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. Given market demand, what is the market price per cubic yard?A) $80

B) $85

C) $90

D) $95

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

28

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Kate's profit?

where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Kate's profit?

A) $10,000

B) $5,000

C) $20,000

D) $15,000

where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Kate's profit?

where P is the price of a cubic yard of concrete and Qdis the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Kate's profit?A) $10,000

B) $5,000

C) $20,000

D) $15,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

29

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Alice's profit?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Alice's profit?

A) $10,000

B) $5,000

C) $20,000

D) $15,000

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Alice's profit?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Alice's profit?A) $10,000

B) $5,000

C) $20,000

D) $15,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

30

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is the difference in Kate's profit when she enters the market first compared to when Kate and Alice choose their outputs simultaneously?

where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is the difference in Kate's profit when she enters the market first compared to when Kate and Alice choose their outputs simultaneously?

A) $11,106.69

B) $5,000

C) $1106.69

D) -$3893.31

where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is the difference in Kate's profit when she enters the market first compared to when Kate and Alice choose their outputs simultaneously?

where P is the price of a cubic yard of concrete andQd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is the difference in Kate's profit when she enters the market first compared to when Kate and Alice choose their outputs simultaneously?A) $11,106.69

B) $5,000

C) $1106.69

D) -$3893.31

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

31

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is  where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is the difference in Alice's profit when Kate enters the market first, compared to when they simultaneously select their outputs?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is the difference in Alice's profit when Kate enters the market first, compared to when they simultaneously select their outputs?

A) $11,106.69

B) $5,000

C) $1106.69

D) -$3893.31

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is the difference in Alice's profit when Kate enters the market first, compared to when they simultaneously select their outputs?

where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is the difference in Alice's profit when Kate enters the market first, compared to when they simultaneously select their outputs?A) $11,106.69

B) $5,000

C) $1106.69

D) -$3893.31

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck