Deck 2: Accounting and Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/252

Play

Full screen (f)

Deck 2: Accounting and Financial Statements

1

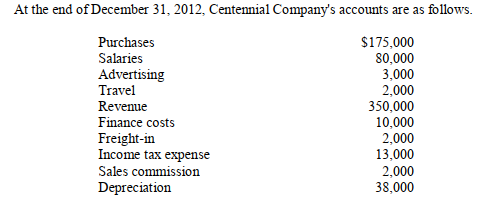

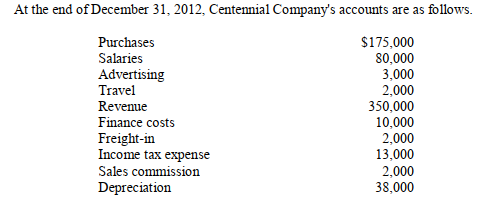

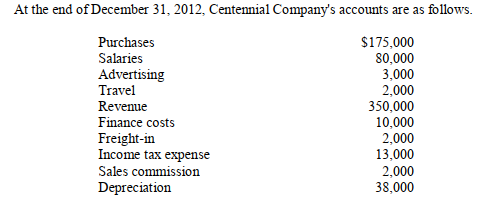

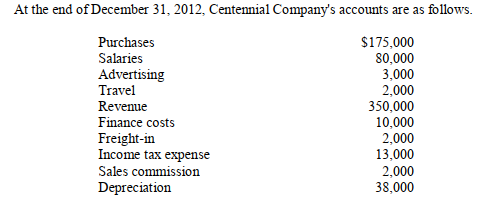

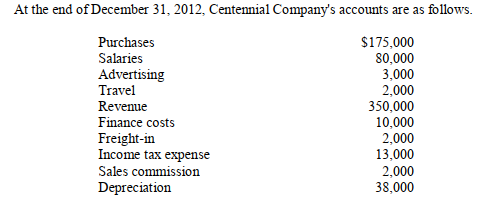

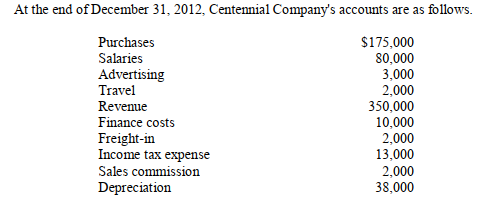

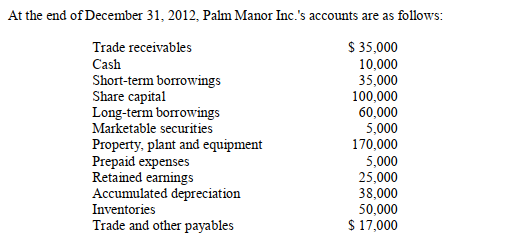

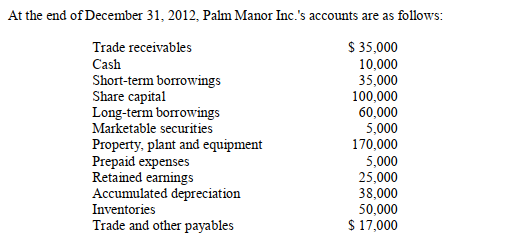

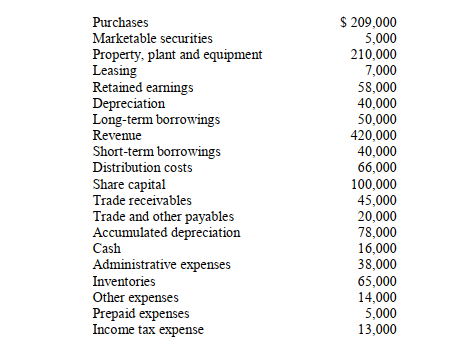

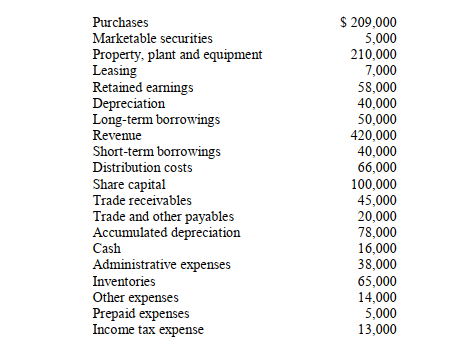

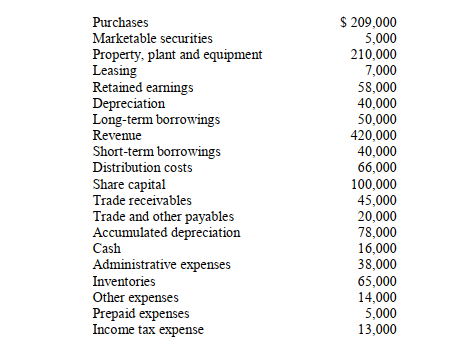

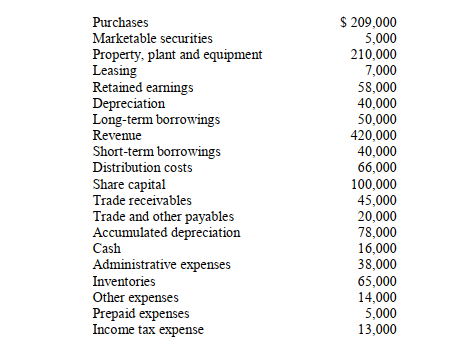

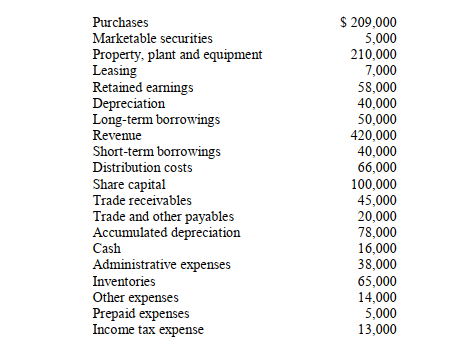

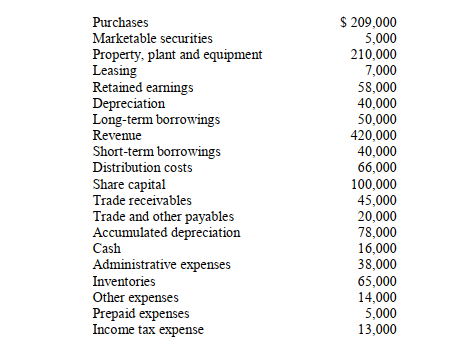

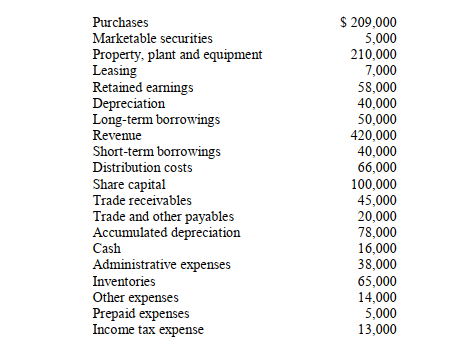

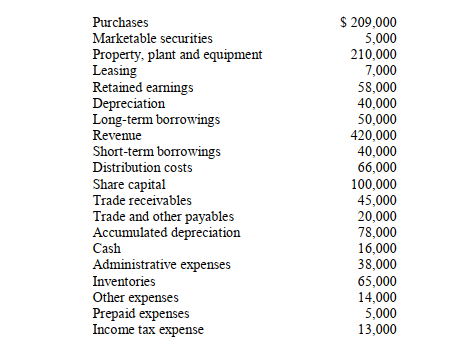

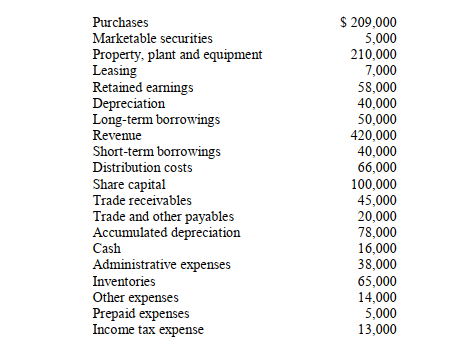

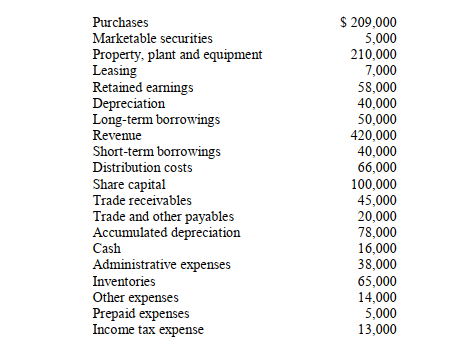

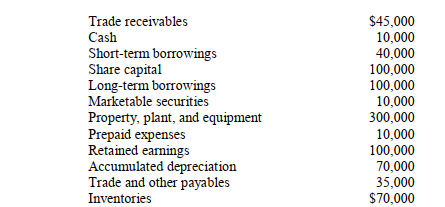

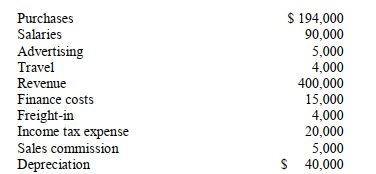

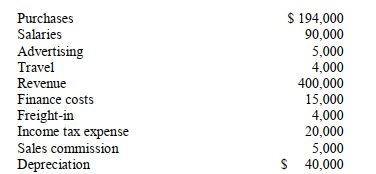

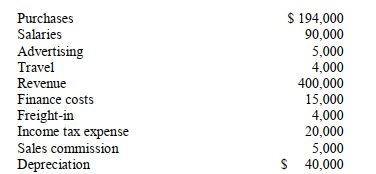

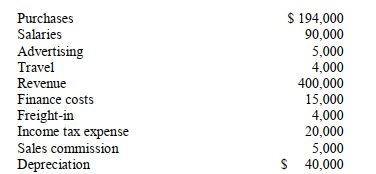

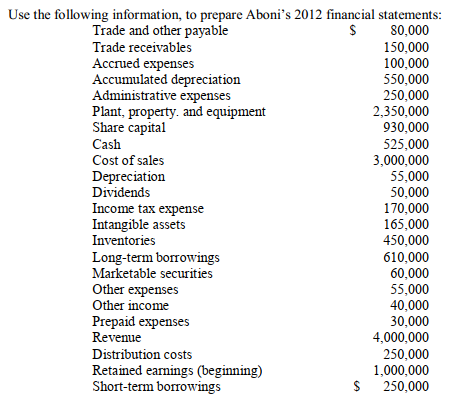

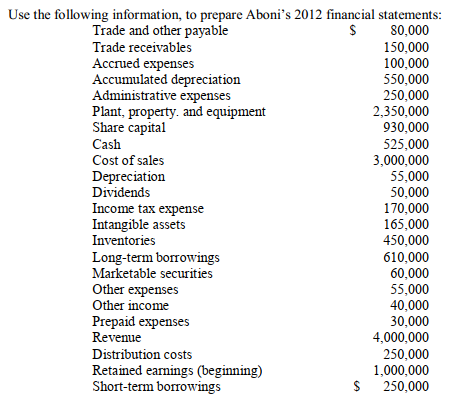

-Cost of sales is _________________________ .

$ 177,000.

2

-Gross profit is _________________________.

$ 173,000.

3

-Total expenses are _________________________ .

$ 135,000.

4

-Profit before taxes is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

5

-Profit for the year is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

6

-The cash flow is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

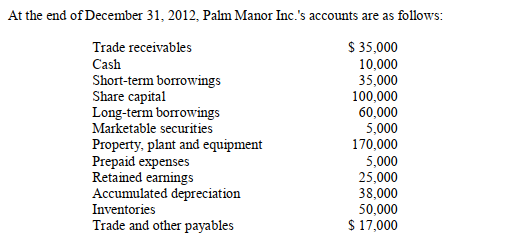

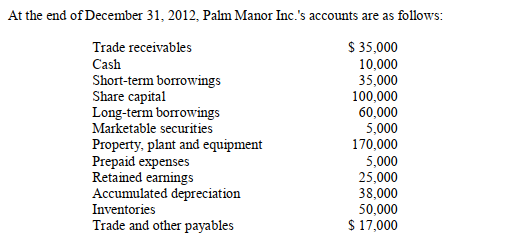

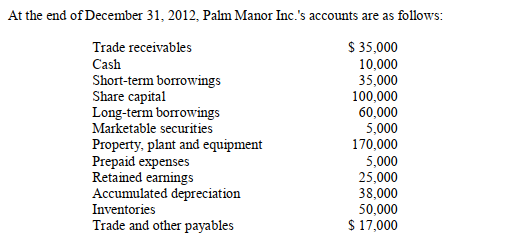

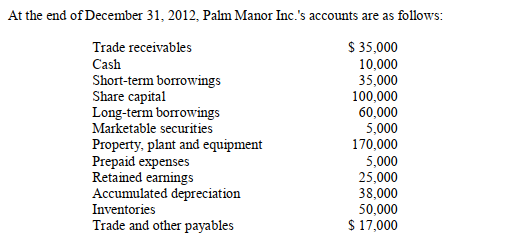

7

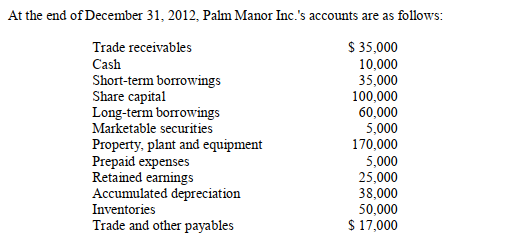

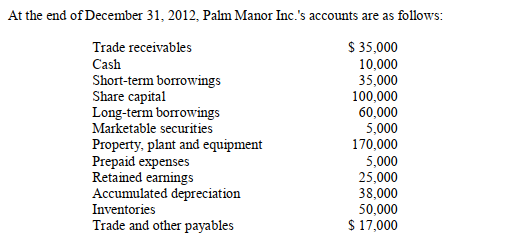

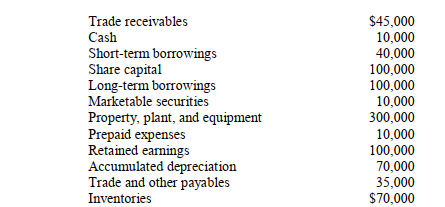

-Total current assets are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

8

-Total non-current assets are_________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

9

-Total assets are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

10

-Total current liabilities are_________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

11

-Long-term borrowings are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

12

-Total liabilities amount to _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

13

-Total equity is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

14

-Total equity and liabilities is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

15

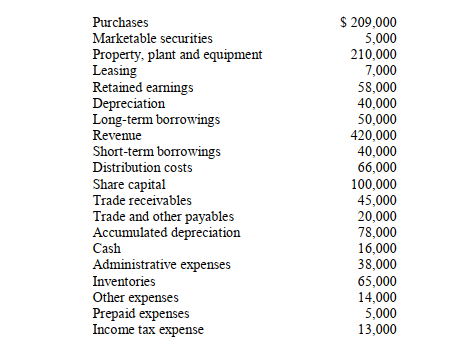

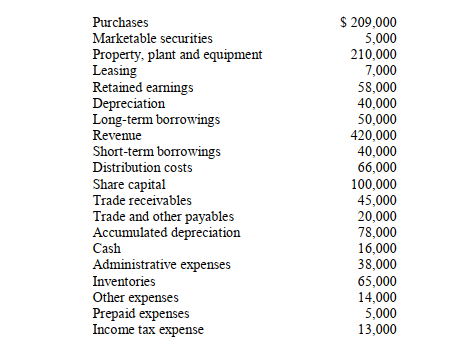

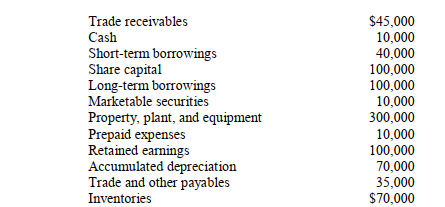

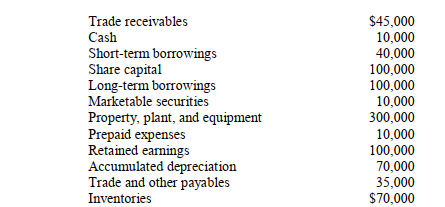

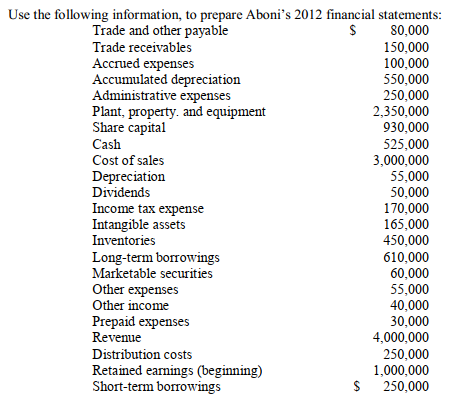

-Purchases are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

16

-Total operating expenses are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

17

-Profit before taxes is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

18

-Profit for the year is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

19

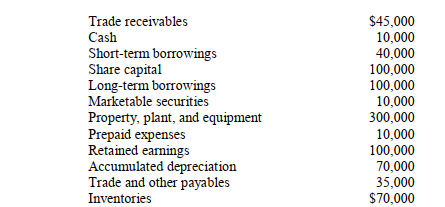

-Total current assets are_________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

20

-Total non-current assets are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

21

-Total assets are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

22

-Total current liabilities are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

23

-Long-term borrowings are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

24

-Total liabilities are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

25

-Total equity is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

26

-Total cash flow is_________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

27

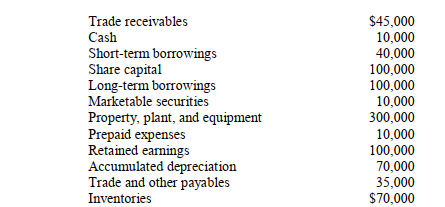

-Total current assets are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

28

-Total non-current assets are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

29

-Total assets are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

30

-Total current liabilities are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

31

-Total liabilities are _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

32

-Total equity is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

33

-Total equity and liabilities is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

34

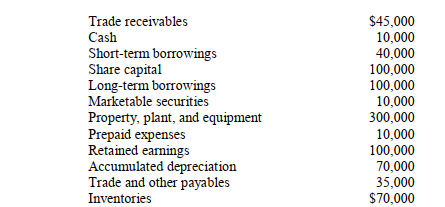

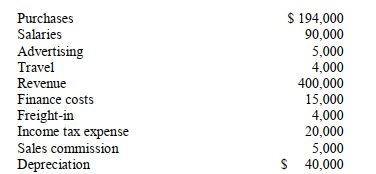

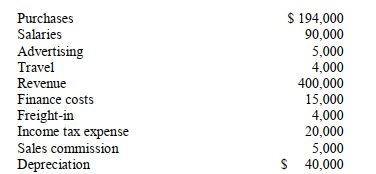

-Cost of sales is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

35

-Gross profit is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

36

-Total operating expenses is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

37

-Profit before taxes is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

38

-Profit for the year is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

39

-Cash flow from operations is _________________________ .

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

40

-The statement of income

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

41

-The statement of retained earnings.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

42

-The statement of financial position.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

43

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Calculate the internal depreciation for the five-year period using the straight-line method.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Calculate the internal depreciation for the five-year period using the straight-line method.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

44

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Calculate the internal depreciation for the 5-year period using the sum-of-the digits method.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Calculate the internal depreciation for the 5-year period using the sum-of-the digits method.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

45

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Calculate the capital cost allowance for the 5-year period.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Calculate the capital cost allowance for the 5-year period.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

46

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Calculate the annual future income taxes payable.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Calculate the annual future income taxes payable.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

47

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Calculate the cumulate future income taxes payable.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Calculate the cumulate future income taxes payable.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

48

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What activities does bookkeeping include?

A) Collecting, classifying and reporting transactions that take place in the business.

B) Recording business transactions in journals.

C) Collecting, classifying and reporting the activities that take place in the business.

D) Ensuring that all transactions are reported in accordance with accepted accounting principles.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What activities does bookkeeping include?

A) Collecting, classifying and reporting transactions that take place in the business.

B) Recording business transactions in journals.

C) Collecting, classifying and reporting the activities that take place in the business.

D) Ensuring that all transactions are reported in accordance with accepted accounting principles.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

49

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-How is the gross profit of a business calculated?

A) Gross profit is the difference between revenues and cost of sales.

B) Gross profit is the excess of revenues over the sum of cost of sales and operating expenses.

C) Gross profit is the sum of revenue and cost of sales.

D) Gross profit is the difference between revenues and cost of sales..

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-How is the gross profit of a business calculated?

A) Gross profit is the difference between revenues and cost of sales.

B) Gross profit is the excess of revenues over the sum of cost of sales and operating expenses.

C) Gross profit is the sum of revenue and cost of sales.

D) Gross profit is the difference between revenues and cost of sales..

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

50

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What are debits and credits?

A) A debit is an increase in an asset or a decrease in a liability, and a credit is an increase in a liability and a decrease in an asset

B) A debit is an increase in a liability or a decrease in an asset, and a credit is an increase in an asset or a decrease in a liability

C) A debit is an increase in shareholders' equity, and a credit is a decrease in shareholders' equity

D) A debit is an increase in revenue or a decrease in expenses and a credit is a decrease in revenue and an increase in expenses entry

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What are debits and credits?

A) A debit is an increase in an asset or a decrease in a liability, and a credit is an increase in a liability and a decrease in an asset

B) A debit is an increase in a liability or a decrease in an asset, and a credit is an increase in an asset or a decrease in a liability

C) A debit is an increase in shareholders' equity, and a credit is a decrease in shareholders' equity

D) A debit is an increase in revenue or a decrease in expenses and a credit is a decrease in revenue and an increase in expenses entry

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

51

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What are journals used for in the accounting cycle?

A) as the books of final entry

B) as the books used to record the days to day activities of a business

C) as the books of original entry

D) as the source of accounting information to prepare a trial balance

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What are journals used for in the accounting cycle?

A) as the books of final entry

B) as the books used to record the days to day activities of a business

C) as the books of original entry

D) as the source of accounting information to prepare a trial balance

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

52

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What statements are included in the statement of earnings?

A) The statements of comprehensive income and other comprehensive income

B) The statement of income and the statement of retained earnings

C) The statements of income and other comprehensive income

D) The statement of income and the statement of comprehensive income

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What statements are included in the statement of earnings?

A) The statements of comprehensive income and other comprehensive income

B) The statement of income and the statement of retained earnings

C) The statements of income and other comprehensive income

D) The statement of income and the statement of comprehensive income

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

53

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What is the accounting equation?

A) A=E+L

B) E=A+L

C) A=L-E

D) A=E-L

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What is the accounting equation?

A) A=E+L

B) E=A+L

C) A=L-E

D) A=E-L

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

54

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is an example of a debit transaction?

A) a decrease in the inventory account

B) an increase in the revenue account

C) an increase in the trade receivables account

D) an increase in the trade payables account

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is an example of a debit transaction?

A) a decrease in the inventory account

B) an increase in the revenue account

C) an increase in the trade receivables account

D) an increase in the trade payables account

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

55

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-How is gross profit calculated?

A) income before taxes less operating expenses

B) revenue less cost of sales

C) profit before taxes less cost of sales

D) operating income less operating expenses

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-How is gross profit calculated?

A) income before taxes less operating expenses

B) revenue less cost of sales

C) profit before taxes less cost of sales

D) operating income less operating expenses

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

56

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-How is profit for the year calculated?

A) by deducting operating expenses from profit before taxes

B) by deducting cost of sales from profit before taxes

C) by deducting cost of sales from revenue

D) by deducting income tax expense from profit before taxes

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-How is profit for the year calculated?

A) by deducting operating expenses from profit before taxes

B) by deducting cost of sales from profit before taxes

C) by deducting cost of sales from revenue

D) by deducting income tax expense from profit before taxes

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

57

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What are dividends deducted from to show the net change in retained earnings?

A) profit for the year

B) expenses

C) profit before taxes

D) revenue

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What are dividends deducted from to show the net change in retained earnings?

A) profit for the year

B) expenses

C) profit before taxes

D) revenue

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

58

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is a current asset?

A) goodwill

B) prepaid expenses

C) accrued liabilities

D) deferred revenue

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is a current asset?

A) goodwill

B) prepaid expenses

C) accrued liabilities

D) deferred revenue

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

59

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What part of the balance sheet contains marketable securities?

A) the revenue accounts

B) the current liability accounts

C) the current asset accounts

D) the non-current asset accounts

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What part of the balance sheet contains marketable securities?

A) the revenue accounts

B) the current liability accounts

C) the current asset accounts

D) the non-current asset accounts

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

60

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is a current liability?

A) marketable securities

B) prepaid expenses

C) mortgage debt

D) accrued expenses

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is a current liability?

A) marketable securities

B) prepaid expenses

C) mortgage debt

D) accrued expenses

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

61

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What term refers to payments made for services that have NOT yet been received?

A) accrued liabilities

B) prepaid expenses

C) accrued expenses

D) prepaid liabilities

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What term refers to payments made for services that have NOT yet been received?

A) accrued liabilities

B) prepaid expenses

C) accrued expenses

D) prepaid liabilities

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

62

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What type of asset is goodwill?

A) a fixed asset

B) a current asset

C) an intangible asset

D) a prepaid asset

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What type of asset is goodwill?

A) a fixed asset

B) a current asset

C) an intangible asset

D) a prepaid asset

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

63

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What do retained earnings represent?

A) the net profit generated by a business less the dividends declared

B) a non-current liability

C) the earnings paid to shareholders

D) a current liability

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What do retained earnings represent?

A) the net profit generated by a business less the dividends declared

B) a non-current liability

C) the earnings paid to shareholders

D) a current liability

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

64

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What does capital cost allowance represent?

A) an amount used to calculate the book value of capital assets

B) an amount used to calculate the residual value of fixed assets

C) Canada Revenue Agency's equivalent of accumulated depreciation

D) Canada Revenue Agency's equivalent of depreciation

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What does capital cost allowance represent?

A) an amount used to calculate the book value of capital assets

B) an amount used to calculate the residual value of fixed assets

C) Canada Revenue Agency's equivalent of accumulated depreciation

D) Canada Revenue Agency's equivalent of depreciation

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

65

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What differences between accounting income and taxable income can lead to a future income tax liability?

A) revenue and accumulated earnings

B) accumulated depreciation and depreciation

C) CCA and accumulated depreciation

D) CCA and depreciation

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What differences between accounting income and taxable income can lead to a future income tax liability?

A) revenue and accumulated earnings

B) accumulated depreciation and depreciation

C) CCA and accumulated depreciation

D) CCA and depreciation

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

66

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What is one of the adjustments required to calculate a company's cash flow?

A) adding accumulated depreciation to profit for the year

B) adding depreciation to profit for the year

C) adding depreciation to profit before taxes

D) adding profit from operations to interest income

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What is one of the adjustments required to calculate a company's cash flow?

A) adding accumulated depreciation to profit for the year

B) adding depreciation to profit for the year

C) adding depreciation to profit before taxes

D) adding profit from operations to interest income

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

67

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What is the opposite of a prepaid expense?

A) intangible asset

B) accounts receivable

C) capital asset

D) accrued liability

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What is the opposite of a prepaid expense?

A) intangible asset

B) accounts receivable

C) capital asset

D) accrued liability

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

68

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur invests $100,000 cash in a business. What is the effect on the financial statements?

A) Current liabilities increase and current assets increase.

B) Current liabilities decrease and current assets decrease.

C) Current assets decrease and equity decreases.

D) Current assets increase and equity increases.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur invests $100,000 cash in a business. What is the effect on the financial statements?

A) Current liabilities increase and current assets increase.

B) Current liabilities decrease and current assets decrease.

C) Current assets decrease and equity decreases.

D) Current assets increase and equity increases.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

69

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur borrows $50,000 from the bank for his business, to be repaid in one year. What is the effect on the financial statements?

A) Current assets increase and shareholder's equity increase.

B) Current assets decrease and current liabilities increase.

C) Current assets increase and current liabilities increase.

D) Current assets increase and long-term liabilities increase.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur borrows $50,000 from the bank for his business, to be repaid in one year. What is the effect on the financial statements?

A) Current assets increase and shareholder's equity increase.

B) Current assets decrease and current liabilities increase.

C) Current assets increase and current liabilities increase.

D) Current assets increase and long-term liabilities increase.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

70

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur purchases advertising on credit. What is the effect on the financial statements?

A) Expenses decrease and accounts payable increase.

B) Expenses increase and accounts payable decrease.

C) Expenses decrease and accounts payable decrease.

D) Expenses increase and accounts payable increase.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur purchases advertising on credit. What is the effect on the financial statements?

A) Expenses decrease and accounts payable increase.

B) Expenses increase and accounts payable decrease.

C) Expenses decrease and accounts payable decrease.

D) Expenses increase and accounts payable increase.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

71

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur buys office furniture to be paid for in 30 days. What is the effect on the financial statements?

A) Capital assets increase and long-term debt increases.

B) Capital assets increase and current liabilities increase.

C) Current assets increase and cash decreases.

D) Current assets increase and current liabilities increase.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur buys office furniture to be paid for in 30 days. What is the effect on the financial statements?

A) Capital assets increase and long-term debt increases.

B) Capital assets increase and current liabilities increase.

C) Current assets increase and cash decreases.

D) Current assets increase and current liabilities increase.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

72

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur collects $13,000 cash for services previously rendered. What is the effect on the financial statements?

A) Current assets increase and revenue increases.

B) Current assets increase and current liabilities increase.

C) Current assets decrease and revenue increases.

D) Current assets increase and current assets decrease.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur collects $13,000 cash for services previously rendered. What is the effect on the financial statements?

A) Current assets increase and revenue increases.

B) Current assets increase and current liabilities increase.

C) Current assets decrease and revenue increases.

D) Current assets increase and current assets decrease.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

73

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur pays $3,000 in cash for salaries. What is the effect on the financial statements?

A) Current assets decrease and expenses increase.

B) Revenues decrease and current assets decrease.

C) Expenses increase and current assets increase.

D) Current liabilities increase and expenses increase.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur pays $3,000 in cash for salaries. What is the effect on the financial statements?

A) Current assets decrease and expenses increase.

B) Revenues decrease and current assets decrease.

C) Expenses increase and current assets increase.

D) Current liabilities increase and expenses increase.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

74

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur repays a $10,000 bank loan. What is the effect on the financial statements?

A) Current assets decrease and expenses increase.

B) Current assets increase and current liabilities decrease.

C) Current assets decrease and expenses decrease.

D) Current assets decrease and current liabilities decrease.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur repays a $10,000 bank loan. What is the effect on the financial statements?

A) Current assets decrease and expenses increase.

B) Current assets increase and current liabilities decrease.

C) Current assets decrease and expenses decrease.

D) Current assets decrease and current liabilities decrease.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

75

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur pays $13,000 in cash for merchandise that was previously purchased on credit. What is the effect on the financial statements?

A) Current assets decrease and current liabilities increase.

B) Current liabilities decrease and expenses increases.

C) Current assets decrease and current liabilities decrease.

D) Current liabilities decrease and long-term debt increases.

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-An entrepreneur pays $13,000 in cash for merchandise that was previously purchased on credit. What is the effect on the financial statements?

A) Current assets decrease and current liabilities increase.

B) Current liabilities decrease and expenses increases.

C) Current assets decrease and current liabilities decrease.

D) Current liabilities decrease and long-term debt increases.

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

76

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is an administrative expense?

A) the cost of merchandise

B) depreciation

C) dividends

D) office salaries

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is an administrative expense?

A) the cost of merchandise

B) depreciation

C) dividends

D) office salaries

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

77

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What account is found on the statement of income?

A) taxes payable

B) accumulated amortization

C) bank loan

D) salaries

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What account is found on the statement of income?

A) taxes payable

B) accumulated amortization

C) bank loan

D) salaries

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

78

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What account is found on the statement of financial position?

A) finance costs

B) office salaries

C) depreciation

D) cash

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-What account is found on the statement of financial position?

A) finance costs

B) office salaries

C) depreciation

D) cash

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

79

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is included in the statement of changes in equity?

A) bank loans

B) dividends payable

C) income taxes

D) profit for the year

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is included in the statement of changes in equity?

A) bank loans

B) dividends payable

C) income taxes

D) profit for the year

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck

80

Cost of the asset$100,000

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is a current liability?

A) trade receivables

B) prepaid expenses

C) preferred shares

D) short-term borrowings

Life of the asset 5 years

Depreciation rate20%

Capital cost allowance rate 50%

Residual value of the asset nil

Income tax rate 50%

-Which of the following is a current liability?

A) trade receivables

B) prepaid expenses

C) preferred shares

D) short-term borrowings

Unlock Deck

Unlock for access to all 252 flashcards in this deck.

Unlock Deck

k this deck