Deck 2: Currencies: Expectations, Parities, and Forecasting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/10

Play

Full screen (f)

Deck 2: Currencies: Expectations, Parities, and Forecasting

1

The inflation rates in the Eurozone and Morocco are expected to be 4% per year and 7% per year, respectively. Which of the following is correct? If the current spot rate for the Moroccan dirham (MDr) is 9.5238 against the euro, then the expected spot rate in three years would be

A) MDr 8.6957

B) MDr 8.9928

C) MDr 10.3720

D) MDr 10.0806

A) MDr 8.6957

B) MDr 8.9928

C) MDr 10.3720

D) MDr 10.0806

MDr 10.3720

2

Which of the following is correct? Suppose the expected inflation in the U.S. on was projected at 5% annually for the next 5 years and at 12% annually in Turkey for the same time period, and the Turkish lira/$ spot rate that day was currently at L2400 = $1, then the PPP estimate of the spot rate five years from now would be

A) 1738

B) 3314

C) 2560

D) 2250

A) 1738

B) 3314

C) 2560

D) 2250

3314

3

The annual inflation rates in the Eurozone and the Hungarian forint (HFt) were expected to be 3% and 8%, respectively. Which of the following is correct? If the current spot rate that day for the drachma was HFt 142.85, then the expected spot rate in three years would be

A) HFt 164.68

B) HFt 121.51

C) HFt 133.16

D) HFt 144.09

A) HFt 164.68

B) HFt 121.51

C) HFt 133.16

D) HFt 144.09

HFt 164.68

4

Which of the following is correct? The annual inflation rates in the Eurozone and Poland are expected to be 4% and 6%, respectively. If the current spot rate is Zl 8.00, then the expected spot rate in two years was

A) Zl 7.70

B) Zl 8.70

C) Zl 8.31

D) Zl 7.49

A) Zl 7.70

B) Zl 8.70

C) Zl 8.31

D) Zl 7.49

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

5

The spot rate on the Swiss franc are SFr2.56/$ and the 180-day forward rate is SFr2.50/$. Which of the following is correct? The difference between the spot and forward rates suggested that

A) interest rates were higher in the U.S. than in Switzerland

B) the Swiss franc will rise in relation to the dollar

C) the inflation rate in Switzerland is declining

D) the Swiss franc is expected to fall in value relative to the dollar

A) interest rates were higher in the U.S. than in Switzerland

B) the Swiss franc will rise in relation to the dollar

C) the inflation rate in Switzerland is declining

D) the Swiss franc is expected to fall in value relative to the dollar

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

6

If the annualized interest rates in the U.S. and Hong Kong are 9% and 13%, respectively, and the spot value of the Hong Kong dollar is HK$9.0171, then at what 180-day forward rate will interest rate parity hold?

A) HK$9.3458

B) HK$8.6957

C) HK$9.1897

D) HK$8.8496

A) HK$9.3458

B) HK$8.6957

C) HK$9.1897

D) HK$8.8496

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

7

The spot rate on the euro is $1.33 and the 180-day forward rate is $1.34. Which of the following is correct? The difference between the two rates means

A) interest rates are higher in the U.S. than in the Eurozone

B) the euro has risen in relation to the U.S. dollar

C) the inflation rate in the Eurozone is declining

D) the euro is expected to fall in value relative to the U.S. dollar

A) interest rates are higher in the U.S. than in the Eurozone

B) the euro has risen in relation to the U.S. dollar

C) the inflation rate in the Eurozone is declining

D) the euro is expected to fall in value relative to the U.S. dollar

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

8

If annualized interest rates in the U.S. and Brazil are 9% and 13%, respectively, and the spot value of the real was R9.017, then at what 180-day forward rate would interest rate parity hold?

A) R9.346

B) R8.696

C) R9.190

D) R8.850

A) R9.346

B) R8.696

C) R9.190

D) R8.850

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

9

The price indexes in South Africa and the Eurozone, which both began the year at 100, are at 117 and 105, respectively, by the end of the year. Which of the following is correct? If the beginning and ending exchange rates, respectively, for the rand are SAR 7.5758 and SAR 8.8889, then the change in the real value of the rand (a " -" indicates a real devaluation) during the year is

A) 0%

B) -5.3%

C) 2.4%

D) -8.2%

A) 0%

B) -5.3%

C) 2.4%

D) -8.2%

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

10

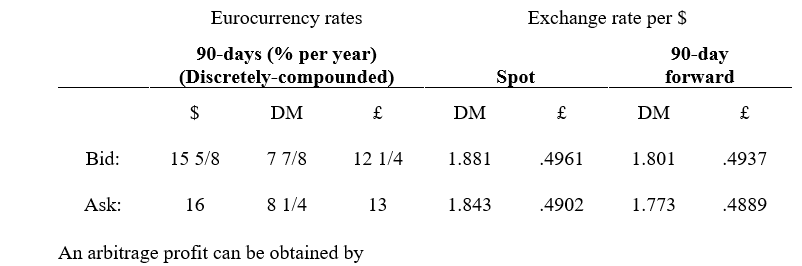

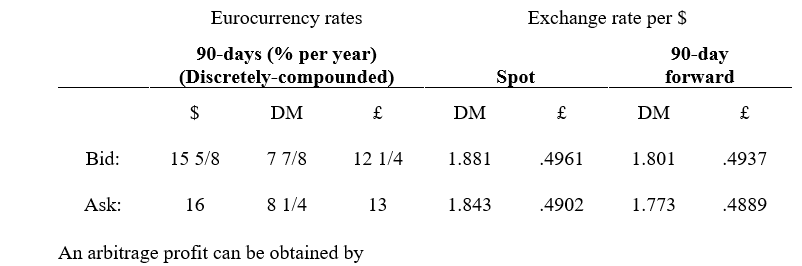

The following exchange and interest rate quotations in 1998 were observed:

A) borrowing British pounds and lending U.S. dollars

B) borrowing U.S. dollars and lending Deutschmarks

C) borrowing Deutschmarks and lending British pounds

D) there are no arbitrage opportunities

A) borrowing British pounds and lending U.S. dollars

B) borrowing U.S. dollars and lending Deutschmarks

C) borrowing Deutschmarks and lending British pounds

D) there are no arbitrage opportunities

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck