Deck 13: Entrepreneurial Finance, Venture Capita, Mergers, Acquisitions, and Corporate Control

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/14

Play

Full screen (f)

Deck 13: Entrepreneurial Finance, Venture Capita, Mergers, Acquisitions, and Corporate Control

1

What is the maximum price Smart Products can pay for Snazzy Snaps?

A) $30,153,951

B) $69,090,200

C) $102,729,660

D) $48,257,950

A) $30,153,951

B) $69,090,200

C) $102,729,660

D) $48,257,950

$69,090,200

2

Suppose Smart Products' stock price is $40 per share, and there are 12,000,000 shares outstanding. How many new shares must Smart issue to acquire Snazzy Snaps at the maximum price?

A) 6,534,325

B) 2,568,242

C) 1,727,255

D) 4,639,773

A) 6,534,325

B) 2,568,242

C) 1,727,255

D) 4,639,773

1,727,255

3

Needsalift, Inc.

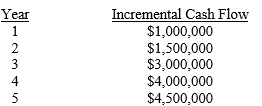

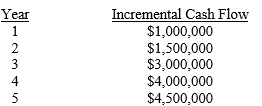

You are analyzing the potential acquisition of Nothing Better! Ice Creams, Inc. by your firm, Needsalift, Inc. The ice cream firm is a wholly owned subsidiary of Grand Lake Investments, which has set a firm selling price of $10,000,000. From your work you estimate that Nothing Better! will generate the following incremental cash flows for Needsalift:

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.

-What is the value of the proposed acquisition to Needsalift?

A) $9,771,379

B) $10,666,344

C) $8,500,678

D) $10,596,175

You are analyzing the potential acquisition of Nothing Better! Ice Creams, Inc. by your firm, Needsalift, Inc. The ice cream firm is a wholly owned subsidiary of Grand Lake Investments, which has set a firm selling price of $10,000,000. From your work you estimate that Nothing Better! will generate the following incremental cash flows for Needsalift:

To fund the $10 million price, Needsalift can use $2 million from internal sources (retained earnings) with a required return of 15 percent, while the rest would come from a new debt issue yielding 10 percent. Needsalift's tax rate is 40 percent.

-What is the value of the proposed acquisition to Needsalift?

A) $9,771,379

B) $10,666,344

C) $8,500,678

D) $10,596,175

$10,666,344

4

Milner - Poudre

Milner Manufacturing plans to acquire Poudre Chemicals, by giving Poudre shareholders 1.75 shares of Milner stock per share of Poudre. There are 2 million shares of Poudre Chemicals outstanding, with a pre-merger-offer price of $25 per share, and Milner's pre-offer stock price is $16.50.

-What is the value of the transaction at the time of the offer for Milner Manufacturing?

A) $87,500,000

B) $33,000,000

C) $50,000,000

D) $57,750,000

Milner Manufacturing plans to acquire Poudre Chemicals, by giving Poudre shareholders 1.75 shares of Milner stock per share of Poudre. There are 2 million shares of Poudre Chemicals outstanding, with a pre-merger-offer price of $25 per share, and Milner's pre-offer stock price is $16.50.

-What is the value of the transaction at the time of the offer for Milner Manufacturing?

A) $87,500,000

B) $33,000,000

C) $50,000,000

D) $57,750,000

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

5

Smart Products

Suppose Smart Products has three divisions which contribute 40, 35, and 25 percent each to its revenues.

-What is Smart Products' Herfindahl Index on focus?

A) 1.0

B) 0.40

C) 0.345

D) 0.333

Suppose Smart Products has three divisions which contribute 40, 35, and 25 percent each to its revenues.

-What is Smart Products' Herfindahl Index on focus?

A) 1.0

B) 0.40

C) 0.345

D) 0.333

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

6

Smith-Miler Merger

Smith Enterprises can acquire Miller, Inc for $250,000 in either cash or stock. Both companies are 100% equity financed. The synergy value of the acquisition for Smith is $35,000. Currently Smith has 25,000 shares outstanding which trade at $29 a share, whereas Miller has 15,000 shares outstanding that trade at $14 a share.

-What is the net value of the acquisition to Smith if cash is used?

A) $245,000

B) -$5,000

C) -$250,000

D) $5,000

Smith Enterprises can acquire Miller, Inc for $250,000 in either cash or stock. Both companies are 100% equity financed. The synergy value of the acquisition for Smith is $35,000. Currently Smith has 25,000 shares outstanding which trade at $29 a share, whereas Miller has 15,000 shares outstanding that trade at $14 a share.

-What is the net value of the acquisition to Smith if cash is used?

A) $245,000

B) -$5,000

C) -$250,000

D) $5,000

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

7

Smith-Miler Merger

Smith Enterprises can acquire Miller, Inc for $250,000 in either cash or stock. Both companies are 100% equity financed. The synergy value of the acquisition for Smith is $35,000. Currently Smith has 25,000 shares outstanding which trade at $29 a share, whereas Miller has 15,000 shares outstanding that trade at $14 a share.

-For Smith and Miller, what is the value of the post merger firm if cash is used?

A) $-5,000

B) $725,000

C) $720,000

D) $250,000

Smith Enterprises can acquire Miller, Inc for $250,000 in either cash or stock. Both companies are 100% equity financed. The synergy value of the acquisition for Smith is $35,000. Currently Smith has 25,000 shares outstanding which trade at $29 a share, whereas Miller has 15,000 shares outstanding that trade at $14 a share.

-For Smith and Miller, what is the value of the post merger firm if cash is used?

A) $-5,000

B) $725,000

C) $720,000

D) $250,000

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

8

3D Company generates 50%, 40%, and 10% of its revenues from unrelated product lines A, B, and C. What is 3D's Herfindahl Index?

A) 100%

B) 65%

C) 42%

D) 33%

A) 100%

B) 65%

C) 42%

D) 33%

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

9

Pickswinners Venture Fund

Pickswinners Venture Fund invested $10 million five years ago in Robotronics Co. The fund received 6 million shares of convertible preferred stock, each of which can be converted into three shares of common stock. Robotronic is now set to complete an IPO, and its shares are being priced at $40 each. Pickswinners will convert its preferred stock to common at the IPO, and will sell its shares along with Robotronic. The investment banking firm handling the IPO will charge an 8% underwriting fee.

-If Pickswinners' common stock position represents 40% of Robotronics equity, how many shares are being offered in the IPO?

A) 15,000,000

B) 18,000,000

C) 25,200,000

D) 45,000,000

Pickswinners Venture Fund invested $10 million five years ago in Robotronics Co. The fund received 6 million shares of convertible preferred stock, each of which can be converted into three shares of common stock. Robotronic is now set to complete an IPO, and its shares are being priced at $40 each. Pickswinners will convert its preferred stock to common at the IPO, and will sell its shares along with Robotronic. The investment banking firm handling the IPO will charge an 8% underwriting fee.

-If Pickswinners' common stock position represents 40% of Robotronics equity, how many shares are being offered in the IPO?

A) 15,000,000

B) 18,000,000

C) 25,200,000

D) 45,000,000

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

10

Pickswinners Venture Fund

Pickswinners Venture Fund invested $10 million five years ago in Robotronics Co. The fund received 6 million shares of convertible preferred stock, each of which can be converted into three shares of common stock. Robotronic is now set to complete an IPO, and its shares are being priced at $40 each. Pickswinners will convert its preferred stock to common at the IPO, and will sell its shares along with Robotronic. The investment banking firm handling the IPO will charge an 8% underwriting fee.

-What proceeds does Pickswinners expect to receive?

A) $662,400,000

B) $220,800,000

C) $720,000,000

D) $552,000,000

Pickswinners Venture Fund invested $10 million five years ago in Robotronics Co. The fund received 6 million shares of convertible preferred stock, each of which can be converted into three shares of common stock. Robotronic is now set to complete an IPO, and its shares are being priced at $40 each. Pickswinners will convert its preferred stock to common at the IPO, and will sell its shares along with Robotronic. The investment banking firm handling the IPO will charge an 8% underwriting fee.

-What proceeds does Pickswinners expect to receive?

A) $662,400,000

B) $220,800,000

C) $720,000,000

D) $552,000,000

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

11

WIMMP Venture Capital

"Where Is My Money" Professional Venture Capital (WIMMP) made a $10 million investment in Bavarian Sausage Technology (BST) 5 years ago and in return received 2.5 million shares of convertible preferred stock that can be converted into 1.5 shares of common stock. After all stock has been converted BST will have 22.5 million shares outstanding. In addition, the company is planning on issuing an additional 5 million shares in an IPO.

-What fraction of BST's common stock will WIMMP own after the IPO?

A) 16.67%

B) 11.11%

C) 9.09%

D) 13.64%

"Where Is My Money" Professional Venture Capital (WIMMP) made a $10 million investment in Bavarian Sausage Technology (BST) 5 years ago and in return received 2.5 million shares of convertible preferred stock that can be converted into 1.5 shares of common stock. After all stock has been converted BST will have 22.5 million shares outstanding. In addition, the company is planning on issuing an additional 5 million shares in an IPO.

-What fraction of BST's common stock will WIMMP own after the IPO?

A) 16.67%

B) 11.11%

C) 9.09%

D) 13.64%

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

12

WIMMP Venture Capital

"Where Is My Money" Professional Venture Capital (WIMMP) made a $10 million investment in Bavarian Sausage Technology (BST) 5 years ago and in return received 2.5 million shares of convertible preferred stock that can be converted into 1.5 shares of common stock. After all stock has been converted BST will have 22.5 million shares outstanding. In addition, the company is planning on issuing an additional 5 million shares in an IPO.

-If the value of BST stock is $21.50 at the end of the first trading day, what is the value of WIMMP's investment?

A) $48.375M

B) $80.625M

C) $63.425M

D) $37.557M

"Where Is My Money" Professional Venture Capital (WIMMP) made a $10 million investment in Bavarian Sausage Technology (BST) 5 years ago and in return received 2.5 million shares of convertible preferred stock that can be converted into 1.5 shares of common stock. After all stock has been converted BST will have 22.5 million shares outstanding. In addition, the company is planning on issuing an additional 5 million shares in an IPO.

-If the value of BST stock is $21.50 at the end of the first trading day, what is the value of WIMMP's investment?

A) $48.375M

B) $80.625M

C) $63.425M

D) $37.557M

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

13

WIMMP Venture Capital

"Where Is My Money" Professional Venture Capital (WIMMP) made a $10 million investment in Bavarian Sausage Technology (BST) 5 years ago and in return received 2.5 million shares of convertible preferred stock that can be converted into 1.5 shares of common stock. After all stock has been converted BST will have 22.5 million shares outstanding. In addition, the company is planning on issuing an additional 5 million shares in an IPO.

-If BST's stock trades at $21.50 at the end of the first trading day, what is the annual return on WIMMP's investment?

A) 51.81%

B) 45.69%

C) 35.26%

D) 68.21%

"Where Is My Money" Professional Venture Capital (WIMMP) made a $10 million investment in Bavarian Sausage Technology (BST) 5 years ago and in return received 2.5 million shares of convertible preferred stock that can be converted into 1.5 shares of common stock. After all stock has been converted BST will have 22.5 million shares outstanding. In addition, the company is planning on issuing an additional 5 million shares in an IPO.

-If BST's stock trades at $21.50 at the end of the first trading day, what is the annual return on WIMMP's investment?

A) 51.81%

B) 45.69%

C) 35.26%

D) 68.21%

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is true concerning the term "venture capital?"

A) In the United States the term refers to all professionally managed, equity-based investments in private, entrepreneurial growth companies while in Europe the term refers to early-and expansion-stage financing.

B) In the United States the term refers to all professionally managed, equity-based investments in private, entrepreneurial growth companies while in Europe the term refers to later-stage financing.

C) In Europe the term refers to all professionally managed, equity-based investments in private, entrepreneurial growth companies while in the United States the term refers to early-and expansion-stage financing.

D) The terms refer to the same thing in both Europe and the United States.

A) In the United States the term refers to all professionally managed, equity-based investments in private, entrepreneurial growth companies while in Europe the term refers to early-and expansion-stage financing.

B) In the United States the term refers to all professionally managed, equity-based investments in private, entrepreneurial growth companies while in Europe the term refers to later-stage financing.

C) In Europe the term refers to all professionally managed, equity-based investments in private, entrepreneurial growth companies while in the United States the term refers to early-and expansion-stage financing.

D) The terms refer to the same thing in both Europe and the United States.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck