Deck 9: Accounting for Inventories

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/51

Play

Full screen (f)

Deck 9: Accounting for Inventories

1

A physical inventory should be taken at least annually, even when a perpetual inventory system is used.

True

2

When goods are shipped f.o.b. shipping point, title passes only when the seller receives full payment for the merchandise.

False

3

Period costs and product costs are both inventoriable costs that relate to manufactured rather than purchased inventory.

False

4

A major argument in favor of the FIFO method of inventory costing is that current costs are matched against current revenues.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

5

LIFO comes closer than FIFO to stating inventory on the balance sheet at current costs.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

6

To alleviate the LIFO liquidation problems and to simplify the accounting, goods can be combined into pools.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

7

Under dollar-value LIFO, there will never be a layer for a particular year unless the quantity of inventory increased during that year.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

8

Inventory should be written down to market when its revenue-producing ability is no longer as great as its cost.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

9

Net realizable value is the estimated selling price in the normal course of business less the normal profit margin.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

10

When inventory is written down to market, this new basis is considered to be the cost basis for future periods.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

11

The use of the gross profit method for interim reports does not preclude the need for a physical inventory to be taken at least annually.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

12

The accountant for the Orion Sales Company is preparing the income statement for 2008 and the balance sheet at December 31, 2008. Orion uses the periodic inventory system. The January 1, 2008 merchandise inventory balance will appear

A) only as an asset on the balance sheet.

B) only in the cost of goods sold section of the income statement.

C) as a deduction in the cost of goods sold section of the income statement and as a current asset on the balance sheet.

D) as an addition in the cost of goods sold section of the income statement and as a current asset on the balance sheet.

A) only as an asset on the balance sheet.

B) only in the cost of goods sold section of the income statement.

C) as a deduction in the cost of goods sold section of the income statement and as a current asset on the balance sheet.

D) as an addition in the cost of goods sold section of the income statement and as a current asset on the balance sheet.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

13

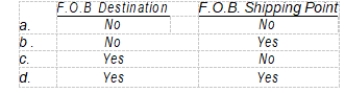

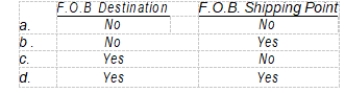

Goods in transit at the balance sheet date should be included in the purchaser's inventory if they are shipped:

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is not valid as it applies to inventory costing methods?

A) If inventory quantities are to be maintained, part of the earnings must be invested (plowed back) in inventories when FIFO is used during a period of rising prices.

B) LIFO tends to smooth out the net income pattern by matching current cost of goods sold with current revenue, when inventories remain at constant quantities.

C) When a firm using the LIFO method fails to maintain its usual inventory position (reduces stock on hand below customary levels), there may be a matching of old costs with current revenue.

D) The use of FIFO permits some control by management over the amount of net income for a period through controlled purchases, which is not true with LIFO.

A) If inventory quantities are to be maintained, part of the earnings must be invested (plowed back) in inventories when FIFO is used during a period of rising prices.

B) LIFO tends to smooth out the net income pattern by matching current cost of goods sold with current revenue, when inventories remain at constant quantities.

C) When a firm using the LIFO method fails to maintain its usual inventory position (reduces stock on hand below customary levels), there may be a matching of old costs with current revenue.

D) The use of FIFO permits some control by management over the amount of net income for a period through controlled purchases, which is not true with LIFO.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following inventory methods comes closest to stating ending inventory at replacement cost?

A) FIFO

B) LIFO

C) Weighted-average

D) Dollar-value LIFO

A) FIFO

B) LIFO

C) Weighted-average

D) Dollar-value LIFO

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

16

The use of LIFO under a perpetual inventory system (units and costs)

A) may yield a higher inventory valuation than LIFO under a periodic inventory system when prices are steadily falling.

B) may yield a higher inventory valuation than LIFO under a periodic inventory system when prices are steadily rising.

C) always yields the same inventory valuation as LIFO under a periodic inventory system.

D) can never yield the same inventory valuation as LIFO under a periodic inventory system.

A) may yield a higher inventory valuation than LIFO under a periodic inventory system when prices are steadily falling.

B) may yield a higher inventory valuation than LIFO under a periodic inventory system when prices are steadily rising.

C) always yields the same inventory valuation as LIFO under a periodic inventory system.

D) can never yield the same inventory valuation as LIFO under a periodic inventory system.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

17

One argument against the use of the specific identification inventory method is

A) actual costs are matched against actual revenues.

B) estimated costs are matched against actual revenues.

C) the potential for the manipulation of net income by selecting costs to match against revenues.

D) that it is difficult to understand.

A) actual costs are matched against actual revenues.

B) estimated costs are matched against actual revenues.

C) the potential for the manipulation of net income by selecting costs to match against revenues.

D) that it is difficult to understand.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following represents a departure from the historical cost basis of valuing inventories?

A) Dollar-value LIFO

B) Specific identification

C) Replacement cost

D) Average cost

A) Dollar-value LIFO

B) Specific identification

C) Replacement cost

D) Average cost

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

19

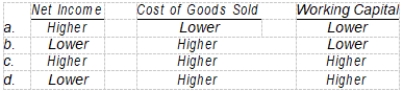

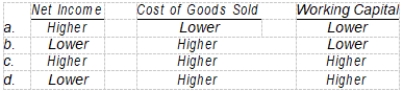

In periods of rising prices, use of LIFO rather than the FIFO inventory method will most likely have what effect on the following items?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

20

The traditional LIFO approach which tends to emphasize specific goods in costing LIFO inventories is often unrealistic because

A) it does not result in a proper matching of costs and revenues in a particular period.

B) cash flows are often distorted and can be delayed for one or two subsequent periods.

C) future price declines will adversely affect the ability to accurately report future earnings.

D) erosion of the LIFO inventory can easily occur which often leads to distortions of net income and large tax payments.

A) it does not result in a proper matching of costs and revenues in a particular period.

B) cash flows are often distorted and can be delayed for one or two subsequent periods.

C) future price declines will adversely affect the ability to accurately report future earnings.

D) erosion of the LIFO inventory can easily occur which often leads to distortions of net income and large tax payments.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements is not true as it relates to the dollar-value LIFO inven-tory method?

A) It is easier to erode LIFO layers using dollar-value LIFO techniques than it is with specific goods pooled LIFO.

B) Under the dollar-value LIFO method, it is possible to have the entire inventory in only one pool.

C) Several pools are commonly employed in using the dollar-value LIFO inventory method.

D) Under dollar-value LIFO, increases and decreases in a pool are determined and measured in terms of total dollar value, not physical quantity.

A) It is easier to erode LIFO layers using dollar-value LIFO techniques than it is with specific goods pooled LIFO.

B) Under the dollar-value LIFO method, it is possible to have the entire inventory in only one pool.

C) Several pools are commonly employed in using the dollar-value LIFO inventory method.

D) Under dollar-value LIFO, increases and decreases in a pool are determined and measured in terms of total dollar value, not physical quantity.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

22

The dollar-value inventory method is an improvement over the traditional LIFO pool approach because

A) the mathematical computations are greatly simplified.

B) it is easier to apply where few inventory items are employed and little change in product mix is anticipated.

C) increases and decreases in a pool are determined and measured in terms of total dollar value rather than the physical quantity of the goods in the inventory pool.

D) dissimilar items of inventory can be grouped to form pools under the dollar-value LIFO method.

A) the mathematical computations are greatly simplified.

B) it is easier to apply where few inventory items are employed and little change in product mix is anticipated.

C) increases and decreases in a pool are determined and measured in terms of total dollar value rather than the physical quantity of the goods in the inventory pool.

D) dissimilar items of inventory can be grouped to form pools under the dollar-value LIFO method.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

23

Estimates of price-level changes for specific inventories are required for which of the following inventory methods?

A) Weighted-average cost

B) FIFO

C) LIFO

D) Dollar-value LIFO

A) Weighted-average cost

B) FIFO

C) LIFO

D) Dollar-value LIFO

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

24

If inventory levels are stable or increasing, an argument which is not an advantage of the LIFO method as compared to FIFO is

A) income taxes tend to be reduced in periods of rising prices.

B) cost of goods sold tends to be stated at approximately current cost on the income statement.

C) cost assignments typically parallel the physical flow of goods.

D) income tends to be smoothed as prices change over time.

A) income taxes tend to be reduced in periods of rising prices.

B) cost of goods sold tends to be stated at approximately current cost on the income statement.

C) cost assignments typically parallel the physical flow of goods.

D) income tends to be smoothed as prices change over time.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following represents the best justification for the departure from the historical cost principle that results when lower-of-cost-or-market is used?

A) It is easier to keep track of market value than it is to keep track of cost as market value is available from any supplier.

B) Cost loses its relevance for the determination of cost of goods sold if the cost of inventory has been incurred in an earlier accounting period.

C) The balance sheet valuation of inventory is the most important consideration in the preparation of financial statements.

D) The loss in utility that results from a decline in the market value of inventory should be charged against revenues in the period in which it occurs.

A) It is easier to keep track of market value than it is to keep track of cost as market value is available from any supplier.

B) Cost loses its relevance for the determination of cost of goods sold if the cost of inventory has been incurred in an earlier accounting period.

C) The balance sheet valuation of inventory is the most important consideration in the preparation of financial statements.

D) The loss in utility that results from a decline in the market value of inventory should be charged against revenues in the period in which it occurs.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

26

Replacement cost is the designated market value used to compare to cost in determining lower-of-cost-or-market when its relationship to the items shown below is

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

27

Under the lower-of-cost-or-market rule, market will be replacement cost except when replacement cost is

A) higher than cost.

B) less than net realizable value.

C) less than net realizable value less a normal profit margin.

D) less than cost.

A) higher than cost.

B) less than net realizable value.

C) less than net realizable value less a normal profit margin.

D) less than cost.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

28

An item of inventory purchased this period for $15.00 has been incorrectly written down to its current replacement cost of $10.00. It sells during the following period for $30.00, its normal selling price, with disposal costs of $3.00 and normal profit of $12.00. Which of the following statements is not true?

A) The cost of sales of the following year will be understated.

B) The current year's income is understated.

C) The closing inventory of the current year is understated.

D) Income of the following year will be understated.

A) The cost of sales of the following year will be understated.

B) The current year's income is understated.

C) The closing inventory of the current year is understated.

D) Income of the following year will be understated.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not a basic assumption of the gross profit method?

A) The beginning inventory plus the purchases equal total goods to be accounted for.

B) Goods not sold must be on hand.

C) If the sales, reduced to the cost basis, are deducted from the sum of the opening inventory plus purchases, the result is the amount of inventory on hand.

D) The total amount of purchases and the total amount of sales remain relatively unchanged from the comparable previous period.

A) The beginning inventory plus the purchases equal total goods to be accounted for.

B) Goods not sold must be on hand.

C) If the sales, reduced to the cost basis, are deducted from the sum of the opening inventory plus purchases, the result is the amount of inventory on hand.

D) The total amount of purchases and the total amount of sales remain relatively unchanged from the comparable previous period.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

30

TJones Manufacturing Company has the following account balances at year end:

What amount should TJones report as inventories in its balance sheet?

What amount should TJones report as inventories in its balance sheet?

A) $72,000

B) $76,000

C) $158,000

D) $162,000

What amount should TJones report as inventories in its balance sheet?

What amount should TJones report as inventories in its balance sheet?A) $72,000

B) $76,000

C) $158,000

D) $162,000

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

31

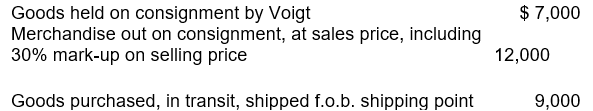

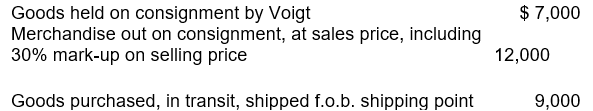

The following items were included in Voigt Corporation's inventory account at December 31, 2008:

Voigt's inventory account at December 31, 2008, should be reduced by

Voigt's inventory account at December 31, 2008, should be reduced by

A) $10,600.

B) $12,600.

C) $16,000.

D) $28,000.

Voigt's inventory account at December 31, 2008, should be reduced by

Voigt's inventory account at December 31, 2008, should be reduced byA) $10,600.

B) $12,600.

C) $16,000.

D) $28,000.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

32

Slowe Company has been using the LIFO cost method of inventory valuation for 8 years. Its 2008 ending inventory was $135,000 but it would have been $180,000 if FIFO had been used. Thus, if FIFO had been used, Slowe's net income before income taxes would have been

A) $45,000 less in 2008.

B) $45,000 more in 2008.

C) $45,000 greater over the 8-year period.

D) $45,000 less over the 8-year period.

A) $45,000 less in 2008.

B) $45,000 more in 2008.

C) $45,000 greater over the 8-year period.

D) $45,000 less over the 8-year period.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

33

Baker Company has been using the LIFO method of inventory valuation for 10 years, since it began operations. Its 2008 ending inventory was $40,000, but it would have been $60,000 if FIFO had been used. Thus, if FIFO had been used, Baker's income before income taxes would have been

A) $20,000 greater over the 10-year period.

B) $20,000 less over the 10-year period.

C) $20,000 greater in 2008.

D) $20,000 less in 2008.

A) $20,000 greater over the 10-year period.

B) $20,000 less over the 10-year period.

C) $20,000 greater in 2008.

D) $20,000 less in 2008.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

34

Green Corporation uses the FIFO method for internal reporting purposes and LIFO for external reporting purposes. The balance in the LIFO Reserve account at the end of 2007 was $80,000. The balance in the same account at the end of 2008 is $120,000. Green's Cost of Goods Sold account has a balance of $600,000 from sales transactions recorded during the year. What amount should Green report as Cost of Goods Sold in the 2008 income statement?

A) $560,000

B) $600,000

C) $640,000

D) $720,000

A) $560,000

B) $600,000

C) $640,000

D) $720,000

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

35

AJ Company had January 1 inventory of $ 100,000 when it adopted dollar-value LIFO. During the year, purchases were $600,000 and sales were $1,000,000. December 31 inventory at year-end prices was $143,360, and the price index was 112.

-What is AJ Company's ending inventory?

A) $100,000

B) $128,000

C) $131,360

D) $143,360

-What is AJ Company's ending inventory?

A) $100,000

B) $128,000

C) $131,360

D) $143,360

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

36

AJ Company had January 1 inventory of $ 100,000 when it adopted dollar-value LIFO. During the year, purchases were $600,000 and sales were $1,000,000. December 31 inventory at year-end prices was $143,360, and the price index was 112.

-What is AJ Company's gross profit?

A) $428,000

B) $431,360

C) $443,460

D) $868,640

-What is AJ Company's gross profit?

A) $428,000

B) $431,360

C) $443,460

D) $868,640

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

37

Amidei Company adopts dollar-value LIFO inventory on 12/31/07 when its inventory at current price is $45,000. The inventory value on 12/31/08 at current 2008 prices is $65,000. If prices increased by 30% during 2008, what is the dollar-value LIFO inventory at 12/31/08?

A) $65,000

B) $58,000

C) $51,500

D) $48,700

A) $65,000

B) $58,000

C) $51,500

D) $48,700

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

38

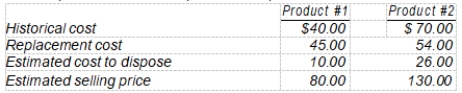

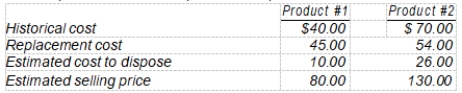

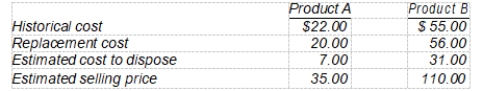

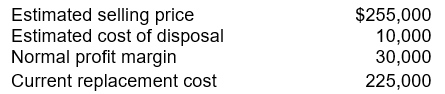

Marr Corporation has two products in its ending inventory, each accounted for at the lower-of-cost-or-market. A profit margin of 30% on selling price is considered normal for each product. Specific data with respect to each product follows:

In pricing its ending inventory using the lower -of-cost-or-market, what unit values should Marr use for products 1 and 2, respectively?

In pricing its ending inventory using the lower -of-cost-or-market, what unit values should Marr use for products 1 and 2, respectively?

A) $40.00 and $65.00

B) $46.00 and $65.00

C) $46.00 and $60.00

D) $45.00 and $54.00

In pricing its ending inventory using the lower -of-cost-or-market, what unit values should Marr use for products 1 and 2, respectively?

In pricing its ending inventory using the lower -of-cost-or-market, what unit values should Marr use for products 1 and 2, respectively?A) $40.00 and $65.00

B) $46.00 and $65.00

C) $46.00 and $60.00

D) $45.00 and $54.00

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

39

A dudad has an original cost of $15 and a replacement cost of $12. The cost of completion and disposal is $2. If the dudad has a net realizable value of $16 and a normal profit margin of $5, its inventory value should be

A) $15.

B) $12.

C) $16.

D) $14.

A) $15.

B) $12.

C) $16.

D) $14.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

40

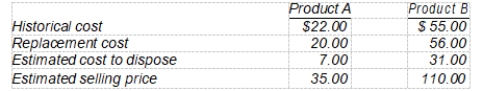

Martinez Corporation has two products in its ending inventory. A profit margin of 30% on selling price is considered normal for each product. Specific data with respect to each product follows:

In pricing its ending inventory using the lower-of-cost-or -market method, what unit values should Martinez use for products A and B, respectively?

In pricing its ending inventory using the lower-of-cost-or -market method, what unit values should Martinez use for products A and B, respectively?

A) $17.50 and $55.00

B) $20.00 and $46.00

C) $20.00 and $55.00

D) $28.00 and $56.00

In pricing its ending inventory using the lower-of-cost-or -market method, what unit values should Martinez use for products A and B, respectively?

In pricing its ending inventory using the lower-of-cost-or -market method, what unit values should Martinez use for products A and B, respectively?A) $17.50 and $55.00

B) $20.00 and $46.00

C) $20.00 and $55.00

D) $28.00 and $56.00

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

41

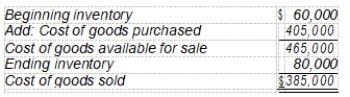

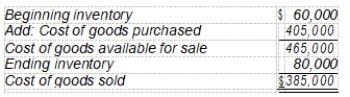

Ace Corporation's computation of cost of goods sold is:

The average days to sell inventory for Ace are

The average days to sell inventory for Ace are

A) 56.9 days.

B) 63.1 days.

C) 66.4 days.

D) 75.8 days.

The average days to sell inventory for Ace are

The average days to sell inventory for Ace areA) 56.9 days.

B) 63.1 days.

C) 66.4 days.

D) 75.8 days.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

42

The 2008 financial statements of Wert Company reported a beginning inventory of $80,000, an ending inventory of $120,000, and cost of goods sold of $600,000 for the year. Wert's inventory turnover ratio for 2008 is

A) 7.5 times.

B) 6.0 times.

C) 5.0 times.

D) 4.3 times.

A) 7.5 times.

B) 6.0 times.

C) 5.0 times.

D) 4.3 times.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

43

Gomez Company had a gross profit of $360,000, total purchases of $420,000, and an ending inventory of $240,000 in its first year of operations as a retailer. Gomez's sales in its first year must have been

A) $540,000.

B) $660,000.

C) $180,000.

D) $600,000.

A) $540,000.

B) $660,000.

C) $180,000.

D) $600,000.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

44

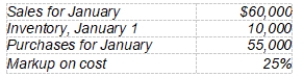

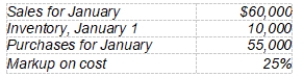

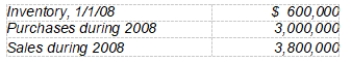

On January 31, fire destroyed the entire inventory of Mojares Company. The following data are available:  The amount of the inventory loss is estimated to be

The amount of the inventory loss is estimated to be

A) $1,620,000.

B) $1,570,000.

C) $1,550,000.

D) $1,500,000.

The amount of the inventory loss is estimated to be

The amount of the inventory loss is estimated to beA) $1,620,000.

B) $1,570,000.

C) $1,550,000.

D) $1,500,000.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

45

Gear Co.'s accounts payable balance at December 31, 2008 was $1,500,000 before considering the following transactions:

• Goods were in transit from a vendor to Gear on December 31, 2008. The invoice price was $70,000, and the goods were shipped f.o.b. shipping point on December 29, 2008. The goods were received on January 4, 2009.

• Goods shipped to Gear, f.o.b. shipping point on December 20, 2008, from a vendor were lost in transit. The invoice price was $50,000. On January 5, 2009, Gear filed a $50,000 claim against the common carrier.

A) $1,620,000

B) $1,570,000.

C) $1,550,000.

D) $1,500,000.

• Goods were in transit from a vendor to Gear on December 31, 2008. The invoice price was $70,000, and the goods were shipped f.o.b. shipping point on December 29, 2008. The goods were received on January 4, 2009.

• Goods shipped to Gear, f.o.b. shipping point on December 20, 2008, from a vendor were lost in transit. The invoice price was $50,000. On January 5, 2009, Gear filed a $50,000 claim against the common carrier.

A) $1,620,000

B) $1,570,000.

C) $1,550,000.

D) $1,500,000.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

46

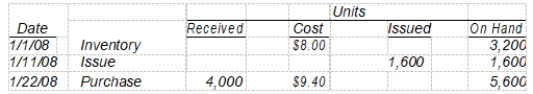

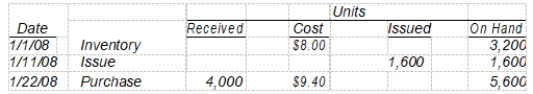

Dark Co. recorded the following data pertaining to raw material X during January 2008:

The moving-average unit cost of X inventory at January 31, 2008 is

The moving-average unit cost of X inventory at January 31, 2008 is

A) $8.70.

B) $8.85.

C) $9.00.

D) $9.40.

The moving-average unit cost of X inventory at January 31, 2008 is

The moving-average unit cost of X inventory at January 31, 2008 isA) $8.70.

B) $8.85.

C) $9.00.

D) $9.40.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

47

Earl Co. was formed on January 2, 2008, to sell a single product. Over a two-year period, Earl's acquisition costs have increased steadily. Physical quantities held in inventory were equal to three months' sales at December 31, 2008, and zero at December 31, 2009. Assuming the periodic inventory system, the inventory cost method which reports the highest amount of each of the following is

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

48

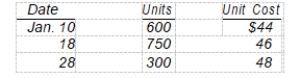

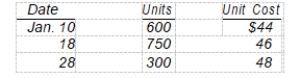

Noll Co. had 450 units of product A on hand at January 1, 2008, costing $42 each. Purchases of product A during January were as follows:

A physical count on January 31, 2008 shows 600 units of product A on hand. The cost of the inventory at January 31, 2008 under the LIFO method is

A physical count on January 31, 2008 shows 600 units of product A on hand. The cost of the inventory at January 31, 2008 under the LIFO method is

A) $28,200.

B) $26,700.

C) $25,500.

D) $24,600.

A physical count on January 31, 2008 shows 600 units of product A on hand. The cost of the inventory at January 31, 2008 under the LIFO method is

A physical count on January 31, 2008 shows 600 units of product A on hand. The cost of the inventory at January 31, 2008 under the LIFO method isA) $28,200.

B) $26,700.

C) $25,500.

D) $24,600.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

49

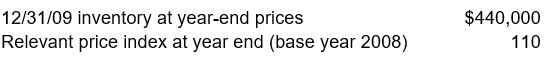

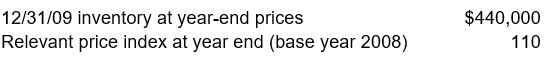

Carr Co. adopted the dollar-value LIFO inventory method on December 31, 2008. Carr's entire inventory constitutes a single pool. On December 31, 2008, the inventory was $320,000 under the dollar-value LIFO method. Inventory data for 2009 are as follows:

Using dollar value LIFO, Carr's inventory at December 31, 2009 is

Using dollar value LIFO, Carr's inventory at December 31, 2009 is

A) $352,000.

B) $408,000.

C) $400,000.

D) $440,000.

Using dollar value LIFO, Carr's inventory at December 31, 2009 is

Using dollar value LIFO, Carr's inventory at December 31, 2009 isA) $352,000.

B) $408,000.

C) $400,000.

D) $440,000.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

50

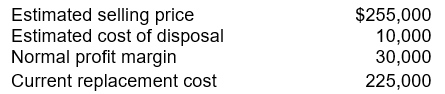

Teel Distribution Co. has determined its December 31, 2008 inventory on a FIFO basis at $250,000. Information pertaining to that inventory follows:

Teel records losses that result from applying the lower-of-cost-or-market rule. At December 31, 2008, the loss that Teel should recognize is

Teel records losses that result from applying the lower-of-cost-or-market rule. At December 31, 2008, the loss that Teel should recognize is

A) $0.

B) $5,000.

C) $20,000.

D) $25,000.

Teel records losses that result from applying the lower-of-cost-or-market rule. At December 31, 2008, the loss that Teel should recognize is

Teel records losses that result from applying the lower-of-cost-or-market rule. At December 31, 2008, the loss that Teel should recognize isA) $0.

B) $5,000.

C) $20,000.

D) $25,000.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

51

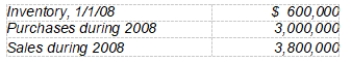

Gore Company's accounting records indicated the following information:

A physical inventory taken on December 31, 2008, resulted in an ending inventory of $700,000. Gore's gross profit on sales has remained constant at 25% in recent years. Gore suspects some inventory may have been taken by a new employee. At December 31, 2008, what is the estimated cost of missing inventory?

A physical inventory taken on December 31, 2008, resulted in an ending inventory of $700,000. Gore's gross profit on sales has remained constant at 25% in recent years. Gore suspects some inventory may have been taken by a new employee. At December 31, 2008, what is the estimated cost of missing inventory?

A) $50,000

B) $150,000

C) $200,000

D) $250,000

A physical inventory taken on December 31, 2008, resulted in an ending inventory of $700,000. Gore's gross profit on sales has remained constant at 25% in recent years. Gore suspects some inventory may have been taken by a new employee. At December 31, 2008, what is the estimated cost of missing inventory?

A physical inventory taken on December 31, 2008, resulted in an ending inventory of $700,000. Gore's gross profit on sales has remained constant at 25% in recent years. Gore suspects some inventory may have been taken by a new employee. At December 31, 2008, what is the estimated cost of missing inventory?A) $50,000

B) $150,000

C) $200,000

D) $250,000

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck