Deck 20: Appendix B: Reporting Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/18

Play

Full screen (f)

Deck 20: Appendix B: Reporting Cash Flows

1

Writedowns, amortization charges, and similar book entries have no effect on cash or net income.

False

2

A loss on the sale of equipment must be added back to net income to arrive at net cash provided by operating activities.

True

3

When accounts payable increase during the year, cost of goods sold and expenses on a cash basis are higher than they are on an accrual basis.

False

4

Some changes in working capital, although they affect cash, do not affect net income.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

5

Cash flows from extraordinary transactions and other events whose effects are included in net income, but which are not related to operations, should be reported either as investing activities or as financing activities.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

6

When the direct method is used in determining cash provided by operating activities, users of the statement of cash flows are unable to reconcile the net income to the net cash provided by operations because this is only provided when the indirect method is used.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

7

Riley Company reports its income from investments under the equity method and recognized income of $25,000 from its investment in Wood Co. during the current year, even though no dividends were declared or paid by Wood during the year. On Riley's statement of cash flows (indirect method), the $25,000 should

A) not be shown.

B) be shown as cash inflow from investing activities.

C) be shown as cash outflow from financing activities.

D) be shown as a deduction from net income in the cash flows from operating activities section.

A) not be shown.

B) be shown as cash inflow from investing activities.

C) be shown as cash outflow from financing activities.

D) be shown as a deduction from net income in the cash flows from operating activities section.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

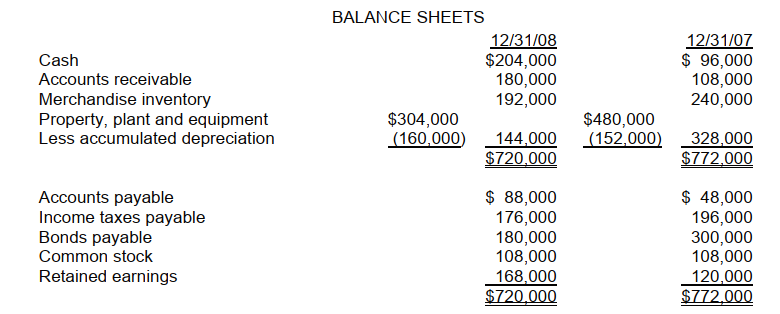

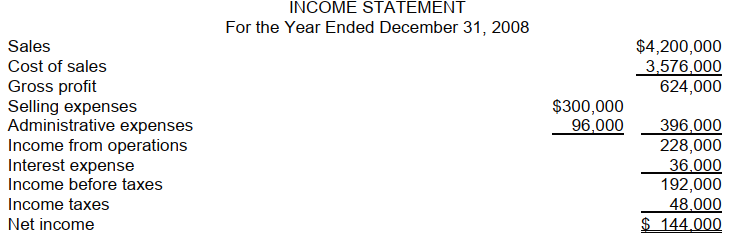

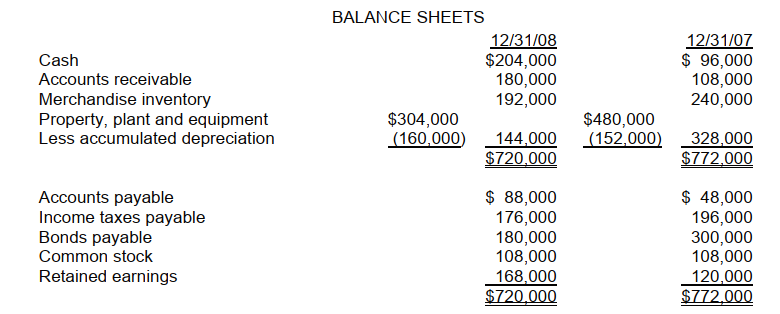

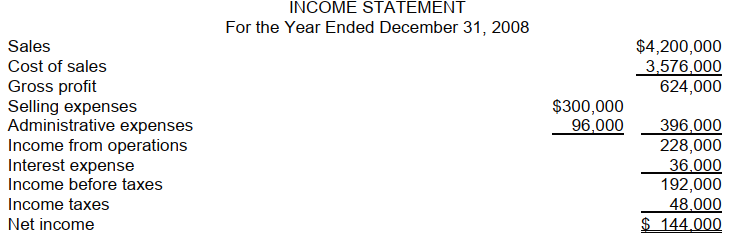

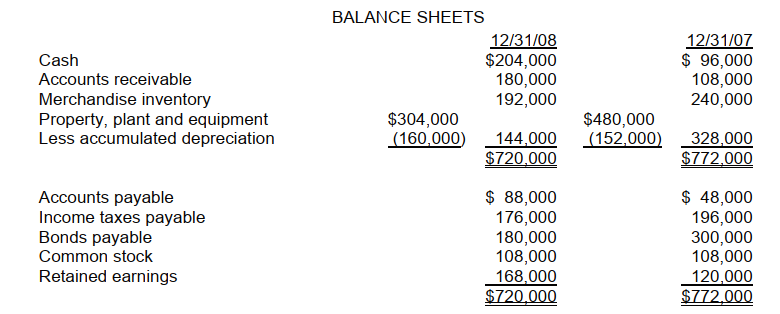

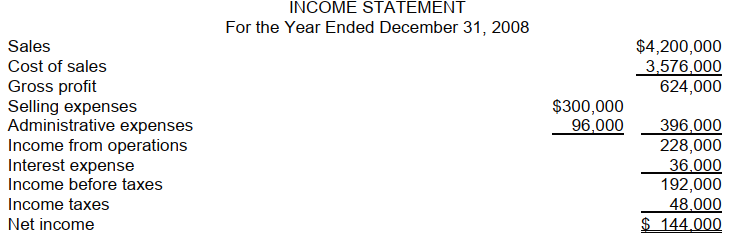

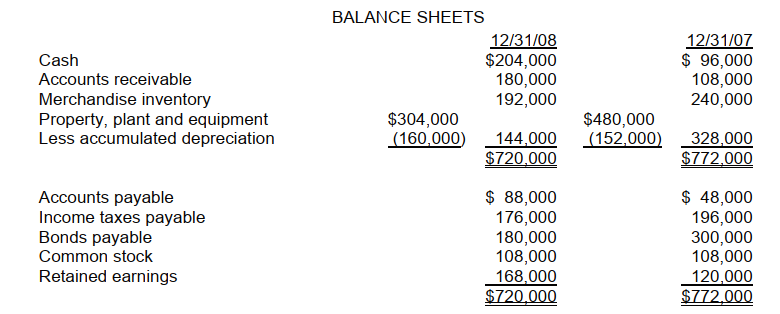

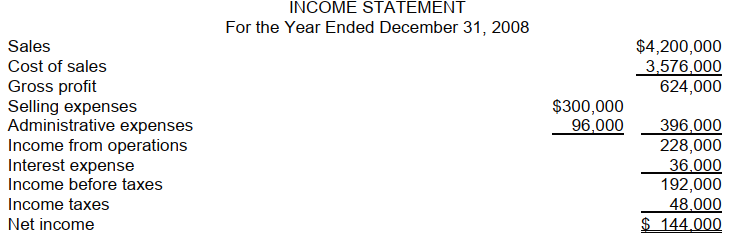

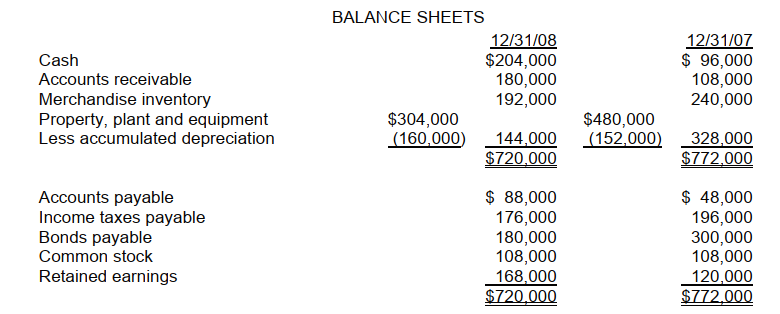

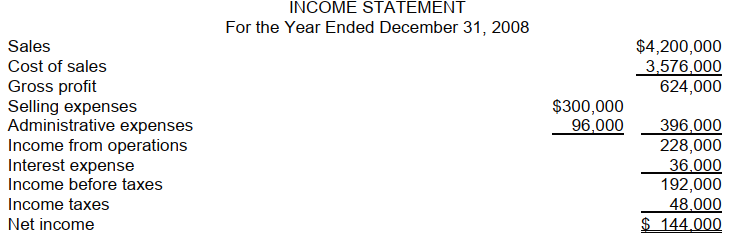

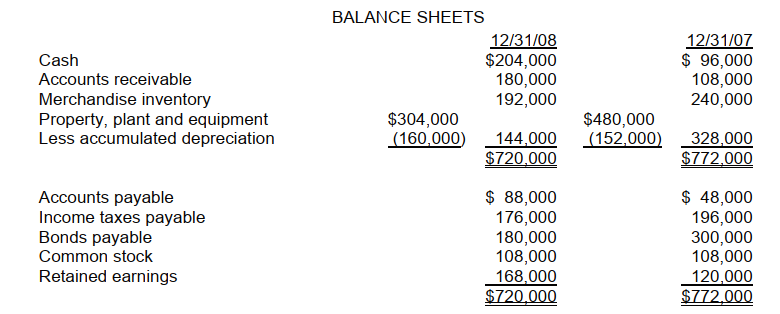

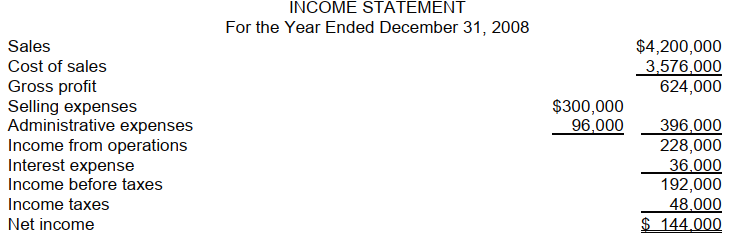

8

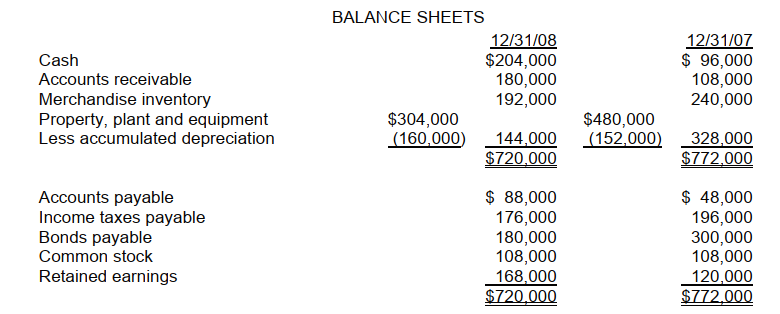

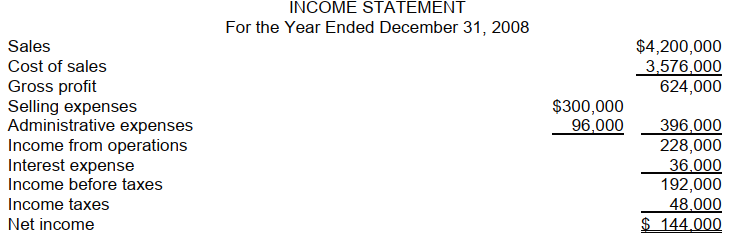

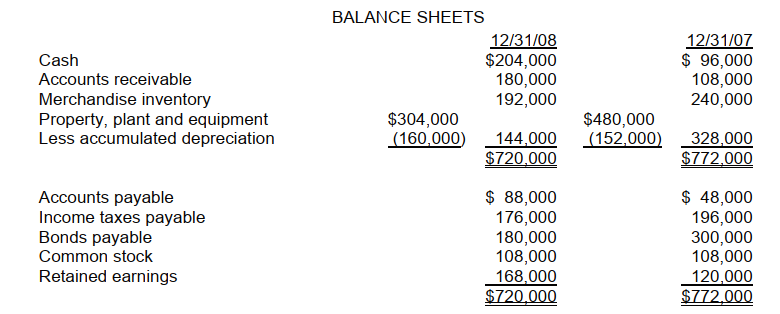

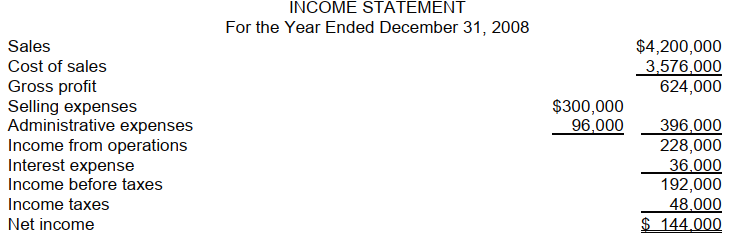

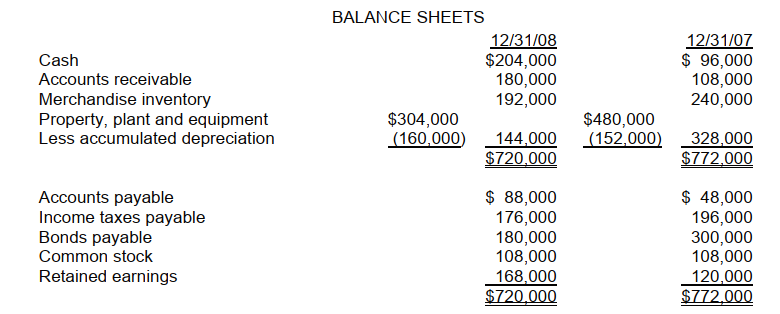

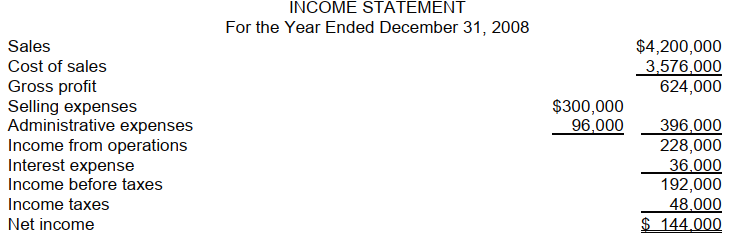

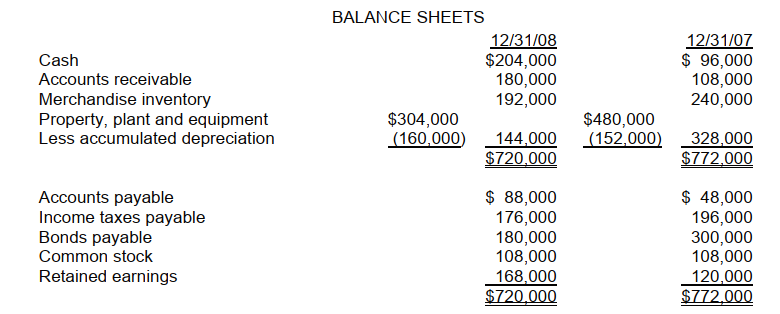

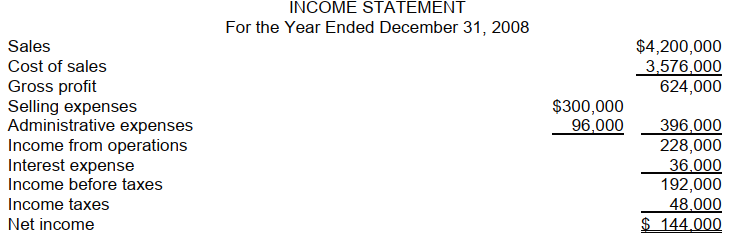

Paxson Mining Co. has recently decided to go public and has hired you as an independent CPA. One statement that the enterprise is anxious to have prepared is a statement of cash flows. Financial statements of Paxson Mining Co. for 2008 and 2007 are provided below.

The following additional data were provided:

The following additional data were provided:

1. Dividends for the year 2008 were $96,000.

2. During the year, equipment was sold for $120,000. This equipment cost $176,000 originally and had a book value of $144,000 at the time of sale. The loss on sale was included in administrative expenses.

3. All depreciation expense is in the selling expense category.

relate to a statement of cash flows (direct method) for the year ended December 31, 2008, for Paxson Mining Company.

-The net cash provided by operating activities is

A) $204,000.

B) $144,000.

C) $120,000.

D) $100,000.

The following additional data were provided:

The following additional data were provided:1. Dividends for the year 2008 were $96,000.

2. During the year, equipment was sold for $120,000. This equipment cost $176,000 originally and had a book value of $144,000 at the time of sale. The loss on sale was included in administrative expenses.

3. All depreciation expense is in the selling expense category.

relate to a statement of cash flows (direct method) for the year ended December 31, 2008, for Paxson Mining Company.

-The net cash provided by operating activities is

A) $204,000.

B) $144,000.

C) $120,000.

D) $100,000.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

9

Paxson Mining Co. has recently decided to go public and has hired you as an independent CPA. One statement that the enterprise is anxious to have prepared is a statement of cash flows. Financial statements of Paxson Mining Co. for 2008 and 2007 are provided below.

The following additional data were provided:

The following additional data were provided:

1. Dividends for the year 2008 were $96,000.

2. During the year, equipment was sold for $120,000. This equipment cost $176,000 originally and had a book value of $144,000 at the time of sale. The loss on sale was included in administrative expenses.

3. All depreciation expense is in the selling expense category.

relate to a statement of cash flows (direct method) for the year ended December 31, 2008, for Paxson Mining Company.

-The net cash provided (used) by investing activities is

A) $(176,000).

B) $24,000.

C) $120,000.

D) $(144,000).

The following additional data were provided:

The following additional data were provided:1. Dividends for the year 2008 were $96,000.

2. During the year, equipment was sold for $120,000. This equipment cost $176,000 originally and had a book value of $144,000 at the time of sale. The loss on sale was included in administrative expenses.

3. All depreciation expense is in the selling expense category.

relate to a statement of cash flows (direct method) for the year ended December 31, 2008, for Paxson Mining Company.

-The net cash provided (used) by investing activities is

A) $(176,000).

B) $24,000.

C) $120,000.

D) $(144,000).

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

10

Paxson Mining Co. has recently decided to go public and has hired you as an independent CPA. One statement that the enterprise is anxious to have prepared is a statement of cash flows. Financial statements of Paxson Mining Co. for 2008 and 2007 are provided below.

The following additional data were provided:

The following additional data were provided:

1. Dividends for the year 2008 were $96,000.

2. During the year, equipment was sold for $120,000. This equipment cost $176,000 originally and had a book value of $144,000 at the time of sale. The loss on sale was included in administrative expenses.

3. All depreciation expense is in the selling expense category.

relate to a statement of cash flows (direct method) for the year ended December 31, 2008, for Paxson Mining Company.

-Under the direct method, the cash received from customers is

A) $4,272,000.

B) $4,128,000.

C) $4,200,000.

D) $4,220,000.

The following additional data were provided:

The following additional data were provided:1. Dividends for the year 2008 were $96,000.

2. During the year, equipment was sold for $120,000. This equipment cost $176,000 originally and had a book value of $144,000 at the time of sale. The loss on sale was included in administrative expenses.

3. All depreciation expense is in the selling expense category.

relate to a statement of cash flows (direct method) for the year ended December 31, 2008, for Paxson Mining Company.

-Under the direct method, the cash received from customers is

A) $4,272,000.

B) $4,128,000.

C) $4,200,000.

D) $4,220,000.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

11

Paxson Mining Co. has recently decided to go public and has hired you as an independent CPA. One statement that the enterprise is anxious to have prepared is a statement of cash flows. Financial statements of Paxson Mining Co. for 2008 and 2007 are provided below.

The following additional data were provided:

The following additional data were provided:

1. Dividends for the year 2008 were $96,000.

2. During the year, equipment was sold for $120,000. This equipment cost $176,000 originally and had a book value of $144,000 at the time of sale. The loss on sale was included in administrative expenses.

3. All depreciation expense is in the selling expense category.

relate to a statement of cash flows (direct method) for the year ended December 31, 2008, for Paxson Mining Company.

-Under the direct method, the cash paid to suppliers is

A) $3,768,000.

B) $3,568,000.

C) $3,528,000.

D) $3,488,000.

The following additional data were provided:

The following additional data were provided:1. Dividends for the year 2008 were $96,000.

2. During the year, equipment was sold for $120,000. This equipment cost $176,000 originally and had a book value of $144,000 at the time of sale. The loss on sale was included in administrative expenses.

3. All depreciation expense is in the selling expense category.

relate to a statement of cash flows (direct method) for the year ended December 31, 2008, for Paxson Mining Company.

-Under the direct method, the cash paid to suppliers is

A) $3,768,000.

B) $3,568,000.

C) $3,528,000.

D) $3,488,000.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

12

Paxson Mining Co. has recently decided to go public and has hired you as an independent CPA. One statement that the enterprise is anxious to have prepared is a statement of cash flows. Financial statements of Paxson Mining Co. for 2008 and 2007 are provided below.

The following additional data were provided:

The following additional data were provided:

1. Dividends for the year 2008 were $96,000.

2. During the year, equipment was sold for $120,000. This equipment cost $176,000 originally and had a book value of $144,000 at the time of sale. The loss on sale was included in administrative expenses.

3. All depreciation expense is in the selling expense category.

relate to a statement of cash flows (direct method) for the year ended December 31, 2008, for Paxson Mining Company.

-The net cash provided (used) by financing activities is

A) $(120,000).

B) $24,000.

C) $(216,000).

D) $96,000

The following additional data were provided:

The following additional data were provided:1. Dividends for the year 2008 were $96,000.

2. During the year, equipment was sold for $120,000. This equipment cost $176,000 originally and had a book value of $144,000 at the time of sale. The loss on sale was included in administrative expenses.

3. All depreciation expense is in the selling expense category.

relate to a statement of cash flows (direct method) for the year ended December 31, 2008, for Paxson Mining Company.

-The net cash provided (used) by financing activities is

A) $(120,000).

B) $24,000.

C) $(216,000).

D) $96,000

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

13

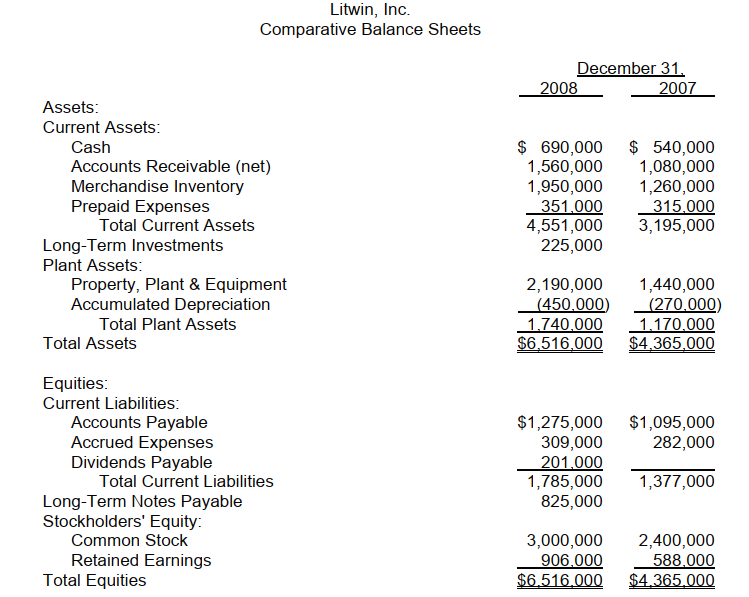

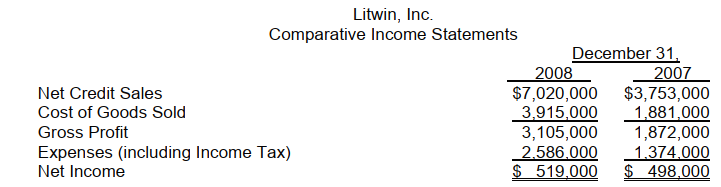

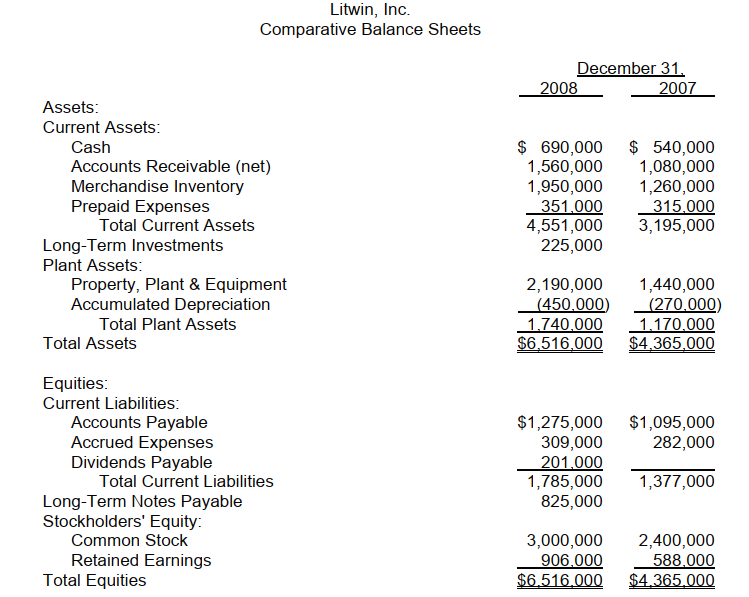

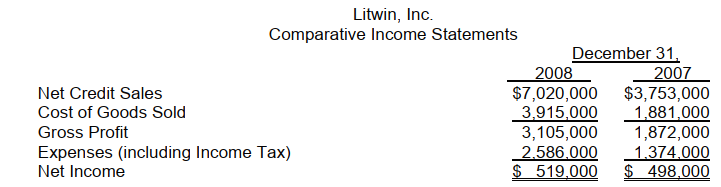

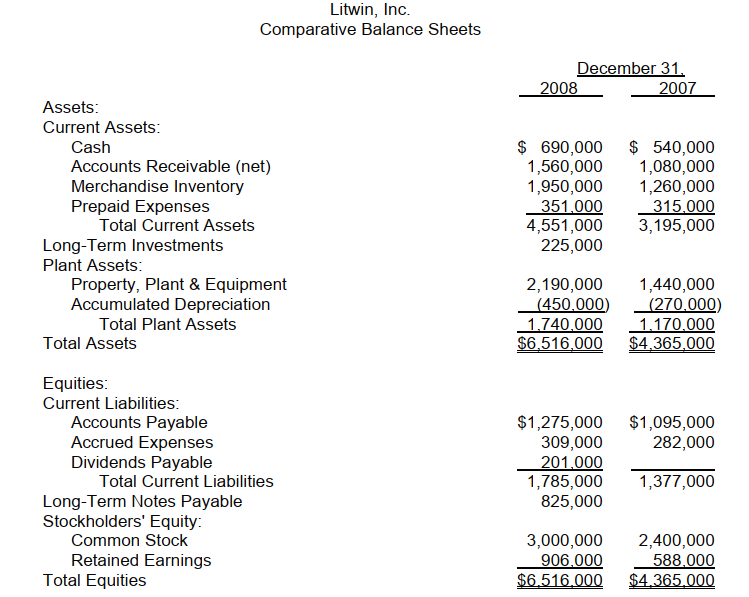

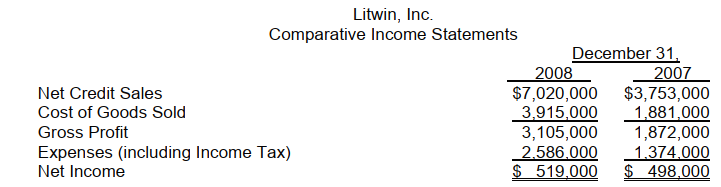

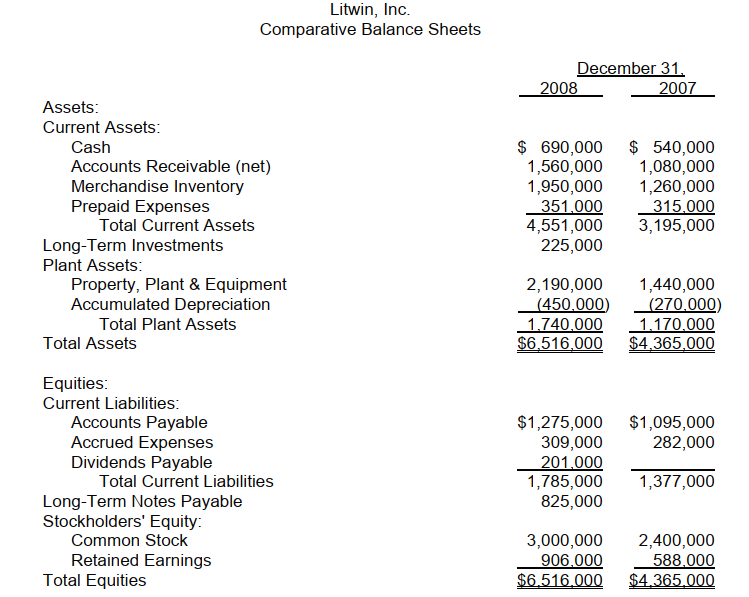

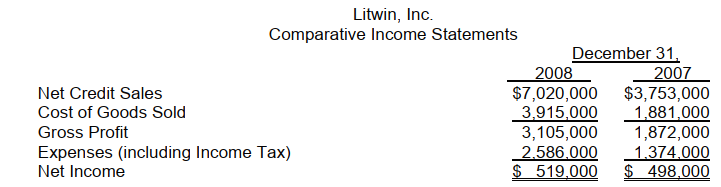

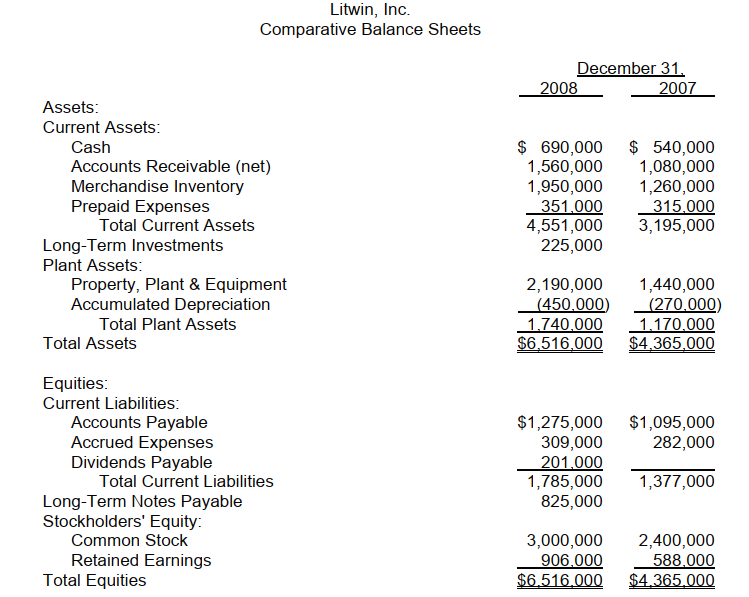

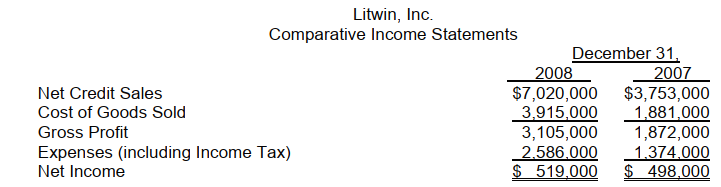

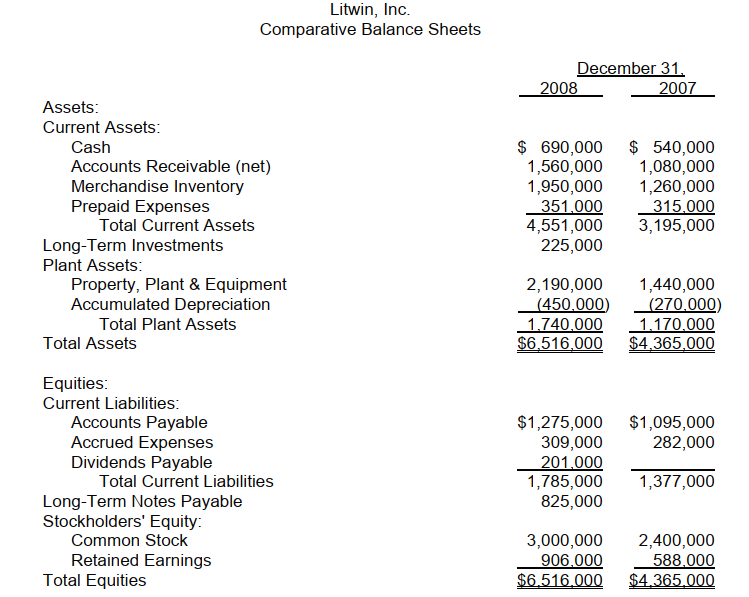

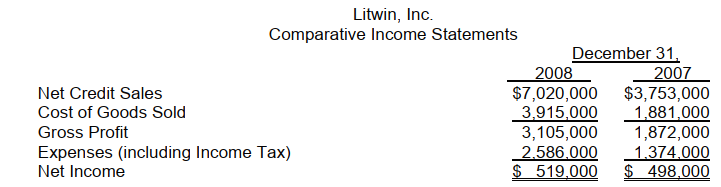

Questions are based on the data shown below related to the statement of cash flows for Litwin, Inc.:

Additional Information:

Additional Information:

a. Accounts receivable and accounts payable relate to merchandise held for sale in the normal course of business. The allowance for bad debts was the same at the end of 2008 and 2007, and no receivables were charged against the allowance. Accounts

payable are recorded net of any discount and are always paid within the discount period.

b. The proceeds from the note payable were used to finance the acquisition of property, plant, and equipment. Capital stock was sold to provide additional working capital.

-The amount to be shown on the cash flow statement as net cash provided by investing activities would total what amount?

A) $225,000

B) $750,000

C) $795,000

D) $975,000

Additional Information:

Additional Information:a. Accounts receivable and accounts payable relate to merchandise held for sale in the normal course of business. The allowance for bad debts was the same at the end of 2008 and 2007, and no receivables were charged against the allowance. Accounts

payable are recorded net of any discount and are always paid within the discount period.

b. The proceeds from the note payable were used to finance the acquisition of property, plant, and equipment. Capital stock was sold to provide additional working capital.

-The amount to be shown on the cash flow statement as net cash provided by investing activities would total what amount?

A) $225,000

B) $750,000

C) $795,000

D) $975,000

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

14

Questions are based on the data shown below related to the statement of cash flows for Litwin, Inc.:

Additional Information:

Additional Information:

a. Accounts receivable and accounts payable relate to merchandise held for sale in the normal course of business. The allowance for bad debts was the same at the end of 2008 and 2007, and no receivables were charged against the allowance. Accounts

payable are recorded net of any discount and are always paid within the discount period.

b. The proceeds from the note payable were used to finance the acquisition of property, plant, and equipment. Capital stock was sold to provide additional working capital.

-What amount of cash was collected from 2008 accounts receivable?

A) $7,500,000

B) $7,020,000

C) $6,540,000

D) $3,270,000

Additional Information:

Additional Information:a. Accounts receivable and accounts payable relate to merchandise held for sale in the normal course of business. The allowance for bad debts was the same at the end of 2008 and 2007, and no receivables were charged against the allowance. Accounts

payable are recorded net of any discount and are always paid within the discount period.

b. The proceeds from the note payable were used to finance the acquisition of property, plant, and equipment. Capital stock was sold to provide additional working capital.

-What amount of cash was collected from 2008 accounts receivable?

A) $7,500,000

B) $7,020,000

C) $6,540,000

D) $3,270,000

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

15

Questions are based on the data shown below related to the statement of cash flows for Litwin, Inc.:

Additional Information:

Additional Information:

a. Accounts receivable and accounts payable relate to merchandise held for sale in the normal course of business. The allowance for bad debts was the same at the end of 2008 and 2007, and no receivables were charged against the allowance. Accounts

payable are recorded net of any discount and are always paid within the discount period.

b. The proceeds from the note payable were used to finance the acquisition of property, plant, and equipment. Capital stock was sold to provide additional working capital.

-What amount of cash was paid on accounts payable to suppliers during 2008?

A) $4,605,000

B) $4,425,000

C) $4,095,000

D) $3,735,000

Additional Information:

Additional Information:a. Accounts receivable and accounts payable relate to merchandise held for sale in the normal course of business. The allowance for bad debts was the same at the end of 2008 and 2007, and no receivables were charged against the allowance. Accounts

payable are recorded net of any discount and are always paid within the discount period.

b. The proceeds from the note payable were used to finance the acquisition of property, plant, and equipment. Capital stock was sold to provide additional working capital.

-What amount of cash was paid on accounts payable to suppliers during 2008?

A) $4,605,000

B) $4,425,000

C) $4,095,000

D) $3,735,000

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

16

The net cash provided by operating activities in Otto Company's statement of cash flows for 2008 was $115,000. For 2008, depreciation on plant assets was $45,000, amortization of patent was $8,000, and cash dividends paid on common stock was $54,000. Based only on the information given above, Otto's net income for 2008 was

A) $115,000.

B) $62,000.

C) $8,000.

D) $116,000.

A) $115,000.

B) $62,000.

C) $8,000.

D) $116,000.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

17

During 2008, Garber Corporation, which uses the allowance method of accounting for doubtful accounts, recorded a provision for bad debt expense of $25,000 and in addition it wrote off, as uncollectible, accounts receivable of $10,000. As a result of these transactions, net cash flows from operating activities would be calculated (indirect method) by adjusting net income with a

A) $25,000 increase.

B) $10,000 increase.

C) $15,000 increase.

D) $15,000 decrease.

A) $25,000 increase.

B) $10,000 increase.

C) $15,000 increase.

D) $15,000 decrease.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

18

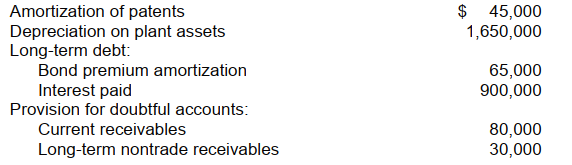

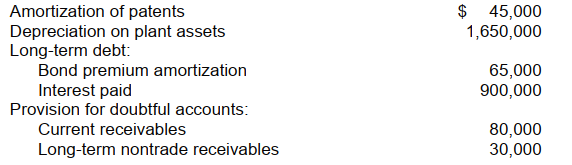

Snow Incorporated, had net income for 2008 of $5,000,000. Additional information is as follows:

What should be the net cash provided by operating activities in the statement of cash flows for the year ended December 31, 2008, based solely on the above information?

What should be the net cash provided by operating activities in the statement of cash flows for the year ended December 31, 2008, based solely on the above information?

A) $6,820,000.

B) $6,870,000.

C) $6,740,000.

D) $6,840,000.

What should be the net cash provided by operating activities in the statement of cash flows for the year ended December 31, 2008, based solely on the above information?

What should be the net cash provided by operating activities in the statement of cash flows for the year ended December 31, 2008, based solely on the above information?A) $6,820,000.

B) $6,870,000.

C) $6,740,000.

D) $6,840,000.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck