Deck 12: Pricing Decisions, Product Profitability Decisions, and Cost Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/36

Play

Full screen (f)

Deck 12: Pricing Decisions, Product Profitability Decisions, and Cost Management

1

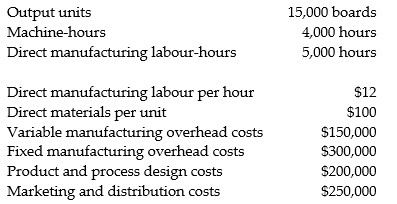

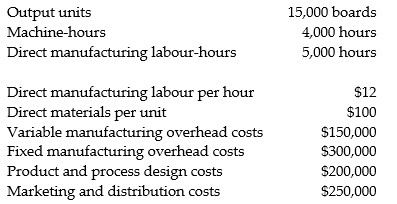

Schlickau Company manufactures basketball backboards. The following information pertains to the

company's normal operations per month:

Required:

a. For long-run pricing, what is the full-cost base per unit?

b. Schlickau Company is approached by an overseas city to fulfill a one-time-only special order for 1,000 units. All cost relationships remain the same except for an additional one-time setup charge of $40,000. No additional design, marketing, or distribution costs will be incurred. What is the minimum acceptable bid per unit on this one-time-only special order?

company's normal operations per month:

Required:

a. For long-run pricing, what is the full-cost base per unit?

b. Schlickau Company is approached by an overseas city to fulfill a one-time-only special order for 1,000 units. All cost relationships remain the same except for an additional one-time setup charge of $40,000. No additional design, marketing, or distribution costs will be incurred. What is the minimum acceptable bid per unit on this one-time-only special order?

2

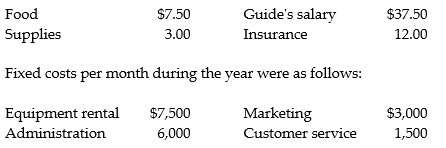

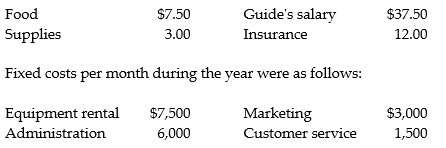

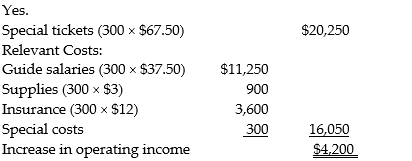

Muskoka Travel offers guided tours through the lake system. Muskoka Travel provides a guide, necessary equipment, and food for a fee of $75 per person per day. Currently the company is providing an average of 600 guide-days per month. Based on available equipment and guides the maximum capacity is 950 guide-days (customers taken on the equivalent of an all day tour) per month.

Variable costs per guide-day for the year were as follows:

Required:

A group of foreign tourists has offered Muskoka Travel a proposal of 300 guide-days in July if they will cut the fee to $67.50 per guide-day. They have their own food and do not want to use the Muskoka Travel menus. Muskoka Travel will incur $300 in additional costs for busing the tourists back and forth to the camp site. If fixed costs would not increase, should Muskoka Travel accept the special offer?

Variable costs per guide-day for the year were as follows:

Required:

A group of foreign tourists has offered Muskoka Travel a proposal of 300 guide-days in July if they will cut the fee to $67.50 per guide-day. They have their own food and do not want to use the Muskoka Travel menus. Muskoka Travel will incur $300 in additional costs for busing the tourists back and forth to the camp site. If fixed costs would not increase, should Muskoka Travel accept the special offer?

3

Brady Lumber Company, a producer of oak lumber for furniture companies has an offer to supply a special load of lumber for an exporter. It will take three months to fill the order of 1,000,000 board metres. During the three months half of its production capacity will be utilized for the special order. The total fixed costs for the three months will be $6,000,000. Variable costs per 1,000 board metres will be $2,500.

The marketing manager believes that half of the capacity taken up by the special order can be utilized with regular business which will generate income of $240,000.

Required:

Determine the minimum price that needs to be charged for the special order.

The marketing manager believes that half of the capacity taken up by the special order can be utilized with regular business which will generate income of $240,000.

Required:

Determine the minimum price that needs to be charged for the special order.

Opportunity costs to be recovered:

$240,000 + Variable costs [$2,500 × (1,000,000/1,000) = $2,500,000]

= Relevant cost (minimum revenue needed) = $2,740,000

Price = $2,740,000/1,000 = $2,740 per 1,000 board metres.

$240,000 + Variable costs [$2,500 × (1,000,000/1,000) = $2,500,000]

= Relevant cost (minimum revenue needed) = $2,740,000

Price = $2,740,000/1,000 = $2,740 per 1,000 board metres.

4

Backwoods Incorporated manufactures rustic furniture. The cost accounting system estimates manufacturing costs to be $80 per table, consisting of 70% variable costs and 30% fixed costs. The company has surplus capacity available. It is Backwoods' policy to add a 50% markup to full costs.

Required:

a. Backwoods Incorporated is invited to bid on an order to supply 100 rustic tables. What is the lowest price Backwoods should bid on this one-time-only special order?

b. A large hotel chain is currently expanding and has decided to decorate all new hotels using the rustic style. Backwoods Incorporated is invited to submit a bid to the hotel chain. What is the lowest price per unit Backwoods should bid on this long-term order?

Required:

a. Backwoods Incorporated is invited to bid on an order to supply 100 rustic tables. What is the lowest price Backwoods should bid on this one-time-only special order?

b. A large hotel chain is currently expanding and has decided to decorate all new hotels using the rustic style. Backwoods Incorporated is invited to submit a bid to the hotel chain. What is the lowest price per unit Backwoods should bid on this long-term order?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

5

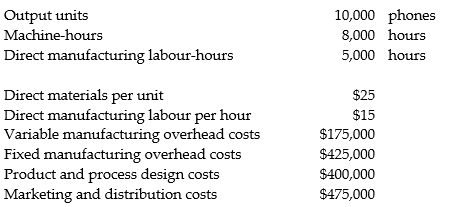

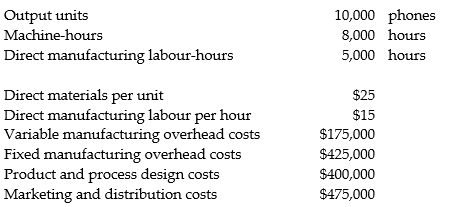

Delgreco Products manufactures high-tech cell phones. Delgreco Products has a policy of adding a 30% markup to full costs and currently has excess capacity. The following information pertains to the company's normal operations per month:

Delgreco Products is approached by an overseas customer to fulfill a one-time-only special order for 1,000 units. All cost relationships remain the same except for a one-time setup charge of $15,000. No additional design, marketing, or distribution costs will be incurred.

Required:

a. What is the minimum acceptable bid per unit on this one-time-only special order?

b. What is the full product cost?

Delgreco Products is approached by an overseas customer to fulfill a one-time-only special order for 1,000 units. All cost relationships remain the same except for a one-time setup charge of $15,000. No additional design, marketing, or distribution costs will be incurred.

Required:

a. What is the minimum acceptable bid per unit on this one-time-only special order?

b. What is the full product cost?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

6

At a management meeting, you just finished presenting your cost analysis report, showing unit costs last year for 60,000 widgets produced were $435.00. The sales manager then complained that she was going to lose a special overseas sale because the customer had indicated they could only pay $425.00. She knew from sources that no competitor would be bidding below $440, and she complained that if the company had better cost control, there would be more profit for everyone. The production manager also would like to take the extra job, since even with the extra production, the plant would be under-capacity.

Required:What type of information would you need in order to be able to determine if the extra order could be profitably produced if the selling price was held to $425 per unit?

Required:What type of information would you need in order to be able to determine if the extra order could be profitably produced if the selling price was held to $425 per unit?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

7

A company uses a long-run time horizon to price its product, an electronic component used in aircraft. To produce a normal production run for a year of 100,000 units direct materials are $90,000; direct labour is $180,000; and, rent on leased equipment is $106,000 per year. Currently re-work is running at 4% of production, after testing. The company has the capacity to test 10 units per hour. Manufacturing Overhead has two cost drivers: testing (cost driver is testing hours at $2.50 per hour); and, rework (cost driver is units reworked at $80 per unit re-worked).

Calculate current total manufacturing costs for 100,000 units.

A) $320,000

B) $376,000

C) $396,000

D) $401,000

E) $721,000

Calculate current total manufacturing costs for 100,000 units.

A) $320,000

B) $376,000

C) $396,000

D) $401,000

E) $721,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

8

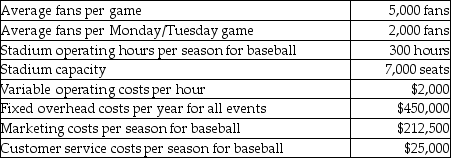

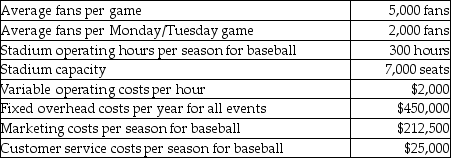

Taylor Stadium is evaluating ticket prices for its baseball games. Studies have shown that Monday and Tuesday ball games average less than half the fans of games on other days. The following information pertains to the stadium's normal operations per season.

The stadium is open for 5 hours on each day a game is played. The stadium is available for some type of use 300 days a year. All employees work by the hour except for the administrators. In addition, only one game is played per day and each fan would have only one ticket per game.

The stadium is open for 5 hours on each day a game is played. The stadium is available for some type of use 300 days a year. All employees work by the hour except for the administrators. In addition, only one game is played per day and each fan would have only one ticket per game.

Required:

What is the unit cost when establishing a long-run price for ball games assuming all tickets are priced the same?

The stadium is open for 5 hours on each day a game is played. The stadium is available for some type of use 300 days a year. All employees work by the hour except for the administrators. In addition, only one game is played per day and each fan would have only one ticket per game.

The stadium is open for 5 hours on each day a game is played. The stadium is available for some type of use 300 days a year. All employees work by the hour except for the administrators. In addition, only one game is played per day and each fan would have only one ticket per game.Required:

What is the unit cost when establishing a long-run price for ball games assuming all tickets are priced the same?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

9

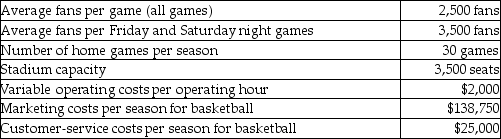

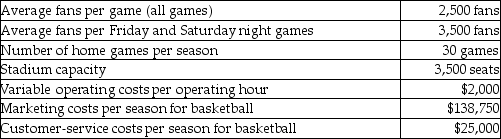

The Maize Eagles are evaluating ticket prices for its basketball games. Studies show that Friday and Saturday night games average more than twice the fans of games on other days. The following information pertains to the stadium's normal operations per season:

The stadium is open for 5 operating hours on each day a game is played. All employees work by the hour except for the administrators. A maximum of one game is played per day and each fan has only one ticket per game.

The stadium is open for 5 operating hours on each day a game is played. All employees work by the hour except for the administrators. A maximum of one game is played per day and each fan has only one ticket per game.

Required:

What is the unit cost when establishing a long-run price for ball games assuming all tickets are priced the same?

The stadium is open for 5 operating hours on each day a game is played. All employees work by the hour except for the administrators. A maximum of one game is played per day and each fan has only one ticket per game.

The stadium is open for 5 operating hours on each day a game is played. All employees work by the hour except for the administrators. A maximum of one game is played per day and each fan has only one ticket per game.Required:

What is the unit cost when establishing a long-run price for ball games assuming all tickets are priced the same?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

10

In a graph with cumulative costs per unit as the Y-axis, with two curves, one being the cumulative costs locked-in, and a second curve showing the cumulative costs per unit incurred in different business functions, which of the following is TRUE?

A) The graph will show the divergence between the amount of locked-in costs and costs incurred, by the end of the production cycle.

B) Locked-in costs rise much slower initially than the incurred cost, but joining the incurred cost line at the completion of the value chain functions.

C) The two cost lines will run parallel.

D) No differences unless the product is manufactured inefficiently.

E) Both curves deal with the same cumulative cost per unit.

A) The graph will show the divergence between the amount of locked-in costs and costs incurred, by the end of the production cycle.

B) Locked-in costs rise much slower initially than the incurred cost, but joining the incurred cost line at the completion of the value chain functions.

C) The two cost lines will run parallel.

D) No differences unless the product is manufactured inefficiently.

E) Both curves deal with the same cumulative cost per unit.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

11

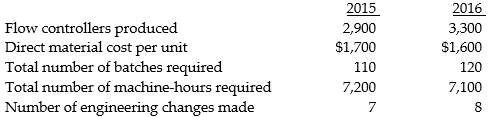

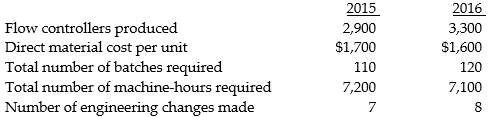

CIMA Engineering uses a manufacturing costing system with one direct cost category (direct materials) and three indirect cost categories:

a. Setup, production order, and materials-handling costs that vary with the number of batches.

b. Manufacturing operations costs that vary with machine-hours.

c. Costs of engineering changes that vary with the number of engineering changes made.

In response to competitive pressures at the end of 2016, Medical Instruments used value-engineering

techniques to reduce manufacturing costs. Actual information for 2015 and 2016 is:

The management of CIMA Engineering wants to evaluate whether value engineering has succeeded in

reducing the target manufacturing cost per unit of one of its flow controllers by 10%. Actual results for 2015 and 2016 for the flow controller are:

Required:

a. Calculate the manufacturing cost for both years.

b. Did the company achieve the target manufacturing cost per unit in 2016? Explain.

a. Setup, production order, and materials-handling costs that vary with the number of batches.

b. Manufacturing operations costs that vary with machine-hours.

c. Costs of engineering changes that vary with the number of engineering changes made.

In response to competitive pressures at the end of 2016, Medical Instruments used value-engineering

techniques to reduce manufacturing costs. Actual information for 2015 and 2016 is:

The management of CIMA Engineering wants to evaluate whether value engineering has succeeded in

reducing the target manufacturing cost per unit of one of its flow controllers by 10%. Actual results for 2015 and 2016 for the flow controller are:

Required:

a. Calculate the manufacturing cost for both years.

b. Did the company achieve the target manufacturing cost per unit in 2016? Explain.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

12

Johnson Petroleum Company is considering pricing its 5,000 litre petroleum tanks using either variable manufacturing or full product costs as the base. The variable cost base provides a prospective price of $2,800 and the full cost base provides a prospective price of $2,850. The difference between the two prices is

A) the amount of profit to be included.

B) due to the fact that the variable cost base must estimate all fixed costs, other variable costs, and desired profit while the full cost base must estimate only desired profit.

C) known as price discrimination.

D) caused by the inability of most companies to estimate fixed cost per unit with any degree of reliability.

E) known as peak pricing.

A) the amount of profit to be included.

B) due to the fact that the variable cost base must estimate all fixed costs, other variable costs, and desired profit while the full cost base must estimate only desired profit.

C) known as price discrimination.

D) caused by the inability of most companies to estimate fixed cost per unit with any degree of reliability.

E) known as peak pricing.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

13

Answer the following question(s) using the information below.

After conducting a market research study, Schultz Manufacturing decided to produce a new interior door to complement its exterior door line. It is estimated that the new interior door can be sold at a target price of $60. The annual target sales volume for interior doors is 20,000. Schultz has target operating income of 20% of sales.

-What are target sales revenues?

A) $960,000

B) $2,000,000

C) $1,800,000

D) $1,000,000

E) $1,200,000

After conducting a market research study, Schultz Manufacturing decided to produce a new interior door to complement its exterior door line. It is estimated that the new interior door can be sold at a target price of $60. The annual target sales volume for interior doors is 20,000. Schultz has target operating income of 20% of sales.

-What are target sales revenues?

A) $960,000

B) $2,000,000

C) $1,800,000

D) $1,000,000

E) $1,200,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

14

Answer the following question(s) using the information below.

After conducting a market research study, Potter Products decided to produce an electric coffee pot to complement its line of kitchen products. It is estimated that the new coffee pot can be sold at a target price of $46. The annual target sales volume for the coffee pot is 300,000. Potter has target operating income of 18% of sales

-What is the target operating income?

A) $2,931,120

B) $2,160,000

C) $2,036,880

D) $2,484,000

E) $248,400

After conducting a market research study, Potter Products decided to produce an electric coffee pot to complement its line of kitchen products. It is estimated that the new coffee pot can be sold at a target price of $46. The annual target sales volume for the coffee pot is 300,000. Potter has target operating income of 18% of sales

-What is the target operating income?

A) $2,931,120

B) $2,160,000

C) $2,036,880

D) $2,484,000

E) $248,400

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

15

Answer the following question(s) using the information below.

After conducting a market research study, Potter Products decided to produce an electric coffee pot to complement its line of kitchen products. It is estimated that the new coffee pot can be sold at a target price of $46. The annual target sales volume for the coffee pot is 300,000. Potter has target operating income of 18% of sales

-What is the total target cost?

A) $9,840,000

B) $11,316,000

C) $13,352,000

D) $9,279,120

E) $1,131,600

After conducting a market research study, Potter Products decided to produce an electric coffee pot to complement its line of kitchen products. It is estimated that the new coffee pot can be sold at a target price of $46. The annual target sales volume for the coffee pot is 300,000. Potter has target operating income of 18% of sales

-What is the total target cost?

A) $9,840,000

B) $11,316,000

C) $13,352,000

D) $9,279,120

E) $1,131,600

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

16

Answer the following question(s) using the information below.

After conducting a market research study, Potter Products decided to produce an electric coffee pot to complement its line of kitchen products. It is estimated that the new coffee pot can be sold at a target price of $46. The annual target sales volume for the coffee pot is 300,000. Potter has target operating income of 18% of sales

-What is the target cost for each coffee pot?

A) $32.80

B) $44.51

C) $30.93

D) $3.77

E) $37.72

After conducting a market research study, Potter Products decided to produce an electric coffee pot to complement its line of kitchen products. It is estimated that the new coffee pot can be sold at a target price of $46. The annual target sales volume for the coffee pot is 300,000. Potter has target operating income of 18% of sales

-What is the target cost for each coffee pot?

A) $32.80

B) $44.51

C) $30.93

D) $3.77

E) $37.72

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

17

Bridget, a college student, plans to operate a hot dog stand at the beach during the summer for three months. Her fixed costs for the booth, which include utilities, will be $2,600. Variable costs per hot dog will be $1.50 for materials and $0.40 for a franchise fee from the hot dog supplier. This year's sales are expected to be 20,000 units based upon the operation of the same booth the prior year. Bridget needs to earn $10,000 so that she can pay part of her college expenses for the coming academic year. Based on competitor's prices, her target price is $2.40

Required:

Determine whether she can expect to earn the $10,000 at the target price.

Required:

Determine whether she can expect to earn the $10,000 at the target price.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

18

Do-It Company manufactures sinker molds for fishing. A sinker mold has a price of $7.00, and costs currently assigned to it of $5.44. A competitor is introducing a new sinker mold that will sell for $6.00. Management believes it must lower the price to $6.00 in order to compete in the highly cost-conscious sinker mold market. Marketing believes that the new price will maintain the current sales level. Do-It Company's sales are currently 200,000 molds per year.

Required:

a. What is the target cost for the new price if target profit is 20 percent of sales?

b. What is the target selling price if costs cannot be reduced and target profit is changed to 15 percent of sales?

c. What is the change in operating income for the year if $6.00 is the new price and costs remain the same?

d. What is the target cost per unit if the selling price is reduced to $6.00 and the company wants to maintain its same income level?

Required:

a. What is the target cost for the new price if target profit is 20 percent of sales?

b. What is the target selling price if costs cannot be reduced and target profit is changed to 15 percent of sales?

c. What is the change in operating income for the year if $6.00 is the new price and costs remain the same?

d. What is the target cost per unit if the selling price is reduced to $6.00 and the company wants to maintain its same income level?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

19

Steven Corporation manufactures fishing poles that have a price of $42.00. It has costs of $32.64 A competitor is introducing a new fishing pole that will sell for $36.00. Management believes it must lower the price to $36.00 to compete in the highly cost-conscious fishing pole market. Marketing believes that the new price will maintain the current sales level. Steven Corporation's sales are currently 200,000 poles per year.

Required:

a. What is the target cost for the new price if target operating income is 20% of sales?

b. What is the change in operating income for the year if $36.00 is the new price and costs remain the same?

c. What is the target cost per unit if the selling price is reduced to $36.00 and the company wants to maintain its same income level?

Required:

a. What is the target cost for the new price if target operating income is 20% of sales?

b. What is the change in operating income for the year if $36.00 is the new price and costs remain the same?

c. What is the target cost per unit if the selling price is reduced to $36.00 and the company wants to maintain its same income level?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

20

Robert's Medical Equipment Company manufactures hospital beds. Its' most popular model, Deluxe, sells for $5,000. It has variable costs of $2,800 and fixed costs of $1,000 per unit, base on an average production run of 5,000 units. It normally has four production runs a year, with $400,000 in setup costs each time. Plant capacity can handle up to six runs a year for a total of 30,000 beds.

A competitor is introducing a new hospital bed similar to Deluxe that will sell for $4,000.

Management believes it must lower the price to compete. Marketing believes that the new price will

increase sales by 25% a year. The plant manager thinks that production can increase by 25% with the

same level of fixed costs. The company currently sells all the Deluxe beds it can produce.

Required:

a. What is the annual operating income from Deluxe at the current price of $5,000 and normal production?

b. What is the annual operating income from Deluxe if the price is reduced to $4,000 and sales in units increase by 25%?

c. What is the target cost per unit for the new price if target operating income is 20% of sales?

A competitor is introducing a new hospital bed similar to Deluxe that will sell for $4,000.

Management believes it must lower the price to compete. Marketing believes that the new price will

increase sales by 25% a year. The plant manager thinks that production can increase by 25% with the

same level of fixed costs. The company currently sells all the Deluxe beds it can produce.

Required:

a. What is the annual operating income from Deluxe at the current price of $5,000 and normal production?

b. What is the annual operating income from Deluxe if the price is reduced to $4,000 and sales in units increase by 25%?

c. What is the target cost per unit for the new price if target operating income is 20% of sales?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

21

Reuter Avionics currently sells radios for $1,800. It has costs of $1,400. A competitor is bringing a new

radio to market that will sell for $1,600. Management believes it must lower the price to $1,600 to

compete in the market for radios. Marketing believes that the new price will cause sales to increase by

10%, even with a new competitor in the market. Reuter's sales are currently 1,000 radios per year.

Required:

a. What is the target cost if target operating income is 25% of sales?

b. What is the change in operating income if marketing is correct and only the sales price is changed?

c. What is the target cost if the company wants to maintain its same income level, and marketing is correct?

radio to market that will sell for $1,600. Management believes it must lower the price to $1,600 to

compete in the market for radios. Marketing believes that the new price will cause sales to increase by

10%, even with a new competitor in the market. Reuter's sales are currently 1,000 radios per year.

Required:

a. What is the target cost if target operating income is 25% of sales?

b. What is the change in operating income if marketing is correct and only the sales price is changed?

c. What is the target cost if the company wants to maintain its same income level, and marketing is correct?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

22

Warthog Avionics currently sells radios for $3,600. It has costs of $2,800. A competitor is bringing a new radio to market that will sell for $3,200. Management believes it must lower the price to $3,200 to compete in the market for radios. Marketing believes that the new price will cause sales to increase by 10%, even with a new competitor in the market. Warthog's sales are currently 1,000 radios per year.

Required:

a. What is the target cost if target operating income is 25% of sales?

b. What is the change in operating income if marketing is correct and only the sales price is changed?

c. What is the target cost if the company wants to maintain its same income level, and marketing is correct?

Required:

a. What is the target cost if target operating income is 25% of sales?

b. What is the change in operating income if marketing is correct and only the sales price is changed?

c. What is the target cost if the company wants to maintain its same income level, and marketing is correct?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

23

Central Dental Company manufactures dental chairs. Its most popular model, Deluxe, sells for $2,500. It has variable costs totaling $1,400 and fixed costs of $500 per unit based on an average production run of 5,000 units. It normally has four production runs a year with $200,000 setup costs each time. Plant capacity can handle up to six runs a year for a total of 30,000 chairs.

A competitor is introducing a new dental chair similar to Deluxe that will sell for $2,000. Management believes it must lower the price in order to compete. Marketing believes that the new price will increase sales by 25 percent a year. The plant manager thinks that production can increase by 25 percent with the same level of fixed costs. The company currently sells all the Deluxe chairs it can produce.

Required:

What is the target cost per unit for the new price if target profit is 20 percent of sales?

A competitor is introducing a new dental chair similar to Deluxe that will sell for $2,000. Management believes it must lower the price in order to compete. Marketing believes that the new price will increase sales by 25 percent a year. The plant manager thinks that production can increase by 25 percent with the same level of fixed costs. The company currently sells all the Deluxe chairs it can produce.

Required:

What is the target cost per unit for the new price if target profit is 20 percent of sales?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

24

Steven Corporation manufactures fishing poles that have a price of $21.00. It has costs of $16.32. A competitor is introducing a new fishing pole that will sell for $18.00. Management believes it must lower the price to $18.00 to compete in the highly cost-conscious fishing pole market. Marketing believes that the new price will maintain the current sales level. Steven Corporation's sales are currently 200,000 poles per year.

Required:

a. What is the target cost for the new price if target operating income is 20% of sales?

b. What is the change in operating income for the year if $18.00 is the new price and costs remain the same?

c. What is the target cost per unit if the selling price is reduced to $18.00 and the company wants to maintain its same income level?

Required:

a. What is the target cost for the new price if target operating income is 20% of sales?

b. What is the change in operating income for the year if $18.00 is the new price and costs remain the same?

c. What is the target cost per unit if the selling price is reduced to $18.00 and the company wants to maintain its same income level?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

25

Kezer Crafts currently sells motor boats for $6,000. It has costs of $4,650. A competitor is bringing a new motor boat to the market that will sell for $5,500. Management believes it must lower the price to $5,500 to compete in the market for motor boats. Marketing believes that the new price will cause sales to increase by 12.5%, even with a new competitor in the market. Kezer Crafts' sales are currently 2,000 motor boats per year.

Required:

a. What is the target cost if target operating income is 25% of sales?

b. What is the change in operating income if marketing is correct and only the sales price is changed?

c. What is the target cost if the company wants to maintain its same income level, and marketing is correct?

Required:

a. What is the target cost if target operating income is 25% of sales?

b. What is the change in operating income if marketing is correct and only the sales price is changed?

c. What is the target cost if the company wants to maintain its same income level, and marketing is correct?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

26

Use the information below to answer the following question(s).

Satellite Inc. is in the process of evaluating its new products. A new signal receiver has two production runs each year, each with $20,000 in setup costs. The new receiver incurred $60,000 in development costs and is expected to be produced for three years. The direct costs of producing the receivers are $80,000 per run of 5,000 receivers. Indirect manufacturing costs charged to each run are $90,000. Destination charges for each receiver average $2.00. Customer service expenses average $0.40 per receiver. The receivers are going to sell for $50 the first year and increase by $6 each year thereafter. Sales units equal production units each year.

-What is the Satellite Inc. life cycle budgeted revenue?

A) $500,000

B) $560,000

C) $1,620,000

D) $1,680,000

E) $1,500,000

Satellite Inc. is in the process of evaluating its new products. A new signal receiver has two production runs each year, each with $20,000 in setup costs. The new receiver incurred $60,000 in development costs and is expected to be produced for three years. The direct costs of producing the receivers are $80,000 per run of 5,000 receivers. Indirect manufacturing costs charged to each run are $90,000. Destination charges for each receiver average $2.00. Customer service expenses average $0.40 per receiver. The receivers are going to sell for $50 the first year and increase by $6 each year thereafter. Sales units equal production units each year.

-What is the Satellite Inc. life cycle budgeted revenue?

A) $500,000

B) $560,000

C) $1,620,000

D) $1,680,000

E) $1,500,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

27

Use the information below to answer the following question(s).

Satellite Inc. is in the process of evaluating its new products. A new signal receiver has two production runs each year, each with $20,000 in setup costs. The new receiver incurred $60,000 in development costs and is expected to be produced for three years. The direct costs of producing the receivers are $80,000 per run of 5,000 receivers. Indirect manufacturing costs charged to each run are $90,000. Destination charges for each receiver average $2.00. Customer service expenses average $0.40 per receiver. The receivers are going to sell for $50 the first year and increase by $6 each year thereafter. Sales units equal production units each year.

-What are the Satellite Inc. life cycle budgeted costs?

A) $424,000

B) $1,272,000

C) $639,000

D) $1,392,000

E) $298,000

Satellite Inc. is in the process of evaluating its new products. A new signal receiver has two production runs each year, each with $20,000 in setup costs. The new receiver incurred $60,000 in development costs and is expected to be produced for three years. The direct costs of producing the receivers are $80,000 per run of 5,000 receivers. Indirect manufacturing costs charged to each run are $90,000. Destination charges for each receiver average $2.00. Customer service expenses average $0.40 per receiver. The receivers are going to sell for $50 the first year and increase by $6 each year thereafter. Sales units equal production units each year.

-What are the Satellite Inc. life cycle budgeted costs?

A) $424,000

B) $1,272,000

C) $639,000

D) $1,392,000

E) $298,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

28

Use the information below to answer the following question(s).

Satellite Inc. is in the process of evaluating its new products. A new signal receiver has two production runs each year, each with $20,000 in setup costs. The new receiver incurred $60,000 in development costs and is expected to be produced for three years. The direct costs of producing the receivers are $80,000 per run of 5,000 receivers. Indirect manufacturing costs charged to each run are $90,000. Destination charges for each receiver average $2.00. Customer service expenses average $0.40 per receiver. The receivers are going to sell for $50 the first year and increase by $6 each year thereafter. Sales units equal production units each year.

-What is the Satellite Inc. life cycle operating income?

A) $408,000

B) $76,000

C) $388,000

D) $348,000

E) $288,000

Satellite Inc. is in the process of evaluating its new products. A new signal receiver has two production runs each year, each with $20,000 in setup costs. The new receiver incurred $60,000 in development costs and is expected to be produced for three years. The direct costs of producing the receivers are $80,000 per run of 5,000 receivers. Indirect manufacturing costs charged to each run are $90,000. Destination charges for each receiver average $2.00. Customer service expenses average $0.40 per receiver. The receivers are going to sell for $50 the first year and increase by $6 each year thereafter. Sales units equal production units each year.

-What is the Satellite Inc. life cycle operating income?

A) $408,000

B) $76,000

C) $388,000

D) $348,000

E) $288,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

29

Knowledge Transfer Associates is in the process of evaluating its new client services for the business systems consulting division.

Server Planning, a new service, incurred $250,000 in development costs.

The direct costs of providing the service, which is all labour, averages $50 per hour.

Other costs for this service are estimated at $300,000 per year.

The current program for server planning is expected to last for two years. At that time, expected new operating systems are likely to make the service non viable.

Customer service expenses average $250 per client, with each job lasting an average of 40 hours. The current staff expects to bill 15,000 hours for each of the two years the program is in effect. Billing averages $90 per hour.

What is the estimated life-cycle operating income for both years combined?

A) $206,250

B) $162,500

C) $(43,750)

D) $(87,500)

E) $412,500

Server Planning, a new service, incurred $250,000 in development costs.

The direct costs of providing the service, which is all labour, averages $50 per hour.

Other costs for this service are estimated at $300,000 per year.

The current program for server planning is expected to last for two years. At that time, expected new operating systems are likely to make the service non viable.

Customer service expenses average $250 per client, with each job lasting an average of 40 hours. The current staff expects to bill 15,000 hours for each of the two years the program is in effect. Billing averages $90 per hour.

What is the estimated life-cycle operating income for both years combined?

A) $206,250

B) $162,500

C) $(43,750)

D) $(87,500)

E) $412,500

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is NOT a benefit of life cycle reporting?

A) The full set of revenues associated with each product becomes visible.

B) The full set of costs associated with each product becomes visible.

C) The differences between products in the percentage of their total costs incurred at earl stages in the life cycle are highlighted.

D) Upstream costs, such as R & D, are the only costs that need to be added in when a life cycle report is complete.

E) Interrelationships among business function cost categories are highlighted.

A) The full set of revenues associated with each product becomes visible.

B) The full set of costs associated with each product becomes visible.

C) The differences between products in the percentage of their total costs incurred at earl stages in the life cycle are highlighted.

D) Upstream costs, such as R & D, are the only costs that need to be added in when a life cycle report is complete.

E) Interrelationships among business function cost categories are highlighted.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

31

Image Products is in the process of evaluating its new cosmetic products. One new product, Nice Hair, has one production run each month with $8,000 in setup costs. Nice Hair incurred $20,000 in development costs and is expected to be produced for three years. The direct costs of producing Nice Hair are $28,000 per run of 15,000 bottles. Indirect manufacturing costs charged to each run are $44,000. Destination charges for each batch average $9,000. Nice Hair sells for $10 in Canada and $20 in all other countries. Sales are one-third domestic and two-thirds exported. Assume everything produced is sold.

Required:

What is the life-cycle budgeted operating income?

Required:

What is the life-cycle budgeted operating income?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

32

Max and Marv are starting a new business venture and are in the process of evaluating their product lines. One new product, hand-made wooden tables, has incurred $30,000 in development costs. These costs are to be amortized over a three-year period, the expected product life cycle. The direct costs of each table averages $90. Other costs for making the tables are estimated at $100,000 per year. The current sales program for tables is expected to change every six months. At that time a new pattern will be put in place with $7,000 of setup costs. Each table requires 12 labour hours and 2 machine hours. Current annual sales are expected to be 2,000 units of each table at $140 each. Customer service expenses average $10 per table.

Required:

What is the life-cycle operating income?

Required:

What is the life-cycle operating income?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

33

Henderson Company is in the process of evaluating a new part using the following information.

Part SLC2002 has one production run each month, each with $16,000 in setup costs.

Part SLC2002 incurred $40,000 in development costs and is expected to be produced over the next three years.

Direct costs of producing Part SLC2002 are $56,000 per run of 24,000 parts each.

Indirect manufacturing costs charged to each run are $88,000.

Destination charges for each run average $18,000.

Part SLC2002 is selling for $12.50 in the Canada and $25 in all other countries. Sales are one-third domestic and two-thirds exported.

Sales units equal production units each year.

Required:

a. What are the estimated life-cycle revenues?

b. What is the estimated life-cycle operating income if the product life cycle is one year?

Part SLC2002 has one production run each month, each with $16,000 in setup costs.

Part SLC2002 incurred $40,000 in development costs and is expected to be produced over the next three years.

Direct costs of producing Part SLC2002 are $56,000 per run of 24,000 parts each.

Indirect manufacturing costs charged to each run are $88,000.

Destination charges for each run average $18,000.

Part SLC2002 is selling for $12.50 in the Canada and $25 in all other countries. Sales are one-third domestic and two-thirds exported.

Sales units equal production units each year.

Required:

a. What are the estimated life-cycle revenues?

b. What is the estimated life-cycle operating income if the product life cycle is one year?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

34

Bicker, Inc., is in the process of evaluating a new product using the following information:

A new transformer has two production runs each year, each with $10,000 in setup costs.

The new transformer incurred $30,000 in development costs and is expected to be produced over the next three years.

Direct costs of producing the transformers are $40,000 per run of 5,000 transformers each.

Indirect manufacturing costs charged to each run are $45,000.

Destination charges for each transformer average $1.00.

Customer service expenses average $0.20 per transformer.

The transformers are selling for $25 the first year and will increase by $3 each year thereafter.

Sales units equal production units each year.

Required:

a. What are the estimated life-cycle revenues?

b. What is the estimated life-cycle operating income if the product life cycle is one year?

A new transformer has two production runs each year, each with $10,000 in setup costs.

The new transformer incurred $30,000 in development costs and is expected to be produced over the next three years.

Direct costs of producing the transformers are $40,000 per run of 5,000 transformers each.

Indirect manufacturing costs charged to each run are $45,000.

Destination charges for each transformer average $1.00.

Customer service expenses average $0.20 per transformer.

The transformers are selling for $25 the first year and will increase by $3 each year thereafter.

Sales units equal production units each year.

Required:

a. What are the estimated life-cycle revenues?

b. What is the estimated life-cycle operating income if the product life cycle is one year?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

35

Grace Greeting Cards Incorporated is starting a new business venture and are in the process of evaluating its product lines. Information for one new product, traditional parchment grade cards, is as follows:

Sixteen times each year, a new card design will be put into production. Each new design will require $600 in setup costs.

The parchment grade card product line incurred $75,000 in development costs and is expected to be produced over the next four years.

Direct costs of producing the designs average $0.50 each.

Indirect manufacturing costs are estimated at $50,000 per year.

Customer service expenses average $0.10 per card.

Current sales are expected to be 2,500 units of each card design. Each card sells for $3.50.

Sales units equal production units each year.

Required:

a. What are the estimated life-cycle revenues?

b. What is the estimated life-cycle operating income if the product life cycle is one year?

c. What is the estimated life-cycle operating income per year for the years after the first year if all of the development costs are charged to the first year?

d. What is the total estimated life-cycle operating income?

Sixteen times each year, a new card design will be put into production. Each new design will require $600 in setup costs.

The parchment grade card product line incurred $75,000 in development costs and is expected to be produced over the next four years.

Direct costs of producing the designs average $0.50 each.

Indirect manufacturing costs are estimated at $50,000 per year.

Customer service expenses average $0.10 per card.

Current sales are expected to be 2,500 units of each card design. Each card sells for $3.50.

Sales units equal production units each year.

Required:

a. What are the estimated life-cycle revenues?

b. What is the estimated life-cycle operating income if the product life cycle is one year?

c. What is the estimated life-cycle operating income per year for the years after the first year if all of the development costs are charged to the first year?

d. What is the total estimated life-cycle operating income?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

36

Ski Vallet provides materials that let people teach themselves how to snow ski. It has six different skill-level programs. Each one includes visual and audio learning aids along with a workbook that can be submitted to the company for grading and evaluation purposes, if the person so desires.

The accounting system of Ski Vallet is very traditional in its reporting functions with the calendar year being the company's fiscal year. It does include an abundance of information that can be used for various reporting purposes.

The company has found that any new idea soon runs its course with an effective life of about three years. Therefore, the company is always in the development stage of some new program. Program development requires experts in the area to provide the know-how of the item being developed and a development team that puts together the video, audio, and workbook materials. The actual costs of reproducing the packages is relatively cheap when compared to the development costs.

Required:

How might product-life-cycle reporting aid the company in improving its overall operations?

The accounting system of Ski Vallet is very traditional in its reporting functions with the calendar year being the company's fiscal year. It does include an abundance of information that can be used for various reporting purposes.

The company has found that any new idea soon runs its course with an effective life of about three years. Therefore, the company is always in the development stage of some new program. Program development requires experts in the area to provide the know-how of the item being developed and a development team that puts together the video, audio, and workbook materials. The actual costs of reproducing the packages is relatively cheap when compared to the development costs.

Required:

How might product-life-cycle reporting aid the company in improving its overall operations?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck