Deck 4: Job Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/49

Play

Full screen (f)

Deck 4: Job Costing

1

A local financial consulting firm employs 30 full-time employees. The budgeted compensation per employee is $50,000. The annual maximum chargeable time to each client is 1,000 hours. Clients always receive their full amount of time. All labour costs are included in a single direct-cost category and are traced to jobs on a per-hour basis.

Any other costs are included in a single indirect-cost pool, allocated according to professional labour-hours. Budgeted indirect costs for the year are $1,050,000, and the firm expects to have 60 clients during the coming year.

What is the budgeted indirect-cost rate per hour?

A) $1,050.00 per hour

B) $50.00 per hour

C) $35.00 per hour

D) $17.50 per hour

E) $10.00 per hour

Any other costs are included in a single indirect-cost pool, allocated according to professional labour-hours. Budgeted indirect costs for the year are $1,050,000, and the firm expects to have 60 clients during the coming year.

What is the budgeted indirect-cost rate per hour?

A) $1,050.00 per hour

B) $50.00 per hour

C) $35.00 per hour

D) $17.50 per hour

E) $10.00 per hour

$17.50 per hour

2

A local financial consulting firm employs 30 full-time staff. The budgeted compensation per employee is $50,000, for 2,000 hours. All direct labour costs are charged to clients.

Any other costs are included in a single indirect-cost pool, allocated according to labour-hours. Actual indirect costs were $750,000. Budgeted indirect costs for the year are $525,000 and the firm expects to have 60 clients during the coming year.

What is the total cost of a job which took 27 hours, using normal costing?

A) $911.25

B) $1,012.50

C) $27,337.50

D) $30,375.00

E) $50,000.00

Any other costs are included in a single indirect-cost pool, allocated according to labour-hours. Actual indirect costs were $750,000. Budgeted indirect costs for the year are $525,000 and the firm expects to have 60 clients during the coming year.

What is the total cost of a job which took 27 hours, using normal costing?

A) $911.25

B) $1,012.50

C) $27,337.50

D) $30,375.00

E) $50,000.00

$911.25

3

Budgeted fixed indirect costs remain constant at $150,000 per month. During high-output months variable indirect costs are budgeted at $120,000, and during low-output months budgeted variable costs are $60,000. What are the respective high and low indirect cost rates if budgeted professional labour-hours are 6,000 for high-output months and 2,000 for low-output months?

A) $31.25 per hour, $87.50 per hour

B) $45.00 per hour, $95.00 per hour

C) $45.00 per hour, $105.00 per hour

D) $56.20 per hour, $105.00 per hour

E) $59.00 per hour, $105.00 per hour

A) $31.25 per hour, $87.50 per hour

B) $45.00 per hour, $95.00 per hour

C) $45.00 per hour, $105.00 per hour

D) $56.20 per hour, $105.00 per hour

E) $59.00 per hour, $105.00 per hour

$45.00 per hour, $105.00 per hour

4

Use the information below to answer the following question(s).

A dental office is in the process of changing their costing system. Their system currently uses a single direct cost pool (professional labour) and a single indirect cost pool (staff support). The direct categories in the new, refined costing system include:

1. Professional partner labour. Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.

2. Dental assistant labour. Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.

3. Office staff. Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.

The indirect category in the new refined costing system includes professional liability insurance. The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours. The dentist and dental assistants are considered professional labour hours.

-What is the budgeted direct cost rate per hour for professional partner labour?

A) $25.00 per hour

B) $50.00 per hour

C) $44.50 per hour

D) $38.00 per hour

E) $46.00 per hour

A dental office is in the process of changing their costing system. Their system currently uses a single direct cost pool (professional labour) and a single indirect cost pool (staff support). The direct categories in the new, refined costing system include:

1. Professional partner labour. Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.

2. Dental assistant labour. Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.

3. Office staff. Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.

The indirect category in the new refined costing system includes professional liability insurance. The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours. The dentist and dental assistants are considered professional labour hours.

-What is the budgeted direct cost rate per hour for professional partner labour?

A) $25.00 per hour

B) $50.00 per hour

C) $44.50 per hour

D) $38.00 per hour

E) $46.00 per hour

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

5

Use the information below to answer the following question(s).

A Hospital uses a job cost system for all surgery patients. In February, the pre-operating room (PRE-OP) and operating room (OR) had budgeted allocation bases of 1,000 nursing hours and 500 nursing hours, respectively, and budgeted nursing overhead charges were $28,000 and $22,000, respectively. The hospital ward rooms for surgery patients had budgeted overhead costs of $200,000 and 2,500 nursing hours for the month. PRE-OP, OR and the hospital ward have separate indirect cost pools. The hospital uses a budgeted overhead rate for applying overhead to patient stays.

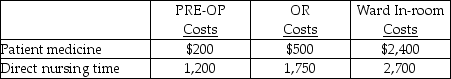

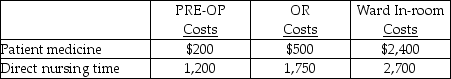

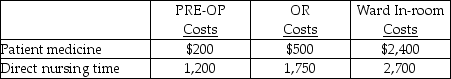

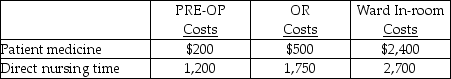

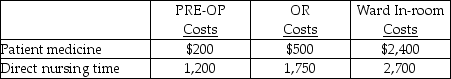

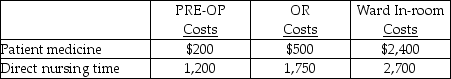

For patient Jones, actual hours incurred were six and eight hours, respectively, in the PRE-OP and OR rooms. He was in the hospital for 5 days (120 hours). Other costs related to Jones were:

-What is the budgeted overhead rate for the hospital floor for surgery?

A) $28.00

B) $44.00

C) $45.75

D) $47.75

E) $80.00

A Hospital uses a job cost system for all surgery patients. In February, the pre-operating room (PRE-OP) and operating room (OR) had budgeted allocation bases of 1,000 nursing hours and 500 nursing hours, respectively, and budgeted nursing overhead charges were $28,000 and $22,000, respectively. The hospital ward rooms for surgery patients had budgeted overhead costs of $200,000 and 2,500 nursing hours for the month. PRE-OP, OR and the hospital ward have separate indirect cost pools. The hospital uses a budgeted overhead rate for applying overhead to patient stays.

For patient Jones, actual hours incurred were six and eight hours, respectively, in the PRE-OP and OR rooms. He was in the hospital for 5 days (120 hours). Other costs related to Jones were:

-What is the budgeted overhead rate for the hospital floor for surgery?

A) $28.00

B) $44.00

C) $45.75

D) $47.75

E) $80.00

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

6

Use the information below to answer the following question(s).

A Hospital uses a job cost system for all surgery patients. In February, the pre-operating room (PRE-OP) and operating room (OR) had budgeted allocation bases of 1,000 nursing hours and 500 nursing hours, respectively, and budgeted nursing overhead charges were $28,000 and $22,000, respectively. The hospital ward rooms for surgery patients had budgeted overhead costs of $200,000 and 2,500 nursing hours for the month. PRE-OP, OR and the hospital ward have separate indirect cost pools. The hospital uses a budgeted overhead rate for applying overhead to patient stays.

For patient Jones, actual hours incurred were six and eight hours, respectively, in the PRE-OP and OR rooms. He was in the hospital for 5 days (120 hours). Other costs related to Jones were:

-What was the total OR cost for patient Jones?

A) $2,418

B) $2,514

C) $2,250

D) $2,602

E) $2,474

A Hospital uses a job cost system for all surgery patients. In February, the pre-operating room (PRE-OP) and operating room (OR) had budgeted allocation bases of 1,000 nursing hours and 500 nursing hours, respectively, and budgeted nursing overhead charges were $28,000 and $22,000, respectively. The hospital ward rooms for surgery patients had budgeted overhead costs of $200,000 and 2,500 nursing hours for the month. PRE-OP, OR and the hospital ward have separate indirect cost pools. The hospital uses a budgeted overhead rate for applying overhead to patient stays.

For patient Jones, actual hours incurred were six and eight hours, respectively, in the PRE-OP and OR rooms. He was in the hospital for 5 days (120 hours). Other costs related to Jones were:

-What was the total OR cost for patient Jones?

A) $2,418

B) $2,514

C) $2,250

D) $2,602

E) $2,474

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

7

Use the information below to answer the following question(s).

A Hospital uses a job cost system for all surgery patients. In February, the pre-operating room (PRE-OP) and operating room (OR) had budgeted allocation bases of 1,000 nursing hours and 500 nursing hours, respectively, and budgeted nursing overhead charges were $28,000 and $22,000, respectively. The hospital ward rooms for surgery patients had budgeted overhead costs of $200,000 and 2,500 nursing hours for the month. PRE-OP, OR and the hospital ward have separate indirect cost pools. The hospital uses a budgeted overhead rate for applying overhead to patient stays.

For patient Jones, actual hours incurred were six and eight hours, respectively, in the PRE-OP and OR rooms. He was in the hospital for 5 days (120 hours). Other costs related to Jones were:

-What was the total PRE-OP cost for patient Jones?

A) $1,400

B) $1,568

C) $1,624

D) $1,664

E) $1,752

A Hospital uses a job cost system for all surgery patients. In February, the pre-operating room (PRE-OP) and operating room (OR) had budgeted allocation bases of 1,000 nursing hours and 500 nursing hours, respectively, and budgeted nursing overhead charges were $28,000 and $22,000, respectively. The hospital ward rooms for surgery patients had budgeted overhead costs of $200,000 and 2,500 nursing hours for the month. PRE-OP, OR and the hospital ward have separate indirect cost pools. The hospital uses a budgeted overhead rate for applying overhead to patient stays.

For patient Jones, actual hours incurred were six and eight hours, respectively, in the PRE-OP and OR rooms. He was in the hospital for 5 days (120 hours). Other costs related to Jones were:

-What was the total PRE-OP cost for patient Jones?

A) $1,400

B) $1,568

C) $1,624

D) $1,664

E) $1,752

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

8

Use the information below to answer the following question(s).

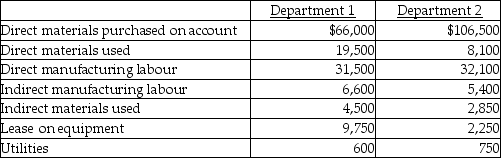

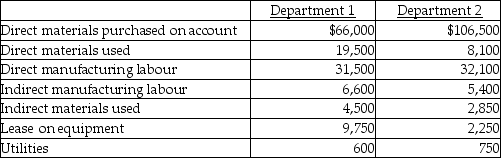

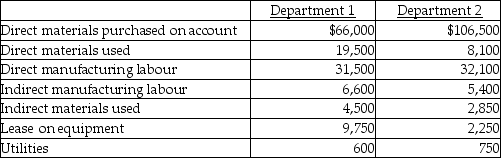

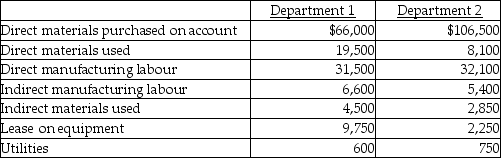

Jim's Computer Products manufactures keyboards for computers. In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2. The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively. For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2. The company uses a budgeted departmental overhead rate for applying overhead to production.

-What is the budgeted indirect cost allocation rate for Department 2?

A) $3.45

B) $3.75

C) $4.60

D) $7.50

E) $8.00

Jim's Computer Products manufactures keyboards for computers. In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2. The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively. For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2. The company uses a budgeted departmental overhead rate for applying overhead to production.

-What is the budgeted indirect cost allocation rate for Department 2?

A) $3.45

B) $3.75

C) $4.60

D) $7.50

E) $8.00

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

9

Use the information below to answer the following question(s).

Jim's Computer Products manufactures keyboards for computers. In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2. The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively. For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2. The company uses a budgeted departmental overhead rate for applying overhead to production.

-What is the total cost assigned to Job 501 based on normal costing?

A) $27,600

B) $91,200

C) $96,900

D) $123,900

E) $126,500

Jim's Computer Products manufactures keyboards for computers. In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2. The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively. For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2. The company uses a budgeted departmental overhead rate for applying overhead to production.

-What is the total cost assigned to Job 501 based on normal costing?

A) $27,600

B) $91,200

C) $96,900

D) $123,900

E) $126,500

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

10

Use the information below to answer the following question(s).

Capable Carts manufactures custom carts for a variety of uses. The following data have been recorded for Job 892, which was recently completed. Direct materials used cost $6,300, the budgeted direct materials were $5,900. There were 180 direct labour hours worked on this job at a direct labour wage rate of $20 per hour; the budgeted direct labour wage rate was $21 per hour. There were 75 machine hours used on this job. The budgeted and actual indirect cost allocation rates are $32 and $29 per machine hour used, respectively.

-What is the total manufacturing cost of Job 892 using normal costing?

A) $9,900

B) $12,300

C) $12,080

D) $12,255

E) $12,075

Capable Carts manufactures custom carts for a variety of uses. The following data have been recorded for Job 892, which was recently completed. Direct materials used cost $6,300, the budgeted direct materials were $5,900. There were 180 direct labour hours worked on this job at a direct labour wage rate of $20 per hour; the budgeted direct labour wage rate was $21 per hour. There were 75 machine hours used on this job. The budgeted and actual indirect cost allocation rates are $32 and $29 per machine hour used, respectively.

-What is the total manufacturing cost of Job 892 using normal costing?

A) $9,900

B) $12,300

C) $12,080

D) $12,255

E) $12,075

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

11

Use the information below to answer the following question(s).

Capable Carts manufactures custom carts for a variety of uses. The following data have been recorded for Job 892, which was recently completed. Direct materials used cost $6,300, the budgeted direct materials were $5,900. There were 180 direct labour hours worked on this job at a direct labour wage rate of $20 per hour; the budgeted direct labour wage rate was $21 per hour. There were 75 machine hours used on this job. The budgeted and actual indirect cost allocation rates are $32 and $29 per machine hour used, respectively.

-What is the total manufacturing cost of Job 892 using actual costing?

A) $9,900

B) $12,300

C) $12,080

D) $12,255

E) $12,075

Capable Carts manufactures custom carts for a variety of uses. The following data have been recorded for Job 892, which was recently completed. Direct materials used cost $6,300, the budgeted direct materials were $5,900. There were 180 direct labour hours worked on this job at a direct labour wage rate of $20 per hour; the budgeted direct labour wage rate was $21 per hour. There were 75 machine hours used on this job. The budgeted and actual indirect cost allocation rates are $32 and $29 per machine hour used, respectively.

-What is the total manufacturing cost of Job 892 using actual costing?

A) $9,900

B) $12,300

C) $12,080

D) $12,255

E) $12,075

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

12

Use the information below to answer the following question(s).

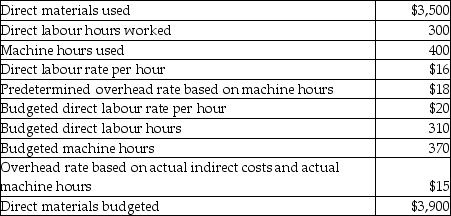

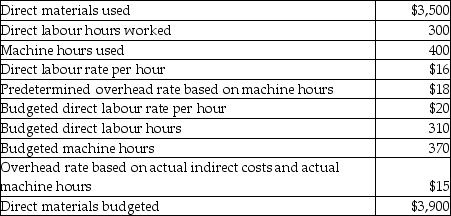

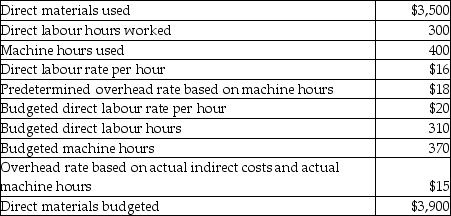

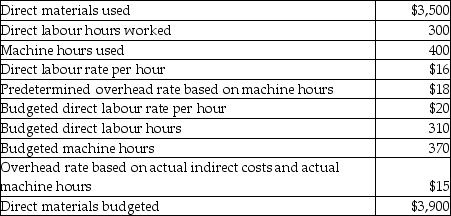

World Engines Ltd. manufactures custom engines for use in the lawn and garden equipment industry. The company allocates manufacturing overhead based on machine hours. Selected data for costs incurred for Job 787 are as follows:

-What is the total manufacturing cost of Job 787 using normal costing?

A) $17,100

B) $14,960

C) $12,800

D) $15,500

E) $14,300

World Engines Ltd. manufactures custom engines for use in the lawn and garden equipment industry. The company allocates manufacturing overhead based on machine hours. Selected data for costs incurred for Job 787 are as follows:

-What is the total manufacturing cost of Job 787 using normal costing?

A) $17,100

B) $14,960

C) $12,800

D) $15,500

E) $14,300

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

13

Use the information below to answer the following question(s).

World Engines Ltd. manufactures custom engines for use in the lawn and garden equipment industry. The company allocates manufacturing overhead based on machine hours. Selected data for costs incurred for Job 787 are as follows:

-What is the total manufacturing cost of Job 787 using actual costing?

A) $17,100

B) $14,960

C) $12,800

D) $15,500

E) $14,300

World Engines Ltd. manufactures custom engines for use in the lawn and garden equipment industry. The company allocates manufacturing overhead based on machine hours. Selected data for costs incurred for Job 787 are as follows:

-What is the total manufacturing cost of Job 787 using actual costing?

A) $17,100

B) $14,960

C) $12,800

D) $15,500

E) $14,300

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

14

Last week Job WPP 298 was charged: DM of $4,606; DL of $1,579; and, MOH of $3,960 based on machine hours. The materials requisition record for this week showed an additional purchase of 10 brackets at a unit cost of $16; the direct labour costs were the same as the first week; and, the total machine hours for both weeks are now 140 hours at $45 per machine hour. Calculate the revised total job cost. (direct materials + direct labour + manufacturing overhead).

A) $10,145

B) $11,884

C) $12,645

D) $18,184

E) $14,224

A) $10,145

B) $11,884

C) $12,645

D) $18,184

E) $14,224

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

15

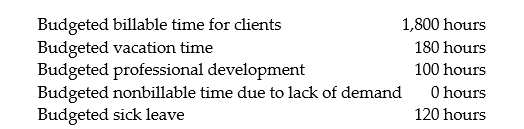

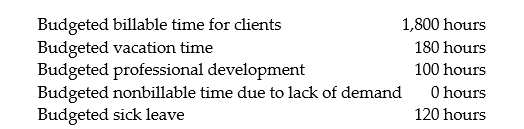

Beacon Company does residential real estate appraisals. There are 40 professionals on its staff. Each professional is allotted the following number of hours per year:

The company receives more jobs than it can handle and therefore rejects most out of town work. The budgeted salary for each professional is $44,000 per year with fringe benefits of $11,000.

During the previous year, the actual salaries were $46,500, plus fringe benefits of $11,500.

Required:

a. What was the total budgeted direct cost rate if the company believes that clients should be charged directly for its employees' salaries and benefits?

b. What was the budgeted direct cost rate if the company wants to charge clients for employee vacation, sick leave, and professional development as an indirect cost?

The company receives more jobs than it can handle and therefore rejects most out of town work. The budgeted salary for each professional is $44,000 per year with fringe benefits of $11,000.

During the previous year, the actual salaries were $46,500, plus fringe benefits of $11,500.

Required:

a. What was the total budgeted direct cost rate if the company believes that clients should be charged directly for its employees' salaries and benefits?

b. What was the budgeted direct cost rate if the company wants to charge clients for employee vacation, sick leave, and professional development as an indirect cost?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

16

Landscape Architects provides landscape consulting services to clients that range from small businesses to large corporations. The budgeted rate charged to customers for consulting per hour is $100. The budgeted overhead for customer-support costs per hour is $45 and the budgeted other direct-cost pool rate is $25 per hour. The budgeted hourly rates charged to jobs are $30 for the architect and $15 for the assistants.

Jobs 200 and 201 for Sheridan College incurred 90 and 240 hours-respectively. Each job included one licensed architect and two assistants. The architect worked 12 hours on Job 200 and 60 hours on Job 201.

Required:

a. Identify the cost objects.

b. Determine the costs of each job using budgeted overhead rates.

Jobs 200 and 201 for Sheridan College incurred 90 and 240 hours-respectively. Each job included one licensed architect and two assistants. The architect worked 12 hours on Job 200 and 60 hours on Job 201.

Required:

a. Identify the cost objects.

b. Determine the costs of each job using budgeted overhead rates.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

17

General Hospital uses a job-costing system for all patients. In March the Critical Care and Special Care facilities had cost allocation bases of 4,000 nursing days and 3,000 nursing days, respectively. The nursing care charges for each department for the month were $2,106,000 and $1,500,000, respectively. The General Care area had costs of $2,700,000 and 7,500 nursing days for the month.

Patient Jim Hansen spent 5 days in Critical Care, 4 days in Special Care and 21 days in General Care during March.

Required:

a. Determine the cost allocation rate for each department.

b. What are the total charges to Mr. Hansen if he was in the facility the entire month of March?

Patient Jim Hansen spent 5 days in Critical Care, 4 days in Special Care and 21 days in General Care during March.

Required:

a. Determine the cost allocation rate for each department.

b. What are the total charges to Mr. Hansen if he was in the facility the entire month of March?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

18

Sedgewick County Hospital uses a job-costing system for all patients. In June, the nursing care charges for each department and the cost allocation bases of nursing days are as follows:

Patient Ms. Graves spent six days in Critical Care and eight days in Special Care during June. The remainder of the 30-day month was spent in the General Care area.

Required:

a. Determine the budgeted overhead rate for each department.

b. What are the total charges to Ms. Graves if she was in the facility the entire month?

Patient Ms. Graves spent six days in Critical Care and eight days in Special Care during June. The remainder of the 30-day month was spent in the General Care area.

Required:

a. Determine the budgeted overhead rate for each department.

b. What are the total charges to Ms. Graves if she was in the facility the entire month?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

19

Cowley County Hospital uses a job-costing system for all patients who have surgery. In March, the Pre-Operating Room (PRE-OP) and Operating Room (OR) had budgeted allocation bases of 4,000 nursing hours and 2,000 nursing hours, respectively. The budgeted nursing overhead costs for each department for the month were $168,000 and $132,000, respectively. The hospital floor for surgery patients had budgeted overhead costs of $1,200,000 and 15,000 nursing hours for the month. For patient Fred Adams, actual hours incurred were eight and four hours, respectively, in the PRE-OP and OR rooms. He was in the hospital for 4 days (96 hours). Other costs related to Adams were:

The hospital uses a budgeted overhead rate for applying overhead to patient stays.

Required:

What is the total cost of the stay of patient Fred Adams?

The hospital uses a budgeted overhead rate for applying overhead to patient stays.

Required:

What is the total cost of the stay of patient Fred Adams?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

20

A local attorney employs ten full-time professionals. The budgeted compensation per employee is $75,000. The maximum billable hours for each client are 200. Clients always receive their full amount of time. All professional labour costs are included in a single direct cost category and are traced to jobs on a per-hour basis. Any other costs are included in a single indirect cost pool, allocated according to professional labour-hours. Budgeted indirect costs for the year are $1,000,000 and the firm had 20 clients.

Required:

a. What is the direct labour budgeted cost rate per hour?

b. What is the indirect cost pool budgeted cost rate per hour?

Required:

a. What is the direct labour budgeted cost rate per hour?

b. What is the indirect cost pool budgeted cost rate per hour?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

21

A local attorney employs ten full-time professionals. The budgeted compensation per employee is $80,000. The maximum billable hours for each client are 400. Clients always receive their full amount of time. All professional labour costs are included in a single direct cost category and are traced to jobs on a per-hour basis. Any other costs are included in a single indirect cost pool, allocated according to professional labour-hours. Budgeted indirect costs for the year are $400,000 and the firm had 20 clients.

Required:

a. What is the direct labour budgeted cost rate per hour?

b. What is the indirect cost pool budgeted cost rate per hour?

Required:

a. What is the direct labour budgeted cost rate per hour?

b. What is the indirect cost pool budgeted cost rate per hour?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

22

A local engineering firm is bidding on a design project for a new client. The total budgeted direct labour costs for the firm are $800,000. The total budgeted indirect costs are $1,200,000. It is estimated that there are 16,000 billable hours in total.

Required:

a. What is the budgeted direct labour cost rate?

b. What is the budgeted indirect cost allocation rate assuming direct labour cost is the cost allocation base?

c. What should be the engineering firm bid on the project if the direct labour hours are estimated at 500 hours?

Required:

a. What is the budgeted direct labour cost rate?

b. What is the budgeted indirect cost allocation rate assuming direct labour cost is the cost allocation base?

c. What should be the engineering firm bid on the project if the direct labour hours are estimated at 500 hours?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

23

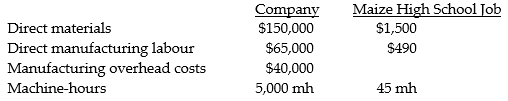

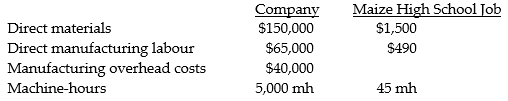

Fox Manufacturing is a small textile manufacturer using machine-hours for the single indirect cost allocation rate to allocate indirect manufacturing costs to the various jobs contracted during the year. The following estimates are provided for the coming year for the company and for the Maize High School Science Olympiad job.

Company Maize High School Job

Required:

a. For Fox Manufacturing, determine the annual manufacturing indirect cost allocation rate.

b. Determine the amount of manufacturing overhead costs allocated to the Maize High School job.

c. Determine the estimated total manufacturing costs for the Maize High School job.

Company Maize High School Job

Required:

a. For Fox Manufacturing, determine the annual manufacturing indirect cost allocation rate.

b. Determine the amount of manufacturing overhead costs allocated to the Maize High School job.

c. Determine the estimated total manufacturing costs for the Maize High School job.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

24

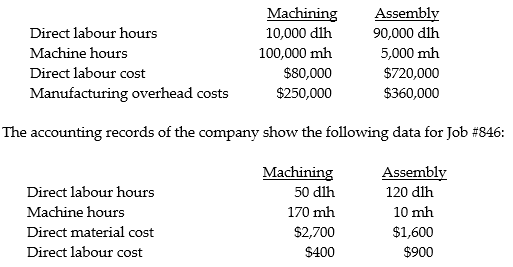

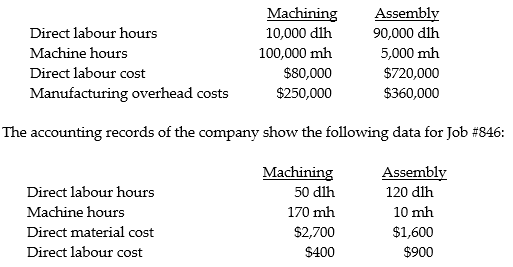

Hill Manufacturing uses departmental cost driver rates to apply manufacturing overhead costs to products. Manufacturing overhead costs are applied on the basis of machine hours in the Machining Department and on the basis of direct labour hours in the Assembly Department. The following estimates were provided at the beginning of the current year:

Required:

a. Compute the manufacturing indirect cost allocation rate for each department.

b. Compute the total cost of Job 846.

c. Provide possible reasons why Hill Manufacturing uses two different cost allocation rates.

Required:

a. Compute the manufacturing indirect cost allocation rate for each department.

b. Compute the total cost of Job 846.

c. Provide possible reasons why Hill Manufacturing uses two different cost allocation rates.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

25

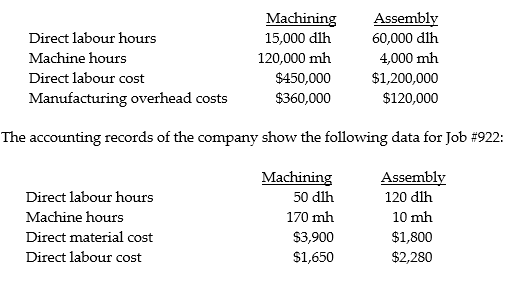

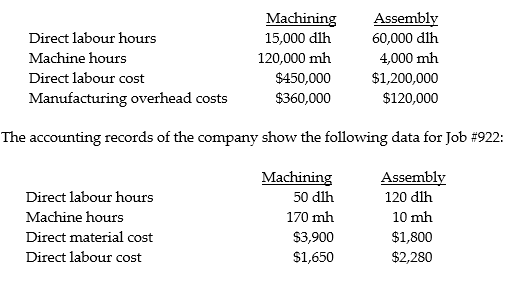

Valley Manufacturing uses departmental cost driver rates to apply manufacturing overhead costs to products. Manufacturing overhead costs are applied on the basis of machine hours in the Machining Department and on the basis of direct labour hours in the Assembly Department. The following estimates were provided at the beginning of the current year:

Required:

a. Compute the manufacturing indirect cost allocation rate for each department.

b. Compute the total cost of Job 922.

c. Provide possible reasons why Valley Manufacturing uses predetermined rather than actual indirect manufacturing cost overhead rates.

Required:

a. Compute the manufacturing indirect cost allocation rate for each department.

b. Compute the total cost of Job 922.

c. Provide possible reasons why Valley Manufacturing uses predetermined rather than actual indirect manufacturing cost overhead rates.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

26

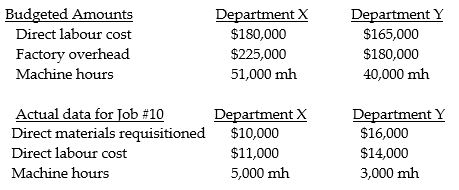

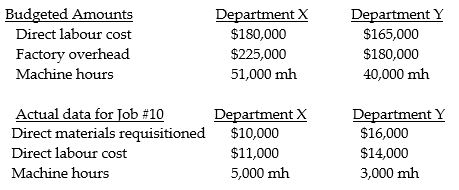

Jordan Company has two departments, X and Y. Overhead is applied based on budgeted direct labour cost in Department X, and budgeted machine hours in Department Y. The following additional information is available.

Required:

a. Compute the budgeted factory indirect cost allocation rate for Department X.

b. Compute the budgeted factory indirect cost allocation rate for Department Y.

c. What is the total overhead cost of Job 10?

d. If Job 10 consists of 50 units of product, what is the unit cost of this job?

Required:

a. Compute the budgeted factory indirect cost allocation rate for Department X.

b. Compute the budgeted factory indirect cost allocation rate for Department Y.

c. What is the total overhead cost of Job 10?

d. If Job 10 consists of 50 units of product, what is the unit cost of this job?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

27

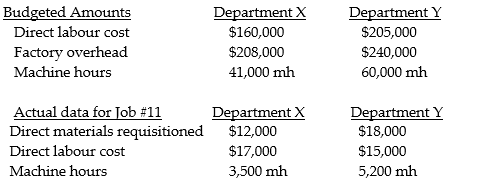

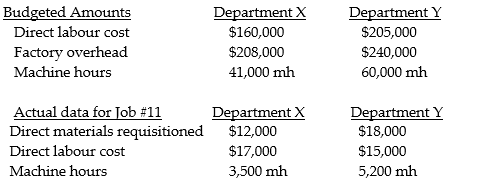

Sanders Company has two departments, X and Y. Overhead is applied based on budgeted direct labour cost in Department X, and budgeted machine hours in Department Y. The following additional information is available.

Required:

a. Compute the budgeted factory indirect cost allocation rate for Department X.

b. Compute the budgeted factory indirect cost allocation rate for Department Y.

c. What is the total overhead cost of Job 11?

d. If Job 11 consists of 40 units of product, what is the unit cost of this job?

Required:

a. Compute the budgeted factory indirect cost allocation rate for Department X.

b. Compute the budgeted factory indirect cost allocation rate for Department Y.

c. What is the total overhead cost of Job 11?

d. If Job 11 consists of 40 units of product, what is the unit cost of this job?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

28

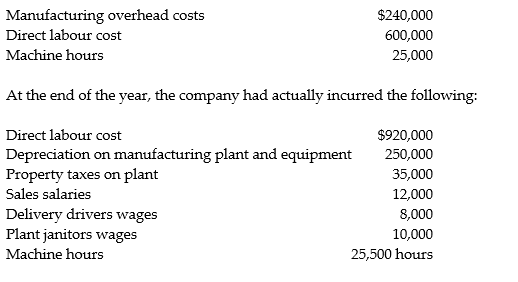

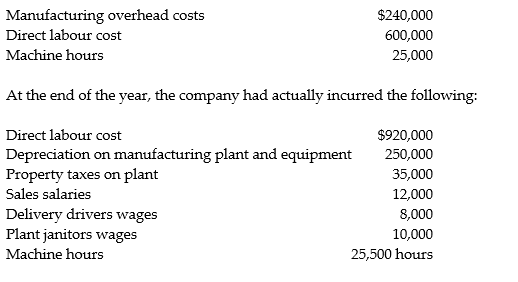

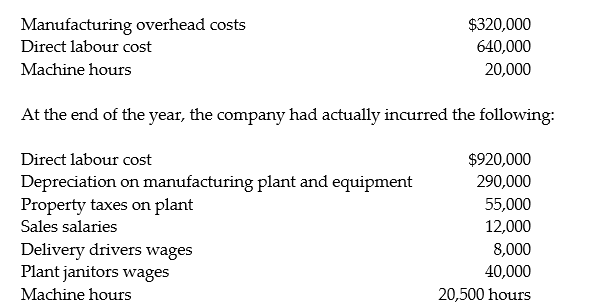

Sambell Manufacturing uses a predetermined manufacturing overhead rate to allocate

overhead to individual jobs. At the beginning of the year, the company expected to incur the following:

Required:

1. Compute Sambell's indirect cost allocation rate based on labour cost.

2. Compute Sambell's indirect cost allocation rate based on machine hours.

3. How much overhead was allocated during the year if the allocation base was direct labour cost?

4. How much manufacturing overhead was incurred during the year?

overhead to individual jobs. At the beginning of the year, the company expected to incur the following:

Required:

1. Compute Sambell's indirect cost allocation rate based on labour cost.

2. Compute Sambell's indirect cost allocation rate based on machine hours.

3. How much overhead was allocated during the year if the allocation base was direct labour cost?

4. How much manufacturing overhead was incurred during the year?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

29

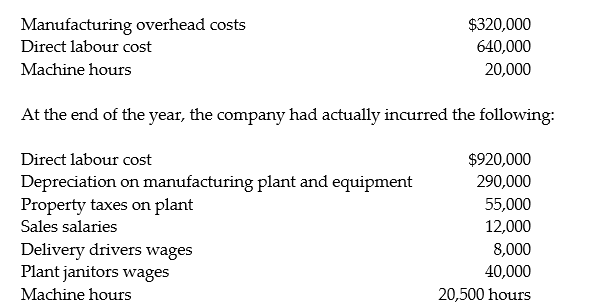

Northern Manufacturing uses a predetermined manufacturing overhead rate to allocate

overhead to individual jobs. At the beginning of the year, the company expected to incur the following:

Required:

1. Compute Northerns's indirect cost allocation rate based on labour cost.

2. Compute Northerns's indirect cost allocation rate based on machine hours.

3. How much overhead was allocated during the year if the allocation base was machine hours?

4. How much manufacturing overhead was incurred during the year?

overhead to individual jobs. At the beginning of the year, the company expected to incur the following:

Required:

1. Compute Northerns's indirect cost allocation rate based on labour cost.

2. Compute Northerns's indirect cost allocation rate based on machine hours.

3. How much overhead was allocated during the year if the allocation base was machine hours?

4. How much manufacturing overhead was incurred during the year?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

30

An accounting firm provides tax consulting for estates and trusts. Their job costing system has a single direct cost category (professional labour) and a single indirect cost pool (research support). The indirect cost pool contains all the costs except direct personnel costs. All budgeted indirect costs are allocated to individual jobs using actual professional labour hours.

Required:

a. Discuss the reasons a consulting firm might use normal costing in its job system rather than actual costing.

b. What might be some ways for the firm to change from a one pool allocation concept?

Required:

a. Discuss the reasons a consulting firm might use normal costing in its job system rather than actual costing.

b. What might be some ways for the firm to change from a one pool allocation concept?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

31

For each item below indicate the source documents that would most likely authorize the journal entry in a job-costing system.

-direct materials purchased

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

-direct materials purchased

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

32

For each item below indicate the source documents that would most likely authorize the journal entry in a job-costing system.

-direct materials used

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

-direct materials used

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

33

For each item below indicate the source documents that would most likely authorize the journal entry in a job-costing system.

-direct manufacturing labour

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

-direct manufacturing labour

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

34

For each item below indicate the source documents that would most likely authorize the journal entry in a job-costing system.

-indirect manufacturing labour

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

-indirect manufacturing labour

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

35

For each item below indicate the source documents that would most likely authorize the journal entry in a job-costing system.

-finished goods control

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

-finished goods control

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

36

For each item below indicate the source documents that would most likely authorize the journal entry in a job-costing system.

-cost of goods sold

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

-cost of goods sold

A) materials requisition record

B) job-cost record

C) sales invoice

D) labour time card

E) purchase invoice

F) labour time card.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

37

In normal costing the manufacturing overhead control and manufacturing overhead allocated accounts in the general ledger respectively, refer to

A) the record of actual overhead costs, and the record of overhead allocated to specific jobs using budgeted rates × actual base units.

B) the record of total budgeted overhead costs and the record of actual overhead allocated to date.

C) the record of actual overhead costs, and the record of overhead allocated to specific jobs using actual rates × budgeted base units.

D) the record of total budgeted overhead costs, and the record of overhead allocated to specific jobs using budgeted rates × actual base units.

E) the record of actual overhead costs, and the record of overhead allocated to specific jobs using budgeted rates × budgeted base units.

A) the record of actual overhead costs, and the record of overhead allocated to specific jobs using budgeted rates × actual base units.

B) the record of total budgeted overhead costs and the record of actual overhead allocated to date.

C) the record of actual overhead costs, and the record of overhead allocated to specific jobs using actual rates × budgeted base units.

D) the record of total budgeted overhead costs, and the record of overhead allocated to specific jobs using budgeted rates × actual base units.

E) the record of actual overhead costs, and the record of overhead allocated to specific jobs using budgeted rates × budgeted base units.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

38

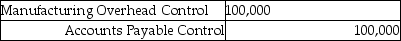

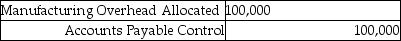

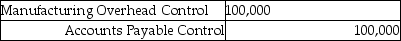

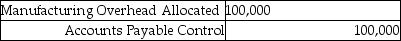

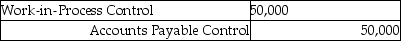

What is the appropriate journal entry if $100,000 of materials were purchased on account for the month of August?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

39

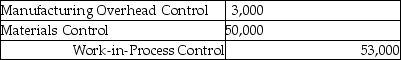

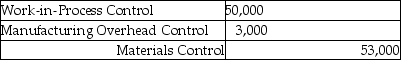

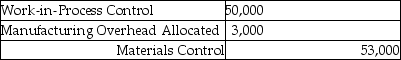

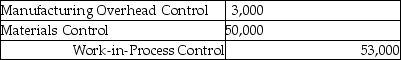

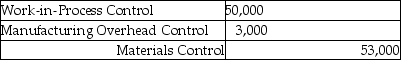

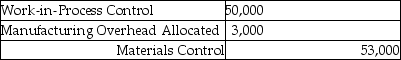

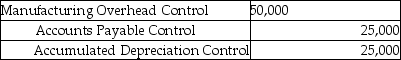

What is the appropriate journal entry if direct materials of $50,000 and indirect materials of $3,000 are sent to the manufacturing plant floor?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

40

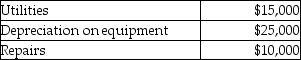

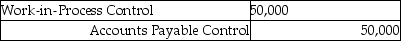

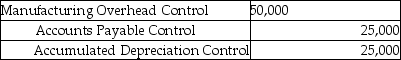

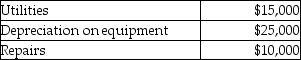

Manufacturing overhead costs incurred for the month are:

Which is the correct journal entry assuming utilities and repairs were on account?

A)

B)

C)

D)

E)

Which is the correct journal entry assuming utilities and repairs were on account?

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

41

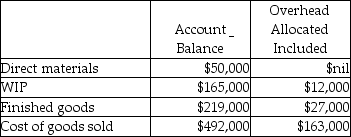

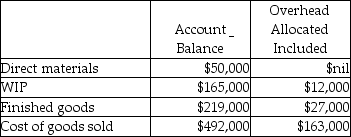

Use the information below to answer the following question(s).

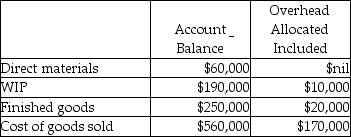

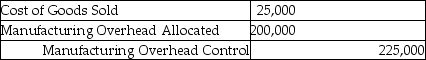

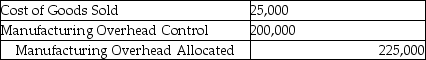

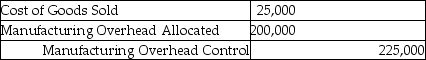

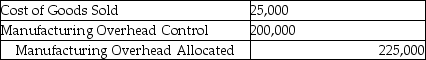

Because the Abernathy Company used a budgeted indirect cost allocation rate for its manufacturing operations, the amount allocated ($200,000) was different from the actual amount incurred ($225,000). These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.

Before disposition of under/overallocated overhead, the following information was available:

-What is the journal entry Abernathy Company should use to write-off the difference between allocated and actual overhead directly to cost of goods sold?

A)

B)

C)

D)

E)

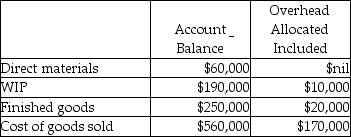

Because the Abernathy Company used a budgeted indirect cost allocation rate for its manufacturing operations, the amount allocated ($200,000) was different from the actual amount incurred ($225,000). These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.

Before disposition of under/overallocated overhead, the following information was available:

-What is the journal entry Abernathy Company should use to write-off the difference between allocated and actual overhead directly to cost of goods sold?

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

42

Use the information below to answer the following question(s).

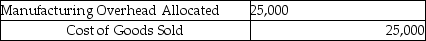

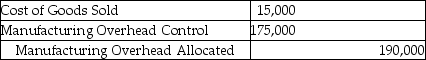

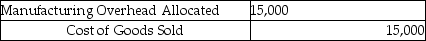

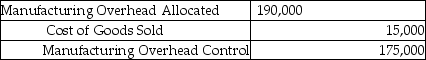

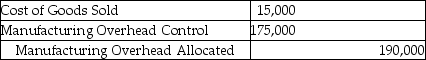

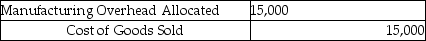

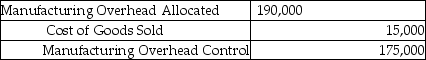

Because the Beckworth Company used a budgeted indirect cost allocation rate for its manufacturing operations, the amount allocated ($190,000) was different from the actual amount incurred ($175,000). These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.

Before disposition of under/overallocated overhead, the following information was available:

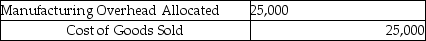

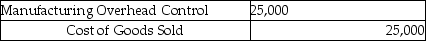

-What is the journal entry Beckworth Company should use to write-off the difference between allocated and actual overhead directly to cost of goods sold?

A)

B)

C)

D)

E)

Because the Beckworth Company used a budgeted indirect cost allocation rate for its manufacturing operations, the amount allocated ($190,000) was different from the actual amount incurred ($175,000). These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.

Before disposition of under/overallocated overhead, the following information was available:

-What is the journal entry Beckworth Company should use to write-off the difference between allocated and actual overhead directly to cost of goods sold?

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

43

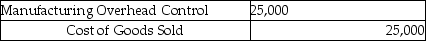

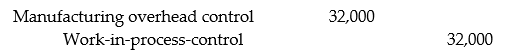

Correct the following journal entry, and explain your changes.

To record the cost of machinery repair labour.

To record the cost of machinery repair labour.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

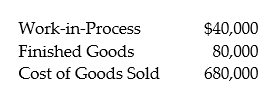

44

Moira Company has just finished its first year of operations and must decide which method to use for adjusting cost of goods sold. The company used a budgeted indirect-cost rate for its manufacturing operations. The amount that was allocated ($435,000) to cost of goods sold was different from the actual amount incurred ($425,000). These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.

Ending balances in the relevant accounts were:

Required:

a. Prepare a journal entry to write off the difference between allocated and actual overhead directly to Cost of Goods Sold. Be sure your journal entry closes the related overhead accounts.

b. Prepare a journal entry that prorates the write-off of the difference between allocated and actual overhead using ending account balances. Be sure your journal entry closes the related overhead

accounts.

Ending balances in the relevant accounts were:

Required:

a. Prepare a journal entry to write off the difference between allocated and actual overhead directly to Cost of Goods Sold. Be sure your journal entry closes the related overhead accounts.

b. Prepare a journal entry that prorates the write-off of the difference between allocated and actual overhead using ending account balances. Be sure your journal entry closes the related overhead

accounts.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

45

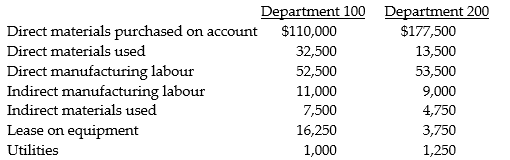

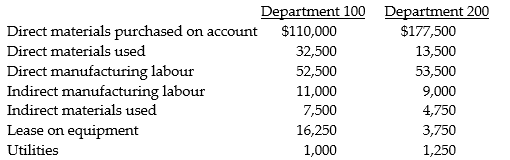

The Dougherty Furniture Company manufactures tables. In March, the two production departments had budgeted allocation bases of 4,000 machine hours in Department 100 and 8,000 direct manufacturing labour hours in Department 200. The budgeted manufacturing overheads for the month were $57,500 and $62,500, respectively. For Job A, the actual costs incurred in the two departments were as follows:

Job A incurred 800 machine hours in Department 100 and 300 manufacturing labour hours in Department 200. The company uses a budgeted indirect cost allocation rate for applying overhead to production.

Required:

a. Determine the budgeted manufacturing indirect cost allocation rate for each department.

b. Prepare the necessary journal entries to summarize the March transactions for Department 100.

c. What is the total cost of Job A?

Job A incurred 800 machine hours in Department 100 and 300 manufacturing labour hours in Department 200. The company uses a budgeted indirect cost allocation rate for applying overhead to production.

Required:

a. Determine the budgeted manufacturing indirect cost allocation rate for each department.

b. Prepare the necessary journal entries to summarize the March transactions for Department 100.

c. What is the total cost of Job A?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

46

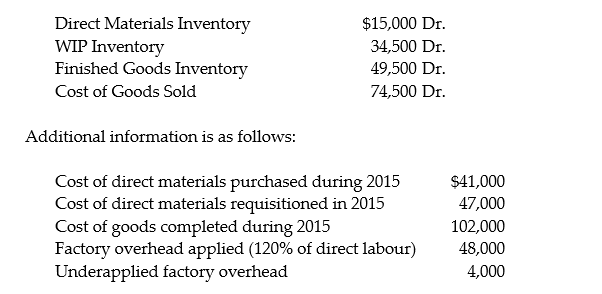

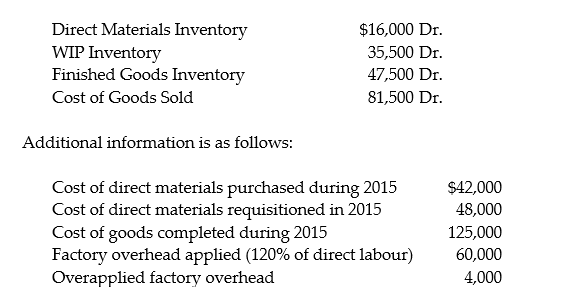

LeBlanc Company has the following balances as of the year ended December 31, 2015.

Required:

a. Compute beginning direct materials inventory.

b. Compute beginning WIP inventory.

c. Compute beginning finished goods inventory.

d. Compute actual factory overhead incurred.

Required:

a. Compute beginning direct materials inventory.

b. Compute beginning WIP inventory.

c. Compute beginning finished goods inventory.

d. Compute actual factory overhead incurred.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

47

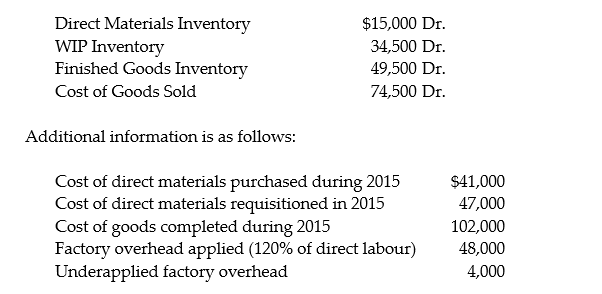

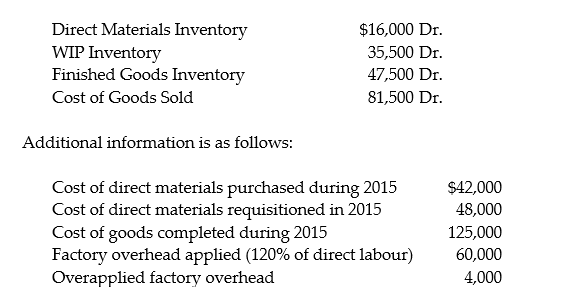

LaFleur Company has the following balances as of the year ended December 31, 2015.

Required:

a. Compute beginning direct materials inventory.

b. Compute beginning WIP inventory.

c. Compute beginning finished goods inventory.

d. Compute actual factory overhead incurred.

Required:

a. Compute beginning direct materials inventory.

b. Compute beginning WIP inventory.

c. Compute beginning finished goods inventory.

d. Compute actual factory overhead incurred.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

48

JamJee Enterprises uses a job costing system. Record the following transactions in JamJee Enterprise's general journal for the current month:

a. Purchased raw materials on account, $49,000.

b. Requisitioned $25,200 of direct materials and $3,400 of indirect materials for use in production.

c. Factory payroll incurred, $54,000; 70% direct labour, 30% indirect labour.

d. Recorded depreciation expense factory equipment $9,200, and other manufacturing overhead of $26,870 (credit accounts payable).

e. Allocated manufacturing overhead costs based on 120% of direct labour cost.

f. Cost of completed production for the current month, $95,800.

g. Cost of finished goods sold, $79,000; selling price, $115,000 (all sales on account).

a. Purchased raw materials on account, $49,000.

b. Requisitioned $25,200 of direct materials and $3,400 of indirect materials for use in production.

c. Factory payroll incurred, $54,000; 70% direct labour, 30% indirect labour.

d. Recorded depreciation expense factory equipment $9,200, and other manufacturing overhead of $26,870 (credit accounts payable).

e. Allocated manufacturing overhead costs based on 120% of direct labour cost.

f. Cost of completed production for the current month, $95,800.

g. Cost of finished goods sold, $79,000; selling price, $115,000 (all sales on account).

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

49

Indell Corporation uses a job costing system. Record the following transactions in Indell Corporation's general journal for the current month:

a. Purchased raw materials on account, $24,000.

b. Requisitioned $36,900 of direct materials and $7,200 of indirect materials for use in production.

c. Factory payroll incurred, $68,000; 70% direct labour, 30% indirect labour.

d. Recorded depreciation expense factory equipment $11,500, and other manufacturing overhead of $31,570 (credit accounts payable).

e. Allocated manufacturing overhead costs based on 120% of direct labour cost.

f. Cost of completed production for the current month, $103,000.

g. Cost of finished goods sold, $81,000; selling price, $125,000 (all sales on account).

a. Purchased raw materials on account, $24,000.

b. Requisitioned $36,900 of direct materials and $7,200 of indirect materials for use in production.

c. Factory payroll incurred, $68,000; 70% direct labour, 30% indirect labour.

d. Recorded depreciation expense factory equipment $11,500, and other manufacturing overhead of $31,570 (credit accounts payable).

e. Allocated manufacturing overhead costs based on 120% of direct labour cost.

f. Cost of completed production for the current month, $103,000.

g. Cost of finished goods sold, $81,000; selling price, $125,000 (all sales on account).

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck