Deck 17: International Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/177

Play

Full screen (f)

Deck 17: International Finance

1

An exchange rate is:

A) determined by the United Nations.

B) the number of units of gold backing a nation's money.

C) the number of units of a nation's output that is equal to one unit of another nation's output.

D) the number of units of a nation's money that is equal to one unit of another nation's money.

A) determined by the United Nations.

B) the number of units of gold backing a nation's money.

C) the number of units of a nation's output that is equal to one unit of another nation's output.

D) the number of units of a nation's money that is equal to one unit of another nation's money.

the number of units of a nation's money that is equal to one unit of another nation's money.

2

The exchange rate for the U.S. dollar:

A) is the number of dollars required to purchase one ounce of gold.

B) shows the amount of another nation's currency that is equal to one dollar.

C) is the service fee charged by banks to convert dollars into another nation's currency.

D) none of the above.

A) is the number of dollars required to purchase one ounce of gold.

B) shows the amount of another nation's currency that is equal to one dollar.

C) is the service fee charged by banks to convert dollars into another nation's currency.

D) none of the above.

shows the amount of another nation's currency that is equal to one dollar.

3

At an exchange rate of 5 South African rand = $1.00, a shirt priced at 120 rand in Cape Town would cost:

A) $24.

B) $60.

C) $240.

D) $600.

A) $24.

B) $60.

C) $240.

D) $600.

$24.

4

At an exchange rate of 1 British pound = $1.80, a raincoat priced at 150 pounds in London would cost:

A) $83.33.

B) $120.00.

C) $180.00.

D) $270.00.

A) $83.33.

B) $120.00.

C) $180.00.

D) $270.00.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

5

At an exchange rate of 5 Mexican pesos = $1.00, a shirt priced at $48 in New York would cost:

A) 9.6 pesos.

B) 43.0 pesos.

C) 96.0 pesos.

D) 240.0 pesos.

A) 9.6 pesos.

B) 43.0 pesos.

C) 96.0 pesos.

D) 240.0 pesos.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

6

At an exchange rate of 1 British pound = $2.00, tickets to a sporting event priced at $140.00 in Houston would cost a British tourist:

A) 35 pounds.

B) 70 pounds.

C) 140 pounds.

D) 280 pounds.

A) 35 pounds.

B) 70 pounds.

C) 140 pounds.

D) 280 pounds.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

7

If one Japanese yen is worth $0.008, one dollar is worth:

A) 1.25 yen.

B) 125.0 yen.

C) 800.0 yen.

D) 0.008 yen.

A) 1.25 yen.

B) 125.0 yen.

C) 800.0 yen.

D) 0.008 yen.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

8

If one British pound is worth $1.60, one dollar is worth:

A) 1.60 pounds.

B) 6.25 pounds.

C) 0.016 pounds.

D) 0.625 pounds.

A) 1.60 pounds.

B) 6.25 pounds.

C) 0.016 pounds.

D) 0.625 pounds.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

9

At an exchange rate of 120 yen = $1.00, 600 yen would convert to:

A) $5.00.

B) $9.80.

C) $50.00.

D) $98.00.

A) $5.00.

B) $9.80.

C) $50.00.

D) $98.00.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

10

At an exchange rate of 1 Hong Kong dollar = $0.20, $60 would convert to:

A) 12 Hong Kong dollars.

B) 150 Hong Kong dollars.

C) 300 Hong Kong dollars.

D) 600 Hong Kong dollars.

A) 12 Hong Kong dollars.

B) 150 Hong Kong dollars.

C) 300 Hong Kong dollars.

D) 600 Hong Kong dollars.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

11

If a British car priced at 30,000 pounds can be purchased for $50,000, then the exchange rate between the pound and the dollar is:

A) $1.00 = 0.30 pounds.

B) $1.00 = 0.60 pounds.

C) $1.00 = 1.20 pounds.

D) $1.00 = 1.67 pounds.

A) $1.00 = 0.30 pounds.

B) $1.00 = 0.60 pounds.

C) $1.00 = 1.20 pounds.

D) $1.00 = 1.67 pounds.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

12

If a bottle of Australian wine priced at 60 Australian dollars can be purchased for $24, then the exchange rate between the U.S. dollar and the Australian dollar is:

A) $1.00 = 0.25 Australian dollars.

B) $1.00 = 0.40 Australian dollars.

C) $1.00 = 2.50 Australian dollars.

D) $1.00 = 4.00 Australian dollars.

A) $1.00 = 0.25 Australian dollars.

B) $1.00 = 0.40 Australian dollars.

C) $1.00 = 2.50 Australian dollars.

D) $1.00 = 4.00 Australian dollars.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

13

An automobile wholesales for 2,000,000 yen in Tokyo to an American car dealer. What is its price in dollars if the exchange rate is 125 yen = $1.00?

A) $15,600.

B) $16,000.

C) $20,500.

D) $25,000.

A) $15,600.

B) $16,000.

C) $20,500.

D) $25,000.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

14

An automobile sells for 2,000,000 yen in Tokyo. What is its price in dollars if the exchange rate is $0.008 = 1.00 yen?

A) $15,600.

B) $16,000.

C) $20,500.

D) $25,000.

A) $15,600.

B) $16,000.

C) $20,500.

D) $25,000.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements is FALSE?

A) Today most economies are on a system of floating, or flexible, exchange rates.

B) Prior to late 1971, exchange rates between the dollar and many other nations' monies were based primarily on gold.

C) When the values of different nations' monies are based on gold, the exchange rates between those monies fluctuate little, if at all.

D) With a flexible exchange rate, the rate is set weekly and holds for a full seven days.

A) Today most economies are on a system of floating, or flexible, exchange rates.

B) Prior to late 1971, exchange rates between the dollar and many other nations' monies were based primarily on gold.

C) When the values of different nations' monies are based on gold, the exchange rates between those monies fluctuate little, if at all.

D) With a flexible exchange rate, the rate is set weekly and holds for a full seven days.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

16

Fixed exchange rates are exchange rates between nations' monies:

A) that are adjusted for differences in inflation rates.

B) that are determined by the forces of supply and demand.

C) where the values of the monies are defined in terms of gold.

D) that are set at a fixed percentage of an index of inflation rates in key countries.

A) that are adjusted for differences in inflation rates.

B) that are determined by the forces of supply and demand.

C) where the values of the monies are defined in terms of gold.

D) that are set at a fixed percentage of an index of inflation rates in key countries.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

17

Exchange rates that change when a nation redefines the value of its currency in terms of gold are called:

A) fixed exchange rates.

B) flexible exchange rates.

C) floating exchange rates.

D) convertible exchange rates.

A) fixed exchange rates.

B) flexible exchange rates.

C) floating exchange rates.

D) convertible exchange rates.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

18

Reducing the amount of gold backing a nation's monetary unit is called:

A) deflation.

B) devaluation.

C) depreciation.

D) deregulation.

A) deflation.

B) devaluation.

C) depreciation.

D) deregulation.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

19

Devaluation in a fixed exchange rate system occurs when:

A) the GDP deflator falls.

B) the impact of inflation is reduced through monetary policy.

C) the amount of gold backing a nation's monetary unit is reduced.

D) the amount of a nation's money available for foreign trade decreases.

A) the GDP deflator falls.

B) the impact of inflation is reduced through monetary policy.

C) the amount of gold backing a nation's monetary unit is reduced.

D) the amount of a nation's money available for foreign trade decreases.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

20

If a dollar's value were set at 1/30 of an ounce of gold, and if a Danish kroner's value were set at 1/45 of an ounce of gold:

A) a good priced at $60 would cost 40 kroner.

B) the dollar and the kroner would be on a fixed exchange rate system.

C) an ounce of gold costs $75 on the world market.

D) all of the above.

A) a good priced at $60 would cost 40 kroner.

B) the dollar and the kroner would be on a fixed exchange rate system.

C) an ounce of gold costs $75 on the world market.

D) all of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

21

If a dollar's value were set at 1/30 of an ounce of gold and an English pound's value were set at 1/20 of an ounce of gold:

A) a good priced at $50 would cost 75 pounds.

B) England's money would be devalued compared to U.S. money.

C) people would give up more than one dollar to get one pound.

D) the U.S. and England would be on a flexible exchange rate system since the values of their monies in gold are not equal.

A) a good priced at $50 would cost 75 pounds.

B) England's money would be devalued compared to U.S. money.

C) people would give up more than one dollar to get one pound.

D) the U.S. and England would be on a flexible exchange rate system since the values of their monies in gold are not equal.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose all nations' monies were backed by gold and Country A devalued its money. This would make Country A's money worth:

A) less in other countries, and other countries' monies worth less in Country A.

B) more in other countries, and other countries' monies worth less in Country A.

C) less in other countries, and other countries' monies worth more in Country A.

D) more in other countries, and other countries' monies worth more in Country A.

A) less in other countries, and other countries' monies worth less in Country A.

B) more in other countries, and other countries' monies worth less in Country A.

C) less in other countries, and other countries' monies worth more in Country A.

D) more in other countries, and other countries' monies worth more in Country A.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

23

If Country B were to devalue its money, which is backed by gold, the prices of foreign goods for buyers in Country B would:

A) increase, and the prices of Country B's goods for foreign buyers would increase.

B) increase, and the prices of Country B's goods for foreign buyers would decrease.

C) decrease, and the prices of Country B's goods for foreign buyers would increase.

D) decrease, and the prices of Country B's goods for foreign buyers would decrease.

A) increase, and the prices of Country B's goods for foreign buyers would increase.

B) increase, and the prices of Country B's goods for foreign buyers would decrease.

C) decrease, and the prices of Country B's goods for foreign buyers would increase.

D) decrease, and the prices of Country B's goods for foreign buyers would decrease.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

24

There is a devaluation of Country A's money relative to Country B's money when the amount of gold backing one unit of Country A's money goes from:

A) 1/50 of an ounce to 1/40 of an ounce, and the amount of gold backing one unit of Country B's money remains unchanged.

B) 1/50 of an ounce to 1/60 of an ounce, and the amount of gold backing one unit of Country B's money remains unchanged.

C) 1/50 of an ounce to 1/25 of an ounce, and the amount of gold backing one unit of Country B's money goes from 1/30 of an ounce to 1/60 of an ounce.

D) none of the above.

A) 1/50 of an ounce to 1/40 of an ounce, and the amount of gold backing one unit of Country B's money remains unchanged.

B) 1/50 of an ounce to 1/60 of an ounce, and the amount of gold backing one unit of Country B's money remains unchanged.

C) 1/50 of an ounce to 1/25 of an ounce, and the amount of gold backing one unit of Country B's money goes from 1/30 of an ounce to 1/60 of an ounce.

D) none of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

25

Exchange rates that are set through the forces of supply and demand are called:

A) fixed exchange rates.

B) flexible exchange rates.

C) variable exchange rates.

D) convertible exchange rates.

A) fixed exchange rates.

B) flexible exchange rates.

C) variable exchange rates.

D) convertible exchange rates.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

26

If the rate at which one nation's money exchanges for one unit of another nation's money is determined by the forces of supply and demand, the two nations are on a:

A) fixed exchange rate system.

B) relative exchange rate system.

C) flexible, or floating, exchange rate system.

D) world-average-of-countries exchange rate system.

A) fixed exchange rate system.

B) relative exchange rate system.

C) flexible, or floating, exchange rate system.

D) world-average-of-countries exchange rate system.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

27

With a system of flexible, or floating, exchange rates, the rates at which nations' monies exchange are determined by:

A) changes in the value of gold.

B) the forces of demand and supply.

C) rules set by the International Monetary Fund.

D) agreements among governments of the largest trading nations.

A) changes in the value of gold.

B) the forces of demand and supply.

C) rules set by the International Monetary Fund.

D) agreements among governments of the largest trading nations.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

28

The demand curve for foreign currency by those with U.S. dollars slopes:

A) upward, indicating less foreign currency is demanded as its price in U.S. dollars increases.

B) upward, indicating less foreign currency is demanded as its price in U.S. dollars decreases.

C) downward, indicating less foreign currency is demanded as its price in U.S. dollars increases.

D) downward, indicating less foreign currency is demanded as its price in U.S. dollars decreases.

A) upward, indicating less foreign currency is demanded as its price in U.S. dollars increases.

B) upward, indicating less foreign currency is demanded as its price in U.S. dollars decreases.

C) downward, indicating less foreign currency is demanded as its price in U.S. dollars increases.

D) downward, indicating less foreign currency is demanded as its price in U.S. dollars decreases.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

29

If you were graphing a demand curve for Jordanian dinars by persons holding U.S. dollars, you would use the vertical axis of the graph to measure:

A) the price of U.S. dollars in gold.

B) the price in U.S. dollars per dinar.

C) the quantity of Jordanian dinars that can be obtained for one dollar.

D) none of the above.

A) the price of U.S. dollars in gold.

B) the price in U.S. dollars per dinar.

C) the quantity of Jordanian dinars that can be obtained for one dollar.

D) none of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

30

As the price that must be paid in U.S. dollars for British pounds increases, the:

A) demand for pounds by holders of U.S. dollars increases.

B) demand for pounds by holders of U.S. dollars decreases.

C) quantity of pounds demanded by holders of U.S. dollars increases.

D) quantity of pounds demanded by holders of U.S. dollars decreases.

A) demand for pounds by holders of U.S. dollars increases.

B) demand for pounds by holders of U.S. dollars decreases.

C) quantity of pounds demanded by holders of U.S. dollars increases.

D) quantity of pounds demanded by holders of U.S. dollars decreases.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

31

As the dollar price of Chinese Yuan goes down, the quantity of Yuan demanded by persons in the United States holding U.S. dollars:

A) decreases because more dollars are needed to acquire Chinese Yuan.

B) decreases because the prices of Chinese goods and investment opportunities go up for U.S. buyers.

C) remains unchanged because the U.S. demand for Yuan depends on factors other than the price of Yuan.

D) increases because more Chinese goods and investment opportunities can be purchased with the same amount of U.S. dollars.

A) decreases because more dollars are needed to acquire Chinese Yuan.

B) decreases because the prices of Chinese goods and investment opportunities go up for U.S. buyers.

C) remains unchanged because the U.S. demand for Yuan depends on factors other than the price of Yuan.

D) increases because more Chinese goods and investment opportunities can be purchased with the same amount of U.S. dollars.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

32

As the dollar price of Japanese yen falls, the dollar prices of Japanese goods also fall for U.S. buyers. For persons in the United States, this leads to:

A) a decrease in the demand for Japanese yen.

B) an increase in the demand for Japanese yen.

C) a decrease in the quantity of Japanese yen demanded.

D) an increase in the quantity of Japanese yen demanded.

A) a decrease in the demand for Japanese yen.

B) an increase in the demand for Japanese yen.

C) a decrease in the quantity of Japanese yen demanded.

D) an increase in the quantity of Japanese yen demanded.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

33

An increase in the price of the dollar compared to a foreign currency would:

A) have no impact on the quantity of dollars supplied.

B) reduce the quantity of dollars demanded.

C) increase the quantity of dollars demanded.

D) have no impact on the quantity of dollars demanded.

A) have no impact on the quantity of dollars supplied.

B) reduce the quantity of dollars demanded.

C) increase the quantity of dollars demanded.

D) have no impact on the quantity of dollars demanded.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

34

A decrease in the value of the dollar compared to a foreign currency would:

A) reduce the dollar prices of foreign goods and investment opportunities.

B) increase the dollar prices of foreign goods and investment opportunities.

C) have no impact on the dollar prices of foreign goods and investment opportunities.

D) none of the above.

A) reduce the dollar prices of foreign goods and investment opportunities.

B) increase the dollar prices of foreign goods and investment opportunities.

C) have no impact on the dollar prices of foreign goods and investment opportunities.

D) none of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

35

A decrease in the U.S. dollar price of Turkish liras causes:

A) Turkish goods and services to become cheaper in the United States.

B) a shift in the demand curve for Turkish liras by persons holding dollars.

C) a decrease in the quantity of Turkish liras demanded by persons holding dollars.

D) none of the above.

A) Turkish goods and services to become cheaper in the United States.

B) a shift in the demand curve for Turkish liras by persons holding dollars.

C) a decrease in the quantity of Turkish liras demanded by persons holding dollars.

D) none of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

36

As the number of British pounds that a certain amount of U.S. dollars will buy increases, the prices of British goods to holders of U.S. dollars:

A) decrease.

B) increase slightly.

C) remain the same.

D) increase significantly.

A) decrease.

B) increase slightly.

C) remain the same.

D) increase significantly.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

37

As the number of Japanese yen that a certain amount of U.S. dollars will buy decreases, the prices of Japanese goods to holders of U.S. dollars:

A) increase.

B) remain the same.

C) decrease slightly.

D) increase significantly.

A) increase.

B) remain the same.

C) decrease slightly.

D) increase significantly.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

38

Suppose the exchange rate between the U.S. dollar and the British pound was $1.50 = 1 pound. If the exchange rate went to $2.00 = 1 pound, the price to U.S. importers of a 12,000 pound British automobile would increase by:

A) $3,000.

B) $4,000.

C) $6,000.

D) none of the above.

A) $3,000.

B) $4,000.

C) $6,000.

D) none of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

39

If the exchange rate between the U.S. dollar and the Mexican peso went from $1.00 = 15 pesos to $1.00 = 10 pesos, the price of a 300 peso hat would:

A) decrease by $5.00.

B) increase by $10.00.

C) decrease by $15.00.

D) increase by $20.00.

A) decrease by $5.00.

B) increase by $10.00.

C) decrease by $15.00.

D) increase by $20.00.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

40

The supply curve of a foreign currency by those wishing to acquire U.S. dollars slopes:

A) upward, indicating more of the foreign currency is supplied as its price in U.S. dollars increases.

B) upward, indicating more of the foreign currency is supplied as its price in U.S. dollars decreases.

C) downward, indicating more of the foreign currency is supplied as its price in U.S. dollars increases.

D) downward, indicating more of the foreign currency is supplied as its price in U.S. dollars decreases.

A) upward, indicating more of the foreign currency is supplied as its price in U.S. dollars increases.

B) upward, indicating more of the foreign currency is supplied as its price in U.S. dollars decreases.

C) downward, indicating more of the foreign currency is supplied as its price in U.S. dollars increases.

D) downward, indicating more of the foreign currency is supplied as its price in U.S. dollars decreases.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

41

An increase in the dollar price of Japanese yen will cause:

A) the supply curve of yen to shift to the left.

B) the U.S. demand curve for yen to shift to the right.

C) a movement upward along the supply curve of yen.

D) a movement downward along the U.S. demand curve for yen.

A) the supply curve of yen to shift to the left.

B) the U.S. demand curve for yen to shift to the right.

C) a movement upward along the supply curve of yen.

D) a movement downward along the U.S. demand curve for yen.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

42

As the dollar price of British pounds goes up, the pound becomes more valuable in terms of the U.S. goods it can purchase. This leads to:

A) a decrease in the supply of pounds to persons in the United States.

B) an increase in the supply of pounds to persons in the United States.

C) a decrease in the quantity of pounds supplied to persons in the United States.

D) an increase in the quantity of pounds supplied to persons in the United States.

A) a decrease in the supply of pounds to persons in the United States.

B) an increase in the supply of pounds to persons in the United States.

C) a decrease in the quantity of pounds supplied to persons in the United States.

D) an increase in the quantity of pounds supplied to persons in the United States.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

43

The supply curve of U.S. dollars slopes upward because as the price of the dollar increases relative to other currencies, people holding:

A) foreign currency will want to convert to dollars to purchase U.S. goods.

B) dollars will want to convert to foreign currencies to purchase U.S. goods.

C) foreign currency will want to convert to dollars to purchase foreign goods.

D) dollars will want to convert to foreign currencies to purchase foreign goods.

A) foreign currency will want to convert to dollars to purchase U.S. goods.

B) dollars will want to convert to foreign currencies to purchase U.S. goods.

C) foreign currency will want to convert to dollars to purchase foreign goods.

D) dollars will want to convert to foreign currencies to purchase foreign goods.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

44

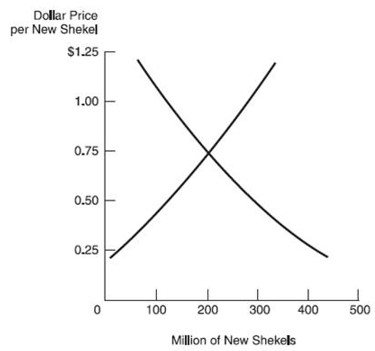

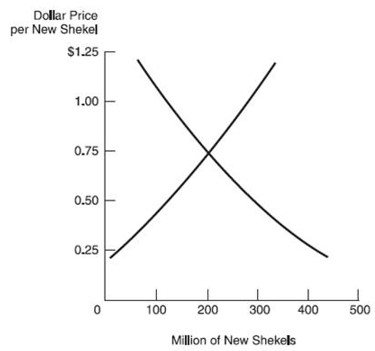

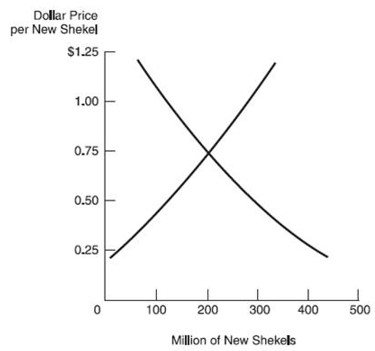

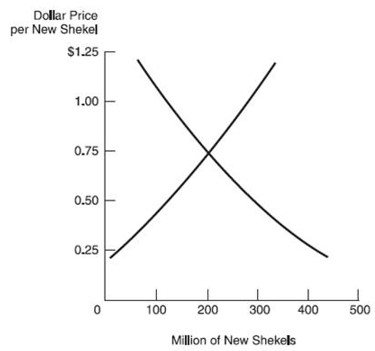

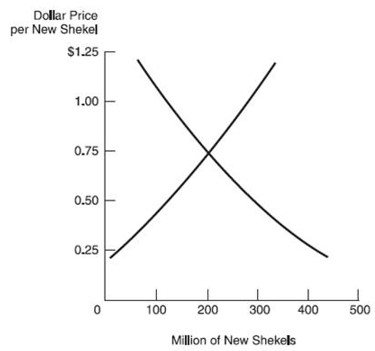

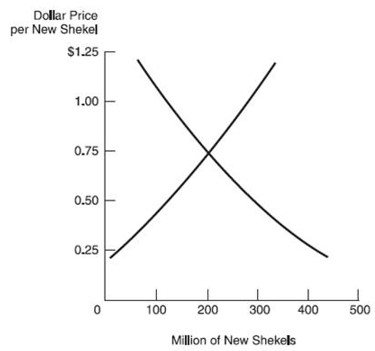

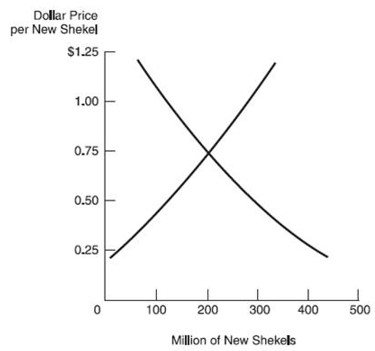

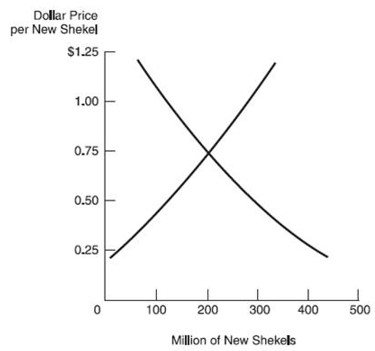

Use the following figure showing the supply of, and demand for, Israeli new shekels by holders of U.S. dollars.

-This figure applies to a:

A) fixed exchange rate system between the dollar and the new shekel.

B) flexible exchange rate system between the dollar and the new shekel.

C) gold-based exchange rate system between the dollar and the new shekel.

D) none of the above.

-This figure applies to a:

A) fixed exchange rate system between the dollar and the new shekel.

B) flexible exchange rate system between the dollar and the new shekel.

C) gold-based exchange rate system between the dollar and the new shekel.

D) none of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

45

Use the following figure showing the supply of, and demand for, Israeli new shekels by holders of U.S. dollars.

-The exchange rate that emerges in this market is:

A) $0.75 = 1.00 new shekel.

B) $0.75 = 1.33 new shekels.

C) $1.00 = 0.75 new shekels.

D) $1.00 = 1.25 new shekels.

-The exchange rate that emerges in this market is:

A) $0.75 = 1.00 new shekel.

B) $0.75 = 1.33 new shekels.

C) $1.00 = 0.75 new shekels.

D) $1.00 = 1.25 new shekels.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

46

Use the following figure showing the supply of, and demand for, Israeli new shekels by holders of U.S. dollars.

-If the dollar price per new shekel were $0.50, there would be a:

A) surplus of new shekels on the market and the dollar price per new shekel would fall.

B) surplus of new shekels on the market and the dollar price per new shekel would rise.

C) shortage of new shekels on the market and the dollar price per new shekel would fall.

D) shortage of new shekels on the market and the dollar price per new shekel would rise.

-If the dollar price per new shekel were $0.50, there would be a:

A) surplus of new shekels on the market and the dollar price per new shekel would fall.

B) surplus of new shekels on the market and the dollar price per new shekel would rise.

C) shortage of new shekels on the market and the dollar price per new shekel would fall.

D) shortage of new shekels on the market and the dollar price per new shekel would rise.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

47

Use the following figure showing the supply of, and demand for, Israeli new shekels by holders of U.S. dollars.

-At this exchange rate, a good costing $24 could be purchased for:

A) 16 new shekels.

B) 18 new shekels.

C) 32 new shekels.

D) 42 new shekels.

-At this exchange rate, a good costing $24 could be purchased for:

A) 16 new shekels.

B) 18 new shekels.

C) 32 new shekels.

D) 42 new shekels.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

48

A decrease in the price of the U.S. dollar relative to foreign currencies will result in all of the following EXCEPT:

A) An increase in U.S. imports.

B) An increase in U.S. exports.

C) An increase in foreign tourism in the U.S.

D) An increase in foreign investment in the U.S.

A) An increase in U.S. imports.

B) An increase in U.S. exports.

C) An increase in foreign tourism in the U.S.

D) An increase in foreign investment in the U.S.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

49

An increase in the price of the U.S. dollar relative to foreign currencies would be expected to increase:

A) U.S. imports.

B) U.S. exports.

C) U.S. employment.

D) all of the above.

A) U.S. imports.

B) U.S. exports.

C) U.S. employment.

D) all of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

50

Under a system of flexible exchange rates, the values of two nations' monies are determined:

A) in a gold market.

B) in a foreign exchange market.

C) using United Nations guidelines for international agreements.

D) on the basis of intergovernmental agreements between the two nations.

A) in a gold market.

B) in a foreign exchange market.

C) using United Nations guidelines for international agreements.

D) on the basis of intergovernmental agreements between the two nations.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

51

The Swiss franc and the U.S. dollar, the Swiss franc and the British pound, and the Japanese yen and the Polish zloty are traded:

A) in the gold market.

B) in the same foreign exchange market.

C) in three different foreign exchange markets.

D) using United Nations guidelines for international agreements.

A) in the gold market.

B) in the same foreign exchange market.

C) in three different foreign exchange markets.

D) using United Nations guidelines for international agreements.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

52

According to Application 17.1, "Foreign Exchange Markets,"which of the following statements is true?

A) Overall, the markets for foreign currencies are the largest markets in the world.

B) The United States, the United Kingdom, and Japan are among the main foreign exchange trading centers.

C) Banks, other financial institutions, and brokers are the main participants in foreign exchange markets.

D) All of the above are true.

A) Overall, the markets for foreign currencies are the largest markets in the world.

B) The United States, the United Kingdom, and Japan are among the main foreign exchange trading centers.

C) Banks, other financial institutions, and brokers are the main participants in foreign exchange markets.

D) All of the above are true.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

53

With a system of floating, or flexible, exchange rates, a decrease in the U.S. demand for Mexican pesos with no change in supply will shift the U.S. demand curve for pesos to the:

A) left, and cause a decrease in the equilibrium dollar price of pesos.

B) left, and cause an increase in the equilibrium dollar price of pesos.

C) right, and cause a decrease in the equilibrium dollar price of pesos.

D) right, and cause an increase in the equilibrium dollar price of pesos.

A) left, and cause a decrease in the equilibrium dollar price of pesos.

B) left, and cause an increase in the equilibrium dollar price of pesos.

C) right, and cause a decrease in the equilibrium dollar price of pesos.

D) right, and cause an increase in the equilibrium dollar price of pesos.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

54

If the demand for Swiss francs by those holding U.S. dollars decreases, the dollar price of francs:

A) and the amount of francs exchanged for dollars will both increase.

B) and the amount of francs exchanged for dollars will both decrease.

C) will increase but the amount of francs exchanged for dollars will decrease.

D) will decrease but the amount of francs exchanged for dollars will increase.

A) and the amount of francs exchanged for dollars will both increase.

B) and the amount of francs exchanged for dollars will both decrease.

C) will increase but the amount of francs exchanged for dollars will decrease.

D) will decrease but the amount of francs exchanged for dollars will increase.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

55

A decrease in the dollar price of Japanese yen and an increase in the number of yen exchanged for dollars would result from:

A) a decrease in the U.S. demand for Japanese yen.

B) an increase in the U.S. demand for Japanese yen.

C) a decrease in the supply of Japanese yen to persons holding U.S. dollars.

D) an increase in the supply of Japanese yen to persons holding U.S. dollars.

A) a decrease in the U.S. demand for Japanese yen.

B) an increase in the U.S. demand for Japanese yen.

C) a decrease in the supply of Japanese yen to persons holding U.S. dollars.

D) an increase in the supply of Japanese yen to persons holding U.S. dollars.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following would increase the value of the British pound when compared to the U.S. dollar?

A) A decrease in the U.S. demand for pounds.

B) An increase in the U.S. demand for pounds.

C) An increase in the supply of pounds to persons holding U.S. dollars.

D) None of the above.

A) A decrease in the U.S. demand for pounds.

B) An increase in the U.S. demand for pounds.

C) An increase in the supply of pounds to persons holding U.S. dollars.

D) None of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

57

An increase in the supply of Mexican pesos to persons holding U.S. dollars would:

A) make the dollar worth less in comparison to the peso.

B) make the dollar worth more in comparison to the peso.

C) have no effect on the value of the dollar or the peso if there were no change in the demand for pesos.

D) increase the value of the dollar in comparison to the peso, and increase the value of the peso in comparison to the dollar.

A) make the dollar worth less in comparison to the peso.

B) make the dollar worth more in comparison to the peso.

C) have no effect on the value of the dollar or the peso if there were no change in the demand for pesos.

D) increase the value of the dollar in comparison to the peso, and increase the value of the peso in comparison to the dollar.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

58

When the value of the dollar drops in comparison to other nations' monies:

A) foreign-made products become more expensive to U.S. buyers.

B) U.S.-made products become more expensive to foreign buyers.

C) foreign purchasers are discouraged from investing in U.S. real estate because it becomes relatively more expensive.

D) all of the above.

A) foreign-made products become more expensive to U.S. buyers.

B) U.S.-made products become more expensive to foreign buyers.

C) foreign purchasers are discouraged from investing in U.S. real estate because it becomes relatively more expensive.

D) all of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

59

Foreign-made goods would become more expensive to U.S. buyers if the:

A) value of the dollar dropped in comparison to other nations' currencies.

B) value of the dollar increased in comparison to other nations' currencies.

C) values of the dollar and all other nations' currencies dropped by the same proportion.

D) values of the dollar and all other nations' currencies increased by the same proportion.

A) value of the dollar dropped in comparison to other nations' currencies.

B) value of the dollar increased in comparison to other nations' currencies.

C) values of the dollar and all other nations' currencies dropped by the same proportion.

D) values of the dollar and all other nations' currencies increased by the same proportion.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

60

A decrease in the dollar price of British pounds would likely lead to:

A) a decrease in U.S. ownership of British assets.

B) an increase in U.S. ownership of British assets.

C) an increase in British ownership of U.S. assets.

D) none of the above.

A) a decrease in U.S. ownership of British assets.

B) an increase in U.S. ownership of British assets.

C) an increase in British ownership of U.S. assets.

D) none of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

61

According to Application 17.2, "Does a Lower-Valued Dollar Help the Economy?,"devaluing the U.S. dollar could:

A) help the U.S. economy by making U.S. exports more competitive.

B) hurt the U.S. economy by increasing cost-push inflationary pressure because businesses have to pay more for imported inputs.

C) hurt the U.S. economy by increasing demand-pull inflationary pressure because of more spending on U.S.-produced goods and services.

D) all of the above.

A) help the U.S. economy by making U.S. exports more competitive.

B) hurt the U.S. economy by increasing cost-push inflationary pressure because businesses have to pay more for imported inputs.

C) hurt the U.S. economy by increasing demand-pull inflationary pressure because of more spending on U.S.-produced goods and services.

D) all of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following would cause the U.S. demand curve for Mexican pesos to shift to the right?

A) Inflation in the United States.

B) The movement of buyers into the U.S. market for Mexican pesos.

C) A higher rate of return on investments in Mexico than on investments in the United States.

D) All of the above.

A) Inflation in the United States.

B) The movement of buyers into the U.S. market for Mexican pesos.

C) A higher rate of return on investments in Mexico than on investments in the United States.

D) All of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

63

A shift of the U.S. demand curve for Japanese yen to the left and a decrease in the dollar price of yen would likely result from:

A) a change in U.S. consumers' tastes away from Japanese products and toward products made in India and China.

B) a perception by U.S. buyers that domestically-produced products are of lower quality than products made in Japan.

C) both of the above.

D) neither of the above.

A) a change in U.S. consumers' tastes away from Japanese products and toward products made in India and China.

B) a perception by U.S. buyers that domestically-produced products are of lower quality than products made in Japan.

C) both of the above.

D) neither of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

64

An increase in foreign demand for U.S. soybeans would lead to:

A) a decrease in the price of dollars to foreign buyers.

B) an increase in the supply of dollars to foreign buyers.

C) an increase in the demand for dollars by foreign buyers.

D) all of the above.

A) a decrease in the price of dollars to foreign buyers.

B) an increase in the supply of dollars to foreign buyers.

C) an increase in the demand for dollars by foreign buyers.

D) all of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following would cause an increase in the U.S. demand for Japanese yen?

A) Inflation in Japan.

B) Inflation in the United States.

C) A decrease in the U.S. demand for Japanese goods.

D) Rising prices on Japanese machinery and equipment.

A) Inflation in Japan.

B) Inflation in the United States.

C) A decrease in the U.S. demand for Japanese goods.

D) Rising prices on Japanese machinery and equipment.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

66

An increase in the popularity of foreign goods in U.S. markets will increase the:

A) supply of U.S. currency.

B) supply of foreign currency.

C) U.S. demand for foreign currency.

D) foreign demand for U.S. currency.

A) supply of U.S. currency.

B) supply of foreign currency.

C) U.S. demand for foreign currency.

D) foreign demand for U.S. currency.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

67

An increase in the popularity of foreign goods in U.S. markets will shift the:

A) U.S. demand curve for foreign currency to the left.

B) U.S. demand curve for foreign currency to the right.

C) supply curve for foreign currency to the U.S. to the left.

D) supply curve for foreign currency to the U.S. to the right.

A) U.S. demand curve for foreign currency to the left.

B) U.S. demand curve for foreign currency to the right.

C) supply curve for foreign currency to the U.S. to the left.

D) supply curve for foreign currency to the U.S. to the right.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

68

A decrease in the U.S. inflation rate relative to inflation rates in other countries would shift the:

A) U.S. demand curve for foreign currency to the left.

B) U.S. demand curve for foreign currency to the right.

C) supply curve for foreign currency to the U.S. to the left.

D) none of the above.

A) U.S. demand curve for foreign currency to the left.

B) U.S. demand curve for foreign currency to the right.

C) supply curve for foreign currency to the U.S. to the left.

D) none of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

69

An increase in the real interest rate in Japan will shift the:

A) U.S. demand curve for Japanese currency to the left.

B) U.S. demand curve for Japanese currency to the right.

C) supply curve for Japanese currency to the U.S. to the right.

D) none of the above.

A) U.S. demand curve for Japanese currency to the left.

B) U.S. demand curve for Japanese currency to the right.

C) supply curve for Japanese currency to the U.S. to the right.

D) none of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

70

Inflation in the United States but not in France would make:

A) U.S. goods relatively less expensive in the United States and in France.

B) French goods relatively more expensive in the United States and in France.

C) French goods relatively less expensive in the United States, and U.S. goods relatively more expensive in France.

D) French goods relatively more expensive in the United States, and U.S. goods relatively less expensive in France.

A) U.S. goods relatively less expensive in the United States and in France.

B) French goods relatively more expensive in the United States and in France.

C) French goods relatively less expensive in the United States, and U.S. goods relatively more expensive in France.

D) French goods relatively more expensive in the United States, and U.S. goods relatively less expensive in France.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

71

An increase in the rate of interest that can be earned on Indian investments above the rate that can be earned on U.S. investments would:

A) increase the supply of Indian rupees to those holding U.S. dollars.

B) decrease the demand for Indian rupees by those holding U.S. dollars.

C) increase the equilibrium dollar price of Indian rupees for those holding U.S. dollars.

D) all of the above.

A) increase the supply of Indian rupees to those holding U.S. dollars.

B) decrease the demand for Indian rupees by those holding U.S. dollars.

C) increase the equilibrium dollar price of Indian rupees for those holding U.S. dollars.

D) all of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

72

If the return on investments in Switzerland were to move above the return on investments in the United States, the:

A) dollar price of Swiss francs would increase.

B) dollar price of Swiss francs would decrease.

C) amount of Swiss francs demanded by U.S. investors would decrease.

D) amount of dollars demanded by Swiss investors would increase.

A) dollar price of Swiss francs would increase.

B) dollar price of Swiss francs would decrease.

C) amount of Swiss francs demanded by U.S. investors would decrease.

D) amount of dollars demanded by Swiss investors would increase.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

73

A decrease in the value of the dollar in foreign exchange markets would:

A) increase the demand for travel in the U.S.

B) make foreign travel more expensive for U.S. citizens.

C) lead to a decrease in the demand for foreign currencies by U.S. citizens.

D) all of the above.

A) increase the demand for travel in the U.S.

B) make foreign travel more expensive for U.S. citizens.

C) lead to a decrease in the demand for foreign currencies by U.S. citizens.

D) all of the above.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

74

An outflow of dollars from the United States occurs when a:

A) U.S. citizen entertains foreign guests in her home.

B) U.S. government security is purchased by a Canadian.

C) U.S. business firm buys an electronics plant in Venezuela.

D) U.S.-built automobile owned by a person in France is sold to a person in Italy.

A) U.S. citizen entertains foreign guests in her home.

B) U.S. government security is purchased by a Canadian.

C) U.S. business firm buys an electronics plant in Venezuela.

D) U.S.-built automobile owned by a person in France is sold to a person in Italy.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following causes an outflow of payments from the United States to a foreign country?

A) A British student comes to school in Boston.

B) A U.S. buyer makes a credit card purchase in Paris.

C) A U.S.-owned firm sells one of its plants to a Swiss firm.

D) A U.S. citizen working for the Italian government deposits her paycheck in an account in Rome.

A) A British student comes to school in Boston.

B) A U.S. buyer makes a credit card purchase in Paris.

C) A U.S.-owned firm sells one of its plants to a Swiss firm.

D) A U.S. citizen working for the Italian government deposits her paycheck in an account in Rome.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

76

The category of international transactions that records payments for imports and exports of goods, net services and investment income, and unilateral transfers is the:

A) trade account.

B) capital account.

C) current account.

D) official reserve account.

A) trade account.

B) capital account.

C) current account.

D) official reserve account.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

77

The number that results when merchandise imports are subtracted from merchandise exports is:

A) the balance of trade.

B) always less than zero.

C) always greater than zero.

D) the official reserve account balance.

A) the balance of trade.

B) always less than zero.

C) always greater than zero.

D) the official reserve account balance.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

78

A balance of trade of -$160 billion means that:

A) U.S. assets abroad have fallen by $160 billion.

B) U.S. buyers purchased $160 billion more of foreign goods than foreign buyers purchased of U.S. goods.

C) foreign buyers purchased $160 billion more of U.S. goods than U.S. buyers purchased of foreign goods.

D) the U.S. government received $160 billion less in payment from foreign governments than it provided in foreign aid.

A) U.S. assets abroad have fallen by $160 billion.

B) U.S. buyers purchased $160 billion more of foreign goods than foreign buyers purchased of U.S. goods.

C) foreign buyers purchased $160 billion more of U.S. goods than U.S. buyers purchased of foreign goods.

D) the U.S. government received $160 billion less in payment from foreign governments than it provided in foreign aid.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is NOT included in the current account?

A) Unilateral transfers.

B) Net U.S. assets abroad.

C) Exports of merchandise.

D) Imports of merchandise.

A) Unilateral transfers.

B) Net U.S. assets abroad.

C) Exports of merchandise.

D) Imports of merchandise.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck

80

The term "balance of trade"and the term "net exports":

A) refer to a current account item, and a capital account item, respectively.

B) both refer to exactly the same thing-the importing and exporting of goods and services.

C) refer to the importing and exporting of goods, and the current account balance, respectively.

D) refer to the importing and exporting of goods, and to the importing and exporting of goods and services, respectively.

A) refer to a current account item, and a capital account item, respectively.

B) both refer to exactly the same thing-the importing and exporting of goods and services.

C) refer to the importing and exporting of goods, and the current account balance, respectively.

D) refer to the importing and exporting of goods, and to the importing and exporting of goods and services, respectively.

Unlock Deck

Unlock for access to all 177 flashcards in this deck.

Unlock Deck

k this deck