Deck 15: International Economic Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/56

Play

Full screen (f)

Deck 15: International Economic Policy

1

The questions with which Chapter 15 is concerned include each of the following except

A) how has the world organized its international monetary system?

B) what is a fixed exchange rate system?

C) what is a floating exchange rate system?

D) what is a sinking exchange rate system?

A) how has the world organized its international monetary system?

B) what is a fixed exchange rate system?

C) what is a floating exchange rate system?

D) what is a sinking exchange rate system?

what is a sinking exchange rate system?

2

The questions with which Chapter 15 is concerned include each of the following except

A) why do most economies today have fixed exchange rate systems?

B) what is a fixed exchange rate system?

C) what is a floating exchange rate system?

D) what were the causes of the three major currency crises of the 1990s?

A) why do most economies today have fixed exchange rate systems?

B) what is a fixed exchange rate system?

C) what is a floating exchange rate system?

D) what were the causes of the three major currency crises of the 1990s?

why do most economies today have fixed exchange rate systems?

3

The questions with which Chapter 15 is concerned include each of the following except

A) why do most economies today have floating exchange rate systems?

B) what are the costs and benefits of fixed exchange rates vis-a-vis floating exchange rates?

C) why does western Europe now have a "monetary union" - a common currency, the euro, and thus an . irrevocable commitment to floating exchange rates within western Europe?

D) what were the causes of the three major currency crises of the 1990s?

A) why do most economies today have floating exchange rate systems?

B) what are the costs and benefits of fixed exchange rates vis-a-vis floating exchange rates?

C) why does western Europe now have a "monetary union" - a common currency, the euro, and thus an . irrevocable commitment to floating exchange rates within western Europe?

D) what were the causes of the three major currency crises of the 1990s?

why does western Europe now have a "monetary union" - a common currency, the euro, and thus an . irrevocable commitment to floating exchange rates within western Europe?

4

The questions with which Chapter 15 is concerned include each of the following except

A) why do most economies today have floating exchange rate systems?

B) what are the costs and benefits of fixed interest rates vis-a-vis floating interest rates?

C) why does western Europe now have a "monetary union" - a common currency, the euro, and thus an . irrevocable commitment to fixed exchange rates within western Europe?

D) what were the causes of the three major currency crises of the 1990s?

A) why do most economies today have floating exchange rate systems?

B) what are the costs and benefits of fixed interest rates vis-a-vis floating interest rates?

C) why does western Europe now have a "monetary union" - a common currency, the euro, and thus an . irrevocable commitment to fixed exchange rates within western Europe?

D) what were the causes of the three major currency crises of the 1990s?

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

5

For most of the past century, the dominant international exchange rate regime

A) has been one of fixed, not floating, exchange rates.

B) has been one of fixed, not floating, interest rates.

C) has been one of floating, not fixed, interest rates.

D) has been one of floating, not fixed, exchange rates.

A) has been one of fixed, not floating, exchange rates.

B) has been one of fixed, not floating, interest rates.

C) has been one of floating, not fixed, interest rates.

D) has been one of floating, not fixed, exchange rates.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

6

Each of the following was a major international financial crisis of the 1990s except

A) the European crisis of 1992.

B) the Mexican crisis of 1995.

C) the oil price increase of 1996.

D) the East Asian crisis of 1997-1998.

A) the European crisis of 1992.

B) the Mexican crisis of 1995.

C) the oil price increase of 1996.

D) the East Asian crisis of 1997-1998.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

7

The gold standard was a _______ exchange rate system because

A) floating; each government would define a unit of its currency as worth a certain amount of gold and buy or sell its currency for gold at that price at any time.

B) fixed; each government would define a unit of its currency as worth a certain amount of gold and buy or sell its currency for gold at that price at any time.

C) fixed; each government would define a unit of its currency as worth a certain amount of gold, but would only buy or sell its currency for gold at that price if it was profitable to do so.

D) floating; each government would define a unit of its currency as worth a certain amount of gold, but would only buy or sell its currency for gold at that price if it was profitable to do so.

A) floating; each government would define a unit of its currency as worth a certain amount of gold and buy or sell its currency for gold at that price at any time.

B) fixed; each government would define a unit of its currency as worth a certain amount of gold and buy or sell its currency for gold at that price at any time.

C) fixed; each government would define a unit of its currency as worth a certain amount of gold, but would only buy or sell its currency for gold at that price if it was profitable to do so.

D) floating; each government would define a unit of its currency as worth a certain amount of gold, but would only buy or sell its currency for gold at that price if it was profitable to do so.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

8

If the U.S. dollar was defined as equal to 1/10 troy ounce of gold, and the French franc was defined asEqual to 1/20 troy ounce of gold, then the dollar price of a franc would be

A) 2.00.

B) .10.

C) .05.

D) .50.

A) 2.00.

B) .10.

C) .05.

D) .50.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

9

If the U.S. dollar was defined as equal to 1/10 troy ounce of gold, and the French franc was defined as equal to 1/20 troy ounce of gold, then the franc price of a dollar would be

A) 2.00.

B) .10.

C) .05.

D) .50.

A) 2.00.

B) .10.

C) .05.

D) .50.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

10

A major disadvantage of the gold standard is that

A) it tends to put inflationary pressures on the world economy.

B) it leads to much currency speculation.

C) it tends to put contractionary pressures on the world economy.

D) it leads to low interest rates.

A) it tends to put inflationary pressures on the world economy.

B) it leads to much currency speculation.

C) it tends to put contractionary pressures on the world economy.

D) it leads to low interest rates.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

11

Under a floating exchange rate system,

A) a country's net exports minus net investment from abroad must equal zero.

B) a country's net exports plus net investment from abroad must equal zero.

C) a country's net exports minus net investment from abroad plus the flow of gold into the country must equal zero.

D) a country's net exports plus net investment from abroad minus the flow of gold into the country must equal zero.

A) a country's net exports minus net investment from abroad must equal zero.

B) a country's net exports plus net investment from abroad must equal zero.

C) a country's net exports minus net investment from abroad plus the flow of gold into the country must equal zero.

D) a country's net exports plus net investment from abroad minus the flow of gold into the country must equal zero.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

12

Under a gold standard,

A) a country's net exports minus net investment from abroad must equal zero.

B) a country's net exports plus net investment from abroad must equal zero.

C) a country's net exports minus net investment from abroad plus the flow of gold into the country must equal zero.

D) a country's net exports plus net investment from abroad minus the flow of gold into the country must equal zero.

A) a country's net exports minus net investment from abroad must equal zero.

B) a country's net exports plus net investment from abroad must equal zero.

C) a country's net exports minus net investment from abroad plus the flow of gold into the country must equal zero.

D) a country's net exports plus net investment from abroad minus the flow of gold into the country must equal zero.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

13

Under a gold standard, if a country's

A) net exports plus net investment from abroad are less than zero, its Treasury will find itself losing gold.

B) net exports plus net investment from abroad are less than zero, its Treasury will find itself gaining gold.

C) net exports minus net investment from abroad are less than zero, its Treasury will find itself losing gold.

D) net exports minus net investment from abroad are less than zero, its Treasury will find itself losing gold

A) net exports plus net investment from abroad are less than zero, its Treasury will find itself losing gold.

B) net exports plus net investment from abroad are less than zero, its Treasury will find itself gaining gold.

C) net exports minus net investment from abroad are less than zero, its Treasury will find itself losing gold.

D) net exports minus net investment from abroad are less than zero, its Treasury will find itself losing gold

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

14

Under a gold standard, if a country's

A) net exports plus net investment from abroad are greater than zero, its Treasury will find itself losing gold.

B) net exports plus net investment from abroad are greater than zero, its Treasury will find itself gaining gold

C) net exports minus net investment from abroad are greater than zero, its Treasury will find itself losing gold

D) net exports minus net investment from abroad are greater than zero, its Treasury will find itself losing gold.

A) net exports plus net investment from abroad are greater than zero, its Treasury will find itself losing gold.

B) net exports plus net investment from abroad are greater than zero, its Treasury will find itself gaining gold

C) net exports minus net investment from abroad are greater than zero, its Treasury will find itself losing gold

D) net exports minus net investment from abroad are greater than zero, its Treasury will find itself losing gold.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

15

Each of the following is a possible option for a country that, under a gold standard, is about to run out of gold except

A) it could try to reduce imports and increase exports.

B) it could abandon payment in gold and let its currency float.

C) it could increase interest rates to attract more foreign investment.

D) it could undertake an expansionary fiscal policy.

A) it could try to reduce imports and increase exports.

B) it could abandon payment in gold and let its currency float.

C) it could increase interest rates to attract more foreign investment.

D) it could undertake an expansionary fiscal policy.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

16

The international gold standard was suspended when

A) the Boer War began.

B) the Russian Revolution occurred.

C) World War I began.

D) the Federal Reserve was created.

A) the Boer War began.

B) the Russian Revolution occurred.

C) World War I began.

D) the Federal Reserve was created.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

17

Each of the following is a possible reason why the gold standard in operation at the time of the Great Depression was a much less secure monetary system than the previous gold standard except

A) everyone knew that governments could abandon their gold parities in an emergency.

B) everyone knew that governments had taken on the additional responsibility of trying to keep interest . rates high enough to keep inflation low.

C) countries after World War I held their reserves in foreign currencies instead of in gold.

D) the post-World War I surplus economies, the United States and France, did not lower their interest rates as gold flowed in.

A) everyone knew that governments could abandon their gold parities in an emergency.

B) everyone knew that governments had taken on the additional responsibility of trying to keep interest . rates high enough to keep inflation low.

C) countries after World War I held their reserves in foreign currencies instead of in gold.

D) the post-World War I surplus economies, the United States and France, did not lower their interest rates as gold flowed in.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

18

Each of the following is a possible reason why the gold standard in operation at the time of the Great Depression was a much less secure monetary system than the previous gold standard except

A) everyone knew that governments could abandon their gold parities in an emergency.

B) everyone knew that governments had taken on the additional responsibility of trying to keep interest . rates low enough to produce full employment.

C) countries after World War I held their reserves in foreign currencies instead of in gold.

D) the post-World War I surplus economies, Russia and Germany, did not lower their interest rates as gold flowed in.

A) everyone knew that governments could abandon their gold parities in an emergency.

B) everyone knew that governments had taken on the additional responsibility of trying to keep interest . rates low enough to produce full employment.

C) countries after World War I held their reserves in foreign currencies instead of in gold.

D) the post-World War I surplus economies, Russia and Germany, did not lower their interest rates as gold flowed in.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

19

During the 1930s, those counties

A) that abandoned the gold standard early in the Depression fared much worse than those that clung to gold.

B) that clung to their gold parities found themselves forced to lower interest rates and expand their money supplies in order to avoid large gold losses.

C) that abandoned the gold standard early in the Depression fared much better than those that clung to gold.

D) that abandoned the gold standard and floated their exchange rates were not able to avoid deflation.

A) that abandoned the gold standard early in the Depression fared much worse than those that clung to gold.

B) that clung to their gold parities found themselves forced to lower interest rates and expand their money supplies in order to avoid large gold losses.

C) that abandoned the gold standard early in the Depression fared much better than those that clung to gold.

D) that abandoned the gold standard and floated their exchange rates were not able to avoid deflation.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

20

During the 1930s, those counties

A) that abandoned the gold standard early in the Depression fared much worse than those that clung to gold.

B) that clung to their gold parities found themselves forced to raise interest rates and contract their money supplies in order to avoid large gold losses.

C) that abandoned the gold standard and fixed their exchange rates were able to avoid deflation.

D) that abandoned the gold standard and floated their exchange rates were not able to avoid deflation.

A) that abandoned the gold standard early in the Depression fared much worse than those that clung to gold.

B) that clung to their gold parities found themselves forced to raise interest rates and contract their money supplies in order to avoid large gold losses.

C) that abandoned the gold standard and fixed their exchange rates were able to avoid deflation.

D) that abandoned the gold standard and floated their exchange rates were not able to avoid deflation.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

21

During the 1930s, those counties

A) that abandoned the gold standard early in the Depression fared much worse than those that clung to gold.

B) that clung to their gold parities found themselves forced to lower interest rates and expand their money supplies in order to avoid large gold losses.

C) that clung to their gold parities found themselves forced to lower interest rates and expand their money supplies in order to avoid large gold surpluses.

D) that abandoned the gold standard and floated their exchange rates were able to avoid deflation.

A) that abandoned the gold standard early in the Depression fared much worse than those that clung to gold.

B) that clung to their gold parities found themselves forced to lower interest rates and expand their money supplies in order to avoid large gold losses.

C) that clung to their gold parities found themselves forced to lower interest rates and expand their money supplies in order to avoid large gold surpluses.

D) that abandoned the gold standard and floated their exchange rates were able to avoid deflation.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

22

Each of the following is a principle that guided the post-World War II international monetary system except

A) a world currency should be created along with a world central bank and a world government.

B) in ordinary times, exchange rates should be fixed: fixed exchange rates encouraged international trade by making the prices of goods made in a foreign country predictable.

C) in extraordinary times, exchange rates should be changed.

D) an institution was needed to watch over the international financial system.

A) a world currency should be created along with a world central bank and a world government.

B) in ordinary times, exchange rates should be fixed: fixed exchange rates encouraged international trade by making the prices of goods made in a foreign country predictable.

C) in extraordinary times, exchange rates should be changed.

D) an institution was needed to watch over the international financial system.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

23

The Bretton Woods system broke down in the early 1970s because of

A) the Watergate scandal.

B) the increased price of oil.

C) an overvalued dollar.

D) an undervalued dollar.

A) the Watergate scandal.

B) the increased price of oil.

C) an overvalued dollar.

D) an undervalued dollar.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

24

To help solve the overvalued dollar problem of the late 1960s, policy makers in other countries thought that the United States should

A) lower interest rates to expand the U.S. economy.

B) devalue the dollar to increase exports and decrease imports.

C) raise interest rates to encourage foreigners to invest in the United States.

D) raise tariffs to discourage imports.

A) lower interest rates to expand the U.S. economy.

B) devalue the dollar to increase exports and decrease imports.

C) raise interest rates to encourage foreigners to invest in the United States.

D) raise tariffs to discourage imports.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

25

To help solve the overvalued dollar problem of the late 1960s, policy makers in the United States wanted to

A) lower interest rates to expand the U.S. economy.

B) devalue the dollar to increase exports and decrease imports.

C) raise interest rates to encourage foreigners to invest in the United States.

D) raise tariffs to discourage imports.

A) lower interest rates to expand the U.S. economy.

B) devalue the dollar to increase exports and decrease imports.

C) raise interest rates to encourage foreigners to invest in the United States.

D) raise tariffs to discourage imports.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

26

Since the early 1970s

A) the exchange rates at which the currencies of the major industrial countries trade against each other have been fixed rates.

B) the interest rates at which the currencies of the major industrial countries trade against each other have been floating rates.

C) the interest rates at which the currencies of the major industrial countries trade against each other have been fixed rates.

D) the exchange rates at which the currencies of the major industrial countries trade against each other have been floating rates.

A) the exchange rates at which the currencies of the major industrial countries trade against each other have been fixed rates.

B) the interest rates at which the currencies of the major industrial countries trade against each other have been floating rates.

C) the interest rates at which the currencies of the major industrial countries trade against each other have been fixed rates.

D) the exchange rates at which the currencies of the major industrial countries trade against each other have been floating rates.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

27

A fixed exchange rate is a commitment by a country

A) to buy and sell its currency at fixed, unchanging prices in terms of other currencies.

B) to buy and sell its currency at a fixed, unchanging price of an ounce of silver.

C) to buy and sell its currency at the market exchange rate.

D) to never change the price of its currency.

A) to buy and sell its currency at fixed, unchanging prices in terms of other currencies.

B) to buy and sell its currency at a fixed, unchanging price of an ounce of silver.

C) to buy and sell its currency at the market exchange rate.

D) to never change the price of its currency.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

28

In order to carry out the commitment made by a country in a fixed exchange rate system,

A) the country's central bank and Treasury must maintain foreign currency reserves.

B) the country's central bank and Treasury must maintain a stock of silver.

C) the country's central bank and Treasury must not change the domestic money supply.

D) must refuse to trade its currency.

A) the country's central bank and Treasury must maintain foreign currency reserves.

B) the country's central bank and Treasury must maintain a stock of silver.

C) the country's central bank and Treasury must not change the domestic money supply.

D) must refuse to trade its currency.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

29

It has proven to be difficult for a country to maintain a fixed exchange rate with today's high degree of capital mobility because

A) foreign exchange speculators can buy so much of the country's currency that the country will run out of the foreign currency that it needs to sell to purchase its own currency.

B) foreign exchange speculators always try to force a country's currency to depreciate.

C) foreign exchange speculators can sell so much of the country's currency that the country will run out of the foreign currency that it needs to sell to purchase its own currency.

D) foreign exchange speculators always try to force a country's currency to appreciate.

A) foreign exchange speculators can buy so much of the country's currency that the country will run out of the foreign currency that it needs to sell to purchase its own currency.

B) foreign exchange speculators always try to force a country's currency to depreciate.

C) foreign exchange speculators can sell so much of the country's currency that the country will run out of the foreign currency that it needs to sell to purchase its own currency.

D) foreign exchange speculators always try to force a country's currency to appreciate.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

30

Under a fixed exchange rate system with a high degree of capital mobility,

A) macroeconomic policy makers determine the interest rate.

B) international currency speculators determine the interest rate.

C) the exchange rate is not as important as it is under a floating exchange rate system.

D) microeconomic policy makers determine the exchange rate.

A) macroeconomic policy makers determine the interest rate.

B) international currency speculators determine the interest rate.

C) the exchange rate is not as important as it is under a floating exchange rate system.

D) microeconomic policy makers determine the exchange rate.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

31

Under a fixed exchange rate system with a high degree of capital mobility, an increase in foreign interest rates

A) will result in a point-for-point decrease in domestic interest rates.

B) will put pressure on the domestic currency to appreciate against other currencies.

C) will result in a point-for-point increase in domestic interest rates.

D) will put pressure on other currencies to depreciate against the domestic currency.

A) will result in a point-for-point decrease in domestic interest rates.

B) will put pressure on the domestic currency to appreciate against other currencies.

C) will result in a point-for-point increase in domestic interest rates.

D) will put pressure on other currencies to depreciate against the domestic currency.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

32

Under a fixed exchange rate system with a high degree of capital mobility, a decrease in foreign interest rates

A) will result in a point-for-point decrease in domestic interest rates.

B) will put pressure on the domestic currency to depreciate against other currencies.

C) will result in a point-for-point increase in domestic interest rates.

D) will put pressure on other currencies to appreciate against the domestic currency.

A) will result in a point-for-point decrease in domestic interest rates.

B) will put pressure on the domestic currency to depreciate against other currencies.

C) will result in a point-for-point increase in domestic interest rates.

D) will put pressure on other currencies to appreciate against the domestic currency.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

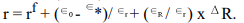

33

Under a fixed exchange rate system with a high degree of capital mobility, an increase in foreign exchange speculators' view of the long-run fundamental value of the exchange rate

A) requires an immediate increase in domestic interest rates of /

B) requires an immediate decrease in domestic interest rates of /.

C) requires an immediate decrease in domestic interest rates of /

D) requires an immediate increase in domestic interest rates of /.

A) requires an immediate increase in domestic interest rates of /

B) requires an immediate decrease in domestic interest rates of /.

C) requires an immediate decrease in domestic interest rates of /

D) requires an immediate increase in domestic interest rates of /.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

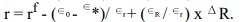

34

Under a fixed exchange rate system with a high degree of capital mobility, a decrease in foreign exchange speculators' view of the long-run fundamental value of the exchange rate

A) requires an immediate increase in domestic interest rates of /

B) requires an immediate decrease in domestic interest rates of /.

C) requires an immediate decrease in domestic interest rates of /

D) requires an immediate increase in domestic interest rates of /.

A) requires an immediate increase in domestic interest rates of /

B) requires an immediate decrease in domestic interest rates of /.

C) requires an immediate decrease in domestic interest rates of /

D) requires an immediate increase in domestic interest rates of /.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

35

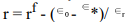

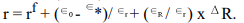

Under a fixed exchange rate system with a high degree of capital mobility, the exchange rate is determined by the following formula

A) (r - rf).

(r - rf).

B) (r - rf).

(r - rf).

C)

D)

A)

(r - rf).

(r - rf).B)

(r - rf).

(r - rf).C)

D)

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

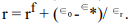

36

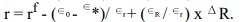

Under a fixed exchange rate system with a high degree of capital mobility, the domestic interest rate is determined by the following formula

A) r = rf-

B) r = rf+

C) r = rf +

D) r = rf -

A) r = rf-

B) r = rf+

C) r = rf +

D) r = rf -

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

37

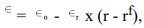

Under a fixed exchange rate system with a low degree of capital mobility, the exchange rate is determined by the following formula

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

38

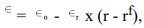

Under a fixed exchange rate system with a low degree of capital mobility, the domestic interest rate is determined by the following formula

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

39

Each of the following is a benefit of a fixed exchange rate system except

A) the reduction of exchange rate risk.

B) the avoidance of the churning of industrial risk.

C) the avoidance of political turmoil.

D) the central bank is free to set interest rates at whatever level it deems desirable.

A) the reduction of exchange rate risk.

B) the avoidance of the churning of industrial risk.

C) the avoidance of political turmoil.

D) the central bank is free to set interest rates at whatever level it deems desirable.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

40

Each of the following is a cost of a fixed exchange rate system except

A) the increase of exchange rate risk.

B) monetary policy is tightly constrained by the requirement of maintaining the exchange rate at fixed parity.

C) the level of interest rates must be devoted to maintaining external balance.

D) rapid transmission of monetary or confidence shocks.

A) the increase of exchange rate risk.

B) monetary policy is tightly constrained by the requirement of maintaining the exchange rate at fixed parity.

C) the level of interest rates must be devoted to maintaining external balance.

D) rapid transmission of monetary or confidence shocks.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

41

Each of the following is a benefit of a floating exchange rate system except

A) exchange rates are set by supply and demand, not by government decree.

B) governments are keeping the contracts they made with investors in foreign countries.

C) monetary or confidence shocks are not rapidly transmitted to other countries.

D) monetary policy is free to set interest rates at whatever level the central bank deems desirable to maintain internal balance.

A) exchange rates are set by supply and demand, not by government decree.

B) governments are keeping the contracts they made with investors in foreign countries.

C) monetary or confidence shocks are not rapidly transmitted to other countries.

D) monetary policy is free to set interest rates at whatever level the central bank deems desirable to maintain internal balance.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

42

Each of the following is a cost of a floating exchange rate system except

A) governments break the contracts they made with investors in foreign countries.

B) international trade is discouraged due to increased exchange rate risk.

C) political turmoil is avoided by floating exchange rate systems.

D) exporters and firms whose products compete with imported goods never know what their competitors' costs are going to be.

A) governments break the contracts they made with investors in foreign countries.

B) international trade is discouraged due to increased exchange rate risk.

C) political turmoil is avoided by floating exchange rate systems.

D) exporters and firms whose products compete with imported goods never know what their competitors' costs are going to be.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

43

The reunification of Germany in 1990

A) led to a large outward shift in the LM curve, following by a tightening of fiscal policy and a shift of the IS curve to the left.

B) led to a large outward shift of the IS curve, and a tightening of monetary policy, which shifted the LM curve to the left and raised real interest rates.

C) led to a large outward shift of the IS curve, and a tightening of monetary policy, which shifted the LM curve to the right and lowered real interest rates.

D) led to a large inward shift of the IS curve, and a tightening of monetary policy, which shifted the LM curve to the left and raised real interest rates.

A) led to a large outward shift in the LM curve, following by a tightening of fiscal policy and a shift of the IS curve to the left.

B) led to a large outward shift of the IS curve, and a tightening of monetary policy, which shifted the LM curve to the left and raised real interest rates.

C) led to a large outward shift of the IS curve, and a tightening of monetary policy, which shifted the LM curve to the right and lowered real interest rates.

D) led to a large inward shift of the IS curve, and a tightening of monetary policy, which shifted the LM curve to the left and raised real interest rates.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

44

In response to rising real interest rates in Germany after German reunification, other western European countries that were part of the European Exchange Rate Mechanism were forced to

A) decrease interest rates because they wanted to maintain fixed exchange rates with the German mark.

B) increase interest rates because they were willing to let their currencies float against the German mark.

C) decrease interest rates because they were willing to let their currencies float against the German mark.

D) increase interest rates because they wanted to maintain fixed exchange rates with the German mark.

A) decrease interest rates because they wanted to maintain fixed exchange rates with the German mark.

B) increase interest rates because they were willing to let their currencies float against the German mark.

C) decrease interest rates because they were willing to let their currencies float against the German mark.

D) increase interest rates because they wanted to maintain fixed exchange rates with the German mark.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

45

In a fixed-exchange rate system with a high degree of capital mobility, if foreign exchange speculators' expectations of the long-run fundamental real value of the exchange rate increases and foreign interest rates increase,

A) the domestic interest rate would increase.

B) the domestic interest rate would decrease.

C) the domestic interest rate would not be affected.

D) the effect on the domestic interest rate would depend on which change has a bigger impact.

A) the domestic interest rate would increase.

B) the domestic interest rate would decrease.

C) the domestic interest rate would not be affected.

D) the effect on the domestic interest rate would depend on which change has a bigger impact.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

46

Each of the following is a strategy undertaken by western European countries that were part of the European Exchange Rate Mechanism in response to the 1992 speculative attack on their currencies except

A) trying to avoid the consequences of the shift in expectations by spending currency reserves to keep their currencies from depreciating.

B) trying to demonstrate that they would defend the fixed exchange rate no matter how high the interest rate required.

C) instituting restrictions on currency trading.

D) abandoning their parity against the German mark and letting their currencies float.

A) trying to avoid the consequences of the shift in expectations by spending currency reserves to keep their currencies from depreciating.

B) trying to demonstrate that they would defend the fixed exchange rate no matter how high the interest rate required.

C) instituting restrictions on currency trading.

D) abandoning their parity against the German mark and letting their currencies float.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

47

One of the reasons that collapses of currencies occur is

A) in situations of limited capital mobility, countries with undervalued exchange rates and large inflation- financed budget deficits suffer speculative attacks.

B) in situations of limited capital mobility, governments with overvalued exchange rates and large budget surpluses suffer speculative attacks.

C) in cases like western Europe in 1992 currencies had suffered speculative attacks when speculators judged that the policies needed to maintain floating exchange rates had become inconsistent with the government's political survival.

D) in situations of limited capital mobility, countries with overvalued exchange rates and large inflation-. financed budget deficits suffer speculative attacks.

A) in situations of limited capital mobility, countries with undervalued exchange rates and large inflation- financed budget deficits suffer speculative attacks.

B) in situations of limited capital mobility, governments with overvalued exchange rates and large budget surpluses suffer speculative attacks.

C) in cases like western Europe in 1992 currencies had suffered speculative attacks when speculators judged that the policies needed to maintain floating exchange rates had become inconsistent with the government's political survival.

D) in situations of limited capital mobility, countries with overvalued exchange rates and large inflation-. financed budget deficits suffer speculative attacks.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

48

One of the reasons that collapses of currencies occur is

A) in situations of limited capital mobility, countries with undervalued exchange rates and large inflation- financed budget deficits suffer speculative attacks.

B) in situations of limited capital mobility, governments with overvalued exchange rates and large budget surpluses suffer speculative attacks.

C) in cases like western Europe in 1992 currencies had suffered speculative attacks when speculators judged that the policies needed to maintain fixed exchange rates had become inconsistent with the government's political survival.

D) in cases like western Europe in 1992 currencies had suffered speculative attacks when speculators judged that the policies needed to maintain floating exchange rates had become inconsistent with the government's political survival.

A) in situations of limited capital mobility, countries with undervalued exchange rates and large inflation- financed budget deficits suffer speculative attacks.

B) in situations of limited capital mobility, governments with overvalued exchange rates and large budget surpluses suffer speculative attacks.

C) in cases like western Europe in 1992 currencies had suffered speculative attacks when speculators judged that the policies needed to maintain fixed exchange rates had become inconsistent with the government's political survival.

D) in cases like western Europe in 1992 currencies had suffered speculative attacks when speculators judged that the policies needed to maintain floating exchange rates had become inconsistent with the government's political survival.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

49

Mexico's peso crisis in 1994-95 was a surprise for each of the following reasons except

A) the government's budget was balanced.

B) profits from investing in Mexico were low.

C) an outbreak of renewed inflation was not generally expected.

D) the government's willingness to raise interest rates was not in question.

A) the government's budget was balanced.

B) profits from investing in Mexico were low.

C) an outbreak of renewed inflation was not generally expected.

D) the government's willingness to raise interest rates was not in question.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

50

Each of the following was a factor that reduced foreign exchange speculators' estimates of the long-run value of the Mexican peso except

A) a guerrilla uprising in the poor southern Mexican province of Chiapas cast doubt on political stability.

B) a wave of assassinations killed the candidate of the ruling Party of the Revolution and the designated successor to the then-Mexican President.

C) Mexico had just entered into the North American Free Trade Agreement.

D) the central bank raised the money supply during 1994.

A) a guerrilla uprising in the poor southern Mexican province of Chiapas cast doubt on political stability.

B) a wave of assassinations killed the candidate of the ruling Party of the Revolution and the designated successor to the then-Mexican President.

C) Mexico had just entered into the North American Free Trade Agreement.

D) the central bank raised the money supply during 1994.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

51

A factor that clearly worsened the impact of the East Asian Crisis of 1997-1998 was

A) many of East Asia's banks and companies had borrowed heavily abroad in amounts denominated in dollars or yen.

B) many of East Asia's banks and companies had loaned heavily abroad in amounts denominated in dollars or yen.

C) the East Asian economies had not been growing very fast in the years leading up to the crisis.

D) there were limits on capital flows in most of the East Asian countries.

A) many of East Asia's banks and companies had borrowed heavily abroad in amounts denominated in dollars or yen.

B) many of East Asia's banks and companies had loaned heavily abroad in amounts denominated in dollars or yen.

C) the East Asian economies had not been growing very fast in the years leading up to the crisis.

D) there were limits on capital flows in most of the East Asian countries.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

52

The U.S. trade deficit has _________ since 2001 which may lead to a _________ of the dollar.

A) continued to grow; depreciation

B) continued to grow; appreciation

C) decreased; depreciation

D) decreased; appreciation

A) continued to grow; depreciation

B) continued to grow; appreciation

C) decreased; depreciation

D) decreased; appreciation

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

53

Using the exchange-rate equation,  a decrease in

a decrease in  means that

means that

A) countries will have to decrease r or let increase.

B) countries will have to increase r or let decrease.

C) countries will have to decrease r or let decrease.

D) countries will have to increase r or let increase.

a decrease in

a decrease in  means that

means thatA) countries will have to decrease r or let increase.

B) countries will have to increase r or let decrease.

C) countries will have to decrease r or let decrease.

D) countries will have to increase r or let increase.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

54

Each of the following is something that a country can do to reduce its vulnerability to foreign exchange crisis except

A) strongly discourage - tax - borrowers from borrowing in foreign currencies.

B) be sure that your exchange rate can float without causing trouble for the domestic economy.

C) recognize that an important part of keeping it fixed are controls over capital movements.

D) recognize that an important part of keeping it fixed is the free flow of capital.

A) strongly discourage - tax - borrowers from borrowing in foreign currencies.

B) be sure that your exchange rate can float without causing trouble for the domestic economy.

C) recognize that an important part of keeping it fixed are controls over capital movements.

D) recognize that an important part of keeping it fixed is the free flow of capital.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

55

Borrowing in foreign currencies

A) hurts a country with a depreciating currency because it means that the real cost of the loans increases as the domestic currency depreciates.

B) hurts a country with an appreciating currency because it means that the real cost of the loans increases as the domestic currency appreciates.

C) helps a country with a depreciating currency because it means that the real cost of the loans decreases as the domestic currency depreciates.

D) helps a country with an appreciating currency because it means that the real cost of the loans increases as the domestic currency appreciates.

A) hurts a country with a depreciating currency because it means that the real cost of the loans increases as the domestic currency depreciates.

B) hurts a country with an appreciating currency because it means that the real cost of the loans increases as the domestic currency appreciates.

C) helps a country with a depreciating currency because it means that the real cost of the loans decreases as the domestic currency depreciates.

D) helps a country with an appreciating currency because it means that the real cost of the loans increases as the domestic currency appreciates.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

56

Raising interest rates to stave off currency depreciation

A) helps a country because high interest rates benefit savers and thus increases investment spending.

B) hurts a country because high interest rates are inflationary.

C) hurts a country because high interest rates reduce investment spending, aggregate demand, output, employment, and economic growth.

D) helps a country because high interest rates are a signal of a strong currency.

A) helps a country because high interest rates benefit savers and thus increases investment spending.

B) hurts a country because high interest rates are inflationary.

C) hurts a country because high interest rates reduce investment spending, aggregate demand, output, employment, and economic growth.

D) helps a country because high interest rates are a signal of a strong currency.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck