Deck 12: Translation of Foreign Currency Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 12: Translation of Foreign Currency Financial Statements

1

The Financial Accounting Standards Board sanctioned the current rate method for remeasuring foreign currency-denominated financial statements to the functional currency.

False

2

Translation and remeasurement of foreign currency financial statements have the same objective.

False

3

A U.S. multinational enterprise remeasures the financial statements of its foreign subsidiaries from the foreign local currency to the subsidiaries' functional currency.

True

4

Under the monetary/nonmonetary method of remeasuring foreign currency financial statements, both inventories and current liabilities are remeasured at appropriate historical exchange rates.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

The current/noncurrent method and the current rate method for translating foreign currency financial statements essentially are identical.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

According to FASB Statement No. 52, "Foreign Currency Translation," inventories of a foreign subsidiary carried at first-in, first-out cost in the subsidiary's functional currency balance sheet are translated to U.S. dollars at the historical exchange rate.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

Foreign currency translation adjustments are not entered in a ledger account of a foreign branch or investee.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Remeasurement is synonymous with translation.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Foreign currency transaction gains and losses are displayed with foreign currency translation adjustments in the translated balance sheet of a foreign entity.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

The remeasured financial statements of a foreign entity need never be translated.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

In the remeasurement of foreign currency financial statements, which of the following items is remeasured at the current exchange rate?

A) Inventories carried at cost

B) Unexpired insurance

C) Goodwill

D) Marketable equity securities carried at current fair value

A) Inventories carried at cost

B) Unexpired insurance

C) Goodwill

D) Marketable equity securities carried at current fair value

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

Inventories carried at cost in a foreign subsidiary's local currency financial statements are remeasured to functional currency dollar amounts at the historical exchange rate under the:

A) Current/noncurrent method

B) Monetary/nonmonetary method

C) Current rate method

D) Local currency method

A) Current/noncurrent method

B) Monetary/nonmonetary method

C) Current rate method

D) Local currency method

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Under FASB Statement No. 52, "Foreign Currency Translation," the appropriate exchange rate for translating plant assets stated in functional currency amounts in the balance sheet of a foreign subsidiary is the:

A) Current exchange rate

B) Average exchange rate for the accounting period

C) Historical exchange rate

D) Average exchange rate over the economic life of each plant asset

A) Current exchange rate

B) Average exchange rate for the accounting period

C) Historical exchange rate

D) Average exchange rate over the economic life of each plant asset

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

If a parent company bills all sales to its foreign subsidiary in U.S. dollars and is to be repaid in the same number of U.S. dollars, the Purchases ledger account in the subsidiary's trial balance is remeasured to U.S. dollars by use of the:

A) Average exchange rate for the accounting period

B) Exchange rate at the beginning of the period

C) Exchange rate at the end of the period

D) Amount in the parent's accounting records for sales to the subsidiary

A) Average exchange rate for the accounting period

B) Exchange rate at the beginning of the period

C) Exchange rate at the end of the period

D) Amount in the parent's accounting records for sales to the subsidiary

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

The account (or accounts) in a foreign subsidiary's trial balance that are not remeasured to U.S. dollars (the functional currency) at the current exchange rate are:

A) Trade accounts payable incurred during the year

B) Long-term liabilities incurred several years ago

C) Long-term receivable obtained several years ago

D) Sales

A) Trade accounts payable incurred during the year

B) Long-term liabilities incurred several years ago

C) Long-term receivable obtained several years ago

D) Sales

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Platt Corporation acquired 80% of the outstanding common stock of Smolt Company, a foreign subsidiary. In the preparation of consolidated financial statements, the paid-in capital of Smolt is translated from the foreign functional currency to U.S. dollars at the:

A) Current exchange rate

B) Exchange rate effective when Smolt was organized

C) Exchange rate effective on the date Platt acquired Smolt's common stock

D) Average exchange rate for the period Platt has owned Smolt's common stock

A) Current exchange rate

B) Exchange rate effective when Smolt was organized

C) Exchange rate effective on the date Platt acquired Smolt's common stock

D) Average exchange rate for the period Platt has owned Smolt's common stock

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

The historical exchange rate is not used to remeasure to the functional currency a foreign subsidiary's:

A) Short-term prepayments

B) Refundable deposits

C) Deferred revenue

D) Goodwill

A) Short-term prepayments

B) Refundable deposits

C) Deferred revenue

D) Goodwill

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

Accumulated foreign currency translation adjustments arising from translation of the financial statements of a foreign entity to the reporting currency from the functional currency are displayed in the:

A) Stockholders' equity section of the entity's balance sheet

B) Other revenue and expenses section of the entity's income statement

C) Prior period adjustments section of the entity's statement of retained earnings

D) Reserves section of the entity's balance sheet

A) Stockholders' equity section of the entity's balance sheet

B) Other revenue and expenses section of the entity's income statement

C) Prior period adjustments section of the entity's statement of retained earnings

D) Reserves section of the entity's balance sheet

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

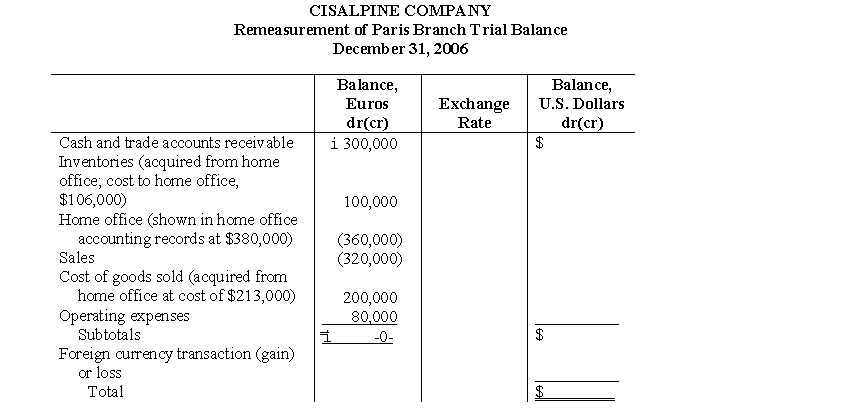

The trial balance of the Paris Branch of Cisalpine Company is presented below:

The exchange rate for the euro on December 31, 2006, was i1 = $1.08, and the average exchange rate for 2006 was i1 = $1.07.

The exchange rate for the euro on December 31, 2006, was i1 = $1.08, and the average exchange rate for 2006 was i1 = $1.07.

Complete the remeasurement of the Paris Branch trial balance to U.S. dollars, the functional currency, on December 31, 2006.

The exchange rate for the euro on December 31, 2006, was i1 = $1.08, and the average exchange rate for 2006 was i1 = $1.07.

The exchange rate for the euro on December 31, 2006, was i1 = $1.08, and the average exchange rate for 2006 was i1 = $1.07.Complete the remeasurement of the Paris Branch trial balance to U.S. dollars, the functional currency, on December 31, 2006.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

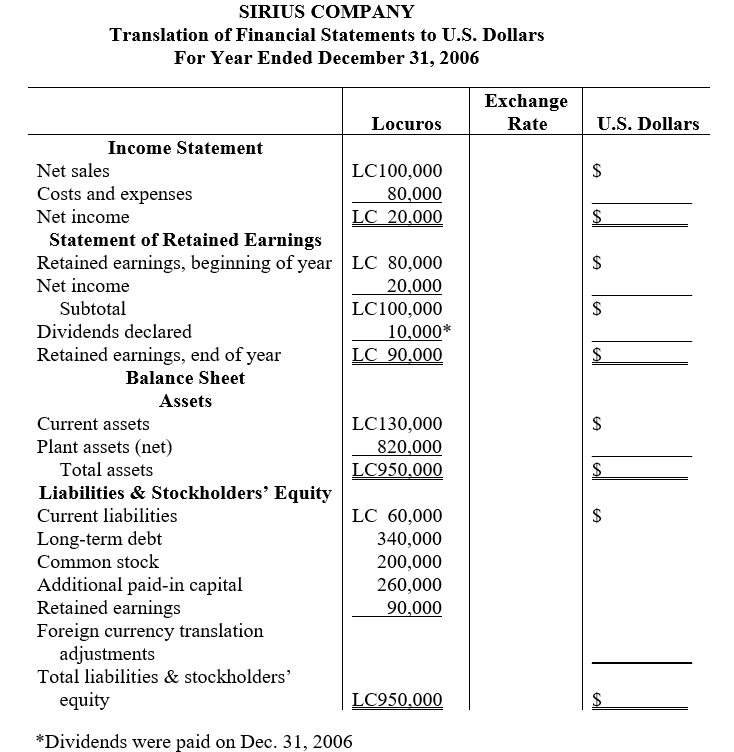

20

On January 2, 2006, Parliament Corporation, a U.S. multinational enterprise, acquired all the outstanding common stock of Sirius Company, which is located in a country whose currency is the locuro (LC). The locuro is the functional currency of Sirius.

For 2006, exchange rates for the locuro were as follows:

For 2006, exchange rates for the locuro were as follows:

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck