Deck 10: Taxation of Individuals

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/24

Play

Full screen (f)

Deck 10: Taxation of Individuals

1

Lennie was a professional cricketer who, during his last game for the club, collected donations from the crowd for a meritorious performance in a game. Are these receipts likely to be assessable as income?

A) Yes as there is a connection between the receipts and the taxpayer's services

B) No as there is no connection between the amounts collected and the taxpayer's services

C) Yes as the mines collected are all in cash

D) No as the monies are collected by way of a gift to the player

A) Yes as there is a connection between the receipts and the taxpayer's services

B) No as there is no connection between the amounts collected and the taxpayer's services

C) Yes as the mines collected are all in cash

D) No as the monies are collected by way of a gift to the player

Yes as there is a connection between the receipts and the taxpayer's services

2

Sarah purchased a small flat in Sydney on 14 December 2014 for$520?000which she lived in until she was forced to move interstate in March 2018. Sarah lived in a rented apartment interstate and has not owned another property. Sarah returned to Sydney in March 2020 and then sold the flat in June 2020 for $750,000. Does Sarah have any CGT liability on the sale of her Sydney flat?

A) Yes, as she rented out the Sydney flat for 2 years then this portion of her ownership period is subject to CGT liability

B) Yes, as she rented out the Sydney flat for 2 years, she completely loses the CGT main residence exemption

C) No, because after the CGT discount, Sarah made a capital loss on the sale

D) No, as the Sydney flat remained her main residence for the whole period of ownership

A) Yes, as she rented out the Sydney flat for 2 years then this portion of her ownership period is subject to CGT liability

B) Yes, as she rented out the Sydney flat for 2 years, she completely loses the CGT main residence exemption

C) No, because after the CGT discount, Sarah made a capital loss on the sale

D) No, as the Sydney flat remained her main residence for the whole period of ownership

No, as the Sydney flat remained her main residence for the whole period of ownership

3

Babu is a bicycle courier who rides for a company called Crisis Couriers. Babu is required to wear a distinctive yellow uniform whilst riding for the courier company and is subject to various rules and regulations imposed by the courier company who also set his hourly rate. Crisis Couriers do not deduct any tax from payments to Babu nor do they provide any superannuation on behalf of Babu. In light of this information, which one of the following statements is likely to be true?

A) Babu is likely to be an independent contractor as no tax is withheld from payments to him and he also has to pay his own superannuation contributions

B) Babu is likely to be an independent contractor as he doesn't supply his own bicycle

C) Babu is effectively an employee of Crisis Couriers under both the control and integration tests

D) Babu is not taxable on the payments from the Courier Company as Babu is undertaking his work in the nature of a hobby

A) Babu is likely to be an independent contractor as no tax is withheld from payments to him and he also has to pay his own superannuation contributions

B) Babu is likely to be an independent contractor as he doesn't supply his own bicycle

C) Babu is effectively an employee of Crisis Couriers under both the control and integration tests

D) Babu is not taxable on the payments from the Courier Company as Babu is undertaking his work in the nature of a hobby

Babu is effectively an employee of Crisis Couriers under both the control and integration tests

4

Trevor is a resident of Australia and who owns 1.000 shares in BBC Bank and during the 2020 tax year the Bank paid him a total of $1,400 in fully franked cash dividends. In light of these facts, which of the following is true?

A) Trevor will need to include both the $1,400 dividend and the $600 franking credit into his assessable income

B) Trevor only needs to include the $1,400 cash franked dividend received into his assessable income as he did not physically receive the franking credit

C) As a resident, Trevor does not include the franking credit into his assessable income

D) The $600 franking credit is taken off the assessable income amount and so Trevor only needs to include $800 into his assessable income

A) Trevor will need to include both the $1,400 dividend and the $600 franking credit into his assessable income

B) Trevor only needs to include the $1,400 cash franked dividend received into his assessable income as he did not physically receive the franking credit

C) As a resident, Trevor does not include the franking credit into his assessable income

D) The $600 franking credit is taken off the assessable income amount and so Trevor only needs to include $800 into his assessable income

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

5

Johnathan is a resident and during the 2020 tax year he derived $62,000 in salary from which $13,000 in PAYG withholding was deducted. He also received $1,100 in bank interest and he also received a fully franked dividend of $700 that had $300 in franking credits attached. Johnathan incurred $2,100 in various work related expenses for which he has kept the required documentation and which are all fully deductible. What is Johnathan's taxable income and will be receive a tax refund or have a balance of tax to pay?

A) $903 refund

B) $2,892 tax payable

C) $1,443 refund

D) $363 refund

A) $903 refund

B) $2,892 tax payable

C) $1,443 refund

D) $363 refund

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

6

Sagar is a non-resident and during the 2020 tax year he derived $28,000 in wages from a part-time job in Australia from which $9,100 in PAYG withholding was deducted. He also received a fully franked dividend of $2,100 from an Australian company that had $900 in franking credits attached. Sagar incurred $290 in various work related expenses for which he has kept the required documentation and which are all fully deductible. What is Sagar's taxable income and will be receive a tax refund or have a balance of tax to pay?

A) $0 refund or tax payable

B) $11,963.25 tax payable

C) $19.25 refund

D) $94.25 refund

A) $0 refund or tax payable

B) $11,963.25 tax payable

C) $19.25 refund

D) $94.25 refund

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

7

Sanjiv is a resident and works full time in an office as an administrator. On weekends from April 2020 he began using his own car as a ride-share operator with Guber. Sanjiv has come to you for tax advice as he thinks his income from Guber is not taxable as he enjoys driving and to him the activity is a hobby. What would you advise him?

A) Sanjiv is mistaken as ridesharing is not a hobby and is treated as a business but he will not need to register for GST or keep proper records and can simply estimate his income at the end of the tax year

B) Sanjiv is mistaken as ridesharing is not a hobby and is treated as a business and he will need to register for GST and keep proper records

C) Sanjiv is correct as whether a business or a hobby is being conducted is a matter is decided entirely by the taxpayer

D) Sanjiv is correct that the ridesharing is simply a hobby and so he will not need to register for GST but he should keep proper records

A) Sanjiv is mistaken as ridesharing is not a hobby and is treated as a business but he will not need to register for GST or keep proper records and can simply estimate his income at the end of the tax year

B) Sanjiv is mistaken as ridesharing is not a hobby and is treated as a business and he will need to register for GST and keep proper records

C) Sanjiv is correct as whether a business or a hobby is being conducted is a matter is decided entirely by the taxpayer

D) Sanjiv is correct that the ridesharing is simply a hobby and so he will not need to register for GST but he should keep proper records

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

8

Dennis purchased a property in Adelaide in April 2010 for $400,000. Dennis lived in that property until 2012 at which time he moved interstate for work and rented out the property. The property remained rented until April 2019 at which time Dennis returned to live in the property. Dennis then sold the property in April 2020 for $560,000. Does Dennis have any CGT liability on the sale of this property?

A) $56,000

B) $112,000

C) $160,000

D) $0

A) $56,000

B) $112,000

C) $160,000

D) $0

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is not true about a genuine early redundancy payment?

A) The employee must be dismissed before they reach 65 years of age

B) The payment represents what would be payable under a normal commercial arrangement

C) A genuine redundancy is not an ETP (eligible termination payment) but rather consists of a tax-free amount up to a certain threshold that is non-assessable non-exempt income.

D) There is an arrangement or agreement at the time of dismissal that the employee be re-employed by the employer6 months after the redundancy payment is made

A) The employee must be dismissed before they reach 65 years of age

B) The payment represents what would be payable under a normal commercial arrangement

C) A genuine redundancy is not an ETP (eligible termination payment) but rather consists of a tax-free amount up to a certain threshold that is non-assessable non-exempt income.

D) There is an arrangement or agreement at the time of dismissal that the employee be re-employed by the employer6 months after the redundancy payment is made

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

10

Byron, a resident of Australia, received a partially franked dividend, franked to 80%, for $1,400 from CBC Bank and a partially franked dividend, franked to 40%, for $1,360 from Sea Worths Ltd in the last tax year. What is the amount of the franking tax offset that Byron is entitled to?

A) $833.14

B) $1,182.86

C) $713.14

D) $469.71

A) $833.14

B) $1,182.86

C) $713.14

D) $469.71

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

11

Don owns a rental property and during the year ended 30 June 2020 he received gross rent of $14,040. From this gross rent, the property manager took out his fee of $1,404 and a leasing fee of $130 and paid, on behalf of Don, the council rates of $1,200. Don paid the water rates of $1,100 and undertook various minor repairs of $220 and also paid bank interest of $7,500. What is Don's net rental income for the year ended 30 June 2020?

A) $2,486 net rental income

B) $10,206 net rental income

C) $6,540 net rental income

D) $2,486 net rental loss

A) $2,486 net rental income

B) $10,206 net rental income

C) $6,540 net rental income

D) $2,486 net rental loss

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

12

Saif is a non-resident of Australia and he has received a fully franked dividend of $700, which has a $300 franking credit and also a partially franked dividend of $1,400, franked to 80%, from Quarry Bank. What is the amount of the franking tax offset that Saif is entitled to?

A) $780

B) $480

C) $300

D) $0

A) $780

B) $480

C) $300

D) $0

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

13

Patricia is 52 years old and she has owned and operated a small cafe bar for the last 6 years. She made a capital gain from selling this business of$600?000the 2019-20 tax year. Patricia also has a carry forward capital loss of $10,000. Assume that Patricia's business meets the basic conditions in Division 152 ITAA97 and so she qualifies for the CGT small business concessions. What is Patricia's net capital gain likely to be for 2020?

A) $580,000

B) $290,000

C) $145,000 before the lifetime retirement exemption and/or small business rollover are applied

D) $0 before the lifetime retirement exemption and/or small business rollover are applied

A) $580,000

B) $290,000

C) $145,000 before the lifetime retirement exemption and/or small business rollover are applied

D) $0 before the lifetime retirement exemption and/or small business rollover are applied

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

14

Anthony contributed $5,000 into his spouse's superannuation fund. His spouse's assessable income was $38,000. What is the amount of the low-income superannuation tax offset that Anthony may be entitled to for the 2020 tax year?

A) $540

B) $360

C) $0

D) $180

A) $540

B) $360

C) $0

D) $180

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

15

Harry is 56 and is under preservation age and has received a lump sum from his superannuation of $250,000. The lump sum was from an untaxed source. What rates of tax will apply to this lump sum?

A) 30% up to the untaxed plan cap amount

B) 45%

C) 0%

D) 15%

A) 30% up to the untaxed plan cap amount

B) 45%

C) 0%

D) 15%

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

16

Eddie is single and a resident and his taxable income for the 2020 tax year is $26,000. What amount of Medicare levy will Eddie pay in the year ended 30 June 2020?

A) $0

B) $520

C) $260

D) $360.20

A) $0

B) $520

C) $260

D) $360.20

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

17

Christine is a 45-year-old single woman. For the 2019-20 tax year, Christine's taxable income was$110?000, and she had reportable fringe benefits of$30?000. Christine did not have private patient hospital cover at any time throughout the year. What is Christine's Medicare levy surcharge liability?

A) $1,100

B) $1,375

C) $1,750

D) $2,100

A) $1,100

B) $1,375

C) $1,750

D) $2,100

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

18

Domenic is a practising lawyer and he recently completed his law degree and his outstanding HELP debt as at 29 June 2020 (before the 2020 tax return is assessed) is $14,800. Domenic's taxable income for the 2020 year was $121,000. Domenic also has a reportable fringe benefit amount of $12,000. What amount of HELP repayment will Domenic have to make in the 2020 tax return?

A) $10,890

B) $11,305

C) $11,970

D) $12,635

A) $10,890

B) $11,305

C) $11,970

D) $12,635

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

19

Robert is a resident and during the 2020 tax year he derived $86,000 in salary from which $25,800 in PAYG withholding was deducted. He also received $400 in bank interest and he also received a fully franked dividend of $2,100 that had $900 in franking credits attached. Robert incurred $3,400 in various work related expenses for which he has kept the required documentation and which are all fully deductible. Robert also has a HELP debt of $10,200. What is Robert's taxable income and will be receive a tax refund or have a balance of tax to pay?

A) $1,403 refund

B) $323 refund

C) $6,563 refund

D) $323 payable

A) $1,403 refund

B) $323 refund

C) $6,563 refund

D) $323 payable

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

20

Shane Edwards, is a resident individual who earned a gross salary of $25,000 and received a fully franked dividend of $10,500 for the year ended 30 June 2020. Shane's also had tax instalments (PAYG) deducted from his salary income of $6,000. Shane has no dependants and is not entitled to any dependant tax offsets/rebates.

What is Shane's net tax payable/refundable (including Medicare levy if applicable but ignoring tax offsets) for the year ended 30 June 2020?

What is Shane's net tax payable/refundable (including Medicare levy if applicable but ignoring tax offsets) for the year ended 30 June 2020?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

21

On 1 November 2019 David Martin received a genuine redundancy payment of $64,000 from his employer RTZ Pty Ltd. David had commenced employment with RTZ Pty Ltd on 1 November 2012.

Based on this information what are the tax implications for David in receiving the redundancy payment?

Based on this information what are the tax implications for David in receiving the redundancy payment?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

22

Meg Ryan is paid a superannuation lump sum of $80,000 on 30 June 2020. Prior to being paid the benefit, the value of Meg's superannuation interest in the fund is $350,000, made up of $70,000 tax free component and $280,000 taxable component.

Based on this information what part of Meg's lump sum would constitute the taxable component?

Based on this information what part of Meg's lump sum would constitute the taxable component?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

23

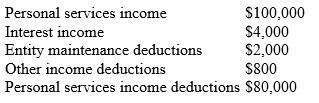

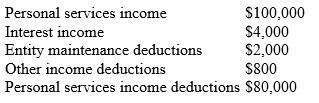

Sandra Livingstone who provides her personal training services through a company called "Get Fit Pty Ltd," has been unable to satisfy any of the Personal Services Income (PSI) tests to warrant exclusion from the PSI rules. The financial records of the company for the year ended 30 June 2020 indicate the following:

Based on the above information, what amount of income will be attributed to Sandra in the year ended 30 June 2020?

Based on the above information, what amount of income will be attributed to Sandra in the year ended 30 June 2020?

Based on the above information, what amount of income will be attributed to Sandra in the year ended 30 June 2020?

Based on the above information, what amount of income will be attributed to Sandra in the year ended 30 June 2020?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

24

Tim Rodgers, aged 64, is a resident and is married with children. Tim derived $85,000 in salary and received $5,300 in fully franked dividends during 2019-20 tax year. His deductions, which all relate to earning his salary, totalled $4,330. Tim's wife, Claire, who does not work and is in receipt of a disability support pension, had an adjusted taxable income of $7,200 (including the pension) for the 2019/20 tax year and was not entitled to, nor claimed, any family tax benefits. Tim has adequate private hospital health insurance cover. The tax paid during the 2019/20 tax year on Tim's salary totalled $19,172.

Based on this information, calculate Tim Rodger's taxable income and tax payable/refund for the tax year ended 30 June 2020

Based on this information, calculate Tim Rodger's taxable income and tax payable/refund for the tax year ended 30 June 2020

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck