Deck 14: Strategic Issues in Making Long-Term Capital Investment Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/97

Play

Full screen (f)

Deck 14: Strategic Issues in Making Long-Term Capital Investment Decisions

1

Strategic planning is the decisions that management makes on a daily basis.

False

2

Capital investment decisions should be not made within the context of an organization's strategic plans.

False

3

Organizations make three general types of long-term capital investments: 1) Replacements and minor improvements, 2) Expansion, and 3) Strategic moves.

True

4

Using time horizons that are too short is a potential difficulty in the justification of investments in high-tech projects.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

5

If past financial records are used to help determine the financial analysis for a project, the financial records should never be adjusted for inflation.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

6

The primary purpose of a due diligence investigation is to determine what long-term capital investments that a company should make.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

7

Using a discount rate that is too low is a potential difficulty in the justification of investments in high-tech projects.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

8

When making a decision for a strategic move, past financial records would tend to be very useful.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

9

Sensitivity analysis is the study of how the outcome of a decision-making process changes as one or more of the assumptions change.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

10

Sensitivity analysis is performed after the long-term investment decision has been made.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

11

Corporate managers can ignore the need to make environmentally friendly investment decisions.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

12

Audits of the decision and implementation of investment projects reveal how well the investment performed compared to expectations.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

13

Not-for-profit organizations do not have to consider tax effects on cash flows when determining capital investment decisions.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

14

Omitting certain data from capital investment proposals or making inaccurate projections are not ethical problems that may be encountered in capital investment decision making.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

15

Potential competitor actions should be ignored in strategic investment decisions because they cannot be known with certainty.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

16

Where the possibility of competitor reaction exist, an Expected Value Analysis Decision Tree should assign a value to a probability to possible reactions

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

17

Real option analysis recognizes that most investments decisions are not reversible at no cost

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

18

Discounted cash flow analysis uses cash flows, not the revenues and expenses computed using accrual accounting.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

19

The present value of receiving $1 each year for the next three years would be the less than receiving $3 at the end of three years.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

20

Tax credits effectively reduce the cost of making investments by decreasing the amount of taxes that a company has to pay.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

21

The present value of paying $12,000 in year 3 would be more than $12,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

22

If the net present value is zero, the internal rate of return will be the same as the discount rate used in determining net present value.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

23

The internal rate of return and the net present value methods will give the same accept/reject decision for the same project.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

24

If the discount rate used is increased, both the net present value and the internal rate of return will decrease.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

25

The internal rate of return method is generally considered to be a superior method to the net present value method.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

26

The time value of money is the concept that cash received later is worth more than cash received earlier.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

27

The discount rate takes risk but not inflation into account.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

28

If the net present value for a project is negative, that would also indicate that the internal rate of return must be negative.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

29

A due diligence investigation is considered most important for which of the following types of long term capital investment decisions?

A) Replacement and minor improvements

B) Expansion

C) Strategic moves

D) It would be equally important in all of the above investment decisions

A) Replacement and minor improvements

B) Expansion

C) Strategic moves

D) It would be equally important in all of the above investment decisions

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

30

For which of the following long term capital investment decisions would past financial records most likely not be useful for?

A) Replacement and minor improvements

B) Expansion

C) Strategic moves

D) It would likely be useful for all of the above

A) Replacement and minor improvements

B) Expansion

C) Strategic moves

D) It would likely be useful for all of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

31

For a long term capital investment decision that is classified as a strategic move, which of the following sources of information would likely be the most useful?

A) Financial records

B) Interviews with Operating and Marketing Personnel

C) Industry Data and Competitor Analysis

D) All of them would be equally useful

A) Financial records

B) Interviews with Operating and Marketing Personnel

C) Industry Data and Competitor Analysis

D) All of them would be equally useful

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following would not be a cause of difficulties in the justification of investments in high-tech projects?

A) Discount rate is too low

B) Time horizons that are too short

C) Exclusion of benefits that are difficult to quantify

D) All of the above are causes of difficulties

A) Discount rate is too low

B) Time horizons that are too short

C) Exclusion of benefits that are difficult to quantify

D) All of the above are causes of difficulties

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following would be nonfinancial factors to consider in a long-term capital investment decision?

A) Impact on employee morale

B) Impact on the environment

C) Ethical issues

D) All of the above

A) Impact on employee morale

B) Impact on the environment

C) Ethical issues

D) All of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

34

____is the study of how the outcome of a decision-making process changes as one or more of the assumptions change.

A) Capital budgeting

B) Long-term investment decisions

C) Sensitivity analysis

D) Strategic decision making

A) Capital budgeting

B) Long-term investment decisions

C) Sensitivity analysis

D) Strategic decision making

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

35

The installation of a more sophisticated inventory control system would be an example of what type of long-term capital investment?

A) Replacements and minor improvements

B) Expansion

C) Strategic moves

D) All of the above

A) Replacements and minor improvements

B) Expansion

C) Strategic moves

D) All of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following are ethical problems in capital investment decisions?

A) Misstating information used for decision making

B) Misstating results

C) Investing in unethical projects

D) All of the above

A) Misstating information used for decision making

B) Misstating results

C) Investing in unethical projects

D) All of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following organizations would not consider the tax shield from depreciation in determining capital investment proposals?

A) GM

B) Dell

C) United States Marines

D) All of the above would consider the tax shield from depreciation

A) GM

B) Dell

C) United States Marines

D) All of the above would consider the tax shield from depreciation

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

38

__________is the economic value of a project at a point in time.

A) Present value

B) Net present value

C) Discount rate

D) Future value

A) Present value

B) Net present value

C) Discount rate

D) Future value

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

39

The discount rate takes which of the following factors into consideration?

A) Risk

B) Inflation

C) Both of the above

D) None of the above

A) Risk

B) Inflation

C) Both of the above

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following would increase the net present value of a proposed investment?

A) Tax credits received from the new investment

B) Gain on the sale of old equipment

C) Both of the above

D) None of the above

A) Tax credits received from the new investment

B) Gain on the sale of old equipment

C) Both of the above

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

41

Without knowing a discount rate, which of the following would most likely represent the highest present value?

A) Present value of receiving $1 at the end of each year for three years

B) Present value of receiving $3 at the end of three years

C) Present value of receiving $1 at the end of each year for five years

D) Present value of receiving $5 at the end of five years

A) Present value of receiving $1 at the end of each year for three years

B) Present value of receiving $3 at the end of three years

C) Present value of receiving $1 at the end of each year for five years

D) Present value of receiving $5 at the end of five years

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

42

Without knowing any other information, which of the following projects would definitely be acceptable to invest in?

A) Project A has a positive net present value

B) Project B has a positive internal rate of return

C) Both of the above

D) None of the above

A) Project A has a positive net present value

B) Project B has a positive internal rate of return

C) Both of the above

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following could be calculated if the discount rate is not known?

A) Internal rate of return

B) Net present value

C) Both of the above

D) None of the above

A) Internal rate of return

B) Net present value

C) Both of the above

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following methods assumes that net cash inflows are reinvested at the predetermined discount rate?

A) Internal rate of return

B) Net present value

C) Both of the above

D) None of the above

A) Internal rate of return

B) Net present value

C) Both of the above

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

45

How would an increase in the discount rate used affect the net present value of a project proposal?

A) Increase

B) Decrease

C) Not affect

D) Cannot be determined

A) Increase

B) Decrease

C) Not affect

D) Cannot be determined

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

46

Lewington Corp. has purchased new equipment that cost $144,965. The equipment is expected to last three years and to provide cash inflows as follows:

Year 1 - $45,000

Year 2 - $60,000

Year 3 - ?

Assuming that the equipment will have an internal rate of return of 12%, what is the expected cash inflow for year 3?

A) $51,280

B) $80,000

C) $100,000

D) None of the above

Year 1 - $45,000

Year 2 - $60,000

Year 3 - ?

Assuming that the equipment will have an internal rate of return of 12%, what is the expected cash inflow for year 3?

A) $51,280

B) $80,000

C) $100,000

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

47

How would an increase in the discount rate used affect the internal rate of return of a project proposal?

A) Increase

B) Decrease

C) Not affect

D) Cannot be determined

A) Increase

B) Decrease

C) Not affect

D) Cannot be determined

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

48

How would an increase in the income tax rate affect the net present value of a project proposal?

A) Increase

B) Decrease

C) Not affect

D) Cannot be determined

A) Increase

B) Decrease

C) Not affect

D) Cannot be determined

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

49

How would an increase in the income tax rate affect the internal rate of return of a project proposal?

A) Increase

B) Decrease

C) Not affect

D) Cannot be determined

A) Increase

B) Decrease

C) Not affect

D) Cannot be determined

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

50

If the discount rate used is decreased, which of the following would increase?

A) Net present value

B) Internal rate of return

C) Both of the above

D) None of the above

A) Net present value

B) Internal rate of return

C) Both of the above

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

51

If the income tax rate is decreased, which of the following would increase?

A) Net present value

B) Internal rate of return

C) Both of the above

D) None of the above

A) Net present value

B) Internal rate of return

C) Both of the above

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following factors is generally not important when calculating a project's net present value? (CPA adapted)

A) Impact of the project on the income taxes to be paid

B) Method of financing the project under consideration

C) Timing of the cash flows relating to the project

D) Amount of cash flows relating to the project

A) Impact of the project on the income taxes to be paid

B) Method of financing the project under consideration

C) Timing of the cash flows relating to the project

D) Amount of cash flows relating to the project

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

53

For which of the following cash flow scenarios could the net present value method be used?

A) The cash flows are constant from period to period

B) The cash flows are uneven from period to period

C) Both of the above

D) None of the above

A) The cash flows are constant from period to period

B) The cash flows are uneven from period to period

C) Both of the above

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

54

Tracy Perry, the accountant for Levy Corp., calculated the net present value for a project proposal. In making the analysis, Ms. Perry assumed that cash inflows would occur at the end of the year, when the cash inflows actually occurred evenly during the year. How will the net present value be affected?

A) It will be overstated

B) It will be understated

C) It will not be affected

D) Cannot be determined

A) It will be overstated

B) It will be understated

C) It will not be affected

D) Cannot be determined

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

55

General Motors' decision to start Saturn would be an example of what type of long-term capital investment?

A) Replacements and minor improvements

B) Expansion

C) Strategic moves

D) All of the above

A) Replacements and minor improvements

B) Expansion

C) Strategic moves

D) All of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

56

A project should be invested in if:

A) The future value of the cash inflows is greater than the future value of the cash outflows

B) The future value of the cash inflows is less than the future value of the cash outflows

C) The present value of the cash inflows is greater than the present value of the cash outflows

D) The present value of the cash inflows is less than the present value of the cash outflows

A) The future value of the cash inflows is greater than the future value of the cash outflows

B) The future value of the cash inflows is less than the future value of the cash outflows

C) The present value of the cash inflows is greater than the present value of the cash outflows

D) The present value of the cash inflows is less than the present value of the cash outflows

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

57

When operating in an inflationary environment, what adjustment should be made to the discount rate used when calculating a project's net present value?

A) It should be increased

B) It should be decreased

C) It should not be changed

D) Cannot be determined

A) It should be increased

B) It should be decreased

C) It should not be changed

D) Cannot be determined

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following considers the time value of money?

A) Internal rate of return

B) Net present value

C) Both of the above

D) None of the above

A) Internal rate of return

B) Net present value

C) Both of the above

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

59

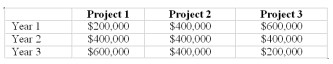

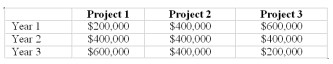

If Chung Corp. considers the time value of money in determining which project to invest in, which project represents the best investment?

The Chung Corp. is considering investing in three mutually exclusive projects. Each project will require a $200,000 initial investment and will provide cash flows as follows for a three-year period:

(Each project will not last beyond three years)

A) Project 1

B) Project 2

C) Project 3

D) All of them represent equally good investments

The Chung Corp. is considering investing in three mutually exclusive projects. Each project will require a $200,000 initial investment and will provide cash flows as follows for a three-year period:

(Each project will not last beyond three years)

A) Project 1

B) Project 2

C) Project 3

D) All of them represent equally good investments

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

60

If the net present value is zero and discount rate used is 12 percent, what is the internal rate of return?

A) Zero

B) Less than 12 percent

C) Equal to 12 percent

D) Greater than 12 percent

A) Zero

B) Less than 12 percent

C) Equal to 12 percent

D) Greater than 12 percent

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

61

Ping Inc. is considering an investment in automated equipment for the manufacturing process. The equipment will cost $210,000, have a useful life of five years, and generate after tax cash flows of $70,000 per year. What is the approximate internal rate of return?

A) 14%

B) 16%

C) 18%

D) 20%

A) 14%

B) 16%

C) 18%

D) 20%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

62

Use the following to answer questions:

Parker Industries is considering purchasing a new machine, instead of preparing its product by hand. The machine would cost $90,000. It would have a life of five years, but would require a $5,000 overhaul at the end of the third year. After five years, the machine could be sold for $15,000. The machine will cost $17,000 per year to operate. The company currently incurs a direct labor cost of $40,000 per year. This cost will not be incurred if the new machine is purchased. The machine will also allow the company to produce an additional 5,000 units per year. The company realizes a contribution margin of $0.70 per unit. Evans requires a 10% return on all investments in equipment. (Ignore taxes)

-What are the net annual cash inflows provided by the machine?

A) $ 3,500

B) $26,500

C) $43,500

D) None of the above

Parker Industries is considering purchasing a new machine, instead of preparing its product by hand. The machine would cost $90,000. It would have a life of five years, but would require a $5,000 overhaul at the end of the third year. After five years, the machine could be sold for $15,000. The machine will cost $17,000 per year to operate. The company currently incurs a direct labor cost of $40,000 per year. This cost will not be incurred if the new machine is purchased. The machine will also allow the company to produce an additional 5,000 units per year. The company realizes a contribution margin of $0.70 per unit. Evans requires a 10% return on all investments in equipment. (Ignore taxes)

-What are the net annual cash inflows provided by the machine?

A) $ 3,500

B) $26,500

C) $43,500

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

63

Use the following to answer questions:

Parker Industries is considering purchasing a new machine, instead of preparing its product by hand. The machine would cost $90,000. It would have a life of five years, but would require a $5,000 overhaul at the end of the third year. After five years, the machine could be sold for $15,000. The machine will cost $17,000 per year to operate. The company currently incurs a direct labor cost of $40,000 per year. This cost will not be incurred if the new machine is purchased. The machine will also allow the company to produce an additional 5,000 units per year. The company realizes a contribution margin of $0.70 per unit. Evans requires a 10% return on all investments in equipment. (Ignore taxes)

-What is the approximate net present value?

A) $80,450

B) $16,000

C) $2,750

D) $(135,600)

Parker Industries is considering purchasing a new machine, instead of preparing its product by hand. The machine would cost $90,000. It would have a life of five years, but would require a $5,000 overhaul at the end of the third year. After five years, the machine could be sold for $15,000. The machine will cost $17,000 per year to operate. The company currently incurs a direct labor cost of $40,000 per year. This cost will not be incurred if the new machine is purchased. The machine will also allow the company to produce an additional 5,000 units per year. The company realizes a contribution margin of $0.70 per unit. Evans requires a 10% return on all investments in equipment. (Ignore taxes)

-What is the approximate net present value?

A) $80,450

B) $16,000

C) $2,750

D) $(135,600)

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

64

Use the following to answer questions:

Parker Industries is considering purchasing a new machine, instead of preparing its product by hand. The machine would cost $90,000. It would have a life of five years, but would require a $5,000 overhaul at the end of the third year. After five years, the machine could be sold for $15,000. The machine will cost $17,000 per year to operate. The company currently incurs a direct labor cost of $40,000 per year. This cost will not be incurred if the new machine is purchased. The machine will also allow the company to produce an additional 5,000 units per year. The company realizes a contribution margin of $0.70 per unit. Evans requires a 10% return on all investments in equipment. (Ignore taxes)

-The internal rate of return for the machine would be:

A) Zero

B) Less than 10 percent

C) Greater than 10 percent

D) Equal to 10 percent

Parker Industries is considering purchasing a new machine, instead of preparing its product by hand. The machine would cost $90,000. It would have a life of five years, but would require a $5,000 overhaul at the end of the third year. After five years, the machine could be sold for $15,000. The machine will cost $17,000 per year to operate. The company currently incurs a direct labor cost of $40,000 per year. This cost will not be incurred if the new machine is purchased. The machine will also allow the company to produce an additional 5,000 units per year. The company realizes a contribution margin of $0.70 per unit. Evans requires a 10% return on all investments in equipment. (Ignore taxes)

-The internal rate of return for the machine would be:

A) Zero

B) Less than 10 percent

C) Greater than 10 percent

D) Equal to 10 percent

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

65

Use the following to answer questions:

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

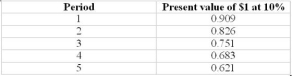

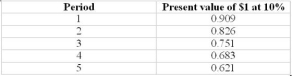

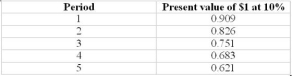

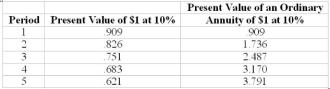

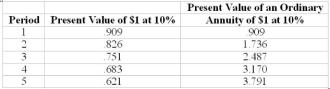

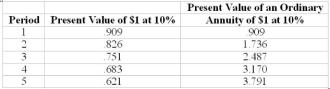

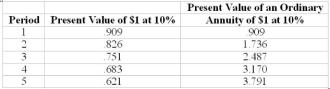

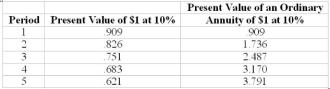

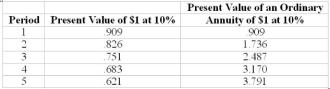

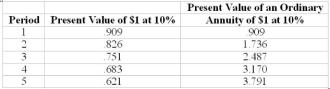

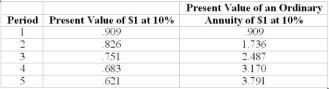

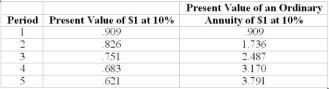

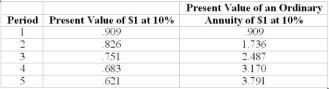

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-Steinberg Industries discounted annual depreciation tax shield is:

A) $10,000

B) $11,400

C) $15,200

D) $38,000

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-Steinberg Industries discounted annual depreciation tax shield is:

A) $10,000

B) $11,400

C) $15,200

D) $38,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

66

Use the following to answer questions:

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

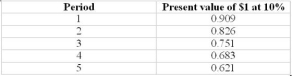

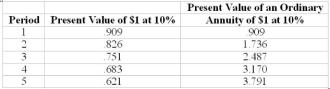

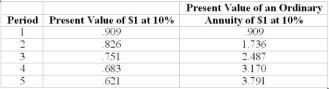

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-The acquisition of the new production machine by Steinberg Industries will contribute a discounted net-of-tax contribution margin of:

A) $200,000

B) $120,000

C) $758,200

D) $454,920

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-The acquisition of the new production machine by Steinberg Industries will contribute a discounted net-of-tax contribution margin of:

A) $200,000

B) $120,000

C) $758,200

D) $454,920

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

67

Use the following to answer questions:

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

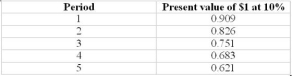

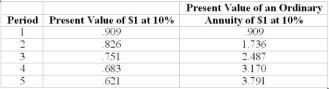

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-The overall discounted cash flow impact of Steinberg Industries' working capital investment for the new production machine would be:

A) $(24,840)

B) $(10,080)

C) $(15,160)

D) $(40,000)

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-The overall discounted cash flow impact of Steinberg Industries' working capital investment for the new production machine would be:

A) $(24,840)

B) $(10,080)

C) $(15,160)

D) $(40,000)

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

68

Use the following to answer questions:

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

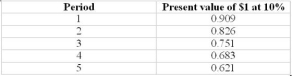

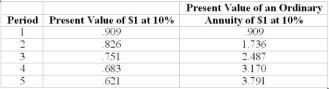

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-What is the after-tax present value of the sale of the machine for $20,000 in five years?

A) $ 7,452

B) $12,000

C) $12,420

D) $20,000

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-What is the after-tax present value of the sale of the machine for $20,000 in five years?

A) $ 7,452

B) $12,000

C) $12,420

D) $20,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following to answer questions:

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-The net present value of the machine is

A) $223,740

B) $314,831

C) $276,841

D) ($415,555)

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-The net present value of the machine is

A) $223,740

B) $314,831

C) $276,841

D) ($415,555)

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

70

Use the following to answer questions:

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-The internal rate of return for the machine is:

A) Less than 10%

B) Equal to 10%

C) More than 10%

D) Cannot be determined

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

? The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

? The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

? The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

? Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

? Steinberg is subject to a 40% income tax rate.

? Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

? Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-The internal rate of return for the machine is:

A) Less than 10%

B) Equal to 10%

C) More than 10%

D) Cannot be determined

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

71

Use the following to answer questions:

Exron Corp. is considering the purchase of a new machine costing $300,000. The new machine will expand Exron's sales capacity and provide $90,000 in additional cash flows (before taxes) over the next five years. The company has decided to depreciate the machine using the straight-line method and no salvage value. At the end of the five years, Exron expects to sell the machine for $20,000.

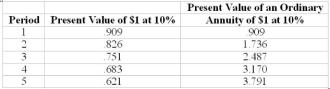

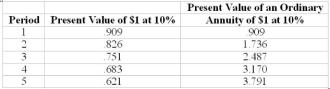

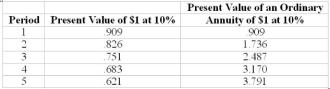

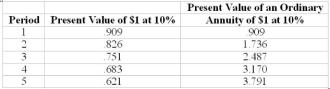

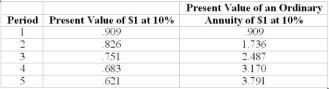

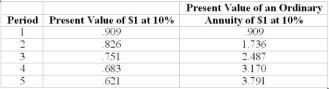

Exron has a 40% tax rate and uses a 10% discount rate to evaluate the purchase of new machines.

-What is the after-tax present value of the sale of the machine in five years?

A) $ 7,452

B) $12,000

C) $12,420

D) $20,000

Exron Corp. is considering the purchase of a new machine costing $300,000. The new machine will expand Exron's sales capacity and provide $90,000 in additional cash flows (before taxes) over the next five years. The company has decided to depreciate the machine using the straight-line method and no salvage value. At the end of the five years, Exron expects to sell the machine for $20,000.

Exron has a 40% tax rate and uses a 10% discount rate to evaluate the purchase of new machines.

-What is the after-tax present value of the sale of the machine in five years?

A) $ 7,452

B) $12,000

C) $12,420

D) $20,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

72

Use the following to answer questions:

Exron Corp. is considering the purchase of a new machine costing $300,000. The new machine will expand Exron's sales capacity and provide $90,000 in additional cash flows (before taxes) over the next five years. The company has decided to depreciate the machine using the straight-line method and no salvage value. At the end of the five years, Exron expects to sell the machine for $20,000.

Exron has a 40% tax rate and uses a 10% discount rate to evaluate the purchase of new machines.

-What is the present value of the machine's depreciation tax shield?

A) $ 90,984

B) $120,000

C) $136,476

D) None of the above

Exron Corp. is considering the purchase of a new machine costing $300,000. The new machine will expand Exron's sales capacity and provide $90,000 in additional cash flows (before taxes) over the next five years. The company has decided to depreciate the machine using the straight-line method and no salvage value. At the end of the five years, Exron expects to sell the machine for $20,000.

Exron has a 40% tax rate and uses a 10% discount rate to evaluate the purchase of new machines.

-What is the present value of the machine's depreciation tax shield?

A) $ 90,984

B) $120,000

C) $136,476

D) None of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

73

Use the following to answer questions:

Exron Corp. is considering the purchase of a new machine costing $300,000. The new machine will expand Exron's sales capacity and provide $90,000 in additional cash flows (before taxes) over the next five years. The company has decided to depreciate the machine using the straight-line method and no salvage value. At the end of the five years, Exron expects to sell the machine for $20,000.

Exron has a 40% tax rate and uses a 10% discount rate to evaluate the purchase of new machines.

-What is the after-tax present value of the net cash inflows generated by the new machine?

A) $136,476

B) $204,714

C) $270,000

D) $450,000

Exron Corp. is considering the purchase of a new machine costing $300,000. The new machine will expand Exron's sales capacity and provide $90,000 in additional cash flows (before taxes) over the next five years. The company has decided to depreciate the machine using the straight-line method and no salvage value. At the end of the five years, Exron expects to sell the machine for $20,000.

Exron has a 40% tax rate and uses a 10% discount rate to evaluate the purchase of new machines.

-What is the after-tax present value of the net cash inflows generated by the new machine?

A) $136,476

B) $204,714

C) $270,000

D) $450,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

74

Use the following to answer questions:

Exron Corp. is considering the purchase of a new machine costing $300,000. The new machine will expand Exron's sales capacity and provide $90,000 in additional cash flows (before taxes) over the next five years. The company has decided to depreciate the machine using the straight-line method and no salvage value. At the end of the five years, Exron expects to sell the machine for $20,000.

Exron has a 40% tax rate and uses a 10% discount rate to evaluate the purchase of new machines.

-What is the machine's net present value?

A) $0

B) $(43,524)

C) $3,150

D) $28,478

Exron Corp. is considering the purchase of a new machine costing $300,000. The new machine will expand Exron's sales capacity and provide $90,000 in additional cash flows (before taxes) over the next five years. The company has decided to depreciate the machine using the straight-line method and no salvage value. At the end of the five years, Exron expects to sell the machine for $20,000.

Exron has a 40% tax rate and uses a 10% discount rate to evaluate the purchase of new machines.

-What is the machine's net present value?

A) $0

B) $(43,524)

C) $3,150

D) $28,478

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

75

Petzall Corp. incurred a $9,000 tax liability on the sale of an old machine. The before-tax gain or loss is equal to 10% of the sale price of the machine. If Petzall's income tax rate is 30%, what was the book value of the machine before it was sold?

A) $ 60,000

B) $240,000

C) $270,000

D) $300,000

A) $ 60,000

B) $240,000

C) $270,000

D) $300,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

76

Which one of the following would not be a primary area investigated in a due diligence investigation?

A) Legal

B) Financial

C) Environmental

D) Public relations

A) Legal

B) Financial

C) Environmental

D) Public relations

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

77

When analyzing investment options, managers should consider

A) Natural Events

B) Economic Events

C) Social and political events

D) All of the Above

A) Natural Events

B) Economic Events

C) Social and political events

D) All of the Above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

78

A Real Option Value Decision Tree will typically include a specific reference to

A) An analysis of the cost of capital

B) Competitor Reaction

C) The probability of income tax changes

D) Cash Flows before discounting

A) An analysis of the cost of capital

B) Competitor Reaction

C) The probability of income tax changes

D) Cash Flows before discounting

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

79

When reviewing an analysis of investment decisions utilizing the Real Option Value computation, managers should be aware that the

A) The information may be misstated due to personal bias of the preparer

B) The information may be misstated due to incorrect information

C) The information may be misstated due to incorrect assumptions

D) All of the above

A) The information may be misstated due to personal bias of the preparer

B) The information may be misstated due to incorrect information

C) The information may be misstated due to incorrect assumptions

D) All of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

80

To analyze strategic decisions, real option value analysis combines which of the following:

A) Decision-tree representation of management flexibility

B) Net present value analysis

C) Expected value analysis

D) All of the above

A) Decision-tree representation of management flexibility

B) Net present value analysis

C) Expected value analysis

D) All of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck