Deck 10: Managing and Allocating Support-Service Costs

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

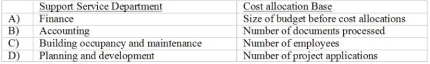

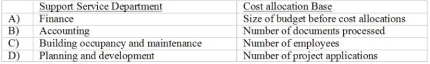

Question

Question

Question

Question

Question

Question

Question

Question

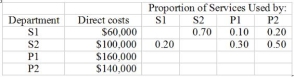

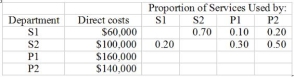

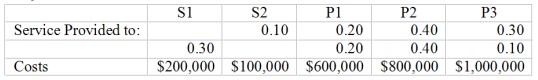

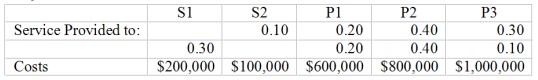

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/80

Play

Full screen (f)

Deck 10: Managing and Allocating Support-Service Costs

1

Support-service department costs are usually facility-level resource decisions.

True

2

Without allocation of service department costs to users, service departments will tend to grow uncontrollably.

True

3

Few companies allocate the cost of corporate headquarters to divisions because the allocations cause low morale for employees.

False

4

If internal customers are required to use internal services, they might spend valuable time negotiating and lobbying over fair prices, resulting in internal inefficiencies.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

5

Using multiple cost pools usually results in better decisions about the use of service resources than single cost pools.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

6

Using fewer cost pools will generally result in cost allocations that match resource use better than using multiple cost pools.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

7

An advantage of the Activity-Based-Costing approach to developing cost pools is that it is cheaper and easier to apply than traditional methods.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

8

In order for allocations to be fair to all departments, all resources should be allocated to user departments, whether or not they were consumed by the departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

9

The use of support-service department resources is not necessarily the same as the supply of those resources.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

10

The space occupied by a department would be an appropriate cost allocation base for allocating the cost of the accounting department to other departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

11

The number of employees in a department would be an appropriate cost allocation base of allocating the Personnel Department cost to other departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

12

Square footage occupied would be an appropriate way to allocate building insurance cost to user departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

13

Occupancy related support-service costs are most appropriately allocated using a space occupied type of cost-allocation base.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

14

The value of equipment would be an appropriate cost allocation base for allocating the cost of insurance on equipment.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

15

The number of machine hours would be an appropriate cost allocation base for allocating the cost of maintenance on equipment.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

16

The direct method of cost allocation allocates the cost of support-service departments to all departments including other service departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

17

The direct method of cost allocation charges cost of support-service departments to internal customers without making allocations among service departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

18

The direct method ignores services provided by one support service department to another.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

19

The step method of allocation ignores services provided by one support service department to another.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

20

Step method allocations usually begin with the service department with the largest proportion of its total allocation base in other service departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

21

The step method ignores any services provided to the largest service department from other service departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

22

The step order in the step method is from least general service department to most general service department.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

23

The step method considers all interactions among service departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

24

The direct-method ignores interactions among service departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

25

When using the step-method of allocation, once the organization makes an allocation from a support-service department, no subsequent allocations are made back to that department.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

26

Under-the step method of allocation, the final amount allocated to any user department depends on the order in which the allocation is made from the service departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

27

Activity-Based-Costing (ABC) cost drivers should reflect cause and effect relations between resource spending and use.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

28

Accuracy should be the only consideration in choosing the appropriate approach for allocating support service costs.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

29

While costly to set up, once implemented, a complex cost allocation system is inexpensive to maintain.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

30

The reciprocal method of cost allocation recognizes and allocates costs of all services provided by any support-service department, including those provided to other service departments.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

31

The equation used to represent total departmental costs using the reciprocal method is: total department costs equals direct costs of the department minus the service costs to be allocated to the department.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is not an appropriate justification for allocating support-service costs?

A) To influence department managers' behavior

B) To minimize total internal accounting costs

C) To facilitate the organization's budgeting for charges and revenues

D) To comply with tax regulations

A) To influence department managers' behavior

B) To minimize total internal accounting costs

C) To facilitate the organization's budgeting for charges and revenues

D) To comply with tax regulations

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is the first step in the process of allocating service costs?

A) Choose the appropriate cost-allocation base(s) and rate(s)

B) Determine whether the cost allocations achieve the desired results

C) Select and use a cost-allocation method

D) Identify the costs to be allocated to internal customers

A) Choose the appropriate cost-allocation base(s) and rate(s)

B) Determine whether the cost allocations achieve the desired results

C) Select and use a cost-allocation method

D) Identify the costs to be allocated to internal customers

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is true regarding the use of multiple cost-pools?

A) Organizations might implement multiple cost pools when the uses of the service resources have both facility-level and unit-level components

B) Designing and maintaining multiple cost pools is a relatively simple undertaking

C) The benefits of using multiple cost pools always outweigh the costs of setting them up

D) Both resources supplied and resources used are allocated with multiple cost pools

A) Organizations might implement multiple cost pools when the uses of the service resources have both facility-level and unit-level components

B) Designing and maintaining multiple cost pools is a relatively simple undertaking

C) The benefits of using multiple cost pools always outweigh the costs of setting them up

D) Both resources supplied and resources used are allocated with multiple cost pools

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following would not be an appropriate cost-allocation base for the Personnel department costs?

A) Space occupied

B) Number of employees

C) Total payroll dollars in department using the equipment

D) Labor hours

A) Space occupied

B) Number of employees

C) Total payroll dollars in department using the equipment

D) Labor hours

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following would not be an appropriate cost-allocation base for allocating the cost of the corporate library in a consulting company with multiple divisions?

A) Number of employees employed in each division

B) Square footage occupied by each division

C) Cost of periodicals ordered by each division

D) Number of consultants employed in each division

A) Number of employees employed in each division

B) Square footage occupied by each division

C) Cost of periodicals ordered by each division

D) Number of consultants employed in each division

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following shows an inappropriate cost allocation base?

A) Item A

B) Item B

C) Item C

D) Item D

A) Item A

B) Item B

C) Item C

D) Item D

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

38

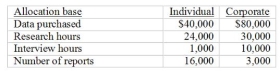

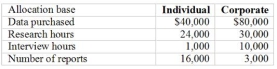

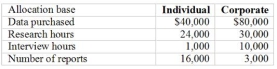

Use the following to answer questions:

Sovereign Credit Checks produces two styles of credit reports: Individual and Corporate. The difference between the two is the amount of background information and data collection required. The Corporate report uses more skilled personnel because additional checking and data are required. The relevant figures for the year just completed follow: Total support service costs to be allocated are $3,200,000.

-Which cost-allocation based would the manager of the Individual Department prefer the most?

A) Data purchased

B) Research hours

C) Interview hours

D) Number of reports

Sovereign Credit Checks produces two styles of credit reports: Individual and Corporate. The difference between the two is the amount of background information and data collection required. The Corporate report uses more skilled personnel because additional checking and data are required. The relevant figures for the year just completed follow: Total support service costs to be allocated are $3,200,000.

-Which cost-allocation based would the manager of the Individual Department prefer the most?

A) Data purchased

B) Research hours

C) Interview hours

D) Number of reports

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

39

Use the following to answer questions:

Sovereign Credit Checks produces two styles of credit reports: Individual and Corporate. The difference between the two is the amount of background information and data collection required. The Corporate report uses more skilled personnel because additional checking and data are required. The relevant figures for the year just completed follow: Total support service costs to be allocated are $3,200,000.

-The manager of the Corporate Report Department would least prefer which method of allocation?

A) Data purchased

B) Research hours

C) Interview hours

D) Number of reports

Sovereign Credit Checks produces two styles of credit reports: Individual and Corporate. The difference between the two is the amount of background information and data collection required. The Corporate report uses more skilled personnel because additional checking and data are required. The relevant figures for the year just completed follow: Total support service costs to be allocated are $3,200,000.

-The manager of the Corporate Report Department would least prefer which method of allocation?

A) Data purchased

B) Research hours

C) Interview hours

D) Number of reports

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

40

Use the following to answer questions:

Sovereign Credit Checks produces two styles of credit reports: Individual and Corporate. The difference between the two is the amount of background information and data collection required. The Corporate report uses more skilled personnel because additional checking and data are required. The relevant figures for the year just completed follow: Total support service costs to be allocated are $3,200,000.

-If service costs are allocated according to the number of reports, the service department cost to be allocated to the Individual report department will be:

A) $2,694,737

B) $505,263

C) $1,066,667

D) $290,909

Sovereign Credit Checks produces two styles of credit reports: Individual and Corporate. The difference between the two is the amount of background information and data collection required. The Corporate report uses more skilled personnel because additional checking and data are required. The relevant figures for the year just completed follow: Total support service costs to be allocated are $3,200,000.

-If service costs are allocated according to the number of reports, the service department cost to be allocated to the Individual report department will be:

A) $2,694,737

B) $505,263

C) $1,066,667

D) $290,909

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

41

Use the following to answer questions:

Sovereign Credit Checks produces two styles of credit reports: Individual and Corporate. The difference between the two is the amount of background information and data collection required. The Corporate report uses more skilled personnel because additional checking and data are required. The relevant figures for the year just completed follow: Total support service costs to be allocated are $3,200,000.

-If service department costs are allocated by data purchased, the Corporate report department will receive an allocation of:

A) $1,777,778

B) $1,066,667

C) $505,263

D) $2,133,333

Sovereign Credit Checks produces two styles of credit reports: Individual and Corporate. The difference between the two is the amount of background information and data collection required. The Corporate report uses more skilled personnel because additional checking and data are required. The relevant figures for the year just completed follow: Total support service costs to be allocated are $3,200,000.

-If service department costs are allocated by data purchased, the Corporate report department will receive an allocation of:

A) $1,777,778

B) $1,066,667

C) $505,263

D) $2,133,333

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

42

Mansfield River Corporation maintains computer equipment and provides services in all 50 states and in 20 countries. The Corporation has a fleet of 3 Corporate Jets and 2 Helicopters and employs 6 full time pilots who receive salary and benefits. The most appropriate way to allocate the total cost of the corporate jets, helicopters and pilots to individual user departments would be:

A) Number of trips taken by each department

B) Sales revenue generated by each department

C) Number of miles flown by each department

D) Number of employees in each department

A) Number of trips taken by each department

B) Sales revenue generated by each department

C) Number of miles flown by each department

D) Number of employees in each department

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is not a recognized method of allocating costs of service departments to user departments?

A) The direct method

B) The reciprocal method

C) The labor hours method

D) The step method

A) The direct method

B) The reciprocal method

C) The labor hours method

D) The step method

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements regarding cost allocations isFalse?

A) Organizations might implement multiple cost pools when uses of service departments have both facility and unit level components

B) Using more cost pools should result in cost allocations that match resource use better than using fewer cost pools

C) All resources consumed in the organization should be allocated to service departments, regardless of whether service departments use the resources or not

D) Design and maintenance of a complex cost allocation system can be costly

A) Organizations might implement multiple cost pools when uses of service departments have both facility and unit level components

B) Using more cost pools should result in cost allocations that match resource use better than using fewer cost pools

C) All resources consumed in the organization should be allocated to service departments, regardless of whether service departments use the resources or not

D) Design and maintenance of a complex cost allocation system can be costly

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

45

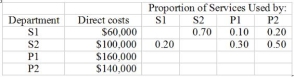

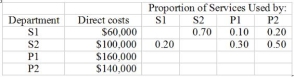

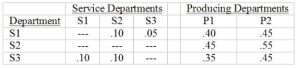

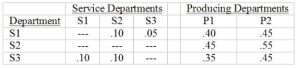

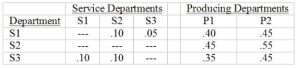

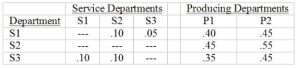

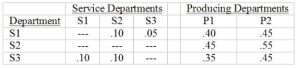

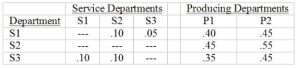

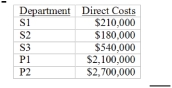

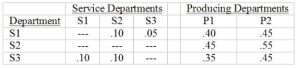

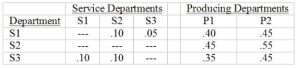

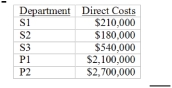

Use the following to answer questions:

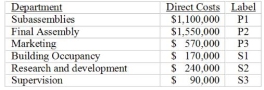

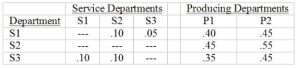

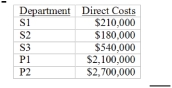

Brandeis Corporation has two production Departments: P1 and P2 and two service departments: S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows:

-Under the step-method of allocation, the total amount of service costs allocated to producing departments would be:

A) $118,000

B) $160,000

C) $140,000

D) $40,000

Brandeis Corporation has two production Departments: P1 and P2 and two service departments: S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows:

-Under the step-method of allocation, the total amount of service costs allocated to producing departments would be:

A) $118,000

B) $160,000

C) $140,000

D) $40,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

46

Use the following to answer questions:

Brandeis Corporation has two production Departments: P1 and P2 and two service departments: S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows:

-Under the step-method of allocation, the total departmental budget for P2 after all allocations have been made will be:

A) $12,000

B) $152,000

C) $240,750

D) $219,250

Brandeis Corporation has two production Departments: P1 and P2 and two service departments: S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows:

-Under the step-method of allocation, the total departmental budget for P2 after all allocations have been made will be:

A) $12,000

B) $152,000

C) $240,750

D) $219,250

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

47

What is the amount of maintenance that would be allocated to the machining department, assuming Hampton uses the step-method to allocate the costs of service departments?

A) $216,000

B) $262,667

C) $315,200

D) $327,520

A) $216,000

B) $262,667

C) $315,200

D) $327,520

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

48

What is the amount of total service costs allocated to the assembly department, assuming Hampton uses the step-method to allocate the costs of service departments?

A) $151,666

B) $171,583

C) $129,000

D) $551,583

A) $151,666

B) $171,583

C) $129,000

D) $551,583

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

49

What will be the total costs of the machining department, assuming Hampton uses the step-method to allocate the costs of service departments?

A) $486,320

B) $551,583

C) $458,333

D) $758,417

A) $486,320

B) $551,583

C) $458,333

D) $758,417

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

50

What is the amount of supervision that would be allocated to the machining department, assuming Hampton uses the direct-method to allocate the costs of service departments?

A) $72,000

B) $93,333

C) $90,000

D) $80,000

A) $72,000

B) $93,333

C) $90,000

D) $80,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

51

What is the total amount of service department costs that would be allocated to the assembly department, assuming Hampton uses the direct-method to allocate the service department costs?

A) $187,000

B) $165,000

C) $171,583

D) $136,334

A) $187,000

B) $165,000

C) $171,583

D) $136,334

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

52

What will be the difference in the total service department costs allocated between the step-method and the direct-method?

A) The step method results in more total cost being allocated to producing departments

B) The direct method results in more total cost being allocated to producing departments

C) There is no difference in the amount of total cost being allocated to producing departments

D) The answer depends on how many service departments are allocated

A) The step method results in more total cost being allocated to producing departments

B) The direct method results in more total cost being allocated to producing departments

C) There is no difference in the amount of total cost being allocated to producing departments

D) The answer depends on how many service departments are allocated

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

53

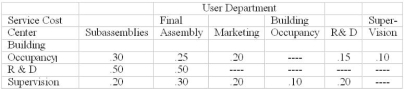

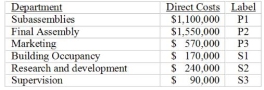

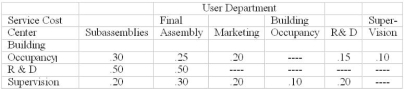

Use the following to answer questions:

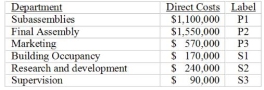

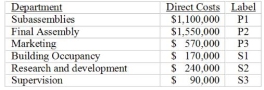

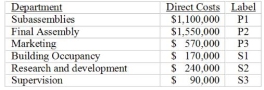

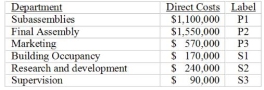

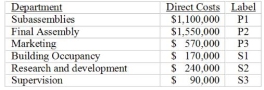

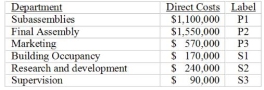

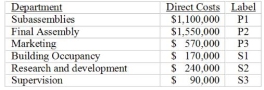

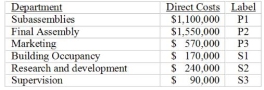

The following costs were incurred in three operating departments and three service departments in

Gagetown Molding Company:

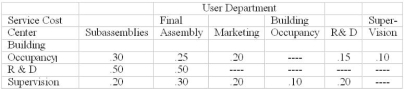

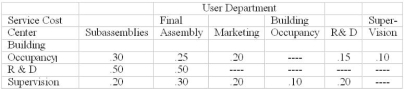

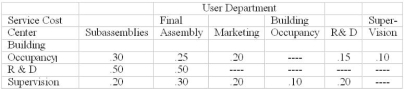

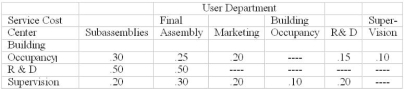

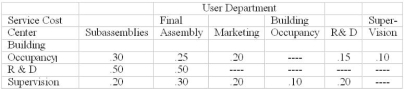

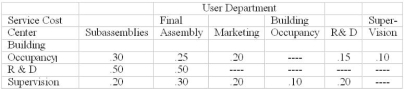

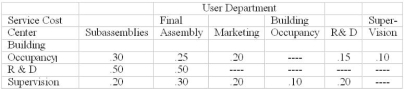

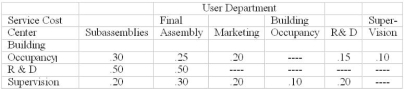

The use of services by other departments is as follows:

The following questions refer to a system of simultaneous linear equations that allocate costs using the reciprocal method.

-The equation for department P1 (subassemblies) is

A) P1 = $1,100,000 + .25P2 + .20P3+ .15S2 + .10S3

B) P1 = $1,100,000 + .30S1 + .50S2 + .20S3

C) P1 = $.30S1 +.50S2 + .20S3

D) P1 = .30S1 + .50S

The following costs were incurred in three operating departments and three service departments in

Gagetown Molding Company:

The use of services by other departments is as follows:

The following questions refer to a system of simultaneous linear equations that allocate costs using the reciprocal method.

-The equation for department P1 (subassemblies) is

A) P1 = $1,100,000 + .25P2 + .20P3+ .15S2 + .10S3

B) P1 = $1,100,000 + .30S1 + .50S2 + .20S3

C) P1 = $.30S1 +.50S2 + .20S3

D) P1 = .30S1 + .50S

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

54

Use the following to answer questions:

The following costs were incurred in three operating departments and three service departments in

Gagetown Molding Company:

The use of services by other departments is as follows:

The following questions refer to a system of simultaneous linear equations that allocate costs using the reciprocal method.

-The equation for department P2 (final assembly) is:

A) P2 = .25S1 + .50S2 + .30S3

B) P2= $1,550,000 + .25P2 + .20P3 + .15S2 + .10S3

C) P2 = $1,550,000 + .30S1+ .50S2 + .20S3

D) P2 = $1,550,000 + .25S1 + .50S2 + .30S3

The following costs were incurred in three operating departments and three service departments in

Gagetown Molding Company:

The use of services by other departments is as follows:

The following questions refer to a system of simultaneous linear equations that allocate costs using the reciprocal method.

-The equation for department P2 (final assembly) is:

A) P2 = .25S1 + .50S2 + .30S3

B) P2= $1,550,000 + .25P2 + .20P3 + .15S2 + .10S3

C) P2 = $1,550,000 + .30S1+ .50S2 + .20S3

D) P2 = $1,550,000 + .25S1 + .50S2 + .30S3

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

55

Use the following to answer questions:

The following costs were incurred in three operating departments and three service departments in

Gagetown Molding Company:

The use of services by other departments is as follows:

The following questions refer to a system of simultaneous linear equations that allocate costs using the reciprocal method.

-The equation for Department P3 (marketing) is:

A) P3= $570,000 + .20S1 + .20S3

B) P3 = $570,000 + .20S1 + .60S2 + .20S3

C) P3 = $570,000 + .20S1 + .20S2 + .60S3

D) P3 = $570,000 + .50S1 + .50S2

The following costs were incurred in three operating departments and three service departments in

Gagetown Molding Company:

The use of services by other departments is as follows:

The following questions refer to a system of simultaneous linear equations that allocate costs using the reciprocal method.

-The equation for Department P3 (marketing) is:

A) P3= $570,000 + .20S1 + .20S3

B) P3 = $570,000 + .20S1 + .60S2 + .20S3

C) P3 = $570,000 + .20S1 + .20S2 + .60S3

D) P3 = $570,000 + .50S1 + .50S2

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

56

Use the following to answer questions:

The following costs were incurred in three operating departments and three service departments in

Gagetown Molding Company:

The use of services by other departments is as follows:

The following questions refer to a system of simultaneous linear equations that allocate costs using the reciprocal method.

-The equation for Department S1 (Building occupancy) is:

A) S1= .10S3

B) S1 = $170,000 + 1.00S3

C) S1= $170,000 + .10S3

D) S1 = $170,000 + .90S2 + .10S3

The following costs were incurred in three operating departments and three service departments in

Gagetown Molding Company:

The use of services by other departments is as follows:

The following questions refer to a system of simultaneous linear equations that allocate costs using the reciprocal method.

-The equation for Department S1 (Building occupancy) is:

A) S1= .10S3

B) S1 = $170,000 + 1.00S3

C) S1= $170,000 + .10S3

D) S1 = $170,000 + .90S2 + .10S3

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

57

Use the following to answer questions:

The following costs were incurred in three operating departments and three service departments in

Gagetown Molding Company:

The use of services by other departments is as follows:

The following questions refer to a system of simultaneous linear equations that allocate costs using the reciprocal method.

-The equation for Department S2 (Research and Development) is:

A) S2 = $240,000 + .15S1 + .65S2 + .20S3

B) S2 = .15S1 + .20S3

C) S2= $240,000 + .15S1 + .20S3

D) S2 = $240,000 + .40S1 + .60S3

The following costs were incurred in three operating departments and three service departments in

Gagetown Molding Company:

The use of services by other departments is as follows:

The following questions refer to a system of simultaneous linear equations that allocate costs using the reciprocal method.

-The equation for Department S2 (Research and Development) is:

A) S2 = $240,000 + .15S1 + .65S2 + .20S3

B) S2 = .15S1 + .20S3

C) S2= $240,000 + .15S1 + .20S3

D) S2 = $240,000 + .40S1 + .60S3

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

58

The equation for Department S3 (Supervision) is:

A) S3 = $90,000 + .90S1 + .10S2

B) S3 = $90,000 + .10S1 + .20S2

C) S3 = $90,000 + 1.00S1

D) S3 = $90,000 +.10S1

A) S3 = $90,000 + .90S1 + .10S2

B) S3 = $90,000 + .10S1 + .20S2

C) S3 = $90,000 + 1.00S1

D) S3 = $90,000 +.10S1

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

59

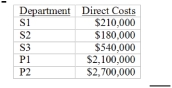

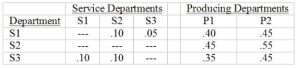

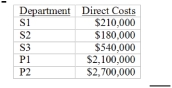

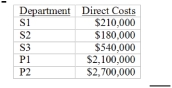

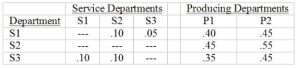

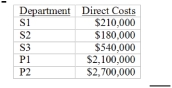

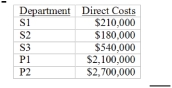

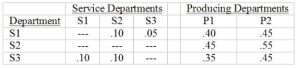

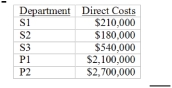

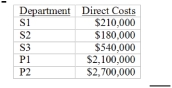

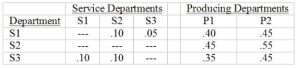

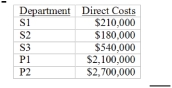

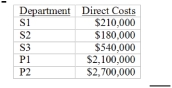

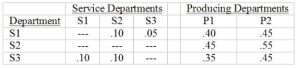

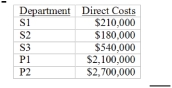

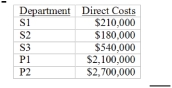

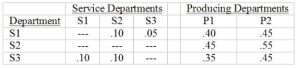

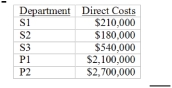

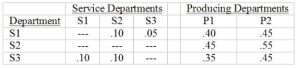

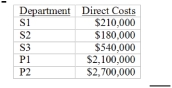

Use the following to answer questions:

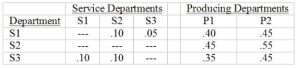

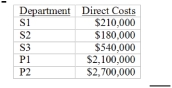

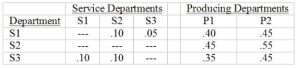

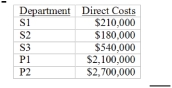

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the direct-method is used, how much of S1's costs would be allocated to S2?

A) $0

B) $21,000

C) $42,000

D) $31,500

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the direct-method is used, how much of S1's costs would be allocated to S2?

A) $0

B) $21,000

C) $42,000

D) $31,500

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following to answer questions:

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the direct-method of allocation is used, how much of S3's occupancy cost would be allocated to P2?

A) $297,000

B) $236,250

C) $303,750

D) $243,000

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the direct-method of allocation is used, how much of S3's occupancy cost would be allocated to P2?

A) $297,000

B) $236,250

C) $303,750

D) $243,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

61

Use the following to answer questions:

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-Assuming the direct-method of allocation is used, what will be the total costs in production department 1 after all allocations have been made?

A) $2,516,074

B) $2,454,000

C) $3,213,926

D) $2,572,056

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-Assuming the direct-method of allocation is used, what will be the total costs in production department 1 after all allocations have been made?

A) $2,516,074

B) $2,454,000

C) $3,213,926

D) $2,572,056

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

62

Use the following to answer questions:

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-In what order should the three service departments be allocated, assuming the step-method is used?

A) S3-S2-S1

B) S3-S1-S2

C) S2-S1-S3

D) S2-S3-S1

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-In what order should the three service departments be allocated, assuming the step-method is used?

A) S3-S2-S1

B) S3-S1-S2

C) S2-S1-S3

D) S2-S3-S1

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

63

Use the following to answer questions:

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the step-method of allocation is used, how much would be allocated from S1 to P1?

A) $55,579

B) $84,000

C) $105,600

D) $95,790

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the step-method of allocation is used, how much would be allocated from S1 to P1?

A) $55,579

B) $84,000

C) $105,600

D) $95,790

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

64

Use the following to answer questions:

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the step-method of allocation is used, how much would be allocated from S1 to S3?

A) $10,500

B) $0

C) $13,200

D) $15,700

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the step-method of allocation is used, how much would be allocated from S1 to S3?

A) $10,500

B) $0

C) $13,200

D) $15,700

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

65

Use the following to answer questions:

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the step-method of allocation is used, the total cost after allocation in P1 would be:

A) $2,516,074

B) $2,454,000

C) $2,517,963

D) $2,572,056

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the step-method of allocation is used, the total cost after allocation in P1 would be:

A) $2,516,074

B) $2,454,000

C) $2,517,963

D) $2,572,056

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

66

Use the following to answer questions:

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the step-method of allocation is used, the amount allocated from S2 to P2 would be:

A) $303,750

B) $143,984

C) $258,450

D) $320,186

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the step-method of allocation is used, the amount allocated from S2 to P2 would be:

A) $303,750

B) $143,984

C) $258,450

D) $320,186

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

67

Use the following to answer questions:

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the reciprocal-method of allocation is used, what equation would represent service department S1?

A) S1= $210,000 + .10S2 + .05S3 + .4P1 + .45P2

B) S1= $210,000 + .45P1 + .55P2

C) S1= $210,000 + .10S2+ .05S3

D) S1= $210,000 + .10S2 + .10S3

A summary of the usage of the service department services by other services departments as well as by two producing departments is as follows:

Direct costs in the various departments are as follows:

-If the reciprocal-method of allocation is used, what equation would represent service department S1?

A) S1= $210,000 + .10S2 + .05S3 + .4P1 + .45P2

B) S1= $210,000 + .45P1 + .55P2

C) S1= $210,000 + .10S2+ .05S3

D) S1= $210,000 + .10S2 + .10S3

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements about the choice of cost-allocation method is false?

A) Improper implementation of cost allocation methods can create distrust among internal departments

B) The direct method does not consider any interactions among service departments

C) The step-method considers all interactions among service departments

D ABC cost-driver bases better reflect cause-and-effect relations between resource spending and use than . traditional cost-allocation bases

A) Improper implementation of cost allocation methods can create distrust among internal departments

B) The direct method does not consider any interactions among service departments

C) The step-method considers all interactions among service departments

D ABC cost-driver bases better reflect cause-and-effect relations between resource spending and use than . traditional cost-allocation bases

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following would be the most effective combination of cost-driver bases?

A) ABC cost-driver bases combined with the reciprocal method

B) The step-method combined with the direct-method

C) The direct-method combined with traditional cost-allocation bases

D) Traditional cost-allocation bases combined with the step-method

A) ABC cost-driver bases combined with the reciprocal method

B) The step-method combined with the direct-method

C) The direct-method combined with traditional cost-allocation bases

D) Traditional cost-allocation bases combined with the step-method

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

70

Island Credit Checks Company produces two styles of credit reports: Individual and Corporate. The difference between the two is the amount of background information and data collection required. The Corporate report uses more skilled personnel because additional checking and data are required. The relevant figures for the year just completed follow. Total support service costs to be allocated are $3,200,000.

Required: For each of the four potential allocation bases, determine the amount of support-service cost allocated to each type of report. Round all percentages to two decimal places.

Required: For each of the four potential allocation bases, determine the amount of support-service cost allocated to each type of report. Round all percentages to two decimal places.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

71

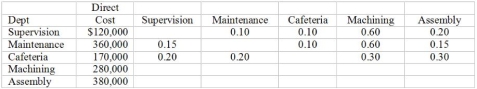

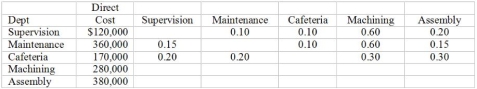

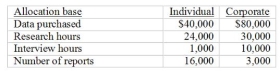

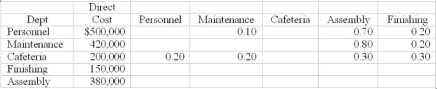

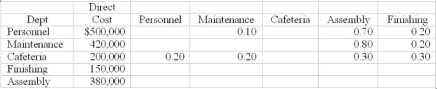

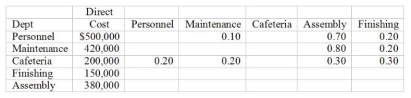

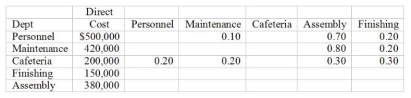

Amherst Corporation has two production departments, Assembly and Finishing and three Service Departments, Personnel, Maintenance and Cafeteria. Data relevant to Amherst are:

Required: Allocate the service department costs of Amherst Corporation using the step-method of cost allocation.

Required: Allocate the service department costs of Amherst Corporation using the step-method of cost allocation.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

72

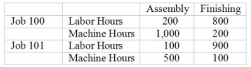

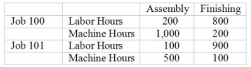

Rogers Corporation has two production departments, Assembly and Finishing and three service departments, Personnel, Maintenance and Cafeteria. Data relevant to Rogers are:

Assembly and Finishing work on two jobs during the month: Job 100 and 101. Costs are allocated to jobs based on machine hours in assembly and labor hours in Finishing. The machine and labor hours worked in each department are as follows:

Required: Determine the amount of service department costs to be allocated to Jobs 100 and 101. Rogers allocates service department costs to production departments using the direct-method of allocation.

Assembly and Finishing work on two jobs during the month: Job 100 and 101. Costs are allocated to jobs based on machine hours in assembly and labor hours in Finishing. The machine and labor hours worked in each department are as follows:

Required: Determine the amount of service department costs to be allocated to Jobs 100 and 101. Rogers allocates service department costs to production departments using the direct-method of allocation.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

73

Bruce Consulting has two service departments: S1 and S2 and three production departments:

P1, P2, and P3. Data for a recent month follow:

Required:

a) Determine the allocations to the production departments when the reciprocal method is used. b) Briefly describe why the reciprocal method is theoretically preferable to other methods of allocation.

P1, P2, and P3. Data for a recent month follow:

Required:

a) Determine the allocations to the production departments when the reciprocal method is used. b) Briefly describe why the reciprocal method is theoretically preferable to other methods of allocation.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

74

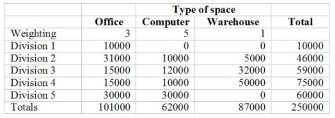

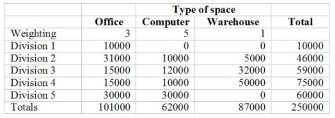

Goldberg and Rogal Consultants is a large, international consulting organization. The company provides consulting services in the computer and Internet areas. The company also has several divisions that provide manufacturing of various computer parts. The company has five divisions which are all profit centers. Each division includes allocated corporate costs in its annual budget. The budget for the coming year for the Building and Grounds Service department is $6,000,000. Included in this budget is the maintenance of all corporate buildings, depreciation, cleaning, insurance and all other facility-related maintenance costs. The company uses a weighted method of allocating facility costs based on the type of space maintained by each division. Space ranges from manufacturing warehouses, which are least expensive to maintain, to computer mainframe space, which requires specialized temperature controls, air conditioning and maintenance. The company has decided to use a weighting system assigning the following relative weights to each type of space: 1 for warehouse, 3 for office and 5 for computer space. Below find data relating to the five divisions and the square footage of each type of space. Currently, Division 5, the Internet consulting division, is the largest in sales volume and profits for the company, which has been growing at the rate of 20% per year, while divisions 3 and 4 have been struggling due to declining margins on technology products.

Required:

Required:

(a) As director of corporate budgeting, you are required to send to each division its facility allocation for the coming year. Prepare a schedule showing how the budget of $6,000,000 will be allocated to each division.

(b) Describe potential motivational problems brought on by these allocations. (Based on an actual company)

Required:

Required:(a) As director of corporate budgeting, you are required to send to each division its facility allocation for the coming year. Prepare a schedule showing how the budget of $6,000,000 will be allocated to each division.

(b) Describe potential motivational problems brought on by these allocations. (Based on an actual company)

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

75

Barletta Corporation has one service department and three producing departments. The budget for the following year allocates the service department costs to the producing departments based on the number of employees in each department. Currently, the budget for the service department is $2,400,000 and the number of employees in each department is as follows:

Department 1: 100

Department 2: 50

Department 3: 150

During the year, due to sudden expanded growth, Department 2 has had to add 50 new employees; however the service department costs have not increased due to budget constraints.

Required:

a) What were the expected service department allocations at the beginning of the year to each production department?

b) What will be the actual allocations based on the number of employees each department has at year end?

c) Comment on the reasonableness of the situation. What are the potential causes of any problems created by this allocation method?

Department 1: 100

Department 2: 50

Department 3: 150

During the year, due to sudden expanded growth, Department 2 has had to add 50 new employees; however the service department costs have not increased due to budget constraints.

Required:

a) What were the expected service department allocations at the beginning of the year to each production department?

b) What will be the actual allocations based on the number of employees each department has at year end?

c) Comment on the reasonableness of the situation. What are the potential causes of any problems created by this allocation method?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

76

Quick Credit Checks produces two styles of credit reports: personal and corporate. The difference between the two is the amount of background information and data collection required. The corporate report uses more skilled personnel because additional checking and data are required. The relevant figures for the year just completed follow: Total support service costs to be allocated are $3,200,000.

Required:

(a) Which method would be preferred by each manager? Which method would be least preferred?

(b) Provide arguments that each manager would make for his/her preferred method. How would each manager argue against his/her least preferred method?

Required:

(a) Which method would be preferred by each manager? Which method would be least preferred?

(b) Provide arguments that each manager would make for his/her preferred method. How would each manager argue against his/her least preferred method?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

77

What are the similarities and differences among the direct-method, the step-method and the reciprocal-method of allocating service costs? Is there any difference in the total amount of service department costs that will be allocated among the three methods?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

78

Bancroft, Fellouris, and Tanner, Inc. is a large multinational consulting company. The company has eight divisions and five service departments: Facilities, Printing, Library, Human Resources, and Accounting/ Finance. The facilities department handles all building maintenance, cost of heat, water, insurance and other facility-related costs. The company has three types of space: office space, computer space which is the most expensive due to special conditioning required at all times and warehouse space for its manufacturing division. The print shop prints all proposals, job bids, special advertising materials, accounting and finance documents and any materials requested by the divisions. The library, staffed by two full time librarians, maintains research materials and personal computers, purchases periodicals and books requested by the consulting divisions. Human resources handles all job applications, on-the-job training and payroll for both corporate and division employees, while accounting and finance performs corporate budgeting, allocations, billing for all divisions, maintains travel and petty cash desks for the extensive travel performed by the consulting divisions. Cost allocations and budgets, which are used to determine overhead rates for the divisions, are very important due to the high percentage of government contracts.

Required:

(a) The company wishes to use a step-method of allocation. Suggest how you would go about determining which service department should be the first step and which should be the last. What considerations would go into your decision?

(b) Suggest appropriate cost allocation bases for the five service departments. (Based on an actual publicly held company)

Required:

(a) The company wishes to use a step-method of allocation. Suggest how you would go about determining which service department should be the first step and which should be the last. What considerations would go into your decision?

(b) Suggest appropriate cost allocation bases for the five service departments. (Based on an actual publicly held company)

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

79

It is now common for many companies to outsource some or all of their internal support services, particularly those that require routine, straightforward procedures. Many companies are also outsourcing human resources, legal, tax and internal audit functions. Several factors affect a company's decision to outsource. Name four factors management must consider when making the decision to outsource and provide an argument for and against outsourcing related to each factor.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

80

(a) Explain why the use of a single-cost driver such as the number of courses may result in inaccurate management information as to the cost of running courses in individual academic departments.

(b) For each of the indirect costs listed below, identify an appropriate cost-driver that might be

? Computer use

? Facility use

? Student services

? Course design

? Lecturing/class meeting time

? Assignment grading

Cost allocation bases are factors that cost management analysts use to assign indirect costs to cost objects. Ideally, cost-allocation bases should reflect a cause-and-effect relationship between resource spending and use. Ideally, an Activity-Based-Costing (ABC. approach will provide a more accurate and useful accounting for an organization's resources. Recent studies have found that, in spite of increasing costs and diminishing resources, very few Higher Education Institutions use the tools and techniques of an ABC cost allocation system to assign costs to academic departments. While direct costs, such as faculty salaries, are traceable to individual academic departments or courses, many indirect costs, such as facility use, computer use, and student support services, are more difficult to assign. In a traditional approach, many higher education institutions assign such costs based on a single factor, such as the number of courses taught in the university. (Source: Activity-Based Costing for Higher Education Institutions, Management Accounting Quarterly, Winter, 2001)

Required:

(b) For each of the indirect costs listed below, identify an appropriate cost-driver that might be

? Computer use

? Facility use

? Student services

? Course design

? Lecturing/class meeting time

? Assignment grading

Cost allocation bases are factors that cost management analysts use to assign indirect costs to cost objects. Ideally, cost-allocation bases should reflect a cause-and-effect relationship between resource spending and use. Ideally, an Activity-Based-Costing (ABC. approach will provide a more accurate and useful accounting for an organization's resources. Recent studies have found that, in spite of increasing costs and diminishing resources, very few Higher Education Institutions use the tools and techniques of an ABC cost allocation system to assign costs to academic departments. While direct costs, such as faculty salaries, are traceable to individual academic departments or courses, many indirect costs, such as facility use, computer use, and student support services, are more difficult to assign. In a traditional approach, many higher education institutions assign such costs based on a single factor, such as the number of courses taught in the university. (Source: Activity-Based Costing for Higher Education Institutions, Management Accounting Quarterly, Winter, 2001)

Required:

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck