Deck 13: Money and Our Banking System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/137

Play

Full screen (f)

Deck 13: Money and Our Banking System

1

When Corrina and Sam use dollars to compare the worth of their respective cars, money is serving

As a(n)

A) unit of accounting.

B) absolute standard.

C) relative standard.

D) medium of exchange.

As a(n)

A) unit of accounting.

B) absolute standard.

C) relative standard.

D) medium of exchange.

unit of accounting.

2

Which one of the following is FALSE?

A) Money facilitates exchange by reducing transaction costs.

B) By serving as a unit of accounting, money allows consumers to compare the relative values of different goods.

C) The use of money as a medium of exchange means that the distribution of money in an economy mirrors the distribution of wealth.

D) The use of money as a medium of exchange permits more specialization in an economy.

A) Money facilitates exchange by reducing transaction costs.

B) By serving as a unit of accounting, money allows consumers to compare the relative values of different goods.

C) The use of money as a medium of exchange means that the distribution of money in an economy mirrors the distribution of wealth.

D) The use of money as a medium of exchange permits more specialization in an economy.

The use of money as a medium of exchange means that the distribution of money in an economy mirrors the distribution of wealth.

3

Why is barter being used more frequently?

A) Because people have lost confidence in money as a medium of exchange

B) Because there is not enough money in the economy to facilitate all the exchanges going on

C) Because a system of barter allows for more specialization of labor than does a monetary system

D) Because the internet has reduced the cost of finding a coincidence of wants

A) Because people have lost confidence in money as a medium of exchange

B) Because there is not enough money in the economy to facilitate all the exchanges going on

C) Because a system of barter allows for more specialization of labor than does a monetary system

D) Because the internet has reduced the cost of finding a coincidence of wants

Because the internet has reduced the cost of finding a coincidence of wants

4

For barter to occur there has to be

A) a commodity to serve as a medium of exchange.

B) a formal market where prices are quoted.

C) a coincidence of wants.

D) a chain of middlemen facilitating the exchange.

A) a commodity to serve as a medium of exchange.

B) a formal market where prices are quoted.

C) a coincidence of wants.

D) a chain of middlemen facilitating the exchange.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following would be considered the most liquid asset you can own?

A) Money

B) Gold

C) Silver

D) Stocks and bonds

A) Money

B) Gold

C) Silver

D) Stocks and bonds

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following items has the most liquidity?

A) Real estate

B) A checking account

C) A diamond ring

D) Season tickets to Chicago Cubs games

A) Real estate

B) A checking account

C) A diamond ring

D) Season tickets to Chicago Cubs games

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

7

Which one of the following statements is TRUE?

A) A fiduciary monetary system uses fiat money.

B) Checkable deposit balances are not money, but currency is.

C) Currency is money, but checkable deposit balances are not.

D) The value of the dollar in exchange is independent of the price level.

A) A fiduciary monetary system uses fiat money.

B) Checkable deposit balances are not money, but currency is.

C) Currency is money, but checkable deposit balances are not.

D) The value of the dollar in exchange is independent of the price level.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

8

The ease of exchange arranged by internet communications means that

A) money is losing its value.

B) barter is becoming more common.

C) money is becoming more liquid.

D) money is becoming less liquid.

A) money is losing its value.

B) barter is becoming more common.

C) money is becoming more liquid.

D) money is becoming less liquid.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

9

The money supply in the United States is backed by

A) trust in its acceptability.

B) gold.

C) silver.

D) government policy.

A) trust in its acceptability.

B) gold.

C) silver.

D) government policy.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

10

United States coins and currency are backed by

A) silver.

B) gold.

C) the Congress.

D) nothing.

A) silver.

B) gold.

C) the Congress.

D) nothing.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

11

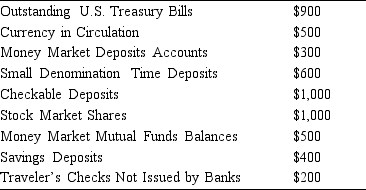

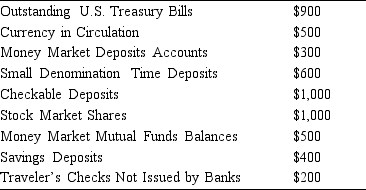

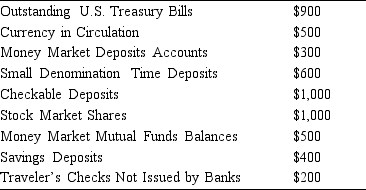

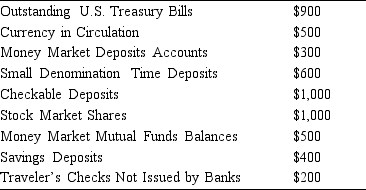

Table 13.1

-Based on the information in Table 13.1, the value of M1 is

A) $2,100.

B) $1,700.

C) $3,000.

D) $3,100.

-Based on the information in Table 13.1, the value of M1 is

A) $2,100.

B) $1,700.

C) $3,000.

D) $3,100.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

12

Table 13.1

-Using the information in Table 13.1, the value of M2 is

A) $3,500.

B) $2,100.

C) $4,500.

D) $5,400.

-Using the information in Table 13.1, the value of M2 is

A) $3,500.

B) $2,100.

C) $4,500.

D) $5,400.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

13

If $10 million is withdrawn from the nation's money market deposit accounts and is deposited in various checkable deposit accounts, then

A) M1 and M2 will remain unchanged.

B) M1 and M2 will increase.

C) M1 will increase, M2 will decrease.

D) M1will increase and M2 will remain unchanged.

A) M1 and M2 will remain unchanged.

B) M1 and M2 will increase.

C) M1 will increase, M2 will decrease.

D) M1will increase and M2 will remain unchanged.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

14

If $5 million is withdrawn from money market deposit accounts and is used to purchase traveler's checks, then

A) M1 will increase by $5 million and M2 will remain unchanged.

B) M1 will increase by $5 million and M2 will decrease by $5 million.

C) M1 will decrease by $5 million and M2 will increase by $5 million.

D) M1 will remain unchanged and M2 will decrease by $5 million.

A) M1 will increase by $5 million and M2 will remain unchanged.

B) M1 will increase by $5 million and M2 will decrease by $5 million.

C) M1 will decrease by $5 million and M2 will increase by $5 million.

D) M1 will remain unchanged and M2 will decrease by $5 million.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

15

M1 is money held for

A) investment purposes.

B) liquidity purposes.

C) transaction purposes.

D) security purposes.

A) investment purposes.

B) liquidity purposes.

C) transaction purposes.

D) security purposes.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

16

M2 is money held for

A) investment purposes.

B) liquidity purposes.

C) transaction purposes.

D) security purposes.

A) investment purposes.

B) liquidity purposes.

C) transaction purposes.

D) security purposes.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

17

Which one of the following is included in M2 but NOT in M1?

A) Coins and currency

B) Checkable deposits

C) Traveler's checks

D) Money market mutual funds

A) Coins and currency

B) Checkable deposits

C) Traveler's checks

D) Money market mutual funds

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is TRUE?

A) M2 is always larger than M1.

B) M1 is always larger than M2.

C) M2 is the narrowest definition of the money supply.

D) Credit card accounts are included in M1 but not in M2.

A) M2 is always larger than M1.

B) M1 is always larger than M2.

C) M2 is the narrowest definition of the money supply.

D) Credit card accounts are included in M1 but not in M2.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following assets are counted in M1?

A) Checkable deposits

B) Mutual market mutual funds

C) Credit card accounts

D) Money market deposit accounts

A) Checkable deposits

B) Mutual market mutual funds

C) Credit card accounts

D) Money market deposit accounts

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following assets are counted in M2?

A) Gold

B) Mutual market mutual funds

C) Credit card accounts

D) Real estate

A) Gold

B) Mutual market mutual funds

C) Credit card accounts

D) Real estate

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

21

When the Federal Reserve injects new reserves into the banking system,

A) the money supply will expand by more than the amount of the new reserves.

B) banks will hold more reserves, but the money supply will remain unchanged.

C) banks will loan out the reserves, but the money supply will remain unchanged.

D) the money supply will expand only if the reserves support commercial loans, rather than consumer loans.

A) the money supply will expand by more than the amount of the new reserves.

B) banks will hold more reserves, but the money supply will remain unchanged.

C) banks will loan out the reserves, but the money supply will remain unchanged.

D) the money supply will expand only if the reserves support commercial loans, rather than consumer loans.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

22

Which governing body determines the future growth of the U.S. money supply?

A) The U.S. Treasury

B) The U.S. Congress

C) The Federal Open Market Committee

D) The Economic Policy Committee, a body composed of the President, Treasury Secretary, and Commerce Secretary

A) The U.S. Treasury

B) The U.S. Congress

C) The Federal Open Market Committee

D) The Economic Policy Committee, a body composed of the President, Treasury Secretary, and Commerce Secretary

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

23

The Board of Governors of the Federal Reserve System has

A) fourteen members appointed by the U.S. Treasury secretary.

B) fourteen members appointed by the House of Representatives.

C) seven members appointed by the House of Representatives.

D) seven members appointed by the U.S. President.

A) fourteen members appointed by the U.S. Treasury secretary.

B) fourteen members appointed by the House of Representatives.

C) seven members appointed by the House of Representatives.

D) seven members appointed by the U.S. President.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

24

The Federal Reserve serves the following functions EXCEPT

A) providing a system for check collection and clearing.

B) setting the course of fiscal policy.

C) supplying the economy with paper currency and coins.

D) regulating the money supply.

A) providing a system for check collection and clearing.

B) setting the course of fiscal policy.

C) supplying the economy with paper currency and coins.

D) regulating the money supply.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

25

Who holds required reserve balances for depository institutions?

A) The Office of the Senate Finance Committee

B) The Office of Management and Budget

C) The Federal Reserve district banks

D) The U.S. Treasury

A) The Office of the Senate Finance Committee

B) The Office of Management and Budget

C) The Federal Reserve district banks

D) The U.S. Treasury

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

26

The Federal Reserve System

A) does not have any control over the money supply.

B) consists of 8 Federal Reserve districts.

C) regulates the U.S. fiscal policy.

D) serves as the U.S. central bank.

A) does not have any control over the money supply.

B) consists of 8 Federal Reserve districts.

C) regulates the U.S. fiscal policy.

D) serves as the U.S. central bank.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

27

The Federal Reserve controls the money supply by

A) determining how much currency to print.

B) setting the price level with a system of price controls.

C) telling banks how much they can accept in the way of deposits.

D) changing the amount of reserves in the banking system.

A) determining how much currency to print.

B) setting the price level with a system of price controls.

C) telling banks how much they can accept in the way of deposits.

D) changing the amount of reserves in the banking system.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

28

The Federal Reserve

A) is the most important regulatory agency in the U.S. monetary system.

B) controls the distribution of income in the U.S.

C) controls the distribution of wealth in the U.S.

D) affects the money supply by setting wage levels.

A) is the most important regulatory agency in the U.S. monetary system.

B) controls the distribution of income in the U.S.

C) controls the distribution of wealth in the U.S.

D) affects the money supply by setting wage levels.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

29

The size of the money multiplier depends on

A) the size of M1.

B) the required reserve ratio.

C) the level of reserves in the banking system.

D) the current price level.

A) the size of M1.

B) the required reserve ratio.

C) the level of reserves in the banking system.

D) the current price level.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is TRUE?

A) Fractional reserve banking is still in its experimental phase, and it may prove to be not viable.

B) In a system of fractional reserve banking, some depositors will find their bank accounts are of no value.

C) Banks make new loans when they have excess reserves.

D) Banks choose to hold the highest level of reserves possible.

A) Fractional reserve banking is still in its experimental phase, and it may prove to be not viable.

B) In a system of fractional reserve banking, some depositors will find their bank accounts are of no value.

C) Banks make new loans when they have excess reserves.

D) Banks choose to hold the highest level of reserves possible.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

31

Money makes an economy more efficient by

A) making the distribution of income more equal.

B) allowing consumers to purchase all the goods they would like to have.

C) guaranteeing producers a profit.

D) allowing for a greater specialization of labor.

A) making the distribution of income more equal.

B) allowing consumers to purchase all the goods they would like to have.

C) guaranteeing producers a profit.

D) allowing for a greater specialization of labor.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

32

Cigarettes served as money in some prisoner of war camps during World War II. Given this, we would have observed that

A) no one ever smoked a cigarette in the camps.

B) people resorted to barter rather than use cigarettes as money.

C) prices of other goods were expressed in terms of cigarettes.

D) only government-issued cigarettes were accepted as money.

A) no one ever smoked a cigarette in the camps.

B) people resorted to barter rather than use cigarettes as money.

C) prices of other goods were expressed in terms of cigarettes.

D) only government-issued cigarettes were accepted as money.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

33

When defining money as M1, you are looking at those assets that

A) can be used in transactions.

B) serve as a medium of exchange but are not liquid.

C) are liquid but do not serve as a medium of exchange.

D) earn interest.

A) can be used in transactions.

B) serve as a medium of exchange but are not liquid.

C) are liquid but do not serve as a medium of exchange.

D) earn interest.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

34

Money market deposit accounts are

A) included in M1 but not in M2.

B) included in M2 but not in M1.

C) included both in M1 and M2.

D) included neither in M1 nor M2.

A) included in M1 but not in M2.

B) included in M2 but not in M1.

C) included both in M1 and M2.

D) included neither in M1 nor M2.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

35

Traveler's checks are

A) included in M1 but not in M2.

B) included in M2 but not in M1.

C) included both in M1 and M2.

D) included neither in M1 nor M2.

A) included in M1 but not in M2.

B) included in M2 but not in M1.

C) included both in M1 and M2.

D) included neither in M1 nor M2.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

36

A fiduciary monetary system

A) is one that does not use a central bank.

B) is one that does not use currency.

C) is one that uses barter.

D) is one in which currency derives its value from its acceptability and predictability.

A) is one that does not use a central bank.

B) is one that does not use currency.

C) is one that uses barter.

D) is one in which currency derives its value from its acceptability and predictability.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

37

The money supply is

A) the total value of the public's holdings in the stock market.

B) the total value of annual output.

C) the amount of money in circulation.

D) the nominal value of aggregate demand.

A) the total value of the public's holdings in the stock market.

B) the total value of annual output.

C) the amount of money in circulation.

D) the nominal value of aggregate demand.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

38

The assets included in M1 are

A) not liquid.

B) assets of value that do not serve as a medium of exchange.

C) the money that has been created outside the banking system.

D) readily used to conduct marketplace transactions.

A) not liquid.

B) assets of value that do not serve as a medium of exchange.

C) the money that has been created outside the banking system.

D) readily used to conduct marketplace transactions.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

39

If money is defined as those assets than can be used in conducting transactions, then the money supply consists of

A) currency only.

B) checkable deposits only.

C) currency and checkable deposits only.

D) currency, checkable deposits, and traveler's checks.

A) currency only.

B) checkable deposits only.

C) currency and checkable deposits only.

D) currency, checkable deposits, and traveler's checks.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

40

The difference between M1 and M2 is

A) M1 includes traveler's checks while M2 does not.

B) M2 includes all paper currency that circulates outside the U.S. while M1 does not.

C) M1 includes all assets that can be easily converted into money while M2 does not.

D) M2 includes near moneys while M1 does not.

A) M1 includes traveler's checks while M2 does not.

B) M2 includes all paper currency that circulates outside the U.S. while M1 does not.

C) M1 includes all assets that can be easily converted into money while M2 does not.

D) M2 includes near moneys while M1 does not.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

41

Something that would be considered near money is

A) an antique car.

B) real estate.

C) a money market deposit account.

D) a share of publicly-traded stock.

A) an antique car.

B) real estate.

C) a money market deposit account.

D) a share of publicly-traded stock.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is TRUE?

A) M1 includes those assets that are near moneys.

B) M1 includes those assets held for the purpose of engaging in marketplace transactions.

C) M1 is always larger than M2.

D) M2 is equal to the value of GDP.

A) M1 includes those assets that are near moneys.

B) M1 includes those assets held for the purpose of engaging in marketplace transactions.

C) M1 is always larger than M2.

D) M2 is equal to the value of GDP.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

43

Which one the following is TRUE?

A) The Federal Reserve regulates the money supply by changing the level of reserves in the banking system.

B) The Federal Reserve regulates the money supply by determining the number of banks that will be allowed to issue loans in any one year.

C) The money multiplier is determined by the current interest rate.

D) The money supply is independent of Federal Reserve actions.

A) The Federal Reserve regulates the money supply by changing the level of reserves in the banking system.

B) The Federal Reserve regulates the money supply by determining the number of banks that will be allowed to issue loans in any one year.

C) The money multiplier is determined by the current interest rate.

D) The money supply is independent of Federal Reserve actions.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

44

What is the formula for the money multiplier?

A) 1 +Required Reserve Ratio

B) 1 - Required Reserve Ratio

C) 1 * Required Reserve Ratio

D) 1 ÷ Required Reserve Ratio

A) 1 +Required Reserve Ratio

B) 1 - Required Reserve Ratio

C) 1 * Required Reserve Ratio

D) 1 ÷ Required Reserve Ratio

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

45

If banks choose to hold more than the required level of reserves,

A) then the money supply will not expand in response to an injection of new reserves.

B) then the actual money multiplier will be more than its potential.

C) then the actual money multiplier will be less than its potential.

D) then the actual money multiplier will be zero.

A) then the money supply will not expand in response to an injection of new reserves.

B) then the actual money multiplier will be more than its potential.

C) then the actual money multiplier will be less than its potential.

D) then the actual money multiplier will be zero.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

46

New reserves are put into the banking system by

A) Congress.

B) Wall Street brokerage houses.

C) the Federal Reserve.

D) taxpayers.

A) Congress.

B) Wall Street brokerage houses.

C) the Federal Reserve.

D) taxpayers.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

47

The liquidity approach to measuring the money supply uses

A) M1 only.

B) near moneys only.

C) M1 plus near moneys.

D) M2 plus near moneys.

A) M1 only.

B) near moneys only.

C) M1 plus near moneys.

D) M2 plus near moneys.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

48

What is the effect of the Federal Reserve increasing the level of reserves in the banking system?

A) People will choose to hold traveler's checks rather than currency.

B) People will choose to hold currency rather than traveler's checks.

C) The money supply will increase.

D) The money supply will decrease.

A) People will choose to hold traveler's checks rather than currency.

B) People will choose to hold currency rather than traveler's checks.

C) The money supply will increase.

D) The money supply will decrease.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

49

Who are the members of the Federal Reserve System?

A) Taxpayers

B) Banks

C) Brokerage houses

D) Elected legislators

A) Taxpayers

B) Banks

C) Brokerage houses

D) Elected legislators

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

50

What happens if the Federal Reserve decreases the level of reserves in the banking system?

A) People will choose to hold traveler's checks rather than currency.

B) People will choose to hold currency rather than traveler's checks.

C) The money supply will increase.

D) The money supply will decrease.

A) People will choose to hold traveler's checks rather than currency.

B) People will choose to hold currency rather than traveler's checks.

C) The money supply will increase.

D) The money supply will decrease.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

51

If banks hold excess reserves,

A) they are not engaged in fractional reserve banking.

B) they will raise the actual money multiplier above its potential.

C) they incur an opportunity cost in terms of interest that could be earned on a loan.

D) they are violating regulations of the Federal Reserve System.

A) they are not engaged in fractional reserve banking.

B) they will raise the actual money multiplier above its potential.

C) they incur an opportunity cost in terms of interest that could be earned on a loan.

D) they are violating regulations of the Federal Reserve System.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

52

When banks find themselves with excess reserves, they typically

A) issue new loans.

B) sell the excess reserves to other banks.

C) encourage their customers to cash more checks.

D) encourage the Federal Reserve to raise the required reserve ratio.

A) issue new loans.

B) sell the excess reserves to other banks.

C) encourage their customers to cash more checks.

D) encourage the Federal Reserve to raise the required reserve ratio.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

53

When you cash a check,

A) you increase M1 and M2.

B) you increase M1 and leave M2 unchanged.

C) you decrease M1 and increase M2.

D) you leave M1 and M2 unchanged.

A) you increase M1 and M2.

B) you increase M1 and leave M2 unchanged.

C) you decrease M1 and increase M2.

D) you leave M1 and M2 unchanged.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

54

When you withdraw cash from a savings account,

A) you increase M1 and M2.

B) you increase M1 and leave M2 unchanged.

C) you decrease M2 and increase M2.

D) you leave M1 and M2 unchanged.

A) you increase M1 and M2.

B) you increase M1 and leave M2 unchanged.

C) you decrease M2 and increase M2.

D) you leave M1 and M2 unchanged.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

55

When you deposit traveler's checks into a money market mutual fund,

A) you increase M1 and M2.

B) you increase M1 and leave M2 unchanged.

C) you decrease M1 and leave M2 unchanged.

D) you leave M1 and M2 unchanged.

A) you increase M1 and M2.

B) you increase M1 and leave M2 unchanged.

C) you decrease M1 and leave M2 unchanged.

D) you leave M1 and M2 unchanged.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

56

Money is

A) anything that serves as a medium of exchange or unit of accounting.

B) a twentieth-century invention.

C) an asset that never loses value over time.

D) anything of value.

A) anything that serves as a medium of exchange or unit of accounting.

B) a twentieth-century invention.

C) an asset that never loses value over time.

D) anything of value.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

57

When you write a check to deposit funds in your savings account,

A) you increase M1 and M2.

B) you increase M1 and leave M2 unchanged.

C) you decrease M1 and leave M2 unchanged.

D) you leave M1 and M2 unchanged.

A) you increase M1 and M2.

B) you increase M1 and leave M2 unchanged.

C) you decrease M1 and leave M2 unchanged.

D) you leave M1 and M2 unchanged.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

58

Why is a smart card less vulnerable to theft than is currency?

A) Because a smart card cannot be used without online authorization from the cardholder's bank

B) Because a smart card cannot be used without a personal code

C) Because a smart card cannot be used without a photo ID of the card holder

D) Because a smart card cannot be used without a fingerprint of the card holder

A) Because a smart card cannot be used without online authorization from the cardholder's bank

B) Because a smart card cannot be used without a personal code

C) Because a smart card cannot be used without a photo ID of the card holder

D) Because a smart card cannot be used without a fingerprint of the card holder

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

59

Digital cash

A) offers no advantages over paper currency.

B) cannot function as a medium of exchange.

C) can only be transferred via the internet.

D) will reduce the cost of transferring funds.

A) offers no advantages over paper currency.

B) cannot function as a medium of exchange.

C) can only be transferred via the internet.

D) will reduce the cost of transferring funds.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

60

Digital cash

A) consists of M1 and M2

B) consists of near moneys.

C) consists of funds stored in computer devices and microchips.

D) cannot be used to pay for internet transactions.

A) consists of M1 and M2

B) consists of near moneys.

C) consists of funds stored in computer devices and microchips.

D) cannot be used to pay for internet transactions.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

61

Smart cards and digital cash

A) cannot serve as a medium of exchange.

B) are more prone to theft than currency is.

C) will increasingly replace checks in many transactions.

D) are only accepted in transactions between banks.

A) cannot serve as a medium of exchange.

B) are more prone to theft than currency is.

C) will increasingly replace checks in many transactions.

D) are only accepted in transactions between banks.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is FALSE?

A) The most liquid assets are those that earn interest.

B) Without money, exchange in conducted by barter.

C) A medium of exchange is something widely accepted as payment for items of value.

D) Barter requires a coincidence of wants.

A) The most liquid assets are those that earn interest.

B) Without money, exchange in conducted by barter.

C) A medium of exchange is something widely accepted as payment for items of value.

D) Barter requires a coincidence of wants.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is FALSE?

A) Banks offer free checking because they are required to do so by the Federal Reserve.

B) A fiduciary monetary system uses fiat money.

C) Money facilitates exchange by reducing transaction costs.

D) The internet has reduced the costs of conducting bartered transactions.

A) Banks offer free checking because they are required to do so by the Federal Reserve.

B) A fiduciary monetary system uses fiat money.

C) Money facilitates exchange by reducing transaction costs.

D) The internet has reduced the costs of conducting bartered transactions.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is FALSE?

A) All assets included in M1 are also included in M2.

B) M2 includes near moneys.

C) Near moneys cannot be used in transactions but are very liquid.

D) Credit card balances are included in M1 but not in M2.

A) All assets included in M1 are also included in M2.

B) M2 includes near moneys.

C) Near moneys cannot be used in transactions but are very liquid.

D) Credit card balances are included in M1 but not in M2.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is FALSE?

A) Balances in money market deposit accounts are included in M2 but not in M1.

B) Currency in circulation is included in M1 but not in M2.

C) Checkable deposits are included in M1 and in M2.

D) The Federal Reserve System is the U.S. central bank.

A) Balances in money market deposit accounts are included in M2 but not in M1.

B) Currency in circulation is included in M1 but not in M2.

C) Checkable deposits are included in M1 and in M2.

D) The Federal Reserve System is the U.S. central bank.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

66

Without money, exchange is conducted by _________ .

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

67

Barter requires a _________ of wants.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

68

Money promotes efficiency in an economy by allowing for the _________ of labor.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

69

The Federal _________ System is the U. S. central bank.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

70

Money is an asset that serves as a _________ _________ _________ and a unit of accounting.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

71

Money facilitates exchange by reducing _________ costs.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

72

The narrowest definition of money is _________.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

73

To the extent that money serves as a _________ _________ _________, it allows for the keeping of financial records.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

74

A _________ monetary system uses fiat money.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

75

The English word _________ comes from a Latin term meaning trust.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

76

Credit card balances are actually short-term _________ .

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

77

Under _________ reserve banking, banks do not hold all of their deposits as reserves.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

78

The Federal Reserve increases the money supply by purchasing _________ _________ in the open market.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

79

The Federal _________ _________ Committee governs the growth of the money supply.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

80

Smart cards contain microchips that contain more information that a _________ stripe on a credit card.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck