Deck 12: Personal Investing - Investing in Bonds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/84

Play

Full screen (f)

Deck 12: Personal Investing - Investing in Bonds

1

A bond's yield to maturity is the annualized percentage return of both interest and capital gains or losses if the bond were held until it matured.

True

2

If you purchased a bond on August 1,2014 on the secondary market with face value $10 000 and received $200 interest on January 1,2015,you would owe tax on the interest earned on your 2014 tax return.

True

3

Generally,bonds have maturities between 1 and 30 years and pay interest annually.

False

4

If a new issue corporate bond offers a coupon rate of 6.2 percent and Government of Canada bonds with the same term and features are paying a 3.8 percent coupon,then the risk premium for the corporate bond is 2.4 percent.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

5

Bonds are issued with a call feature when the issuers expect interest rates to rise.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

6

A convertible bond allows the investor to exchange that bond for another issue of bonds within the convertible period.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

7

A bond with a coupon rate of 6.5 percent and trading at $960 will pay annual interest of $62.40.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

8

If you purchased a bond with face value $10 000 and coupon of 6 percent, then sold it for $10600a half year later, you would have to pay tax on the capital gain as well as tax on the coupon payment of $300.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

9

Real return bonds have their par value and coupon payments adjusted by CPI.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

10

If you expect that interest rates will decline,it would make sense to switch from a $10 000 par value bond with a 4 percent semi-annual coupon maturing in three years to a bond with the same features,except maturing in 12 years.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

11

The maturity matching strategy of investing in bonds is the surest way to have money available to meet a specific goal.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

12

Canada Savings Bonds and T-Bills are both secure short-term debt securities which can be purchased on the secondary market.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

13

If you paid $9600 for a bond with par value of $10 000 and a 5 percent coupon rate,the semi-annual payment would be $250.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

14

A government of Canada strip bond maturing in 22 years has lower interest rate risk than a real return bond maturing in 10 years.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

15

T-Bills and BAs are both very secure short-term debt securities which pay the same interest rate.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

16

Bond interest is exempt from income tax if it is held in an RRSP,a TFSA or an RESP.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

17

The bond par value or face value is the amount the investor will be paid when the bond matures.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

18

A real return bond with a 7 percent coupon will increase its interest payment annually to $71.40 if inflation rises by 2 percent.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

19

A passive strategy of bond investing consists of buying bonds for the long-term and not selling them until maturity.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

20

A bond with a call feature would pay a slightly higher interest rate than the same bond without this feature.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

21

Investors purchase bonds because

A)they are a risk-free investment.

B)they pay interest income.

C)they pay dividends.

D)the returns are higher than with stocks.

A)they are a risk-free investment.

B)they pay interest income.

C)they pay dividends.

D)the returns are higher than with stocks.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

22

If an issuer wanted to protect against a drop in interest rates,the issuer of a bond would probably include which feature?

A)Callable

B)A put

C)Extendible

D)Convertible

A)Callable

B)A put

C)Extendible

D)Convertible

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

23

The amount returned to the investor when a bond matures is called

A)principal.

B)interest gain.

C)capital gain.

D)terminal value.

A)principal.

B)interest gain.

C)capital gain.

D)terminal value.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

24

A bond with a credit rating of Aa is riskier than a bond with a credit rating of A.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

25

If an investor is expecting a period of higher interest rates soon,which bond feature would she prefer?

A)Callable

B)Retractable

C)Convertible

D)Extendible

A)Callable

B)Retractable

C)Convertible

D)Extendible

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

26

A put feature on a bond is attractive to investors who believe interest rates will drop before the bond matures.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

27

Callable bonds and mortgage backed securities both have prepayment risk.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

28

A retractable bond pays a lower interest rate,all else equal.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following bonds would be most attractive to an investor who is very concerned about risk?

A)A real return bond maturing in five years

B)A government of Canada bond maturing in fifteen years

C)A government of Canada strip bond maturing in ten years

D)An AAA rated corporate bond maturing in five years

A)A real return bond maturing in five years

B)A government of Canada bond maturing in fifteen years

C)A government of Canada strip bond maturing in ten years

D)An AAA rated corporate bond maturing in five years

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

30

When considering the risk from investing in a 25-year government of Canada bond yielding 4 percent,the most significant risk is interest rate risk.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

31

The benefit of the extendible feature of a bond is that

A)it allows the issuer to extend the callable period when interest rates rise.

B)it allows the investor to continue receiving a higher interest rate for a longer period.

C)it allows the issuer the option to extend the bond during lower interest rate periods.

D)it allows the investor the option of extending the period before the bond will become callable.

A)it allows the issuer to extend the callable period when interest rates rise.

B)it allows the investor to continue receiving a higher interest rate for a longer period.

C)it allows the issuer the option to extend the bond during lower interest rate periods.

D)it allows the investor the option of extending the period before the bond will become callable.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

32

You should be willing to pay $12 064 for a $10 000 face value bond with semi-annual 5 percent coupon which matures in 14 years,if similar bonds are now yielding 4 percent.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

33

Bonds usually pay interest

A)annually.

B)semi-annually.

C)quarterly.

D)monthly.

A)annually.

B)semi-annually.

C)quarterly.

D)monthly.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

34

Convertible bonds are suitable for investors who

A)want to maximize interest returns in periods when interest rates are low.

B)want to convert the bond into a longer term at the same rate of interest.

C)want the possibility of benefiting from a rise in the issuer's share price.

D)have a lower risk tolerance and are seeking income.

A)want to maximize interest returns in periods when interest rates are low.

B)want to convert the bond into a longer term at the same rate of interest.

C)want the possibility of benefiting from a rise in the issuer's share price.

D)have a lower risk tolerance and are seeking income.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

35

When the economic conditions are weak,bonds with higher default risk become more susceptible.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

36

The yield to maturity on at $10 000 face value bond with semi-annual coupon of 3 percent,maturing in three years and price of $9180 is 6 percent.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

37

A debenture and a bond issued by the same company are the same.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

38

A 25-year strip bond with face value of $25 000 and yielding 4.2 percent should cost $8844.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

39

A corporate bond trading at below par will have

A)a higher yield to maturity than the coupon rate.

B)a lower yield to maturity than the coupon rate.

C)lower risk than one trading at par.

D)higher risk than one trading at par.

A)a higher yield to maturity than the coupon rate.

B)a lower yield to maturity than the coupon rate.

C)lower risk than one trading at par.

D)higher risk than one trading at par.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is wrong?

A)The par value of a bond is its face value.

B)The par value of a bond is its market value in the secondary market.

C)The par value of a bond will be paid to the bondholder at maturity.

D)The par value multiplied by the coupon rate equals the interest paid to investors annually.

A)The par value of a bond is its face value.

B)The par value of a bond is its market value in the secondary market.

C)The par value of a bond will be paid to the bondholder at maturity.

D)The par value multiplied by the coupon rate equals the interest paid to investors annually.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

41

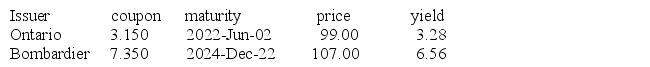

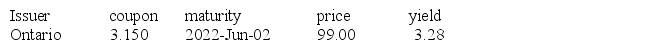

Given the following bond quotations:

Which of the following statements is True?

A)The Bombardier bond appears to have a higher risk premium.

B)The Ontario bond has a 6.3 percent annual coupon rate.

C)The yields on these bonds illustrate the liquidity preference theory.

D)The Ontario bond is a better price.

Which of the following statements is True?

A)The Bombardier bond appears to have a higher risk premium.

B)The Ontario bond has a 6.3 percent annual coupon rate.

C)The yields on these bonds illustrate the liquidity preference theory.

D)The Ontario bond is a better price.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

42

The contractual rate of interest on a bond is always stated as a(n)

A)daily rate.

B)monthly rate.

C)semi-annual rate.

D)annual rate.

A)daily rate.

B)monthly rate.

C)semi-annual rate.

D)annual rate.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

43

Investing in bonds gives you the possibility of

A)capital gains and interest income.

B)guaranteed income with no capital risk.

C)capital gains and dividend income.

D)deferring taxes on accrued interest.

A)capital gains and interest income.

B)guaranteed income with no capital risk.

C)capital gains and dividend income.

D)deferring taxes on accrued interest.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

44

Given the following ATT Ltd.bond information: $10 000 par value,maturity Dec 22,2023,semi-annual coupon 7.75 percent,price 105.50 and yield 7.4 percent.How much interest does it pay annually?

A)$7.50

B)$77.50

C)$7.40

D)$74.00

A)$7.50

B)$77.50

C)$7.40

D)$74.00

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

45

On the secondary bond market,

A)only new bonds can be sold.

B)bonds are guaranteed to bring at least par value.

C)bond prices vary with interest rate movement.

D)bond prices remain constant but yields vary with interest rate movement.

A)only new bonds can be sold.

B)bonds are guaranteed to bring at least par value.

C)bond prices vary with interest rate movement.

D)bond prices remain constant but yields vary with interest rate movement.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

46

What is a disadvantage of issuing bonds compared to shares?

A)The dividends must be paid indefinitely.

B)Bond interest expense is not tax deductible.

C)Interest must be paid on a periodic basis regardless of earnings.

D)Bondholders may require early repayment.

A)The dividends must be paid indefinitely.

B)Bond interest expense is not tax deductible.

C)Interest must be paid on a periodic basis regardless of earnings.

D)Bondholders may require early repayment.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following should be the highest yield bonds?

A)Standard and Poor's rated C bonds

B)Moody's rated C bonds

C)Standard and Poor's rated CCC bonds

D)Moody's rated Ca bonds

A)Standard and Poor's rated C bonds

B)Moody's rated C bonds

C)Standard and Poor's rated CCC bonds

D)Moody's rated Ca bonds

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

48

The normal yield curve suggests

A)that reinvestment risk is higher for higher coupon rates.

B)that selecting short-term maturities for borrowing and long term for investing will be profitable.

C)that interest rate risk is higher for longer-term bonds.

D)that short-term bonds give the best risk return trade-off.

A)that reinvestment risk is higher for higher coupon rates.

B)that selecting short-term maturities for borrowing and long term for investing will be profitable.

C)that interest rate risk is higher for longer-term bonds.

D)that short-term bonds give the best risk return trade-off.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

49

The total return on a 5 year bond with $10 000 par value and an annual coupon rate of 6 percent will be most favourable if interest rates

A)increase to 8 percent.

B)decrease to 4 percent.

C)increase to 7 percent.

D)decrease to 5 percent.

A)increase to 8 percent.

B)decrease to 4 percent.

C)increase to 7 percent.

D)decrease to 5 percent.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

50

If you held a bond with face value of $10 000 maturity in 12 years,semi-annual coupon of 6 percent,and the coupons on par value bonds with the same maturity today are 3 percent,how much would your bond be worth now on the secondary market?

A)$10 000

B)$13 005

C)$19 781

D)$14 908

A)$10 000

B)$13 005

C)$19 781

D)$14 908

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

51

If a company's stock price is expected to increase substantially over the next few years,which of the following may entice potential bondholders to accept a lower coupon rate?

A)Extendibility

B)Call feature

C)Convertibility

D)A put feature

A)Extendibility

B)Call feature

C)Convertibility

D)A put feature

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

52

What is the current yield to maturity on the following bond: $10 000 par value,semi-annual coupon of 5 percent,maturing in six years and currently trading for $10 777?

A)3)30

B)4)20

C)5)00

D)4)64

A)3)30

B)4)20

C)5)00

D)4)64

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following features of a bond could result in the company never paying out cash to redeem the bonds?

A)Extendibility

B)Callability

C)Convertibility

D)Defaultation

A)Extendibility

B)Callability

C)Convertibility

D)Defaultation

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following government of Canada bonds (with all other features the same)would have the most interest rate risk?

A)A 3% coupon bond maturing in ten years

B)A 6% coupon bond maturing in ten years

C)A 3% coupon bond maturing in five years

D)A 6% coupon bond maturing in five years

A)A 3% coupon bond maturing in ten years

B)A 6% coupon bond maturing in ten years

C)A 3% coupon bond maturing in five years

D)A 6% coupon bond maturing in five years

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

55

Investors are willing to purchase bonds with a call feature only if the bonds offer a

A)slightly lower return than similar bonds without a call feature.

B)slightly higher number of shares of the issuer's stock.

C)slightly higher interest rate than similar bonds without a call feature.

D)sinking fund provision.

A)slightly lower return than similar bonds without a call feature.

B)slightly higher number of shares of the issuer's stock.

C)slightly higher interest rate than similar bonds without a call feature.

D)sinking fund provision.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

56

If a company anticipates a substantive decline in interest rates during the term of the bond,which feature is likely to be included in its bond offering?

A)Extendible

B)Callable

C)Convertible

D)retractable

A)Extendible

B)Callable

C)Convertible

D)retractable

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

57

Bonds that may be exchanged for common stock at the option of the bondholders are called

A)option bonds.

B)convertible bonds.

C)callable bonds.

D)stock bonds.

A)option bonds.

B)convertible bonds.

C)callable bonds.

D)stock bonds.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

58

Given the following ATT Ltd.bond information: $1000 par value,maturity Dec 22,2023,semi-annual coupon 7.75 percent,price 105.50 and yield 7.4 percent.How much would a $1000 par value ATT Ltd.bond cost as of the day of this listing?

A)$105.50

B)$740

C)$1000

D)$1055

A)$105.50

B)$740

C)$1000

D)$1055

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is the greatest risk in holding a Provincial bond with face value ?$10 000 which matures in five years,has a semi-annual 7% coupon,which you purchased ?for $12 050?

A)The inflation risk because the real return may not beat inflation of two percent

B)Reinvestment risk that the coupons may not be able to be reinvested at the same return

C)Default risk if interest rates rise by two percent

D)Interest rate risk because interest rates may increase by one percent

A)The inflation risk because the real return may not beat inflation of two percent

B)Reinvestment risk that the coupons may not be able to be reinvested at the same return

C)Default risk if interest rates rise by two percent

D)Interest rate risk because interest rates may increase by one percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

60

One difference between a regular bond and a convertible bond is that a regular bond has

A)a higher interest rate.

B)a lower interest rate.

C)a shorter maturity.

D)a longer maturity.

A)a higher interest rate.

B)a lower interest rate.

C)a shorter maturity.

D)a longer maturity.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

61

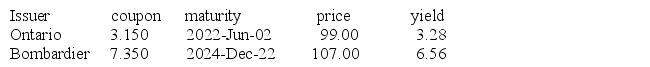

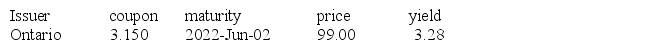

Given the following bond information:

What would be the taxable income on this bond if it were purchased at this price on December 20th and sold a year later for a price of 103.00? Assume face value of $10 000 and a semi-annual coupon payment.

A)Taxable capital gain of $400 and interest of $735

B)Taxable capital loss of $400 and interest of $735

C)Taxable capital loss of $200 and interest of $735

D)Taxable capital gain of $200 and interest of $656

What would be the taxable income on this bond if it were purchased at this price on December 20th and sold a year later for a price of 103.00? Assume face value of $10 000 and a semi-annual coupon payment.

A)Taxable capital gain of $400 and interest of $735

B)Taxable capital loss of $400 and interest of $735

C)Taxable capital loss of $200 and interest of $735

D)Taxable capital gain of $200 and interest of $656

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

62

Investing in bonds based on interest rate expectations

A)can be a reliable strategy to enhance bond yields.

B)can be costly if predictions on interest rates are incorrect.

C)increases bond values if you move to long-term bonds when interest rates rise.

D)works well when the yield curve is inverted.

A)can be a reliable strategy to enhance bond yields.

B)can be costly if predictions on interest rates are incorrect.

C)increases bond values if you move to long-term bonds when interest rates rise.

D)works well when the yield curve is inverted.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

63

You expect interest rates to rise in the short term.Your best strategy would be to

A)buy T-bills and keep rolling them over.

B)buy long bonds and use interest income to purchase higher yields.

C)buy short bonds only and keep rolling them over.

D)buy T-bills in anticipation of locking in higher rates after the increase.

A)buy T-bills and keep rolling them over.

B)buy long bonds and use interest income to purchase higher yields.

C)buy short bonds only and keep rolling them over.

D)buy T-bills in anticipation of locking in higher rates after the increase.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

64

Bonds with a high degree of default risk are most susceptible to default when economic conditions are

A)strong.

B)weak.

C)stable.

D)expanding.

A)strong.

B)weak.

C)stable.

D)expanding.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

65

Michael decided to buy a strip bond for his RRSP.He purchased a three year $5000 face bond for $3777.What is the annualized return on this investment?

A)7)80 percent

B)9)80 percent

C)9)36 percent

D)8)15 percent

A)7)80 percent

B)9)80 percent

C)9)36 percent

D)8)15 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

66

Your son will be ready for college in 10 years and your daughter in 14 years.Which of the following bond strategies would be best suited to your goal of financing your children's education?

A)Interest rate

B)Passive

C)Maturity matching

D)Active

A)Interest rate

B)Passive

C)Maturity matching

D)Active

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

67

Jan buys a $1000 10 percent semi-annual coupon bond for a price of $1094 and holds it to maturity in six years.What is the bond's yield to maturity?

A)10 percent

B)8)0 percent

C)8)6 percent

D)9)0 percent

A)10 percent

B)8)0 percent

C)8)6 percent

D)9)0 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

68

If the bond market expects a 10 percent yield,and ABC Ltd.pays coupon interest on its $1000 par value bond at eight percent semi-annually,the discount rate that investors should apply in the calculation of ABC Ltd.bond price should be

A)4 percent.

B)10 percent.

C)8 percent.

D)5 percent.

A)4 percent.

B)10 percent.

C)8 percent.

D)5 percent.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

69

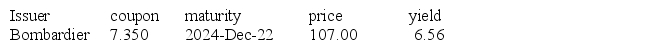

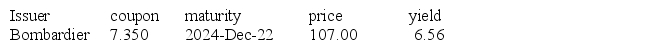

Given the following bond information:

What would be the taxable income on this bond if it were purchased at this price on June 1st and sold December 1st for a price of 103.00 and has face value of $20 000 and a semi-annual coupon payment?

A)Taxable capital gain of $800 and interest of $630.

B)Taxable capital gain of $400 and interest of $315.

C)Taxable capital gain of $1600 and interest of $656.

D)Taxable capital gain of $200 and interest of $157.50.

What would be the taxable income on this bond if it were purchased at this price on June 1st and sold December 1st for a price of 103.00 and has face value of $20 000 and a semi-annual coupon payment?

A)Taxable capital gain of $800 and interest of $630.

B)Taxable capital gain of $400 and interest of $315.

C)Taxable capital gain of $1600 and interest of $656.

D)Taxable capital gain of $200 and interest of $157.50.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

70

When there is an element of default risk on a bond,the interest rate will include

A)additional premium.

B)risk premium.

C)default premium.

D)nominal premium.

A)additional premium.

B)risk premium.

C)default premium.

D)nominal premium.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following bond quotes might indicate a bond has a high default risk?

A)GM 6 percent due 11/19 with a current yield of 7.5 percent

B)Cott Beverages 6.5 percent due 09/19 with a current yield of 7.75 percent

C)Eaglecrest Explorations 5.75 percent due 06/19 with a current yield of 7.60 percent

D)Abitibi Price 7.0 percent due 09/19 with a current yield of 9.85 percent

A)GM 6 percent due 11/19 with a current yield of 7.5 percent

B)Cott Beverages 6.5 percent due 09/19 with a current yield of 7.75 percent

C)Eaglecrest Explorations 5.75 percent due 06/19 with a current yield of 7.60 percent

D)Abitibi Price 7.0 percent due 09/19 with a current yield of 9.85 percent

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

72

If you buy a corporate bond for $9700 and sell it six months later for $10 500,you will have

A)interest income of $800.

B)a capital gain of $800.

C)a taxable capital gain of $800.

D)non-taxable income of $800.

A)interest income of $800.

B)a capital gain of $800.

C)a taxable capital gain of $800.

D)non-taxable income of $800.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

73

The risk that you will be forced to sell your bond back to the issuer prior to maturity is the

A)call risk.

B)default risk.

C)interest rate risk.

D)economic risk.

A)call risk.

B)default risk.

C)interest rate risk.

D)economic risk.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

74

Other things being equal,in general,which of the following bonds is the lowest-risk bond?

A)Aa

B)AAA

C)AA

D)These are the same.

A)Aa

B)AAA

C)AA

D)These are the same.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

75

A Government of Canada bond has a 6 percent coupon which pays semi-annually and matures in 11 years.If interest rates have declined to 5.4 percent for similar bonds,what should be the price for this bond? (Assume $1000 par value)

A)$1006.99

B)$1048.81

C)$1031.62

D)$1049.28

A)$1006.99

B)$1048.81

C)$1031.62

D)$1049.28

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

76

If interest rates are rising,which of the following bonds would you would want to hold? (Ignore default risk factors. )

A)Government of Canada 3.5 percent due 04/29

B)CN Rail 3.75 percent due 06/17

C)Province of Ontario 4 percent due 09/27

D)Maple Leaf Foods 3.5 percent due 11/22

A)Government of Canada 3.5 percent due 04/29

B)CN Rail 3.75 percent due 06/17

C)Province of Ontario 4 percent due 09/27

D)Maple Leaf Foods 3.5 percent due 11/22

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

77

List and describe three strategies to invest in bonds.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

78

Mortgage-backed securities are

A)issued by the Government of Canada for individual mortgages on residential homes.

B)backed by a pool of mortgages guaranteed by CMHC.

C)a pool of mortgages issued and guaranteed by banks.

D)a pool of CMHC mortgages not available on the secondary market.

A)issued by the Government of Canada for individual mortgages on residential homes.

B)backed by a pool of mortgages guaranteed by CMHC.

C)a pool of mortgages issued and guaranteed by banks.

D)a pool of CMHC mortgages not available on the secondary market.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

79

Investors who buy bonds that are callable

A)have a higher chance of default risk.

B)risk reinvesting at lower rates if called.

C)have very little interest rate risk.

D)pay a premium for the feature.

A)have a higher chance of default risk.

B)risk reinvesting at lower rates if called.

C)have very little interest rate risk.

D)pay a premium for the feature.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

80

Allan purchased a five-year strip bond from the Government of Canada with a $100 000 face value.The equivalent yield is 5.91 percent.What interest will the bond earn over the five-year term?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck