Deck 6: Psychological Disorders and Therapy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/11

Play

Full screen (f)

Deck 6: Psychological Disorders and Therapy

1

Suppose that in Mysore, the reserve-deposit ratio is res = 0.5 - 2i, where i is the nominal interest rate. The currency-deposit ratio is 0.2 and the monetary base equals 100. The real quantity of money demanded is given by the money demand function L(Y, i) = 0.5Y - 10i, where Y is real output. Currently, the real interest rate is 5% and the economy expects an inflation rate of 5%. Assume that the price level P is equal to 1. The value of output Y that clears the asset market is

A) 240.

B) 460.

C) 480.

D) 482.

A) 240.

B) 460.

C) 480.

D) 482.

482.

2

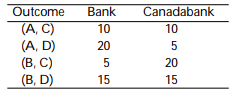

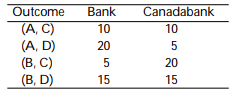

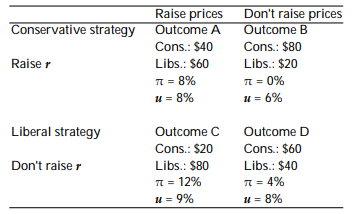

Members of the Central Bank and Canadabank are both vying for promotions. Central Bank members receive promotions if they keep interest rates and unemployment low. Canadabank Officers receive promotions if they make loans with few defaults. In case A, the Bank keeps money Growth low, minimizing inflation, but hurting growth; and in Case B, they allow money growth,Which reduces interest rates, but increases inflation in the long run. In case C, Canadabank officers Make few loans, minimizing the variability of profits; and in case D, they make many loans,Increasing the variability of profits. The possible outcomes and promotions are listed below:

Assume members of the Bank and Canadabank don't care whether other people receive Promotions. If the Bank makes their policy move first, what action will each bank take?

A) (A, D)

B) (B, D)

C) (A, C)

D) (B, C)

Assume members of the Bank and Canadabank don't care whether other people receive Promotions. If the Bank makes their policy move first, what action will each bank take?

A) (A, D)

B) (B, D)

C) (A, C)

D) (B, C)

(A, C)

3

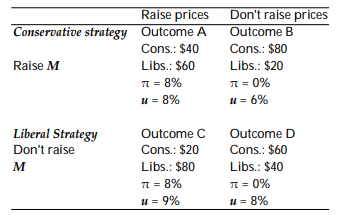

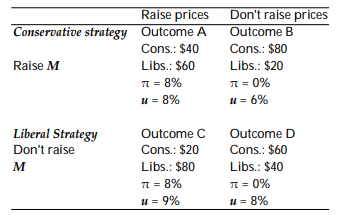

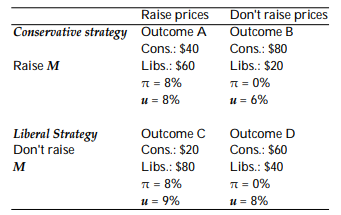

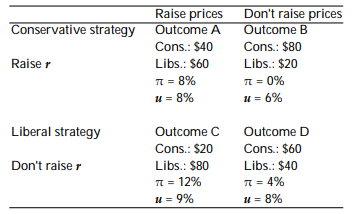

There is an election coming up. Conservatives are currently in government, and will be able to raise more money for the next election campaign if they keep inflation and unemployment low.

Conservatives can persuade firms whether or not to raise prices; Liberals can persuade the Bank Whether or not to increase the money supply. The amount of money raised by each party and the Resulting inflation and unemployment rates are given below. If the Conservatives can move first, What will be the outcome of this game?

A) Outcome A

B) Outcome B

C) Outcome C

D) Outcome D

Conservatives can persuade firms whether or not to raise prices; Liberals can persuade the Bank Whether or not to increase the money supply. The amount of money raised by each party and the Resulting inflation and unemployment rates are given below. If the Conservatives can move first, What will be the outcome of this game?

A) Outcome A

B) Outcome B

C) Outcome C

D) Outcome D

Outcome D

4

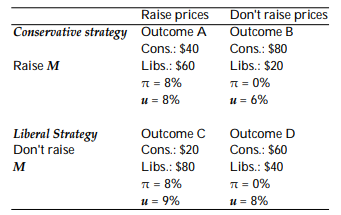

There is an election coming up. Conservatives are currently in government, and will be able to raise more money for the next federal election if they keep inflation and unemployment low. Conservatives can persuade firms whether or not to raise prices; Liberals can persuade the Bank whether or not to increase the money supply. The amount of money raised by each party and the resulting inflation and unemployment rates are given below. If the Liberals can move first, what will be the outcome of this game?

A) Outcome A

B) Outcome B

C) Outcome C

D) Outcome D

A) Outcome A

B) Outcome B

C) Outcome C

D) Outcome D

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

5

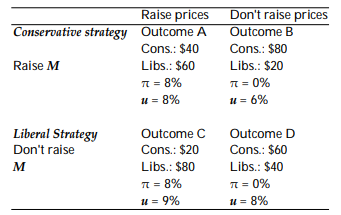

There is an election coming up. Liberals can persuade firms whether or not to raise prices; Conservatives can persuade the Bank whether or not to increase the money supply. The Liberals move first. The amount of money raised by each party and the resulting inflation and unemployment rates are given below. What will be the outcome of this game?

A) Outcome A

B) Outcome B

C) Outcome C

D) Outcome D

A) Outcome A

B) Outcome B

C) Outcome C

D) Outcome D

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

6

Consider an economy with a fractional reserve banking and no currency held by public. If the monetary base is $1,000,000 and the reserve-deposit ratio 0.1, the money supply is

A) $ 5,000,000

B) $10,000,000

C) $100,000

D) $900,000

A) $ 5,000,000

B) $10,000,000

C) $100,000

D) $900,000

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

7

In an economy with a fractional system banking, cu=0.6, res=0.2, and M=1,000,000. What is the monetary base?

A) $500,000

B) $2,000,000

C) $5,000,000

D) $10,000,000

A) $500,000

B) $2,000,000

C) $5,000,000

D) $10,000,000

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose the reserve-deposit ratio is res = 0.5 - 2i, where i is the nominal interest rate. The currency-deposit ratio is 0.2 and the monetary base equals 100. The real quantity of money demanded is given by the more demand function L(Y, i) = 0.5Y - 10i, where Y is real output. Currently the real interest rate is 5% and the economy expects an inflation rate of 5%. Assume the price level P is equal to 1.

a. Calculate the money multiplier.

b. Calculate the reserve-deposit ratio.

c. Calculate the money supply.

d. Calculate the value of output Y that clears the asset market.

a. Calculate the money multiplier.

b. Calculate the reserve-deposit ratio.

c. Calculate the money supply.

d. Calculate the value of output Y that clears the asset market.

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

9

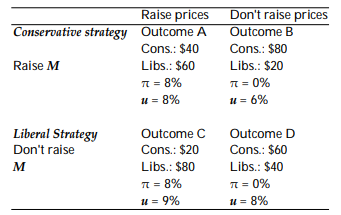

There is an election coming up. Conservatives are currently in government, and will be able to raise more money for the next election campaign if they keep interest rates and unemployment low. Conservatives can persuade firms whether or not to raise prices; Liberals can persuade the Bank whether or not to increase interest rates. The amount of money raised by each party and the resulting inflation and unemployment rates are given below.

a. If the Conservatives can move first, what will be the outcome of this game?

b. Now suppose the Liberals move first. What will be the outcome?

c. Suppose the roles are reversed and Liberals can influence prices, while Conservatives influence the money supply. What is the outcome if Liberals move first? If Conservatives move first?

a. If the Conservatives can move first, what will be the outcome of this game?

b. Now suppose the Liberals move first. What will be the outcome?

c. Suppose the roles are reversed and Liberals can influence prices, while Conservatives influence the money supply. What is the outcome if Liberals move first? If Conservatives move first?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

10

Suppose that all workers place a value on their leisure of 75 goods per day. The production function relating output per day Y to the number of people working per day N is Y = 500N - 0.4N2, and the marginal product of labour is MPN = 500 - 0.8N. A 25% tax is levied on wages.

a. How much is output per day?

b. In terms of lost output, what is the cost of the distortion introduced by this tax?

a. How much is output per day?

b. In terms of lost output, what is the cost of the distortion introduced by this tax?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

11

Real money demand in the economy is given by L = 0.3Y - 600i, where Y is real income and i is the nominal interest rate. In equilibrium, real money demand L equals real money supply M/P. Suppose that Y equals 2000 and the real interest rate is 5%.

a. At what rate of inflation is seignorage maximized?

b. What is the maximum amount of seignorage revenue?

a. At what rate of inflation is seignorage maximized?

b. What is the maximum amount of seignorage revenue?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck