Deck 4: Tax Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

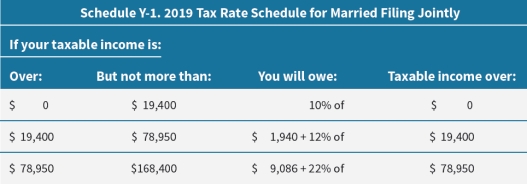

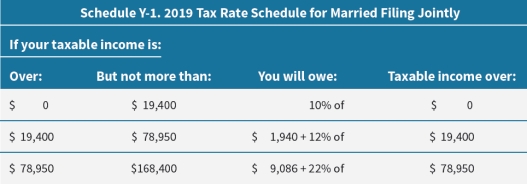

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

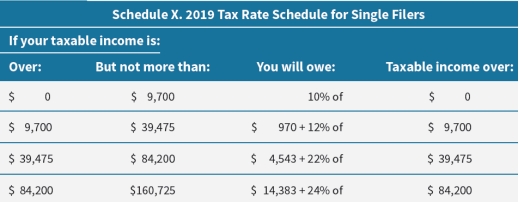

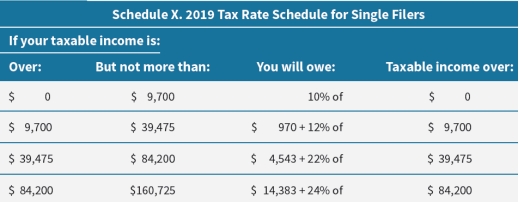

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/84

Play

Full screen (f)

Deck 4: Tax Planning

1

The U.S. income tax is considered

A) progressive.

B) illegal.

C) regressive.

D) transgressive.

A) progressive.

B) illegal.

C) regressive.

D) transgressive.

progressive.

2

A progressive tax is one in which

A) you pay more if you earn more.

B) you pay less if you earn more.

C) you pay the same regardless of earnings.

D) taxes are used for progressive services.

A) you pay more if you earn more.

B) you pay less if you earn more.

C) you pay the same regardless of earnings.

D) taxes are used for progressive services.

you pay more if you earn more.

3

A tax that places a disproportionate burden on taxpayers with lower incomes is

A) reformative.

B) progressive.

C) regressive.

D) liberal.

A) reformative.

B) progressive.

C) regressive.

D) liberal.

regressive.

4

The sales tax

A) is a regressive tax.

B) takes a bigger bite out of low-income families' disposable incomes.

C) places a disproportionate burden on taxpayers with lower incomes.

D) All the choices reflect sales tax.

A) is a regressive tax.

B) takes a bigger bite out of low-income families' disposable incomes.

C) places a disproportionate burden on taxpayers with lower incomes.

D) All the choices reflect sales tax.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

5

FICA is a ________tax, which is _________.

A) sales; progressive

B) sales; regressive

C) payroll; progressive

D) payroll; regressive

A) sales; progressive

B) sales; regressive

C) payroll; progressive

D) payroll; regressive

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

6

What is the FICA tax used to pay for?

A) Social Security

B) Medicare

C) Medicaid and Medicare

D) Social Security and Medicare

A) Social Security

B) Medicare

C) Medicaid and Medicare

D) Social Security and Medicare

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

7

Marginal tax rates today are relatively ______ by historical standards.

A) high

B) low

C) average

D) equal

A) high

B) low

C) average

D) equal

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

8

In 2020, the lowest marginal tax rate is ___ percent.

A) 0

B) 10

C) 12

D) 15

A) 0

B) 10

C) 12

D) 15

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is the formula for calculating the average tax rate?

A) Taxes paid/Taxable income

B) Taxes paid/Gross income

C) Taxable income/Gross income

D) Taxable income/Adjusted gross income

A) Taxes paid/Taxable income

B) Taxes paid/Gross income

C) Taxable income/Gross income

D) Taxable income/Adjusted gross income

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

10

If your taxable income is $86,000, your gross income is $115,000, and you paid $18,000 in taxes, what is your average tax rate? (Round to the nearest percent.)

A) 17%

B) 21%

C) 26%

D) 48%

A) 17%

B) 21%

C) 26%

D) 48%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

11

Janette had a gross income of $82,750 this year. She paid $18,945 in taxes and was not eligible for any tax credits. If her average tax rate was 24.8%, how much did Janette claim in total deductions? (Round your answer to the nearest dollar.)

A) $0

B) $4,698

C) $6,359

D) $20,522

A) $0

B) $4,698

C) $6,359

D) $20,522

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

12

Judy is self-employed and is in the 24% federal marginal tax bracket. If she works an extra 20 hours during the year, billing $175 an hour, how much will her after-tax income increase if her Social Security tax is 6.2% and her Medicare tax is 1.45%? Assume that the state income tax rate is 3.5%. (Round to the nearest whole dollar.)

A) $1,967

B) $2,090

C) $2,270

D) $2,625

A) $1,967

B) $2,090

C) $2,270

D) $2,625

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

13

Betsy is assessed payroll taxes on $136,500 of income. If her earnings increase to $139,000, how much more will she pay in payroll tax due to the additional income, assuming the Social Security cap is set at $137,700?

A) $36.25

B) $74.40

C) $110.65

D) $191.25

A) $36.25

B) $74.40

C) $110.65

D) $191.25

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

14

Joe and Sally file for federal taxes as married filing jointly. They originally anticipated that they will pay a total of $28,765 in taxes on an estimated taxable income of $168,400. When they filed their taxes at the end of the year, they calculated their tax burden to be $30,193 on a taxable income of $174,351. What was Joe and Sally's actual average tax rate at the end of the year?

A) 16.50%

B) 17.08%

C) 17.32%

D) 17.93%

A) 16.50%

B) 17.08%

C) 17.32%

D) 17.93%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

15

To which of the following does the marginal tax rate apply?

A) First dollar of income

B) Next dollar of income

C) Last dollar of income

D) Average dollar of income

A) First dollar of income

B) Next dollar of income

C) Last dollar of income

D) Average dollar of income

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

16

The reduction in taxes owed as a result of a financial decision is known as the

A) regressive tax effect.

B) progressive tax effect.

C) marginal tax effect.

D) average tax effect.

A) regressive tax effect.

B) progressive tax effect.

C) marginal tax effect.

D) average tax effect.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

17

When a tax system is progressive, with higher rates on higher levels of income, your average tax rate will always be _______ your marginal rate.

A) more than

B) less than

C) the same as

D) more than or equal to

A) more than

B) less than

C) the same as

D) more than or equal to

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

18

Sue and Jenny both earn gross income of $40,000 per year. Jenny qualifies for a $1,000 child tax credit but Sue does not, because she does not have children. All other things being equal, who will have the higher tax rate? (Select any two.)

A) Jenny has the higher average tax rate.

B) Sue has the higher average tax rate.

C) Jenny and Sue will have the same average tax rate.

D) Jenny has the higher marginal tax rate.

E) Sue has the higher marginal tax rate.

F) Jenny and Sue will have the same marginal tax rate.

A) Jenny has the higher average tax rate.

B) Sue has the higher average tax rate.

C) Jenny and Sue will have the same average tax rate.

D) Jenny has the higher marginal tax rate.

E) Sue has the higher marginal tax rate.

F) Jenny and Sue will have the same marginal tax rate.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

19

You are single with a $67,200 annual salary and a taxable income of $55,000. Your marginal tax rate is 22%, and you owe $7,959 in taxes. What is your average tax rate?

A) 11.84%

B) 13.03%

C) 14.47%

D) 22.00%

A) 11.84%

B) 13.03%

C) 14.47%

D) 22.00%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

20

Income levels applicable to each marginal tax bracket are adjusted each year based on

A) presidential executive order

B) budget deficits

C) inflation

D) Federal Reserve

A) presidential executive order

B) budget deficits

C) inflation

D) Federal Reserve

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

21

You have taxable income of $60,000 (22% federal marginal tax bracket). If you combine your federal marginal tax with payroll tax and state income tax, your total marginal tax rate on additional earnings is 37.65%. You learn that your employer will give you a $5,000 bonus at the end of the year. How much of your bonus will you be able to spend? (Round to the nearest whole dollar.)

A) $1,250

B) $1,883

C) $3,118

D) $3,750

A) $1,250

B) $1,883

C) $3,118

D) $3,750

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

22

Harold is divorced and not remarried. He lives with his children, for which he pays more than half of the support. Harold's filing status is

A) single.

B) divorced filing separately.

C) head of household.

D) married filing separately.

A) single.

B) divorced filing separately.

C) head of household.

D) married filing separately.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

23

Taxpayers can choose whether they want to take ________ or _______.

A) the standard deduction; itemized deductions

B) the standard deduction; tax credit

C) itemized deductions; tax credit

D) any deductions; tax credits

A) the standard deduction; itemized deductions

B) the standard deduction; tax credit

C) itemized deductions; tax credit

D) any deductions; tax credits

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

24

The total of your earned income plus your unearned income less certain allowed adjustments is known as

A) taxable income.

B) gross income.

C) net income.

D) adjusted gross income.

A) taxable income.

B) gross income.

C) net income.

D) adjusted gross income.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

25

The dollar amount of a standard deduction depends upon

A) filing status.

B) the number of members in the household.

C) income level.

D) the amount of itemized deductions.

A) filing status.

B) the number of members in the household.

C) income level.

D) the amount of itemized deductions.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

26

Which is not considered by the IRS to be earned income?

A) Bonus

B) Commissions

C) Self-employment income

D) Net business income

A) Bonus

B) Commissions

C) Self-employment income

D) Net business income

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

27

In which scenario are you not required to file a tax return?

A) Your AGI exceeds your allowed deductions.

B) Your AGI does not exceed your allowed deductions.

C) Your earned income exceeds your allowed deductions but not your unearned income.

D) Your unearned income exceeds your allowed deductions but not your earned income.

A) Your AGI exceeds your allowed deductions.

B) Your AGI does not exceed your allowed deductions.

C) Your earned income exceeds your allowed deductions but not your unearned income.

D) Your unearned income exceeds your allowed deductions but not your earned income.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not used in the calculation of taxable income?

A) Unearned income

B) Standard deduction

C) Itemized deduction

D) Tax credit

A) Unearned income

B) Standard deduction

C) Itemized deduction

D) Tax credit

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

29

If you made a mistake on last year's tax return, you would file a

A) 1040ext.

B) 1040ES.

C) 1040X.

D) 1099X.

A) 1040ext.

B) 1040ES.

C) 1040X.

D) 1099X.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

30

A member of a household who receives at least half of his or her support from the head of the household is a(n)

A) allowance.

B) dependent.

C) child.

D) kiddie.

A) allowance.

B) dependent.

C) child.

D) kiddie.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

31

If you're a qualifying ______, you _____ file your own tax return .

A) dependent; must

B) dependent; do not have to

C) child; do not have to

D) child; may have to

A) dependent; must

B) dependent; do not have to

C) child; do not have to

D) child; may have to

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

32

Taxpayers should itemize deductions when _____ exceed(s) the standard deduction.

A) the Schedule A total

B) the Schedule B total

C) tax credits

D) unearned income

A) the Schedule A total

B) the Schedule B total

C) tax credits

D) unearned income

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

33

Tom is retired and lives off the rent he collects from his properties. Which form will Tom need to include rental income with his return?

A) Schedule A

B) Schedule B

C) Schedule D

D) Schedule E

A) Schedule A

B) Schedule B

C) Schedule D

D) Schedule E

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

34

Mary had taxable income of $1,560 in the form of dividends and interest payments. While Mary is claimed as a dependent by her parents, she will

A) be required to file a tax return.

B) not be required to file a tax return.

C) be required to file a tax return only if she also had earned income.

D) be required to file a tax return only if she is seeking a tax refund.

A) be required to file a tax return.

B) not be required to file a tax return.

C) be required to file a tax return only if she also had earned income.

D) be required to file a tax return only if she is seeking a tax refund.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

35

Polly and Steve are married graduate students t who earned a total income of $23,600 this year. Based on their situation, Polly and Steve are

A) required to file a joint tax return.

B) required to file a tax return as any qualified filing status.

C) not required to file a tax return, if they each file separate tax returns.

D) not required to file a tax return but should do so if they are owed a refund.

A) required to file a joint tax return.

B) required to file a tax return as any qualified filing status.

C) not required to file a tax return, if they each file separate tax returns.

D) not required to file a tax return but should do so if they are owed a refund.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

36

Carla and Anthony are a married couple. Carla had earned income of $21,500 and had $2,750 withheld in federal income taxes by her employer, and Anthony was a full-time student. Based on their status and income, Carla should file a

A) joint tax return seeking a refund of $2,750.

B) single filer tax return seeking a refund of $1,820.

C) married but filing separate tax return seeking a refund of $1,820.

D) head of household tax return seeking a refund of $2,435.

A) joint tax return seeking a refund of $2,750.

B) single filer tax return seeking a refund of $1,820.

C) married but filing separate tax return seeking a refund of $1,820.

D) head of household tax return seeking a refund of $2,435.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

37

Ray's accountant informed him that he qualifies for the American opportunity tax credit because he is a full-time student at the local university. Assuming Ray qualifies for a $2,500 tax credit, this means the credit will

A) reduce his taxes owed by $2,500.

B) reduce his taxable income by $2,500.

C) increase his itemized deductions by $2,500.

D) guarantee him a tax refund of $2,500.

A) reduce his taxes owed by $2,500.

B) reduce his taxable income by $2,500.

C) increase his itemized deductions by $2,500.

D) guarantee him a tax refund of $2,500.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

38

Hector has been very busy with his construction work due to peak season and has not been able to collect all of the paperwork for completing his taxes on time. What should Hector do?

A) He can receive an automatic six-month extension to file his taxes by filing Form 4868 by April 15.

B) He can apply by April 15 to see if he can get a 6-month extension by filing Form 4868.

C) He can send his tax return late within 6-months and avoid interest but pay a penalty.

D) He should call the IRS and make a case for extra time. The IRS may or may not grant him the extension upon review.

A) He can receive an automatic six-month extension to file his taxes by filing Form 4868 by April 15.

B) He can apply by April 15 to see if he can get a 6-month extension by filing Form 4868.

C) He can send his tax return late within 6-months and avoid interest but pay a penalty.

D) He should call the IRS and make a case for extra time. The IRS may or may not grant him the extension upon review.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

39

Greg and Jamie are married and both work part-time while in graduate school. Greg earns $12,000, and Jaimie earns 11,000. Based on Greg and Jamie's situation, which of the following is true?

A) Greg and Jamie will only pay federal income tax.

B) Greg and Jamie will pay federal income tax and payroll taxes.

C) Greg and Jamie will only pay payroll taxes.

D) Greg and Jamie will not pay any form of tax.

A) Greg and Jamie will only pay federal income tax.

B) Greg and Jamie will pay federal income tax and payroll taxes.

C) Greg and Jamie will only pay payroll taxes.

D) Greg and Jamie will not pay any form of tax.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

40

Matthew is 16 years old and can be claimed as a dependent by his parents. He received $1,500 in dividends and $650 in interest and earned $4,800 from odd jobs during the year. Will Matthew need to file a separate tax return? Why?

A) Yes. His earned income exceeds the maximum limit for a dependent.

B) Yes. His unearned income exceeds the maximum limit for a dependent.

C) No. His gross income does not exceed the maximum limit for a dependent.

D) No. His gross income is under the standard deduction.

A) Yes. His earned income exceeds the maximum limit for a dependent.

B) Yes. His unearned income exceeds the maximum limit for a dependent.

C) No. His gross income does not exceed the maximum limit for a dependent.

D) No. His gross income is under the standard deduction.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

41

While preparing his tax return, Emilio accidentally added his IRA retirement contribution of $2,900 to his gross income instead of subtracting it. If he is in the 24% marginal tax bracket, what will be the impact of this error on his federal taxes?

A) His reported taxes will be higher by $1,392.

B) His reported taxes will be lower by $1,392.

C) His reported taxes will be lower by $696.

D) His reported taxes will be higher by $696.

A) His reported taxes will be higher by $1,392.

B) His reported taxes will be lower by $1,392.

C) His reported taxes will be lower by $696.

D) His reported taxes will be higher by $696.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

42

Heidi filed as a head of household and took the standard deduction this year despite her daughter moving out last year following her graduation from college. The standard deduction for single filers is $12,200, and head of household is $18,350. Assuming a marginal tax rate of 32%, how much is this error worth? (Round to nearest whole number.)

A) $1,968

B) $3,094

C) $4,182

D) $5,872

A) $1,968

B) $3,094

C) $4,182

D) $5,872

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

43

Natasha had earned income of $58,500 and will claim the standard deduction of $12,200 as a single taxpayer. If she has no other adjustment to her tax return, what will she owe in taxes? (Round to nearest whole number.)

A) $6,045

B) $8,729

C) $10,186

D) $12,870

A) $6,045

B) $8,729

C) $10,186

D) $12,870

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

44

The first step in calculating federal income taxes owed is to

A) make adjustments to income.

B) subtract tax credits.

C) add up all sources of income.

D) subtract taxes already paid through employer withholding.

A) make adjustments to income.

B) subtract tax credits.

C) add up all sources of income.

D) subtract taxes already paid through employer withholding.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is not included in total income on federal income tax returns?

A) Interest income

B) Tips

C) Life insurance proceeds

D) Unemployment compensation

A) Interest income

B) Tips

C) Life insurance proceeds

D) Unemployment compensation

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following must be included in total income on federal income tax returns?

A) Child support received

B) Tips and bonuses

C) Worker's compensation benefits

D) Insurance claim payments

A) Child support received

B) Tips and bonuses

C) Worker's compensation benefits

D) Insurance claim payments

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

47

Lee earned a salary of $25,000 from his job as a server last year. In addition, he earned $12,500 in tips, $135 in interest income, and $200 in dividend income from investments. What was Lee's total income last year?

A) $25,000

B) $25,335

C) $37,500

D) $37,835

A) $25,000

B) $25,335

C) $37,500

D) $37,835

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

48

Whether your investment income qualifies for capital gains taxation instead of ordinary income taxation, it depends on

A) how long you owned the investment.

B) how long you owned the investment and how much you earn.

C) your filing status only.

D) how long you owned the investment, how much you earn, and your filing status.

A) how long you owned the investment.

B) how long you owned the investment and how much you earn.

C) your filing status only.

D) how long you owned the investment, how much you earn, and your filing status.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is an expense that is subtracted from total income to arrive at adjusted gross income?

A) Individual retirement account contributions

B) Long-term capital gains

C) Child-care tax credit

D) Lottery winnings

A) Individual retirement account contributions

B) Long-term capital gains

C) Child-care tax credit

D) Lottery winnings

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following filing status categories receives the largest standard deduction?

A) Single and 65 or older

B) Head of household

C) Married filing separately

D) Married filing jointly

A) Single and 65 or older

B) Head of household

C) Married filing separately

D) Married filing jointly

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following types of taxes paid is not an allowable itemized deduction?

A) State income taxes

B) Personal property taxes

C) Interest on personal loan

D) Mortgage interest

A) State income taxes

B) Personal property taxes

C) Interest on personal loan

D) Mortgage interest

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

52

Medical expenses that add up to more than ____ percent of adjusted gross income can be deducted.

A) 5

B) 7.5

C) 10

D) 12.5

A) 5

B) 7.5

C) 10

D) 12.5

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

53

Which is not an itemized deduction?

A) Taxes you paid

B) Interest you paid

C) Retirement plan contributions

D) Casualty and theft losses

A) Taxes you paid

B) Interest you paid

C) Retirement plan contributions

D) Casualty and theft losses

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following occupations would be the most likely to pay estimated taxes?

A) Self-employed tax preparer

B) Software engineer for Microsoft

C) Nurse at local hospital

D) Public school teacher

A) Self-employed tax preparer

B) Software engineer for Microsoft

C) Nurse at local hospital

D) Public school teacher

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

55

A $1,000 tax credit for someone with a 35 percent marginal tax rate is worth

A) $350.

B) $650.

C) $1,000.

D) $1,350.

A) $350.

B) $650.

C) $1,000.

D) $1,350.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

56

If you sell shares of stock that you have owned for 15 months, any profit made on the sale would be classified as

A) ordinary income.

B) a short-term capital gain.

C) a long-term capital gain.

D) earned income.

A) ordinary income.

B) a short-term capital gain.

C) a long-term capital gain.

D) earned income.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

57

Noncash contributions, such as food or clothing, given to charitable organizations are

A) allowed as deductible contributions to a qualifying charity, only if itemizing deductions.

B) allowed as deductible contributions to a qualifying charity even if using the standard deduction.

C) not deductible contributions.

D) not deductible contributions but may qualifying for a tax credit.

A) allowed as deductible contributions to a qualifying charity, only if itemizing deductions.

B) allowed as deductible contributions to a qualifying charity even if using the standard deduction.

C) not deductible contributions.

D) not deductible contributions but may qualifying for a tax credit.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

58

Glenda has W-2 gross earnings of $125,000. A total of $8,500 of her income was deferred to her company's retirement plan, and $5,800 was used to pay for her health-care premiums. What will be her W-2 taxable income?

A) $110,700

B) $116,500

C) $119,200

D) $125,000

A) $110,700

B) $116,500

C) $119,200

D) $125,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

59

Yvonne's adjusted gross income is $54,455. She is a single parent with a qualifying dependent. Her itemized deductions total $6,800. What is her taxable income, given the following standard deductions?

Standard deduction

Married/joint: $24,400

Single: $12,200

Head of household: $18,350

Married/separate: $12,200

Dependent: $1,000

A) $36,105

B) $41,255

C) $47,655

D) $46,655

Standard deduction

Married/joint: $24,400

Single: $12,200

Head of household: $18,350

Married/separate: $12,200

Dependent: $1,000

A) $36,105

B) $41,255

C) $47,655

D) $46,655

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

60

Jim and Judy file taxes jointly as a married couple. They have a combined adjusted gross income of $97,651. Their Schedule A itemized expenses are as follows: interest on home mortgage, $11,986; property taxes on home, $7,300; state income taxes, $3,880; and charitable contributions, $1,500. What is their taxable income, given the following standard deductions?

Standard deduction

Married/joint: $24,400

Single: $12,200

Head of household: $18,350

Married/separate: $12,200

Dependent: $1,000

A) $72,985

B) $73,251

C) $74,485

D) $74,971

Standard deduction

Married/joint: $24,400

Single: $12,200

Head of household: $18,350

Married/separate: $12,200

Dependent: $1,000

A) $72,985

B) $73,251

C) $74,485

D) $74,971

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

61

To calculate taxable income, which of the following must be subtracted from adjusted gross income (AGI)?

A) Adjustments to total income

B) Tax credits

C) FICA payroll tax

D) Standard or itemized deductions

A) Adjustments to total income

B) Tax credits

C) FICA payroll tax

D) Standard or itemized deductions

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

62

David and Elaine have an AGI of $97,800 and file jointly as a married couple. What proportion of their gross income will not be taxed at all, assuming the couple claims a standard deduction of $24,400? (round to nearest percent.)

A) 0%

B) 25%

C) 75%

D) 100%

A) 0%

B) 25%

C) 75%

D) 100%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

63

Yulia and Mikhail had a joint taxable income of $58,700; and according to the tax tables, they owe $7,886 in federal taxes. Yulia is a full-time student earning her four-year degree at the local university. If their employers withheld $8,942 in federal taxes from their salaries and they qualify for a $2,000 education tax credit, calculate how much they owe or how much refund they can expect this year.

A) $3,056 refund

B) $3,056 owed

C) $1,056 refund

D) $1,056 owed

A) $3,056 refund

B) $3,056 owed

C) $1,056 refund

D) $1,056 owed

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

64

Bill and Miley had an adjusted gross income of $75,000. They file taxes jointly and the standard deduction for married filing jointly is $24,400. They listed their itemized expenses as follows: home mortgage interest, $4,750; house property tax, $5,890; state income tax, $3,000; and charitable gifts (market value), $245. How much do they owe in federal income tax?

A) $5,684

B) $6,072

C) $6,946

D) $7,334

A) $5,684

B) $6,072

C) $6,946

D) $7,334

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

65

Donald sold his primary residence for $198,425 after owning it for seven years. His profit on the sale was $24,500. The long-term capital gains tax rate is 0 percent for those in the 10 or 12 percent tax brackets, 20 percent for those with taxable income over $434,550 (single), and 15 percent for everyone else. If Donald is in the 35 percent tax bracket, how much tax will he owe on the listed transactions? (Round to the nearest whole dollar.)

A) $0

B) $3,675

C) $4,900

D) $8,575

A) $0

B) $3,675

C) $4,900

D) $8,575

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

66

Some of the cost of child-care expenses can be subtracted from your taxes through which of the following mechanisms?

A) Deduction

B) Exemption

C) Credit

D) Adjustment

A) Deduction

B) Exemption

C) Credit

D) Adjustment

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following tax credits best applies to a low-income family with two children?

A) Lifetime learning credit

B) Retirement savings contribution credit

C) Child tax credit

D) American opportunity credit

A) Lifetime learning credit

B) Retirement savings contribution credit

C) Child tax credit

D) American opportunity credit

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following tax credits applies only to qualified undergraduate education expenses?

A) Lifetime learning credit

B) Retirement savings contribution credit

C) Child tax credit

D) American opportunity tax credit

A) Lifetime learning credit

B) Retirement savings contribution credit

C) Child tax credit

D) American opportunity tax credit

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following tax credits best applies to a low-income person contributing to an IRA?

A) Lifetime learning tax credit

B) Retirement savings contribution credit

C) Earned income tax credit

D) American opportunity credit

A) Lifetime learning tax credit

B) Retirement savings contribution credit

C) Earned income tax credit

D) American opportunity credit

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

70

The alternative minimum tax was designed to

A) make sure that high-income people don't take advantage of too many special tax rules to avoid paying their fair share of taxes.

B) reduce the tax burden on working parents by providing an alternative tax schedule.

C) avoid double taxation and offset taxes paid to another country against federal income taxes owed.

D) make sure that low-income people don't take advantage of too many special tax rules to avoid paying their fair share of taxes.

A) make sure that high-income people don't take advantage of too many special tax rules to avoid paying their fair share of taxes.

B) reduce the tax burden on working parents by providing an alternative tax schedule.

C) avoid double taxation and offset taxes paid to another country against federal income taxes owed.

D) make sure that low-income people don't take advantage of too many special tax rules to avoid paying their fair share of taxes.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is most likely to trigger the alternative minimum tax (AMT) for a tax filer?

A) Reporting the standard deduction instead of itemized deductions

B) Contributing to your company's tax-sheltered retirement plan

C) Claiming large number of deductions or credits

D) Filing as head of household

A) Reporting the standard deduction instead of itemized deductions

B) Contributing to your company's tax-sheltered retirement plan

C) Claiming large number of deductions or credits

D) Filing as head of household

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

72

When your employer takes money out of your paycheck and sends it to the government, it is called

A) an itemized deduction.

B) payroll withholding.

C) a tax credit.

D) a regressive tax.

A) an itemized deduction.

B) payroll withholding.

C) a tax credit.

D) a regressive tax.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

73

Reimbursement accounts for qualified medical and child-care expenses are known as

A) option plans.

B) cafeteria plans.

C) deferred compensation plans.

D) flexible spending accounts.

A) option plans.

B) cafeteria plans.

C) deferred compensation plans.

D) flexible spending accounts.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following retirement accounts allows tax-free withdrawals at retirement?

A) Roth IRAs

B) 403(b) plans

C) 401(k) plans

D) Traditional IRAs

A) Roth IRAs

B) 403(b) plans

C) 401(k) plans

D) Traditional IRAs

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is not deductible from income for federal income taxes?

A) Traditional IRA contribution

B) Roth IRA contribution

C) Medical flexible spending account contribution

D) Employer retirement plan contribution

A) Traditional IRA contribution

B) Roth IRA contribution

C) Medical flexible spending account contribution

D) Employer retirement plan contribution

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is considered tax evasion?

A) Working under the table for someone who pays you in cash and does not withhold taxes

B) Contributing to tax-deferred retirement plans

C) Holding a stock an extra day to avoid short-term capital gain

D) Tracking your expenses during the year with the goal of itemizing expenses on your taxes

A) Working under the table for someone who pays you in cash and does not withhold taxes

B) Contributing to tax-deferred retirement plans

C) Holding a stock an extra day to avoid short-term capital gain

D) Tracking your expenses during the year with the goal of itemizing expenses on your taxes

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

77

Which action is against the law and is subject to criminal penalties?

A) Tax avoidance

B) Tax evasion

C) Tax deferral

D) Tax exemption

A) Tax avoidance

B) Tax evasion

C) Tax deferral

D) Tax exemption

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

78

For most taxpayers, their biggest tax shelter is their

A) IRA.

B) flexible spending account.

C) employer retirement account.

D) home.

A) IRA.

B) flexible spending account.

C) employer retirement account.

D) home.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

79

All tax audits by the IRS are

A) in person at the IRS.

B) by mail.

C) in person at your home.

D) All the choices are correct.

A) in person at the IRS.

B) by mail.

C) in person at your home.

D) All the choices are correct.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

80

A taxpayer can reduce his or her taxes paid by taking all of the following actions except

A) filing late and delaying the tax payments.

B) shifting income between years to reduce the tax rate.

C) taking advantage of all deductions available under the laws.

D) availing of all tax credits that he or she is eligible for.

A) filing late and delaying the tax payments.

B) shifting income between years to reduce the tax rate.

C) taking advantage of all deductions available under the laws.

D) availing of all tax credits that he or she is eligible for.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck