Deck 12: Accounting for Partnerships

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/18

Play

Full screen (f)

Deck 12: Accounting for Partnerships

1

An advantage of partnerships is mutual agency.

False

2

In a limited partnership, one or more partners have limited liability for the debts of the firm.

True

3

In a limited liability partnership, a partner cannot be held liable for the negligence of the people directly supervised by that partner.

False

4

In a partnership where the division of profits and losses is based on salaries, interest, and a stated ratio, if the salary and interest allocation will exceed the profit, the profit is allocated only by the stated ratio instead.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

5

A partnership is considered an accounting entity for financial reporting purposes.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

6

When the partnership contract does not specify the manner in which profits and losses are to be divided, profits and losses are distributed based on the average capital balances of each partner during the year.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

7

The statement of partners' capital explains the changes in each partner's capital account and in total partnership capital during the year.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

8

Admission of a new partner to the partnership does not result in the legal dissolution of the existing partnership.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

9

If a partnership is admitting a new partner to the existing partnership and the existing partners are to receive a bonus, this bonus would be allocated on the basis of their profit and loss ratios before the admission of the new partner.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

10

Upon liquidation, once the assets have been sold and the creditors paid, the final cash is distributed equally among partners.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

11

Which one of the following is not a feature of partnerships?

A) Limited life

B) Limited liability

C) Mutual agency

D) Co-ownership of property

A) Limited life

B) Limited liability

C) Mutual agency

D) Co-ownership of property

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

12

B invests $60,000 for a 25% interest in a partnership that has total capital of $200,000 after admitting B. Which of the following is true?

A) B's capital is $60,000.

B) B's capital is $35,000.

C) B received a bonus of $10,000.

D) The original partners received a total bonus of $10,000.

A) B's capital is $60,000.

B) B's capital is $35,000.

C) B received a bonus of $10,000.

D) The original partners received a total bonus of $10,000.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

13

Partners A and B receive a salary allowance of $12,000 and $18,000, respectively, and share the remainder equally. If the company earned $20,000 during the period, what is the effect on A's capital?

A) $12,000 increase

B) $7,000 decrease

C) $7,000 increase

D) $10,000 increase

A) $12,000 increase

B) $7,000 decrease

C) $7,000 increase

D) $10,000 increase

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

14

After selling the assets and paying the creditors, the partnership had $90,000 cash remaining. A, B, and C had capital balances of $20,000, $30,000 and $40,000 respectively. Profit is shared on a ratio of 1:3:5, respectively. The cash to be received by partner C would be:

A) $30,000.

B) $40,000.

C) $45,000.

D) $50,000.

A) $30,000.

B) $40,000.

C) $45,000.

D) $50,000.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

15

Selling partnership assets and paying the proceeds to creditors and owners refers to:

A) dissolution.

B) unlimited liability.

C) mutual agency.

D) liquidation.

A) dissolution.

B) unlimited liability.

C) mutual agency.

D) liquidation.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

16

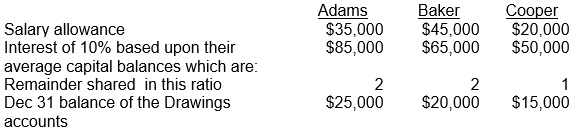

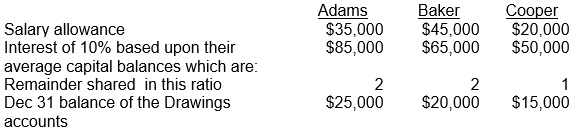

ABC Partnership has a profit of $150,000 for the year ended December 31, 2011. The partnership agreement states that profit and losses are to be distributed using salary allowances, interest allowances, and a ratio for the remainder. Information about the agreement and the balance of the Drawings accounts is contained in the table below.

(a) Prepare a detailed schedule to show how the profit would be allocated among the three partners.

(a) Prepare a detailed schedule to show how the profit would be allocated among the three partners.

(b) Assume that the revenue and expense accounts have been closed. Prepare the remaining closing entries.

(a) Prepare a detailed schedule to show how the profit would be allocated among the three partners.

(a) Prepare a detailed schedule to show how the profit would be allocated among the three partners.(b) Assume that the revenue and expense accounts have been closed. Prepare the remaining closing entries.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

17

On July 1, the Duncan & Evan partnership agreed to admit Foster to the partnership. Foster will receive a 40% share of the business for a cash investment of $200,000. Information regarding the partnership records prior to the admission of Foster is located in the table.

Prepare the journal entry to admit Foster into the partnership. Show calculations.

Prepare the journal entry to admit Foster into the partnership. Show calculations.

Prepare the journal entry to admit Foster into the partnership. Show calculations.

Prepare the journal entry to admit Foster into the partnership. Show calculations.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

18

Define Limited Partnerships and Limited Liability Partnerships, indicating the difference between the two.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck