Deck 17: Macroeconomic policy II: fiscal policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/123

Play

Full screen (f)

Deck 17: Macroeconomic policy II: fiscal policy

1

Assume the marginal propensity to consume (MPC)is 0.8 and the government cuts taxes by $250 billion.The aggregate demand curve will shift to the:

A)right by $1000 billion.

B)right by $750 billion.

C)left by $1000 billion.

D)left by $750 billion.

A)right by $1000 billion.

B)right by $750 billion.

C)left by $1000 billion.

D)left by $750 billion.

A

2

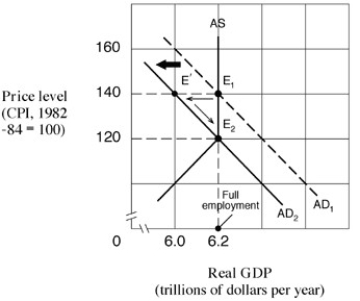

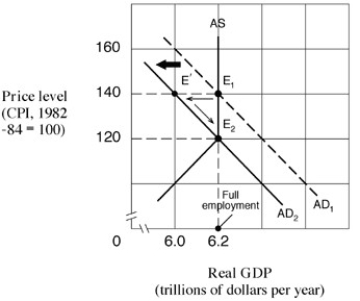

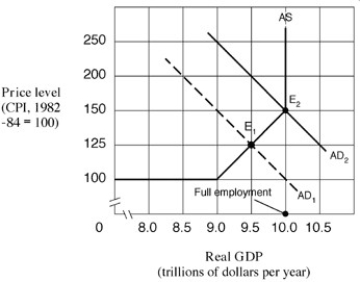

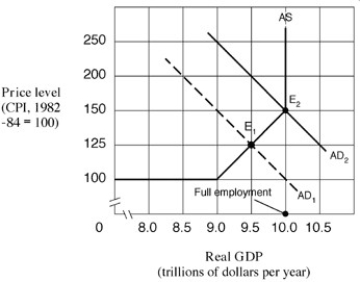

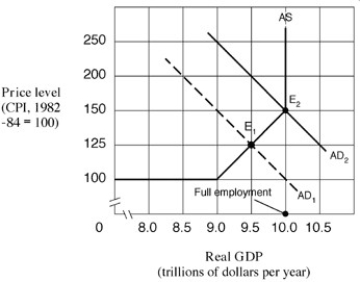

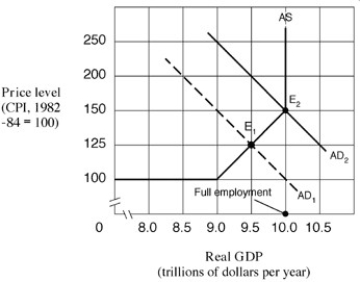

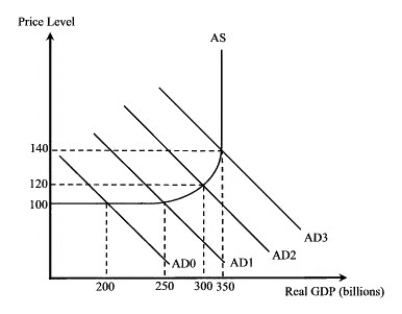

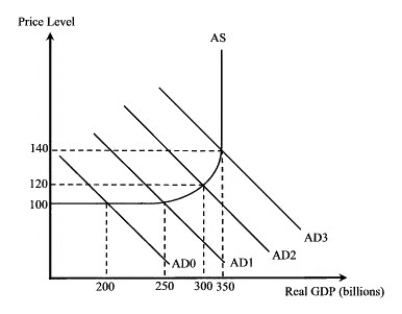

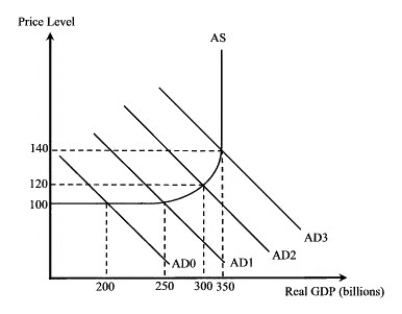

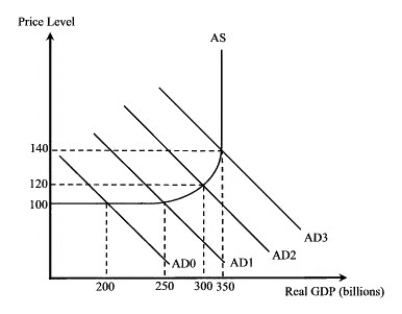

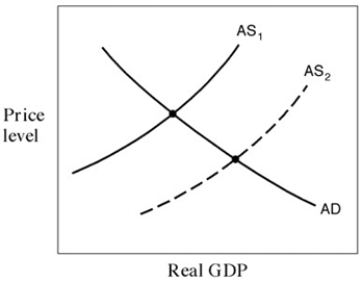

Exhibit 17-2 Aggregate demand and supply model

Suppose the economy in Exhibit 17-2 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.75.Following Keynesian economics,the federal government can move the economy to point E₂ and reduce inflation by:

A)increasing government tax revenue by $6 billion.

B)decreasing government tax revenue by $6.1 billion.

C)decreasing government tax revenue by $200 billion.

D)increasing government tax revenue by approximately $66 billion.

E)decreasing government tax revenue by approximately $66 billion.

Suppose the economy in Exhibit 17-2 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.75.Following Keynesian economics,the federal government can move the economy to point E₂ and reduce inflation by:

A)increasing government tax revenue by $6 billion.

B)decreasing government tax revenue by $6.1 billion.

C)decreasing government tax revenue by $200 billion.

D)increasing government tax revenue by approximately $66 billion.

E)decreasing government tax revenue by approximately $66 billion.

D

3

Assume the economy is in recession and real GDP is below full employment.The marginal propensity to consume (MPC)is 0.75 and the government follows Keynesian economics by using expansionary fiscal policy to increase aggregate demand (total spending).If an increase of $1000 billion aggregate demand can restore full employment,the government should:

A)decrease spending by $750 billion.

B)increase spending by $750 billion.

C)increase spending by $1000 billion.

D)increase spending by $250 billion.

A)decrease spending by $750 billion.

B)increase spending by $750 billion.

C)increase spending by $1000 billion.

D)increase spending by $250 billion.

D

4

Suppose inflation is a threat because the current aggregate demand curve will increase by $600 billion at any price level.If the marginal propensity to consume is 0.75,federal policymakers can follow Keynesian economics and restrain inflation by:

A)decreasing tax revenues by $600 billion.

B)decreasing transfer payments by $200 billion.

C)increasing tax revenues by $200 billion.

D)increasing government purchases by $150 billion.

A)decreasing tax revenues by $600 billion.

B)decreasing transfer payments by $200 billion.

C)increasing tax revenues by $200 billion.

D)increasing government purchases by $150 billion.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

5

If the marginal propensity to consume (MPC)is 0.8 and the parliament votes for a $100 million tax cut.What is the change in aggregate demand?

A)$250 million.

B)$200 million.

C)$100 million.

D)$80 million.

A)$250 million.

B)$200 million.

C)$100 million.

D)$80 million.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

6

If no fiscal policy changes are made,suppose the current aggregate demand curve will increase horizontally by $1000 billion and cause inflation.If the marginal propensity to consume is 0.75,federal policymakers could follow Keynesian economics and restrain inflation by decreasing:

A)government spending by $250 billion.

B)taxes by $100 billion.

C)taxes by $1000 billion.

D)government spending by $1000 billion.

E)government spending by $750 billion.

A)government spending by $250 billion.

B)taxes by $100 billion.

C)taxes by $1000 billion.

D)government spending by $1000 billion.

E)government spending by $750 billion.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

7

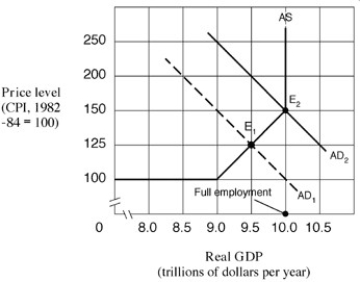

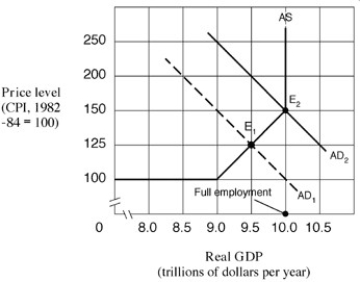

Exhibit 17-1 Aggregate demand and supply model

Beginning at equilibrium E₁ in Exhibit 17-1,when the government increases spending or cuts taxes the economy will experience:

A)an inflationary recession.

B)stagflation.

C)cost-push inflation.

D)demand-pull inflation.

E)steady state.

Beginning at equilibrium E₁ in Exhibit 17-1,when the government increases spending or cuts taxes the economy will experience:

A)an inflationary recession.

B)stagflation.

C)cost-push inflation.

D)demand-pull inflation.

E)steady state.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

8

If government reduces taxes by $10 billion and the MPC is equal to 0.8,the spending is expected to increase by:

A)$0.8 billion.

B)$5 billion.

C)$8 billion.

D)$10 billion.

A)$0.8 billion.

B)$5 billion.

C)$8 billion.

D)$10 billion.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

9

A tax multiplier equal to -4.30 would imply that a $100 tax increase would lead to a:

A)$430 decline in real GDP.

B)$430 increase in real GDP.

C)4.3 per cent increase in real GDP.

D)4.3 per cent decrease in real GDP.

E)43 per cent decrease in real GDP.

A)$430 decline in real GDP.

B)$430 increase in real GDP.

C)4.3 per cent increase in real GDP.

D)4.3 per cent decrease in real GDP.

E)43 per cent decrease in real GDP.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

10

Assume the marginal propensity to consume (MPC)is 0.75 and the government increases taxes by $250 billion.The aggregate demand curve will shift to the:

A)left by $1000 billion.

B)right by $1000 billion.

C)left by $750 billion.

D)right by $750 billion.

A)left by $1000 billion.

B)right by $1000 billion.

C)left by $750 billion.

D)right by $750 billion.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

11

To combat a recession,Keynesian fiscal policy recommends:

A)an increase in taxes.

B)an increase in government spending.

C)an increase in taxes and a decrease in government purchases to balance the budget.

D)a reduction in both taxes and government spending.

A)an increase in taxes.

B)an increase in government spending.

C)an increase in taxes and a decrease in government purchases to balance the budget.

D)a reduction in both taxes and government spending.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

12

Exhibit 17-1 Aggregate demand and supply model

Suppose the economy in Exhibit 17-1 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.8.Following Keynesian economics,to restore full employment,the government should increase its spending by:

A)$200 billion.

B)$250 billion.

C)$500 billion.

D)$1 trillion.

Suppose the economy in Exhibit 17-1 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.8.Following Keynesian economics,to restore full employment,the government should increase its spending by:

A)$200 billion.

B)$250 billion.

C)$500 billion.

D)$1 trillion.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

13

Exhibit 17-2 Aggregate demand and supply model

Suppose the economy in Exhibit 17-2 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.75.Following Keynesian economics,the federal government can move the economy to point E₂ and reduce inflation by:

A)increasing government spending by $50 billion.

B)decreasing government spending by $6 billion.

C)decreasing government spending by $50 billion.

D)decreasing government spending by $100 billion.

Suppose the economy in Exhibit 17-2 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.75.Following Keynesian economics,the federal government can move the economy to point E₂ and reduce inflation by:

A)increasing government spending by $50 billion.

B)decreasing government spending by $6 billion.

C)decreasing government spending by $50 billion.

D)decreasing government spending by $100 billion.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

14

If the economy is experiencing unemployment,then the most appropriate government policy would be to shift the aggregate:

A)demand curve by using a tax increase coupled with spending cuts.

B)demand curve by using a tax increase coupled with more spending.

C)demand curve by using a tax cut coupled with spending cuts.

D)demand curve by using a tax cut coupled with more spending.

E)supply curve by using a tax cut coupled with spending cuts.

A)demand curve by using a tax increase coupled with spending cuts.

B)demand curve by using a tax increase coupled with more spending.

C)demand curve by using a tax cut coupled with spending cuts.

D)demand curve by using a tax cut coupled with more spending.

E)supply curve by using a tax cut coupled with spending cuts.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

15

Assume that we want to drive our economy out of recession by generating a $400 billion change in real GDP.The MPC is 0.8.Which of the following policy prescriptions would generate the targeted $400 billion change in income?

A)$120 billion increase in government spending and $50 billion increase in tax revenue.

B)$140 billion increase in government spending and $70 billion increase in tax revenue.

C)$160 billion increase in government spending and $120 billion increase in tax revenue.

D)$220 billion increase in government spending and $100 billion increase in tax revenue.

E)$400 billion increase in government spending and $300 billion increase in tax revenue.

A)$120 billion increase in government spending and $50 billion increase in tax revenue.

B)$140 billion increase in government spending and $70 billion increase in tax revenue.

C)$160 billion increase in government spending and $120 billion increase in tax revenue.

D)$220 billion increase in government spending and $100 billion increase in tax revenue.

E)$400 billion increase in government spending and $300 billion increase in tax revenue.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

16

It is inflationary for government to increase spending if:

A)it also cuts taxes.

B)the aggregate supply curve is flat.

C)the economy is at full employment.

D)the equilibrium real GDP is well below full employment.

A)it also cuts taxes.

B)the aggregate supply curve is flat.

C)the economy is at full employment.

D)the equilibrium real GDP is well below full employment.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

17

What is the spending multiplier if the MPC is equal 0.75?

A)0.75.

B)1.

C)4.

D)7.5.

A)0.75.

B)1.

C)4.

D)7.5.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

18

If the MPC is 0.6 and if the goal is to increase real GDP by $200 million,then by how much would government spending have to change to generate this increase in real GDP?

A)$240 million.

B)$200 million.

C)$180 million.

D)$80 million.

A)$240 million.

B)$200 million.

C)$180 million.

D)$80 million.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

19

Exhibit 17-1 Aggregate demand and supply model

Suppose the economy in Exhibit 17-1 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.8.Following Keynesian economics,to restore full employment,the government should cut taxes by:

A)$200 billion.

B)$250 billion.

C)$500 billion.

D)$1 trillion.

Suppose the economy in Exhibit 17-1 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.8.Following Keynesian economics,to restore full employment,the government should cut taxes by:

A)$200 billion.

B)$250 billion.

C)$500 billion.

D)$1 trillion.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

20

The deliberate use of changes in government spending and/or taxes to alter AD and stabilise the business cycle is called:

A)monetary policy.

B)important international policy.

C)continuous fiscal policy.

D)discretionary fiscal policy.

A)monetary policy.

B)important international policy.

C)continuous fiscal policy.

D)discretionary fiscal policy.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

21

Unemployment benefits act as automatic stabilisers by:

A)allowing for more consumer spending during prosperity.

B)increasing spending during a recession.

C)making the unemployment rate worse during a recession.

D)allowing for less consumer spending during a recession.

E)changing the Phillips curve to a Laffer curve.

A)allowing for more consumer spending during prosperity.

B)increasing spending during a recession.

C)making the unemployment rate worse during a recession.

D)allowing for less consumer spending during a recession.

E)changing the Phillips curve to a Laffer curve.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

22

Equal increases in government expenditures and taxes will:

A)cancel each other out so that the equilibrium level of output will remain unchanged.

B)lead to an equal decrease in the equilibrium level of output.

C)lead to an equal increase in the equilibrium level of output.

D)lead to an increase in the equilibrium level of real GDP output that is larger than the initial change in government expenditures and taxes.

E)lead to an increase in the equilibrium level of output that is smaller than the initial change in government expenditures and taxes.

A)cancel each other out so that the equilibrium level of output will remain unchanged.

B)lead to an equal decrease in the equilibrium level of output.

C)lead to an equal increase in the equilibrium level of output.

D)lead to an increase in the equilibrium level of real GDP output that is larger than the initial change in government expenditures and taxes.

E)lead to an increase in the equilibrium level of output that is smaller than the initial change in government expenditures and taxes.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

23

Assume Parliament enacts a $10 billion decrease in spending and a $10 billion decrease in tax revenue.The result of this balanced-budget approach is a:

A)$10 billion decrease in aggregate demand.

B)$20 billion decrease in aggregate demand.

C)$100 billion decrease in aggregate demand.

D)$10 billion increase in aggregate demand.

A)$10 billion decrease in aggregate demand.

B)$20 billion decrease in aggregate demand.

C)$100 billion decrease in aggregate demand.

D)$10 billion increase in aggregate demand.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

24

Assume Parliament enacts a $500 billion increase in spending and a $500 billion tax increase to finance the additional government spending.The result of this balanced-budget approach is a:

A)$500 billion decrease in aggregate demand.

B)$500 billion increase in aggregate demand.

C)$1000 billion increase in aggregate demand.

D)$1000 billion decrease in aggregate demand.

A)$500 billion decrease in aggregate demand.

B)$500 billion increase in aggregate demand.

C)$1000 billion increase in aggregate demand.

D)$1000 billion decrease in aggregate demand.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

25

Unemployment benefits are an example of a/an:

A)discretionary stabiliser.

B)countercyclical stabiliser.

C)automatic stabiliser.

D)seasonal stabiliser.

A)discretionary stabiliser.

B)countercyclical stabiliser.

C)automatic stabiliser.

D)seasonal stabiliser.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

26

The result of the balanced-budget multiplier is that aggregate demand changes by the amount of the change in:

A)government spending.

B)tax revenue.

C)government spending plus tax revenue.

D)government spending minus tax revenue.

A)government spending.

B)tax revenue.

C)government spending plus tax revenue.

D)government spending minus tax revenue.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

27

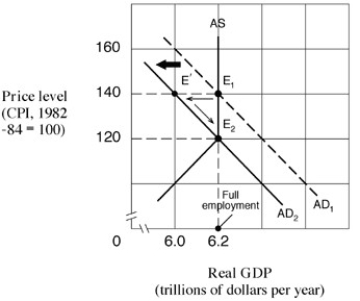

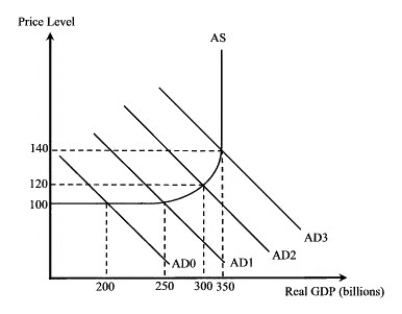

Exhibit 17-3

According to Exhibit 17-3,if we assume the MPC is 0.9,then a shift in the AD curve from AD₀ to AD₁ would require an increase in government spending of:

A)$50 billion.

B)$10 billion.

C)$5 billion.

D)greater than $50 billion to allow for inflation.

E)less than $10 billion to allow for inflation.

According to Exhibit 17-3,if we assume the MPC is 0.9,then a shift in the AD curve from AD₀ to AD₁ would require an increase in government spending of:

A)$50 billion.

B)$10 billion.

C)$5 billion.

D)greater than $50 billion to allow for inflation.

E)less than $10 billion to allow for inflation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

28

Assume Parliament enacts a $10 billion increase in spending and a $10 billion tax increase to finance the additional government spending.The result of this balanced-budget approach is a:

A)$20 billion increase in aggregate demand.

B)$10 billion increase in aggregate demand.

C)$100 billion increase in aggregate demand.

D)$10 billion decrease in aggregate demand.

A)$20 billion increase in aggregate demand.

B)$10 billion increase in aggregate demand.

C)$100 billion increase in aggregate demand.

D)$10 billion decrease in aggregate demand.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

29

Because of the automatic stabilisers,a decline in the level of economic activity will cause:

A)an increase in tax revenues collected.

B)a decrease in government expenditures.

C)a smaller budget deficit.

D)an increase in welfare payments.

A)an increase in tax revenues collected.

B)a decrease in government expenditures.

C)a smaller budget deficit.

D)an increase in welfare payments.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

30

Automatic stabilisers are:

A)state expenditures and revenues.

B)similar to discretionary fiscal policy.

C)federal expenditures and tax revenue that changes over the course of the business cycle.

D)mechanisms allowed to accelerate the boom and amplify the recession.

A)state expenditures and revenues.

B)similar to discretionary fiscal policy.

C)federal expenditures and tax revenue that changes over the course of the business cycle.

D)mechanisms allowed to accelerate the boom and amplify the recession.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

31

When the government levies a $100 million tax on people's income and puts the $100 million back into the economy in the form of a spending program,such as new interstate highway construction,the:

A)tax multiplier magnifies the effect of taxes on the level of real GDP.

B)tax then generates a $100 million decline in real GDP.

C)level of real GDP expands by $100 million.

D)level of real GDP expands by $100 million multiplied by the MPC.

E)tax multiplier overpowers the income multiplier, triggering a rollback in real GDP.

A)tax multiplier magnifies the effect of taxes on the level of real GDP.

B)tax then generates a $100 million decline in real GDP.

C)level of real GDP expands by $100 million.

D)level of real GDP expands by $100 million multiplied by the MPC.

E)tax multiplier overpowers the income multiplier, triggering a rollback in real GDP.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

32

Exhibit 17-3

According to Exhibit 17-3,if we assume the MPC is 0.8,then a shift in the AD curve from AD₀ to AD₃ would require an increase in government spending of:

A)$15 billion.

B)$30 billion.

C)$150 billion.

D)greater than $30 billion to allow for inflation.

E)less than $30 billion to allow for inflation.

According to Exhibit 17-3,if we assume the MPC is 0.8,then a shift in the AD curve from AD₀ to AD₃ would require an increase in government spending of:

A)$15 billion.

B)$30 billion.

C)$150 billion.

D)greater than $30 billion to allow for inflation.

E)less than $30 billion to allow for inflation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

33

Automatic stabilisers tend to stabilise the level of real GDP because:

A)Parliament quickly changes spending and tax revenue.

B)federal expenditures and tax revenues change as the level of real GDP changes.

C)the spending and tax multiplier are constant.

D)wages are controlled by the minimum wage law.

A)Parliament quickly changes spending and tax revenue.

B)federal expenditures and tax revenues change as the level of real GDP changes.

C)the spending and tax multiplier are constant.

D)wages are controlled by the minimum wage law.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

34

Personal income taxes:

A)make recessions and inflationary episodes more severe.

B)make recessions and inflationary episodes less severe.

C)make recessions more severe and inflationary episodes less severe.

D)make recessions less severe and inflationary episodes more severe.

E)have no effect on the severity of recessions and inflationary episodes.

A)make recessions and inflationary episodes more severe.

B)make recessions and inflationary episodes less severe.

C)make recessions more severe and inflationary episodes less severe.

D)make recessions less severe and inflationary episodes more severe.

E)have no effect on the severity of recessions and inflationary episodes.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

35

A decrease in real GDP would affect the Australian economy by:

A)cutting tax revenues and raising government expenditures.

B)cutting government expenditures and raising tax revenues.

C)raising both tax revenues and government expenditures.

D)cutting both government expenditures and tax revenues.

A)cutting tax revenues and raising government expenditures.

B)cutting government expenditures and raising tax revenues.

C)raising both tax revenues and government expenditures.

D)cutting both government expenditures and tax revenues.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

36

When the economy enters a prosperity phase,unemployment benefits:

A)fall and so disposable income and spending fall more slowly than real GDP.

B)fall and so disposable income and spending do not rise as rapidly as real GDP.

C)rise and so disposable income and spending do not rise as rapidly as real GDP.

D)rise and so disposable income and spending fall more slowly than real GDP.

E)fall and so disposable income and spending fall at the same rate as real GDP.

A)fall and so disposable income and spending fall more slowly than real GDP.

B)fall and so disposable income and spending do not rise as rapidly as real GDP.

C)rise and so disposable income and spending do not rise as rapidly as real GDP.

D)rise and so disposable income and spending fall more slowly than real GDP.

E)fall and so disposable income and spending fall at the same rate as real GDP.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not an example of an automatic stabiliser?

A)Welfare payments.

B)Unemployment benefits.

C)Transfer payments.

D)Highway construction.

A)Welfare payments.

B)Unemployment benefits.

C)Transfer payments.

D)Highway construction.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

38

The balanced budget multiplier is always equal to:

A)0.5.

B)0.75.

C)1.

D)1.5.

E)1 / MPC.

A)0.5.

B)0.75.

C)1.

D)1.5.

E)1 / MPC.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

39

Exhibit 17-3

According to Exhibit 17-3,if we assume the MPC is 0.8,then a shift in the AD curve from AD₀ to AD₁ would require an increase in government spending of:

A)$5 billion.

B)$10 billion.

C)$50 billion.

D)greater than $50 billion to allow for inflation.

E)less than $10 billion to allow for inflation.

According to Exhibit 17-3,if we assume the MPC is 0.8,then a shift in the AD curve from AD₀ to AD₁ would require an increase in government spending of:

A)$5 billion.

B)$10 billion.

C)$50 billion.

D)greater than $50 billion to allow for inflation.

E)less than $10 billion to allow for inflation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

40

When the economy enters a prosperity phase,personal income tax collections:

A)fall and so disposable income and spending fall more slowly than real GDP.

B)fall and so disposable income and spending do not rise as rapidly as real GDP.

C)rise and so disposable income and spending do not rise as rapidly as real GDP.

D)rise and so disposable income and spending fall more slowly than real GDP.

E)fall and so disposable income and spending fall at the same rate as real GDP.

A)fall and so disposable income and spending fall more slowly than real GDP.

B)fall and so disposable income and spending do not rise as rapidly as real GDP.

C)rise and so disposable income and spending do not rise as rapidly as real GDP.

D)rise and so disposable income and spending fall more slowly than real GDP.

E)fall and so disposable income and spending fall at the same rate as real GDP.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

41

The tariff reforms that Australia has undergone over the past 20 years are an example of:

A)demand-side fiscal policy.

B)demand-side monetary policy.

C)supply-side fiscal policy.

D)supply-side monetary policy.

E)labour market reform.

A)demand-side fiscal policy.

B)demand-side monetary policy.

C)supply-side fiscal policy.

D)supply-side monetary policy.

E)labour market reform.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following groups believes that the economy can achieve full employment without inflation through tax reductions,lower resource prices and deregulation?

A)The classical school.

B)The Keynesian school.

C)The neo-Keynesian school.

D)The rational expectations school.

E)The supply-side school.

A)The classical school.

B)The Keynesian school.

C)The neo-Keynesian school.

D)The rational expectations school.

E)The supply-side school.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

43

Transfer payments are an example of a/an:

A)discretionary stabiliser.

B)countercyclical stabiliser.

C)procyclical stabiliser.

D)seasonal stabiliser.

E)automatic stabiliser.

A)discretionary stabiliser.

B)countercyclical stabiliser.

C)procyclical stabiliser.

D)seasonal stabiliser.

E)automatic stabiliser.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

44

Along with lower tax rates,supply-siders' policy recommendations include:

A)spending cuts and increased government regulation.

B)lower resource prices and decreased government regulation.

C)spending increases and decreased government regulation.

D)spending increases and increased government regulation.

A)spending cuts and increased government regulation.

B)lower resource prices and decreased government regulation.

C)spending increases and decreased government regulation.

D)spending increases and increased government regulation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

45

According to supply-side fiscal policy,reducing tax rates on wages and profits will:

A)create demand-pull inflation.

B)lower the price level but may trigger a recession.

C)result in stagflation.

D)reduce both unemployment and inflation.

A)create demand-pull inflation.

B)lower the price level but may trigger a recession.

C)result in stagflation.

D)reduce both unemployment and inflation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

46

'Tax cuts - by providing incentives to work,save and invest - will raise employment and lower the price level.' This argument is made by the:

A)Keynesian economists.

B)supply-side economists.

C)classical economists.

D)monetarists.

A)Keynesian economists.

B)supply-side economists.

C)classical economists.

D)monetarists.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

47

Australian microeconomic reforms can be viewed as:

A)new demand-side reforms.

B)strictly political decision.

C)supply-side fiscal policies.

D)unnecessary spending.

A)new demand-side reforms.

B)strictly political decision.

C)supply-side fiscal policies.

D)unnecessary spending.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

48

The supply-side fiscal policy:

A)accelerates consumers' confidence in obtaining more goods at lower prices.

B)promotes taxes on producers but not consumers.

C)aims to achieve higher aggregate supply to increase real output, full employment and lower prices.

D)aims to achieve low aggregate supply to stabilise real output, full employment and lower prices.

A)accelerates consumers' confidence in obtaining more goods at lower prices.

B)promotes taxes on producers but not consumers.

C)aims to achieve higher aggregate supply to increase real output, full employment and lower prices.

D)aims to achieve low aggregate supply to stabilise real output, full employment and lower prices.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

49

According to supply-side economists,substantial tax cuts will result in:

A)a decrease in the supply of labour.

B)a decrease in the after-tax wage.

C)a decrease in the AS curve.

D)an increase in productive investment.

A)a decrease in the supply of labour.

B)a decrease in the after-tax wage.

C)a decrease in the AS curve.

D)an increase in productive investment.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is not an example of a supply-side fiscal policy used in Australia?

A)Tariff reform.

B)Financial market deregulation.

C)Taxation reform.

D)Reform in education.

A)Tariff reform.

B)Financial market deregulation.

C)Taxation reform.

D)Reform in education.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

51

An advocate of supply-side fiscal policy would advocate which of the following?

A)More taxes on research and development activities.

B)Stricter regulation.

C)Increase in resource prices.

D)Reduction in taxes.

A)More taxes on research and development activities.

B)Stricter regulation.

C)Increase in resource prices.

D)Reduction in taxes.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

52

During the Reagan administration,the Laffer curve was used to argue that:

A)the supply-side effects of tax cuts are relatively small.

B)discretionary tax cuts are unwise because they create stagflation.

C)lower income tax rates could increase tax revenues.

D)a 'flat tax' would simplify the tax code and stimulate economic growth.

A)the supply-side effects of tax cuts are relatively small.

B)discretionary tax cuts are unwise because they create stagflation.

C)lower income tax rates could increase tax revenues.

D)a 'flat tax' would simplify the tax code and stimulate economic growth.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

53

According to the supply-side economists,substantial tax cuts will:

A)cause only the AD curve to increase.

B)cause the AD curve to increase but the AS curve to decrease.

C)cause both the AD and AS curves to increase.

D)have little effect on either the AD or AS curves.

E)cause only the AS curve to decrease.

A)cause only the AD curve to increase.

B)cause the AD curve to increase but the AS curve to decrease.

C)cause both the AD and AS curves to increase.

D)have little effect on either the AD or AS curves.

E)cause only the AS curve to decrease.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

54

According to supply-side economists,lowering corporate income taxes:

A)results in wage hikes for employees but no economic growth.

B)moves society toward greater income equality.

C)checks the expansion of real GDP and employment.

D)stimulates investment and economic growth.

E)does not create enough incentive for producers to increase production.

A)results in wage hikes for employees but no economic growth.

B)moves society toward greater income equality.

C)checks the expansion of real GDP and employment.

D)stimulates investment and economic growth.

E)does not create enough incentive for producers to increase production.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

55

Microeconomic reform in Australia included:

A)the reduction of tariffs.

B)higher regulation of the Australian financial system.

C)holding interest rate under controls.

D)less flexibility in work practices.

A)the reduction of tariffs.

B)higher regulation of the Australian financial system.

C)holding interest rate under controls.

D)less flexibility in work practices.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

56

According to supply-side economists,substantial tax cuts will result in:

A)a decrease in the supply of labour.

B)a decrease in the after-tax wage.

C)an increase in the AS curve.

D)a decrease in productive investment.

A)a decrease in the supply of labour.

B)a decrease in the after-tax wage.

C)an increase in the AS curve.

D)a decrease in productive investment.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

57

The overall goal of microeconomic reform in Australia has been to:

A)shift the AS curve to the left.

B)shift the AS curve to the right.

C)shift the AD curve to the left.

D)leave the AD and AS curves unchanged.

A)shift the AS curve to the left.

B)shift the AS curve to the right.

C)shift the AD curve to the left.

D)leave the AD and AS curves unchanged.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

58

The Laffer curve shows that as tax rates rise,tax revenue:

A)always rises.

B)first rises, then falls and then rises again.

C)always falls.

D)first rises and then falls.

E)remains at a constant level.

A)always rises.

B)first rises, then falls and then rises again.

C)always falls.

D)first rises and then falls.

E)remains at a constant level.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is true?

A)A reduction in tax rates along the downward-sloping portion of the Laffer curve would increase tax revenues.

B)According to supply-side fiscal policy, lower tax rates would shift the aggregate demand curve to the right, expanding the economy and creating some inflation.

C)The presence of the automatic stabilisers tends to destabilise the economy.

D)To combat inflation, Keynesians recommend lower taxes and greater government spending.

A)A reduction in tax rates along the downward-sloping portion of the Laffer curve would increase tax revenues.

B)According to supply-side fiscal policy, lower tax rates would shift the aggregate demand curve to the right, expanding the economy and creating some inflation.

C)The presence of the automatic stabilisers tends to destabilise the economy.

D)To combat inflation, Keynesians recommend lower taxes and greater government spending.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

60

Lower taxes create a multiplier effect in the economy.It leads to:

A)decreases in prices.

B)technological advances.

C)increases in aggregate demand.

D)subsidies.

A)decreases in prices.

B)technological advances.

C)increases in aggregate demand.

D)subsidies.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

61

A country's national debt is:

A)not held by the central bank.

B)partially held by the central bank.

C)fully held by the central bank.

D)fully held by the foreign banks.

A)not held by the central bank.

B)partially held by the central bank.

C)fully held by the central bank.

D)fully held by the foreign banks.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

62

Australia's current national debt is:

A)a burden because each person owes on average $1500-2000.

B)a burden because most of it is held by overseas interests.

C)a burden in comparison to Japan's current national debt.

D)not a burden because it is mostly internal and not owed to foreigners.

A)a burden because each person owes on average $1500-2000.

B)a burden because most of it is held by overseas interests.

C)a burden in comparison to Japan's current national debt.

D)not a burden because it is mostly internal and not owed to foreigners.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

63

The RBA purchase of securities issued by the government is known as:

A)debt financing.

B)money financing.

C)national debt.

D)private debt.

A)debt financing.

B)money financing.

C)national debt.

D)private debt.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

64

Increases in the fraction of national debt held by foreigners will _____ the burden of debt service on future generations _____.

A)decrease; because it is easier for the borrowing nation to default on the debt

B)decrease; but may make the country more vulnerable to foreign intervention

C)decrease; because debt servicing accomplished by increases in the money supply is not as inflationary as it would be if all debt were held domestically

D)increase; because taxes to pay the debt are collected within the country but more interest payments on the debt are sent outside

E)increase; because foreign bond-holding pushes up interest rates at date of issue, increasing crowding out

A)decrease; because it is easier for the borrowing nation to default on the debt

B)decrease; but may make the country more vulnerable to foreign intervention

C)decrease; because debt servicing accomplished by increases in the money supply is not as inflationary as it would be if all debt were held domestically

D)increase; because taxes to pay the debt are collected within the country but more interest payments on the debt are sent outside

E)increase; because foreign bond-holding pushes up interest rates at date of issue, increasing crowding out

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

65

'Crowding out' refers to a side-effect of fiscal rather than monetary policy because:

A)it is based on rising rather than falling interest rates.

B)it is based on falling rather than rising interest rates.

C)under monetary policy, private debt doesn't replace public debt.

D)under monetary policy, the dollar appreciates rather than depreciates.

E)monetary policy won't affect net exports.

A)it is based on rising rather than falling interest rates.

B)it is based on falling rather than rising interest rates.

C)under monetary policy, private debt doesn't replace public debt.

D)under monetary policy, the dollar appreciates rather than depreciates.

E)monetary policy won't affect net exports.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is true?

A)National debt is not a burden if it is held by overseas interests.

B)National debt redistributes income from taxpayers to those holding government securities.

C)National debt increases when the RBA buys securities from the government.

D)National debt imposes an unfair burden on the current generation.

E)The current level of national debt in Australia is higher than at any stage since the Second World War.

A)National debt is not a burden if it is held by overseas interests.

B)National debt redistributes income from taxpayers to those holding government securities.

C)National debt increases when the RBA buys securities from the government.

D)National debt imposes an unfair burden on the current generation.

E)The current level of national debt in Australia is higher than at any stage since the Second World War.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

67

The issuing of government securities to the general public is considered _____ to the government.

A)an asset

B)a liability

C)inflationary

D)as money financing

A)an asset

B)a liability

C)inflationary

D)as money financing

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

68

If government deficits stimulate the private economy:

A)'crowding out' must be zero.

B)investment may rise.

C)'crowding out' is more than offset by increases in investment demand.

D)'crowding out' and 'crowding in' cancel each other out.

E)interest rates must fall.

A)'crowding out' must be zero.

B)investment may rise.

C)'crowding out' is more than offset by increases in investment demand.

D)'crowding out' and 'crowding in' cancel each other out.

E)interest rates must fall.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

69

To finance a budget deficit,the government must:

A)reduce taxes.

B)buy securities.

C)sell securities.

D)increase unemployment rate.

A)reduce taxes.

B)buy securities.

C)sell securities.

D)increase unemployment rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

70

If the government 'monetises' its debt,then:

A)government securities have been bought by the private sector.

B)government securities have been bought by the RBA.

C)the money supply will increase by an equal amount.

D)the money supply will increase.

A)government securities have been bought by the private sector.

B)government securities have been bought by the RBA.

C)the money supply will increase by an equal amount.

D)the money supply will increase.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

71

'Crowding out' refers to the government's increased demand for credit,which:

A)displaces some private-sector consumption by decreasing the price level.

B)displaces some private-sector borrowing by decreasing the interest rate.

C)displaces some private-sector borrowing by increasing the interest rate.

D)hires labour away from the private sector.

E)means longer lines at government agencies.

A)displaces some private-sector consumption by decreasing the price level.

B)displaces some private-sector borrowing by decreasing the interest rate.

C)displaces some private-sector borrowing by increasing the interest rate.

D)hires labour away from the private sector.

E)means longer lines at government agencies.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

72

If the majority of national debt is held domestically,economists would consider this not to be a burden because:

A)we owe the debt to ourselves.

B)it is only future generations that will have to repay the debt, not us.

C)we can easily pay for this debt out of export income.

D)the government knows how to spend the money better than us.

A)we owe the debt to ourselves.

B)it is only future generations that will have to repay the debt, not us.

C)we can easily pay for this debt out of export income.

D)the government knows how to spend the money better than us.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

73

When the government engages in debt financing to fund a budget deficit:

A)the money supply will increase.

B)government securities are effectively monetised.

C)national debt will rise if the securities are bought by the private sector or by overseas financial institutions.

D)national debt will rise if the securities are bought by the RBA.

A)the money supply will increase.

B)government securities are effectively monetised.

C)national debt will rise if the securities are bought by the private sector or by overseas financial institutions.

D)national debt will rise if the securities are bought by the RBA.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

74

National debt is defined as:

A)total public and private debt owed to foreign institutions.

B)the value of outstanding notes and coins issued by the RBA.

C)the value of outstanding government securities.

D)total private debt owed domestically and internationally.

E)total private debt owed domestically.

A)total public and private debt owed to foreign institutions.

B)the value of outstanding notes and coins issued by the RBA.

C)the value of outstanding government securities.

D)total private debt owed domestically and internationally.

E)total private debt owed domestically.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

75

If the national debt is owed _____,then the burden of the debt will fall disproportionately on _____.

A)domestically; overseas interests

B)overseas; overseas interests

C)domestically; future generations

D)overseas; future generations

E)overseas; the current generation.

A)domestically; overseas interests

B)overseas; overseas interests

C)domestically; future generations

D)overseas; future generations

E)overseas; the current generation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

76

The 'crowding out' of private investment is associated with:

A)a reduction in profitable investment opportunities due to a recession.

B)increased competition from foreign investors in Australian markets.

C)higher interest rates resulting from a declining rate of saving.

D)higher interest rates resulting from increased borrowing by the federal government.

E)higher interest rates resulting from restrictive monetary policy.

A)a reduction in profitable investment opportunities due to a recession.

B)increased competition from foreign investors in Australian markets.

C)higher interest rates resulting from a declining rate of saving.

D)higher interest rates resulting from increased borrowing by the federal government.

E)higher interest rates resulting from restrictive monetary policy.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

77

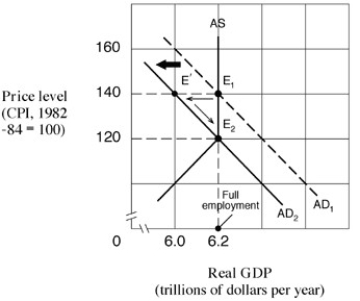

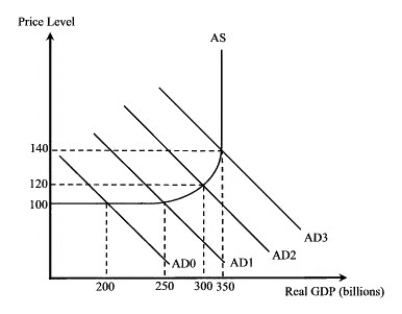

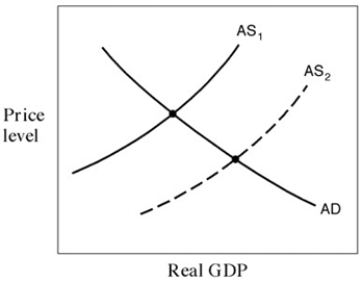

Exhibit 17-4 Aggregate demand and supply curves

In Exhibit 17-4,supply-siders claimed that the shift from AS₁ to AS₂ would occur if the government:

A)increased tax rates and increased the amount of government regulation.

B)increased tax rates and decreased the amount of government regulation.

C)increased tax rates only.

D)decreased tax rates and decreased the amount of government regulation.

E)decreased tax rates and increased the amount of government regulation.

In Exhibit 17-4,supply-siders claimed that the shift from AS₁ to AS₂ would occur if the government:

A)increased tax rates and increased the amount of government regulation.

B)increased tax rates and decreased the amount of government regulation.

C)increased tax rates only.

D)decreased tax rates and decreased the amount of government regulation.

E)decreased tax rates and increased the amount of government regulation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is not true?

A)If the government has a budget deficit, the national debt is increased.

B)National debt is a marginal value of outstanding Commonwealth Government securities.

C)National debt represents the extent of previous borrowing by the federal government.

D)A portion of national debt is held by the central bank.

A)If the government has a budget deficit, the national debt is increased.

B)National debt is a marginal value of outstanding Commonwealth Government securities.

C)National debt represents the extent of previous borrowing by the federal government.

D)A portion of national debt is held by the central bank.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

79

When a federal budget deficit causes crowding out:

A)real GDP does not increase by as much as the government purchases of goods and services multiplier would predict because bond-holders' saving declines.

B)real GDP does not increase by as much as the government purchases of goods and services multiplier would predict because investment declines.

C)interest rates fall, reducing the burden of the debt.

D)interest rates fall, bringing the current deficit back down.

E)interest rates fall, so that decreases in investment and government purchases of goods and services exactly offset the expansionary effect of the deficit.

A)real GDP does not increase by as much as the government purchases of goods and services multiplier would predict because bond-holders' saving declines.

B)real GDP does not increase by as much as the government purchases of goods and services multiplier would predict because investment declines.

C)interest rates fall, reducing the burden of the debt.

D)interest rates fall, bringing the current deficit back down.

E)interest rates fall, so that decreases in investment and government purchases of goods and services exactly offset the expansionary effect of the deficit.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

80

If the government issues securities in order to finance current consumption,then:

A)it may be a burden to future generations if the securities were bought by foreign interests.

B)it may be a burden as current generations need to pay for the interest repayments without any improvement in the country's productive capacity.

C)it will not be a burden if the securities were bought by foreign interests.

D)it will not be a burden if the debt is held domestically.

A)it may be a burden to future generations if the securities were bought by foreign interests.

B)it may be a burden as current generations need to pay for the interest repayments without any improvement in the country's productive capacity.

C)it will not be a burden if the securities were bought by foreign interests.

D)it will not be a burden if the debt is held domestically.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck