Deck 8: Inflation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 8: Inflation

1

If the CPI rises from 206.7 to 212.7 between two consecutive years, by how much has the cost of living changed between these two years?

A)The cost of living has increased by 6%.

B)The cost of living has increased by 2.9%.

C)The cost of living has increased by 12.7%.

D)The cost of living has decreased by 6%.

A)The cost of living has increased by 6%.

B)The cost of living has increased by 2.9%.

C)The cost of living has increased by 12.7%.

D)The cost of living has decreased by 6%.

The cost of living has increased by 2.9%.

2

If consumers purchase fewer of those products that increase most in price and more of those products that decrease in price as compared to the CPI basket, then changes in the CPI:

A)accurately reflect the true rate of inflation.

B)understate the true rate of inflation.

C)overstate the true rate of inflation.

D)are unrelated to the true rate of inflation.

A)accurately reflect the true rate of inflation.

B)understate the true rate of inflation.

C)overstate the true rate of inflation.

D)are unrelated to the true rate of inflation.

overstate the true rate of inflation.

3

Which of the following is a correct description of 'inflation'?

A)Inflation refers to an increase in relative prices throughout the economy.

B)Inflation is the change in the price level from one year to another.

C)Inflation is a sustained increase in the price level.

D)Inflation is when there is a one-time jump in the price level.

A)Inflation refers to an increase in relative prices throughout the economy.

B)Inflation is the change in the price level from one year to another.

C)Inflation is a sustained increase in the price level.

D)Inflation is when there is a one-time jump in the price level.

Inflation is a sustained increase in the price level.

4

When the price of petrol rises, some consumers begin riding their bikes more frequently or taking public transport instead of driving their cars. The fact that the CPI does not fully account for such changes in consumer behaviour is called:

A)outlet bias.

B)increase in quality bias.

C)substitution bias.

D)discrimination bias.

A)outlet bias.

B)increase in quality bias.

C)substitution bias.

D)discrimination bias.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

What is the broadest measure of the price level which includes all final goods and services?

A)producer price index

B)consumer price index

C)wholesale price index

D)GDP deflator

A)producer price index

B)consumer price index

C)wholesale price index

D)GDP deflator

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

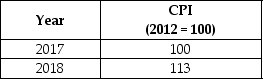

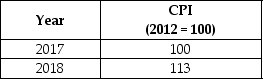

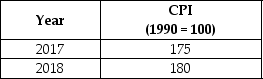

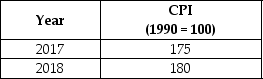

6

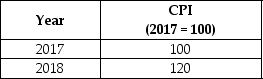

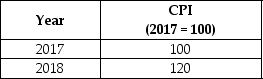

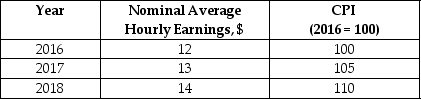

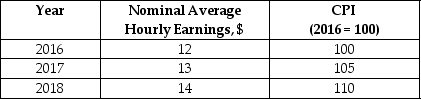

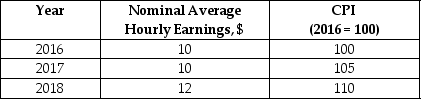

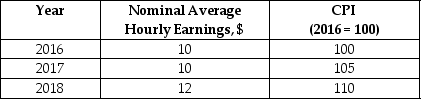

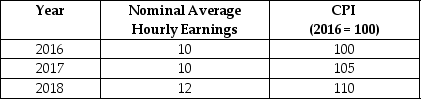

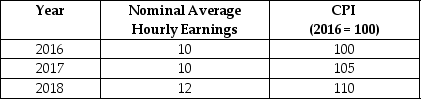

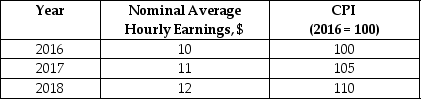

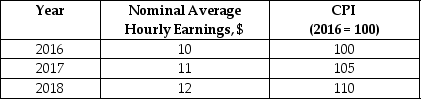

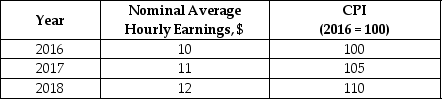

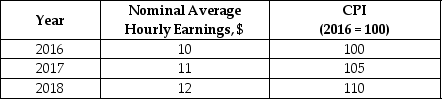

From the data in the following table we can say that the cost of living rose by ________ between 2017 and 2018.

A)2%

B)5%

C)8%

D)13%

A)2%

B)5%

C)8%

D)13%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

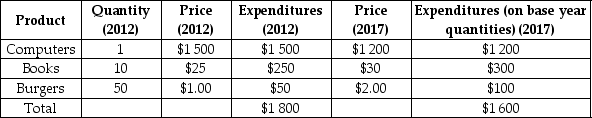

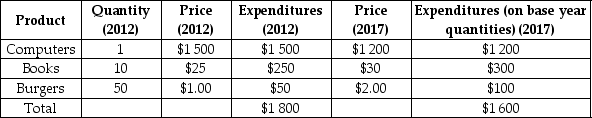

7

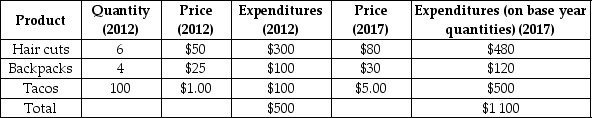

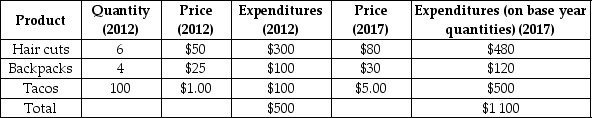

Suppose an economy has only three goods, and the typical family purchases the amounts given in the following table. If 2012 is the base year, then what is the CPI for 2017?

A)89

B)125

C)212

D)163

A)89

B)125

C)212

D)163

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

The 'inflation rate' is measured as the:

A)percentage change in the relevant price index from one time period to another.

B)change in the price level between two time periods, multiplied by 100.

C)percentage change in prices in time period 1 minus the percentage change in prices in time period 2, multiplied by 100.

D)price index in time period 2 minus the price index in time period 1.

A)percentage change in the relevant price index from one time period to another.

B)change in the price level between two time periods, multiplied by 100.

C)percentage change in prices in time period 1 minus the percentage change in prices in time period 2, multiplied by 100.

D)price index in time period 2 minus the price index in time period 1.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose that the data in the following table reflects the prices in an economy. What is the inflation rate in between 2017 and 2018?

A)2%

B)5%

C)20%

D)10%

A)2%

B)5%

C)20%

D)10%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

If the CPI changes from 125 to 120 between 2017 and 2018, how did prices change between 2017 and 2018?

A)increased by 4%

B)decreased by 5%

C)increased by 25%

A)increased by 4%

B)decreased by 5%

C)increased by 25%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

The most widely used measure of inflation is based on which of the following price indices?

A)producer price index

B)consumer price index

C)GDP deflator

D)wholesale price index

A)producer price index

B)consumer price index

C)GDP deflator

D)wholesale price index

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

The formula for calculating the CPI is:

A)(Expenditures in the current year/Expenditures in the base year)× 100.

B)(Expenditures in the current year × Expenditures in the base year)/100.

C)(Expenditures in the base year/Expenditures in the current year).

D)(Expenditures in the base year × 100)/(Expenditures in the current year).

A)(Expenditures in the current year/Expenditures in the base year)× 100.

B)(Expenditures in the current year × Expenditures in the base year)/100.

C)(Expenditures in the base year/Expenditures in the current year).

D)(Expenditures in the base year × 100)/(Expenditures in the current year).

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

Weekly expenditures for a family of four in 2017 averaged $1 500. In 2018, the cost of the same purchases was $1 600. If 2017 is the base year, what was the CPI in 2018?

A)110

B)107

C)100

D)93

A)110

B)107

C)100

D)93

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose an economy has only three goods and the typical family purchases the amounts given in the following table. If 2012 is the base year, then what is the CPI for 2017?

A)220

B)208

C)40.08

D)100

A)220

B)208

C)40.08

D)100

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

Of the market basket that makes up the CPI, which of the following is the smallest portion?

A)education

B)clothing and footwear

C)transportation

D)housing

A)education

B)clothing and footwear

C)transportation

D)housing

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following describes the accuracy of the Consumer Price Index (CPI)?

A)Changes in the CPI accurately reflect the true rate of inflation.

B)Changes in the CPI understate the true rate of inflation.

C)Changes in the CPI overstate the true rate of inflation.

D)Changes in the CPI are unrelated to the true rate of inflation.

A)Changes in the CPI accurately reflect the true rate of inflation.

B)Changes in the CPI understate the true rate of inflation.

C)Changes in the CPI overstate the true rate of inflation.

D)Changes in the CPI are unrelated to the true rate of inflation.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

When does 'inflation' occur?

A)when the value of money is rising

B)when the value of real GDP decreases

C)when the value of real GDP increases

D)when the general price level is rising

A)when the value of money is rising

B)when the value of real GDP decreases

C)when the value of real GDP increases

D)when the general price level is rising

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose that the data in the following table reflects the prices in the economy. What is the inflation rate in between 2017 and 2018?

A)5%

B)2)9%

C)4)6%

D)7)5%

A)5%

B)2)9%

C)4)6%

D)7)5%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

'Inflation' is an increase in the:

A)overall level of economic activity.

B)rate of growth of GDP.

C)average hourly wage rate.

D)general price level in the economy.

A)overall level of economic activity.

B)rate of growth of GDP.

C)average hourly wage rate.

D)general price level in the economy.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

Of the market basket that makes up CPI, which of the following is the largest portion?

A)health

B)clothing and footwear

C)housing

D)communication

A)health

B)clothing and footwear

C)housing

D)communication

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

If nominal wages rise slower than the price level, then real wages have ________ and the purchasing power of income has ________.

A)fallen; fallen

B)fallen; risen

C)risen; risen

D)risen; fallen

A)fallen; fallen

B)fallen; risen

C)risen; risen

D)risen; fallen

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

The 'PPI' is the:

A)price parity index.

B)prime producer index.

C)producer price index.

D)production performance indicator.

A)price parity index.

B)prime producer index.

C)producer price index.

D)production performance indicator.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

The 'producer price index' tracks the prices firms receive for goods and services at all stages of production.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

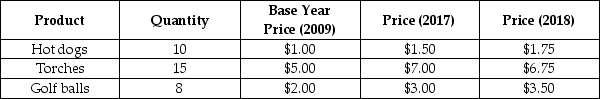

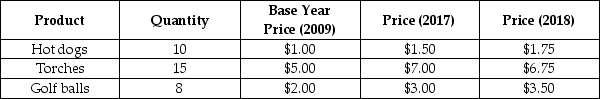

24

Consider a simple economy that produces only three products: hot dogs, torches and golf balls. Use the information in the following table to calculate the inflation rate for 2017, as measured by the consumer price index.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

What does the producer price index (PPI)measure?

A)The average change in the prices paid for all goods produced in the economy over a given year.

B)The average of the prices received by producers of goods and services at all stages of the production process.

C)The level of production of goods and services generated in the economy in a given year.

D)The difference between the prices consumers pay for goods and services and the prices producers pay for goods and services.

A)The average change in the prices paid for all goods produced in the economy over a given year.

B)The average of the prices received by producers of goods and services at all stages of the production process.

C)The level of production of goods and services generated in the economy in a given year.

D)The difference between the prices consumers pay for goods and services and the prices producers pay for goods and services.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

If the CPI falls from 142 to 140 between two consecutive years, this implies that prices fell by 2% between those two years.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

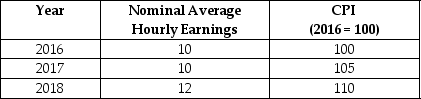

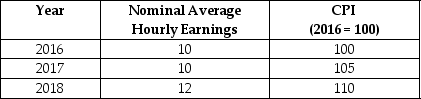

Looking at the following table, real wages ________ from 2016 to 2017 and real wages ________ from 2017 to 2018.

A)rose; rose

B)rose; fell

C)fell; fell

D)fell; rose

A)rose; rose

B)rose; fell

C)fell; fell

D)fell; rose

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

Explain how the CPI is constructed, and discuss any weaknesses with this measurement technique.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

List three different price indices and explain how they differ in terms of the market basket on which they are based.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

Looking at the following table, real average hourly earnings equals ________ in 2016.

A)$9.52

B)$9.00

C)$10.00

D)$12.00

A)$9.52

B)$9.00

C)$10.00

D)$12.00

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

How many broad categories of goods and services are in the CPI market basket, and which three largest groups comprise almost half of the market basket?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

Assume that the base period for CPI calculations is 1980. In Australia in 2016, around 30% of people accessed the Internet through a broadband connection that did not exist in the 1980s. This potential for bias in the CPI is referred to as ________ bias and results in ________.

A)outlet; the CPI underestimating the true change in the cost of living

B)new product; the CPI overestimating the true change in the cost of living

C)outlet; the CPI overestimating the true change in the cost of living

D)net product; the CPI underestimating the true change in the cost of living

A)outlet; the CPI underestimating the true change in the cost of living

B)new product; the CPI overestimating the true change in the cost of living

C)outlet; the CPI overestimating the true change in the cost of living

D)net product; the CPI underestimating the true change in the cost of living

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

Explain the difference between the 'price level', 'inflation' and the 'inflation rate'.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

The 'GDP deflator includes the price changes of all newly produced goods and services while the 'consumer price index' only includes the price changes of some newly produced goods and services.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

In 1986, an Apple IIe computer with 65 kilobytes of memory cost around $1 500. Today, a $1 500 iMac computer (also made by Apple)comes with 8 gigabytes of memory. This illustrates the potential for what kind of bias in CPI calculations?

A)new product bias

B)substitution bias

C)increase in quality bias

D)outlet bias

A)new product bias

B)substitution bias

C)increase in quality bias

D)outlet bias

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

If a disease affected apple trees in Australia and significantly reduced the availability of apples for a year, what affect would this have on the CPI and would using the CPI to calculate the rate of inflation produce an accurate representation of the rate of inflation in that year?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

The 'inflation rate' measures the percentage increase in the price level from one year to the next.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

Assume that between 2017 and 2018, the CPI of a country rose from 182 to 185. If household incomes rose by 3% during that period of time, then which of the following is true?

A)The purchasing power of household income fell between 2017 and 2018.

B)The purchasing power of household income rose between 2017 and 2018.

C)The purchasing power of household income remained constant between 2017 and 2018.

D)The CPI cannot be used to determine how the purchasing power of household income changes over time.

A)The purchasing power of household income fell between 2017 and 2018.

B)The purchasing power of household income rose between 2017 and 2018.

C)The purchasing power of household income remained constant between 2017 and 2018.

D)The CPI cannot be used to determine how the purchasing power of household income changes over time.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

If nominal wages rise faster than the price level, then real wages have ________ and the purchasing power of income has ________.

A)fallen; fallen

B)fallen; risen

C)risen; risen

D)risen; fallen

A)fallen; fallen

B)fallen; risen

C)risen; risen

D)risen; fallen

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

What is 'outlet bias'?

A)The tendency for households to spend more money over time.

B)The tendency for households to spend their money at discount stores as prices rise.

C)The tendency for the quality of products to improve over time, even though the CPI does not measure changes in quality.

D)The tendency for consumers to purchase newer, more technologically advanced products even though they have higher prices.

A)The tendency for households to spend more money over time.

B)The tendency for households to spend their money at discount stores as prices rise.

C)The tendency for the quality of products to improve over time, even though the CPI does not measure changes in quality.

D)The tendency for consumers to purchase newer, more technologically advanced products even though they have higher prices.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

Using the following table, calculate the real average wage for 1998 and 2018. Calculate the rate of growth of real average wages from 1998 to 2018. Are workers in this country better off in terms of the purchasing power of a dollar in 1998 or 2018? Explain why.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

The nominal interest rate will be less than the real interest rate when the:

A)rate of inflation is positive but decreasing.

B)rate of inflation is positive and increasing.

C)rate of inflation is negative.

D)real interest rate is negative.

A)rate of inflation is positive but decreasing.

B)rate of inflation is positive and increasing.

C)rate of inflation is negative.

D)real interest rate is negative.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

To calculate real wages in Year 1, it is correct to divide nominal wages in Year 1 by the CPI in year 1, and multiply the resultant figure by 100.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

If the anticipated rate of inflation is 5% and workers agree to a wage increase of 4%, if the anticipated rate occurs, then nominal wages will:

A)fall by 1%.

B)rise by 4%.

C)rise by 5%.

D)fall by 5%.

A)fall by 1%.

B)rise by 4%.

C)rise by 5%.

D)fall by 5%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

If the real interest rate is 8% and the inflation rate is 3%, then the nominal interest rate is:

A)4%.

B)8%.

C)11%.

D)-4%.

A)4%.

B)8%.

C)11%.

D)-4%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

The stated interest rate on a loan is the:

A)real interest rate.

B)nominal interest rate.

C)actual inflation rate.

D)expected inflation rate.

A)real interest rate.

B)nominal interest rate.

C)actual inflation rate.

D)expected inflation rate.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

You lend $5 000 to a friend for one year at a nominal interest rate of 10%. The CPI over that year rises from 180 to 190. What is the real rate of interest you will earn?

A)0%

B)4)4%

C)5)5%

D)5)8%

A)0%

B)4)4%

C)5)5%

D)5)8%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

During a deflationary period, the:

A)nominal interest rate is less than the real interest rate.

B)real interest rate is less than the nominal interest rate.

C)price level rises.

D)nominal interest rate does not change.

A)nominal interest rate is less than the real interest rate.

B)real interest rate is less than the nominal interest rate.

C)price level rises.

D)nominal interest rate does not change.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

Assume that the CPI in 2018 was 217, while the CPI in 1990 was 82. If a person had $6000 in 1990, its equivalent purchasing power in 2018 would be $10 850.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

The 'real rate' of interest is the:

A)nominal interest rate plus the expected inflation rate.

B)nominal interest rate minus the expected inflation rate.

C)interest rate determined by the supply and demand in the money market.

D)nominal interest rate.

A)nominal interest rate plus the expected inflation rate.

B)nominal interest rate minus the expected inflation rate.

C)interest rate determined by the supply and demand in the money market.

D)nominal interest rate.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

Looking at the following table, what is the rate of growth of the average price level from 2016 to 2017?

A)1%

B)2%

C)3%

D)5%

A)1%

B)2%

C)3%

D)5%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

If the nominal rate of interest is 6% and the inflation rate is 3%, what is the real rate of interest?

A)-9.5%

B)-305%

C)1)5%

D)3%

A)-9.5%

B)-305%

C)1)5%

D)3%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

Inflation that is ________ than what is expected benefits ________ and hurts ________.

A)less; creditors; debtors

B)less; debtors; creditors

C)greater; creditors; debtors

D)greater; creditors; no-one

A)less; creditors; debtors

B)less; debtors; creditors

C)greater; creditors; debtors

D)greater; creditors; no-one

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

Looking at the following table, what is the rate of growth of real average hourly earnings from 2016 to 2017?

A)5%

B)-5%

C)15%

D)-15%

A)5%

B)-5%

C)15%

D)-15%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

If the anticipated rate of inflation is 3% but the subsequent actual rate of inflation is 5%, the likely outcome will be that the purchasing power of money will:

A)fall and lenders will benefit.

B)increase and borrowers will benefit.

C)fall and borrowers will benefit.

D)increase and lenders will benefit.

A)fall and lenders will benefit.

B)increase and borrowers will benefit.

C)fall and borrowers will benefit.

D)increase and lenders will benefit.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

Looking at the following table, what is the rate of growth of the average price level from 2016 to 2018?

A)1)52%

B)2%

C)3)5%

D)4)76%

A)1)52%

B)2%

C)3)5%

D)4)76%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

If you want to earn a real interest rate of 3.5% on money you lend and you expect that inflation will be 2.5%, what nominal rate of interest will you charge?

A)1%

B)5%

C)6%

D)9%

A)1%

B)5%

C)6%

D)9%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

Looking at the following table, real average hourly earnings equal ________ in 2017.

A)$9.52

B)$9.00

C)$10.47

D)$12.00

A)$9.52

B)$9.00

C)$10.47

D)$12.00

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

If the nominal interest rate is 8% and the inflation rate is 3%, then the real interest rate is:

A)4%.

B)8%.

C)3%.

D)5%.

A)4%.

B)8%.

C)3%.

D)5%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

Using the following table, calculate real average hourly earnings for 2016, 2017 and 2018. Calculate the rate of growth of real average hourly earnings from 2017 to 2018.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

What is the difference between the nominal interest rate and the real interest rate?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

What is the result if inflation increases unexpectedly?

A)lenders lose

B)borrowers lose

C)lenders gain and borrowers gain

D)neither borrowers nor lenders lose

A)lenders lose

B)borrowers lose

C)lenders gain and borrowers gain

D)neither borrowers nor lenders lose

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is not an economic cost of higher than anticipated inflation?

A)Purchasing power of people on fixed incomes will fall.

B)A person who has borrowed money at a fixed interest rate will be disadvantaged.

C)Businesses incur costs through having to change prices.

D)Banks who have loaned out money at a fixed interest rate will be disadvantaged.

A)Purchasing power of people on fixed incomes will fall.

B)A person who has borrowed money at a fixed interest rate will be disadvantaged.

C)Businesses incur costs through having to change prices.

D)Banks who have loaned out money at a fixed interest rate will be disadvantaged.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

If inflation is higher than expected, in the case of a fixed interest rate loan, this helps borrowers (by reducing the real interest rate they pay)and hurts lenders (by reducing the real interest rate they receive).

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

What are 'menu costs'?

A)The full list of a firm's costs of production.

B)The costs to a firm of changing prices.

C)The cost to a household of borrowing money when there is deflation.

D)The opportunity cost of dining in a restaurant instead of at home.

A)The full list of a firm's costs of production.

B)The costs to a firm of changing prices.

C)The cost to a household of borrowing money when there is deflation.

D)The opportunity cost of dining in a restaurant instead of at home.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

Who, of the following options, does not suffer the costs of inflation?

A)people on fixed incomes

B)people whose incomes rise more rapidly than inflation

C)firms that have to devote more time and labour to raising prices

D)an investor that has to pay higher taxes because of the inflation

A)people on fixed incomes

B)people whose incomes rise more rapidly than inflation

C)firms that have to devote more time and labour to raising prices

D)an investor that has to pay higher taxes because of the inflation

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

What is caused by high anticipated inflation?

A)Real wages will fall.

B)Real interest rates will fall.

C)Real wages will rise.

D)There will be no change in real interest rates.

A)Real wages will fall.

B)Real interest rates will fall.

C)Real wages will rise.

D)There will be no change in real interest rates.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

Inflation that is ________ than what is expected benefits ________ and hurts ________.

A)less; lenders; borrowers

B)less; borrowers; lenders

C)greater; lenders; borrowers

D)greater; lenders; no-one

A)less; lenders; borrowers

B)less; borrowers; lenders

C)greater; lenders; borrowers

D)greater; lenders; no-one

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements is true?

A)When unanticipated inflation occurs regularly, the degree of risk associated with investments in the economy decreases.

B)Inflation that is higher than expected benefits debtors and inflation that is lower than expected benefits creditors.

C)Inflation improves the balance of trade as exports appear relatively cheaper to overseas buyers and imports become relatively more expensive.

D)There are no costs or losses associated with inflation when it is fully anticipated.

A)When unanticipated inflation occurs regularly, the degree of risk associated with investments in the economy decreases.

B)Inflation that is higher than expected benefits debtors and inflation that is lower than expected benefits creditors.

C)Inflation improves the balance of trade as exports appear relatively cheaper to overseas buyers and imports become relatively more expensive.

D)There are no costs or losses associated with inflation when it is fully anticipated.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

If borrowers and lenders anticipate that the rate of inflation will be 5%, but instead it turns out to be 3%, which of the following is likely to occur?

A)The real interest rate is higher than expected.

B)Lenders wish that they had made fewer loans.

C)Borrowers wish that they had borrowed more money.

D)Insufficient loans will have been made by lenders to maintain profit levels.

A)The real interest rate is higher than expected.

B)Lenders wish that they had made fewer loans.

C)Borrowers wish that they had borrowed more money.

D)Insufficient loans will have been made by lenders to maintain profit levels.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

Financial institutions who have loaned money at a fixed rate of interest will most likely:

A)experience losses if the inflation rate is higher than anticipated.

B)experience losses if the inflation rate is lower than anticipated.

C)earn an increased profit margin between the interest paid on deposits and the interest received on loans.

D)benefit if the inflation rate is higher than anticipated.

A)experience losses if the inflation rate is higher than anticipated.

B)experience losses if the inflation rate is lower than anticipated.

C)earn an increased profit margin between the interest paid on deposits and the interest received on loans.

D)benefit if the inflation rate is higher than anticipated.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

What is the cost to firms of changing prices?

A)redistribution costs

B)anticipation costs

C)menu costs

D)money illusion costs

A)redistribution costs

B)anticipation costs

C)menu costs

D)money illusion costs

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

There is a negative relationship between real interest rates and inflation rates.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

74

If inflation is completely anticipated:

A)no-one loses.

B)borrowers lose.

C)lenders lose.

D)firms lose because they incur menu costs.

A)no-one loses.

B)borrowers lose.

C)lenders lose.

D)firms lose because they incur menu costs.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

Suppose you obtain a fixed interest rate mortgage during a period of relatively high inflation. During the next 10 years, inflation falls. Are you a winner or a loser due to inflation? Explain why.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is not generally a cost posed by inflation?

A)Inflation reduces the affordability of goods and services to the average consumer.

B)Consumers and firms lose purchasing power to the extent that money loses value.

C)Firms must pay for changing prices on products and printing new catalogues.

D)Banks can lose if they under-predict inflation and charge an interest rate that does not completely compensate for inflation.

A)Inflation reduces the affordability of goods and services to the average consumer.

B)Consumers and firms lose purchasing power to the extent that money loses value.

C)Firms must pay for changing prices on products and printing new catalogues.

D)Banks can lose if they under-predict inflation and charge an interest rate that does not completely compensate for inflation.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following individuals would be most negatively affected by 'anticipated inflation'?

A)A retired railway engineer who receives a fixed income payment every month.

B)A union contractor whose pay is adjusted based on changes in the CPI.

C)A full-time employee at a pizza shop who earns more than the minimum wage.

D)A student who borrows $10 000 at a nominal interest rate of 5% to finance educational expenses.

A)A retired railway engineer who receives a fixed income payment every month.

B)A union contractor whose pay is adjusted based on changes in the CPI.

C)A full-time employee at a pizza shop who earns more than the minimum wage.

D)A student who borrows $10 000 at a nominal interest rate of 5% to finance educational expenses.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

The nominal interest rate minus the inflation rate equals the real interest rate.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements is false?

A)Whether you gain or lose during a period of inflation depends on whether your income rises faster or slower than the prices of things you buy.

B)Inflation that is higher than expected benefits debtors and inflation that is lower than expected benefits creditors.

C)When unanticipated inflation occurs regularly, the degree of risk associated with investments in the economy increases.

D)There are no costs or losses associated with inflation when it is fully anticipated.

A)Whether you gain or lose during a period of inflation depends on whether your income rises faster or slower than the prices of things you buy.

B)Inflation that is higher than expected benefits debtors and inflation that is lower than expected benefits creditors.

C)When unanticipated inflation occurs regularly, the degree of risk associated with investments in the economy increases.

D)There are no costs or losses associated with inflation when it is fully anticipated.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

People who have borrowed money from banks at a fixed rate of interest will most likely:

A)experience losses if the inflation rate is higher than anticipated.

B)benefit if the inflation rate is lower than anticipated.

C)experience a rise in their real interest rate.

D)benefit if the inflation rate is higher than anticipated.

A)experience losses if the inflation rate is higher than anticipated.

B)benefit if the inflation rate is lower than anticipated.

C)experience a rise in their real interest rate.

D)benefit if the inflation rate is higher than anticipated.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck