Deck 8: Application: the Costs of Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

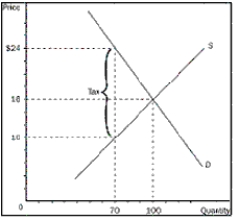

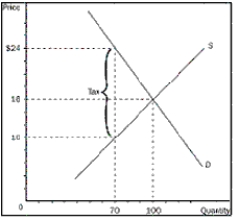

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/222

Play

Full screen (f)

Deck 8: Application: the Costs of Taxation

1

What effect does a tax levied on the buyers of a product have

A)It shifts the supply curve upward (or to the left).

B)It shifts the supply curve downward (or to the right).

C)It shifts the demand curve downward (or to the left).

D)It shifts the demand curve upward (or to the right).

A)It shifts the supply curve upward (or to the left).

B)It shifts the supply curve downward (or to the right).

C)It shifts the demand curve downward (or to the left).

D)It shifts the demand curve upward (or to the right).

It shifts the demand curve downward (or to the left).

2

Which of the following is used in economic analysis to judge the effect of taxes on economic welfare

A)government deficits

B)consumer and producer surplus

C)equilibrium price and quantity

D)opportunity cost

A)government deficits

B)consumer and producer surplus

C)equilibrium price and quantity

D)opportunity cost

consumer and producer surplus

3

When will buyers of a product pay the majority of a tax placed on a product

A)when the tax is placed on the seller of the product

B)when demand is more elastic than supply

C)when supply is more elastic than demand

D)when the tax is placed on the buyer of the product

A)when the tax is placed on the seller of the product

B)when demand is more elastic than supply

C)when supply is more elastic than demand

D)when the tax is placed on the buyer of the product

when supply is more elastic than demand

4

Why does it NOT matter whether a tax is levied on the buyer or seller of the good

A)because sellers always bear the full burden of the tax

B)because buyers always bear the full burden of the tax

C)because buyers and sellers always share the burden of the tax

D)because government always bears the full burden of the tax

A)because sellers always bear the full burden of the tax

B)because buyers always bear the full burden of the tax

C)because buyers and sellers always share the burden of the tax

D)because government always bears the full burden of the tax

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

5

When a tax is levied on a good,what is the effect on buyers and sellers and who is worse off

A)Buyers pay less, sellers receive less, and they are both worse off.

B)Buyers pay more, sellers receive more, and they are both worse off.

C)Buyers pay less, sellers receive more, and they are both worse off.

D)Buyers pay more, sellers receive less, and they are both worse off.

A)Buyers pay less, sellers receive less, and they are both worse off.

B)Buyers pay more, sellers receive more, and they are both worse off.

C)Buyers pay less, sellers receive more, and they are both worse off.

D)Buyers pay more, sellers receive less, and they are both worse off.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

6

What must we do to fully understand how taxes affect economic well-being

A)assume that economic well-being is not affected if all tax revenue is spent on goods and services for the Canadian public

B)know the dollar amount of all taxes raised in the country each year

C)compare the reduced welfare of buyers and sellers to the amount of government revenue raised

D)compare the expenditures of the federal government to its tax revenue

A)assume that economic well-being is not affected if all tax revenue is spent on goods and services for the Canadian public

B)know the dollar amount of all taxes raised in the country each year

C)compare the reduced welfare of buyers and sellers to the amount of government revenue raised

D)compare the expenditures of the federal government to its tax revenue

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

7

When a tax is levied on a good,how will the quantity sold and price of the good change

A)The quantity of the good sold will decrease but the price of the good sold will not change.

B)The price of the good sold will increase but the quantity of the good sold will not change.

C)The quantity of the good sold will decrease but the price of the good sold will increase.

D)The price of the good sold will decrease but the quantity of the good sold will increase.

A)The quantity of the good sold will decrease but the price of the good sold will not change.

B)The price of the good sold will increase but the quantity of the good sold will not change.

C)The quantity of the good sold will decrease but the price of the good sold will increase.

D)The price of the good sold will decrease but the quantity of the good sold will increase.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

8

When a tax is placed on the buyers of snowboards,what is the result

A)The size of the snowboards market is reduced.

B)The price of snowboards decreases.

C)The supply of snowboards decreases.

D)The price of snowboards increases, and the equilibrium quantity of snowboards is unchanged.

A)The size of the snowboards market is reduced.

B)The price of snowboards decreases.

C)The supply of snowboards decreases.

D)The price of snowboards increases, and the equilibrium quantity of snowboards is unchanged.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

9

A tax is imposed on a market with elastic demand and inelastic supply.Who bears most of the burden of the tax

A)Buyers will bear most of the burden of the tax.

B)Sellers will bear most of the burden of the tax.

C)The burden of the tax will be shared equally between buyers and sellers.

D)The burden of the tax will be shared equally between buyers and the government.

A)Buyers will bear most of the burden of the tax.

B)Sellers will bear most of the burden of the tax.

C)The burden of the tax will be shared equally between buyers and sellers.

D)The burden of the tax will be shared equally between buyers and the government.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

10

What effect does a tax on a good have on prices

A)It raises the price buyers pay and lowers the price sellers receive.

B)It raises both the price buyers pay and the price sellers receive.

C)It lowers both the price buyers pay and the price sellers receive.

D)It lowers the price buyers pay and raises the price sellers receive.

A)It raises the price buyers pay and lowers the price sellers receive.

B)It raises both the price buyers pay and the price sellers receive.

C)It lowers both the price buyers pay and the price sellers receive.

D)It lowers the price buyers pay and raises the price sellers receive.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

11

What effect does a tax placed on a product have on the buyer and the seller

A)The price the buyer pays and the price the seller receives are higher.

B)The price the buyer pays and the price the seller receives are lower.

C)The price the buyer pays is lower and the price the seller receives is higher.

D)The price the buyer pays is higher and the price the seller receives is lower.

A)The price the buyer pays and the price the seller receives are higher.

B)The price the buyer pays and the price the seller receives are lower.

C)The price the buyer pays is lower and the price the seller receives is higher.

D)The price the buyer pays is higher and the price the seller receives is lower.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

12

Which outcome will occur as a result of a tax,whether the tax is placed on the buyer or the seller

A)size of the market is reduced

B)price the seller receives is higher

C)supply curve will shift upward

D)demand curve will shift upward

A)size of the market is reduced

B)price the seller receives is higher

C)supply curve will shift upward

D)demand curve will shift upward

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

13

When a good is taxed,are buyers and sellers worse off or better off

A)Both buyers and sellers are worse off.

B)Buyers are worse off and sellers are better off.

C)Sellers are worse off and buyers are better off.

D)Both buyers and sellers are better off.

A)Both buyers and sellers are worse off.

B)Buyers are worse off and sellers are better off.

C)Sellers are worse off and buyers are better off.

D)Both buyers and sellers are better off.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

14

What should be used to analyze economic well-being in an economy

A)demand and supply

B)producer and consumer surplus

C)government spending and tax revenue

D)equilibrium price and quantity

A)demand and supply

B)producer and consumer surplus

C)government spending and tax revenue

D)equilibrium price and quantity

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

15

Suppose a tax is imposed on the buyers of a product.On whom will the burden of the tax fall

A)on the buyers and the government

B)on the sellers and the government

C)on the buyers, sellers and the government

D)on the buyers and the sellers

A)on the buyers and the government

B)on the sellers and the government

C)on the buyers, sellers and the government

D)on the buyers and the sellers

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

16

A tax is imposed on a market with an inelastic demand and an elastic supply.How is the burden of the tax divided

A)sellers pay the majority of the tax

B)buyers pay the majority of the tax

C)the tax burden is equally divided between buyers and sellers

D)the tax burden is divided, but it cannot be determined how

A)sellers pay the majority of the tax

B)buyers pay the majority of the tax

C)the tax burden is equally divided between buyers and sellers

D)the tax burden is divided, but it cannot be determined how

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

17

What effect does a tax placed on kite buyers have

A)It shifts demand upward, causing both the price received by sellers and the equilibrium quantity to fall.

B)It shifts demand downward, causing both the price received by sellers and the equilibrium quantity to fall.

C)It shifts supply downward, causing the price received by sellers to fall and equilibrium quantity to rise.

D)It shifts supply upward, causing the price received by sellers to rise and equilibrium quantity to fall.

A)It shifts demand upward, causing both the price received by sellers and the equilibrium quantity to fall.

B)It shifts demand downward, causing both the price received by sellers and the equilibrium quantity to fall.

C)It shifts supply downward, causing the price received by sellers to fall and equilibrium quantity to rise.

D)It shifts supply upward, causing the price received by sellers to rise and equilibrium quantity to fall.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

18

If a tax is imposed on the buyer of a product,what is the effect on the demand curve

A)It shifts downward by the amount of the tax.

B)It shifts upward by the amount of the tax.

C)It shifts downward by less than the amount of the tax.

D)It shifts upward by more than the amount of the tax.

A)It shifts downward by the amount of the tax.

B)It shifts upward by the amount of the tax.

C)It shifts downward by less than the amount of the tax.

D)It shifts upward by more than the amount of the tax.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

19

When a tax is placed on the buyer of a product,what is the result

A)buyers pay less and sellers receive more

B)buyers pay less and sellers receive less

C)buyers pay more and sellers receive more

D)buyers pay more and sellers receive less

A)buyers pay less and sellers receive more

B)buyers pay less and sellers receive less

C)buyers pay more and sellers receive more

D)buyers pay more and sellers receive less

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

20

What effect does a tax levied on the supplier of a product have

A)It shifts the supply curve upward (or to the left).

B)It shifts the supply curve downward (or to the right).

C)It shifts the demand curve upward (or to the right).

D)It shifts the demand curve downward (or to the left).

A)It shifts the supply curve upward (or to the left).

B)It shifts the supply curve downward (or to the right).

C)It shifts the demand curve upward (or to the right).

D)It shifts the demand curve downward (or to the left).

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

21

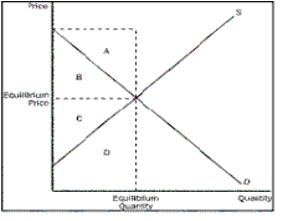

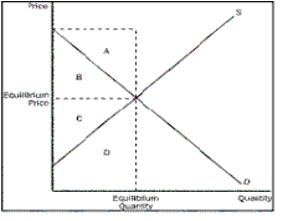

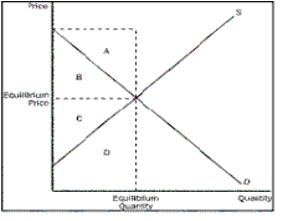

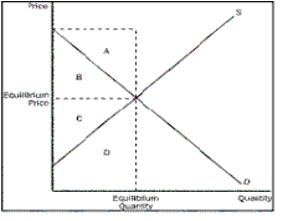

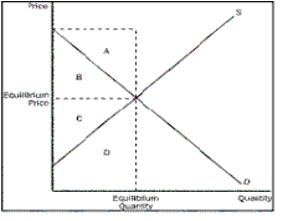

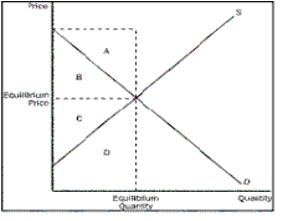

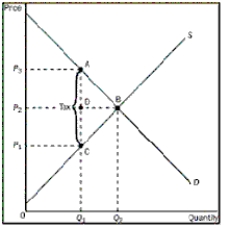

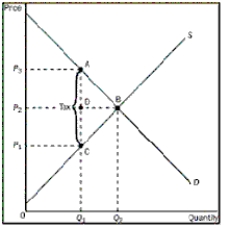

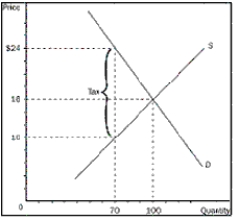

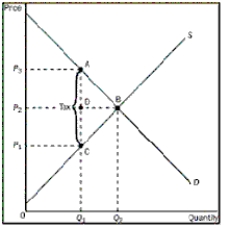

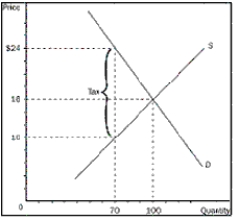

Figure 8-1

Refer to Figure 8-1.When the market is in equilibrium,what area represents producer surplus

A)A + B

B)B + C

C)C

D)A + D

Refer to Figure 8-1.When the market is in equilibrium,what area represents producer surplus

A)A + B

B)B + C

C)C

D)A + D

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

22

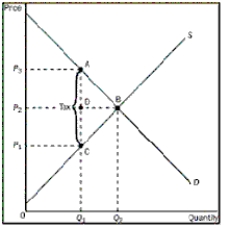

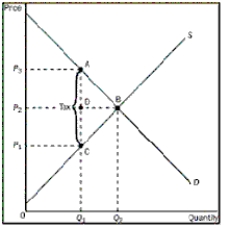

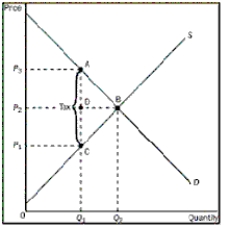

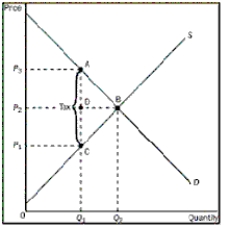

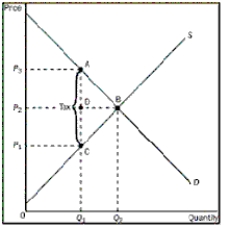

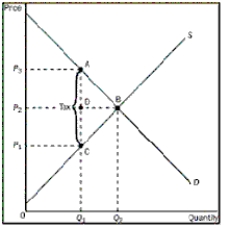

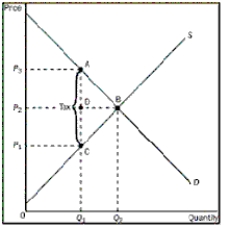

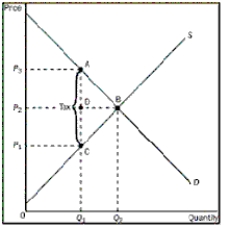

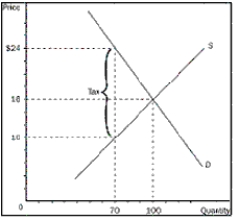

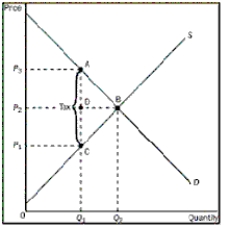

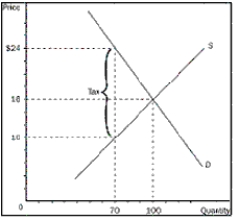

Figure 8-2

Refer to Figure 8-2.What is the price paid and quantity supplied after the tax

A)P₁ and Q₁

B)P₂ and Q₂

C)P₃ and Q₁

D)P₂ and Q₁

Refer to Figure 8-2.What is the price paid and quantity supplied after the tax

A)P₁ and Q₁

B)P₂ and Q₂

C)P₃ and Q₁

D)P₂ and Q₁

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose a $2 tax is placed on the sellers of BBQ propane.How will the supply curve shift

A)right (downward) by exactly $2

B)left (upward) by less than $2

C)left (upward) by exactly $2

D)right (downward) by less than $2

A)right (downward) by exactly $2

B)left (upward) by less than $2

C)left (upward) by exactly $2

D)right (downward) by less than $2

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

24

Who bears the burden of a tax imposed on lawn fertilizer

A)Buyers bear the entire burden of the tax.

B)Sellers bear the entire burden of the tax.

C)Buyers and sellers share the burden of the tax.

D)The government bears the entire burden of the tax.

A)Buyers bear the entire burden of the tax.

B)Sellers bear the entire burden of the tax.

C)Buyers and sellers share the burden of the tax.

D)The government bears the entire burden of the tax.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

25

When a tax is levied on the sellers of a good,how does the supply curve shift

A)up by the amount of the tax

B)down by the amount of the tax

C)up by less than the tax

D)down by less than the tax

A)up by the amount of the tax

B)down by the amount of the tax

C)up by less than the tax

D)down by less than the tax

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

26

Figure 8-1

Refer to Figure 8-1.Which area represents total economic surplus

A)A + B

B)B + C

C)C + D

D)A + D

Refer to Figure 8-1.Which area represents total economic surplus

A)A + B

B)B + C

C)C + D

D)A + D

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

27

How is the benefit received by buyers in the market measured

A)by the demand curve

B)by consumer surplus

C)by the amount buyers are willing to pay for the good

D)by the equilibrium price

A)by the demand curve

B)by consumer surplus

C)by the amount buyers are willing to pay for the good

D)by the equilibrium price

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

28

How is the tax benefit received by the government measured

A)by deadweight loss

B)by tax revenue

C)by equilibrium price

D)by equilibrium quantity

A)by deadweight loss

B)by tax revenue

C)by equilibrium price

D)by equilibrium quantity

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

29

Figure 8-2

Refer to Figure 8-2.What is the equilibrium price and quantity before the tax

A)P₁ and Q₁

B)P₂ and Q₂

C)P₂ and Q₁

D)P₃ and Q₂

Refer to Figure 8-2.What is the equilibrium price and quantity before the tax

A)P₁ and Q₁

B)P₂ and Q₂

C)P₂ and Q₁

D)P₃ and Q₂

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

30

How is tax burden related to the elasticity of the market

A)A tax burden falls most heavily on the side of the market that is elastic.

B)A tax burden falls most heavily on the side of the market that is inelastic.

C)A tax burden falls most heavily on the side of the market that is closer to unit elastic.

D)A tax burden is not influenced by the relative elasticities of supply and demand.

A)A tax burden falls most heavily on the side of the market that is elastic.

B)A tax burden falls most heavily on the side of the market that is inelastic.

C)A tax burden falls most heavily on the side of the market that is closer to unit elastic.

D)A tax burden is not influenced by the relative elasticities of supply and demand.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

31

When a tax on a good is enacted,who bears the burden of the tax

A)Buyers and sellers share the burden of the tax regardless of whom it is levied on.

B)Buyers always bear the full burden of the tax.

C)Sellers always bear the full burden of the tax.

D)The full burden of the tax falls on whoever the tax is levied on.

A)Buyers and sellers share the burden of the tax regardless of whom it is levied on.

B)Buyers always bear the full burden of the tax.

C)Sellers always bear the full burden of the tax.

D)The full burden of the tax falls on whoever the tax is levied on.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

32

When a tax is levied on a good,what happens to the market price and why

A)The market price falls because quantity demanded falls.

B)The market price falls because quantity supplied falls.

C)The market price rises because both quantity demanded and quantity supplied falls.

D)The market price rises because both quantity demanded and quantity supplied rises.

A)The market price falls because quantity demanded falls.

B)The market price falls because quantity supplied falls.

C)The market price rises because both quantity demanded and quantity supplied falls.

D)The market price rises because both quantity demanded and quantity supplied rises.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

33

When a tax is levied on the sellers of a good,what happens to the supply curve

A)shifts left (up) by more than the tax

B)shifts right (down) by more than the tax

C)shifts left (up) by an amount equal to the tax

D)shifts right (down) by an amount equal to the tax

A)shifts left (up) by more than the tax

B)shifts right (down) by more than the tax

C)shifts left (up) by an amount equal to the tax

D)shifts right (down) by an amount equal to the tax

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

34

How is the benefit from a tax measured

A)by how much the public gains from the government spending the tax revenue

B)by the cost of collecting the tax

C)by the interest saved because the government did not borrow the funds

D)by the government's surplus, which is tax revenue minus government expenditures

A)by how much the public gains from the government spending the tax revenue

B)by the cost of collecting the tax

C)by the interest saved because the government did not borrow the funds

D)by the government's surplus, which is tax revenue minus government expenditures

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

35

What does a tax placed on a good do

A)It causes the price of the good to fall.

B)It affects buyers of the good, but not sellers.

C)It causes the size of the market for the good to shrink.

D)It affects sellers of the good, but not buyers.

A)It causes the price of the good to fall.

B)It affects buyers of the good, but not sellers.

C)It causes the size of the market for the good to shrink.

D)It affects sellers of the good, but not buyers.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

36

When a tax is imposed on a product,what happens to quantity demanded and quantity supplied

A)Quantity demanded will increase and quantity supplied will decrease.

B)Quantity demanded will decrease and quantity supplied will increase.

C)Quantity demanded and quantity supplied will both increase.

D)Quantity demanded and quantity supplied will both decrease.

A)Quantity demanded will increase and quantity supplied will decrease.

B)Quantity demanded will decrease and quantity supplied will increase.

C)Quantity demanded and quantity supplied will both increase.

D)Quantity demanded and quantity supplied will both decrease.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

37

Figure 8-2

Refer to Figure 8-2.What is the price sellers receive after the tax

A)P₁

B)P₂

C)P₃

D)P₃ - P₂

Refer to Figure 8-2.What is the price sellers receive after the tax

A)P₁

B)P₂

C)P₃

D)P₃ - P₂

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

38

What will a tax placed on coffee do to the equilibrium price and quantity

A)It will reduce the equilibrium price of coffee and increase the equilibrium quantity.

B)It will increase the equilibrium price of coffee and reduce the equilibrium quantity.

C)It will increase the equilibrium price of coffee and increase the equilibrium quantity.

D)It will reduce the equilibrium price of coffee and reduce the equilibrium quantity.

A)It will reduce the equilibrium price of coffee and increase the equilibrium quantity.

B)It will increase the equilibrium price of coffee and reduce the equilibrium quantity.

C)It will increase the equilibrium price of coffee and increase the equilibrium quantity.

D)It will reduce the equilibrium price of coffee and reduce the equilibrium quantity.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

39

How is the benefit received by sellers in a market measured

A)by the supply curve

B)by producer surplus

C)by the amount sellers receive for their product

D)by the sellers' costs

A)by the supply curve

B)by producer surplus

C)by the amount sellers receive for their product

D)by the sellers' costs

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

40

Figure 8-1

Refer to Figure 8-1.If the market is in equilibrium,what area represents consumer surplus

A)A

B)B

C)C

D)D

Refer to Figure 8-1.If the market is in equilibrium,what area represents consumer surplus

A)A

B)B

C)C

D)D

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

41

What does deadweight loss represent

A)the reduction in total surplus that results from a tax

B)the loss of profit to businesses when a tax is imposed

C)the reduction in producer surplus when a tax is placed on buyers

D)the decline in government revenue when taxes are reduced in a market

A)the reduction in total surplus that results from a tax

B)the loss of profit to businesses when a tax is imposed

C)the reduction in producer surplus when a tax is placed on buyers

D)the decline in government revenue when taxes are reduced in a market

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

42

Which term refers to the loss in total surplus resulting from a tax

A)market loss

B)economic loss

C)deadweight loss

D)efficiency loss

A)market loss

B)economic loss

C)deadweight loss

D)efficiency loss

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

43

Figure 8-2

Refer to Figure 8-2.What is the per unit burden of the tax on buyers

A)(P₃ - P₁) / (Q₂ - Q₁)

B)P₃ - P₂

C)(P₂ - P₁) / (Q₂ - Q₁)

D)P₂ - P₁

Refer to Figure 8-2.What is the per unit burden of the tax on buyers

A)(P₃ - P₁) / (Q₂ - Q₁)

B)P₃ - P₂

C)(P₂ - P₁) / (Q₂ - Q₁)

D)P₂ - P₁

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

44

Figure 8-2

Refer to Figure 8-2.What area represents the amount of tax revenue received by the government

A)P₃ACP₁

B)ABC

C)P₂DAP₃

D)P₁CDP₂

Refer to Figure 8-2.What area represents the amount of tax revenue received by the government

A)P₃ACP₁

B)ABC

C)P₂DAP₃

D)P₁CDP₂

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

45

When a tax is imposed on a good,what do we know about the losses to buyers and sellers

A)They are equal to the revenue raised by the government.

B)They are less than the revenue raised by the government.

C)They exceed the revenue raised by the government.

D)They cannot be compared to the tax revenue raised by the government since the amount of the tax will vary from good to good.

A)They are equal to the revenue raised by the government.

B)They are less than the revenue raised by the government.

C)They exceed the revenue raised by the government.

D)They cannot be compared to the tax revenue raised by the government since the amount of the tax will vary from good to good.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

46

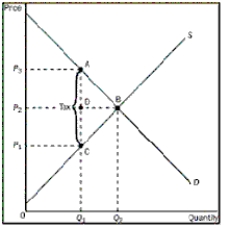

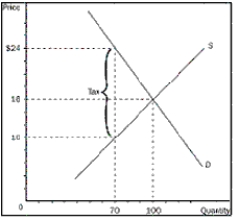

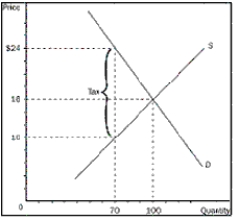

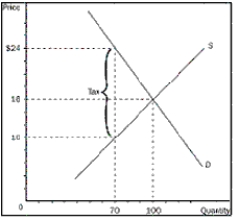

Figure 8-3

Refer to Figure 8-3.What is the equilibrium price before the tax

A)$6

B)$10

C)$16

D)$24

Refer to Figure 8-3.What is the equilibrium price before the tax

A)$6

B)$10

C)$16

D)$24

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

47

When evaluating the size of the deadweight loss due to a tax,what do we know

A)the greater the elasticities of supply and demand, the greater the deadweight loss

B)the smaller the elasticities of supply and demand, the greater the deadweight loss

C)the smaller the decrease in both quantity demanded and quantity supplied, the greater the deadweight loss

D)the greater the elasticities of supply and demand, the smaller the deadweight loss

A)the greater the elasticities of supply and demand, the greater the deadweight loss

B)the smaller the elasticities of supply and demand, the greater the deadweight loss

C)the smaller the decrease in both quantity demanded and quantity supplied, the greater the deadweight loss

D)the greater the elasticities of supply and demand, the smaller the deadweight loss

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

48

Figure 8-2

Refer to Figure 8-2.What is the per-unit burden of the tax on the sellers

A)(P₃ - P₁)/(Q₂ - Q₁)

B)P₃ - P₂

C)(P₂ - P₁)/(Q₂ - Q₁)

D)P₂ - P₁

Refer to Figure 8-2.What is the per-unit burden of the tax on the sellers

A)(P₃ - P₁)/(Q₂ - Q₁)

B)P₃ - P₂

C)(P₂ - P₁)/(Q₂ - Q₁)

D)P₂ - P₁

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

49

Figure 8-3

Refer to Figure 8-3.What is the amount of the tax imposed

A)$6

B)$8

C)$14

D)$16

Refer to Figure 8-3.What is the amount of the tax imposed

A)$6

B)$8

C)$14

D)$16

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

50

Figure 8-2

Refer to Figure 8-2.What area represents the amount of deadweight loss associated with the tax

A)P₃ACP₁

B)ABC

C)P₂DAP₃

D)P₁CDP₂

Refer to Figure 8-2.What area represents the amount of deadweight loss associated with the tax

A)P₃ACP₁

B)ABC

C)P₂DAP₃

D)P₁CDP₂

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

51

Figure 8-3

Refer to Figure 8-3.What is the price that will be paid after the tax

A)$8

B)$10

C)$16

D)$24

Refer to Figure 8-3.What is the price that will be paid after the tax

A)$8

B)$10

C)$16

D)$24

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

52

What does the deadweight loss of taxation measure

A)the loss in benefit to buyers and sellers in a market due to the tax

B)the loss in revenue to the government when buyers choose to buy less of the product

C)the loss of efficiency in a market as a result of government intervention

D)the lost revenue to businesses because of higher prices to consumers from the tax

A)the loss in benefit to buyers and sellers in a market due to the tax

B)the loss in revenue to the government when buyers choose to buy less of the product

C)the loss of efficiency in a market as a result of government intervention

D)the lost revenue to businesses because of higher prices to consumers from the tax

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

53

Assume that the demand for fries is relatively inelastic and that the demand for poutine is relatively elastic.If the same percentage tax were placed on both goods,the tax on which product would create a larger deadweight loss

A)fries, if the supply of the fries is also relatively inelastic

B)poutine, if the supply of the poutine is also relatively elastic

C)fries, if the supply of the fries is relatively elastic

D)poutine, if the supply of the poutine is relatively inelastic

A)fries, if the supply of the fries is also relatively inelastic

B)poutine, if the supply of the poutine is also relatively elastic

C)fries, if the supply of the fries is relatively elastic

D)poutine, if the supply of the poutine is relatively inelastic

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

54

How is the amount of deadweight loss that will result from a tax determined

A)by the price elasticity of demand and supply

B)by the number of buyers of the product in the market

C)by the number of suppliers of the product in the market

D)by the percentage of the purchase price that the tax represents

A)by the price elasticity of demand and supply

B)by the number of buyers of the product in the market

C)by the number of suppliers of the product in the market

D)by the percentage of the purchase price that the tax represents

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

55

Figure 8-3

Refer to Figure 8-3.What is the price sellers receive after the tax

A)$8

B)$10

C)$16

D)$24

Refer to Figure 8-3.What is the price sellers receive after the tax

A)$8

B)$10

C)$16

D)$24

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

56

Figure 8-2

Refer to Figure 8-2.What is the amount of the tax imposed

A)P₃ - P₁

B)P₃

C)P₂ - P₁

D)P₁

Refer to Figure 8-2.What is the amount of the tax imposed

A)P₃ - P₁

B)P₃

C)P₂ - P₁

D)P₁

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

57

Why does a tax have a deadweight loss

A)because it induces the government to run a deficit

B)because it induces buyers to consume less and sellers to produce less

C)because it causes a disequilibrium in the market

D)because the loss to buyers is greater than the loss to sellers

A)because it induces the government to run a deficit

B)because it induces buyers to consume less and sellers to produce less

C)because it causes a disequilibrium in the market

D)because the loss to buyers is greater than the loss to sellers

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

58

Suppose the government places a tax on a product.How does the cost of the tax compare with the revenue raised

A)The cost of the tax to buyers and sellers is less than the revenue raised from the tax by the government.

B)The cost of the tax to buyers and sellers equals the revenue raised from the tax by the government.

C)The cost of the tax to buyers and sellers exceeds the revenue raised from the tax by the government.

D)Without additional information, such as the elasticity of demand for this product, it is impossible to compare tax cost with tax revenue.

A)The cost of the tax to buyers and sellers is less than the revenue raised from the tax by the government.

B)The cost of the tax to buyers and sellers equals the revenue raised from the tax by the government.

C)The cost of the tax to buyers and sellers exceeds the revenue raised from the tax by the government.

D)Without additional information, such as the elasticity of demand for this product, it is impossible to compare tax cost with tax revenue.

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

59

Figure 8-3

Refer to Figure 8-3.What is the per-unit burden of the tax on buyers

A)$6

B)$8

C)$14

D)$16

Refer to Figure 8-3.What is the per-unit burden of the tax on buyers

A)$6

B)$8

C)$14

D)$16

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

60

What happens if the deadweight loss of taxation grows larger

A)the larger the deadweight loss of taxation, the more people will choose to not buy the product

B)the larger the deadweight loss of taxation, the more the burden of the tax will fall on the buyer and not the seller

C)the larger the deadweight loss of taxation, the more the burden of the tax will fall on the seller and not the buyer

D)the larger the deadweight loss of taxation, the larger the cost of any government program

A)the larger the deadweight loss of taxation, the more people will choose to not buy the product

B)the larger the deadweight loss of taxation, the more the burden of the tax will fall on the buyer and not the seller

C)the larger the deadweight loss of taxation, the more the burden of the tax will fall on the seller and not the buyer

D)the larger the deadweight loss of taxation, the larger the cost of any government program

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

61

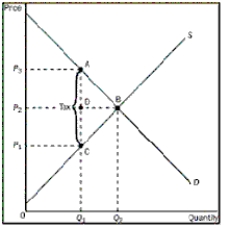

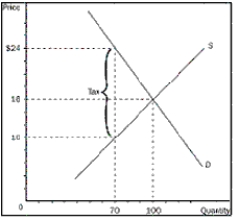

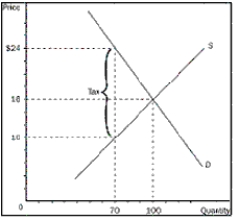

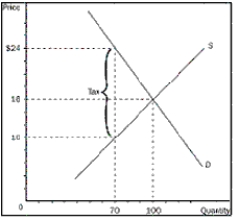

Figure 8-4

Refer to Figure 8-4.Which area represents consumer surplus after the tax is levied on the consumer

A)A

B)A + B

C)A + B + C

D)D + E + F

Refer to Figure 8-4.Which area represents consumer surplus after the tax is levied on the consumer

A)A

B)A + B

C)A + B + C

D)D + E + F

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

62

Figure 8-4

Refer to Figure 8-4.Which area represents producer surplus after the tax is levied on the producer

A)A

B)A + B + C

C)D + E

D)F

Refer to Figure 8-4.Which area represents producer surplus after the tax is levied on the producer

A)A

B)A + B + C

C)D + E

D)F

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

63

Figure 8-4

Refer to Figure 8-4.What is the price sellers receive after the tax and the quantity sold

A)P₁ and Q₁

B)P₂ and Q₂

C)P₃ and Q₂

D)P₂ and Q₁

Refer to Figure 8-4.What is the price sellers receive after the tax and the quantity sold

A)P₁ and Q₁

B)P₂ and Q₂

C)P₃ and Q₂

D)P₂ and Q₁

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

64

Figure 8-4

Refer to Figure 8-4.Assume the tax was levied on the consumer.Which area represents the reduction in producer surplus

A)A

B)B + C

C)D + E

D)D + E + F

Refer to Figure 8-4.Assume the tax was levied on the consumer.Which area represents the reduction in producer surplus

A)A

B)B + C

C)D + E

D)D + E + F

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

65

Figure 8-4

Refer to Figure 8-4.Which area represents producer surplus before the tax

A)A

B)A + B + C

C)D + E

D)D + E + F

Refer to Figure 8-4.Which area represents producer surplus before the tax

A)A

B)A + B + C

C)D + E

D)D + E + F

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

66

Figure 8-5

Refer to Figure 8-5.Without the tax,what would the equilibrium price and quantity be

A)$6 and 300

B)$10 and 300

C)$10 and 600

D)$16 and 300

Refer to Figure 8-5.Without the tax,what would the equilibrium price and quantity be

A)$6 and 300

B)$10 and 300

C)$10 and 600

D)$16 and 300

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

67

Figure 8-4

Refer to Figure 8-4.What is the equilibrium market price and quantity before the tax is imposed

A)P₁ and Q₁

B)P₂ and Q₂

C)P₃ and Q₁

D)P₁ and Q₂

Refer to Figure 8-4.What is the equilibrium market price and quantity before the tax is imposed

A)P₁ and Q₁

B)P₂ and Q₂

C)P₃ and Q₁

D)P₁ and Q₂

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

68

Figure 8-4

Refer to Figure 8-4.Assume the tax was levied on the producer.Which area represents the reduction in consumer surplus

A)A

B)B + C

C)C + E

D)D + E

Refer to Figure 8-4.Assume the tax was levied on the producer.Which area represents the reduction in consumer surplus

A)A

B)B + C

C)C + E

D)D + E

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

69

Figure 8-4

Refer to Figure 8-4.Which area represents the loss in total welfare resulting from the levying of the tax on the buyer

A)A + B + C

B)D + E + F

C)A + B + D + F

D)C + E

Refer to Figure 8-4.Which area represents the loss in total welfare resulting from the levying of the tax on the buyer

A)A + B + C

B)D + E + F

C)A + B + D + F

D)C + E

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

70

Figure 8-4

Refer to Figure 8-4.Which area represents producer surplus after the tax is levied on the consumer

A)A

B)A + B + C

C)D + E

D)F

Refer to Figure 8-4.Which area represents producer surplus after the tax is levied on the consumer

A)A

B)A + B + C

C)D + E

D)F

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

71

Figure 8-4

Refer to Figure 8-4.Assume the tax was levied on the consumer.Which area represents the reduction in consumer surplus

A)A

B)B + C

C)C + E

D)D + E

Refer to Figure 8-4.Assume the tax was levied on the consumer.Which area represents the reduction in consumer surplus

A)A

B)B + C

C)C + E

D)D + E

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

72

Figure 8-4

Refer to Figure 8-4.Which area represents the loss in total welfare resulting from the levying of the tax on the seller

A)A + B + C

B)A + B + D + F

C)C + E

D)D + E + F

Refer to Figure 8-4.Which area represents the loss in total welfare resulting from the levying of the tax on the seller

A)A + B + C

B)A + B + D + F

C)C + E

D)D + E + F

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

73

Figure 8-4

Refer to Figure 8-4.Assume the tax was levied on the producer.Which area represents the reduction in producer surplus

A)A

B)B + C

C)D + E

D)D + E + F

Refer to Figure 8-4.Assume the tax was levied on the producer.Which area represents the reduction in producer surplus

A)A

B)B + C

C)D + E

D)D + E + F

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

74

Figure 8-3

Refer to Figure 8-3.What is the per-unit burden of the tax on the sellers

A)$6

B)$8

C)$14

D)$16

Refer to Figure 8-3.What is the per-unit burden of the tax on the sellers

A)$6

B)$8

C)$14

D)$16

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

75

Figure 8-3

Refer to Figure 8-3.What is the amount of deadweight loss as a result of the tax

A)$210

B)$420

C)$560

D)$980

Refer to Figure 8-3.What is the amount of deadweight loss as a result of the tax

A)$210

B)$420

C)$560

D)$980

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

76

Figure 8-3

Refer to Figure 8-3.What is the amount of tax revenue received by the government

A)$210

B)$420

C)$560

D)$980

Refer to Figure 8-3.What is the amount of tax revenue received by the government

A)$210

B)$420

C)$560

D)$980

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

77

Figure 8-4

Refer to Figure 8-4.What is the price buyers pay after the tax and the quantity buyers receive

A)P₁ and Q₁

B)P₂ and Q₂

C)P₃ and Q₂

D)P₃ and Q₁

Refer to Figure 8-4.What is the price buyers pay after the tax and the quantity buyers receive

A)P₁ and Q₁

B)P₂ and Q₂

C)P₃ and Q₂

D)P₃ and Q₁

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

78

Figure 8-4

Refer to Figure 8-4.Which area represents consumer surplus before the tax was levied

A)A

B)A +B

C)A + B + C

D)D + E + F

Refer to Figure 8-4.Which area represents consumer surplus before the tax was levied

A)A

B)A +B

C)A + B + C

D)D + E + F

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

79

Figure 8-4

Refer to Figure 8-4.Which area represents the total surplus (consumer,producer,and government) with the tax

A)A + B + C

B)A + B + D

C)A + B + D + F

D)D + E + F

Refer to Figure 8-4.Which area represents the total surplus (consumer,producer,and government) with the tax

A)A + B + C

B)A + B + D

C)A + B + D + F

D)D + E + F

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck

80

Figure 8-4

Refer to Figure 8-4.Which area represents the benefit to the government (total tax revenue)

A)A + B

B)B + D

C)B + D + F

D)D + F

Refer to Figure 8-4.Which area represents the benefit to the government (total tax revenue)

A)A + B

B)B + D

C)B + D + F

D)D + F

Unlock Deck

Unlock for access to all 222 flashcards in this deck.

Unlock Deck

k this deck