Deck 12: The Design of the Tax System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/200

Play

Full screen (f)

Deck 12: The Design of the Tax System

1

What is the largest source of income for the federal government

A)personal income taxes

B)corporate taxes

C)fines and penalties

D)EI payroll taxes

A)personal income taxes

B)corporate taxes

C)fines and penalties

D)EI payroll taxes

personal income taxes

2

How does one calculate personal income taxes

A)It is based on a person's taxable income and a tax schedule.

B)It is largely unaffected by deductions.

C)It is the person's total income minus tax credits.

D)It is some constant percentage of income.

A)It is based on a person's taxable income and a tax schedule.

B)It is largely unaffected by deductions.

C)It is the person's total income minus tax credits.

D)It is some constant percentage of income.

It is based on a person's taxable income and a tax schedule.

3

What happens as a result of the marginal tax rate increasing as income rises

A)Higher-income individuals, in general, pay a larger percentage of their income in taxes.

B)Lower-income individuals, in general, pay a larger percentage of their income in taxes.?c.A disproportionately large share of the tax burden falls unjustly upon the poor.?d.Higher-income individuals pay the same percentage of their income in taxes as lower-income families.

A)Higher-income individuals, in general, pay a larger percentage of their income in taxes.

B)Lower-income individuals, in general, pay a larger percentage of their income in taxes.?c.A disproportionately large share of the tax burden falls unjustly upon the poor.?d.Higher-income individuals pay the same percentage of their income in taxes as lower-income families.

Higher-income individuals, in general, pay a larger percentage of their income in taxes.

4

In 1980,what percentage of total income did Canadian governments collect in taxes

A)approximately 20 percent

B)approximately 28 percent

C)approximately 32 percent

D)approximately 40 percent

A)approximately 20 percent

B)approximately 28 percent

C)approximately 32 percent

D)approximately 40 percent

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

5

In 2013-2014,what were the approximate EI payroll taxes for the average Canadian

A)$145

B)$500

C)$612

D)$1155

A)$145

B)$500

C)$612

D)$1155

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

6

The federal government collects taxes in a number of ways.Which of the following ranks the following sources of revenue from the largest to the smallest

A)corporate income taxes, GST, personal income taxes, and excise taxes and duties

B)corporate income taxes, EI payroll taxes, personal income taxes, and excise taxes and duties

C)personal income taxes, corporate income taxes, excise taxes and duties, and GST

D)personal income taxes, corporate income taxes, GST, and excise taxes and duties

A)corporate income taxes, GST, personal income taxes, and excise taxes and duties

B)corporate income taxes, EI payroll taxes, personal income taxes, and excise taxes and duties

C)personal income taxes, corporate income taxes, excise taxes and duties, and GST

D)personal income taxes, corporate income taxes, GST, and excise taxes and duties

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

7

In 2014,approximately how much did the average Canadian pay to the federal government

A)$3000

B)$5600

C)$6500

D)$7600

A)$3000

B)$5600

C)$6500

D)$7600

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

8

Which country has the largest tax burden

A)France

B)Italy

C)Germany

D)Canada

A)France

B)Italy

C)Germany

D)Canada

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

9

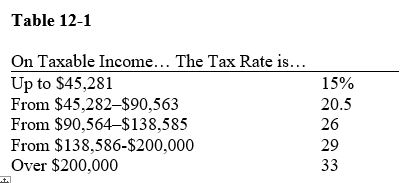

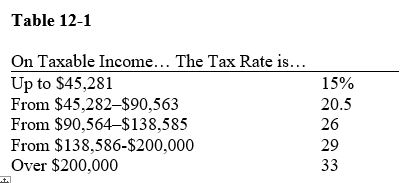

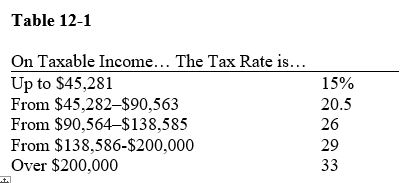

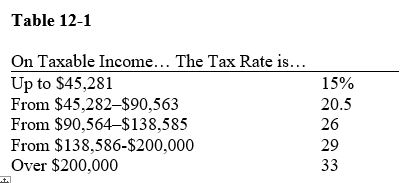

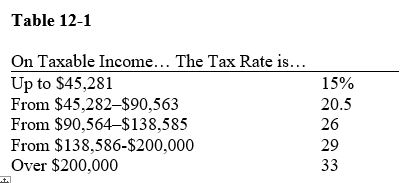

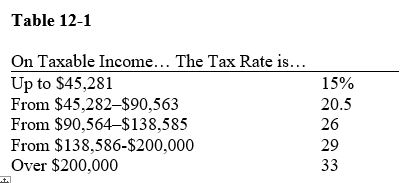

Table 12-1

Refer to Table 12-1.If Janine makes $97,500 this year,what would her tax liability be,approximately

A)$18,525

B)$25,350

C)$28,275

D)$29,740

Refer to Table 12-1.If Janine makes $97,500 this year,what would her tax liability be,approximately

A)$18,525

B)$25,350

C)$28,275

D)$29,740

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

10

Table 12-1

Refer to Table 12-1.If Morgan makes $142,700 this year,what would her tax liability be,approximately

A)$26,502

B)$37,102

C)$41,383

D)$50,659

Refer to Table 12-1.If Morgan makes $142,700 this year,what would her tax liability be,approximately

A)$26,502

B)$37,102

C)$41,383

D)$50,659

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

11

In 2013-2014,what was the total spending per person by the federal government

A)$4750

B)$5445

C)$6410

D)$7644

A)$4750

B)$5445

C)$6410

D)$7644

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

12

Table 12-1

Refer to Table 12-1.If Tressa makes $40,000 this year at her new job,what would her tax liability be,approximately

A)$4058

B)$6000

C)$7500

D)$10,450

Refer to Table 12-1.If Tressa makes $40,000 this year at her new job,what would her tax liability be,approximately

A)$4058

B)$6000

C)$7500

D)$10,450

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

13

Who said,"In this world nothing is certain but death and taxes"

A)Mark Twain

B)Winston Churchill

C)Benjamin Franklin

D)Pierre Elliott Trudeau

A)Mark Twain

B)Winston Churchill

C)Benjamin Franklin

D)Pierre Elliott Trudeau

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

14

Since 1980,what has happened as the economy's income has grown

A)Tax rates have fallen as a percentage of total income.

B)Tax revenues have fallen as a percentage of total income.

C)Household after-tax income has fallen.

D)Governments took larger portions of total income as taxes through the 1990s and then took smaller portions since the late 1990s.

A)Tax rates have fallen as a percentage of total income.

B)Tax revenues have fallen as a percentage of total income.

C)Household after-tax income has fallen.

D)Governments took larger portions of total income as taxes through the 1990s and then took smaller portions since the late 1990s.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

15

Which statement shows the percentage of total income the Canadian government took as taxes in 1980 and 2013

A)In 1980, the government collected 16 percent of total income; in 2013, it collected 46 percent.

B)In 1980, the government collected 28 percent of total income; in 2013, it collected 13 percent.

C)In 1980, the government collected 33 percent of total income; in 2013, it collected 35 percent.

D)In 1980, the government collected 40 percent of total income; in 2013, it collected 38 percent.

A)In 1980, the government collected 16 percent of total income; in 2013, it collected 46 percent.

B)In 1980, the government collected 28 percent of total income; in 2013, it collected 13 percent.

C)In 1980, the government collected 33 percent of total income; in 2013, it collected 35 percent.

D)In 1980, the government collected 40 percent of total income; in 2013, it collected 38 percent.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

16

What is the ranking of these taxes from most to least important to the federal government

A)personal income taxes, corporate income taxes, EI payroll taxes

B)EI payroll taxes, corporate income taxes, personal income taxes

C)corporate income taxes, personal income taxes, EI payroll taxes

D)corporate income taxes, EI payroll taxes, personal income taxes

A)personal income taxes, corporate income taxes, EI payroll taxes

B)EI payroll taxes, corporate income taxes, personal income taxes

C)corporate income taxes, personal income taxes, EI payroll taxes

D)corporate income taxes, EI payroll taxes, personal income taxes

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

17

What does a person's tax liability refer to

A)the percentage of income that a person must pay in taxes

B)the amount of tax a person owes to the government

C)the amount of tax the government is required to refund each person

D)deductions that can be legally subtracted from a person's income each year

A)the percentage of income that a person must pay in taxes

B)the amount of tax a person owes to the government

C)the amount of tax the government is required to refund each person

D)deductions that can be legally subtracted from a person's income each year

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

18

Which country has the largest tax burden

A)Japan

B)United States

C)Germany

D)the United Kingdom

A)Japan

B)United States

C)Germany

D)the United Kingdom

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

19

Approximately what percentage of the federal government's receipts come from personal income taxes

A)10

B)25

C)35

D)48

A)10

B)25

C)35

D)48

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

20

When is the marginal tax rate for a taxpayer necessarily equal to his average tax rate

A)only when he has a very high income

B)only when he has a very low income

C)only when he is self-employed

D)only when he invests in a retirement plan

A)only when he has a very high income

B)only when he has a very low income

C)only when he is self-employed

D)only when he invests in a retirement plan

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

21

When government receipts exceed total government spending during a fiscal year,what is the difference

A)a budget surplus

B)a budget deficit

C)the national debt

D)the federal debt

A)a budget surplus

B)a budget deficit

C)the national debt

D)the federal debt

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

22

From which source do provincial and local governments NOT generate revenue

A)sales taxes

B)the federal government

C)corporate income taxes

D)customs duties

A)sales taxes

B)the federal government

C)corporate income taxes

D)customs duties

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

23

What happens as government debt increases

A)Evidence suggests that spending on social insurance programs will be reduced.

B)Government must spend a larger share of its revenue on interest payments.

C)A trade-off with government deficits is inevitable.

D)Taxes must rise to cover the deficit.

A)Evidence suggests that spending on social insurance programs will be reduced.

B)Government must spend a larger share of its revenue on interest payments.

C)A trade-off with government deficits is inevitable.

D)Taxes must rise to cover the deficit.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

24

When does a budget deficit occur

A)when government receipts are less than spending

B)when government spending is less than tax revenue

C)when government receipts plus tax revenue is less than spending

D)when government spending plus tax revenue is less than government receipts

A)when government receipts are less than spending

B)when government spending is less than tax revenue

C)when government receipts plus tax revenue is less than spending

D)when government spending plus tax revenue is less than government receipts

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

25

What is a payroll tax

A)a tax on the wages that a firm pays its workers

B)a tax on each additional dollar of income earned by a worker

C)a tax on specific goods like gasoline and cigarettes

D)a tax on a firm based on the number of workers it has on its payroll

A)a tax on the wages that a firm pays its workers

B)a tax on each additional dollar of income earned by a worker

C)a tax on specific goods like gasoline and cigarettes

D)a tax on a firm based on the number of workers it has on its payroll

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

26

The Canadian federal government spends its revenues in a number of ways.What is the rank of the following spending categories from largest to smallest

A)CHST, equalization, national defence, EI

B)CHST, EI, Old Age Security, net interest

C)Old Age Security, CHST, national defence, federal judicial system

D)Old Age Security, EI, national defence, CHST

A)CHST, equalization, national defence, EI

B)CHST, EI, Old Age Security, net interest

C)Old Age Security, CHST, national defence, federal judicial system

D)Old Age Security, EI, national defence, CHST

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

27

What is the single largest expenditure by provincial governments

A)social services

B)debt service

C)health

D)education

A)social services

B)debt service

C)health

D)education

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

28

What is the most common explanation for payments to senior citizens accounting for a larger share of federal government expenditures

A)increases in life expectancy

B)people becoming eligible for Old Age Security benefits at an earlier age

C)increases in birth rates among teenagers and the poor

D)falling payroll tax receipts

A)increases in life expectancy

B)people becoming eligible for Old Age Security benefits at an earlier age

C)increases in birth rates among teenagers and the poor

D)falling payroll tax receipts

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

29

What are the three largest categories of spending by the federal government in order from first to third

A)Old Age Security, EI, CHST

B)equalization, CHST, Old Age Security

C)CHST, EI, Old Age Security

D)CHST, Old Age Security, EI

A)Old Age Security, EI, CHST

B)equalization, CHST, Old Age Security

C)CHST, EI, Old Age Security

D)CHST, Old Age Security, EI

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

30

How do provincial governments receive revenue from within the tax system

A)They are funded entirely by their own tax base.

B)They receive the majority of their tax revenues from corporate income tax.

C)They are generally not responsible for collecting sales tax.

D)They receive some of their funds from the federal government.

A)They are funded entirely by their own tax base.

B)They receive the majority of their tax revenues from corporate income tax.

C)They are generally not responsible for collecting sales tax.

D)They receive some of their funds from the federal government.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

31

Provinces are sometimes given the responsibility of administering federal programs under federal guidelines.What category do these types of programs usually fall into

A)defence

B)CHST

C)foreign affairs

D)Old Age Security

A)defence

B)CHST

C)foreign affairs

D)Old Age Security

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

32

The share of provincial government spending on health has risen substantially over time.What is the most likely reason

A)a rising poor population in the economy

B)the elderly population growing more rapidly than the overall population

C)immigration policy that continues to promote an influx of migrant farm workers

D)hospital overcrowding

A)a rising poor population in the economy

B)the elderly population growing more rapidly than the overall population

C)immigration policy that continues to promote an influx of migrant farm workers

D)hospital overcrowding

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

33

What are taxes on specific goods such as cigarettes,gasoline,and alcoholic beverages called

A)sales taxes

B)excise taxes

C)social insurance taxes

D)consumption taxes

A)sales taxes

B)excise taxes

C)social insurance taxes

D)consumption taxes

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

34

Most analysts expect one of the largest federal spending categories to continue to grow in importance for many years into the future.What category of spending is this

A)national defence

B)Old Age Security

C)income security

D)farm support programs

A)national defence

B)Old Age Security

C)income security

D)farm support programs

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

35

Where do provincial governments receive the largest portion of their tax revenues

A)sales taxes and personal income taxes

B)payroll taxes and property taxes

C)payroll taxes and personal income taxes

D)property taxes and sales taxes

A)sales taxes and personal income taxes

B)payroll taxes and property taxes

C)payroll taxes and personal income taxes

D)property taxes and sales taxes

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

36

The payroll tax differs from the individual income tax in that the payroll tax is primarily earmarked to pay for which of the following

A)employer-provided pensions

B)employment insurance

C)employer-provided health benefits

D)job loss and training programs

A)employer-provided pensions

B)employment insurance

C)employer-provided health benefits

D)job loss and training programs

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

37

What is the tax that generates the most revenue for provincial and local governments

A)corporate income tax

B)personal income tax

C)property tax

D)excise tax

A)corporate income tax

B)personal income tax

C)property tax

D)excise tax

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

38

Which tax is levied on the total amount spent in retail stores

A)sales tax

B)excise tax

C)retail tax

D)commercial tax

A)sales tax

B)excise tax

C)retail tax

D)commercial tax

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

39

How does the government tax corporate income

A)on the basis of profit

B)on the basis of the amount the firm receives for the goods or services it sells

C)on the basis of the number of employees

D)on the basis of domestic revenue

A)on the basis of profit

B)on the basis of the amount the firm receives for the goods or services it sells

C)on the basis of the number of employees

D)on the basis of domestic revenue

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

40

What do provincial and local governments do to generate revenue

A)They use a mix of taxes and fees.

B)They are required by federal mandate to levy income taxes.

C)They are required to tax property at a standard rate set by the federal government.

D)They impose provincial excise taxes on products that are taxed by the federal government.

A)They use a mix of taxes and fees.

B)They are required by federal mandate to levy income taxes.

C)They are required to tax property at a standard rate set by the federal government.

D)They impose provincial excise taxes on products that are taxed by the federal government.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

41

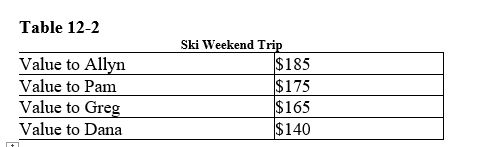

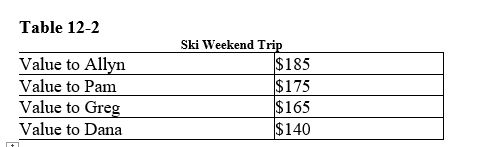

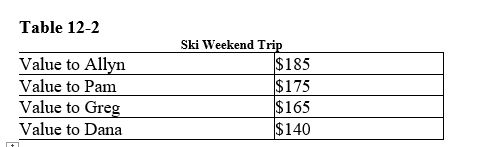

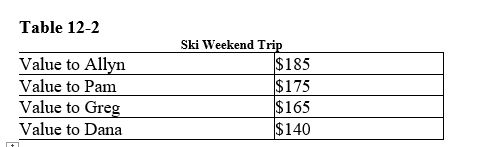

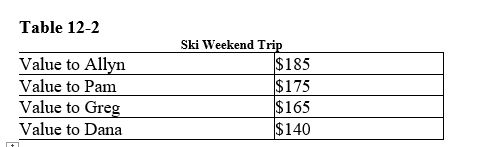

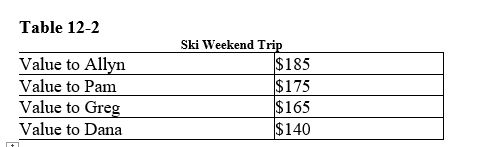

Table 12-2

Refer to Table 12-2.If the price of a weekend ski pass is $138 and this price reflects the actual unit cost of providing a weekend of skiing,how much consumer surplus accrues to Allyn and Greg,respectively

A)$37 and $17

B)$47 and $27

C)$49 and $35

D)$85 and $65

Refer to Table 12-2.If the price of a weekend ski pass is $138 and this price reflects the actual unit cost of providing a weekend of skiing,how much consumer surplus accrues to Allyn and Greg,respectively

A)$37 and $17

B)$47 and $27

C)$49 and $35

D)$85 and $65

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

42

Which factor makes up part of the deadweight loss from taxing labour earnings

A)People will work more.

B)People will be reluctant to hire accountants to file their tax returns.

C)People with low tax liabilities will universally be worse off than under some other tax policy.

D)People will work less.

A)People will work more.

B)People will be reluctant to hire accountants to file their tax returns.

C)People with low tax liabilities will universally be worse off than under some other tax policy.

D)People will work less.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

43

What does a deadweight loss from taxes in a market represent

A)the inefficiency that taxes create

B)the shift in benefit from producers to consumers

C)the part of consumer and producer surplus that is now revenue to the government

D)the loss in profit to producers when quantity demanded falls as a result of higher prices

A)the inefficiency that taxes create

B)the shift in benefit from producers to consumers

C)the part of consumer and producer surplus that is now revenue to the government

D)the loss in profit to producers when quantity demanded falls as a result of higher prices

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

44

What did provincial government spending in 2013-2014 on health,education and social services together amount to

A)50% of provincial spending

B)71% of provincial spending

C)85% of provincial spending

D)92% of provincial spending

A)50% of provincial spending

B)71% of provincial spending

C)85% of provincial spending

D)92% of provincial spending

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

45

Among the major spending categories for provincial and local governments,which is the largest expenditure category

A)health care

B)public welfare

C)public education

D)debt service

A)health care

B)public welfare

C)public education

D)debt service

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

46

For provincial governments,what percent of spending does education account for

A)5

B)20

C)21

D)50

A)5

B)20

C)21

D)50

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

47

What is one reason that deadweight losses are so difficult to avoid

A)Taxes distort the decisions that people make.

B)Income taxes are not paid by everyone.

C)Consumption taxes must be universally applied to all commodities.

D)Administrative burden and deadweight loss reflect a clear tradeoff to policymakers.

A)Taxes distort the decisions that people make.

B)Income taxes are not paid by everyone.

C)Consumption taxes must be universally applied to all commodities.

D)Administrative burden and deadweight loss reflect a clear tradeoff to policymakers.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

48

Who pays primarily for public schools,which educate most students through high school

A)provincial governments

B)local governments

C)the federal government

D)taxpayers directly

A)provincial governments

B)local governments

C)the federal government

D)taxpayers directly

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

49

When the government taxes labour earnings,what can we expect people to do

A)work more so they can keep the same standard of living

B)work less and enjoy more leisure

C)quit their present job and find one that pays better

D)stop working altogether and go on welfare in protest

A)work more so they can keep the same standard of living

B)work less and enjoy more leisure

C)quit their present job and find one that pays better

D)stop working altogether and go on welfare in protest

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

50

What is the second largest component of provincial spending,after health care

A)education

B)social services

C)transportation and communication

D)police and protection

A)education

B)social services

C)transportation and communication

D)police and protection

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

51

In which markets do deadweight losses occur

A)markets in which firms decide to downsize

B)markets in which the government imposes a tax

C)markets in which profits fall because of low consumer demand

D)markets in which equilibrium price rises, causing a loss in consumer surplus

A)markets in which firms decide to downsize

B)markets in which the government imposes a tax

C)markets in which profits fall because of low consumer demand

D)markets in which equilibrium price rises, causing a loss in consumer surplus

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

52

Table 12-2

Refer to Table 12-2.The price of a weekend ski pass is $138 and this price reflects the actual unit cost of providing a weekend of skiing.If the government imposes a tax of $15 on each weekend ski pass,what is the deadweight loss associated with the tax

A)$2

B)$37

C)$52

D)$79

Refer to Table 12-2.The price of a weekend ski pass is $138 and this price reflects the actual unit cost of providing a weekend of skiing.If the government imposes a tax of $15 on each weekend ski pass,what is the deadweight loss associated with the tax

A)$2

B)$37

C)$52

D)$79

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

53

What is the ranking of the following provincial and local government expenditure categories from largest to smallest

A)health, education, social services

B)debt service, health, education

C)social services, debt service, education

D)health, social services, education

A)health, education, social services

B)debt service, health, education

C)social services, debt service, education

D)health, social services, education

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

54

What do most people agree about the tax system

A)It should be both efficient and equitable.

B)It cannot raise enough revenue to cover government expenditures.

C)It could raise more revenue if tax rates were lowered.

D)It should be rewritten to require everyone to pay the same percentage of their income to taxes.

A)It should be both efficient and equitable.

B)It cannot raise enough revenue to cover government expenditures.

C)It could raise more revenue if tax rates were lowered.

D)It should be rewritten to require everyone to pay the same percentage of their income to taxes.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

55

What does an efficient tax system do

A)It imposes small deadweight losses and administrative burdens.

B)It imposes small marginal rates and deadweight losses.

C)It imposes small administrative burdens and transfers of money.

D)It imposes small marginal rates and transfers of money.

A)It imposes small deadweight losses and administrative burdens.

B)It imposes small marginal rates and deadweight losses.

C)It imposes small administrative burdens and transfers of money.

D)It imposes small marginal rates and transfers of money.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

56

Why has spending on health been the focus of many proposed reforms over the past several years

A)Health care costs have risen more rapidly than the cost of other goods and services produced in the economy.

B)Provincial health care systems have demonstrated that they are more efficient than private health care systems.

C)Cures for many major diseases are likely to be found in the next few years.

D)Increasing access to doctors will increase the general health of the population.

A)Health care costs have risen more rapidly than the cost of other goods and services produced in the economy.

B)Provincial health care systems have demonstrated that they are more efficient than private health care systems.

C)Cures for many major diseases are likely to be found in the next few years.

D)Increasing access to doctors will increase the general health of the population.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

57

What do social services primarily consist of

A)welfare programs for low-income people

B)a government health plan for the poor

C)the same services as Old Age Security

D)pensions collected for the infirm

A)welfare programs for low-income people

B)a government health plan for the poor

C)the same services as Old Age Security

D)pensions collected for the infirm

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

58

What is NOT a cost of taxes to taxpayers

A)the tax payment itself

B)deadweight losses

C)administrative burdens

D)goods and services provided by the government

A)the tax payment itself

B)deadweight losses

C)administrative burdens

D)goods and services provided by the government

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

59

Why do taxes create deadweight losses

A)They reduce profits of firms.

B)They distort incentives.

C)They cause prices to rise.

D)They create revenue for the government.

A)They reduce profits of firms.

B)They distort incentives.

C)They cause prices to rise.

D)They create revenue for the government.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

60

Table 12-2

Refer to Table 12-2.If the price of a weekend ski pass is $138 and this price reflects the actual unit cost of providing a weekend of skiing,what is the amount of surplus value that accrues to all four skiers from their weekend trip

A)$105

B)$113

C)$140

D)$265

Refer to Table 12-2.If the price of a weekend ski pass is $138 and this price reflects the actual unit cost of providing a weekend of skiing,what is the amount of surplus value that accrues to all four skiers from their weekend trip

A)$105

B)$113

C)$140

D)$265

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

61

When is one tax system less efficient than another

A)when it places a lower tax burden on lower income families than on higher income families

B)when it places a higher tax burden on lower income families than on higher income families

C)when it raises a given amount of revenue at a higher cost to taxpayers

D)when it raises a given amount of revenue at a lower cost to taxpayers

A)when it places a lower tax burden on lower income families than on higher income families

B)when it places a higher tax burden on lower income families than on higher income families

C)when it raises a given amount of revenue at a higher cost to taxpayers

D)when it raises a given amount of revenue at a lower cost to taxpayers

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

62

Who generates the deadweight loss associated with a tax on a commodity

A)those consumers who still choose to consume the commodity, but pay a higher price that reflects the tax

B)those consumers who choose not to consume the commodity that is taxed

C)all citizens who are able to use services provided by government

D)those consumers who are unable to avoid paying the tax

A)those consumers who still choose to consume the commodity, but pay a higher price that reflects the tax

B)those consumers who choose not to consume the commodity that is taxed

C)all citizens who are able to use services provided by government

D)those consumers who are unable to avoid paying the tax

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

63

Scenario 12-1

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.How much consumer surplus does Kelsey receive from consuming her slice of turkey

A)$3

B)$6

C)$9

D)$12

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.How much consumer surplus does Kelsey receive from consuming her slice of turkey

A)$3

B)$6

C)$9

D)$12

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

64

How is a tax system best defined if it is characterized by small deadweight losses and small administrative burdens

A)equitable

B)communistic

C)capitalistic

D)efficient

A)equitable

B)communistic

C)capitalistic

D)efficient

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is an effect of an income tax

A)It distorts incentives.

B)It discourages the poor to save more.

C)It discourages the rich to save more.

D)It reduces the administrative burden of taxation.

A)It distorts incentives.

B)It discourages the poor to save more.

C)It discourages the rich to save more.

D)It reduces the administrative burden of taxation.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

66

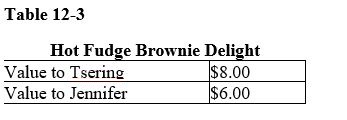

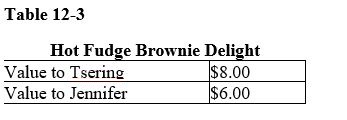

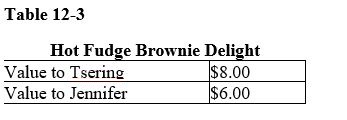

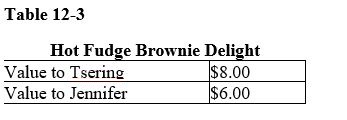

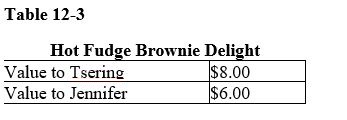

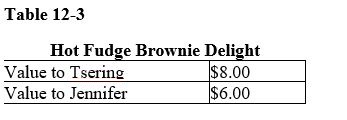

Table 12-3

Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,why does a deadweight loss arise

A)Jennifer will pay more tax as a percentage of her value of Delights than Tsering.

B)Tsering must pay the $2.00 tax from his consumer surplus.

C)Tsering will have to pay a higher price for Delights.

D)Jennifer will leave the market.

Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,why does a deadweight loss arise

A)Jennifer will pay more tax as a percentage of her value of Delights than Tsering.

B)Tsering must pay the $2.00 tax from his consumer surplus.

C)Tsering will have to pay a higher price for Delights.

D)Jennifer will leave the market.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

67

Scenario 12-1

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.If a tax of $2 is levied on each slice of turkey,what is the deadweight loss of the tax

A)$0

B)$3

C)$6

D)$8

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.If a tax of $2 is levied on each slice of turkey,what is the deadweight loss of the tax

A)$0

B)$3

C)$6

D)$8

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

68

When do taxes create deadweight loss

A)when they distort behaviour

B)when they cause the price of the product to increase

C)when they don't raise sufficient government revenue

D)when they cannot be computed easily

A)when they distort behaviour

B)when they cause the price of the product to increase

C)when they don't raise sufficient government revenue

D)when they cannot be computed easily

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

69

Table 12-3

Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,what happens to total consumer surplus

A)It falls by less than the tax revenue generated.

B)It falls by more than the tax revenue generated.

C)It falls by the same amount as the tax revenue generated.

D)It will not fall since Jennifer will no longer be in the market.

Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,what happens to total consumer surplus

A)It falls by less than the tax revenue generated.

B)It falls by more than the tax revenue generated.

C)It falls by the same amount as the tax revenue generated.

D)It will not fall since Jennifer will no longer be in the market.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

70

What results when taxes are imposed on a commodity

A)There is never a deadweight loss.

B)Some consumers alter their consumption by not purchasing the taxed commodity.

C)Tax revenue will rise by the amount of the tax multiplied by the before-tax level of consumption.

D)Taxes will make the consumers who purchase the commodity worse off but not the consumers who do not purchase the commodity.

A)There is never a deadweight loss.

B)Some consumers alter their consumption by not purchasing the taxed commodity.

C)Tax revenue will rise by the amount of the tax multiplied by the before-tax level of consumption.

D)Taxes will make the consumers who purchase the commodity worse off but not the consumers who do not purchase the commodity.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

71

Scenario 12-1

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.If a tax of $4 is levied on each slice of turkey,who bears the deadweight loss

A)Jeremy will bear the full burden of the deadweight loss.

B)Kelsey will bear the full burden of the deadweight loss.

C)Both Kelsey and Jeremy will share the burden of the deadweight loss.

D)There will be no deadweight loss.

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.If a tax of $4 is levied on each slice of turkey,who bears the deadweight loss

A)Jeremy will bear the full burden of the deadweight loss.

B)Kelsey will bear the full burden of the deadweight loss.

C)Both Kelsey and Jeremy will share the burden of the deadweight loss.

D)There will be no deadweight loss.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

72

Scenario 12-1

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.If a tax of $4 is levied on each slice of turkey,how much tax revenue will be generated from sales to Jeremy and Kelsey

A)$0

B)$4

C)$8

D)$12

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.If a tax of $4 is levied on each slice of turkey,how much tax revenue will be generated from sales to Jeremy and Kelsey

A)$0

B)$4

C)$8

D)$12

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

73

What kind of taxes are deadweight losses from taxation associated with

A)taxes that distort the incentives that people face

B)taxes that target expenditures on survivor's benefits for Old Age Security

C)taxes that have no efficiency losses

D)lump-sum taxes

A)taxes that distort the incentives that people face

B)taxes that target expenditures on survivor's benefits for Old Age Security

C)taxes that have no efficiency losses

D)lump-sum taxes

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

74

Table 12-3

Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,what happens to total consumer surplus

A)It will fall from $3 to $1.

B)It will fall from $4 to $1.

C)It will fall from $7 to $3.

D)It will fall from $7 to $4.

Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,what happens to total consumer surplus

A)It will fall from $3 to $1.

B)It will fall from $4 to $1.

C)It will fall from $7 to $3.

D)It will fall from $7 to $4.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

75

What is part of the administrative burden of a tax associated with

A)the money people pay to the government in taxes

B)reducing the size of the market because of the tax

C)the time taxpayers spend filling out tax forms

D)the cost of administering programs that use tax revenue

A)the money people pay to the government in taxes

B)reducing the size of the market because of the tax

C)the time taxpayers spend filling out tax forms

D)the cost of administering programs that use tax revenue

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

76

Scenario 12-1

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.If a tax of $4 is levied on each slice of turkey,what is the deadweight loss of the tax

A)$3

B)$6

C)$8

D)$9

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.If a tax of $4 is levied on each slice of turkey,what is the deadweight loss of the tax

A)$3

B)$6

C)$8

D)$9

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

77

Scenario 12-1

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.Assume that the government places a tax of $4 on each slice of turkey.What is Kelsey's consumer surplus from turkey

A)$0

B)$2

C)$3

D)$6

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.Assume that the government places a tax of $4 on each slice of turkey.What is Kelsey's consumer surplus from turkey

A)$0

B)$2

C)$3

D)$6

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

78

In the absence of taxes,Janet would prefer to purchase a large sport utility vehicle (SUV).However,the government has recently decided to place a $10,000 nuisance tax on SUVs.Which statement best reflects the effect of this tax if Janet decides to purchase a small economy car as a result of the tax

A)Other people who choose to purchase SUVs will incur the cost of the deadweight loss of the tax.

B)There are no deadweight losses as long as some people still choose to purchase SUVs.

C)All deadweight losses are mitigated if there is a net decrease in air pollution.

D)Janet is worse off, and her loss of welfare is part of the deadweight loss of the tax.

A)Other people who choose to purchase SUVs will incur the cost of the deadweight loss of the tax.

B)There are no deadweight losses as long as some people still choose to purchase SUVs.

C)All deadweight losses are mitigated if there is a net decrease in air pollution.

D)Janet is worse off, and her loss of welfare is part of the deadweight loss of the tax.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

79

What happens when interest income from savings is taxed

A)For the poor people, more will be saved than without the tax to make up for what is lost in taxes.

B)For the rich people, more will be saved than without the tax to make up for what is lost in taxes.

C)For the rich people, less will be saved than without the tax since tax lowers the return on income.

D)For the poor people, less will be saved without tax since tax lowers the cost of investment.

A)For the poor people, more will be saved than without the tax to make up for what is lost in taxes.

B)For the rich people, more will be saved than without the tax to make up for what is lost in taxes.

C)For the rich people, less will be saved than without the tax since tax lowers the return on income.

D)For the poor people, less will be saved without tax since tax lowers the cost of investment.

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck

80

Scenario 12-1

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.How much total consumer surplus do Kelsey and Jeremy collectively receive from consuming turkey when it is priced at $2 a slice

A)$3

B)$6

C)$9

D)$12

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

Refer to Scenario 12-1.How much total consumer surplus do Kelsey and Jeremy collectively receive from consuming turkey when it is priced at $2 a slice

A)$3

B)$6

C)$9

D)$12

Unlock Deck

Unlock for access to all 200 flashcards in this deck.

Unlock Deck

k this deck