Deck 20: Financial Globalization: Opportunity and Crisis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

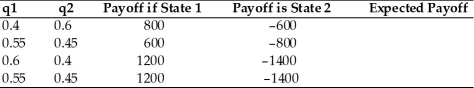

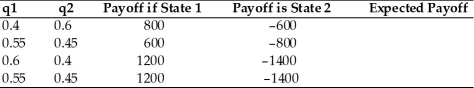

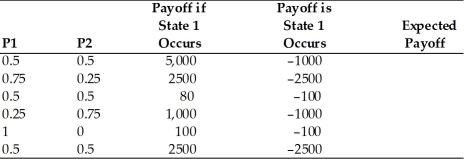

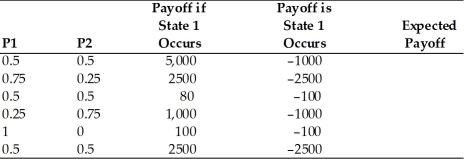

Question

Question

Question

Question

Question

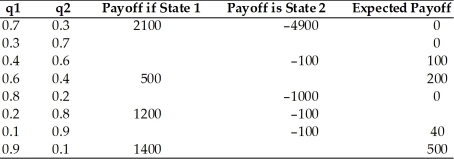

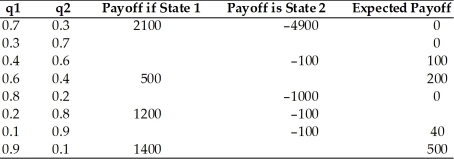

Question

Question

Question

Question

Question

Question

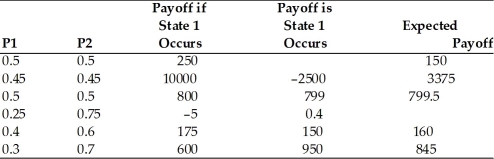

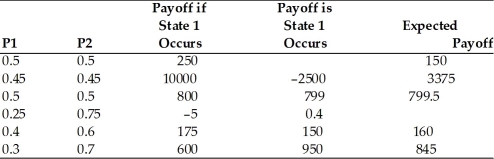

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/113

Play

Full screen (f)

Deck 20: Financial Globalization: Opportunity and Crisis

1

What is the basic motive for asset trade?

A) the belief that large risks will lead to large returns

B) restoration of the balance of payments

C) portfolio unification

D) economic stability

E) increase expected returns and reduced risk

A) the belief that large risks will lead to large returns

B) restoration of the balance of payments

C) portfolio unification

D) economic stability

E) increase expected returns and reduced risk

increase expected returns and reduced risk

2

Asset trades that deal with equity instruments are best described as

A) share of stock.

B) exchange rate.

C) bonds.

D) bank deposits.

E) factors.

A) share of stock.

B) exchange rate.

C) bonds.

D) bank deposits.

E) factors.

share of stock.

3

Describe three types of gains from trades?

A) trades of exchange rates for goods or services, trades of goods or services for property, and trades of gold for textiles

B) trades of goods or services for goods or services, trades of goods or services for assets, and trades of assets for assets

C) trades of imports for exports, trades of exports for imports, and trades of natural resources for financial assets

D) trades of services for goods, trades of currency for services, and trades of one type of currency for another

E) trades of current goods for future services, trades of currency for gold, and trades of one type of currency for another

A) trades of exchange rates for goods or services, trades of goods or services for property, and trades of gold for textiles

B) trades of goods or services for goods or services, trades of goods or services for assets, and trades of assets for assets

C) trades of imports for exports, trades of exports for imports, and trades of natural resources for financial assets

D) trades of services for goods, trades of currency for services, and trades of one type of currency for another

E) trades of current goods for future services, trades of currency for gold, and trades of one type of currency for another

trades of goods or services for goods or services, trades of goods or services for assets, and trades of assets for assets

4

Equity Instruments include

A) stocks.

B) bonds.

C) banks deposits.

D) receipts.

E) bank statements.

A) stocks.

B) bonds.

C) banks deposits.

D) receipts.

E) bank statements.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

5

Risk averse people

A) will never hold bonds denominated in several different currencies because of transaction costs.

B) will always hold bonds denominated in several different currencies because of transaction costs.

C) may hold bonds denominated in several different currencies.

D) may hold bonds denominated in several different currencies only if satisfying the well known interest party condition.

E) will hold only domestic bonds because of the home bias effect.

A) will never hold bonds denominated in several different currencies because of transaction costs.

B) will always hold bonds denominated in several different currencies because of transaction costs.

C) may hold bonds denominated in several different currencies.

D) may hold bonds denominated in several different currencies only if satisfying the well known interest party condition.

E) will hold only domestic bonds because of the home bias effect.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

6

If you are offered a gamble in which you win 500 dollars 3/8 of the time and you lose 500 dollars 5/8 of the time, what is your expected payoff and your behavior given that you are a risk-lover?

A) $500, take the gamble

B) -$125, take the gamble

C) -$125, it is unclear what you would do without further information

D) $500, decline the gamble

E) -$125, decline the gamble

A) $500, take the gamble

B) -$125, take the gamble

C) -$125, it is unclear what you would do without further information

D) $500, decline the gamble

E) -$125, decline the gamble

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

7

For the following questions assume the following facts:

(1)Balance of Payments = 0 prior to the transactions.

(2)Person A (who lives in the United States) purchases an airplane from British Airways for $150,000.

(3)Person A pays with a check from his account at First Union Bank in the United States.

(4)British airways, since it will need dollars in 1 month, deposits the check at the Bank of England.

(5)Bank of England deposits the $150,000 at Commonwealth bank, which is located in the United States.

Due to the transactions above, what are the effects on the reserve at the Fed?

A) Fact 2 is a decrease of $150,000, fact 5 is a decrease of $150,000, a net effect of -$300,000.

B) Fact 3 is a decrease of $150,000, fact 5 is an increase of $150,000, a net effect of 0.

C) Fact 3 is an increase of $150,000, fact 5 is a decrease of $150,000, a net effect of 0.

D) Both fact 3 and fact 5 result in increases of $150,000, a net effect of +$300,000.

E) Both fact 3 and fact 5 result in decrease of $150,000, a net effect of -$300,000.

(1)Balance of Payments = 0 prior to the transactions.

(2)Person A (who lives in the United States) purchases an airplane from British Airways for $150,000.

(3)Person A pays with a check from his account at First Union Bank in the United States.

(4)British airways, since it will need dollars in 1 month, deposits the check at the Bank of England.

(5)Bank of England deposits the $150,000 at Commonwealth bank, which is located in the United States.

Due to the transactions above, what are the effects on the reserve at the Fed?

A) Fact 2 is a decrease of $150,000, fact 5 is a decrease of $150,000, a net effect of -$300,000.

B) Fact 3 is a decrease of $150,000, fact 5 is an increase of $150,000, a net effect of 0.

C) Fact 3 is an increase of $150,000, fact 5 is a decrease of $150,000, a net effect of 0.

D) Both fact 3 and fact 5 result in increases of $150,000, a net effect of +$300,000.

E) Both fact 3 and fact 5 result in decrease of $150,000, a net effect of -$300,000.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

8

What are the three types of transactions between the residents of different countries?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

9

For most practical matters, economists assume that

A) individuals are risk neutral.

B) individuals are risk lovers.

C) individuals are risk averse.

D) most individuals are risk lovers.

E) most individuals are risk neutral.

A) individuals are risk neutral.

B) individuals are risk lovers.

C) individuals are risk averse.

D) most individuals are risk lovers.

E) most individuals are risk neutral.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

10

The international capital market is:

A) the international currency exchange.

B) a market in which capital assets are exchanged for services.

C) the market that is subject to intense regulation and must file a report to the Basel committee on a biannual basis.

D) not really a single market, but a group of closely interconnected markets in which asset exchanges with some international dimension take place.

E) an organization of fiscal policies that dictate international trade.

A) the international currency exchange.

B) a market in which capital assets are exchanged for services.

C) the market that is subject to intense regulation and must file a report to the Basel committee on a biannual basis.

D) not really a single market, but a group of closely interconnected markets in which asset exchanges with some international dimension take place.

E) an organization of fiscal policies that dictate international trade.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

11

People who are risk averse

A) value a collection of assets only on the basis of its expected returns.

B) value a collection of assets only on the basis of the risk of that return.

C) value a collection of assets not only on the basis of its expected returns but also on the basis of the risk of that return.

D) are less likely to invest in life insurance.

E) are less likely to have a diverse portfolio.

A) value a collection of assets only on the basis of its expected returns.

B) value a collection of assets only on the basis of the risk of that return.

C) value a collection of assets not only on the basis of its expected returns but also on the basis of the risk of that return.

D) are less likely to invest in life insurance.

E) are less likely to have a diverse portfolio.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

12

Intertemporal trade is

A) the exchange of goods but not services for claims to future goods.

B) the exchange of services but not goods for claims to future services.

C) the exchange of goods and services for claims to future goods and services.

D) the exchange of domestic goods and services for foreign goods and services.

E) the type of trade that the U.S. government focuses most upon.

A) the exchange of goods but not services for claims to future goods.

B) the exchange of services but not goods for claims to future services.

C) the exchange of goods and services for claims to future goods and services.

D) the exchange of domestic goods and services for foreign goods and services.

E) the type of trade that the U.S. government focuses most upon.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

13

For the following question assume the following facts:

(1)Balance of Payments = 0 prior to the transactions.

(2)Person A (who lives in the United States) purchases an airplane from British Airways for $150,000.

(3)Person A pays with a check from his account at First Union Bank in the United States.

(4)British airways, since it will need dollars in 1 month, deposits the check at the Bank of England.

(5)Bank of England deposits the $150,000 at Commonwealth bank, which is located in the United States.

Due to the transactions above, what are the effects on the balance of payments?

A) -$150,000 due to import of good (current account debit)

B) +$150,000 due to import of good (current account credit)

C) -$150,000 due to deposit of Bank of England (capital account debit)

D) +$150,000 due to deposit of Bank of England (capital account credit)

E) No effect (150,000 current account debit and 150,000 capital account credit)

(1)Balance of Payments = 0 prior to the transactions.

(2)Person A (who lives in the United States) purchases an airplane from British Airways for $150,000.

(3)Person A pays with a check from his account at First Union Bank in the United States.

(4)British airways, since it will need dollars in 1 month, deposits the check at the Bank of England.

(5)Bank of England deposits the $150,000 at Commonwealth bank, which is located in the United States.

Due to the transactions above, what are the effects on the balance of payments?

A) -$150,000 due to import of good (current account debit)

B) +$150,000 due to import of good (current account credit)

C) -$150,000 due to deposit of Bank of England (capital account debit)

D) +$150,000 due to deposit of Bank of England (capital account credit)

E) No effect (150,000 current account debit and 150,000 capital account credit)

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose one is offered a gamble in which you win $1,000 half the time but lose $1,000 half the time. Since in this case one is as likely to win as to lose the $1,000, the average payoff on this gamble-its expected value-is:

0)5 ∗ $1,000 + 0.5 ∗ (-$1,000) = 0.

Under such circumstances:

A) no one will take the gamble.

B) risk averse individuals will take the gamble.

C) risk lovers individuals will not take the gamble.

D) risk neutral individuals will not take the gamble.

E) risk lovers and risk neutral individuals may take the gamble.

0)5 ∗ $1,000 + 0.5 ∗ (-$1,000) = 0.

Under such circumstances:

A) no one will take the gamble.

B) risk averse individuals will take the gamble.

C) risk lovers individuals will not take the gamble.

D) risk neutral individuals will not take the gamble.

E) risk lovers and risk neutral individuals may take the gamble.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

15

Using international asset trade, countries can

A) never really eliminate all risk.

B) eliminate all risk.

C) actually increase their risk in some cases.

D) eliminate all their risk except for emerging markets.

E) never really diversify their holdings.

A) never really eliminate all risk.

B) eliminate all risk.

C) actually increase their risk in some cases.

D) eliminate all their risk except for emerging markets.

E) never really diversify their holdings.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

16

The two types of trade, intertemporal and pure asset swap ________ perfect substitutes, because ________.

A) are; they both offer considerable payoff and are equal in the long run

B) are; they both involve the smoothing out of now and future consumption

C) are not; asset swapping is immediate and involves only assets, while intertemporal trade takes two time periods and involves both assets and goods/services

D) could possibly be; different economic states occur at different points in time

E) are not; asset swapping never relates to intertemporal trade

A) are; they both offer considerable payoff and are equal in the long run

B) are; they both involve the smoothing out of now and future consumption

C) are not; asset swapping is immediate and involves only assets, while intertemporal trade takes two time periods and involves both assets and goods/services

D) could possibly be; different economic states occur at different points in time

E) are not; asset swapping never relates to intertemporal trade

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

17

Asset trades that deal with debt instruments are best described as

A) share of stock.

B) exchange rate.

C) receipts.

D) factors.

E) bonds or bank deposits.

A) share of stock.

B) exchange rate.

C) receipts.

D) factors.

E) bonds or bank deposits.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

18

Imagine that there are two countries, Home and Far Far Away, and that residents of each own only one asset, domestic land yielding an annual harvest of mangoes. Assume that the yield on the land is uncertain. Half the time, Home's land yields a harvest of 5,000 tons of mangoes at the same time as Far Far Away's land yields a harvest of 2,500 tons. The other half of the time the outcomes are reversed. The average for each country mango harvest is

A) 2500.

B) 2750.

C) 3500.

D) 3750.

E) 3000.

A) 2500.

B) 2750.

C) 3500.

D) 3750.

E) 3000.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

19

What would best describe the international capital markets?

A) the market of exchange of bonds

B) the market of exchange of stocks

C) the market of exchange of real estate

D) the market in which residents of different countries trade assets

E) the currency market

A) the market of exchange of bonds

B) the market of exchange of stocks

C) the market of exchange of real estate

D) the market in which residents of different countries trade assets

E) the currency market

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

20

The idea of risk aversion

A) is at odds with the idea of insurance.

B) helps explain the profitability of insurance companies.

C) has nothing to do with insurance companies.

D) helps explain the losses suffered by the insurance industry.

E) helps explain why insurance companies in the long run are zero profit companies.

A) is at odds with the idea of insurance.

B) helps explain the profitability of insurance companies.

C) has nothing to do with insurance companies.

D) helps explain the losses suffered by the insurance industry.

E) helps explain why insurance companies in the long run are zero profit companies.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

21

Suppose you are offered a gamble in which you win $1,000 half the time but lose $1,000 half the time. If you are risk averter will you take the gamble?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

22

Define risk aversion and give an example of a risk-averse person?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

23

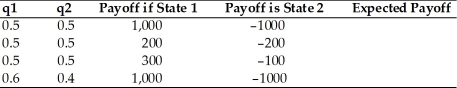

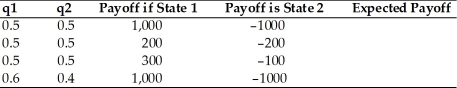

Calculate the expected payoff for the following cases, where q1 and q2 are the probabilities of state 1 and 2, respectively.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

24

Complete the following table.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

25

The following simple two-country question illustrates how countries are made better off by trade in assets. Imagine that there are two countries, Home and Foreign, and that residents of each own only one asset, domestic land yielding an annual harvest of kiwi fruit. Assume that the yield on the land is uncertain. Half the time, Home's land yields a harvest of 100 tons of kiwi fruit at the same time as Foreign's land yields a harvest of 50 tons. The other half of the time the outcomes are reversed. The Foreign's harvest is 100 tons, but the Home harvest is only 50.

Suppose that trade in asset is not allowed but the two countries sign a treaty that guarantees the sending of 25 tons of kiwi in good time by the high output country in that season. What will the outcome be of such a treaty?

Explain why.

Suppose that trade in asset is not allowed but the two countries sign a treaty that guarantees the sending of 25 tons of kiwi in good time by the high output country in that season. What will the outcome be of such a treaty?

Explain why.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

26

The following simple two-country question illustrates how countries are made better off by trade in assets. Imagine that there are two countries, Home and Foreign, and that residents of each own only one asset, domestic land yielding an annual harvest of kiwi fruit. Assume that the yield on the land is uncertain. Half the time, Home's land yields a harvest of 100 tons of kiwi fruit at the same time as Foreign's land yields a harvest of 50 tons. The other half of the time the outcomes are reversed. The Foreign's harvest is 100 tons, but the Home harvest is only 50.

Suppose the two countries can trade shares in the ownership of their perspective assets. Further assume that a Home owner owns a 25 percent share in Foreign land. He will receive 25 percent share in Foreign land and thus receives 25 percent of the annual Foreign kiwi fruit harvest. Further assume also that a Foreign owner of a 25 percent share in Home land is permitted. In this case, a Foreigner is entitled to 25 percent of the Home harvest. Calculate the expected value of kiwi fruit for each investor.

Suppose the two countries can trade shares in the ownership of their perspective assets. Further assume that a Home owner owns a 25 percent share in Foreign land. He will receive 25 percent share in Foreign land and thus receives 25 percent of the annual Foreign kiwi fruit harvest. Further assume also that a Foreign owner of a 25 percent share in Home land is permitted. In this case, a Foreigner is entitled to 25 percent of the Home harvest. Calculate the expected value of kiwi fruit for each investor.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

27

The following simple two-country question illustrates how countries are made better off by trade in assets. Imagine that there are two countries, Home and Foreign, and that residents of each own only one asset, domestic land yielding an annual harvest of kiwi fruit. Assume that the yield on the land is uncertain. Half the time, Home's land yields a harvest of 100 tons of kiwi fruit at the same time as Foreign's land yields a harvest of 50 tons. The other half of the time the outcomes are reversed. The Foreign's harvest is 100 tons, but the Home harvest is only 50.

Calculate the average, for each country of kiwi harvest.

Calculate the average, for each country of kiwi harvest.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

28

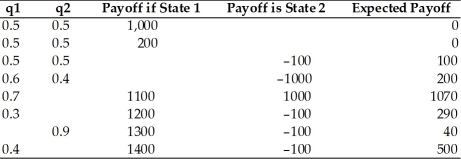

Calculate the expected payoff for the following cases, where q1 and q2 are the probabilities of state 1 and 2, respectively.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

29

Explain Tobin's idea of "Don't put all your eggs in one basket."

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

30

Why is portfolio diversification so important in international trade?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

31

Complete the following table.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

32

How can international trade in assets make both countries better off?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

33

Why is it useful to make a distinction between debt and equity instruments?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

34

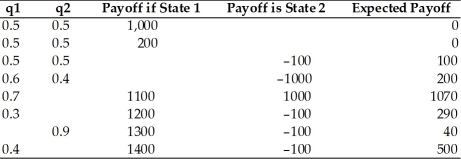

Calculate the expected payoff for the following cases with the formula: (P1) * (payoff if state 1) + (P2) * (payoff if state 2), where P1 and P2 are the probabilities of state 1 and 2, respectively.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

35

Why is the foreign exchange market so vital?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

36

The following simple two-country question illustrates how countries are made better off by trade in assets. Imagine that there are two countries, Home and Foreign, and that residents of each own only one asset, domestic land yielding an annual harvest of kiwi fruit. Assume that the yield on the land is uncertain. Half the time, Home's land yields a harvest of 100 tons of kiwi fruit at the same time as Foreign's land yields a harvest of 50 tons. The other half of the time the outcomes are reversed. The Foreign's harvest is 100 tons, but the Home harvest is only 50.

Suppose the two countries can trade shares in the ownership of their perspective assets. Further, assume that a Home owner owns a 10 percent share in Foreign land. He will receive 10 percent share in Foreign land, and thus receives 10 percent of the annual Foreign kiwi fruit harvest. Further assume that a Foreign owner of a 10 percent share in Home land is permitted. In this case, a Foreigner is entitled to 10 percent of the Home harvest. Calculate the expected value of kiwi fruit for each investor. Is the investor better off?

Suppose the two countries can trade shares in the ownership of their perspective assets. Further, assume that a Home owner owns a 10 percent share in Foreign land. He will receive 10 percent share in Foreign land, and thus receives 10 percent of the annual Foreign kiwi fruit harvest. Further assume that a Foreign owner of a 10 percent share in Home land is permitted. In this case, a Foreigner is entitled to 10 percent of the Home harvest. Calculate the expected value of kiwi fruit for each investor. Is the investor better off?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose you are offered a gamble in which you win $1,000 1/3 of the time but lose $800 2/3 of the time. If you are risk lover will you take the gamble?

What will your expected payoff be?

What will your expected payoff be?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

38

What is the difference between equity instruments and debt instruments?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

39

Complete the following table with the formula (P1) * (payoff if state 1) + (P2)* (payoff if state 2), where P1 and P2 are the probabilities of state 1 and 2, respectively.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

40

The following simple two-country question illustrates how countries are made better off by trade in assets. Imagine that there are two countries, Home and Foreign, and that residents of each own only one asset, domestic land yielding an annual harvest of kiwi fruit. Assume that the yield on the land is uncertain. Half the time, Home's land yields a harvest of 100 tons of kiwi fruit at the same time as Foreign's land yields a harvest of 50 tons. The other half of the time the outcomes are reversed. The Foreign's harvest is 100 tons, but the Home harvest is only 50.

Suppose the two countries can trade shares in the ownership of their perspective assets without any restrictions. Assume that the consumers in both countries would like to totally smooth their consumption. Describe the outcomes.

Suppose the two countries can trade shares in the ownership of their perspective assets without any restrictions. Assume that the consumers in both countries would like to totally smooth their consumption. Describe the outcomes.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

41

Credit Suisse, Goldman Sachs, and Lazard Freres are examples of

A) commercial banks.

B) corporations.

C) non-bank financial institutions, such as insurance companies, pension funds, and mutual funds. This includes investment banks, which specialize in underwriting sales of stocks and bonds by corporations and in some cases governments.

D) central banks and other government agencies.

E) non-profit organizations.

A) commercial banks.

B) corporations.

C) non-bank financial institutions, such as insurance companies, pension funds, and mutual funds. This includes investment banks, which specialize in underwriting sales of stocks and bonds by corporations and in some cases governments.

D) central banks and other government agencies.

E) non-profit organizations.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

42

A business's use of a bank located outside of the home country is called

A) Swiss banking.

B) offshore banking.

C) international banking.

D) domestic banking.

E) international swapping.

A) Swiss banking.

B) offshore banking.

C) international banking.

D) domestic banking.

E) international swapping.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

43

The scale of transactions in the international capital market has

A) grown more quickly than world GDP since the early 1970s.

B) grown less quickly than world GDP since the early 1970s.

C) grown about the same rate as the world GDP since the early 1970s.

D) been fixed by international regulations.

E) decreased more quickly than world GDP since the early 1970s.

A) grown more quickly than world GDP since the early 1970s.

B) grown less quickly than world GDP since the early 1970s.

C) grown about the same rate as the world GDP since the early 1970s.

D) been fixed by international regulations.

E) decreased more quickly than world GDP since the early 1970s.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

44

Which type of main institution in the international capital market most often is involved in foreign exchange intervention?

A) central banks

B) non-bank financial institutions

C) insurance companies

D) corporations

E) commercial banks

A) central banks

B) non-bank financial institutions

C) insurance companies

D) corporations

E) commercial banks

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

45

Describe the role of offshore banking and of offshore currency (eurocurrencies) trading.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

46

Which one of the following possibilities is TRUE?

A) Much of eurocurrency trading occurs in Europe.

B) Much of eurocurrency trading occurs in the United States.

C) Eurocurrencies trading occurs everywhere except the United States.

D) Eurocurrencies trading occurs everywhere except Europe.

E) Eurocurrencies trading occurs everywhere except China.

A) Much of eurocurrency trading occurs in Europe.

B) Much of eurocurrency trading occurs in the United States.

C) Eurocurrencies trading occurs everywhere except the United States.

D) Eurocurrencies trading occurs everywhere except Europe.

E) Eurocurrencies trading occurs everywhere except China.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

47

Eurodollars are

A) dollar deposits located in the United States.

B) dollar deposits located in Europe.

C) dollar deposits located outside Europe.

D) dollar deposits located outside the United States.

E) dollar deposits located outside both Europe and the United States.

A) dollar deposits located in the United States.

B) dollar deposits located in Europe.

C) dollar deposits located outside Europe.

D) dollar deposits located outside the United States.

E) dollar deposits located outside both Europe and the United States.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

48

As a country begins to liberalize its capital account, what would you expect to happen to the difference between the interest rates for similar assets in this country and another country with open capital markets?

A) get larger

B) get smaller

C) stay the same

D) It depends on the existing exchange rate.

E) exponential divergence

A) get larger

B) get smaller

C) stay the same

D) It depends on the existing exchange rate.

E) exponential divergence

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

49

What do you expect would be the effects of 9/11 on the size of the Eurocurrency markets?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

50

Who are the main actors in the international capital market?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

51

Investment banks in the U.S. are

A) regular banks specializing in investment projects.

B) not banks at all but institutions which specialize in underwriting sales of stocks and bonds.

C) special arm of the U.S. government for U.S. banks operating outside the U.S.

D) regular banks specializing in investment projects, but allowed to offer limited domestic transactions.

E) international banks that are heavily invested in the U.S.

A) regular banks specializing in investment projects.

B) not banks at all but institutions which specialize in underwriting sales of stocks and bonds.

C) special arm of the U.S. government for U.S. banks operating outside the U.S.

D) regular banks specializing in investment projects, but allowed to offer limited domestic transactions.

E) international banks that are heavily invested in the U.S.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

52

What are the types of institution banks used to conduct foreign business?

A) corporations

B) central banks

C) commercial banks

D) agency offices, subsidiary banks, and foreign branches

E) state-owned enterprises

A) corporations

B) central banks

C) commercial banks

D) agency offices, subsidiary banks, and foreign branches

E) state-owned enterprises

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

53

Besides world trade growth, what can explain the growth of international banking since the 1960s?

A) war in the Middle East

B) government focus on banking regulation

C) an increase in world travel

D) the emergence of developing countries like China

E) desire of depositors to hold currencies outside the jurisdiction of the countries that issue them

A) war in the Middle East

B) government focus on banking regulation

C) an increase in world travel

D) the emergence of developing countries like China

E) desire of depositors to hold currencies outside the jurisdiction of the countries that issue them

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

54

Regulatory asymmetries can explain why the following places have become main Eurocurrency centers

A) the United States.

B) Germany.

C) Zurich, Somalia, and Mozambique.

D) London, Luxembourg, and The United States.

E) London, Luxembourg, and Hong Kong.

A) the United States.

B) Germany.

C) Zurich, Somalia, and Mozambique.

D) London, Luxembourg, and The United States.

E) London, Luxembourg, and Hong Kong.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

55

Eurobanks are

A) all European Banks.

B) all non American banks.

C) banks that accept deposits denominated in Eurocurrencies excluding Eurodollars.

D) banks that accept deposits denominated in Eurocurrencies including Eurodollars.

E) banks that do not take U.S. dollars.

A) all European Banks.

B) all non American banks.

C) banks that accept deposits denominated in Eurocurrencies excluding Eurodollars.

D) banks that accept deposits denominated in Eurocurrencies including Eurodollars.

E) banks that do not take U.S. dollars.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

56

Explain why a London Eurobank has a competitive advantage over a bank in New York in attracting dollar deposits.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

57

What structures make up the international capital markets?

A) stock market, IFM, and the World bank

B) bond market, foreign exchange rates, IFM, and the World bank

C) commercial banks, corporations, non-bank financial institutions, the central banks, and other government agencies

D) commercial banks and corporations

E) the central banks and non-bank financial institutions

A) stock market, IFM, and the World bank

B) bond market, foreign exchange rates, IFM, and the World bank

C) commercial banks, corporations, non-bank financial institutions, the central banks, and other government agencies

D) commercial banks and corporations

E) the central banks and non-bank financial institutions

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

58

The difference between an agency office located abroad and a subsidiary bank located abroad is

A) an agency office is just a home bank in another country, while a subsidiary bank is controlled by a foreign bank and subject to the same regulations as local banks.

B) an agency office is just a home bank in another country, while a subsidiary bank arranges loans and transfers funds but does not accept deposits.

C) an agency office arranges loans and transfers funds but does not accept deposits, while a subsidiary bank is controlled by a foreign bank and subject to the same regulations as local banks.

D) an agency office arranges loans and transfers funds but does not accept deposits, while a subsidiary bank is just a home bank in a foreign country.

E) an agency office is controlled by a foreign bank and subject to the same regulations as local banks, while a subsidiary bank arranges loans and transfers funds but does not accept deposits.

A) an agency office is just a home bank in another country, while a subsidiary bank is controlled by a foreign bank and subject to the same regulations as local banks.

B) an agency office is just a home bank in another country, while a subsidiary bank arranges loans and transfers funds but does not accept deposits.

C) an agency office arranges loans and transfers funds but does not accept deposits, while a subsidiary bank is controlled by a foreign bank and subject to the same regulations as local banks.

D) an agency office arranges loans and transfers funds but does not accept deposits, while a subsidiary bank is just a home bank in a foreign country.

E) an agency office is controlled by a foreign bank and subject to the same regulations as local banks, while a subsidiary bank arranges loans and transfers funds but does not accept deposits.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

59

Offshore banking can take place at which institution?

A) agency office only

B) subsidiary bank only

C) foreign bank only

D) subsidiary bank and foreign bank

E) agency office, subsidiary bank, and foreign branch

A) agency office only

B) subsidiary bank only

C) foreign bank only

D) subsidiary bank and foreign bank

E) agency office, subsidiary bank, and foreign branch

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

60

The leading center of Eurocurrency trading is

A) New York City.

B) Chicago.

C) London.

D) Paris.

E) Frankfurt.

A) New York City.

B) Chicago.

C) London.

D) Paris.

E) Frankfurt.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

61

In the United States, which of the following safety precautions has the government NOT taken to reduce Bank failures?

A) implemented deposits insurance

B) bank reserve requirements

C) capital requirements and asset restrictions

D) required bank examination

E) forcibly closing poorly run banks

A) implemented deposits insurance

B) bank reserve requirements

C) capital requirements and asset restrictions

D) required bank examination

E) forcibly closing poorly run banks

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is TRUE?

A) Bank failures inflict serious financial harm on individual depositors.

B) Bank failures do not inflict serious financial harm on individual depositors.

C) Bank failures inflict not only serious financial harm on individual depositors, but also harm the macroeconomic stability of the economy.

D) Bank failures inflict serious financial harm on individual depositors, but fortunately do not harm the macroeconomic stability of the economy.

E) Bank failures only inflict serious financial harm on the macroeconomic stability of the economy.

A) Bank failures inflict serious financial harm on individual depositors.

B) Bank failures do not inflict serious financial harm on individual depositors.

C) Bank failures inflict not only serious financial harm on individual depositors, but also harm the macroeconomic stability of the economy.

D) Bank failures inflict serious financial harm on individual depositors, but fortunately do not harm the macroeconomic stability of the economy.

E) Bank failures only inflict serious financial harm on the macroeconomic stability of the economy.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

63

The main problem with securitization is that

A) governments are no longer able to repackage bank assets.

B) securitized banks grow too large and create oligopolies.

C) There is no problem. Governments can still get an accurate picture of global financial flows by simply examining bank balance sheets.

D) governments are not able to monitor bank assets or to asses a bank's risk to the soundness of the international banking system.

E) the bank assets are not marketable.

A) governments are no longer able to repackage bank assets.

B) securitized banks grow too large and create oligopolies.

C) There is no problem. Governments can still get an accurate picture of global financial flows by simply examining bank balance sheets.

D) governments are not able to monitor bank assets or to asses a bank's risk to the soundness of the international banking system.

E) the bank assets are not marketable.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

64

In the U.S., banks

A) cannot be forced to sell assets that the bank examiner deems too risky.

B) can be forced to sell assets that the bank examiner deems too risky.

C) can be forced to sell assets that the bank examiner deems too risky only after a court order.

D) can be forced to sell assets that the bank examiner deems too risky only after both examiners from the Fed and from the FDIC agree.

E) can be forced to trade assets that the bank examiner deems too risky.

A) cannot be forced to sell assets that the bank examiner deems too risky.

B) can be forced to sell assets that the bank examiner deems too risky.

C) can be forced to sell assets that the bank examiner deems too risky only after a court order.

D) can be forced to sell assets that the bank examiner deems too risky only after both examiners from the Fed and from the FDIC agree.

E) can be forced to trade assets that the bank examiner deems too risky.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following statements is TRUE for the U.S.?

A) Federally chartered banks are required to make contributions to the FDIC to cover the cost of bank deposits insurance.

B) Federally chartered banks are not required to make contributions to the FDIC to cover the cost of bank deposits insurance.

C) The States are not required to make contributions to the FDIC to cover the cost of bank deposits insurance for banks with their main branch in that State.

D) The States are required to make contributions to the FDIC to cover the cost of bank deposits insurance for banks with their main branch in that State.

E) The specific municipality where the main branch of the bank is located is required to make contributions to the FDIC to cover the cost of bank deposits insurance.

A) Federally chartered banks are required to make contributions to the FDIC to cover the cost of bank deposits insurance.

B) Federally chartered banks are not required to make contributions to the FDIC to cover the cost of bank deposits insurance.

C) The States are not required to make contributions to the FDIC to cover the cost of bank deposits insurance for banks with their main branch in that State.

D) The States are required to make contributions to the FDIC to cover the cost of bank deposits insurance for banks with their main branch in that State.

E) The specific municipality where the main branch of the bank is located is required to make contributions to the FDIC to cover the cost of bank deposits insurance.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

66

U.S. reserve requirements

A) are rejected by half the banks operating in the United States.

B) show how regulatory asymmetries can operate to enhance the profitability of Eurocurrency trading.

C) tend to harm the bank's business and decrease monetary aggregates.

D) force banks to hold a portion of its assets in a liquid form easily mobilized to meet sudden deposit outflows.

E) remain in place, but capital requirements have begun defaulting.

A) are rejected by half the banks operating in the United States.

B) show how regulatory asymmetries can operate to enhance the profitability of Eurocurrency trading.

C) tend to harm the bank's business and decrease monetary aggregates.

D) force banks to hold a portion of its assets in a liquid form easily mobilized to meet sudden deposit outflows.

E) remain in place, but capital requirements have begun defaulting.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is TRUE?

A) Bank failure is limited to banks that have mismanaged their assets.

B) Bank failure is limited to banks that have invested in real estate.

C) Bank failure is limited to banks that have invested in government bonds.

D) Bank failure is limited to a few banks.

E) Bank failure is NOT limited to banks that have mismanaged their assets.

A) Bank failure is limited to banks that have mismanaged their assets.

B) Bank failure is limited to banks that have invested in real estate.

C) Bank failure is limited to banks that have invested in government bonds.

D) Bank failure is limited to a few banks.

E) Bank failure is NOT limited to banks that have mismanaged their assets.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

68

Banks in the U.S.

A) cannot hold common stocks.

B) can hold common stocks.

C) cannot hold common stocks of companies they do business with.

D) cannot hold common stocks of companies that have their headquarters in the same state.

E) can hold risky assets.

A) cannot hold common stocks.

B) can hold common stocks.

C) cannot hold common stocks of companies they do business with.

D) cannot hold common stocks of companies that have their headquarters in the same state.

E) can hold risky assets.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements is TRUE for the U.S.?

A) The FDIC does not provide insurance for deposits for Savings and Loans (S&L) associations.

B) The FDIC does provide insurance for deposits for Savings and Loans (S&L) associations, but only up to $50,000.

C) The FDIC does provide insurance for deposits for Savings and Loans (S&L) associations up to $250,000.

D) The FDIC does provide insurance for deposits for Savings and Loans (S&L) associations up to $150,000.

E) The FDIC does provide insurance for deposits for Savings and Loans (S&L) associations up to $100,000.

A) The FDIC does not provide insurance for deposits for Savings and Loans (S&L) associations.

B) The FDIC does provide insurance for deposits for Savings and Loans (S&L) associations, but only up to $50,000.

C) The FDIC does provide insurance for deposits for Savings and Loans (S&L) associations up to $250,000.

D) The FDIC does provide insurance for deposits for Savings and Loans (S&L) associations up to $150,000.

E) The FDIC does provide insurance for deposits for Savings and Loans (S&L) associations up to $100,000.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

70

In the U.S., banks

A) may not be forced by bank examiner to adjust their balance sheets by writing off loans the examiner thinks will not be repaid.

B) may be forced by bank examiner to adjust their balance sheets by writing off loans the examiner thinks will not be repaid.

C) may be forced by bank examiner to adjust their balance sheets by writing off loans the examiner thinks will not be repaid only if the Fed and the FDIC examiners agree.

D) may be forced by bank examiner to adjust their balance sheets by writing off loans the examiner thinks will not be repaid only if the Fed and the Office of the Comptroller of the Currency examiners agree.

E) may be forced by bank examiner to adjust their balance sheets by paying off loans the examiner thinks will not be repaid.

A) may not be forced by bank examiner to adjust their balance sheets by writing off loans the examiner thinks will not be repaid.

B) may be forced by bank examiner to adjust their balance sheets by writing off loans the examiner thinks will not be repaid.

C) may be forced by bank examiner to adjust their balance sheets by writing off loans the examiner thinks will not be repaid only if the Fed and the FDIC examiners agree.

D) may be forced by bank examiner to adjust their balance sheets by writing off loans the examiner thinks will not be repaid only if the Fed and the Office of the Comptroller of the Currency examiners agree.

E) may be forced by bank examiner to adjust their balance sheets by paying off loans the examiner thinks will not be repaid.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

71

The case where people purposely act in a careless way, for example, driving recklessly because they are insured, is called

A) asymmetric information.

B) risk aversion.

C) moral hazard.

D) bounded rationality.

E) thrill-seeking.

A) asymmetric information.

B) risk aversion.

C) moral hazard.

D) bounded rationality.

E) thrill-seeking.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following statements is TRUE for the U.S.?

A) The Federal Deposit Insurance Corporation (FDIC) insures bank deposits against losses up to $250,000.

B) The Federal Deposit Insurance Corporation (FDIC) insures bank deposits against losses up to $100,000.

C) The Federal Deposit Insurance Corporation (FDIC) insures bank deposits against losses up to $10,000.

D) The Federal Deposit Insurance Corporation (FDIC) insures bank deposits against natural disaster up to $100,000.

E) The Federal Deposit Insurance Corporation (FDIC) insures bank deposits against floods up to $100,000.

A) The Federal Deposit Insurance Corporation (FDIC) insures bank deposits against losses up to $250,000.

B) The Federal Deposit Insurance Corporation (FDIC) insures bank deposits against losses up to $100,000.

C) The Federal Deposit Insurance Corporation (FDIC) insures bank deposits against losses up to $10,000.

D) The Federal Deposit Insurance Corporation (FDIC) insures bank deposits against natural disaster up to $100,000.

E) The Federal Deposit Insurance Corporation (FDIC) insures bank deposits against floods up to $100,000.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

73

Capital markets of poor developing countries that liberalized their financial systems to allow private asset trade with foreigners are called

A) direct foreign markets.

B) foreign exchange markets.

C) stock & bond markets.

D) emerging markets.

E) fledgling financial markets.

A) direct foreign markets.

B) foreign exchange markets.

C) stock & bond markets.

D) emerging markets.

E) fledgling financial markets.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

74

Banks in the U.S.

A) are prevented from holding assets that are "too risky."

B) are not prevented from holding assets that are "too risky."

C) are encouraged not to hold assets that are "too risky."

D) are not encouraged not to hold assets that are "too risky."

E) are encouraged to lend to a single private customer.

A) are prevented from holding assets that are "too risky."

B) are not prevented from holding assets that are "too risky."

C) are encouraged not to hold assets that are "too risky."

D) are not encouraged not to hold assets that are "too risky."

E) are encouraged to lend to a single private customer.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

75

The purpose of the Basel Committee was to

A) achieve a better coordination of the surveillance exercised by national authorities over the international banking system.

B) achieve a better coordination of domestic banking systems.

C) achieve a better coordination between brokers and investment bankers.

D) achieve a better coordination between bond holder and bond issuers.

E) manipulate bank rates for more leverage profits.

A) achieve a better coordination of the surveillance exercised by national authorities over the international banking system.

B) achieve a better coordination of domestic banking systems.

C) achieve a better coordination between brokers and investment bankers.

D) achieve a better coordination between bond holder and bond issuers.

E) manipulate bank rates for more leverage profits.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

76

Explain what Eurocurrencies are and why they are significant.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

77

A bank faced with a large and sudden loss of deposits is likely to shut down despite a fundamentally sound balance sheet. Why could this be?

A) Banks have accountants that are too optimistic.

B) Banks purposely lie about their balance sheets in order to attract more clients.

C) Many bank assets are illiquid and cannot be sold quickly to meet deposit obligations without substantial loss to the bank.

D) Many banks operate on a budget that exceeds their actual reserves.

E) Many banks will shut down to preserve their interest profits.

A) Banks have accountants that are too optimistic.

B) Banks purposely lie about their balance sheets in order to attract more clients.

C) Many bank assets are illiquid and cannot be sold quickly to meet deposit obligations without substantial loss to the bank.

D) Many banks operate on a budget that exceeds their actual reserves.

E) Many banks will shut down to preserve their interest profits.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

78

Banks in the U.S.

A) face rules against lending too large a fraction of their assets to a single private customer only.

B) face rules against lending too large a fraction of their assets to a single private customer or to a single foreign government borrower.

C) face rules against lending too large a fraction of their assets to a single foreign government borrower only.

D) face rules against lending to too many foreign organizations and corporations.

E) face rules against lending to other banks.

A) face rules against lending too large a fraction of their assets to a single private customer only.

B) face rules against lending too large a fraction of their assets to a single private customer or to a single foreign government borrower.

C) face rules against lending too large a fraction of their assets to a single foreign government borrower only.

D) face rules against lending to too many foreign organizations and corporations.

E) face rules against lending to other banks.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

79

Which statement is NOT true regarding emerging markets?

A) Emerging market financial institutions have generally proven to be weaker than those in industrialized countries.

B) Emerging markets are the capital markets of poorer, developing countries that have liberalized their financial system to allow private asset trade with foreigners.

C) Countries with emerging markets include Brazil, Mexico, and Thailand.

D) Countries with emerging markets have been unable to liberalize their financial systems to allow private trade with foreigners.

E) Emerging market financial institutions contributed to the financial crisis of 1997-1999.

A) Emerging market financial institutions have generally proven to be weaker than those in industrialized countries.

B) Emerging markets are the capital markets of poorer, developing countries that have liberalized their financial system to allow private asset trade with foreigners.

C) Countries with emerging markets include Brazil, Mexico, and Thailand.

D) Countries with emerging markets have been unable to liberalize their financial systems to allow private trade with foreigners.

E) Emerging market financial institutions contributed to the financial crisis of 1997-1999.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

80

In the U.S., the following agencies have the right to examine the bank's books:

A) the Fed and the FDIC.

B) the FDIC and the Office of the Comptroller of the Currency.

C) the Fed and the Department of Commerce

D) the FDIC, Fed and the Office of the Comptroller of the Currency.

E) only the Fed.

A) the Fed and the FDIC.

B) the FDIC and the Office of the Comptroller of the Currency.

C) the Fed and the Department of Commerce

D) the FDIC, Fed and the Office of the Comptroller of the Currency.

E) only the Fed.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck