Deck 9: Working With Financial Tools and Functions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/150

Play

Full screen (f)

Deck 9: Working With Financial Tools and Functions

1

You should reference worksheet cells in which the values are entered so the values are easily visible.

True

2

The list of values in the IRR function must include at least one positive cash flow and one negative cash flow.

True

3

You can calculate cumulative payments on interest and principal using the CUMIPMT and CUMPRINC functions.

True

4

The NPER function returns the number of payment periods,not necessarily the number of years.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

5

An error indicator (a red triangle in the upper-left corner of a cell)flags cells with an error or a potential error.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

6

The fv argument is required in the PMT function.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

7

If you are making periodic monthly payments,and the interest is compounded monthly,then the number of periods is in years.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

8

To calculate a declining balance depreciation,use the DVB function.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

9

To properly use financial functions,always place argument values directly into a financial formula.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

10

Error values will propagate throughout a workbook.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

11

If the NPER function returns #NUM!,the loan cannot be repaid in any length of time.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

12

The functions used to work with loans are the same ones you used to work with investments;the only difference is the direction of the cash flow.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

13

The major advantage of the payback period is that it takes into account the time value of money.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

14

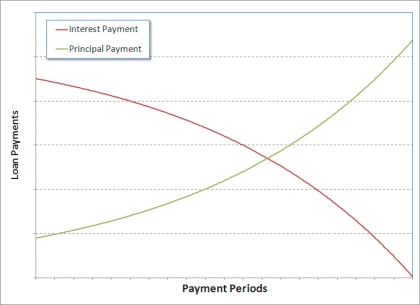

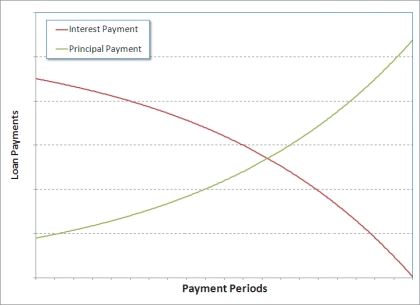

As shown in the accompanying figure,earlier payment periods apply more of the payment toward the principal.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

15

Assets such as raw materials a company uses to manufacture cars are considered tangible assets.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

16

Cash flow is not concerned with the direction of the money as it moves in and out of the company.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

17

Both the NPV and the IRR functions assume the cash flows occur at evenly spaced intervals.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

18

Cash flow has nothing to do with who owns the money.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

19

In an amortization schedule,use relative references to refer to the original loan conditions and use absolute references to refer to information about specific payment periods.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

20

The financial definition of net present value is the difference between the present value of future cash flows and the current cost of the initial investment.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

21

A regular cash flow occurs when cash is going away from the investor._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

22

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the amount of a loan payment used to pay off the interest

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the amount of a loan payment used to pay off the interest

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

23

When using the PMT function to calculate monthly loan payments,the interest rate and the number of payments should be based on the interest rate per year and the total months to pay off the loan._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

24

The financial functions automatically format calculated values as currency with negative cash flow appearing in a green font._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

25

At higher rates of return,the net present value of the investment goes up._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

26

The function DDB is used to calculate a declining balance depreciation._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

27

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the amount of a loan payment applied to the principal

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the amount of a loan payment applied to the principal

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

28

With the FV function,if the amount invested each month is -30,000,this represents a positive cash flow._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

29

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the number of payments required to pay off a loan or reach an investment goal

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the number of payments required to pay off a loan or reach an investment goal

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

30

To calculate an annual rate,multiply the value returned by the RATE function by the number of payments per year._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

31

If you don't include an fv value,Excel assumes a future value of 1._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

32

The possibility that the entire transaction will fail,resulting in a loss of the initial investment is called the chance._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

33

The FV function calculates the full value of an investment or loan._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

34

As you repay a loan,each payment represents a positive cash flow as you are sending money to the lending institution._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

35

You can extrapolate a series of values from the Series dialog box._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

36

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the per period interest rate required to pay off a loan or reach an investment goal

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the per period interest rate required to pay off a loan or reach an investment goal

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

37

If the NPER function returns the error value #REF a loan cannot be paid back in any length of time._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

38

Amortization schedules often format all entries as positive values,and then label the columns to indicate the values represent negative values._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

39

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the payment in each period required to pay off a loan or reach an investment goal

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the payment in each period required to pay off a loan or reach an investment goal

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

40

If you plan to invest money for 18 months,the value of the nper argument in the PMT function is 1.5._________________________

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

41

The ____ function calculates the number of payment periods in an investment or loan.

A) RATE

B) PV

C) NPER

D) FV

A) RATE

B) PV

C) NPER

D) FV

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

42

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

The difference between the present value of an investment and the initial expenditure on that investment

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

The difference between the present value of an investment and the initial expenditure on that investment

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

43

With the PMT function,the type argument is ____ when the payments are made at the beginning of each period.

A) 0

B) 1

C) a

D) -1

A) 0

B) 1

C) a

D) -1

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

44

The PMT value is also known as the ____ payment.

A) periodic

B) placement

C) inflow

D) indexed

A) periodic

B) placement

C) inflow

D) indexed

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

45

The ____ function calculates the interest rate charged or received during each payment period.

A) RATE

B) PV

C) NPER

D) FV

A) RATE

B) PV

C) NPER

D) FV

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

46

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the present value of a series of future cash flows

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the present value of a series of future cash flows

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

47

Cash flow is the movement of cash assets ____ an account.

A) into

B) out of

C) into or out of

D) none of the above

A) into

B) out of

C) into or out of

D) none of the above

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

48

The ____ function calculates the amount paid into an investment or loan during each payment period.

A) NPER

B) RATE

C) PMT

D) INT

A) NPER

B) RATE

C) PMT

D) INT

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

49

The ____ function calculates the present value of an investment or loan.

A) PRES

B) PV

C) NPER

D) FV

A) PRES

B) PV

C) NPER

D) FV

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

50

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Return rate for a series of future cash flows that will result in a net present value of zero

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Return rate for a series of future cash flows that will result in a net present value of zero

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

51

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the future value of a loan or an investment

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the future value of a loan or an investment

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

52

To calculate the number of ____ payments required to pay off a loan or meet an investment goal,use the NPER function.

A) monthly

B) daily

C) quarterly

D) either a.or c.

A) monthly

B) daily

C) quarterly

D) either a.or c.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

53

Financial functions format calculated values as currency,with ____.

A) positive cash flow appearing in red font

B) positive cash flow enclosed in parentheses

C) negative cash flow appearing in green font

D) negative cash flow appearing in red font

A) positive cash flow appearing in red font

B) positive cash flow enclosed in parentheses

C) negative cash flow appearing in green font

D) negative cash flow appearing in red font

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

54

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the internal rate of return for a series of unevenly spaced payments

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the internal rate of return for a series of unevenly spaced payments

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

55

FV is used to calculate the ____ of a fund.

A) future value

B) fixed value

C) forecast value

D) first value

A) future value

B) fixed value

C) forecast value

D) first value

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

56

To calculate the number of quarterly payments required to pay off a loan,use the ____ function.

A) PMT

B) PV

C) FV

D) NPER

A) PMT

B) PV

C) FV

D) NPER

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

57

With the PMT function,the type argument is ____ when the payments are made at the end of each period.

A) 0

B) 1

C) a

D) -1

A) 0

B) 1

C) a

D) -1

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

58

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the present value of a loan or an investment

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

Calculates the present value of a loan or an investment

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

59

The ____ function calculates the future value of an investment or loan.

A) RATE

B) PV

C) NPER

D) FV

A) RATE

B) PV

C) NPER

D) FV

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

60

MATCHING

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

An interest rate that compares the value of current dollars to future dollars from a series of cash flows

Identify the letter of the choice that best matches the phrase or definition.

a.PPMT function

g.PMT function

b.rate of return

h.XIRR function

c.IPMT function

i.NPV

d.IRR

j.NPER function

e.NPV function

k.FV function

f.RATE function

l.PV function

An interest rate that compares the value of current dollars to future dollars from a series of cash flows

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

61

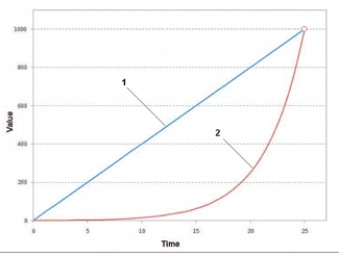

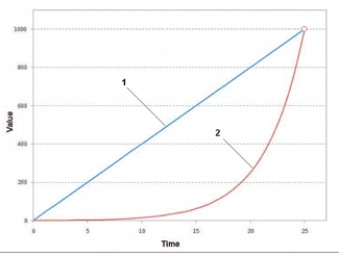

As shown in the accompanying figure,in a(n)____ trend,the values do not change by a constant amount.

A) periodic

B) growth

C) orthogonal

D) linear

A) periodic

B) growth

C) orthogonal

D) linear

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

62

The difference between a company's sales revenue and the cost of goods sold is the company's ____.

A) cost of operation

B) gross profit

C) growth trend

D) total revenue

A) cost of operation

B) gross profit

C) growth trend

D) total revenue

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

63

To calculate the annual rate,you must ____ the value returned by the RATE function by the number of payments per year.

A) add

B) subtract

C) multiply

D) divide

A) add

B) subtract

C) multiply

D) divide

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

64

As shown in the accompanying figure,when plotted,a(n)____ trend displays the greatest increases near the end of the series.

A) periodic

B) growth

C) orthogonal

D) linear

A) periodic

B) growth

C) orthogonal

D) linear

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

65

In a(n)____ trend,the values change by a constant amount.

A) linear

B) growth

C) periodic

D) orthogonal

A) linear

B) growth

C) periodic

D) orthogonal

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

66

A(n)____ shows how much money a business makes or loses over a specified period of time.

A) income projection

B) expense report

C) profit analysis

D) income statement

A) income projection

B) expense report

C) profit analysis

D) income statement

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

67

As shown in the accompanying figure,a(n)____ trend appears as a straight line.

A) periodic

B) growth

C) orthogonal

D) linear

A) periodic

B) growth

C) orthogonal

D) linear

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

68

To ____ a series,the cells between the first and last cells in the series must be blank.

A) extrapolate

B) concatenate

C) integrate

D) interpolate

A) extrapolate

B) concatenate

C) integrate

D) interpolate

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

69

Most Excel financial functions require a particular ____ to the cash flow to return the correct value.

A) index

B) valence

C) orientation

D) direction

A) index

B) valence

C) orientation

D) direction

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

70

The item marked 1 in the accompanying figure represents the ____ trend.

A) periodic

B) growth

C) orthogonal

D) linear

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

71

In a(n)____ trend,values change by a constant percentage and usually appear as a curve.

A) linear

B) growth

C) periodic

D) orthogonal

A) linear

B) growth

C) periodic

D) orthogonal

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

72

The item marked 2 in the accompanying figure represents the ____ trend.

A) periodic

B) growth

C) orthogonal

D) linear

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

73

As shown in the accompanying figure,later payment periods apply more of the payment toward the ____.

A) index

B) interest rate

C) interest

D) principal

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

74

If the NPER function returns the error value ____,the loan cannot be paid back in any length of time.

A) #REF!

B) #NUM!

C) #TIME!

D) #PER!

A) #REF!

B) #NUM!

C) #TIME!

D) #PER!

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

75

Income statements are often created ____.

A) monthly

B) semiannually

C) annually

D) any of the above

A) monthly

B) semiannually

C) annually

D) any of the above

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

76

In the function =CUMIPMT(rate,nper,pv,start,end,type),it is ____ that defines whether the payments are made at the beginning or end of each period.

A) rate

B) nper

C) end

D) type

A) rate

B) nper

C) end

D) type

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

77

When you borrow money,the money you receive represents a ____ cash flow.

A) positive

B) negative

C) fixed

D) neutral

A) positive

B) negative

C) fixed

D) neutral

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

78

The ____ function returns the amount of a particular payment that is used to pay the interest on the loan.

A) PMT

B) IPMT

C) INPMT

D) NPMT

A) PMT

B) IPMT

C) INPMT

D) NPMT

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following shows the syntax of the NPER function?

A) =NPER(pmt,pv,[fv=0],[type=0])

B) =NPER(rate,pmt,[fv=0],[type=0])

C) =NPER(rate,pmt,pv [,fv=0] [,type=0])

D) =NPER(pmt,rate,pv,[fv=0],[type=0])

A) =NPER(pmt,pv,[fv=0],[type=0])

B) =NPER(rate,pmt,[fv=0],[type=0])

C) =NPER(rate,pmt,pv [,fv=0] [,type=0])

D) =NPER(pmt,rate,pv,[fv=0],[type=0])

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

80

When using the PMT function to calculate monthly loan payments,the interest rate and the number of payments should be based on the interest rate per month and the total ____ to pay off the loan.

A) weeks

B) months

C) years

D) any of the above

A) weeks

B) months

C) years

D) any of the above

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck