Deck 19: Multinational Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 19: Multinational Capital Budgeting

1

Of the following, which would NOT be considered an initial outlay at time 0 (today)?

A) investment in new equipment

B) initial investment in additional net working capital

C) shipping and handling costs associated with the new investment

D) All of the above are initial outlays.

A) investment in new equipment

B) initial investment in additional net working capital

C) shipping and handling costs associated with the new investment

D) All of the above are initial outlays.

All of the above are initial outlays.

2

For financial reporting purposes, U.S. firms must consolidate the earnings of any subsidiary that is over ________ owned.

A) 20%

B) 40%

C) 50%

D) 75%

A) 20%

B) 40%

C) 50%

D) 75%

50%

3

A foreign firm that is 20% to 49% owned by a parent is called a/an ________.

A) subsidiary

B) affiliate

C) partner

D) rival

A) subsidiary

B) affiliate

C) partner

D) rival

affiliate

4

Project evaluation from the ________ viewpoint serves some useful purposes and/but should ________ the ________ viewpoint.

A) local; be subordinated to; parent's

B) local; not be subordinated to; parent's

C) parent's; be subordinated to; local

D) none of the above

A) local; be subordinated to; parent's

B) local; not be subordinated to; parent's

C) parent's; be subordinated to; local

D) none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

Of the following capital budgeting decision criteria, which does NOT use discounted cash flows?

A) net present value

B) internal rate of return

C) accounting rate of return

D) All of these techniques typically use discounted cash flows.

A) net present value

B) internal rate of return

C) accounting rate of return

D) All of these techniques typically use discounted cash flows.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

Given a current spot rate of 8.10 Norwegian krone per U.S. dollar, expected inflation rates of 6% in Norway and 3% per annum in the U.S., use the formula for relative purchasing power parity to estimate the one-year spot rate of krone per dollar.

A) 7.87 krone per dollar

B) 8.10 krone per dollar

C) 8.34 krone per dollar

D) There is not enough information to answer this question.

A) 7.87 krone per dollar

B) 8.10 krone per dollar

C) 8.34 krone per dollar

D) There is not enough information to answer this question.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Instruction 19.1:

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. What is the NPV of the European expansion if Wheel Deal first computes the NPV in euros and then converts that figure to dollars using the current spot rate?

A) $1,520,000

B) $1,684,210

C) -$75,310

D) -$71,544

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. What is the NPV of the European expansion if Wheel Deal first computes the NPV in euros and then converts that figure to dollars using the current spot rate?

A) $1,520,000

B) $1,684,210

C) -$75,310

D) -$71,544

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

Instruction 19.1:

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. What are the annual after-tax cash flows for the Wheel Deal project?

A) euro 400,000

B) euro 240,000

C) euro 120,000

D) euro 360,000

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. What are the annual after-tax cash flows for the Wheel Deal project?

A) euro 400,000

B) euro 240,000

C) euro 120,000

D) euro 360,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

When determining a firm's weighted average cost of capital (wacc) which of the following terms is NOT necessary?

A) the firm's tax rate

B) the firm's cost of debt

C) the firm's cost of equity

D) All of the above are necessary.

A) the firm's tax rate

B) the firm's cost of debt

C) the firm's cost of equity

D) All of the above are necessary.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT a basic step in the capital budgeting process?

A) Identify the initial capital invested.

B) Estimate the cash flows to be derived from the project over time.

C) Identify the appropriate interest rate at which to discount future cash flows.

D) All of the above are steps in the capital budgeting process.

A) Identify the initial capital invested.

B) Estimate the cash flows to be derived from the project over time.

C) Identify the appropriate interest rate at which to discount future cash flows.

D) All of the above are steps in the capital budgeting process.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

When evaluating capital budgeting projects, which of the following would NOT necessarily be an indicator of an acceptable project?

A) an NPV > $0

B) an IRR > the project's required rate of return

C) an IRR > $0

D) All of the above are correct indicators.

A) an NPV > $0

B) an IRR > the project's required rate of return

C) an IRR > $0

D) All of the above are correct indicators.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

When determining a firm's weighted average cost of capital (wacc) which of the following terms is NOT necessary?

A) the firm's weight of equity financing

B) the risk-free rate of return

C) the firm's weight of debt financing

D) All of the above are necessary to determine a firm's wacc.

A) the firm's weight of equity financing

B) the risk-free rate of return

C) the firm's weight of debt financing

D) All of the above are necessary to determine a firm's wacc.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

Affiliate firms are consolidated on the parent's financial statements on a ________ basis.

A) pro rated

B) 50%

C) 75%

D) 100%

A) pro rated

B) 50%

C) 75%

D) 100%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

Instruction 19.1:

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. What is the initial investment for the Wheel Deal project?

A) $1,500,000

B) euro 1,600,000

C) $1,600,000

D) euro 1,500,000

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. What is the initial investment for the Wheel Deal project?

A) $1,500,000

B) euro 1,600,000

C) $1,600,000

D) euro 1,500,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

There are no important differences between domestic and international capital budgeting methods.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

Instruction 19.1:

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. In euros, what is the NPV of the Wheel Deal expansion?

A) euro 1,524,690

B) $1,611,317

C) -euro 75,310

D) -euro 111,317

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. In euros, what is the NPV of the Wheel Deal expansion?

A) euro 1,524,690

B) $1,611,317

C) -euro 75,310

D) -euro 111,317

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

Given a current spot rate of 8.10 Norwegian krone per U.S. dollar, expected inflation rates of 3% in Norway and 6% per annum in the U.S., use the formula for relative purchasing power parity to estimate the one-year spot rate of krone per dollar.

A) 7.87 krone per dollar

B) 8.10 krone per dollar

C) 8.34 krone per dollar

D) There is not enough information to answer this question.

A) 7.87 krone per dollar

B) 8.10 krone per dollar

C) 8.34 krone per dollar

D) There is not enough information to answer this question.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

The traditional financial analysis applied to foreign or domestic projects, to determine the project's value to the firm is called ________.

A) cost of capital analysis

B) capital budgeting

C) capital structure analysis

D) agency theory

A) cost of capital analysis

B) capital budgeting

C) capital structure analysis

D) agency theory

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is NOT a reason why capital budgeting for a foreign project is more complex than for a domestic project?

A) Parent cash flows must be distinguished from project cash flows.

B) Parent firms must specifically recognize remittance of funds due to differing rules and regulations concerning remittance of cash flows, taxes, and local norms.

C) Differing rates of inflation between the foreign and domestic economies.

D) All of the above add complexity to the international capital budgeting process.

A) Parent cash flows must be distinguished from project cash flows.

B) Parent firms must specifically recognize remittance of funds due to differing rules and regulations concerning remittance of cash flows, taxes, and local norms.

C) Differing rates of inflation between the foreign and domestic economies.

D) All of the above add complexity to the international capital budgeting process.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

It is important that firms adopt a common standard for the capital budgeting process for choosing among foreign and domestic projects.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

When dealing with international capital budgeting projects, the value of the project is NOT sensitive to the firm's cost of capital.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is NOT an example of political risk?

A) Expropriation of cash flows by a foreign government.

B) The U.S. government restricts trade with a foreign country where your firm has investments.

C) The foreign government nationalizes all foreign-owned assets.

D) All of the above are examples of political risk.

A) Expropriation of cash flows by a foreign government.

B) The U.S. government restricts trade with a foreign country where your firm has investments.

C) The foreign government nationalizes all foreign-owned assets.

D) All of the above are examples of political risk.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Projects that have ________ are often rejected by traditional discounted cash flow models of capital budgeting.

A) long lives

B) cash flow returns in later years

C) high risk levels

D) all of the above

A) long lives

B) cash flow returns in later years

C) high risk levels

D) all of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

________ is the risk that a foreign government will place restrictions such as limiting the amount of funds that can be remitted to the parent firm, or even expropriation of cash flows earned in that country.

A) Exchange risk

B) Foreign risk

C) Political risk

D) Unnecessary risk

A) Exchange risk

B) Foreign risk

C) Political risk

D) Unnecessary risk

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

Generally speaking a firm's cost of ________ capital is greater than the firm's ________.

A) debt; equity

B) debt; wacc

C) equity; wacc

D) None of the above is true.

A) debt; equity

B) debt; wacc

C) equity; wacc

D) None of the above is true.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

Your company just received a $500,000 cash remittance from its British subsidiary. If the risk-free one-year T-bill rate is 4.5% and the current exchange rate is $1.45/£, and the one-year forward rate is $1.44/£, then the present value of the remittance is ________.

A) $725,000

B) $500,000

C) $693,780

D) $478,469

A) $725,000

B) $500,000

C) $693,780

D) $478,469

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

Instruction 19.1:

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. What is the IRR of the Wheel Deal expansion?

A) 14.4%

B) 10.3%

C) 12.0%

D) 8.6%

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. What is the IRR of the Wheel Deal expansion?

A) 14.4%

B) 10.3%

C) 12.0%

D) 8.6%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

Generally speaking, a firm wants to receive cash flows from a currency that is ________ relative to their own, and pay out in currencies that are ________ relative to their home currency.

A) appreciating; depreciating

B) depreciating; depreciating

C) appreciating; appreciating

D) depreciating; appreciating

A) appreciating; depreciating

B) depreciating; depreciating

C) appreciating; appreciating

D) depreciating; appreciating

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

For international investments, relative to project cash flows, parent cash flows are often dependent on the form of financing.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

Real option analysis allows managers to analyze all of the following EXCEPT:

A) the option to defer.

B) the option to abandon.

C) the option to alter capacity.

D) All of the above may be analyzed using real option analysis.

A) the option to defer.

B) the option to abandon.

C) the option to alter capacity.

D) All of the above may be analyzed using real option analysis.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

An alternative to traditional discounted cash flow models is ________.

A) the capital asset pricing model

B) dividend growth model

C) real option analysis model

D) none of the above

A) the capital asset pricing model

B) dividend growth model

C) real option analysis model

D) none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

If a firm undertakes a project with ordinary cash flows and estimates that the firm has a positive NPV, then the IRR will be ________.

A) less than the cost of capital

B) greater than the cost of capital

C) greater than the cost of the project

D) cannot be determined from this information

A) less than the cost of capital

B) greater than the cost of capital

C) greater than the cost of the project

D) cannot be determined from this information

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Calculate the cost of equity for Boston Industries using the following information: The cost of debt is 7%, the corporate tax rate is 40%, the rate on Treasury Bills is 4%, the firm has a beta of 1.1, and the expected return on the market is 12%.

A) 12.8%

B) 12.6%

C) 13.2%

D) 6.6%

A) 12.8%

B) 12.6%

C) 13.2%

D) 6.6%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following considerations is NOT important for a parent firm when considering foreign investment?

A) the form of financing

B) remittance of funds at risk due to political considerations

C) differing rates of national inflation

D) All of the above are important considerations.

A) the form of financing

B) remittance of funds at risk due to political considerations

C) differing rates of national inflation

D) All of the above are important considerations.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

When estimating a firm's cost of equity capital using the CAPM, you need to estimate

A) the risk-free rate of return.

B) the expected return on the market portfolio.

C) the firm's beta.

D) all of the above.

A) the risk-free rate of return.

B) the expected return on the market portfolio.

C) the firm's beta.

D) all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

Instruction 19.1:

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. The European expansion would have a greater NPV in dollar terms if the euro appreciated in value over the five-year life of the project and the project had a positive NPV, other things equal.

Use the information for following question(s).

The Wheel Deal Inc., a company that produces scooters and other wheeled non-motorized recreational equipment is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of euro 1,200,000 and additional installation of euro 300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to increase revenues by euro 600,000 per year over current levels for the next 5 years, however; expenses will also increase by euro 200,000 per year. (Note: Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for euro 500,000. The firm's required rate of return is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro 0 over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of euro 100,000 (to be recovered at the sale of the equipment at the end of five years). The current spot rate is $0.95/euro , and the expected inflation rate in the U.S. is 4% per year and 3% per year in Europe.

Refer to Instruction 19.1. The European expansion would have a greater NPV in dollar terms if the euro appreciated in value over the five-year life of the project and the project had a positive NPV, other things equal.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is NOT a method for considering additional risk with international projects?

A) adding an additional risk premium to the discount factor used

B) decreasing expected cash flows

C) conducting detailed sensitively and scenario analysis

D) All of the above are legitimate methods for considering additional risk.

A) adding an additional risk premium to the discount factor used

B) decreasing expected cash flows

C) conducting detailed sensitively and scenario analysis

D) All of the above are legitimate methods for considering additional risk.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

The only proper way to estimate the NPV of a foreign project is to discount the appropriate cash flows first and then convert them to the domestic currency at the current spot rate.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

Benson Manufacturing has an after-tax cost of debt of 7% and a cost of equity of 12%. If Benson is in a 30% tax bracket, and finances 40% of assets with debt, what is the firm's wacc?

A) 11.20%

B) 10.36%

C) 9.72%

D) 7.68%

A) 11.20%

B) 10.36%

C) 9.72%

D) 7.68%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

Capital budgeting analysis for a foreign project is more complex than for the domestic case for all of the following reasons EXCEPT:

A) differences in national inflation rates.

B) parent cash flows must be distinguished from project cash flows.

C) the possibility of unanticipated foreign exchange rate changes.

D) All of the above are correct.

A) differences in national inflation rates.

B) parent cash flows must be distinguished from project cash flows.

C) the possibility of unanticipated foreign exchange rate changes.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

Explain how political risk and exchange rate risk increase the uncertainty of international projects for the purpose of capital budgeting.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

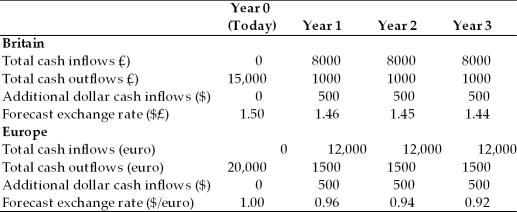

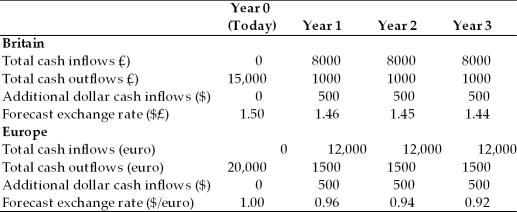

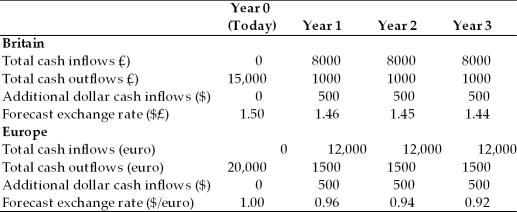

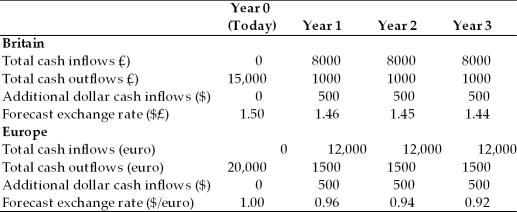

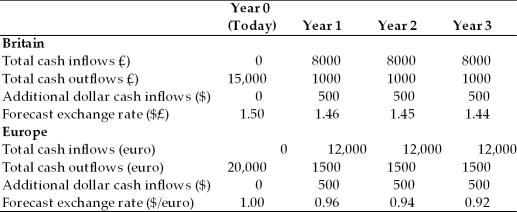

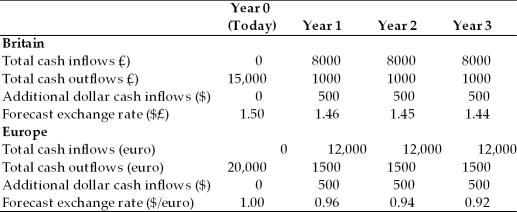

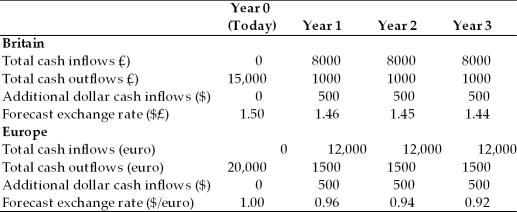

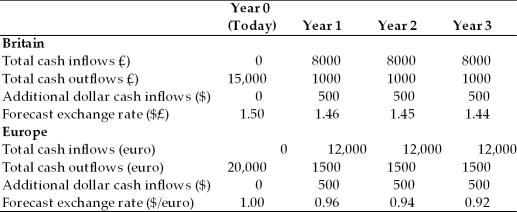

TABLE 19.1

Use the information to answer following question(s).

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

Refer to Table 19.1. The NPV for the British investment is estimated at ________.

A) $3,092

B) $6,420

C) £3,092

D) $0

Use the information to answer following question(s).

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

Refer to Table 19.1. The NPV for the British investment is estimated at ________.

A) $3,092

B) $6,420

C) £3,092

D) $0

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

Hydrotech Manufacturing of Houston Texas expects to receive dividends each year from a foreign subsidiary for the next 5 years. The dividend is expected to grow at a rate of 7% per year. If the euro appreciates in value against the dollar at a rate of 2% per year over the life of the dividends, then the present value of the euro dividends to Hydrotech will be ________ if there had been no change in the relative values of the euro and dollar.

A) less than

B) greater than

C) the same as

D) There is not enough information to answer this question.

A) less than

B) greater than

C) the same as

D) There is not enough information to answer this question.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

A Mexican firm wishes to build a new plant in the USA in one year. The cost in Mexican pesos will be greater if the peso appreciates against the USD in the interim and the Mexican firm does not hedge.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

As in domestic capital budgeting, a potential international project or capital budget will be considered a net benefit to the firms if

A) the project has a net present value greater than zero.

B) the IRR on the project is less than the wacc.

C) the IRR exceed the project's NPV.

D) All of the above are true.

A) the project has a net present value greater than zero.

B) the IRR on the project is less than the wacc.

C) the IRR exceed the project's NPV.

D) All of the above are true.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

Which is NOT considered a shortcoming of the parent simply adjusting discount rates to account for the additional risk that stems from a project's foreign location?

A) Cash flows are already highly subjective.

B) Two-sided risk in that foreign currency may appreciate or depreciate.

C) Increased sales volume might offset the lower value of a local currency.

D) These are all shortcomings associated with discount rate adjustment.

A) Cash flows are already highly subjective.

B) Two-sided risk in that foreign currency may appreciate or depreciate.

C) Increased sales volume might offset the lower value of a local currency.

D) These are all shortcomings associated with discount rate adjustment.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

Project finance is characterized by which of the following features?

A) long project life

B) high capital intensity of undertaking the investment

C) production or provision of a basic commodity or service

D) All of the above.

A) long project life

B) high capital intensity of undertaking the investment

C) production or provision of a basic commodity or service

D) All of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

TABLE 19.1

Use the information to answer following question(s).

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

Refer to Table 19.1. If the euro was forecast to remain constant at $1.00/euro throughout the investment period, how would the investment decision now be characterized?

A) The project would be even better than forecast.

B) The British investment should be chosen over the European investment.

C) The NPV is $6,420.

D) All of the above are true.

Use the information to answer following question(s).

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

Refer to Table 19.1. If the euro was forecast to remain constant at $1.00/euro throughout the investment period, how would the investment decision now be characterized?

A) The project would be even better than forecast.

B) The British investment should be chosen over the European investment.

C) The NPV is $6,420.

D) All of the above are true.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

When a foreign project is analyzed from the parent's point of view, the additional risk that stems from it's "foreign" location is typically measured by ________ or ________.

A) adjusting the discount rates; adjusting the timing

B) adjusting the timing; adjusting the cash flows

C) adjusting the discount rates; adjusting the cash flows

D) none of the above

A) adjusting the discount rates; adjusting the timing

B) adjusting the timing; adjusting the cash flows

C) adjusting the discount rates; adjusting the cash flows

D) none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

When a parent corporation performs a capital budgeting analysis, the additional risks due to the foreign location of a project should generally be handled by

A) decreasing the project's hurdle rate.

B) modifying the quarterly tax payments in advance.

C) adjusting the cash flows to the parent.

D) informing all investors of the risk potential.

A) decreasing the project's hurdle rate.

B) modifying the quarterly tax payments in advance.

C) adjusting the cash flows to the parent.

D) informing all investors of the risk potential.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

An international investment opportunity should be rejected if

A) the project's NPV > parent viewpoint NPV.

B) the IRR of the project is < 20%.

C) the NPV of the project is > 0, but the NPV of the parental viewpoint is < 0.

D) All of the above are true.

A) the project's NPV > parent viewpoint NPV.

B) the IRR of the project is < 20%.

C) the NPV of the project is > 0, but the NPV of the parental viewpoint is < 0.

D) All of the above are true.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Machintosh Outerwear of Canada is a large retailer of high quality outdoor recreation equipment, clothing, and accessories. They are considering opening three U.S. stores in Minneapolis, Spokane, and Seattle. The current cost of a new store in Canada is C$1,000,000 per year and expected construction costs in the U.S. are expected to increase at a rate of 15% per year. The U.S.stores will be built in one year, the current exchange rate is $1.02/C$, the forward rate is $1.04/C$. If the stores are built in one year and the firm has a required rate of return of 14%, what is the present value in Canadian dollars of building the new stores?

A) C$3,000,000

B) $3,000,000

C) C$2,731,092

D) C$3,140,756

A) C$3,000,000

B) $3,000,000

C) C$2,731,092

D) C$3,140,756

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

The authors highlight a strong theoretical argument in favor of analyzing any foreign project from the viewpoint of the parent. Provide at least three reasons why the parent's viewpoint is superior to the local viewpoint and give an example of when the local viewpoint fails to maximize the value of the firm.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

A German firm wishes to build a new plant in the USA in one year. The cost in euros will be greater if the euro depreciates against the USD in the interim and the German firm does not hedge.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

Chemical Magic of New Orleans, Louisiana expects to receive dividends each year from a foreign subsidiary for the next 3 years. The dividend is expected to grow at a rate of 5% per year. If the euro depreciates in value against the dollar at a rate of 4% per year over the life of the dividends, then the present value of the euro dividends to Chemical Magic will be ________ if there had been no change in the relative values of the euro and dollar.

A) less than

B) greater than

C) the same as

D) There is not enough information to answer this question.

A) less than

B) greater than

C) the same as

D) There is not enough information to answer this question.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

Empirical evidence shows that foreign direct investment always increases a U.S. firm's cost capital no matter where the foreign investment is made.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is NOT a risk commensurate with international investments?

A) foreign exchange rate risk

B) country risk

C) political risk

D) All of the above are relevant risks.

A) foreign exchange rate risk

B) country risk

C) political risk

D) All of the above are relevant risks.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

TABLE 19.1

Use the information to answer following question(s).

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

Refer to Table 19.1. The NPV for the European investment is estimated at ________.

A) euro 4,945

B) $4,945

C) $6,420

D) euro 6,420

Use the information to answer following question(s).

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

Refer to Table 19.1. The NPV for the European investment is estimated at ________.

A) euro 4,945

B) $4,945

C) $6,420

D) euro 6,420

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

TABLE 19.1

Use the information to answer following question(s).

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

Refer to Table 19.1. Which of the following best summarizes the preliminary results of the investment analysis for the two prospective investments.

A) The British investment should be accepted, the European investment rejected.

B) The British investment is superior to the European investment.

C) Both investments are acceptable.

D) None of the above is true.

Use the information to answer following question(s).

Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow.

Refer to Table 19.1. Which of the following best summarizes the preliminary results of the investment analysis for the two prospective investments.

A) The British investment should be accepted, the European investment rejected.

B) The British investment is superior to the European investment.

C) Both investments are acceptable.

D) None of the above is true.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

Cash flows to parents are ultimately the basis for dividends to stockholders, reinvestment elsewhere in the world, repayment of corporate-wide debt, and other proposals that affect the firm's many interest groups. Therefore, analysis of any foreign project should be from the viewpoint of the ________.

A) host country

B) parent

C) project

D) local government

A) host country

B) parent

C) project

D) local government

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck