Deck 1: Business Decisions and Financial Accounting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/211

Play

Full screen (f)

Deck 1: Business Decisions and Financial Accounting

1

Stockholders' equity is the difference between a company's assets and its liabilities.

True

2

The Securities and Exchange Commission (SEC)is the government agency that has primary responsibility for setting accounting standards in the U.S.

False

3

Dividends are subtracted from revenues on the income statement.

False

4

Building a new warehouse is an operating activity on the statement of cash flows.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

5

Creditors are mainly interested in the profitability of a company.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

6

In the United States,generally accepted accounting principles (GAAP)are established by the PCAOB (Public Company Accounting Oversight Board).

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

7

Amounts reported on financial statements are sometimes rounded to the nearest million.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

8

The Sarbanes-Oxley Act (SOX)requires top management of companies to sign a report certifying that the financial statements are free of error.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

9

Revenue is reported on the income statement only if cash was received at the point of sale.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

10

Generally Accepted Accounting Principles (GAAP)require profitable companies to distribute some of their earnings to their stockholders.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

11

If a company reports net income on the income statement,then the statement of cash flows will report the same amount as cash flows from operating activities for the period.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

12

Common Stock is reported as an asset on the balance sheet.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

13

A company owes $200,000 on a bank loan.It will be reported by the company as Notes Payable.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

14

Accounts Payable,Notes Payable,and Salaries and Wages Payable are examples of liabilities.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

15

Stockholders are creditors of a corporation.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

16

A stock that does not pay a dividend is an undesirable investment.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

17

All corporations acquire financing by issuing stock for sale on public stock exchanges.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

18

The daily activities involved in running a business,such as buying supplies and paying salaries and wages,are classified as operating activities on the statement of cash flows.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

19

The payment of dividends is a financing activity on the statement of cash flows.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

20

You paid $10,000 to buy 1% of the stock in a corporation that is now bankrupt.The company owes $10 million dollars to its creditors.As a result of the bankruptcy,you are responsible for paying $100,000 (or $10 million × 1%)of the amount owed to the creditors.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

21

With respect to the audience targeted for financial accounting reports,which of the parties below is not an external user?

A) Customers of the company issuing the reports

B) Creditors of the company issuing the reports

C) Managers of the company issuing the reports

D) Stockholders of the company issuing the reports

A) Customers of the company issuing the reports

B) Creditors of the company issuing the reports

C) Managers of the company issuing the reports

D) Stockholders of the company issuing the reports

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following business organizations has only one owner?

A) Corporation

B) Sole proprietorship

C) Public company

D) Partnership

A) Corporation

B) Sole proprietorship

C) Public company

D) Partnership

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

23

The main goal of an accounting system is to:

A) capture information about a business so that it can be reported to decision makers.

B) earn a profit for the company's stockholders.

C) prove that assets equal liabilities plus stockholders' equity.

D) provide initial financing for a new start-up.

A) capture information about a business so that it can be reported to decision makers.

B) earn a profit for the company's stockholders.

C) prove that assets equal liabilities plus stockholders' equity.

D) provide initial financing for a new start-up.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements below is correct about a corporation and a partnership?

A) A partnership is comprised of two or more owners, whereas a corporation must have only one owner.

B) A corporation is legally responsible for its own taxes and debts.

C) Owners of both entities are legally responsible for the taxes and debts of the business.

D) Both entities issue shares of stock to owners.

A) A partnership is comprised of two or more owners, whereas a corporation must have only one owner.

B) A corporation is legally responsible for its own taxes and debts.

C) Owners of both entities are legally responsible for the taxes and debts of the business.

D) Both entities issue shares of stock to owners.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

25

The owner is not responsible for the entity's taxes and debts if the entity is organized as a(n):

A) corporation

B) sole proprietorship

C) unlimited liability corporation

D) limited liability corporation

A) corporation

B) sole proprietorship

C) unlimited liability corporation

D) limited liability corporation

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

26

An investor who is looking at a company's financial statements cannot determine whether the:

A) company's earnings are rising or falling.

B) company pays a dividend.

C) company has positive cash flow.

D) company's owners are financially sound.

A) company's earnings are rising or falling.

B) company pays a dividend.

C) company has positive cash flow.

D) company's owners are financially sound.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

27

Creditors are:

A) people or organizations who owe money to a business.

B) people or organizations to whom a business owes money.

C) stockholders of a business.

D) customers of a business.

A) people or organizations who owe money to a business.

B) people or organizations to whom a business owes money.

C) stockholders of a business.

D) customers of a business.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

28

The primary goal of most companies is to:

A) raise capital.

B) make a profit.

C) reduce liabilities.

D) pay taxes.

A) raise capital.

B) make a profit.

C) reduce liabilities.

D) pay taxes.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

29

Financing that individuals or institutions have provided to a corporation is:

A) always classified as a liability.

B) classified as a liability when provided by creditors and as stockholders' equity when provided by owners.

C) always classified as equity.

D) classified as a stockholders' equity when provided by creditors and a liability when provided by owners.

A) always classified as a liability.

B) classified as a liability when provided by creditors and as stockholders' equity when provided by owners.

C) always classified as equity.

D) classified as a stockholders' equity when provided by creditors and a liability when provided by owners.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements about organizational forms of a business is not correct?

A) In a sole proprietorship form of business or in a partnership form, the owner(s) are personally responsible for the debts of the business.

B) The partnership agreement states how profits are to be shared between partners and what happens when a new partner is to be admitted or an existing partner is retiring.

C) A corporation is a separate entity from both a legal and accounting perspective.

D) The owners of a corporation are legally responsible for the corporation's debts and taxes.

A) In a sole proprietorship form of business or in a partnership form, the owner(s) are personally responsible for the debts of the business.

B) The partnership agreement states how profits are to be shared between partners and what happens when a new partner is to be admitted or an existing partner is retiring.

C) A corporation is a separate entity from both a legal and accounting perspective.

D) The owners of a corporation are legally responsible for the corporation's debts and taxes.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is typically not a benefit of corporations over other organizational forms?

A) Easier to transfer ownership

B) Easier to limit an owner's liability for the organization's debt

C) Easier to raise large amounts of money

D) Easier to create with few legal fees

A) Easier to transfer ownership

B) Easier to limit an owner's liability for the organization's debt

C) Easier to raise large amounts of money

D) Easier to create with few legal fees

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following expressions of the accounting equation is correct?

A) Liabilities + Assets = Stockholder's Equity

B) Stockholder's Equity + Assets = Liabilities

C) Assets = Liabilities - Stockholder's Equity

D) Stockholder's Equity = Assets - Liabilities

A) Liabilities + Assets = Stockholder's Equity

B) Stockholder's Equity + Assets = Liabilities

C) Assets = Liabilities - Stockholder's Equity

D) Stockholder's Equity = Assets - Liabilities

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements about financial accounting is correct?

A) Financial accounting reports are used primarily by employees to make business decisions related to production.

B) Financial accounting reports are used primarily by management to understand whether a product line should be discontinued.

C) Financial accounting reports are primarily prepared to provide information for external decision makers.

D) Financial accounting reports primarily contain detailed internal records of the company.

A) Financial accounting reports are used primarily by employees to make business decisions related to production.

B) Financial accounting reports are used primarily by management to understand whether a product line should be discontinued.

C) Financial accounting reports are primarily prepared to provide information for external decision makers.

D) Financial accounting reports primarily contain detailed internal records of the company.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

34

Internal users of financial data include:

A) investors.

B) creditors.

C) management.

D) regulatory authorities.

A) investors.

B) creditors.

C) management.

D) regulatory authorities.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

35

Managerial accounting reports prepared for internal use are used by the company's:

A) suppliers.

B) bank.

C) employees.

D) stockholders.

A) suppliers.

B) bank.

C) employees.

D) stockholders.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

36

Accounting systems:

A) are summarized in publicly published reports.

B) analyze, record, summarize, and the activities affecting its financial condition and performance.

C) monitor business activities only in financial terms.

D) capture only the information that is needed by the owners of the company.

A) are summarized in publicly published reports.

B) analyze, record, summarize, and the activities affecting its financial condition and performance.

C) monitor business activities only in financial terms.

D) capture only the information that is needed by the owners of the company.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following a characteristic of a sole proprietorship?

A) The owner is personally responsible for the debts of the business even if the debts are more than the owner has invested in the business.

B) It is a legal entity separate from its owner.

C) Its income is taxed twice - once on the company's income tax return and again on the owner's individual income tax returns.

D) It is the only organizational form appropriate for service businesses.

A) The owner is personally responsible for the debts of the business even if the debts are more than the owner has invested in the business.

B) It is a legal entity separate from its owner.

C) Its income is taxed twice - once on the company's income tax return and again on the owner's individual income tax returns.

D) It is the only organizational form appropriate for service businesses.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

38

Public corporations are businesses:

A) owned by two or more people, each of whom is personally liable for the debts of the business.

B) whose stock is bought and sold on a stock exchange.

C) whose stock is bought and sold privately.

D) where stock is not used as evidence of ownership.

A) owned by two or more people, each of whom is personally liable for the debts of the business.

B) whose stock is bought and sold on a stock exchange.

C) whose stock is bought and sold privately.

D) where stock is not used as evidence of ownership.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

39

The owner(s)of a business are taxed on the profits of the business if the business is a:

A) sole proprietorship.

B) partnership.

C) corporation.

D) public partnership.

A) sole proprietorship.

B) partnership.

C) corporation.

D) public partnership.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

40

A legal document called a stock certificate is used to indicate ownership in a:

A) Corporation.

B) Sole proprietorship.

C) Partnership.

D) Both sole proprietorship and partnership.

A) Corporation.

B) Sole proprietorship.

C) Partnership.

D) Both sole proprietorship and partnership.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

41

Operating activities include:

A) interest paid on a bank loan

B) the buying or selling of land, buildings, equipment, and other long-term investments.

C) the repayment of loan proceeds to the bank.

D) obtaining a bank loan to cover the payment of wages, rent and other operating costs.

A) interest paid on a bank loan

B) the buying or selling of land, buildings, equipment, and other long-term investments.

C) the repayment of loan proceeds to the bank.

D) obtaining a bank loan to cover the payment of wages, rent and other operating costs.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

42

The separate entity assumption assumes:

A) the financial reports of a business include only the results of that business's activities.

B) assets equal liabilities plus stockholder's equity.

C) revenues and expenses are reported in separate sections of a company's income statement.

D) assets are reported in a separate financial statement from liabilities.

A) the financial reports of a business include only the results of that business's activities.

B) assets equal liabilities plus stockholder's equity.

C) revenues and expenses are reported in separate sections of a company's income statement.

D) assets are reported in a separate financial statement from liabilities.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

43

A cost of doing business is referred to as a(n)______ and it is necessary to earn ______.

A) revenue; assets

B) expense; revenue

C) liability; expenses

D) dividend; revenue

A) revenue; assets

B) expense; revenue

C) liability; expenses

D) dividend; revenue

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

44

Alpha sold $2,000 of services to Beta on credit.Beta promised to pay for it next month.Alpha will report a $2,000:

A) Accounts Receivable.

B) Account Payable.

C) increase in Cash, since Beta is sure to pay next month.

D) net loss.

A) Accounts Receivable.

B) Account Payable.

C) increase in Cash, since Beta is sure to pay next month.

D) net loss.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

45

The separate entity assumption means:

A) a company's financial statements reflect only the business activities of that company.

B) each separate owner's finances must be revealed in the financial statements.

C) each separate entity that has a claim on a company's assets must be shown in the financial statements.

D) if the business is a sole proprietorship, the owners' personal activities are included in the company's financial statements.

A) a company's financial statements reflect only the business activities of that company.

B) each separate owner's finances must be revealed in the financial statements.

C) each separate entity that has a claim on a company's assets must be shown in the financial statements.

D) if the business is a sole proprietorship, the owners' personal activities are included in the company's financial statements.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

46

An economic resource that is owned by a company and will provide future benefits is referred to as:

A) revenue.

B) an asset.

C) retained earnings.

D) net income.

A) revenue.

B) an asset.

C) retained earnings.

D) net income.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

47

Financial statements are most commonly prepared:

A) daily.

B) monthly, quarterly and annually.

C) as needed.

D) weekly.

A) daily.

B) monthly, quarterly and annually.

C) as needed.

D) weekly.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

48

When a company earns net income,the company's Retained Earnings:

A) increase.

B) decrease.

C) are converted to cash.

D) are paid to stockholders.

A) increase.

B) decrease.

C) are converted to cash.

D) are paid to stockholders.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

49

Expenses are:

A) equal to a company's liabilities.

B) always less than revenues .

C) the costs of doing business that are necessary to earn revenue.

D) always less than the amount of cash a company has available.

A) equal to a company's liabilities.

B) always less than revenues .

C) the costs of doing business that are necessary to earn revenue.

D) always less than the amount of cash a company has available.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

50

Mauricio invested $30,000 in Pizza Aroma in exchange for its stock.Pizza Aroma now has:

A) a liability.

B) retained earnings.

C) common stock.

D) net income.

A) a liability.

B) retained earnings.

C) common stock.

D) net income.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

51

Expenses are reported on the:

A) income statement in the time period in which they are paid.

B) income statement in the time period in which they are incurred.

C) balance sheet in the time period in which they are paid.

D) balance sheet in the time period in which they are incurred.

A) income statement in the time period in which they are paid.

B) income statement in the time period in which they are incurred.

C) balance sheet in the time period in which they are paid.

D) balance sheet in the time period in which they are incurred.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

52

Net income is the amount:

A) the company earned after subtracting expenses and dividends from revenue.

B) by which assets exceed expenses.

C) by which assets exceed liabilities.

D) by which revenues exceed expenses.

A) the company earned after subtracting expenses and dividends from revenue.

B) by which assets exceed expenses.

C) by which assets exceed liabilities.

D) by which revenues exceed expenses.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

53

The financial reports of a business include only the results of that business's activities.This is:

A) required only for large corporations.

B) the cost principle.

C) the accounting equation.

D) true only for financial statements prepared under IFRS.

E) the separate entity assumption.

A) required only for large corporations.

B) the cost principle.

C) the accounting equation.

D) true only for financial statements prepared under IFRS.

E) the separate entity assumption.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

54

Cash flows from (used in)investing activities includes amounts:

A) received from a company's stockholders for the sale of stock.

B) received from the sale of the company's office building.

C) paid for dividends to the company's stockholders.

D) paid for salaries of employees.

A) received from a company's stockholders for the sale of stock.

B) received from the sale of the company's office building.

C) paid for dividends to the company's stockholders.

D) paid for salaries of employees.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

55

Alpha sold $2,000 of services to Beta on credit.Beta promised to pay for it next month.Beta will report a $2,000:

A) Account Payable.

B) Accounts Receivable.

C) Decrease in Cash, since it plans to pay for sure next month.

D) Net income.

A) Account Payable.

B) Accounts Receivable.

C) Decrease in Cash, since it plans to pay for sure next month.

D) Net income.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

56

Revenues are:

A) earned by selling goods or services to customers.

B) amounts that owners have contributed directly to the business.

C) cash payments that a business has made directly to its owners.

D) the amount of cash a company has left after it has paid its liabilities.

A) earned by selling goods or services to customers.

B) amounts that owners have contributed directly to the business.

C) cash payments that a business has made directly to its owners.

D) the amount of cash a company has left after it has paid its liabilities.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

57

Profit is equal to:

A) revenues minus expenses.

B) assets minus liabilities.

C) the amount of cash that a company has.

D) the amount of cash that owners have contributed to the business.

A) revenues minus expenses.

B) assets minus liabilities.

C) the amount of cash that a company has.

D) the amount of cash that owners have contributed to the business.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

58

Ace Electronics sold $5,000 of goods to customers of which $3,000 has been collected.Ace Electronics should report revenues of:

A) $5,000.

B) $3,000.

C) $2,000.

D) $0.

A) $5,000.

B) $3,000.

C) $2,000.

D) $0.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following would not represent a financing activity?

A) Paying dividends to stockholders.

B) An investment of capital by the owners.

C) Borrowing money from a bank to purchase new equipment.

D) Buying supplies on account.

A) Paying dividends to stockholders.

B) An investment of capital by the owners.

C) Borrowing money from a bank to purchase new equipment.

D) Buying supplies on account.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

60

The types of business activities measured by the statement of cash flows are:

A) selling goods, selling services, and obtaining financing.

B) operating activities, investing activities, and financing activities.

C) hiring, producing, and advertising.

D) generating revenues, paying expenses, and paying dividends.

A) selling goods, selling services, and obtaining financing.

B) operating activities, investing activities, and financing activities.

C) hiring, producing, and advertising.

D) generating revenues, paying expenses, and paying dividends.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

61

The Don't Bite Me Pest Control Company has 10,000 gallons of insecticide supplies on hand that cost $300,000; a bill from the vendor for $100,000 of these supplies has not yet been paid.The company expects to earn $800,000 for its services when it uses the insecticide supplies.The company's balance sheet would include an asset,Supplies,in the amount of:

A) $10,000.

B) $200,000.

C) $300,000.

D) $800,000.

A) $10,000.

B) $200,000.

C) $300,000.

D) $800,000.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

62

A net loss for a period arises when:

A) Assets are greater than liabilities.

B) Revenues are less than expenses.

C) Liabilities are greater than stockholder's equity.

D) Revenues are greater than expenses.

A) Assets are greater than liabilities.

B) Revenues are less than expenses.

C) Liabilities are greater than stockholder's equity.

D) Revenues are greater than expenses.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

63

If XYZ Company had $12 million in revenue and net income of $3 million,then its:

A) expenses must have been $15 million.

B) expenses must have been $9 million.

C) assets must have been $12 million.

D) assets must have been $3 million.

A) expenses must have been $15 million.

B) expenses must have been $9 million.

C) assets must have been $12 million.

D) assets must have been $3 million.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following are the three basic elements of the balance sheet?

A) assets, liabilities, and retained earnings.

B) assets, liabilities, and common stock.

C) assets, liabilities, and revenues.

D) assets, liabilities, and stockholders' equity.

A) assets, liabilities, and retained earnings.

B) assets, liabilities, and common stock.

C) assets, liabilities, and revenues.

D) assets, liabilities, and stockholders' equity.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

65

At the end of last year,the company's assets totaled $860,000 and its liabilities totaled $740,000.During the current year,the company's total assets increased by $58,000 and its total liabilities increased by $24,000.At the end of the current year,stockholders' equity was:

A) $154,000.

B) $120,000.

C) $34,000.

D) $178,000.

A) $154,000.

B) $120,000.

C) $34,000.

D) $178,000.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

66

Maxine's Bakery recorded $220,000 in revenues, $165,000 in expenses, and $30,000 of dividends for the year.The company began the year with total assets of $190,000 and stockholder's equity of $87,000.

Use the information above to answer the following question.What net income (loss)was reported by Maxine's Bakery for the year?

A) $25,000

B) $63,000

C) $55,000

D) $33,000

Use the information above to answer the following question.What net income (loss)was reported by Maxine's Bakery for the year?

A) $25,000

B) $63,000

C) $55,000

D) $33,000

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

67

The obligations and debts of a business are referred to as:

A) equities.

B) assets.

C) dividends.

D) liabilities.

A) equities.

B) assets.

C) dividends.

D) liabilities.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

68

If total liabilities decreased by $25,000 and stockholders' equity increased by $5,000 during a period of time,then total assets must change by what amount and direction during that same time period?

A) $20,000 increase

B) $20,000 decrease

C) $30,000 increase

D) $30,000 decrease

A) $20,000 increase

B) $20,000 decrease

C) $30,000 increase

D) $30,000 decrease

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

69

During its first year of operations,Widgets Incorporated reported Sales Revenue of $386,000 but collected only $303,000 from customers.At the end of the year,Accounts Receivable equal:

A) $689,000.

B) $386,000.

C) $303,000.

D) $83,000.

A) $689,000.

B) $386,000.

C) $303,000.

D) $83,000.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is not correct?

A) Assets = Liabilities + Stockholders' Equity

B) Liabilities = Assets - Stockholders' Equity

C) Stockholders' Equity + Liabilities - Assets = 0

D) Assets = Liabilities - Stockholders' Equity

A) Assets = Liabilities + Stockholders' Equity

B) Liabilities = Assets - Stockholders' Equity

C) Stockholders' Equity + Liabilities - Assets = 0

D) Assets = Liabilities - Stockholders' Equity

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following statements about a fiscal year is correct?

A) Companies can choose to end their fiscal year on any date they feel is most relevant.

B) Companies must end their fiscal year on March 31, June 30, September 30, or December 31.

C) Companies can select any date except a holiday to end their fiscal year.

D) Companies must end their fiscal year on December 31.

A) Companies can choose to end their fiscal year on any date they feel is most relevant.

B) Companies must end their fiscal year on March 31, June 30, September 30, or December 31.

C) Companies can select any date except a holiday to end their fiscal year.

D) Companies must end their fiscal year on December 31.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

72

Assets:

A) represent the amounts earned by a company.

B) must equal the liabilities of a company.

C) must equal the stockholders' equity of the company.

D) represent the resources presently controlled by a company.

A) represent the amounts earned by a company.

B) must equal the liabilities of a company.

C) must equal the stockholders' equity of the company.

D) represent the resources presently controlled by a company.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

73

Maxine's Bakery recorded $220,000 in revenues, $165,000 in expenses, and $30,000 of dividends for the year.The company began the year with total assets of $190,000 and stockholder's equity of $87,000.

Use the information above to answer the following question.Suppose that liabilities increased by $60,000 and stockholders' equity increased by $25,000.What would be the change in Maxine's assets?

A) $112,000 increase

B) $85,000 increase

C) $103,000 increase

D) $35,000 increase

Use the information above to answer the following question.Suppose that liabilities increased by $60,000 and stockholders' equity increased by $25,000.What would be the change in Maxine's assets?

A) $112,000 increase

B) $85,000 increase

C) $103,000 increase

D) $35,000 increase

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

74

Net income that has been paid out to the company's stockholders for their own personal use is referred to as:

A) dividends.

B) equities.

C) revenues.

D) Retained Earnings.

A) dividends.

B) equities.

C) revenues.

D) Retained Earnings.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

75

The Publish or Perish Printing Company paid a dividend to stockholders.This will be reported on the:

A) audit report.

B) income statement.

C) balance sheet.

D) statement of retained earnings.

A) audit report.

B) income statement.

C) balance sheet.

D) statement of retained earnings.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

76

During Year 3,a company's assets increase by $56,000 and its liabilities increase by $38,000.If no dividends were paid and there were no changes in the amount of common stock issued during the year,net income for Year 3 was:

A) $56,000.

B) $18,000.

C) $94,000.

D) $38,000.

A) $56,000.

B) $18,000.

C) $94,000.

D) $38,000.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

77

The Whackem-Smackem Software Company sold $11 million of computer games in its first year of operations.The company received payments of $7.5 million for these computer games.The company's income statement would report:

A) Accounts Receivable of $3.5 million.

B) expenses of $3.5 million.

C) Sales Revenue of $7.5 million.

D) Sales Revenue of $11 million.

A) Accounts Receivable of $3.5 million.

B) expenses of $3.5 million.

C) Sales Revenue of $7.5 million.

D) Sales Revenue of $11 million.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

78

If National Inc.has Common Stock of $80,000,total assets of $170,000,and total liabilities of $70,000,its Retained Earnings equals:

A) $20,000.

B) $90,000.

C) $100,000.

D) $110,000.

A) $20,000.

B) $90,000.

C) $100,000.

D) $110,000.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

79

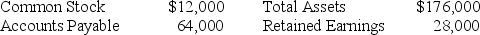

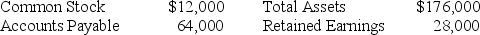

A company's balance sheet contained the following information:

Notes Payable is the only other item on the balance sheet.Notes Payable must equal:

A) $200,000.

B) $8,000.

C) $72,000.

D) $344,000.

Notes Payable is the only other item on the balance sheet.Notes Payable must equal:

A) $200,000.

B) $8,000.

C) $72,000.

D) $344,000.

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck

80

A company began the year with assets of $100,000,liabilities of $20,000,and stockholders' equity of $80,000.During the year assets increased $55,000 and stockholders' equity increased $20,000.What was the change in liabilities for the year?

A) Increase of $75,000

B) Increase of $35,000

C) Decrease of $75,000

D) Decrease of $35,000

A) Increase of $75,000

B) Increase of $35,000

C) Decrease of $75,000

D) Decrease of $35,000

Unlock Deck

Unlock for access to all 211 flashcards in this deck.

Unlock Deck

k this deck