Deck 8: Sources of Short-Term Financing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/113

Play

Full screen (f)

Deck 8: Sources of Short-Term Financing

1

Approximately 40% of all short-term financing is in the form of loans from the bank.

False

2

Larger firms tend to be net users of trade credit, rather than net providers.

False

3

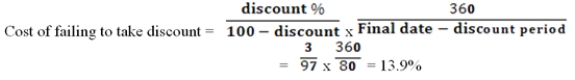

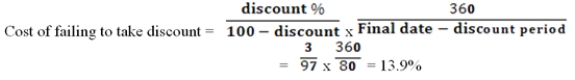

Myrdal Boots can take a cash discount but has to borrow money from the bank to do so. The bank offers a 12% interest rate. The terms of the cash discount are 3/10, net 90. Because of this, Myrdal Boots should borrow from the bank to take the discount.

True

4

Although the prime rate is the rate that U.S. banks charge their most credit-worthy customers, the prime rate is normally higher than the London Interbank Offered Rate (LIBOR).

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

5

Compensating balances are important for banks because their existence allows them to make loans at lower quoted rates.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

6

Even during slack loan periods, banks will never loan out money at an interest rate lower than the prime rate because the prime rate is their best rate.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

7

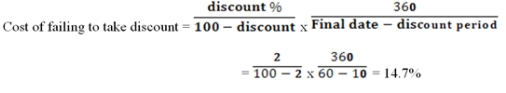

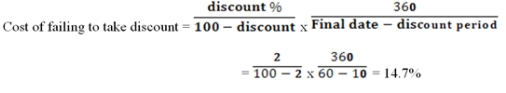

Leontief's Wigs can take a cash discount but has to borrow money from the bank to do so. The bank offers a 16% interest rate. The terms of the cash discount are 2/10, net 60. Because of this; Leontief's should borrow from the bank to take the discount.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

8

Small companies finance a relatively greater proportion of their assets through trade credit than do larger firms.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

9

The lender's primary concern is whether the borrower's capacity to generate accounts receivables is sufficient to liquidate the loan as it comes due.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

10

On 2/10, net 30 trade terms, if the discount is not taken, the buyer is said to receive 20 days of free credit

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

11

"Stretching the payment period" refers to the practice of trying to take a trade discount after the discount period.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

12

Accounts payable is a spontaneous source of funds that usually grows as the business expands.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

13

Firms can almost always increase the amount of time they take to pay for purchases without incurring problems.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

14

The London Interbank Offered Rate (LIBOR) is used to set a base lending rate for some U.S. domestic corporate loans.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

15

A cash discount calls for a reduction in price if payment cannot be made within a specified time period.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

16

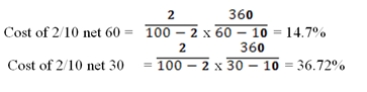

The cost of NOT taking a discount is higher for terms of 2/10, net 60 than for 2/10, net 30.

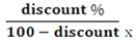

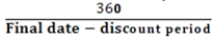

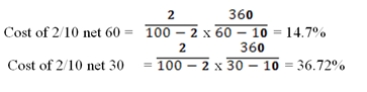

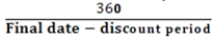

Cost of failing to take discount =

Cost of failing to take discount =

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

17

Approximately 40% of all short-term financing is in the form of accounts payable or trade credit.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

18

Trade credit is usually extended for periods of one year or more.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

19

The largest source of short-term funds for most companies is suppliers (trade credit).

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

20

The cost of not taking a 2/10, net 30 cash discount is usually less than the prime rate.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

21

The commercial paper market is available to all New York Stock Exchange companies.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

22

Monthly installment loans usually increase the effective interest rate of borrowing by approximately 2 times the stated interest rate.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

23

Commercial paper represents secured short-term borrowing by large companies.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

24

Finance paper, unlike commercial paper, represents a long-term, unsecured promissory note.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

25

Compensating balances represent unfair hidden costs of borrowing.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

26

Commercial paper is an unsecured short-term IOU from a large financially secure company.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

27

Issuers of commercial paper can be divided into finance paper or direct paper, dealer paper, and asset-backed commercial paper.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

28

A compensating balance will be lower in periods of tight money than in periods of credit easing.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

29

It is easier for small firms to obtain financing through bank loans than through the commercial paper market.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

30

One major advantage of commercial paper is that it can always be "rolled over" (reissued) when it matures.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

31

One major disadvantage of commercial paper is that if the company's credit quality declines, refinancing existing commercial paper might be impossible to achieve through a new issue of commercial paper.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

32

Finance paper usually carries a higher rate of interest than direct paper.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

33

Compensating balances are a way for banks to recover the cost of corporate services provided, but not directly charged.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

34

The annual percentage rate (APR) is a measure of the effective rate of interest on a loan on an annualized basis.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

35

Small businesses frequently find commercial paper a useful means of obtaining funds when it is not possible to raise funds by other means.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

36

Firms using commercial paper are generally required to maintain commercial bank lines of credit equal to the amount of the paper outstanding.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

37

Factoring accounts receivable, unlike pledging accounts receivable, typically passes the risk of loss on the accounts receivable to the buyer.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

38

The term "credit crunch" refers to a period in which the interest rate on credit is so high that firms cannot afford to borrow money.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

39

All commercial paper involves the physical transfer of actual paper certificates.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

40

One advantage to an issuer of commercial paper is that the issuer eliminates the need for maintaining compensating balances and credit lines with a commercial bank.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

41

A trust receipt acknowledges that the lender trusts the borrower to repay the loan before any dividends are paid.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

42

A self-liquidating loan is preferable to a bank because it generally provides them with a higher return.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

43

A blanket inventory lien is where items are not identified or tagged, and there is no physical transfer of control of the inventory from the borrower.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

44

General Motors Acceptance Corporation (GMAC) is one of the biggest issuers of asset-backed securities.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

45

One major advantage of factoring accounts receivable is that the selling firm receives money from its accounts receivable faster than if it waited until the customers paid.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

46

The annual percentage rate (APR) is generally lower than the interest rate stated by the bank.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

47

The higher the cost of bank financing, the more beneficial it is to take the cash discount.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

48

In times of tight credit in the United States, Eurodollar loans become difficult to obtain.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

49

The most common form of short-term financing is a bank loan.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

50

The sale of asset-backed securities can sometimes enable the issuing firm to acquire lower-cost funds than it normally would receive from a bank loan or bond offering.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

51

A term loan is less risky to the bank, thus they provide a fixed rate to the customer.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

52

It is difficult to acquire a loan in U.S. dollars outside the United States.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

53

The movement of the exchange rate between two currencies can increase the total cost of a loan by making the principal repayment require more money than the original amount of the loan.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

54

The biggest categories of asset-backed securities are the home equity loans, automobile receivables, and credit card receivables.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

55

The sale of securities backed by the receivables of large credit-worthy firms is a large and growing source of financing.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

56

Companies to can hedging to eliminate all or some foreign currency risk.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

57

What is generally the largest source of short-term credit for small firms?

A) Bank loans

B) Commercial paper

C) Installment loans

D) Trade credit

A) Bank loans

B) Commercial paper

C) Installment loans

D) Trade credit

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

58

Eurodollar loans are similar to U.S. bank loans in that they are usually short-term to intermediate-term in nature.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

59

Hedging refers to a transaction that avoids any financial risks.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

60

At historically low interest rate levels, compensating balances increase.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

61

Trade credit is considered what type of loan?

A) when a firm owes money to a supplier.

B) when a firm owes money to a customer.

C) when a firm owes money to a bank.

D) all of the answers are true.

A) when a firm owes money to a supplier.

B) when a firm owes money to a customer.

C) when a firm owes money to a bank.

D) all of the answers are true.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

62

A term loan is usually characterized by

A) a maturity of one to seven years.

B) a variable interest rate.

C) monthly or quarterly installment payments.

D) all of these options are true.

A) a maturity of one to seven years.

B) a variable interest rate.

C) monthly or quarterly installment payments.

D) all of these options are true.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

63

Analog Computers needs to borrow $475,000 from the Midland Bank. The bank requires a 15% compensating balance. How much money will Analog need to borrow in order to end up with $475,000 spendable cash?

A) $546,250

B) $758,264

C) $558,824

D) $71,250

A) $546,250

B) $758,264

C) $558,824

D) $71,250

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

64

The prime rate

A) is the rate a bank charges its risky customers.

B) has been quite volatile during the past two decades, moving several percentage points in a 12-month period.

C) is usually lower than Treasury bill rates.

D) None of these options are true.

A) is the rate a bank charges its risky customers.

B) has been quite volatile during the past two decades, moving several percentage points in a 12-month period.

C) is usually lower than Treasury bill rates.

D) None of these options are true.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

65

The cost of not taking the discount on trade credit of 3/20, net 90 is approximately ______.

A) 15.9%

B) 16.3%

C) 18.0%

D) 17.4%

A) 15.9%

B) 16.3%

C) 18.0%

D) 17.4%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

66

General Rent-All's officers arrange a $50,000 loan for the company. The company is required to maintain a minimum checking account balance of 10% of the outstanding loan. This practice is called

A) an installment loan.

B) a compensating balance.

C) a discounted loan.

D) a balloon payment.

A) an installment loan.

B) a compensating balance.

C) a discounted loan.

D) a balloon payment.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

67

From the banker's point of view, short-term bank credit is an excellent way of financing

A) fixed assets.

B) permanent working capital needs.

C) repayment of long-term debt.

D) seasonal bulges in inventory and receivables.

A) fixed assets.

B) permanent working capital needs.

C) repayment of long-term debt.

D) seasonal bulges in inventory and receivables.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

68

The cost of not taking the discount on trade credit of 2/10, net 30 is approximately ______.

A) 44.54%

B) 43.20%

C) 36.73%

D) None of these options are true

A) 44.54%

B) 43.20%

C) 36.73%

D) None of these options are true

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

69

In determining the cost of bank financing, which is the most important factor?

A) The prime rate

B) The nominal rate

C) The effective rate

D) The discount rate

A) The prime rate

B) The nominal rate

C) The effective rate

D) The discount rate

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

70

Kantorovich Company normally takes 30 days to pay for its average daily credit purchases of $2,000. It has average daily sales of $3,000, and collects accounts in 25 days. What is its net credit position?

A) $15,000

B) $1,000

C) ($1,000)

D) ($15,000)

A) $15,000

B) $1,000

C) ($1,000)

D) ($15,000)

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

71

Trade credit may be used to finance a major part of a firm's working capital when

A) the firm extends less liberal credit terms than the supplier.

B) the firm extends more liberal credit terms than the supplier.

C) the firm and the supplier both extend the same credit terms.

D) neither the firm nor the supplier extends credit.

A) the firm extends less liberal credit terms than the supplier.

B) the firm extends more liberal credit terms than the supplier.

C) the firm and the supplier both extend the same credit terms.

D) neither the firm nor the supplier extends credit.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

72

Bank loans to business firms

A) are usually short-term in nature.

B) are preferred by the banker to be self-liquidating.

C) may require compensating balances.

D) All of these options are true.

A) are usually short-term in nature.

B) are preferred by the banker to be self-liquidating.

C) may require compensating balances.

D) All of these options are true.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

73

LIBOR is

A) a resource used in production.

B) an interest rate paid on Eurodollar loans in the London market.

C) an interest rate paid by European firms when they borrow Eurodollar deposits from U.S. banks.

D) the interest rate paid by the British government on its long-term bonds.

A) a resource used in production.

B) an interest rate paid on Eurodollar loans in the London market.

C) an interest rate paid by European firms when they borrow Eurodollar deposits from U.S. banks.

D) the interest rate paid by the British government on its long-term bonds.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

74

Commercial bank term loans

A) usually carry fixed interest rates.

B) are very short-term in nature.

C) are offered to superior credit applicants.

D) are very short-term in nature and are offered to superior credit applicants.

A) usually carry fixed interest rates.

B) are very short-term in nature.

C) are offered to superior credit applicants.

D) are very short-term in nature and are offered to superior credit applicants.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

75

Large firms tend to be

A) net users of trade credit.

B) net suppliers of trade credit.

C) firms with high levels of profitability.

D) firms with low levels of inventory turnover and accounts receivable turnover.

A) net users of trade credit.

B) net suppliers of trade credit.

C) firms with high levels of profitability.

D) firms with low levels of inventory turnover and accounts receivable turnover.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

76

Compensating balances

A) are used by banks as a substitute for charging service fees.

B) are created by having a sweep account.

C) generate returns to customers from interest-bearing accounts.

D) are used to reward new accounts.

A) are used by banks as a substitute for charging service fees.

B) are created by having a sweep account.

C) generate returns to customers from interest-bearing accounts.

D) are used to reward new accounts.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

77

Recent problems facing the U.S. financial system were the result of all but which one of the following?

A) A huge increase in the amount of mortgage-backed securities being bundled up and sold in the markets

B) A huge drop in the value of mortgage-backed securities

C) An increase in the use of commercial paper for short-term financing

D) The government permitting commercial and investment banks to merge

A) A huge increase in the amount of mortgage-backed securities being bundled up and sold in the markets

B) A huge drop in the value of mortgage-backed securities

C) An increase in the use of commercial paper for short-term financing

D) The government permitting commercial and investment banks to merge

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

78

A large manufacturing firm has been selling on a 3/10, net 30 basis. The firm changes its credit terms to 2/20, net 90. What change might be expected on the balance sheets of the manufacturing firm?

A) Decreased receivables

B) Increased receivables

C) Increased payables

D) Decreased payables

A) Decreased receivables

B) Increased receivables

C) Increased payables

D) Decreased payables

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

79

The London Interbank Offered Rate (LIBOR)

A) competes with the U.S. Prime Rate for those companies with an international presence.

B) has been lower than the U.S. Prime Rate for at least the last decade.

C) is an estimate of the interbank lending rate for London banks.

D) all of these options are correct.

A) competes with the U.S. Prime Rate for those companies with an international presence.

B) has been lower than the U.S. Prime Rate for at least the last decade.

C) is an estimate of the interbank lending rate for London banks.

D) all of these options are correct.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

80

If Analog Computers can borrow at 8% annually for three years, what is the effective rate of interest on a $1,000,000 loan where a 15% compensating balance is required?

A) 11.18%

B) 17.27%

C) 9.41%

D) 24%

A) 11.18%

B) 17.27%

C) 9.41%

D) 24%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck