Deck 7: The Finances of Housing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/109

Play

Full screen (f)

Deck 7: The Finances of Housing

1

Real estate agents will provide you with services using an hourly rate.

False

2

Qualifying for a mortgage is much different then obtaining other forms of credit.

False

3

Negotiating a purchase price for a home usually involves an offer and counteroffers.

True

4

A lease only protects the rights of the tenant.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

5

Ease of mobility is an advantage of renting.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

6

The total debt service ratio is your monthly mortgage payment and other outstanding debts as a percentage of your gross monthly income.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

7

Lenders commonly use a GDS ratio of 50% and a TDS ratio of 60% as guidelines to determine the amount you can comfortably afford for housing.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

8

Cooperative housing involves the renting of a living unit by the people involved in ownership of the building on a nonprofit basis.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

9

Financial guidelines suggest that you should "spend no more than 10 to 20 percent of your take home pay on housing".

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

10

Condominiums involve the purchase of an individual living unit rather than an entire building.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

11

Amortization refers to changes in the monthly payment for a variable rate mortgage.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

12

Variable rate mortgages with a rate cap prevent the borrower from having to pay an interest rate significantly higher than the one in the original agreement.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

13

Past interest rates can affect the price of a home.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

14

Many people believe that location is the most important factor to consider when selecting a home.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

15

Zoning laws are restrictions on how the property area can be used.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

16

One significant drawback of home ownership is financial uncertainty.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

17

Opportunity costs of housing can refer to time and effort involved in finding and repairing a place to live along with lost interest earnings on security deposits and down payments.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

18

A lease does not protect tenants from rent increases during the term of the lease.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

19

The amount of the down payment will affect the amount of mortgage a person can afford.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

20

The gross debt service ratio is your monthly mortgage payment (including principal, interest, heating and taxes) as a percentage of your gross monthly income.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is typically excluded from a lease agreement?

A)the conditions under which the landlord may enter the apartment.

B)the tenant's right to sublet the rental unit.

C)A list of utilities, appliances etc that are included in the rental amount.

D)the penalty for missing rental payments.

E)restrictions regarding specific activities (e.g.remodeling).

A)the conditions under which the landlord may enter the apartment.

B)the tenant's right to sublet the rental unit.

C)A list of utilities, appliances etc that are included in the rental amount.

D)the penalty for missing rental payments.

E)restrictions regarding specific activities (e.g.remodeling).

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

22

What is the purpose of subletting an apartment?

A)to increase the rent

B)to lower maintenance costs

C)to convert the units to condominiums

D)to meet certain government housing regulations

E)to obtain another tenant to complete a lease period

A)to increase the rent

B)to lower maintenance costs

C)to convert the units to condominiums

D)to meet certain government housing regulations

E)to obtain another tenant to complete a lease period

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

23

Renting would be most appropriate for people who

A)have limited funds currently available.

B)have difficulty establishing credit.

C)want to reduce their taxes.

D)enjoy remodeling their residence.

E)desire the financial benefits of increased equity.

A)have limited funds currently available.

B)have difficulty establishing credit.

C)want to reduce their taxes.

D)enjoy remodeling their residence.

E)desire the financial benefits of increased equity.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

24

The main financial benefit of renting is

A)tax deductions.

B)increased equity.

C)investment value growth.

D)lower initial costs.

E)high financial commitment.

A)tax deductions.

B)increased equity.

C)investment value growth.

D)lower initial costs.

E)high financial commitment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

25

A common opportunity cost associated with renting is

A)interest lost on the down payment.

B)interest lost on closing costs.

C)property taxes.

D)maintenance costs.

E)interest lost on the security deposit.

A)interest lost on the down payment.

B)interest lost on closing costs.

C)property taxes.

D)maintenance costs.

E)interest lost on the security deposit.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

26

Belinda Williams plans to rent instead of buying her house.What advantage of renting will Belinda encounter?

A)tax advantages

B)financial benefits

C)community pride

D)lower initial costs

E)home improvement flexibility

A)tax advantages

B)financial benefits

C)community pride

D)lower initial costs

E)home improvement flexibility

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

27

Condominiums involve the purchase of an entire building.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

28

Real estate agents will provide you with services and are paid commission on the selling of a home.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

29

Current interest rates can affect the price of a home.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

30

A lease always gives the landlord the right to:

A)to increase the rent

B)to evict the tenant at any time

C)to take legal action against a tenant for nonpayment of rent

D)to ignore government housing regulations

E)cancel the lease

A)to increase the rent

B)to evict the tenant at any time

C)to take legal action against a tenant for nonpayment of rent

D)to ignore government housing regulations

E)cancel the lease

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

31

An escrow account is designed to reduce the cost of a mortgage.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

32

Home improvements may contribute more to the value of the home than the cost of the renovations.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

33

Renting is more advantageous than buying a home for

A)lower short-term living costs.

B)financial benefits.

C)long-term investment purposes.

D)receiving tax benefits.

E)permanence of residence.

A)lower short-term living costs.

B)financial benefits.

C)long-term investment purposes.

D)receiving tax benefits.

E)permanence of residence.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

34

One significant drawback of home ownership is financial commitment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

35

Ease of mobility is an advantage of owning a house.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

36

Lenders commonly use a GDS ratio of 30% and a TDS ratio of 40% as guidelines to determine the amount you can comfortably afford for housing.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

37

Financial guidelines suggest that you should "spend no more than 25 to 30 percent of your take home pay on housing".

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

38

Closing costs are the fees and charges owed when making the decision to refinance a home.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

39

A split-rate mortgage helps to reduce interest rate risk.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

40

If you decide to purchase a condominium for potential benefits you are probably:

A)single parent.

B)young couple, no children.

C)couple, young children

D)young single

E)retired person.

A)single parent.

B)young couple, no children.

C)couple, young children

D)young single

E)retired person.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

41

A conventional mortgage usually involves

A)a variable interest rate.

B)a government guarantee.

C)a balloon payment.

D)equal payments.

E)a payment cap.

A)a variable interest rate.

B)a government guarantee.

C)a balloon payment.

D)equal payments.

E)a payment cap.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

42

Brian Pittman rents a living unit as a result of his membership in a nonprofit housing organization.What name is commonly used for this type of housing?

A)modular housing

B)government-subsidized housing

C)zoned housing

D)a condominium

E)cooperative housing

A)modular housing

B)government-subsidized housing

C)zoned housing

D)a condominium

E)cooperative housing

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following are disadvantages of home ownership?

A)limited responsibility

B)few financial benefits

C)low initial costs.

D)limited mobility.

E)lifestyle flexibility.

A)limited responsibility

B)few financial benefits

C)low initial costs.

D)limited mobility.

E)lifestyle flexibility.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following would increase the amount that a person could afford to spend on a home?

A)lower financial obligations

B)increased interest rates

C)increased down payment

D)decreased family income

E)increased monthly living expenses

A)lower financial obligations

B)increased interest rates

C)increased down payment

D)decreased family income

E)increased monthly living expenses

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

45

The purpose of zoning laws is to

A)restrictions on property use.

B)encourage new housing development.

C)minimize people moving from an area.

D)reduce real estate property taxes.

E)assist real estate agents in finding homes for sale.

A)restrictions on property use.

B)encourage new housing development.

C)minimize people moving from an area.

D)reduce real estate property taxes.

E)assist real estate agents in finding homes for sale.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

46

At the closing of home purchase, the "earnest" money has the purpose of:

A)paying real estate property taxes.

B)reducing the mortgage interest rate.

C)paying a mortgage application fee.

D)paying the real estate agent's commission.

E)serving as evidence of serious intent.

A)paying real estate property taxes.

B)reducing the mortgage interest rate.

C)paying a mortgage application fee.

D)paying the real estate agent's commission.

E)serving as evidence of serious intent.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is not a common financial risk of home ownership?

A)interest rates may change.

B)property values may decrease.

C)repairs and maintenance.

D)susceptibility to macroeconomic factors

E)capital gains taxes on the sale of a principal residence.

A)interest rates may change.

B)property values may decrease.

C)repairs and maintenance.

D)susceptibility to macroeconomic factors

E)capital gains taxes on the sale of a principal residence.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

48

The amount of mortgage a person is eligible for would be increased by

A)higher interest rates.

B)a lower down payment.

C)high debt obligations.

D)a low family income.

E)lower interest rates.

A)higher interest rates.

B)a lower down payment.

C)high debt obligations.

D)a low family income.

E)lower interest rates.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

49

As William Quintal conducts an investigation of property value factors, most real estate experts tell him that ____________ most influences the housing values in an area.

A)community pride

B)style of homes

C)quality of schools

D)age of neighborhood

E)zoning laws

A)community pride

B)style of homes

C)quality of schools

D)age of neighborhood

E)zoning laws

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

50

A common financial benefit of home ownership is

A)increased property value.

B)tax deductibility of the down payment.

C)amortization of the growth of equity.

D)a low security deposit.

E)low interest financing.

A)increased property value.

B)tax deductibility of the down payment.

C)amortization of the growth of equity.

D)a low security deposit.

E)low interest financing.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

51

Negative amortization has the effect of:

A)extending the number of payments to pay off the mortgage.

B)decreasing the number of payments to pay off the mortgage.

C)a lower escrow account.

D)lower interest rates.

E)a lower down payment.

A)extending the number of payments to pay off the mortgage.

B)decreasing the number of payments to pay off the mortgage.

C)a lower escrow account.

D)lower interest rates.

E)a lower down payment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

52

The most commonly considered factor when selecting a home is the

A)size of the home.

B)condition of the home.

C)location of the home.

D)local zoning laws.

E)current interest rates.

A)size of the home.

B)condition of the home.

C)location of the home.

D)local zoning laws.

E)current interest rates.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

53

A real estate agent can best assist a homebuyer by

A)assisting in getting a mortgage

B)setting the purchase price.

C)offering new home warranties.

D)assisting you in obtaining financing.

E)paying the first month's mortgage payment.

A)assisting in getting a mortgage

B)setting the purchase price.

C)offering new home warranties.

D)assisting you in obtaining financing.

E)paying the first month's mortgage payment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

54

The purpose of a counteroffer is to

A)negotiate the purchase price.

B)reduce mortgage payments.

C)lower real estate property taxes.

D)avoid paying points at closing.

E)avoid paying the real estate agent's commission.

A)negotiate the purchase price.

B)reduce mortgage payments.

C)lower real estate property taxes.

D)avoid paying points at closing.

E)avoid paying the real estate agent's commission.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

55

A cooperative housing arrangement involves

A)government-supported rental units.

B)a nonprofit organization.

C)individual ownership of a living unit in a building.

D)factory built and on-site assembly.

E)housing units owned by a real estate developer.

A)government-supported rental units.

B)a nonprofit organization.

C)individual ownership of a living unit in a building.

D)factory built and on-site assembly.

E)housing units owned by a real estate developer.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

56

The purpose of a rate cap with a variable rate mortgage is to

A)minimize interest costs.

B)prevent changes in the amount of the monthly payment.

C)increase negative amortization.

D)restrict the amount by which the interest rate can increase.

E)lower the escrow account.

A)minimize interest costs.

B)prevent changes in the amount of the monthly payment.

C)increase negative amortization.

D)restrict the amount by which the interest rate can increase.

E)lower the escrow account.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

57

Assuming semi-annual compounding and a quoted mortgage rate of 9 percent, what are the effective annual rate and the effective monthly rate?

A)4.5 percent, 1 percent

B)9 percent, 0.75 percent

C)9.2 percent, 0.736 percent

D)18.81 percent, 0.75 percent

E)18.81 percent.0.736 percent

A)4.5 percent, 1 percent

B)9 percent, 0.75 percent

C)9.2 percent, 0.736 percent

D)18.81 percent, 0.75 percent

E)18.81 percent.0.736 percent

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

58

The Gross Debt Service (GDS) ratio measures:

A)your monthly mortgage payment, including any outstanding debt as a percentage of gross monthly income.

B)your monthly mortgage payment, including principal, interest, heating, and taxes as a percentage of gross monthly income.

C)your monthly mortgage payment as a percentage of gross monthly income.

D)your annual mortgage payment, including any outstanding debt, as a percentage of gross annual income.

E)your annual mortgage payment, including principal, interest, heating, and taxes, as a percentage of gross annual income.

A)your monthly mortgage payment, including any outstanding debt as a percentage of gross monthly income.

B)your monthly mortgage payment, including principal, interest, heating, and taxes as a percentage of gross monthly income.

C)your monthly mortgage payment as a percentage of gross monthly income.

D)your annual mortgage payment, including any outstanding debt, as a percentage of gross annual income.

E)your annual mortgage payment, including principal, interest, heating, and taxes, as a percentage of gross annual income.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is an example of a conventional mortgage?

A)a First Home mortgage

B)a buy down

C)a fixed rate mortgage

D)a shared appreciation mortgage

E)a home equity loan

A)a First Home mortgage

B)a buy down

C)a fixed rate mortgage

D)a shared appreciation mortgage

E)a home equity loan

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following would increase the speed of equity growth for a homebuyer?

A)making a down payment of 10 percent instead of 20 percent

B)obtaining a mortgage interest rate of 9 percent instead of 8 percent

C)obtaining a 15-year mortgage instead of a 30-year mortgage

D)making larger deposits to the escrow account

E)making smaller deposit to the escrow account

A)making a down payment of 10 percent instead of 20 percent

B)obtaining a mortgage interest rate of 9 percent instead of 8 percent

C)obtaining a 15-year mortgage instead of a 30-year mortgage

D)making larger deposits to the escrow account

E)making smaller deposit to the escrow account

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

61

A cost associated with home buying would be

A)appraisal.

B)property taxes.

C)legal fees.

D)A & B are correct.

E)A, B and C are correct.

A)appraisal.

B)property taxes.

C)legal fees.

D)A & B are correct.

E)A, B and C are correct.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

62

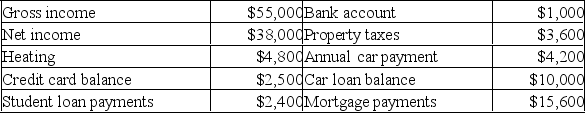

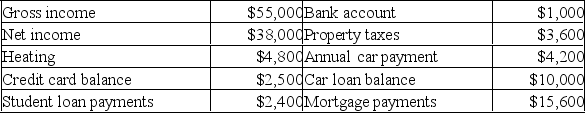

Given the following, calculate the GDS ratio.All income and expense items are annual.

A)28%

B)41%

C)44%

D)52%

E)63%

A)28%

B)41%

C)44%

D)52%

E)63%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

63

The main financial benefit of owning is

A)lower living expenses.

B)don't pay GST.

C)investment value growth.

D)lower initial costs.

E)high financial commitment.

A)lower living expenses.

B)don't pay GST.

C)investment value growth.

D)lower initial costs.

E)high financial commitment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following are disadvantages of home ownership?

A)limited responsibility

B)few financial benefits

C)low initial costs.

D)financial commitment.

E)lifestyle flexibility.

A)limited responsibility

B)few financial benefits

C)low initial costs.

D)financial commitment.

E)lifestyle flexibility.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

65

A home equity loan is also referred to as a ____________ mortgage.

A)shared appreciation

B)graduated payment

C)growing equity

D)second

E)buy down

A)shared appreciation

B)graduated payment

C)growing equity

D)second

E)buy down

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

66

Refinancing of a mortgage is recommended when

A)interest rates rise.

B)interest rates fall.

C)the escrow account balance declines.

D)two or more points are required by the lender at the time of closing.

E)refinancing costs are low

A)interest rates rise.

B)interest rates fall.

C)the escrow account balance declines.

D)two or more points are required by the lender at the time of closing.

E)refinancing costs are low

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is an example of a closing cost?

A)origination fee

B)mortgage application fee

C)earnest money

D)title insurance

E)down payment

A)origination fee

B)mortgage application fee

C)earnest money

D)title insurance

E)down payment

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following expenses is paid from an escrow account?

A)title insurance

B)property insurance

C)points

D)loan application fee

E)real estate agent's commission

A)title insurance

B)property insurance

C)points

D)loan application fee

E)real estate agent's commission

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

69

If you sell your home without the use of a real estate agent, you should still make use of a

A)broker.

B)insurance agent.

C)lawyer.

D)contractor.

E)rental agent.

A)broker.

B)insurance agent.

C)lawyer.

D)contractor.

E)rental agent.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

70

The amount of mortgage a person is eligible for would be increased by

A)higher interest rates.

B)a lower down payment.

C)high debt obligations.

D)a low family income.

E)a larger down payment.

A)higher interest rates.

B)a lower down payment.

C)high debt obligations.

D)a low family income.

E)a larger down payment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

71

Renting would be most appropriate for people who

A)own a variety of pets.

B)have difficulty establishing credit.

C)want to reduce their taxes.

D)enjoy remodeling their residence.

E)desire the financial benefits of increased equity.

A)own a variety of pets.

B)have difficulty establishing credit.

C)want to reduce their taxes.

D)enjoy remodeling their residence.

E)desire the financial benefits of increased equity.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

72

The purpose of title insurance is to

A)transfer ownership of property.

B)reduce the chance of a decrease in property value.

C)guarantee the boundaries of the property.

D)protect an owner from changes in mortgage interest rates.

E)cover the closing costs of a real estate transaction.

A)transfer ownership of property.

B)reduce the chance of a decrease in property value.

C)guarantee the boundaries of the property.

D)protect an owner from changes in mortgage interest rates.

E)cover the closing costs of a real estate transaction.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

73

The most common service provided by a real estate agent when selling your home is

A)providing legal advice.

B)qualifying buyers for a mortgage.

C)screening potential buyers.

D)making needed repairs.

E)getting you the lowest offer

A)providing legal advice.

B)qualifying buyers for a mortgage.

C)screening potential buyers.

D)making needed repairs.

E)getting you the lowest offer

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following would increase the speed of equity growth for a homebuyer?

A)making a down payment of 10 percent instead of 20 percent

B)obtaining a mortgage interest rate of 9 percent instead of 8 percent

C)obtaining a 20-year mortgage instead of a 25-year mortgage

D)making larger deposits to the escrow account

E)making smaller deposit to the escrow account

A)making a down payment of 10 percent instead of 20 percent

B)obtaining a mortgage interest rate of 9 percent instead of 8 percent

C)obtaining a 20-year mortgage instead of a 25-year mortgage

D)making larger deposits to the escrow account

E)making smaller deposit to the escrow account

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

75

You made a $100,000 down payment on a $400,000 house and financed the remaining amount with a Canadian fixed-rate mortgage.Your mortgage has a term of three years, an amortization period of 25 years, a quoted rate of 7% and payments are made monthly.Identify the correct statement.

A)The 7% quoted rate does not represent the effective annual rate charged on the mortgage.

B)The interest rate is fixed for 25 years.

C)You will make a total of 36 monthly payments to pay off the mortgage.

D)You have a high-ratio mortgage.

E)Your interest rate is fixed for 3 years, variable for 22 years.

A)The 7% quoted rate does not represent the effective annual rate charged on the mortgage.

B)The interest rate is fixed for 25 years.

C)You will make a total of 36 monthly payments to pay off the mortgage.

D)You have a high-ratio mortgage.

E)Your interest rate is fixed for 3 years, variable for 22 years.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

76

Lenders commonly use a TDS ratio of _________ and a GDS ratio of __________ to help determine the amount most people can comfortably afford for housing.

A)20%; 30%

B)40%; 20%

C)40%; 30%

D)30%; 20%

E)20%; 40%

A)20%; 30%

B)40%; 20%

C)40%; 30%

D)30%; 20%

E)20%; 40%

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following would increase the amount that a person could afford to spend on a home?

A)higher financial obligations

B)decreased interest rates

C)increased down payment

D)decreased family income

E)increased monthly living expenses

A)higher financial obligations

B)decreased interest rates

C)increased down payment

D)decreased family income

E)increased monthly living expenses

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

78

Renting is more advantageous than buying a home for

A)minimal financial commitment.

B)financial benefits.

C)long-term investment purposes.

D)receiving tax benefits.

E)permanence of residence.

A)minimal financial commitment.

B)financial benefits.

C)long-term investment purposes.

D)receiving tax benefits.

E)permanence of residence.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

79

The purpose of an appraisal is to

A)estimate the current value of a home.

B)reduce the amount paid for property taxes.

C)qualify for a reduced mortgage rate.

D)eliminate the need for home insurance.

E)reduce the mortgage payments.

A)estimate the current value of a home.

B)reduce the amount paid for property taxes.

C)qualify for a reduced mortgage rate.

D)eliminate the need for home insurance.

E)reduce the mortgage payments.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

80

Which document is used to transfer ownership of property from one party to another?

A)Title

B)Escrow account

C)Settlement statement

D)Appraisal

E)Deed

A)Title

B)Escrow account

C)Settlement statement

D)Appraisal

E)Deed

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck